Internet Of Things (IoT) Networks Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432157 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Internet Of Things (IoT) Networks Market Size

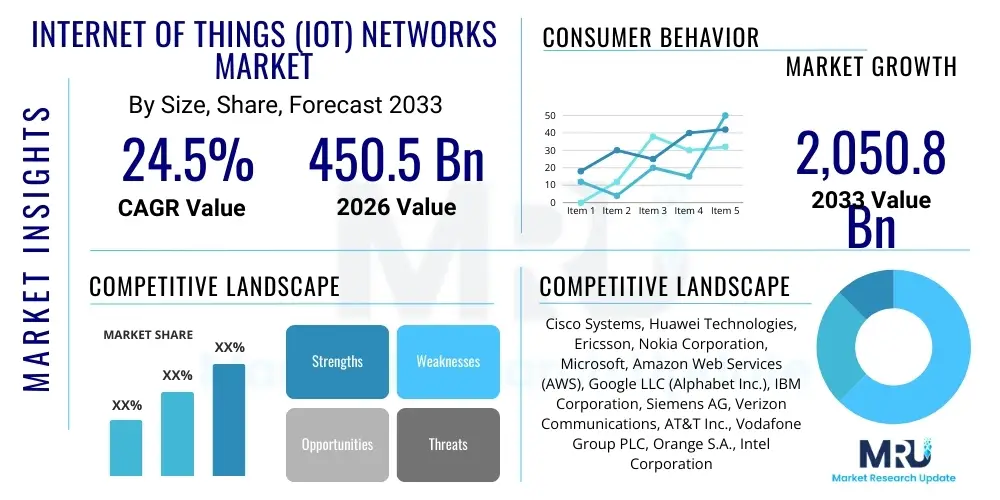

The Internet Of Things (IoT) Networks Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 24.5% between 2026 and 2033. The market is estimated at USD 450.5 Billion in 2026 and is projected to reach USD 2,050.8 Billion by the end of the forecast period in 2033.

Internet Of Things (IoT) Networks Market introduction

The Internet of Things (IoT) Networks Market encompasses the technologies, protocols, hardware, and software infrastructure essential for connecting billions of physical devices globally, enabling data exchange, remote monitoring, and automated control. This market is fundamentally defined by the convergence of low-power connectivity solutions, advanced sensor technologies, and scalable cloud platforms. The increasing need for operational efficiency, predictive maintenance, and real-time data acquisition across major industrial sectors, including manufacturing, healthcare, smart cities, and automotive, forms the bedrock of this market’s substantial expansion. IoT networks utilize diverse communication standards, ranging from short-range technologies like Bluetooth and Wi-Fi to wide-area solutions such as cellular (5G/LTE-M) and Low-Power Wide-Area Networks (LPWAN) like LoRaWAN and NB-IoT, ensuring robust connectivity regardless of deployment scale or environment.

Major applications of IoT networks span vertical industries, dramatically transforming business models and service delivery. In the industrial sector, applications include asset tracking, supply chain management, and Industrial IoT (IIoT) platforms that optimize production lines and enhance worker safety. Smart city initiatives leverage these networks for intelligent traffic management, utility metering, public safety, and environmental monitoring, yielding significant public benefits through resource optimization and enhanced citizen services. Furthermore, the proliferation of connected consumer devices, particularly in smart homes (thermostats, security systems, appliances), constitutes a substantial and growing application area, driven by convenience and energy efficiency demands. The versatility of IoT network architecture allows for customized solutions addressing unique environmental and security challenges specific to each deployment.

Key driving factors accelerating market growth include rapid advancements in semiconductor technology, leading to smaller, cheaper, and more energy-efficient sensors and microcontrollers. The global rollout of 5G infrastructure provides the high bandwidth and low latency necessary for critical, real-time IoT applications, such as autonomous vehicles and remote surgery. Regulatory support for digitalization, alongside massive investments in smart infrastructure projects by governments worldwide, further stimulates demand. Moreover, the inherent benefits derived from IoT implementations—including reduced operational costs, improved decision-making through actionable data insights, and the creation of entirely new service offerings—provide compelling economic incentives for widespread adoption across enterprises of all sizes.

Internet Of Things (IoT) Networks Market Executive Summary

The Internet of Things (IoT) Networks Market is experiencing robust acceleration, primarily propelled by favorable business trends centered around digital transformation and the adoption of hybrid cloud models for data processing and storage. Enterprise expenditure is shifting heavily toward integrated solutions that combine network connectivity with powerful analytics platforms, emphasizing end-to-end security architecture. Key business trends highlight strategic partnerships between traditional telecom operators and hyperscale cloud providers (e.g., AWS, Azure, Google Cloud) to deliver comprehensive, scalable IoT solutions that address latency and data sovereignty requirements. Furthermore, the market is characterized by intense competition in the connectivity layer, pushing down costs for cellular IoT modules and simultaneously increasing the capabilities of unlicensed spectrum technologies like LoRaWAN, making deployment more accessible for smaller entities and niche applications.

Regionally, the market exhibits differential growth rates and technology adoption profiles. North America and Europe currently dominate the market share, driven by high technology maturity, established regulatory frameworks, and early adoption in advanced manufacturing and healthcare. However, the Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) over the forecast period, fueled by massive government investments in smart city projects (particularly in China, India, and Southeast Asia) and rapid industrial digitalization. The Middle East and Africa (MEA) and Latin America (LATAM) are emerging markets, primarily focused on oil and gas monitoring, mining operations, and basic infrastructure improvements, where LPWAN technologies offer cost-effective coverage across vast geographical areas.

Segment trends reveal a significant shift toward the integration of specialized vertical platforms. The software and services segment, which includes data management, security services, and professional consulting, is expanding faster than the hardware segment, indicating that complexity management and data monetization are becoming the primary value drivers. Among connectivity technologies, 5G and cellular IoT (e.g., LTE-M, NB-IoT) are gaining momentum, particularly for mission-critical applications requiring high reliability and mobility. Simultaneously, the market for low-power, long-range networks continues to thrive in large-scale non-critical deployments, such as environmental sensing and agricultural monitoring. The increasing focus on edge computing and distributed processing is also defining segment growth, pushing analytics capabilities closer to the data source to minimize bandwidth requirements and ensure faster response times.

AI Impact Analysis on Internet Of Things (IoT) Networks Market

Common user questions regarding AI's impact on IoT Networks often revolve around how artificial intelligence can manage the complexity and scale of data generated by billions of connected devices, enhance network security against sophisticated cyber threats, and facilitate truly autonomous decision-making at the edge. Users seek clarity on AI's role in predictive maintenance, asking whether AI-driven analytics can significantly reduce downtime and operational expenditures beyond traditional monitoring methods. A major concern is the scalability of current network infrastructures to handle AI model deployment and training, particularly considering latency constraints. Users are highly interested in how AI algorithms optimize network resource allocation (AIOps), ensuring Quality of Service (QoS) and maintaining connectivity reliability in dynamic environments. The core expectation is that AI will transform raw IoT data into immediate, actionable intelligence, moving the network infrastructure from a reactive system to a highly adaptive and predictive operational framework.

The integration of AI into IoT networks fundamentally transforms operational paradigms by enabling advanced network automation and optimization. AI algorithms are deployed to dynamically manage spectrum allocation, predict network congestion, and automatically reroute data traffic to ensure optimal performance and energy efficiency across massive device deployments. This proactive management capability is crucial for handling the sporadic and diverse traffic patterns characteristic of large-scale IoT ecosystems. Furthermore, AI fuels the shift towards "Cognitive IoT," where connected devices are capable of learning from their environment and executing complex tasks without constant cloud interaction, thereby reducing network load and improving response times critical for applications like industrial robots and remote diagnostics.

From a security perspective, AI provides a crucial defense layer against the expanding threat surface introduced by numerous interconnected devices. Traditional signature-based security models are insufficient for IoT; thus, AI-driven anomaly detection is deployed to profile normal network behavior and instantly flag deviations, such as unauthorized data access attempts or malware lateral movement. This capability is enhanced through machine learning models trained on vast datasets of threat intelligence, allowing the network itself to become an intelligent security entity. Moreover, AI is central to data management, enabling efficient data filtering, compression, and prioritization at the edge, ensuring that only relevant, high-value data is transmitted to the cloud, significantly mitigating bandwidth strain and cloud processing costs associated with massive data ingestion.

- AI drives AIOps for dynamic network resource optimization and automated fault management.

- Machine learning enhances IoT security through advanced anomaly detection and threat modeling at the device and network level.

- AI enables predictive maintenance by analyzing sensor data patterns to forecast equipment failures before they occur.

- Edge AI facilitates real-time, decentralized decision-making, reducing latency critical for mission-critical applications.

- Natural Language Processing (NLP) integration improves human-machine interaction within industrial IoT environments.

- Reinforcement learning optimizes energy consumption in low-power wide-area networks (LPWAN).

- AI assists in data normalization and governance, ensuring data quality and compliance across heterogeneous IoT ecosystems.

DRO & Impact Forces Of Internet Of Things (IoT) Networks Market

The Internet of Things (IoT) Networks Market is governed by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape its growth trajectory and competitive landscape. The primary drivers include the mandatory need for operational visibility and cost reduction across major enterprises, particularly in asset-intensive industries. The exponential proliferation of smart devices—both industrial and consumer—demands robust, scalable network infrastructure. Additionally, the standardization and widespread deployment of 5G connectivity provide a fundamental technological catalyst, offering the necessary speed, latency, and device density support previously unavailable. Opportunities lie in the vertical integration of services, focusing on niche application areas like connected healthcare (remote patient monitoring) and smart agriculture (precision farming), where tailored network solutions create high-value propositions. The inherent impact forces are overwhelmingly positive, driven by accelerating digital transformation agendas globally.

However, the market faces significant restraints that necessitate careful strategic navigation. Foremost among these is the escalating concern over cybersecurity and data privacy. The fragmented nature of the IoT ecosystem, involving multiple vendors and diverse device standards, creates vast security vulnerabilities that must be addressed through sophisticated, unified security solutions. Furthermore, interoperability challenges persist, as different communication protocols and proprietary platforms hinder seamless integration and large-scale deployment. High initial capital expenditure required for installing advanced network infrastructure (especially private 5G networks) and the lack of globally standardized regulatory frameworks regarding frequency allocation and data handling also act as constraints, particularly in emerging economies.

The opportunities within the market are substantial and leverage technological advancements and evolving connectivity standards. The expansion of edge computing represents a major growth avenue, shifting data processing closer to the device to mitigate bandwidth limitations and latency issues, thereby enabling truly real-time applications. The development of specialized Low-Power Wide-Area Networks (LPWAN) like NB-IoT and LoRaWAN continues to unlock new market segments by offering cost-effective, battery-efficient connectivity for remote or low-data-rate applications. Furthermore, the rise of Network-as-a-Service (NaaS) models offers enterprises flexible, scalable, and consumption-based access to complex network infrastructure, lowering the entry barrier for SMEs and accelerating adoption across new verticals, solidifying the market's long-term growth prospects.

Segmentation Analysis

The Internet of Things (IoT) Networks Market is broadly segmented based on Component, Connectivity Technology, Application, and Industry Vertical, reflecting the diverse requirements and complexity inherent in global IoT deployments. This granular segmentation is crucial for understanding specific market dynamics, competitive advantages, and investment priorities. The component segmentation differentiates between hardware (sensors, modules, gateways), software (platform and middleware), and services (managed and professional). The rapid growth in complexity necessitates advanced software platforms capable of device management, data ingestion, and application enablement, making the software segment particularly dynamic. Understanding these segments helps solution providers tailor their offerings to address specific needs, such as low-power efficiency required by LPWAN devices or high-throughput demanded by 5G-enabled vehicular networks.

Connectivity Technology segmentation is perhaps the most defining characteristic of the market, driven by varying criteria such as range, power consumption, data rate, and cost. This includes short-range technologies (Wi-Fi, Bluetooth), cellular technologies (LTE-M, NB-IoT, 5G), and long-range, low-power technologies (LoRaWAN, Sigfox). The choice of technology is highly dependent on the application vertical; for instance, manufacturing often relies on high-speed, low-latency 5G/private networks, while utility metering frequently utilizes cost-effective, long-battery-life LPWAN solutions. The continual evolution of these standards, particularly the optimization of 5G for massive machine-type communication (mMTC), is creating new market subsets and obsolescing older technologies in certain use cases.

Vertical industry segmentation clearly illustrates the end-user adoption patterns and the economic impact of IoT networks. Key verticals include Smart Cities, Industrial IoT (IIoT), Healthcare, Automotive, Retail, and Agriculture. The IIoT segment typically commands the largest market share due to the immediate return on investment provided by enhanced operational efficiency and predictive maintenance systems. Meanwhile, the Smart Cities segment offers massive long-term growth potential driven by municipal investments in public safety, energy management, and infrastructure monitoring. Analyzing the adoption within these verticals allows businesses to focus product development on specific compliance needs, regulatory environments, and critical functional requirements unique to each industry.

- By Component:

- Hardware (Gateways, Routers, Sensors, Modules)

- Software (Platform, Middleware, Network Management)

- Services (Professional Services, Managed Services, Integration Services)

- By Connectivity Technology:

- Short-Range (Wi-Fi, Bluetooth, Zigbee)

- Cellular (5G, LTE-M, NB-IoT, 4G)

- LPWAN (LoRaWAN, Sigfox)

- Satellite Connectivity

- Ethernet/Fiber

- By Application:

- Asset Tracking and Management

- Remote Monitoring and Control

- Security and Surveillance

- Data Collection and Analysis

- Predictive Maintenance

- By Industry Vertical:

- Industrial IoT (Manufacturing, Energy & Utilities)

- Smart Cities and Infrastructure

- Healthcare (Remote Patient Monitoring)

- Automotive and Transportation

- Retail and Logistics

- Agriculture

Value Chain Analysis For Internet Of Things (IoT) Networks Market

The value chain for the Internet of Things (IoT) Networks Market is complex and multi-layered, beginning with upstream activities focused on foundational technology and extending through integration, operation, and downstream service delivery. Upstream analysis primarily involves hardware manufacturers, including sensor and semiconductor vendors (producing microcontrollers, RF chips, and communication modules), alongside core infrastructure providers (developing networking hardware like routers and gateways). Innovation in the upstream sector is characterized by intense R&D efforts aimed at reducing component size, lowering power consumption, and enhancing security features, which ultimately dictates the cost-effectiveness and performance capabilities of the final IoT solution. Key upstream suppliers must ensure component interoperability and longevity to support long-term deployment cycles inherent in industrial and smart infrastructure projects.

The midstream involves connectivity providers and platform developers, representing the core value proposition of IoT networking. Connectivity provision includes Mobile Network Operators (MNOs) offering cellular IoT services (5G, NB-IoT), specialized LPWAN operators, and satellite communication providers, who are responsible for maintaining robust network coverage and quality of service. Platform developers, including cloud service providers (CSPs) and specialized IoT platform vendors, offer the middleware necessary for device management, data ingestion, processing, and application enablement. This midstream segment is critical, as it bridges the gap between raw data collection and actionable business intelligence, often focusing on security, scalability, and ease of integration via APIs.

Downstream analysis focuses on system integration, implementation, and end-user engagement, where the value of the network is realized. This phase involves specialized system integrators, professional service providers, and application developers who customize and deploy solutions tailored to specific industry verticals (e.g., smart factory implementation or hospital asset tracking). The distribution channel relies heavily on direct sales for large, complex enterprise projects requiring extensive customization, while indirect channels, utilizing distributors, value-added resellers (VARs), and strategic channel partners, handle standardized solutions and smaller deployments. The direct channel ensures deep technical support and customization, while the indirect channel maximizes market reach and speed of deployment, particularly in geographically diverse markets.

Internet Of Things (IoT) Networks Market Potential Customers

The potential customers for the Internet of Things (IoT) Networks Market are highly diverse, spanning large multinational corporations, governmental agencies, and small to medium-sized enterprises (SMEs) across nearly every industrial vertical. The primary buyers are organizations seeking to leverage real-time data for operational improvement, risk mitigation, and the introduction of new data-driven services. In the industrial sector, major end-users include manufacturing conglomerates (automotive, electronics assembly), energy providers (smart grids, utility metering companies), and logistics giants, all focused on asset performance management (APM) and supply chain visibility. These enterprise customers prioritize secure, high-throughput, and highly reliable connectivity, often driving demand for private 5G networks and sophisticated cloud-to-edge architectures.

Government and municipal entities represent another crucial segment of potential customers, driven by the imperative to enhance public services and urban sustainability through Smart City initiatives. These buyers, including city planning departments, public transit authorities, and environmental agencies, seek network solutions that can efficiently manage millions of endpoints—from streetlights and parking sensors to waste management bins. Their purchasing decisions are heavily influenced by the need for expansive geographical coverage, long device battery life, and adherence to public infrastructure standards, making them key consumers of LPWAN and public cellular IoT technologies.

Furthermore, the healthcare and consumer sectors constitute rapidly expanding customer bases. Healthcare providers (hospitals, clinics) purchase IoT network solutions for remote patient monitoring (RPM), medical asset tracking, and optimizing hospital operations, demanding connectivity that meets stringent regulatory requirements like HIPAA/GDPR for data security. Consumer-focused buyers, including broadband providers and smart home device manufacturers, drive demand for localized, short-range networking technologies (Wi-Fi 6/7, Thread, Bluetooth Mesh) that integrate seamless device functionality within residential settings. The common factor across all these buyer groups is the need for a scalable, secure, and cost-effective network foundation upon which specialized IoT applications can be reliably built and maintained over extended periods.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Billion |

| Market Forecast in 2033 | USD 2,050.8 Billion |

| Growth Rate | 24.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Cisco Systems, Huawei Technologies, Ericsson, Nokia Corporation, Microsoft, Amazon Web Services (AWS), Google LLC (Alphabet Inc.), IBM Corporation, Siemens AG, Verizon Communications, AT&T Inc., Vodafone Group PLC, Orange S.A., Intel Corporation, Qualcomm Technologies, Inc., Sierra Wireless, Semtech Corporation, Sigfox, T-Mobile US, Inc., Bosch Global Software Technologies |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Internet Of Things (IoT) Networks Market Key Technology Landscape

The technology landscape of the Internet of Things (IoT) Networks Market is characterized by rapid innovation across multiple layers, from the physical communication medium to the data processing architecture. A pivotal technology trend is the proliferation of Low-Power Wide-Area Networks (LPWAN), specifically LoRaWAN and Narrowband IoT (NB-IoT), which are designed to support massive-scale deployments requiring minimal power consumption and extensive coverage, often over unlicensed or standardized cellular spectrum. LoRaWAN excels in proprietary or campus-specific implementations, offering flexible network setup and cost control, while NB-IoT leverages existing cellular infrastructure, providing guaranteed Quality of Service (QoS) and enhanced security protocols managed by Mobile Network Operators (MNOs). This dual-path approach ensures that diverse application requirements, from remote environmental sensing to smart utility metering, are addressed efficiently.

The maturation and deployment of 5G New Radio (NR) technology is fundamentally reshaping the high-end of the IoT network spectrum, specifically targeting mission-critical and high-bandwidth applications. 5G’s enhanced Mobile Broadband (eMBB), Ultra-Reliable Low-Latency Communication (URLLC), and Massive Machine Type Communication (mMTC) capabilities are essential for enabling transformative applications such as autonomous factory automation, telemedicine, and vehicle-to-everything (V2X) communication. The ability of 5G to support network slicing allows operators to create dedicated, isolated virtual networks optimized for specific IoT use cases, guaranteeing performance and security levels previously unattainable with shared cellular infrastructure. This has spurred significant interest in private 5G networks, enabling enterprises to maintain complete control over their industrial IoT infrastructure and data.

Beyond connectivity, the critical architectural shift involves the adoption of Edge Computing and Distributed Ledger Technologies (DLT). Edge computing moves data processing and analytics closer to the devices, drastically reducing network latency and the volume of data transmitted to the centralized cloud. This is paramount for real-time control loops in industrial automation and safety-critical systems. Concurrently, DLT, particularly blockchain, is being explored to enhance data provenance, security, and trust across complex, multi-party IoT ecosystems. Blockchain provides an immutable record of device interactions and data transactions, addressing core concerns related to data integrity and device identity management, thereby fortifying the overall trust framework of the IoT network infrastructure.

Regional Highlights

- North America: North America holds a dominant position in the global IoT Networks Market, characterized by high adoption rates across sophisticated verticals like healthcare, aerospace, and advanced manufacturing. The region benefits from early and extensive investment in 5G infrastructure, providing a robust platform for high-value industrial and commercial IoT applications. Strong presence of major technology providers, hyperscale cloud vendors, and system integrators fuels innovation and deployment complexity. Regulatory initiatives, such as those related to smart grids and connected vehicles, further mandate the implementation of advanced network architectures. The market focus is heavily weighted toward AI integration at the edge and robust cybersecurity solutions to manage escalating data privacy concerns.

- Europe: The European market is a mature and highly dynamic segment, driven primarily by strong governmental support for industrial digitalization (Industry 4.0) and stringent data protection regulations (GDPR). Germany, the UK, and the Nordic countries are leaders in industrial IoT and smart energy management. Europe demonstrates a balanced adoption of both cellular technologies (especially NB-IoT and LTE-M) and LPWAN (LoRaWAN) due to diverse geographical and regulatory landscapes. Key regional priorities include achieving energy efficiency, promoting sustainable smart city development, and establishing robust cross-border data governance frameworks for IoT data transmission.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, owing to massive population centers, rapid urbanization, and significant public-sector investment, particularly in China, South Korea, India, and Japan. Government-led smart city projects and large-scale industrial park developments are the main demand generators. While China leads in 5G deployment and IIoT manufacturing capabilities, countries like India and Indonesia are focusing on cost-effective LPWAN solutions for remote agriculture and utilities monitoring across vast rural areas. The region is characterized by intense price competition and a focus on high-volume, commodity IoT device manufacturing and deployment.

- Latin America (LATAM): The LATAM market is in an emerging growth phase, with key activity concentrated in Brazil and Mexico. Adoption is primarily centered around addressing operational inefficiencies in resource-intensive sectors like mining, agriculture, and oil and gas, alongside infrastructure improvements in metropolitan areas. Connectivity deployment often faces challenges related to geographical complexity and inconsistent regulatory environments, leading to a strong reliance on satellite and hybrid cellular/LPWAN solutions for remote monitoring applications. Investment in secure network infrastructure is rising as enterprises seek to mitigate risks associated with volatile operational environments.

- Middle East and Africa (MEA): Growth in the MEA region is bifurcated: the Gulf Cooperation Council (GCC) states are making rapid, large-scale investments in visionary smart city and mega-project developments (e.g., NEOM in Saudi Arabia), prioritizing cutting-edge 5G and high-density IoT networks. In contrast, Africa's market development is slower but substantial, focusing on mobile connectivity, utility management, and basic asset tracking. Telecommunication providers play a pivotal role in market development across MEA, often partnering with government entities to deploy ubiquitous, centrally managed IoT networks tailored for resource management and public safety applications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Internet Of Things (IoT) Networks Market.- Cisco Systems, Inc.

- Huawei Technologies Co., Ltd.

- Ericsson

- Nokia Corporation

- Microsoft Corporation

- Amazon Web Services (AWS)

- Google LLC (Alphabet Inc.)

- IBM Corporation

- Siemens AG

- Verizon Communications Inc.

- AT&T Inc.

- Vodafone Group PLC

- Orange S.A.

- Intel Corporation

- Qualcomm Technologies, Inc.

- Sierra Wireless, Inc.

- Semtech Corporation

- Sigfox

- T-Mobile US, Inc.

- Bosch Global Software Technologies

Frequently Asked Questions

Analyze common user questions about the Internet Of Things (IoT) Networks market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the most rapidly growing connectivity technology within the IoT Networks Market?

The most rapidly growing connectivity segment is 5G Massive Machine Type Communication (mMTC), alongside Low-Power Wide-Area Network (LPWAN) technologies like NB-IoT and LoRaWAN. 5G facilitates high-throughput, low-latency applications essential for industrial automation and autonomous systems, while LPWAN expands market reach into massive, low-data-rate, and remote monitoring use cases by maximizing battery life and coverage efficiency.

How is cybersecurity being managed in increasingly complex IoT network ecosystems?

Cybersecurity management is shifting from perimeter defense to holistic, zero-trust architectures integrated directly into the network and device layers. Key strategies include AI-driven behavioral anomaly detection, firmware over-the-air (FOTA) updates for patching vulnerabilities, secure element integration in hardware modules, and the utilization of blockchain or DLT for immutable device identity management and data integrity verification.

What role does Edge Computing play in the expansion of IoT networks?

Edge computing is crucial as it processes data locally at the network periphery, reducing the need to transmit massive volumes of data to the centralized cloud. This minimizes network latency, enabling real-time control loops necessary for critical applications (e.g., factory robotics and connected vehicles), while simultaneously enhancing data governance and resilience in environments with intermittent connectivity.

Which industry vertical is currently driving the highest revenue in the IoT Networks Market?

The Industrial Internet of Things (IIoT) vertical, encompassing manufacturing, oil and gas, and energy utilities, consistently drives the highest revenue. This is due to large-scale deployments focused on high-value applications such as predictive maintenance, remote asset performance management, and production line optimization, offering significant measurable return on investment (ROI) through enhanced operational efficiency.

What are the primary challenges hindering the universal adoption of IoT networks globally?

The primary challenges include the lack of globally unified technical standards, persistent security and privacy concerns related to data handling, and complex interoperability issues arising from diverse vendor ecosystems and proprietary protocols. Additionally, the significant initial capital expenditure required for deploying advanced network infrastructure remains a restraint for smaller market entrants and developing regions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager