Intravitreal Injectable Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435511 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Intravitreal Injectable Market Size

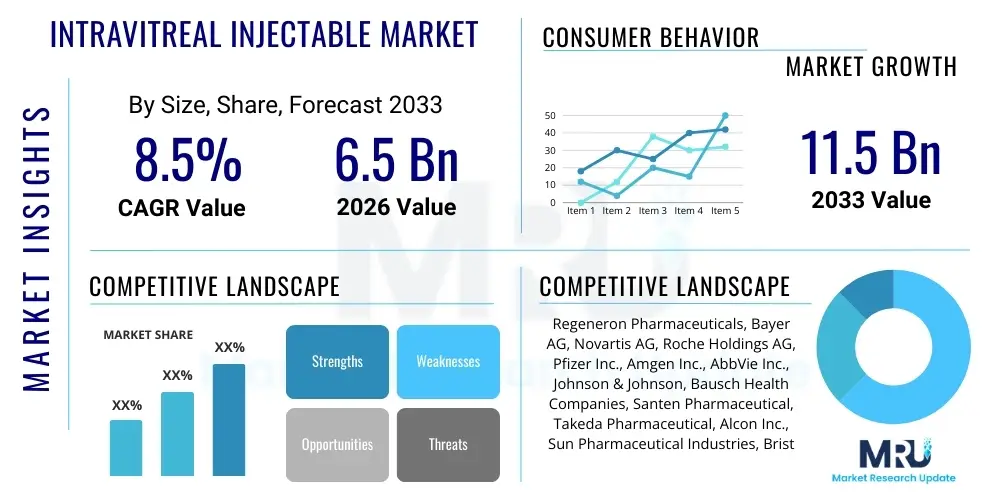

The Intravitreal Injectable Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 6.5 Billion in 2026 and is projected to reach USD 11.5 Billion by the end of the forecast period in 2033. This substantial growth is driven primarily by the escalating global prevalence of chronic ocular diseases such as Age-related Macular Degeneration (AMD) and Diabetic Retinopathy (DR), coupled with significant advancements in drug delivery systems and pharmacological agents tailored for posterior segment diseases.

Intravitreal Injectable Market introduction

The Intravitreal Injectable Market encompasses therapeutic agents, predominantly biologics and corticosteroids, administered directly into the vitreous humor of the eye. This targeted delivery mechanism ensures optimal drug concentration at the retina and choroid, making it the gold standard treatment for managing severe retinal vascular diseases and inflammatory conditions. Key products include vascular endothelial growth factor (VEGF) inhibitors, which revolutionize the management of neovascular AMD and diabetic macular edema (DME) by inhibiting pathological angiogenesis and reducing vascular permeability. The effectiveness of intravitreal injections stems from their ability to bypass systemic barriers, minimizing side effects while maximizing therapeutic efficacy within the eye.

Major applications driving this market include the treatment of Age-related Macular Degeneration (wet AMD), Diabetic Retinopathy (DR), Diabetic Macular Edema (DME), and Retinal Vein Occlusion (RVO). These conditions represent significant global public health burdens, often leading to irreversible vision loss if left untreated. The core benefit of intravitreal therapeutics is the preservation and improvement of visual acuity, offering patients a minimally invasive, outpatient procedure with high clinical success rates. Furthermore, the sustained release formulations currently under development promise to reduce the frequency of injections, thereby improving patient compliance and reducing the burden on healthcare systems.

Driving factors for market expansion include the rapidly aging global population, which correlates directly with an increased incidence of AMD; the rising prevalence of diabetes worldwide, leading to higher cases of DR and DME; and continuous innovation in drug development, particularly the introduction of biosimilars and novel agents targeting multiple pathways. Additionally, enhanced diagnostic capabilities and increased awareness among ophthalmologists regarding early intervention protocols further bolster market growth, cementing intravitreal administration as the primary modality for severe posterior segment ocular diseases.

Intravitreal Injectable Market Executive Summary

The Intravitreal Injectable Market is characterized by robust commercial activity, dominated by a few major pharmaceutical entities specializing in ophthalmology biologics. Key business trends include the intense competitive landscape in the anti-VEGF segment, prompting heavy investment in next-generation molecules offering extended durability, such as high-dose formulations and novel combination therapies. The trend towards sustained-release implants and reservoir devices is a transformative technological shift, aiming to reduce the treatment burden associated with frequent injections. Furthermore, strategic partnerships and acquisitions focusing on gene therapy delivery systems for ocular conditions are shaping the long-term strategic direction of major players, indicating a pivot toward potentially curative or long-lasting single-dose treatments.

Regionally, North America maintains the largest market share due to sophisticated healthcare infrastructure, high reimbursement rates, and early adoption of premium injectable therapies. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth rate, fueled by the massive diabetic population in countries like China and India, increasing access to advanced healthcare, and rising disposable incomes that enable patients to afford biological treatments. European markets remain strong, driven by centralized healthcare systems and increasing utilization of approved biosimilars, which are applying downward pressure on pricing while expanding patient access. Regulatory harmonization across major jurisdictions is also facilitating faster market entry for new injectable products, supporting global market expansion.

Segment trends highlight the persistent dominance of the Anti-VEGF drug class, which accounts for the majority of market revenue, driven by established efficacy and wide-ranging application across AMD and DME. Within applications, Age-related Macular Degeneration continues to be the primary revenue generator, although Diabetic Macular Edema is rapidly gaining share due to the global diabetes epidemic. The End User segment is shifting, with a growing number of procedures moving from inpatient hospital settings to specialized retina clinics and Ambulatory Surgical Centers (ASCs), driven by cost-efficiency and convenience. This decentralization of care necessitates the optimization of supply chains and cold chain logistics for these temperature-sensitive injectable drugs.

AI Impact Analysis on Intravitreal Injectable Market

User queries regarding AI's influence in the Intravitreal Injectable Market frequently revolve around two main themes: enhancing diagnostic accuracy for treatment initiation, and optimizing the treatment workflow (prediction of response, personalized dosing). Users are keen to understand how AI algorithms can predict which patients will respond best to anti-VEGF therapy, thus reducing unnecessary injections and minimizing the associated risks. Concerns are also raised about the integration challenges of AI-powered image analysis tools (OCT and fundus photography) into existing clinical workflows and the regulatory hurdles associated with using machine learning models for critical treatment decisions. The consensus expectation is that AI will primarily serve as a powerful tool for screening, precise disease monitoring, and clinical trial acceleration, rather than directly replacing the procedural administration of the injectables themselves.

AI's role is particularly transformative in improving injection scheduling. Currently, many patients receive injections based on rigid schedules (e.g., monthly). However, AI models trained on vast datasets of imaging and patient characteristics can identify subtle changes indicative of disease activity recurrence, enabling ophthalmologists to adopt more personalized, proactive treatment regimens (treat-and-extend protocols). This optimization not only improves patient outcomes by reducing the time spent in active disease but also significantly lowers the overall cost and volume of injections required over the patient's lifetime, thereby altering market demand dynamics towards higher efficacy and reduced injection frequency.

Furthermore, Artificial Intelligence is increasingly being deployed in manufacturing and quality control processes for injectable drug formulation. AI-driven robotics and advanced analytics ensure higher precision, sterility, and consistency in filling and packaging sensitive biological agents, reducing batch failures and optimizing yield. In clinical development, AI accelerates the identification of viable drug candidates and simulates complex biological responses, shortening the time-to-market for novel intravitreal therapies. This multifaceted application of AI, spanning diagnostics, personalized medicine, and manufacturing efficiency, reinforces its critical role as an enabling technology across the entire value chain.

- AI facilitates high-throughput screening of retinal images (OCT/Fundus) for early detection of pathology.

- Predictive analytics optimize personalized dosing and injection frequency, potentially reducing the total volume of administered drugs per patient.

- Machine learning models aid in identifying non-responders to standard anti-VEGF therapy, directing patients toward alternative treatments faster.

- Automation and robotics, often AI-guided, enhance the precision and safety of intravitreal injection manufacturing and packaging.

- AI accelerates clinical trial design and patient recruitment for new injectable candidates, speeding up R&D cycles.

DRO & Impact Forces Of Intravitreal Injectable Market

The Intravitreal Injectable Market is subject to a complex interplay of drivers, restraints, and opportunities that collectively shape its trajectory. The primary driver is the exponentially increasing global burden of chronic eye diseases linked to lifestyle factors and population demographics, necessitating long-term therapeutic intervention. However, the market faces significant restraints, notably the high cost associated with proprietary biological drugs and the need for frequent administration, which presents a substantial logistical and financial burden on patients and healthcare systems. The inherent risks of the procedure itself, including endophthalmitis and vitreous hemorrhage, also limit patient acceptance in certain demographics. Despite these hurdles, the opportunity landscape is vast, centered around developing long-acting therapies, exploring combination products, and expanding market penetration into emerging economies where treatment rates are currently low.

Impact forces within this specialized market are intensely regulated, requiring substantial clinical evidence for new product approvals. The market is also heavily influenced by reimbursement policies, particularly in Western markets, where the coverage of high-cost biologics dictates physician prescribing behavior and patient access. Technological impact forces, particularly those relating to sustained-release technologies (e.g., port delivery systems) and gene therapies, promise to revolutionize the treatment paradigm by significantly extending the duration of action, potentially transforming chronic treatment regimens into intermittent or even one-time interventions. Competitive forces are extremely high, driven by patent expirations leading to biosimilar erosion in established anti-VEGF segments, forcing innovators to continually invest in novel mechanisms of action to maintain market leadership.

Furthermore, socio-economic factors related to global aging and rising incidence of diabetes act as profound external drivers, constantly inflating the patient pool requiring intravitreal intervention. Conversely, the complexity of manufacturing biologics, requiring strict adherence to cold chain management and sophisticated sterile techniques, acts as a structural restraint to rapid market entry by smaller competitors. Successfully navigating the development of user-friendly injection devices, coupled with robust patient education initiatives, will be crucial for capitalizing on the market opportunities presented by the underserved populations globally.

Segmentation Analysis

The Intravitreal Injectable Market is segmented across Drug Class, Application, and End User, providing a detailed view of the therapeutic landscape and consumption patterns. Segmentation by Drug Class is critical, distinguishing between established anti-VEGF agents, which form the bedrock of current treatment, and niche classes like corticosteroids and antibiotics used for inflammatory and infectious conditions, respectively. The Application segment reveals the disease burden distribution, with AMD historically dominating revenues, although the sheer volume associated with diabetic complications (DR/DME) is rapidly increasing its market prominence. Analyzing the End User segment highlights the shift in procedural location, reflecting optimization strategies adopted by payers and providers to minimize overhead costs and enhance patient flow efficiency.

Understanding these segments is essential for strategic planning. For instance, companies focusing on the Anti-VEGF class must anticipate biosimilar competition and differentiate their offerings based on durability (extended dosing intervals) and specific patient profiles. Conversely, segments focusing on niche applications, such as uveitis treatments utilizing specialized corticosteroids or immunosuppressants, often command higher premium pricing but have smaller target populations. The growing emphasis on preventative care and early diagnosis, particularly for diabetic retinopathy, suggests that future growth will increasingly concentrate on less invasive monitoring and treatment regimens, potentially shifting the focus toward less frequent, high-impact therapeutic interventions, thereby impacting the unit sales volume but boosting the value per dose.

The segmentation structure reflects the maturity of the market. While anti-VEGF therapies are well-established, significant future growth is expected from emerging segments like targeted protein inhibitors and gene therapies designed for sustained intraocular expression. The shift towards Ambulatory Surgical Centers (ASCs) as preferred sites for injections in developed economies is a direct result of successful healthcare policy initiatives aimed at reducing hospital reliance for routine outpatient procedures, demanding specialized logistical support from drug manufacturers and distributors to ensure timely supply to these decentralized facilities.

- By Drug Class:

- Anti-VEGF Agents (Aflibercept, Ranibizumab, Bevacizumab, Brolucizumab, Faricimab)

- Corticosteroids (Dexamethasone, Fluocinolone Acetonide)

- Antibiotics/Antifungals (For endophthalmitis)

- Novel Agents and Biosimilars

- By Application:

- Age-related Macular Degeneration (AMD)

- Diabetic Retinopathy (DR)

- Diabetic Macular Edema (DME)

- Retinal Vein Occlusion (RVO)

- Uveitis and other Ocular Inflammations

- By End User:

- Hospitals

- Specialty Clinics

- Ambulatory Surgical Centers (ASCs)

Value Chain Analysis For Intravitreal Injectable Market

The value chain for the Intravitreal Injectable Market is highly specialized and complex, beginning with extensive upstream research and development, predominantly conducted by large pharmaceutical and biotechnology companies. Upstream activities involve the discovery of novel biological targets, often requiring complex genetic engineering and large-scale cell culture for manufacturing monoclonal antibodies or fusion proteins. The regulatory burden at this stage is extremely high, contributing significantly to the final cost of the product. Key upstream suppliers include bioreactor manufacturers, specialized excipient providers, and contract research organizations (CROs) supporting clinical trials. Efficiency in upstream processing, particularly achieving high yield in biologic manufacturing, is a major competitive differentiator.

Midstream activities focus on formulation, aseptic filling, and packaging. Due to the sensitivity of biologics and the strict requirement for sterility in an ophthalmic product, specialized cold chain logistics are integrated early in the manufacturing process. Manufacturers often employ advanced isolator technology to ensure the injectable solutions are prepared in a highly controlled environment. The distribution channel is crucial; direct distribution models are often used for high-value biologics to maintain tight control over temperature monitoring and inventory management, ensuring product integrity until it reaches the point of care. Indirect distribution involves specialized wholesalers and distributors that maintain certified cold storage facilities, particularly important for reaching smaller specialty clinics.

Downstream analysis centers on the prescribing physicians (retina specialists) and the end users (hospitals, specialty clinics, and ASCs). The market is highly influenced by payer dynamics; strong reimbursement support is necessary for market success. The final stage involves the actual administration of the drug, which is a highly technical, minimally invasive procedure requiring trained personnel. Potential customers, therefore, are not just the prescribing physicians but also the institutional buyers who manage the procurement and stock levels of these high-cost therapeutics. The rapid growth of ASCs suggests a streamlining of the downstream workflow, focusing on patient throughput and optimizing the overall injection experience.

Intravitreal Injectable Market Potential Customers

The primary potential customers and end-users of intravitreal injectables are institutional entities responsible for providing specialized ophthalmic care to patients suffering from posterior segment eye diseases. These buyers include large tertiary care hospitals, which handle complex cases and often serve as training centers; dedicated specialty eye clinics, which focus exclusively on retina diseases and perform the highest volume of injections; and Ambulatory Surgical Centers (ASCs), increasingly preferred for routine, repetitive procedures due to lower operational costs compared to hospitals. The buying decision is highly influenced by formulary inclusion and negotiated pricing contracts, often managed by pharmacy and therapeutics (P&T) committees within these organizations, prioritizing drugs based on efficacy, safety profile, and cost-effectiveness in comparison to biosimilar alternatives.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.5 Billion |

| Market Forecast in 2033 | USD 11.5 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Regeneron Pharmaceuticals, Bayer AG, Novartis AG, Roche Holdings AG, Pfizer Inc., Amgen Inc., AbbVie Inc., Johnson & Johnson, Bausch Health Companies, Santen Pharmaceutical, Takeda Pharmaceutical, Alcon Inc., Sun Pharmaceutical Industries, Bristol-Myers Squibb, Mylan N.V. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Intravitreal Injectable Market Key Technology Landscape

The technological landscape of the Intravitreal Injectable Market is rapidly evolving, moving beyond standard bolus injections toward sustained drug delivery systems designed to significantly reduce the frequency of patient visits and improve therapeutic continuity. The paramount technology currently garnering attention is the development of sustained-release drug delivery platforms. These include biodegradable polymer implants, such as those used for corticosteroids, and non-biodegradable reservoir systems, such as port delivery systems (PDS), which are surgically inserted and refilled. These innovations fundamentally change the treatment modality from reactive, frequent injections to prophylactic, long-term drug exposure, dramatically improving the quality of life for chronically ill patients and potentially enhancing overall clinical outcomes by maintaining consistent therapeutic drug levels.

Another crucial technological advancement involves the formulation science for the biological drugs themselves. Next-generation anti-VEGF agents are being engineered for higher potency and greater affinity for the target, allowing for the administration of lower doses or maintaining efficacy over longer intervals. This includes utilizing bispecific antibodies or small molecule inhibitors that target multiple pathological pathways, such as anti-VEGF and anti-Angiopoietin-2. Furthermore, the convergence of ophthalmology and gene therapy represents a long-term transformative technology. Gene therapy aims to deliver genetic material (via AAV vectors) directly into retinal cells, instructing them to perpetually produce the therapeutic protein (e.g., an anti-VEGF factor), offering the prospect of a one-time, potentially curative treatment. While still in early commercial stages, these technologies represent the highest value potential within the R&D pipeline.

The technology of injection devices is also undergoing refinement. The focus is on improving patient comfort and reducing the risk of procedural complications, particularly endophthalmitis. This includes pre-filled syringes optimized for precise volume delivery and minimizing medication waste, as well as the integration of advanced visualization technologies to ensure accurate drug placement. The overall technological thrust is directed at reducing the treatment burden—both logistical (fewer visits) and biological (extended duration of action)—thereby cementing the market's trajectory towards highly sophisticated, long-acting therapeutics. The implementation of AI in diagnostics and follow-up monitoring complements these pharmacological advancements by ensuring that these sophisticated treatments are deployed optimally and personalized to individual patient needs, further maximizing the cost-effectiveness of these premium technological solutions.

Regional Highlights

North America, particularly the United States, holds the dominant share in the Intravitreal Injectable Market. This leadership position is attributed to several critical factors including high per capita healthcare spending, the presence of major pharmaceutical innovators, and a well-established reimbursement framework that readily covers high-cost biological therapies for chronic retinal diseases. The region benefits from a high incidence of age-related diseases and a robust clinical practice environment where retina specialists are quick to adopt newly approved, technologically advanced injectables. The intense competition between pharmaceutical giants drives continuous product innovation and aggressive marketing strategies, maintaining the region's revenue superiority. Furthermore, the strong regulatory environment, while stringent, provides a high level of confidence in product quality, supporting premium pricing models.

Europe represents a mature market characterized by universal healthcare coverage and increasing cost consciousness. While the prevalence of target diseases remains high, market dynamics are shifting due to the successful entry and adoption of anti-VEGF biosimilars, particularly in countries like Germany and the UK. This trend is facilitating broader patient access but is exerting downward pressure on average selling prices (ASPs) of established branded drugs. Key growth is concentrated in Central and Eastern Europe, where healthcare infrastructure improvements are making specialized retina treatments more accessible. Regulatory bodies, such as the European Medicines Agency (EMA), facilitate relatively unified market access, but national procurement policies significantly influence the commercial success of individual products.

The Asia Pacific (APAC) region is forecasted to be the fastest-growing market globally. This exponential growth is underpinned by the region's massive and rapidly aging population, coupled with the alarming rise in diabetes prevalence, particularly in developing economies such as India, China, and Southeast Asia. The market expansion is supported by increasing government investment in healthcare infrastructure, growing awareness among patients, and the gradual improvement in reimbursement mechanisms for advanced ophthalmic treatments. While cost sensitivity remains a constraint, the sheer volume of potential patients creates significant market opportunity. Japan and South Korea, with their advanced healthcare systems, serve as early adopters of high-end therapies, bridging the technology gap between North America and the rest of APAC, thereby driving overall regional market acceleration and influencing regional distribution strategies.

- North America: Market leader due to high adoption rates of premium biologics, strong reimbursement policies, and established infrastructure for specialized retina care.

- Europe: Significant market driven by high disease prevalence; increasing biosimilar penetration and cost-containment measures are defining commercial strategies.

- Asia Pacific (APAC): Highest growth trajectory fueled by demographic factors, massive diabetic population growth, and increasing access to modern specialty treatments in China and India.

- Latin America (LATAM): Emerging market characterized by fragmented healthcare systems and reliance on public tenders; growth is slow but steady, driven by urbanization and rising disease incidence.

- Middle East and Africa (MEA): Smallest market share, but experiencing growth driven by medical tourism hubs and increasing governmental efforts to modernize specialized healthcare services in affluent Gulf nations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Intravitreal Injectable Market, encompassing their strategic initiatives, product portfolios, R&D expenditures, recent developments, and market positioning. These companies are central to defining therapeutic standards and innovation within the ophthalmology sector.- Regeneron Pharmaceuticals (Dominant in anti-VEGF market with established products and pipeline innovations.)

- Bayer AG (Strong commercial partnership with Regeneron, focusing on ex-U.S. distribution and market penetration.)

- Novartis AG (Major player with a broad ophthalmology portfolio, focusing on next-generation anti-VEGF therapies and sustained-release delivery.)

- Roche Holdings AG (Leading innovator, strategically investing in long-acting molecules and port delivery systems to revolutionize chronic care.)

- Pfizer Inc. (Engaged in the market primarily through research collaboration and targeting biosimilar development and niche therapeutic areas.)

- Amgen Inc. (Focusing heavily on biosimilars development for key anti-VEGF agents, leveraging expertise in large molecule manufacturing.)

- AbbVie Inc. (Investments focused on sustained-release technology and expanding portfolio through strategic acquisitions in ocular drug delivery.)

- Johnson & Johnson (Utilizing advanced delivery technologies and exploring adjacent therapeutic areas like inflammation and gene therapy.)

- Bausch Health Companies (Concentrating on specialized ophthalmic pharmaceuticals and devices, ensuring broad product accessibility.)

- Santen Pharmaceutical (Strong presence in the Asian market, developing drugs for posterior segment diseases and specialty injectables.)

- Takeda Pharmaceutical (Expanding presence in complex biologics, with pipeline focus on inflammatory ocular conditions.)

- Alcon Inc. (Primarily focused on surgical devices but provides supportive injection preparation and administration tools.)

- Sun Pharmaceutical Industries (Growing presence in generic and biosimilar ophthalmology, particularly targeting emerging markets.)

- Bristol-Myers Squibb (Strategic R&D in novel targets for retinal disease and inflammatory pathways.)

- Mylan N.V. (Now Viatris, a key provider of cost-effective biosimilar options, increasing global market accessibility.)

Frequently Asked Questions

Analyze common user questions about the Intravitreal Injectable market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary applications of intravitreal injectables?

The primary applications include treating chronic sight-threatening conditions affecting the retina, such as Age-related Macular Degeneration (AMD), Diabetic Macular Edema (DME), and Retinal Vein Occlusion (RVO). These treatments aim to stabilize or improve vision by inhibiting pathological vessel growth and reducing fluid leakage.

How is the Intravitreal Injectable Market expected to grow?

The market is projected to grow significantly at a CAGR of 8.5% through 2033, driven by the global aging population, the rising incidence of diabetes, and continuous innovation in long-acting drug delivery technologies that improve patient compliance and efficacy.

What are the key technological advancements transforming the market?

Key technological advancements include the development of sustained-release drug delivery systems (implants and port devices) that reduce injection frequency, the emergence of highly potent next-generation anti-VEGF molecules, and the introduction of ocular gene therapies aiming for long-term vision maintenance with a single dose.

How do biosimilars impact the pricing and access in this market?

Biosimilars exert substantial downward pressure on the pricing of originator anti-VEGF products, leading to cost savings for healthcare systems. This increased competition improves patient access to high-quality biological treatments, especially in cost-sensitive regions like Europe and emerging APAC markets, accelerating overall volume growth.

Which region dominates the Intravitreal Injectable Market and why?

North America dominates the market due to its advanced healthcare infrastructure, high purchasing power, generous reimbursement policies for premium biologics, and the early adoption of innovative therapeutic strategies by specialized retina practices.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager