Intravenous Needles Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431583 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Intravenous Needles Market Size

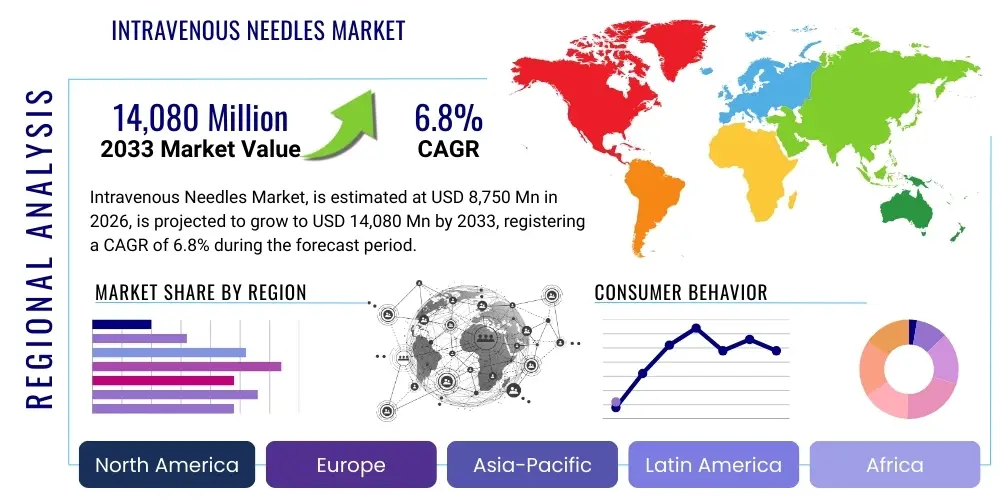

The Intravenous Needles Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 8,750 Million in 2026 and is projected to reach USD 14,080 Million by the end of the forecast period in 2033.

Intravenous Needles Market introduction

The Intravenous (IV) Needles Market encompasses a diverse range of sterile medical devices primarily utilized for administering fluids, medications, nutrients, or blood products directly into the circulatory system, or for the collection of blood samples. These devices are fundamental to modern healthcare, spanning crucial areas such as diagnostics, therapeutics, and emergency care. Key products include standard hypodermic needles used in conjunction with syringes, specialized winged infusion sets (butterfly needles), IV cannulas, and catheters designed for long-term vascular access. The quality, material composition (often stainless steel, sometimes plastic components), and design (gauge size, bevel configuration) of these needles are critical determinants of patient comfort, safety, and procedural efficacy, driving continuous innovation focused on minimizing pain and reducing the risk of needlestick injuries and associated bloodborne pathogen transmission. The core purpose remains establishing secure and efficient venous access across all hospital settings, clinics, ambulatory surgical centers, and home care environments, facilitating life-saving treatments globally.

Major applications of IV needles are extensive and integrated deeply into clinical practice, including chemotherapy administration, hydration therapy, parenteral nutrition delivery, anesthetic administration during surgery, and rapid drug delivery in critical care units. The significant benefits offered by these products include precise dosage delivery directly into the bloodstream, achieving rapid therapeutic effect, and providing reliable access for long-term patient management, particularly in chronic disease states. The inherent efficiency of IV delivery bypasses the gastrointestinal tract, ensuring high bioavailability of essential medications. Furthermore, the development of safety-engineered IV needles and catheters, featuring retractable shields or blunting mechanisms, has drastically improved occupational safety for healthcare workers, a major evolutionary leap in this market segment.

The market is currently being driven by several macro and micro factors. Globally escalating rates of chronic diseases, such as cancer, diabetes, and cardiovascular disorders, necessitate frequent and prolonged intravenous treatments, thereby increasing demand for these consumables. The expansion of the geriatric population, which often requires complex medication regimens administered intravenously, further fuels market growth. Moreover, significant advancements in healthcare infrastructure in emerging economies, coupled with increased surgical volumes worldwide, sustain the robust demand for high-quality, reliable vascular access devices. Technological advancements aimed at improving needle precision, reducing penetration pain, and integrating anti-reflux mechanisms are also key driving forces sustaining the market’s positive trajectory.

Intravenous Needles Market Executive Summary

The Intravenous Needles Market is characterized by robust business trends centered on safety standardization and technological refinement. A significant business trend involves the rapid adoption of safety IV catheters and needles across developed markets, driven by stringent regulatory mandates such as the Needlestick Safety and Prevention Act in the U.S. and similar directives in Europe. This shift requires manufacturers to focus intensely on research and development for retractable, shielded, and passive safety mechanisms, thereby increasing production costs but enhancing market value proposition. Consolidation among major medical device manufacturers is also a prevalent trend, leading to integrated portfolios that offer comprehensive vascular access solutions, influencing pricing strategies and global distribution networks. Furthermore, the growing trend toward outpatient care and home healthcare necessitates the development of user-friendly, specialized IV devices suitable for non-clinical settings, fostering market expansion into non-traditional avenues.

Regionally, North America maintains its dominance due to high healthcare expenditure, established reimbursement policies, and early adoption of advanced safety devices and sophisticated diagnostic procedures. Europe follows closely, driven by standardized healthcare systems and a focus on preventative measures and patient safety protocols. However, the Asia Pacific (APAC) region is poised for the fastest growth, propelled by rapidly improving healthcare infrastructure, massive patient populations, increasing medical tourism, and rising awareness regarding the benefits of sterile, single-use devices. Countries like China and India are emerging as critical manufacturing hubs and massive consumption markets, challenging the traditional market shares held by Western manufacturers, though regulatory complexity and fragmented distribution channels remain regional hurdles.

Segmentation trends indicate a strong performance for the IV Catheter segment, specifically peripheral intravenous catheters (PIVCs), due to their wide usage in routine hospital care. Safety-engineered products are expected to witness the highest CAGR within the product type segment, aligning with global occupational safety mandates. The material segment sees dominance from stainless steel but increasing exploration into advanced polymer coatings to enhance biocompatibility and reduce friction during insertion. End-user analysis highlights Hospitals and Clinics as the primary revenue generators, though specialized segments like Ambulatory Surgical Centers (ASCs) and Dialysis Centers are showing accelerated demand growth, driven by shifting patient volumes away from traditional inpatient settings. Personalized medicine and specialized treatment areas, such as oncology and infectious disease management, are also creating micro-trends demanding specialized, high-gauge needles for targeted, precise drug delivery.

AI Impact Analysis on Intravenous Needles Market

Analysis of common user questions regarding AI's impact on the Intravenous Needles Market reveals key themes centered around precision enhancement, procedural automation, and supply chain optimization. Users frequently inquire whether AI-driven imaging or robotics will make traditional manual needle insertion obsolete, focusing on the potential for autonomous venipuncture systems to reduce human error and minimize patient discomfort. There is significant interest in how AI can optimize the inventory management of high-volume consumables like IV needles within large hospital systems, predicting demand fluctuations and reducing waste. Furthermore, questions arise concerning AI's role in analyzing material science data to design more biocompatible and sharper needles, reducing complication rates associated with prolonged vascular access. The consensus expectation is that AI will revolutionize the *process* surrounding needle use rather than the fundamental product design itself, primarily through guided insertion and logistical efficiency.

- AI integration enhances procedural precision through robotic-assisted or image-guided venipuncture systems, reducing first-attempt failure rates.

- Predictive analytics driven by AI optimizes hospital inventory levels for various needle gauges and types, minimizing stockouts and overstocking.

- Machine learning algorithms analyze large patient datasets to predict the optimal vascular access site and needle type based on patient demographics and clinical history.

- AI-powered quality control systems utilize computer vision to inspect needle sharpness, bevel consistency, and sterility during the manufacturing process, ensuring higher product reliability.

- AI aids in material science research by simulating the interaction of needle surfaces with biological tissues, accelerating the development of low-friction, biocompatible coatings.

- Automated documentation and risk assessment tools, driven by AI, streamline the process of recording IV access procedures and identifying high-risk patients for infiltration or phlebitis.

DRO & Impact Forces Of Intravenous Needles Market

The dynamics of the Intravenous Needles Market are governed by a compelling interplay of driving forces (D), restrictive challenges (R), and latent opportunities (O), which collectively define the overall impact forces shaping its trajectory. The primary driving forces include the mandated implementation of safety-engineered devices globally, fueled by regulatory bodies like the FDA and occupational safety organizations, aiming to protect healthcare professionals from accidental needlesticks and the transmission of bloodborne diseases. Simultaneously, the global rise in the prevalence of chronic illnesses requiring long-term IV therapy, coupled with the expansion of global surgical volumes, consistently drives the baseline demand for both routine and specialized intravenous access products. These factors create a high-volume, high-value environment focused on safety and quality, propelling continuous market expansion.

Conversely, the market faces significant restraints. Pricing pressures, particularly in highly competitive and government-controlled healthcare systems, limit profit margins, forcing manufacturers to seek cost efficiencies in production or relocate manufacturing to low-cost regions. The challenge of proper clinical training and adherence to best practices in peripheral venous access insertion across all healthcare settings contributes to procedural variability and complications, sometimes leading to unfavorable perceptions of device reliability. Furthermore, the risk of accidental needlestick injuries, although mitigated by safety devices, still represents a persistent safety challenge and a major liability concern for manufacturers and healthcare providers alike, requiring substantial investment in continuous risk management and design refinement.

Opportunities for growth are concentrated in the rapid expansion within emerging economies, where healthcare modernization projects are underway, creating vast, untapped markets for advanced, safety-focused IV devices. Technological opportunities lie in the development of "smart" IV devices integrated with sensing capabilities to monitor catheter position and detect complications like infiltration or phlebitis early, offering significant clinical differentiation. Additionally, the increasing trend toward self-administration of therapies in home care settings opens a lucrative avenue for developing extremely simple, patient-friendly, and pre-filled intravenous access systems. The overall impact forces are predominantly positive, favoring safety innovation and global market penetration, albeit tempered by sustained cost containment demands and the need for stringent regulatory compliance.

Segmentation Analysis

The Intravenous Needles Market is systematically segmented based on Product Type, Application, Material, and End-User, providing a granular view of demand patterns and growth drivers across various clinical settings. Product segmentation is crucial as it differentiates between standard hypodermic needles used in syringes, specialized IV infusion sets (e.g., winged or butterfly needles), and the significantly more complex IV catheters (peripheral and central venous catheters), which represent the largest revenue stream due to their indispensable role in hospital care. The distinction between safety-engineered devices and conventional devices heavily influences market share, with the safety segment dominating growth forecasts due to mandatory regulatory adoption and a heightened focus on occupational health standards globally. This intricate segmentation allows manufacturers to tailor their R&D and marketing strategies to specific clinical needs and regulatory requirements, such as focusing on specialized port needles for chemotherapy access or high-flow catheters for emergency trauma care.

Further segmentation by Application demonstrates the pervasive reach of these devices, covering vital areas such as drug delivery (the largest segment), fluid and electrolyte balance restoration, blood sampling/transfusion, and nutrition administration (parenteral feeding). Each application demands specific needle attributes, such as ultra-thin walls for less painful blood draws or specialized anti-kinking materials for long-term central line placement. The End-User segment provides insight into consumption patterns, clearly delineating the massive volume usage in Hospitals and large Clinics compared to the specialized, perhaps lower volume but higher-margin, use in Ambulatory Surgical Centers (ASCs), Diagnostic Laboratories, and Home Healthcare settings. Understanding the purchasing power and clinical protocols unique to each end-user category is vital for accurate market forecasting and distribution planning.

The material segmentation, while currently dominated by stainless steel alloys for the needle shaft itself, is increasingly factoring in the polymers and plastics used for the hubs, safety mechanisms, and catheter tubing. Innovations in polymeric materials focus on improving flexibility, reducing thrombus formation, and enhancing durability for extended dwell times. This detailed market structuring provides the analytical framework necessary for stakeholders to identify high-growth niches, assess competitive threats from alternative drug delivery systems, and prioritize investments in regions or product lines most sensitive to chronic disease proliferation and regulatory adherence. The persistent need for rapid, safe, and effective vascular access across the entire spectrum of medical care solidifies the foundational importance of these segments.

- By Product Type:

- IV Catheters (Peripheral IV Catheters, Midline Catheters, Central Venous Catheters)

- Hypodermic Needles

- Infusion Sets (Winged/Butterfly Needles)

- Specialty Needles (e.g., Implantable Port Access Needles)

- By Safety Mechanism:

- Safety IV Needles/Catheters (Retractable, Shielded, Blunting Mechanism)

- Conventional IV Needles/Catheters

- By Application:

- Drug Delivery (Therapeutics, Chemotherapy)

- Fluid and Nutrient Delivery (Hydration, Parenteral Nutrition)

- Blood Transfusion and Sampling

- By End-User:

- Hospitals and Clinics

- Ambulatory Surgical Centers (ASCs)

- Diagnostic Laboratories

- Home Healthcare Settings

- By Material:

- Stainless Steel

- Polymers (PTFE, Polyurethane, Polyethylene)

Value Chain Analysis For Intravenous Needles Market

The value chain for the Intravenous Needles Market begins with upstream analysis, which is heavily reliant on the sourcing and processing of specialized raw materials, primarily medical-grade stainless steel (for needle shafts) and high-quality polymers (such as PTFE, FEP, and Polyurethane for catheter tubing and hubs). Manufacturers focus intensely on securing reliable suppliers for these materials, emphasizing compliance with stringent purity and biocompatibility standards. The initial manufacturing stage involves precision engineering: grinding the stainless steel tips to achieve optimal bevel sharpness and lubricating surfaces, followed by molding plastic components for hubs and safety features. Technological superiority in micro-manufacturing and sterilization techniques (often using Ethylene Oxide or radiation) is paramount at this stage, establishing the quality foundation for the entire value chain. Investment in automated assembly lines and cleanroom technology represents a major cost component in the upstream phase, ensuring the high-volume production of sterile, single-use devices necessary to meet global demand.

The midstream segment involves the core manufacturing, assembly, packaging, and regulatory approval process. After assembly of the needle, hub, and often complex safety mechanisms, the products undergo rigorous quality control testing, including leak tests, flow rate assessment, and sterility validation, before being packaged in sterile blister packs. Regulatory bodies such as the FDA, CE Mark organizations, and local health ministries play a critical role, requiring extensive documentation and clinical data to ensure device efficacy and safety before market release. Marketing and sales efforts are also integral at this stage, requiring specialized teams capable of articulating the clinical benefits of advanced safety features and adherence to hospital protocols. Pricing strategies are highly competitive, often negotiated in bulk purchasing agreements with large group purchasing organizations (GPOs) or national health systems, impacting margins significantly.

The downstream analysis focuses on distribution channels and end-user consumption. Distribution is primarily handled through a mix of direct sales forces (for major companies targeting key hospital systems) and specialized third-party medical device distributors and wholesalers. These distributors are responsible for managing complex logistics, warehousing sterile stock, and ensuring just-in-time delivery to thousands of end-users, including hospitals, clinics, blood banks, and diagnostic labs. The influence of group purchasing organizations (GPOs) is immense, as they centralize procurement decisions, acting as gatekeepers to major healthcare networks. Indirect channels, such as online marketplaces and specialized medical supply stores, play a growing role, particularly for smaller clinics and home healthcare providers. The final consumption occurs at the patient level, where nurses, physicians, and paramedics utilize the devices, driving feedback loops back to manufacturers regarding ease of use, patient comfort, and needlestick safety performance, thereby initiating further refinements in the value chain.

Intravenous Needles Market Potential Customers

The Intravenous Needles Market targets a broad spectrum of end-users whose operations fundamentally rely on efficient and safe vascular access. The primary and largest customer segment consists of Hospitals and large Clinic chains. These institutions are characterized by high patient turnover, high acuity levels, and the necessity for continuous, high-volume consumables across emergency rooms, surgical suites, general wards, intensive care units (ICUs), and specialized departments like oncology and cardiology. Their purchasing decisions are heavily influenced by product reliability, compliance with safety regulations (driving demand for safety IV devices), and favorable pricing structures achieved through GPO contracts. Hospitals seek comprehensive solutions from manufacturers, often preferring bundled packages that include various needle types, catheters, and peripheral supplies, standardizing their inventory for clinical efficiency.

Another significant customer segment includes Ambulatory Surgical Centers (ASCs) and Outpatient Facilities. As healthcare trends shift toward minimizing inpatient stays, ASCs have become crucial for performing same-day surgeries and minor procedures, requiring reliable IV access for anesthesia administration and perioperative fluid management. While their volume is generally lower than large hospitals, ASCs often demand premium, high-quality, and easy-to-use devices that facilitate quick patient turnover and reduce recovery time complications. Diagnostic Laboratories and Blood Banks form a specialized customer group, primarily utilizing hypodermic needles and butterfly sets for high-frequency phlebotomy. For these users, needle sharpness, minimum patient pain, and accurate venipuncture are key purchasing criteria, often preferring specific smaller gauge options for pediatric or geriatric patients.

The fastest-growing potential customer segment is the Home Healthcare and Long-Term Care segment. Driven by the increasing prevalence of chronic conditions managed outside of traditional clinical settings (e.g., home infusion therapy for chronic infections or pain management), this segment requires simple, robust, and highly reliable devices suitable for administration by caregivers or the patients themselves. The focus here shifts slightly from pure hospital-grade durability to ergonomic design and ease of self-use. Pharmaceutical companies and Contract Research Organizations (CROs) also constitute niche customers, purchasing IV needles for use in clinical trials, requiring meticulously sterilized and often customized specifications for precise drug testing protocols, ensuring that the integrity of the clinical data is maintained.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8,750 Million |

| Market Forecast in 2033 | USD 14,080 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Becton Dickinson (BD), Teleflex Incorporated, B. Braun Melsungen AG, Nipro Corporation, Vygon SA, Medtronic plc, Terumo Corporation, Fresenius SE & Co. KGaA, ICU Medical Inc., Retractable Technologies, Inc., Smiths Group plc, Cardinal Health, AngioDynamics, Inc., ITL Biomedical, Argon Medical Devices, Inc., Trivitron Healthcare, Romsons Group, C. R. Bard (now part of BD), McKesson Corporation, HMD Healthcare |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Intravenous Needles Market Key Technology Landscape

The technological landscape of the Intravenous Needles Market is defined by a relentless pursuit of safety, precision, and material science innovation. The primary technological advancements revolve around safety mechanisms designed to prevent accidental needlestick injuries, adhering strictly to global regulations. This includes the widespread implementation of passive safety features, such as automated retraction systems and spring-loaded shields that immediately cover the sharp tip upon successful withdrawal from the patient. These passive systems represent a major technological upgrade over active systems, which require the user to manually activate the safety feature, thus eliminating human error and significantly improving healthcare worker protection. The manufacturing technology utilized for producing these complex, multi-component safety catheters requires highly specialized tooling, precision injection molding of polymers, and automated assembly in certified cleanroom environments, maintaining extremely tight tolerances for optimal function.

Material science technology is also playing a crucial role in enhancing performance and patient outcomes. Innovations focus on developing catheter materials, such as advanced polyurethanes and proprietary fluoropolymers, that offer better biocompatibility, reduced thrombogenicity (clot formation), and enhanced resistance to kinking and compression, allowing for longer dwelling times and reducing the incidence of phlebitis. Furthermore, technologies like thin-wall cannula design allow for larger flow rates through smaller gauge needles, improving patient comfort while maintaining clinical utility. Needle tips are continuously optimized using complex bevel geometries (e.g., lancet points, back-cut bevels) and electropolishing techniques to minimize friction and insertion pain, improving first-pass success rates, a critical measure in clinical efficiency and patient satisfaction scores.

Looking forward, the integration of smart technologies is defining the next generation of IV access devices. This includes catheters equipped with micro-sensors capable of monitoring subtle changes in pressure or pH, which can signal early infiltration or infection, transmitting data wirelessly to monitoring systems. Visualization technology, such as near-infrared (NIR) vein finders, while external to the needle itself, is becoming an indispensable auxiliary tool, significantly improving the success rate of venipuncture, especially in difficult-to-access patients (e.g., obese, dehydrated, or pediatric populations). These technological advancements collectively drive premium pricing and differentiation among market competitors, shifting the focus from commodity pricing toward value-based procurement based on verifiable safety and clinical efficacy data. The adoption of radio-opaque markers within catheter material also remains a vital technological specification, ensuring visibility under X-ray or fluoroscopy for accurate placement confirmation.

Regional Highlights

- North America (U.S. and Canada): This region is the undisputed leader in the Intravenous Needles Market, driven by high per capita healthcare spending, well-established reimbursement frameworks, and mandatory enforcement of safety regulations regarding sharp devices. The U.S. represents the largest individual market globally, characterized by high adoption rates of premium, safety-engineered IV catheters and advanced diagnostic procedures. The presence of major market players and sophisticated research institutions further propels technological innovation and rapid commercialization of new products.

- Europe (Germany, UK, France, Italy, Spain): Europe holds a substantial market share, marked by centralized healthcare systems prioritizing patient safety and universal access. Regulatory harmonization through the European Medicines Agency (EMA) and similar bodies ensures consistent quality standards. Growth is steady, fueled by an aging population and increasing demand for specialized long-term vascular access devices, though intense competition often results in aggressive price negotiations.

- Asia Pacific (APAC) (China, India, Japan, South Korea): APAC is projected to exhibit the highest CAGR due to rapid infrastructure development, increased government investment in healthcare modernization, and a vast, growing patient base suffering from chronic lifestyle diseases. China and India are major engines of demand and also emerging manufacturing powerhouses. However, market penetration varies significantly; Japan and South Korea demonstrate mature market characteristics with high safety adoption, while developing nations are rapidly transitioning from reusable to single-use sterile devices.

- Latin America (Brazil, Mexico, Argentina): This region is characterized by fragmented healthcare systems and significant economic disparities, leading to a strong price sensitivity. The market is slowly adopting safety devices, primarily driven by international hospital accreditation requirements and private sector investment. Growth is steady, relying heavily on imports from global manufacturers, with increasing awareness campaigns on infection prevention serving as a key driver.

- Middle East and Africa (MEA) (GCC Countries, South Africa): The Gulf Cooperation Council (GCC) nations are major contributors to market growth in MEA, owing to significant investments in world-class medical infrastructure and high standards of care, attracting medical tourists. Demand is focused on specialized products and premium devices. In contrast, the African subcontinent presents high market potential but faces challenges related to limited infrastructure, low reimbursement rates, and dependence on international aid for essential medical supplies, focusing primarily on low-cost, conventional devices.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Intravenous Needles Market.- Becton Dickinson (BD)

- Teleflex Incorporated

- B. Braun Melsungen AG

- Nipro Corporation

- Vygon SA

- Medtronic plc

- Terumo Corporation

- Fresenius SE & Co. KGaA

- ICU Medical Inc.

- Retractable Technologies, Inc.

- Smiths Group plc

- Cardinal Health

- AngioDynamics, Inc.

- ITL Biomedical

- Argon Medical Devices, Inc.

- Trivitron Healthcare

- Romsons Group

- C. R. Bard (now part of BD)

- McKesson Corporation

- HMD Healthcare

- Nipro Medical Corporation

- Narang Medical Limited

- F. Hoffmann-La Roche Ltd

- Johnson & Johnson Services, Inc.

- Nihon Kohden Corporation

- Boston Scientific Corporation

- Conmed Corporation

- Sterin Labs

- Dispo Lab

- Sterlite India

- Kawasaki Medical Corporation

- Mani, Inc.

- Narang Medical Devices

- Sutures India Pvt. Ltd.

- JMS Co., Ltd.

- Cook Medical LLC

- B. Braun Medical Inc.

- BD Medical

- Teleflex Medical

- Vygon SAS

- Terumo Medical Corporation

- Smiths Medical International

- Cardinal Health, Inc.

- Argon Medical Devices

- ITL Health Group

Frequently Asked Questions

Analyze common user questions about the Intravenous Needles market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Intravenous Needles Market?

Market growth is primarily driven by the increasing global prevalence of chronic diseases requiring frequent IV therapy, the mandatory adoption of safety-engineered devices to protect healthcare workers from needlestick injuries, and significant advancements in healthcare infrastructure, particularly in emerging economies.

How does the mandate for safety-engineered devices impact product development?

The regulatory mandates necessitate continuous investment in R&D to develop passive safety features, such as automated retraction and shielded mechanisms, shifting the market focus toward higher-value products and away from conventional, non-safety devices, thereby increasing the average selling price and market complexity.

Which product segment holds the largest share in the IV Needles Market?

The IV Catheters segment, specifically Peripheral Intravenous Catheters (PIVCs), maintains the largest market share due to their widespread, indispensable use across almost all hospital settings for fluid and drug administration, diagnostics, and routine patient care.

What role does the Asia Pacific region play in the future market growth?

The Asia Pacific region is expected to demonstrate the highest Compound Annual Growth Rate (CAGR) due to rapid improvements in healthcare access, large patient populations, rising health awareness, and substantial government investments aimed at modernizing medical facilities and improving clinical standards.

What technological innovations are currently trending in the IV Needles Market?

Key technological trends include the integration of advanced materials for enhanced biocompatibility, the development of ultra-sharp bevel geometries for reduced insertion pain, and the emergence of "smart" IV devices incorporating sensors to detect early signs of complications like infiltration or phlebitis.

Are pricing pressures significantly restraining market expansion?

Yes, intense competition and centralized purchasing power from Group Purchasing Organizations (GPOs) and national health systems often result in aggressive pricing negotiations, acting as a restraint on profit margins, particularly for conventional and non-differentiated products.

How is the shift toward home healthcare influencing the demand for IV needles?

The expansion of home healthcare for chronic condition management is creating a growing demand for user-friendly, highly reliable IV access devices, suitable for self-administration or use by non-professional caregivers, opening opportunities for specialized, pre-packaged infusion kits.

What are the critical considerations for manufacturers in the upstream value chain?

Manufacturers must prioritize secure sourcing of high-purity medical-grade stainless steel and polymers, invest in sophisticated precision engineering techniques for bevel grinding, and maintain stringent cleanroom standards for sterile assembly and packaging to ensure product safety and quality compliance.

Which end-user segment is showing the fastest adoption of specialized IV needles?

Ambulatory Surgical Centers (ASCs) and specialized Dialysis Centers are showing accelerated adoption rates, driven by high procedural volumes and the need for premium, efficient vascular access devices to manage rapid patient throughput and minimize complications outside of traditional inpatient settings.

Does Artificial Intelligence have a direct impact on needle design?

While AI does not directly manufacture the needle, it significantly influences the process. AI supports material science R&D by simulating tissue interaction and optimizes manufacturing quality control through computer vision, ensuring consistency in sharpness and safety mechanism function.

What are the major challenges in the Latin American market?

The Latin American market faces challenges related to fragmented healthcare systems, high price sensitivity, reliance on imported goods, and varying levels of regulatory compliance across different countries, although private sector growth is slowly driving modernization and safety adoption.

How important are GPOs in the distribution channel?

Group Purchasing Organizations (GPOs) are immensely important, acting as central purchasing agents for large hospital networks. They standardize product selection, negotiate bulk pricing, and effectively control market access for major manufacturers, making GPO contracts essential for achieving significant market penetration.

What material advancements are key for IV catheters?

Key advancements focus on proprietary polymer formulations (e.g., advanced polyurethanes) offering superior flexibility, anti-kink properties, and reduced surface roughness to minimize friction upon insertion and reduce the risk of phlebitis and clot formation during extended dwell times.

What is the estimated growth rate (CAGR) for the forecast period?

The Intravenous Needles Market is projected to exhibit a Compound Annual Growth Rate (CAGR) of 6.8% between the years 2026 and 2033, reflecting consistent demand fueled by global healthcare needs and safety innovations.

Why is sterilization technique critical in the manufacturing of IV needles?

Sterilization, typically using Ethylene Oxide or radiation, is critical because IV needles are invasive, single-use devices. Absolute sterility is paramount to prevent hospital-acquired infections (HAIs) and ensure patient safety, making sterilization compliance a non-negotiable regulatory requirement.

What distinguishes Central Venous Catheters from Peripheral IV Catheters in market segmentation?

Central Venous Catheters (CVCs) are designed for long-term, high-flow access into major veins, often requiring surgical placement and specialized materials, commanding a higher price point. Peripheral IV Catheters (PIVCs) are common, short-term devices inserted into superficial veins, representing the highest volume segment of the market.

How do chronic diseases influence IV needle demand?

The rise in chronic diseases, such as cancer and diabetes, necessitates repeated or continuous intravenous treatments (e.g., chemotherapy, insulin infusions), directly increasing the demand for highly reliable, specialized IV access products and long-term catheter solutions.

What is the significance of the thin-wall cannula technology?

Thin-wall cannula technology allows manufacturers to produce needles that have a larger internal diameter (lumen) relative to their external gauge size. This facilitates higher flow rates, which is crucial in emergency medicine or rapid infusion scenarios, without compromising patient comfort associated with a wider needle insertion.

Which application segment accounts for the highest usage volume?

The Drug Delivery application segment accounts for the highest usage volume, covering the vast administration of therapeutics, antibiotics, pain management medications, and chemotherapy agents directly into the bloodstream in various clinical settings globally.

What are the key geopolitical challenges affecting the global supply chain for IV needles?

Geopolitical challenges include reliance on specific regions (like Asia Pacific) for raw material sourcing and manufacturing, trade tariffs, and sudden export/import restrictions, which can disrupt the supply chain for these high-volume, essential medical consumables, requiring manufacturers to establish robust contingency plans.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager