Internet Of Things (IoT) Connected Devices Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435894 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Internet Of Things (IoT) Connected Devices Market Size

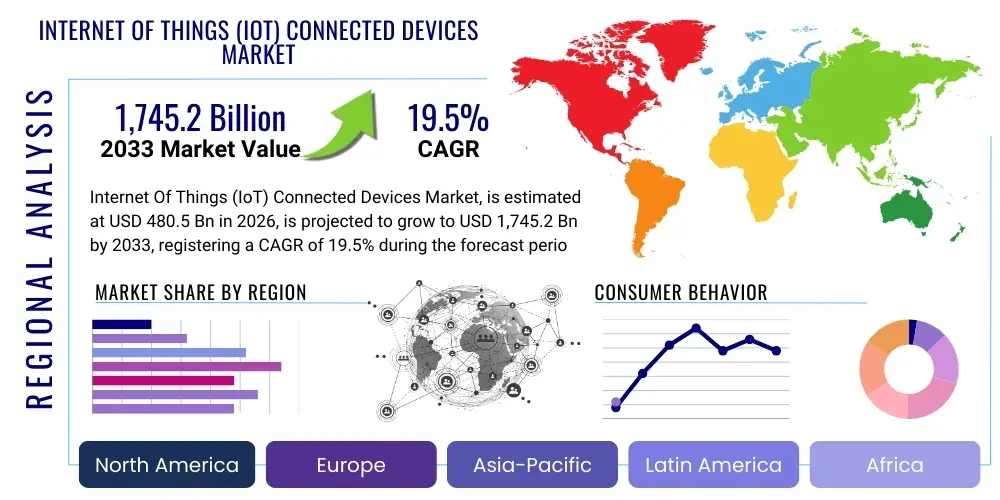

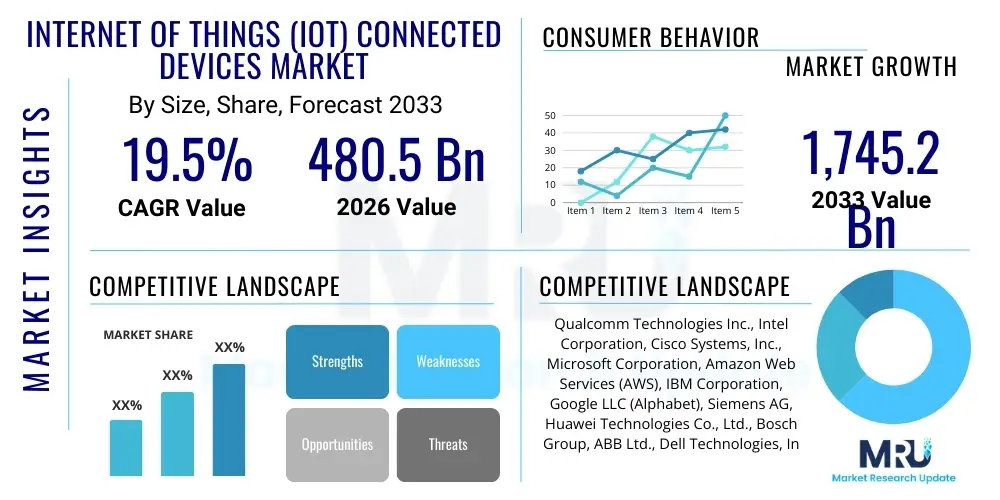

The Internet Of Things (IoT) Connected Devices Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 19.5% between 2026 and 2033. The market is estimated at USD 480.5 billion in 2026 and is projected to reach USD 1,745.2 billion by the end of the forecast period in 2033. This substantial expansion is primarily driven by the accelerated integration of smart technologies across industrial, commercial, and residential sectors globally. The foundational shift towards ubiquitous connectivity, coupled with declining sensor costs and the widespread deployment of advanced networking infrastructure, particularly 5G, creates a highly favorable environment for market valuation growth. Furthermore, governmental initiatives promoting digital transformation and smart city projects globally contribute significantly to the sheer volume of connected endpoints being deployed.

Internet Of Things (IoT) Connected Devices Market introduction

The Internet of Things (IoT) Connected Devices Market encompasses the ecosystem of physical objects—ranging from simple sensors and embedded systems to complex machinery and consumer electronics—that are interconnected via the internet, facilitating data exchange and operational intelligence without requiring human-to-human or human-to-computer interaction. The core product scope includes sensors, actuators, network interface cards, microcontrollers, and the associated communication modules (Wi-Fi, Bluetooth, Zigbee, Cellular IoT such as NB-IoT and LTE-M). These devices are engineered to collect environmental data, monitor performance, and execute commands, thereby transforming raw data into actionable insights crucial for enhanced efficiency and decision-making across numerous verticals. The technological architecture supporting these devices involves layered complexity, starting from the edge device level, moving through network gateways, and ultimately relying on cloud or edge computing platforms for data processing and storage, ensuring scalability and real-time responsiveness essential for industrial and mission-critical applications.

Major applications of IoT connected devices span a vast array of industries. In the industrial sector (IIoT), applications include predictive maintenance, asset tracking, remote monitoring of machinery, supply chain optimization, and quality control systems in smart factories. Healthcare leverages IoT for remote patient monitoring (RPM), wearable health trackers, and smart hospital management systems, improving patient outcomes and operational efficiency. In the consumer domain, smart home devices, including security systems, thermostats, lighting controls, and entertainment systems, form a significant application segment, enhancing convenience and energy management. Smart city initiatives utilize connected devices for intelligent traffic management, public safety, utility metering, and environmental monitoring. The versatility and adaptability of IoT technology mean that nearly every aspect of modern infrastructure and daily life is becoming subject to optimization through connected device integration, cementing its status as a critical foundational technology for the digital age.

Key driving factors accelerating market adoption include the increasing availability of high-speed, low-latency connectivity, especially with the global rollout of 5G networks, which fundamentally changes the performance profile of IoT deployments, enabling mass device connectivity and reliable data transfer for critical applications. Furthermore, the enhanced maturity of big data analytics and machine learning technologies provides the necessary backend capabilities to derive value from the massive streams of data generated by connected devices, justifying the investment for enterprises seeking operational competitive advantages. Regulatory support, particularly in fields such as automotive safety (connected vehicles) and energy management (smart grids), also serves as a strong catalyst. The inherent benefits derived from IoT implementations—such as significant reductions in operational costs through automation, improved efficiency, enhanced security surveillance, and the creation of entirely new service models based on usage data—further compel sustained market expansion and robust investment across both developed and emerging economies.

Internet Of Things (IoT) Connected Devices Market Executive Summary

The IoT Connected Devices Market is characterized by intense technological evolution and rapid fragmentation across business models, driven primarily by the confluence of robust hardware innovation and sophisticated software platforms focused on data orchestration and security. Current business trends indicate a strong shift from simple device sales to comprehensive "as-a-service" models, where revenue is generated through recurring subscriptions for data management, maintenance, and analytics, often bundled with the hardware. Key strategic movements include substantial investments in edge computing capabilities, necessitated by the need for low-latency processing in critical industrial and automotive applications, reducing reliance on centralized cloud infrastructures. Furthermore, heightened scrutiny regarding data privacy and cybersecurity mandates the integration of advanced security protocols—such as hardware root of trust and sophisticated encryption at the device level—becoming a non-negotiable component of modern IoT solutions, influencing procurement decisions and vendor differentiation in the competitive landscape. Consolidation efforts are also visible, as major technology conglomerates acquire specialized platform providers to offer end-to-end solutions capable of scaling complex, multi-protocol deployments across diverse vertical markets.

Regionally, North America maintains market dominance, primarily due to high technology penetration, significant early adoption in sectors like healthcare and manufacturing, and the strong presence of major technology developers and cloud service providers who form the backbone of the IoT ecosystem. However, the Asia Pacific (APAC) region is demonstrating the most accelerated growth trajectory, fueled by massive government investments in smart cities, rapid industrial digitalization (particularly in countries like China, India, and Japan), and large-scale consumer electronics manufacturing capabilities that drive down hardware costs. Europe focuses heavily on regulatory compliance and sustainable IoT applications, prioritizing standards related to energy efficiency and data sovereignty (GDPR), which shapes their unique implementation strategies. The Middle East and Africa (MEA) and Latin America are emerging markets, primarily focused on oil and gas monitoring, mining operations, and developing smart infrastructure projects, often leapfrogging older technologies directly into 5G-enabled IoT solutions, indicating a diverse and geographically specific pattern of technology adoption.

In terms of segmentation, the component segment is witnessing rapid growth in the sensor and connectivity module categories, reflecting the continuous need for cost-effective, energy-efficient data acquisition points, especially those supporting LPWAN standards like LoRaWAN and Sigfox, designed for long-range, low-power applications. The application segment continues to be dominated by smart manufacturing (IIoT), given its high return on investment potential through optimization of complex supply chains and production lines. However, the rapidly expanding healthcare and connected vehicles segments are poised to significantly increase their market share, driven by demographic changes (aging population requiring RPM) and stringent regulations mandating advanced safety and connectivity features in new vehicles. The deployment model shows a pronounced shift towards hybrid and edge deployments, moving away from purely centralized cloud architectures, reflecting the operational demands for real-time processing, enhanced reliability, and compliance with data localization mandates required by large-scale enterprise clients worldwide.

AI Impact Analysis on Internet Of Things (IoT) Connected Devices Market

Analysis of common user questions regarding the nexus between AI and IoT reveals key themes centered around four core areas: real-time decision making, data handling efficiency, security automation, and the complexity of deployment. Users frequently inquire about how AI enables predictive maintenance capabilities beyond simple threshold alerts, specifically seeking detailed examples of anomaly detection powered by machine learning at the edge. A major concern revolves around the overwhelming volume of data generated by billions of connected devices; users question how AI algorithms can effectively filter, process, and derive meaningful insights from this scale without incurring prohibitive cloud costs and network bandwidth constraints, leading to high interest in edge AI solutions. Furthermore, security is a pervasive theme, with inquiries focusing on AI's role in proactive threat detection, automated vulnerability response, and continuous behavioral profiling of devices to identify compromises, moving beyond traditional signature-based security. Finally, users seek clarity on the practical steps and necessary skillsets required to integrate sophisticated AI models into constrained IoT device environments, highlighting the need for user-friendly AI development and deployment frameworks tailored for embedded systems, underscoring expectations for transformative operational efficiency coupled with manageable integration overhead.

The synergy between Artificial Intelligence (AI) and the Internet of Things (IoT), often termed the Artificial Intelligence of Things (AIoT), represents the next frontier of digital transformation, fundamentally changing how connected devices operate and deliver value. AI integration transitions IoT solutions from mere data collectors to intelligent, autonomous systems capable of complex decision-making in real-time. This profound shift is driving demand for microprocessors optimized for AI inferencing at the edge, drastically reducing reliance on backhaul communication and cloud processing for immediate actions, such as shutting down a malfunctioning machine or adjusting traffic light patterns based on instantaneous flow analysis. This localized intelligence not only enhances system responsiveness and reliability but also significantly addresses major corporate concerns regarding data latency and operational continuity, making AI a mandatory component for mission-critical deployments in manufacturing, automotive, and utility sectors globally. The evolution towards AIoT is fundamentally redefining the competitive landscape, emphasizing vendors who can provide integrated hardware-software stacks capable of supporting sophisticated machine learning workloads.

The most immediate and high-impact application of AI in the IoT market lies in advanced data processing and predictive modeling. By applying machine learning algorithms to the vast historical and real-time data streams generated by connected sensors, enterprises can achieve unprecedented levels of accuracy in forecasting equipment failures (predictive maintenance), optimizing complex supply chain logistics, and personalizing consumer experiences based on observed behavior patterns. This ability to anticipate needs and prevent costly downtime translates directly into quantifiable economic benefits, justifying the typically higher investment associated with AIoT systems. Moreover, AI plays a crucial role in managing the inherent heterogeneity of the IoT ecosystem, automatically standardizing and cleaning data from disparate sources, and facilitating interoperability between diverse protocols and hardware platforms, thereby reducing the complexity and time required for large-scale enterprise integrations and enabling cross-functional data synthesis for strategic business intelligence.

- AI enables real-time inferencing and autonomous decision-making directly at the network edge.

- Machine Learning (ML) algorithms are critical for predictive maintenance, anomaly detection, and operational forecasting.

- AI significantly improves data utilization efficiency by filtering noisy or irrelevant sensor data before transmission to the cloud.

- Enhanced IoT cybersecurity is achieved through AI-driven behavioral analytics and automated threat detection mechanisms.

- AI optimizes power consumption and resource allocation within constrained IoT devices, extending battery life.

- Natural Language Processing (NLP) integration improves user interaction with smart home and enterprise devices.

- AI platforms facilitate the rapid development and deployment of customized IoT applications across diverse industry verticals.

DRO & Impact Forces Of Internet Of Things (IoT) Connected Devices Market

The dynamics of the IoT Connected Devices Market are shaped by powerful and interacting forces encompassing strong technology drivers, persistent integration challenges acting as restraints, and expansive market opportunities created by technological leaps and societal needs. The primary drivers include the global implementation of 5G, providing necessary high throughput and ultra-low latency; the continuous decrease in the cost and size of sensor hardware; and the proliferation of powerful, cost-effective microcontrollers suitable for embedded AI tasks. These forces collectively lower the barrier to entry for large-scale deployments. Conversely, major restraints include deep-seated concerns over pervasive security vulnerabilities, the lack of universal standardization across communication protocols, leading to interoperability hurdles, and the regulatory uncertainty surrounding cross-border data governance and privacy protection, which complicates global deployment strategies for multinational corporations. Opportunities are abundant, primarily centered on emerging specialized domains like connected healthcare (post-pandemic demand for remote monitoring), the expansion of industrial digital twins, and the integration of blockchain technology to enhance the transparency and security of data transactions among distributed IoT nodes, promising substantial long-term growth and market innovation.

Impact forces within the ecosystem—such as supplier power, buyer power, the threat of new entrants, the threat of substitutes, and competitive rivalry—are constantly shifting the market structure. Supplier power, particularly from semiconductor manufacturers (chips, microcontrollers, communication modules) and dominant cloud infrastructure providers (AWS, Azure, GCP), remains high due to proprietary technological barriers and high switching costs associated with complex platforms. Buyer power is substantial in fragmented vertical markets, where end-users (e.g., large industrial conglomerates, governments) demand highly customized, secure, and cost-effective solutions, forcing vendors to prioritize vertical specialization. The threat of new entrants is moderate; while hardware barriers are lowering, the complexity of developing secure, scalable, and multi-protocol software platforms maintains a significant barrier, favoring established software providers and system integrators. The primary threat of substitutes comes from non-connected automation systems or alternative data collection methods, though IoT's unique capability for real-time, remote intelligence diminishes this threat significantly in high-value industrial and critical infrastructure applications.

Competitive rivalry is extremely high and intensifying, characterized by a mix of large-scale technology giants competing on platform breadth and ecosystem integration, and highly specialized startups focused on niche application layers (e.g., specific predictive maintenance algorithms or secure device identity management). This rivalry drives rapid innovation, particularly in areas like battery efficiency, miniaturization, and embedded security features, ensuring a constant flow of technologically advanced products. Furthermore, strategic partnerships and alliances among hardware manufacturers, network operators, and application developers are becoming crucial for delivering comprehensive, integrated solutions required by enterprise customers. The market’s sustained growth rate and the vast potential across untapped emerging economies suggest that while competition is fierce, the expanding total addressable market (TAM) provides ample space for multiple major players to coexist, provided they focus on robust security, compliance, and vertical-specific value delivery, moving the core competition from price to specialized capability.

Segmentation Analysis

The Internet of Things (IoT) Connected Devices Market is meticulously segmented across multiple dimensions to accurately capture its intricate structure and diverse application profile. Key segmentation pillars include the Component type, which details the essential building blocks like hardware, software, and services; the Connectivity Technology utilized, ranging from short-range protocols like Bluetooth and Wi-Fi to wide-area solutions such as Cellular IoT (5G, LTE-M, NB-IoT) and LPWAN; the Application or End-Use Vertical, encompassing specific industries such as Smart Homes, Industrial IoT (IIoT), Healthcare, and Automotive; and the Geographical Region, analyzing adoption patterns and growth drivers across major global markets. This multidimensional analysis allows stakeholders to pinpoint areas of greatest investment, understand technological dependencies, and tailor solutions to meet the specific functional and regulatory requirements of distinct vertical markets, essential for strategic product planning and market entry strategies within this highly fragmented ecosystem.

- Component

- Hardware (Sensors, Actuators, Processors/Controllers, Connectivity Modules, Gateways)

- Software (Data Management Platforms, Application Enablement Platforms (AEPs), Security Software, Analytics Software)

- Services (Professional Services, Managed Services, Integration Services)

- Connectivity Technology

- Short Range (Wi-Fi, Bluetooth, Zigbee, NFC)

- Long Range/Wide Area Network (Cellular IoT (4G/LTE, 5G), LPWAN (LoRaWAN, Sigfox), Satellite)

- Application/Vertical

- Smart Home and Consumer Electronics (Security, Appliances, Entertainment)

- Smart City (Traffic Management, Public Safety, Utility Management)

- Industrial IoT (IIoT) and Manufacturing (Asset Tracking, Predictive Maintenance, Supply Chain Monitoring)

- Healthcare (Remote Patient Monitoring, Clinical Asset Management, Telemedicine)

- Automotive and Transportation (Connected Cars, Fleet Management, Infotainment)

- Retail (Inventory Management, Personalized Marketing)

- Agriculture (Smart Farming, Precision Agriculture)

- Geography

- North America (U.S., Canada, Mexico)

- Europe (U.K., Germany, France, Italy, Rest of Europe)

- Asia Pacific (China, Japan, India, South Korea, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East & Africa (UAE, Saudi Arabia, South Africa, Rest of MEA)

Value Chain Analysis For Internet Of Things (IoT) Connected Devices Market

The IoT Connected Devices market value chain is extensive and highly collaborative, spanning from upstream component manufacturing to downstream service delivery and end-user data monetization. Upstream activities involve the fabrication of foundational elements, including semiconductor chips (microcontrollers, specialized AI/ML chips), sensor production (MEMS, chemical, optical), and the manufacturing of connectivity modules (e.g., cellular modems, Wi-Fi modules). These suppliers hold significant bargaining power due to the high technological complexity and specialized intellectual property required. Further upstream are the operating system and platform providers (e.g., embedded Linux, proprietary RTOS), which dictate the functional capabilities and security baseline of the final device. Efficiency and security injected at this initial stage are crucial, as retrofitting security features later is often costly or impossible, fundamentally relying on robust component supply chains for reliability and performance.

Midstream activities focus on system integration, device manufacturing, and network connectivity provision. Device manufacturers assemble the components into finished products (gateways, endpoints, wearables), followed by system integrators who customize and implement these devices into complex enterprise environments, bridging the gap between hardware and operational technology (OT) systems. Network operators (mobile network operators, specialized LPWAN providers) provide the essential connectivity backbone, often segmenting their offerings based on required data rates, latency, and power consumption profiles. Distribution channels for IoT solutions are multifaceted: Direct sales models are common for large Industrial IoT deployments requiring bespoke integration and long-term service contracts, whereas indirect channels, utilizing established electronics distributors, value-added resellers (VARs), and e-commerce platforms, dominate the high-volume consumer IoT market, requiring robust inventory management and standardized installation protocols.

Downstream activities center on data management, application development, and value realization. This segment involves Application Enablement Platforms (AEPs) and Cloud Service Providers (CSPs) that host the data, provide analytics tools, and offer APIs for application development. The final step is the end-user application layer, where customized software applications generate specific business value, such as optimizing energy use, managing patient health records, or automating production lines. Data monetization—where derived insights or processed data are sold or used to enhance service offerings—is the ultimate driver of value. The entire chain relies heavily on robust feedback loops between service providers and hardware manufacturers to ensure continuous improvement in security patches, protocol support, and hardware design iteration to match evolving application demands and enhance overall ecosystem reliability and cost-effectiveness over the device lifecycle.

Internet Of Things (IoT) Connected Devices Market Potential Customers

Potential customers and primary buyers of IoT connected devices span nearly every sector of the global economy, categorized by their scale of deployment and specific requirements regarding device ruggedness, security, and connectivity standards. Large enterprise clients in the manufacturing, logistics, and utilities sectors are foundational buyers, utilizing complex IoT systems (IIoT) for critical infrastructure management, asset monitoring, and operational technology integration. These customers prioritize industrial-grade hardware, reliability under harsh environmental conditions, adherence to strict regulatory standards (e.g., ISA/IEC 62443), and long-term software support and integration capabilities with existing ERP and SCADA systems. The procurement cycles for these large industrial buyers are typically lengthy and require proof-of-concept validation, focusing heavily on total cost of ownership (TCO) over a lifespan that can exceed a decade.

The government and public sector constitute another major customer base, particularly through global smart city initiatives. Municipalities and federal agencies purchase connected devices for public services, including intelligent transportation systems, environmental monitoring, smart grid management, and public safety surveillance. These customers are driven by mandates for efficiency, sustainability goals, and enhanced citizen services, often relying on public-private partnerships (PPPs) for funding and implementation. Their key requirements emphasize data security, privacy compliance (particularly governmental data retention policies), and open standards to ensure vendor diversity and system longevity, making procurement processes transparent and highly compliance-focused regarding security and performance metrics specific to public infrastructure deployment.

Finally, the massive consumer segment represents a highly diversified customer base, purchasing devices ranging from basic smart light bulbs to complex home security ecosystems. Driven by ease of use, aesthetic design, platform interoperability (e.g., compatibility with Google Home or Amazon Alexa), and competitive pricing, consumer adoption is characterized by rapid technological cycles and preference for subscription services that enhance device functionality (e.g., cloud storage for video surveillance). Specific B2B segments, such as healthcare providers (hospitals, clinics) and agricultural enterprises, are also rapidly growing end-users, seeking tailored solutions for remote diagnostics, patient management, and precision farming techniques that optimize resource utilization and yield quality, demanding high standards for data privacy (HIPAA compliance) and robust wireless performance in diverse operational settings.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 480.5 Billion |

| Market Forecast in 2033 | USD 1,745.2 Billion |

| Growth Rate | 19.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Qualcomm Technologies Inc., Intel Corporation, Cisco Systems, Inc., Microsoft Corporation, Amazon Web Services (AWS), IBM Corporation, Google LLC (Alphabet), Siemens AG, Huawei Technologies Co., Ltd., Bosch Group, ABB Ltd., Dell Technologies, Inc., Samsung Electronics Co., Ltd., Hewlett Packard Enterprise (HPE), PTC Inc., Texas Instruments, STMicroelectronics, Ericsson, Honeywell International Inc., SAP SE |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Internet Of Things (IoT) Connected Devices Market Key Technology Landscape

The technological landscape of the IoT Connected Devices Market is characterized by intense innovation across several critical layers, driven by the persistent need for faster processing, lower power consumption, and enhanced security. At the foundational hardware level, the shift towards specialized microcontrollers and System-on-Chips (SoCs) optimized for low-power Wide Area Network (LPWAN) protocols like NB-IoT and LoRaWAN is paramount, enabling devices to operate for years on small batteries, drastically improving the commercial viability of massive-scale deployments in remote or inaccessible areas. Furthermore, the integration of hardware-level security elements, such as trusted platform modules (TPMs) and secure enclaves, is becoming standard practice to establish a robust root of trust for device identity and data encryption from the moment of manufacturing, proactively addressing widespread security vulnerabilities inherent in earlier generations of connected devices and facilitating secure over-the-air (OTA) updates which are vital for long-term device maintenance and threat mitigation in the field.

Connectivity remains the backbone, with the widespread deployment of 5G technology marking a pivotal transformation. 5G’s enhanced mobile broadband (eMBB), massive machine-type communications (mMTC), and ultra-reliable low-latency communications (URLLC) capabilities are essential for enabling new, mission-critical IoT applications, particularly in autonomous vehicles, remote surgery, and industrial control systems that demand near-instantaneous response times and guaranteed reliability. Simultaneously, edge computing technologies are rising rapidly in prominence, shifting data processing capabilities closer to the data source (the devices themselves). This architecture, utilizing micro-data centers or smart gateways, drastically reduces network traffic congestion and latency, enabling real-time analytics and autonomous operation even during network disruptions, which is crucial for maximizing uptime and maintaining productivity in decentralized industrial environments, representing a fundamental change from centralized cloud-only processing models prevalent in the last decade.

On the software and platform side, the technological focus is heavily on interoperability and scalability, addressing the challenge posed by the vast heterogeneity of IoT devices and protocols. Application Enablement Platforms (AEPs) now utilize open standards and modular architectures to simplify device onboarding, data integration, and cross-platform communication, providing developers with robust tools for rapid application deployment across diverse hardware ecosystems. Additionally, the increasing convergence of IoT data streams with enterprise operational systems necessitates advanced middleware solutions capable of secure data governance and integration with legacy IT infrastructure. Finally, the strategic integration of Artificial Intelligence (AI) and Machine Learning (ML) algorithms, leveraging lightweight models optimized for edge deployment, is driving the next wave of innovation, moving devices beyond simple data reporting into sophisticated predictive analysis and autonomous, intelligent operation that maximizes the value extracted from the massive influx of sensor data generated globally every second.

Regional Highlights

The global IoT Connected Devices market exhibits distinct regional dynamics driven by varying levels of infrastructure maturity, regulatory environments, and vertical market dominance.

- North America (U.S. and Canada) remains the largest market in terms of revenue and early adoption of complex, high-value IoT solutions, particularly within the healthcare, manufacturing, and defense sectors. This dominance is supported by the rapid rollout of commercial 5G networks, the strong presence of major cloud service providers (AWS, Azure), and substantial private sector investment in IIoT and advanced analytics platforms, leading to high average selling prices (ASPs) for connected devices and associated services.

- Asia Pacific (APAC) is the fastest-growing region, characterized by large-scale government-backed Smart City projects (especially in China, India, and South Korea), rapid industrial automation efforts driven by manufacturing sector dominance, and a huge consumer base driving adoption of smart home devices. The market growth here is volume-driven, benefiting from local manufacturing capabilities that reduce component costs, and is increasingly leveraging NB-IoT and other cost-effective LPWAN technologies for extensive coverage and large-scale deployment.

- Europe demonstrates strong growth, heavily influenced by regulatory focus on sustainability, data protection (GDPR), and industrial modernization (Industry 4.0). Key application areas include smart grids, automotive connectivity (driven by safety mandates), and specialized industrial automation. The European market prioritizes high standards for cybersecurity and interoperability, often favoring open-source solutions and localized data processing to comply with strict data sovereignty laws, shaping a unique market characterized by robust regulatory oversight and quality mandates.

- Latin America and the Middle East & Africa (MEA) are emerging regions showing high potential, primarily concentrated in resource extraction (oil, gas, mining) monitoring, large-scale agricultural projects, and initial phases of smart city development in major urban centers (e.g., UAE, Saudi Arabia, Brazil). Adoption here is often accelerated by adopting satellite and specialized cellular IoT for challenging geographical areas lacking extensive fixed infrastructure, focusing on solutions that offer immediate operational visibility and security monitoring in remote industrial environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Internet Of Things (IoT) Connected Devices Market.- Qualcomm Technologies Inc.

- Intel Corporation

- Cisco Systems, Inc.

- Microsoft Corporation

- Amazon Web Services (AWS)

- IBM Corporation

- Google LLC (Alphabet)

- Siemens AG

- Huawei Technologies Co., Ltd.

- Bosch Group

- ABB Ltd.

- Dell Technologies, Inc.

- Samsung Electronics Co., Ltd.

- Hewlett Packard Enterprise (HPE)

- PTC Inc.

- Texas Instruments

- STMicroelectronics

- Ericsson

- Honeywell International Inc.

- SAP SE

Frequently Asked Questions

Analyze common user questions about the Internet Of Things (IoT) Connected Devices market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor accelerating the growth of the IoT Connected Devices Market?

The most significant acceleration factor is the global deployment of 5G networking infrastructure, which provides the necessary low latency, high bandwidth, and massive connectivity capacity crucial for supporting complex industrial, automotive, and large-scale smart city IoT deployments, coupled with the persistent decline in the cost of sensor hardware components.

How are cybersecurity threats impacting enterprise adoption of IoT devices?

Cybersecurity concerns represent a major restraint on enterprise adoption, leading to increased demand for IoT solutions that incorporate security by design, including hardware root of trust, advanced encryption at the device level, and AI-driven behavioral monitoring for real-time anomaly detection and automated threat mitigation strategies.

Which geographical region holds the largest market share for IoT Connected Devices and why?

North America currently holds the largest market share, driven by high technological maturity, extensive investment in advanced vertical applications (IIoT, healthcare), and the substantial presence of key ecosystem players, including leading chip manufacturers and cloud platform providers, which facilitates rapid innovation and market scaling of high-value solutions.

What is the distinction between LPWAN and 5G Cellular IoT in terms of device deployment?

LPWAN (e.g., LoRaWAN, NB-IoT) is optimized for massive machine-type communication (mMTC) requiring low data rates, long battery life (years), and wide area coverage for simple sensors and metering. Conversely, 5G Cellular IoT targets high-throughput, low-latency applications (e.g., autonomous vehicles, real-time industrial control) that demand continuous, high-reliability connectivity and higher power consumption budgets for complex data processing tasks.

What role does Edge Computing play in the future development of the IoT market?

Edge computing is vital as it shifts data processing and analytics closer to the connected devices, enabling real-time decision-making, significantly reducing data transport costs and network latency, and ensuring operational continuity for mission-critical systems even when cloud connectivity is compromised. This architecture is essential for achieving true autonomy in industrial and remote applications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager