Invar Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433718 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Invar Market Size

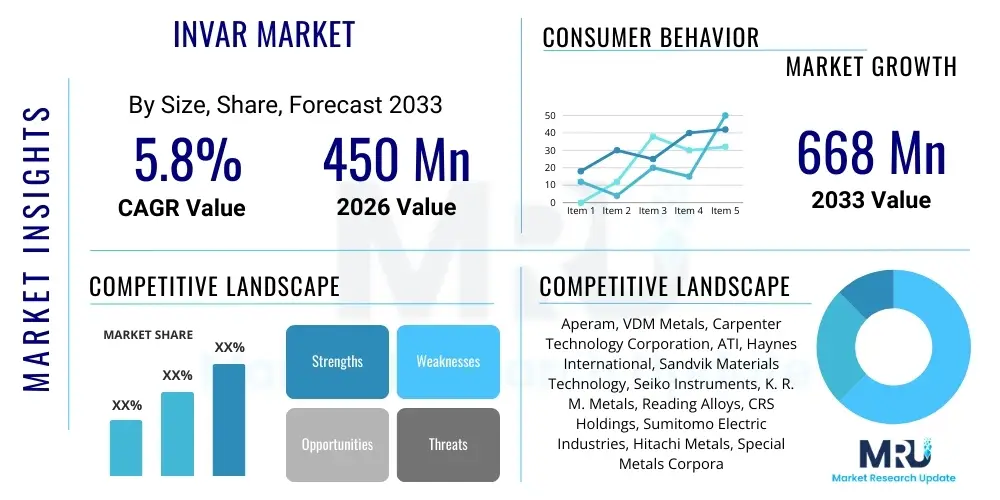

The Invar Market, driven by its exceptional thermal expansion stability critical for precision engineering applications, is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 668 Million by the end of the forecast period in 2033. This consistent growth trajectory is largely underpinned by increasing demand from sectors requiring high thermal stability, such as advanced optics, satellite communication systems, and cryogenic liquid handling infrastructure, where temperature fluctuations must not compromise structural integrity or operational precision.

The valuation reflects the high cost associated with producing and processing these specialized nickel-iron alloys, particularly given the stringent quality control and certification required for aerospace and defense applications. Market expansion is strategically constrained yet highly valued, focusing less on volume and more on specialized, high-margin segments. Investment in additive manufacturing techniques for Invar components is expected to slightly reduce production costs and lead times, thereby contributing marginally to volume growth while significantly expanding application scope, especially in custom, geometrically complex parts for high-tech instrumentation.

Invar Market introduction

The Invar market encompasses the production, processing, and distribution of Invar alloys, primarily Invar 36 (FeNi36), renowned for its uniquely low coefficient of thermal expansion (CTE) at ambient temperatures. This material, typically composed of 36% nickel and 64% iron, is indispensable in applications where dimensional stability across varying temperatures is paramount, preventing measurement drift or structural failure. Key product descriptions include various forms such as rods, sheets, plates, wires, and specialized components manufactured through casting, forging, and increasingly, powder metallurgy techniques. The exceptional characteristic of Invar, often termed the Invar effect, makes it a critical material for high-precision systems.

Major applications of Invar span high-stakes industries including aerospace (for satellite components, composite tooling molds, and critical structural elements), optics and photonics (in laser systems, precision instruments, and telescope mirror mounts), electronics (for CRT shadow masks and specialized semiconductor manufacturing equipment), and civil engineering (in precision measuring tapes and specialized bimetallic strips). The primary benefit of using Invar is the minimization of thermal strain, which ensures operational reliability and longevity of complex systems operating across wide temperature differentials, offering performance impossible to achieve with conventional structural metals.

Driving factors for this specialized market include the escalating global investment in space infrastructure, the proliferation of high-resolution optical instruments for research and defense, and the continuous miniaturization and performance enhancement required in semiconductor fabrication equipment. Furthermore, the growing use of advanced composite materials necessitates precision tooling, frequently made of Invar, to ensure the composites cure without internal stress caused by mismatched CTEs between the tool and the part. These factors collectively establish Invar as an irreplaceable material for cutting-edge technological development.

Invar Market Executive Summary

The global Invar market is experiencing steady growth characterized by technological advancements in processing and sustained high demand from highly specialized end-use sectors. Business trends highlight a consolidation of manufacturing capabilities among major specialty metal producers, focusing on vertical integration to control quality and supply chain resilience. Innovation is centered around developing modified Invar alloys (e.g., Super Invar, Kovar) tailored for specific thermal and magnetic requirements, and leveraging Additive Manufacturing (AM) to create near-net-shape components, reducing material waste and machining time which are traditionally high cost drivers for this alloy.

Regional trends indicate that North America and Europe, driven by well-established aerospace, defense, and high-energy physics research infrastructures, continue to be the dominant consumption centers for high-grade Invar. However, the Asia Pacific (APAC) region, particularly China and India, is emerging as the fastest-growing market segment, fueled by rapid expansion in domestic electronics manufacturing, optics production, and ambitious space programs. This regional shift is compelling global producers to establish stronger distribution networks and localized processing capabilities within APAC to meet rising industrial requirements.

Segment trends underscore the dominance of the sheet and plate segment due to their extensive use in composite tooling and large optical components. Application-wise, the Aerospace and Defense sector maintains the largest market share due to critical reliance on Invar for satellite stabilization, guidance systems, and complex composite layup molds. Simultaneously, the Semiconductor and Electronics segment is showing accelerated growth, prompted by the increasing need for ultra-precise lithography and etching equipment where nanometric stability is non-negotiable. Pricing stability remains robust, reflecting the proprietary nature of manufacturing expertise and the high barrier to entry for new competitors in the production of certified, high-purity Invar alloys.

AI Impact Analysis on Invar Market

User queries regarding the impact of Artificial Intelligence (AI) on the Invar market primarily revolve around three central themes: optimization of complex alloy manufacturing processes, enhancement of quality control through predictive analytics, and AI's role in optimizing the design and placement of Invar components within high-performance systems. Users are keenly interested in how machine learning algorithms can manage the intricate thermal treatments required to achieve the optimal low CTE properties of Invar and whether AI can predict potential material flaws before extensive machining is undertaken. The consensus concern is efficiency; stakeholders seek confirmation that AI integration will lead to higher yield rates and reduced production time for these expensive, specialized materials.

AI is transforming the fabrication and application stages of the Invar market by enabling smarter manufacturing. AI algorithms are deployed to analyze spectroscopic data and thermal imaging during the forging and heat treatment processes, allowing for micro-adjustments in real-time to ensure maximum compositional uniformity and minimize deviations from the required low thermal expansion characteristic. This predictive maintenance and quality assurance capability significantly reduces the instances of expensive scrap material that is typically generated during the production of ultra-high-precision components. Furthermore, generative AI and simulation tools are used by engineers to topologically optimize Invar component designs for reduced mass while maintaining critical thermal stability, particularly crucial in aerospace applications.

- AI-driven optimization of thermal processing cycles, ensuring consistent low CTE properties.

- Predictive quality control using machine learning to detect material defects in early stages.

- Generative design for lightweight Invar structures in aerospace and satellite construction.

- Enhanced simulation capabilities for predicting thermal stress in complex Invar assemblies.

- Streamlining supply chain logistics and inventory management for specialized alloy forms.

DRO & Impact Forces Of Invar Market

The Invar market dynamics are shaped by a unique combination of high-precision technological drivers, stringent material constraints, and significant capital expenditure requirements. The primary Drivers revolve around the intensifying technological requirements for dimensional stability in critical sectors like space exploration and advanced lithography. Restraints are predominantly linked to the high cost of raw materials (high-ppurity nickel), the complex and time-consuming manufacturing processes (including specialized melting and homogenization), and the limited number of certified producers, creating supply constraints. Opportunities lie primarily in leveraging additive manufacturing techniques for cost-effective customization and expanding application into new fields such as quantum computing infrastructure, which requires extreme cryogenic stability.

The primary Impact Forces driving market valuation are the escalating investment in advanced defense systems globally, which rely heavily on stable optical and sensing platforms, and the relentless quest for performance improvements in high-throughput satellite communication systems. Conversely, the market is moderately sensitive to global economic downturns that can delay large-scale capital projects in astronomy, particle physics, or satellite deployment. Technological substitution, while challenging due to Invar's unique properties, represents a moderate force; alternatives like carbon fiber composites or specialized ceramics are sometimes utilized, but rarely match Invar's specific low CTE across practical temperature ranges.

Market sustainability is also influenced by environmental regulations concerning high-nickel content alloys and their processing. While the overall volume of the Invar market is small, the focus on sustainable sourcing and waste reduction in specialized manufacturing remains an increasing operational concern. The continuous need for high thermal performance in emerging technologies reinforces Invar's strategic importance, ensuring its high-value position despite the inherent manufacturing difficulties and cost barriers associated with its production and processing into final forms.

Segmentation Analysis

The Invar market is comprehensively segmented based on its alloy type, physical form, end-use application, and geographical region. This segmentation provides a granular view of specific demand pockets and technological adoption rates across various industries. Alloy type distinction is crucial as requirements for specific applications, such as extremely low CTE or specialized magnetic properties, necessitate the use of Invar 36, Super Invar, or derivatives like Kovar. The segmentation by form reflects the required input for subsequent machining or component integration, ranging from bulk material to intricate component parts.

Application-based segmentation clearly illustrates the disproportionate demand originating from high-tech, mission-critical sectors. Aerospace remains the foundation of high-value Invar consumption due to the extreme environments encountered in orbit and the requirement for zero drift in measurement and alignment systems. However, the rapidly expanding optics and photonics sector, driven by advancements in commercial laser systems and scientific research instruments, is projected to be the fastest-growing application segment, reflecting the pervasive need for thermal stability in modern sensor technology.

- By Alloy Type:

- Invar 36 (FeNi36)

- Super Invar (FeNiCo Alloys)

- Kovar (FeNiCo Alloys for Glass Sealing)

- Other Low Expansion Alloys

- By Form:

- Sheets and Plates

- Rods and Bars

- Wires and Strips

- Forged Components

- Powder (for Additive Manufacturing)

- By Application:

- Aerospace and Defense (Satellite Components, Composite Tooling)

- Optics and Photonics (Telescope Mounts, Laser Systems)

- Electronics and Semiconductors (Lithography Equipment, Circuit Boards)

- Cryogenics and Scientific Research

- Instrumentation and Measurement

- General Industrial

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Invar Market

The Invar market value chain is characterized by high complexity and stringent quality requirements, commencing with the sourcing of high-purity raw materials. The upstream segment involves the mining and purification of high-grade nickel, iron, and trace elements like cobalt, which are crucial for specialized Invar alloys. Due to the requirement for precise compositional control, only a select group of specialty alloy producers participate in the melting and casting phase, representing a significant bottleneck in the value chain. This phase utilizes Vacuum Induction Melting (VIM) and Vacuum Arc Remelting (VAR) to ensure compositional homogeneity and purity, minimizing impurities that could compromise the low CTE property.

The midstream process involves primary fabrication (hot rolling, cold rolling, forging) to create standard forms like sheets, rods, and plates. Certification and testing, often involving rigorous thermal cycling tests, are mandatory steps here, adding substantial cost and time. Distribution channels are typically direct or through highly specialized industrial distributors who maintain expertise in handling and supplying certified specialty metals to precision industries. Direct distribution dominates when supplying major aerospace or defense contractors due to security and quality control mandates.

The downstream segment consists of precision machining and fabrication, where the Invar material is converted into finished components such as mirror mounts, tooling molds, or electronic housing units. End-users (e.g., satellite manufacturers, telescope makers) often purchase the semi-finished forms and perform the final, highly precise machining themselves. The value added dramatically increases downstream due to the high costs associated with precision finishing, grinding, and often, plating or coating processes necessary for system integration. Indirect channels are rare, usually restricted to smaller volume sales for general scientific instrumentation.

Invar Market Potential Customers

Potential customers for Invar alloys are predominantly entities involved in mission-critical applications where thermal stability is non-negotiable, effectively insulating them from the price sensitivity typically seen in commodity markets. These end-users are concentrated in sectors governed by high specifications, long product lifecycles, and substantial research and development budgets. Major buyers include national space agencies (NASA, ESA, JAXA), large-scale aerospace prime contractors (e.g., Lockheed Martin, Boeing, Airbus), and defense organizations requiring stable platforms for guidance and surveillance systems.

Beyond aerospace, a significant customer base resides within the scientific instrumentation and optics industries. This includes major observatories and research institutions demanding mirror supports for ground-based and space telescopes, as well as manufacturers of high-power laser systems, where even minor thermal expansion can compromise beam alignment. Furthermore, semiconductor equipment manufacturers (e.g., ASML, Applied Materials) are essential consumers, using Invar for critical masks and tooling within lithography machines to maintain nanoscale positioning accuracy during fabrication processes, making them high-volume, continuous buyers of specialized Invar forms.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 668 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Aperam, VDM Metals, Carpenter Technology Corporation, ATI, Haynes International, Sandvik Materials Technology, Seiko Instruments, K. R. M. Metals, Reading Alloys, CRS Holdings, Sumitomo Electric Industries, Hitachi Metals, Special Metals Corporation, Precision Castparts Corp., Shanghai Jinxin Special Steel, Fushun Special Steel, JLC Electromet, Materion Corporation, China North Industries Group Corporation, Sapa Extrusions. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Invar Market Key Technology Landscape

The manufacturing technology landscape for Invar is highly specialized, focusing on purity, homogeneity, and dimensional accuracy. The foundation of Invar production relies on advanced primary melting technologies such as Vacuum Induction Melting (VIM) followed by secondary refining processes like Vacuum Arc Remelting (VAR) or Electro-Slag Remelting (ESR). These techniques are essential to control the alloy's composition with high precision and minimize gas content and inclusions, which are detrimental to the material's magnetic and thermal properties. The thermal stability of Invar is highly sensitive to trace elements, necessitating rigorous control throughout the initial processing stages. Post-melting, sophisticated forging and rolling techniques are used to ensure proper grain structure and microstructure development, which directly influences the final CTE.

In terms of component fabrication, the key technologies involve specialized precision machining, particularly high-speed CNC milling and grinding, often performed under temperature-controlled environments to prevent induced thermal expansion during the finishing process. The machinability of Invar can be challenging due to its toughness and tendency to work-harden, leading to the use of specialized cutting tools and coolants. A major trend transforming the landscape is the rapid maturation of Additive Manufacturing (AM), specifically Laser Powder Bed Fusion (L-PBF) techniques, utilizing Invar powder. AM allows for the creation of complex, near-net-shape components with internal geometries previously impossible to achieve, significantly reducing material waste and post-machining requirements, which is crucial for high-cost materials like Invar.

Furthermore, non-destructive testing (NDT) and advanced metrology play a critical role. Techniques like ultrasonic testing, eddy current analysis, and high-resolution thermal imaging are employed to certify component quality and ensure the final CTE remains within tight tolerances required by standards like ASTM F1684. Surface finishing technologies, including specialized passivation and plating for corrosion resistance, also form a vital part of the technological ecosystem, guaranteeing the longevity and performance of Invar components in harsh operational environments, such as deep vacuum or cryogenic temperatures.

Regional Highlights

The global Invar market exhibits distinct consumption patterns and technological leadership across key geographical regions, largely correlating with concentrations of high-tech manufacturing, defense spending, and fundamental scientific research infrastructure.

- North America: This region holds the largest market share, primarily driven by the robust presence of leading aerospace and defense companies (A&D), particularly in the United States. Demand is intensely concentrated in critical applications such as satellite manufacturing, intercontinental ballistic missile guidance systems, and advanced military optics. The strong commitment to government-funded scientific research (e.g., CERN, major observatories) also drives steady, high-value consumption of Invar for ultra-stable instrumentation. The technological environment fosters collaboration between material suppliers and end-users to develop next-generation Super Invar variants tailored for specific mission requirements.

- Europe: Europe is the second-largest market, characterized by strong scientific research collaboration (e.g., ESA programs, major particle accelerators) and a sophisticated automotive supply chain requiring precision tooling and gauges. Germany and France are key consumption hubs, supporting major players in optics, photonics, and precision machinery. The region is a leader in specialty metal production technology and is actively investigating the industrial scalability of Invar components manufactured via additive processes.

- Asia Pacific (APAC): APAC is projected to register the highest CAGR during the forecast period. This growth is fueled by rapid industrialization, massive state-backed investments in domestic space programs (especially in China and India), and the booming electronics and semiconductor manufacturing sector. While quality and certification standards are rapidly catching up to Western counterparts, the regional demand is highly sensitive to the expansion of domestic 5G infrastructure and high-resolution display manufacturing, both of which require Invar in production equipment. Japan and South Korea remain critical players, especially in the advanced display and optics segments.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions represent smaller, nascent markets for Invar, with demand primarily concentrated in specialized infrastructure projects, oil and gas instrumentation (requiring high-stability sensors), and burgeoning defense modernization programs. Growth is slower, heavily relying on imports, but shows potential in select countries investing in localized space or advanced telecommunications infrastructure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Invar Market.- Aperam

- VDM Metals (A ThyssenKrupp Company)

- Carpenter Technology Corporation

- ATI (Allegheny Technologies Incorporated)

- Haynes International

- Sandvik Materials Technology

- Seiko Instruments

- K. R. M. Metals

- Reading Alloys

- CRS Holdings (AeroMet)

- Sumitomo Electric Industries

- Hitachi Metals

- Special Metals Corporation (A PCC Company)

- Precision Castparts Corp. (PCC)

- Shanghai Jinxin Special Steel

- Fushun Special Steel

- JLC Electromet

- Materion Corporation

- China North Industries Group Corporation (NORINCO)

- Sapa Extrusions

Frequently Asked Questions

Analyze common user questions about the Invar market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Invar used for, and why is its low CTE property so critical?

Invar is primarily used in applications requiring exceptional dimensional stability across varying temperatures, such as satellite components, high-precision optical mounts, and composite tooling. Its low Coefficient of Thermal Expansion (CTE) minimizes warping or misalignment caused by temperature fluctuations, which is critical for the accuracy and reliability of high-stakes systems.

How does the adoption of Additive Manufacturing (AM) influence Invar production costs?

AM, particularly powder bed fusion, influences Invar production by allowing manufacturers to create complex, near-net-shape components with minimal material waste. Since Invar raw material and machining are expensive, AM significantly reduces overall manufacturing time and material consumption, offering a cost-effective solution for specialized geometries.

Which end-use industry represents the largest demand segment for high-grade Invar alloys?

The Aerospace and Defense industry currently represents the largest market share for high-grade Invar. This sector relies heavily on Invar for satellite systems, space instrumentation, and critical composite tooling molds, where stability under extreme thermal cycling is a non-negotiable performance requirement.

What are the main restraints hindering the rapid expansion of the Invar market?

The primary restraints include the high cost and volatility of raw materials (especially high-purity nickel), the complex and energy-intensive specialized melting and processing required to achieve optimal alloy homogeneity, and the limited global capacity of certified, specialized producers necessary to meet aerospace quality standards.

Where is the Invar market seeing the fastest growth geographically?

The Asia Pacific (APAC) region, specifically countries like China and India, is projected to experience the fastest market growth. This acceleration is driven by significant state-led investment in domestic space programs, expansion of advanced optics manufacturing, and increasing demand from the regional electronics and semiconductor fabrication industries.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager