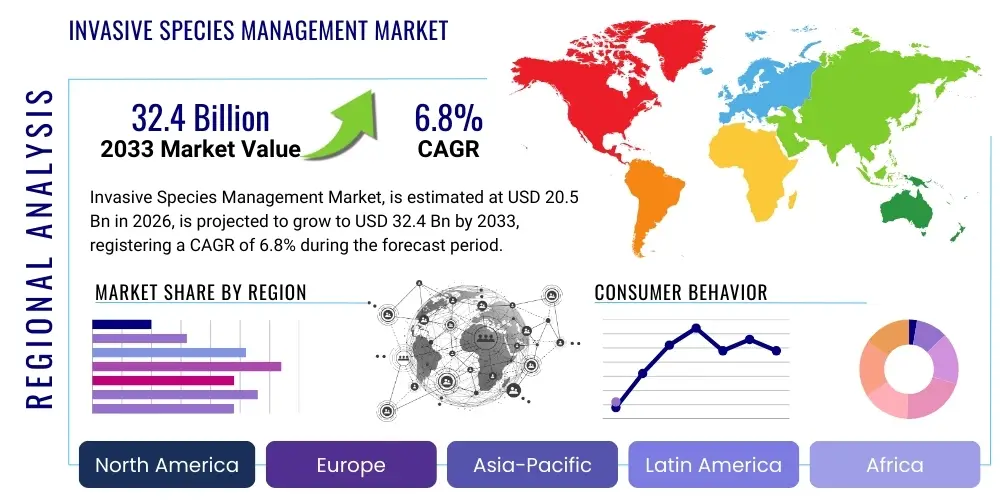

Invasive Species Management Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437232 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Invasive Species Management Market Size

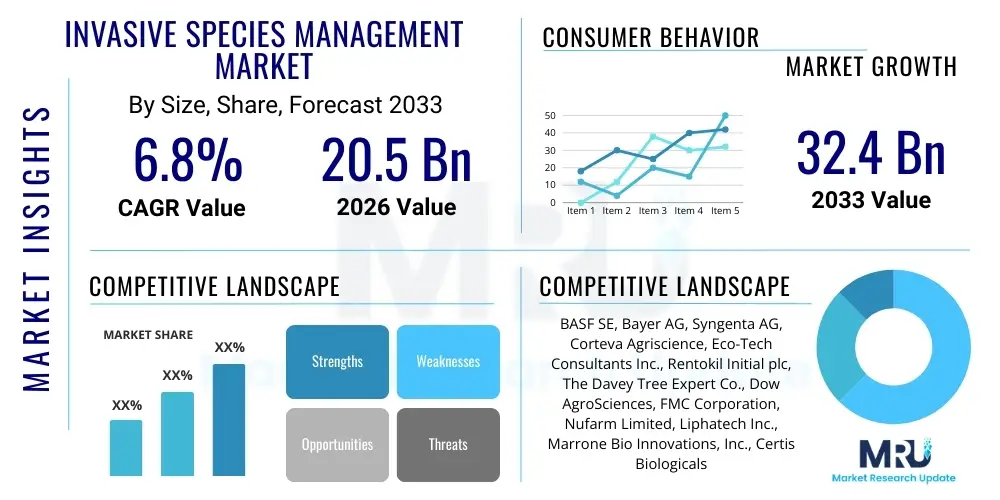

The Invasive Species Management Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $20.5 Billion in 2026 and is projected to reach $32.4 Billion by the end of the forecast period in 2033.

Invasive Species Management Market introduction

The Invasive Species Management Market encompasses the suite of services, products, and technologies deployed to prevent the introduction, establishment, and spread of non-native organisms that pose a threat to natural resources, biodiversity, agriculture, and human health. This includes ecological monitoring, biological control agents, chemical treatments, mechanical removal techniques, and advanced data analytics used for early detection. The necessity for effective management arises directly from the substantial economic damage and ecological instability caused by these species, driving governments, agricultural enterprises, and conservation organizations to invest heavily in preventative and reactive strategies.

Key applications of invasive species management span terrestrial, aquatic, and marine environments, addressing threats posed by invasive plants (e.g., water hyacinth, kudzu), insects (e.g., emerald ash borer, spotted lanternfly), pathogens, and vertebrates. The product landscape is diverse, featuring specialized herbicides and pesticides, sophisticated drone-based surveillance systems, and high-precision application equipment designed to target specific species with minimal collateral damage to native ecosystems. The increasing frequency of global trade, climate change, and human migration patterns exacerbates the risk of biological invasions, making robust management protocols indispensable for maintaining ecological resilience and supporting primary industries.

Major benefits derived from effective invasive species management include safeguarding native biodiversity, protecting agricultural yields, reducing infrastructure damage (e.g., clogged waterways, damaged utility poles), and preserving ecosystem services vital for human well-being. Driving factors for market growth involve stricter global regulatory frameworks (such as the Convention on Biological Diversity), rising public awareness concerning biodiversity loss, and significant advancements in technological capabilities, particularly in genomics and remote sensing, which allow for more targeted and proactive intervention strategies across diverse geographic areas.

Invasive Species Management Market Executive Summary

The Invasive Species Management Market exhibits strong growth driven primarily by escalating ecological threats and enhanced regulatory enforcement worldwide. Business trends indicate a pivot toward integrated pest management (IPM) strategies, emphasizing a combination of biological controls and environmentally sensitive chemical applications over broad-spectrum methods. There is a notable consolidation among service providers, with larger firms acquiring specialized technology companies to integrate offerings like geospatial mapping and predictive modeling into their core services. Furthermore, public-private partnerships are becoming crucial for funding large-scale eradication projects, particularly those addressing widespread aquatic invasive species that impact infrastructure and public water access.

Regionally, North America and Europe remain the dominant markets due to high levels of regulatory compliance, substantial funding for conservation efforts, and the presence of advanced technological infrastructure facilitating rapid response systems. However, the Asia Pacific (APAC) region is projected to register the fastest growth, propelled by rapid industrialization, expansion of international trade, and the resulting influx of novel invasive species impacting critical agricultural economies. Governments across APAC are increasing budgetary allocations for biosecurity and investing in advanced early detection systems, shifting the market focus from reactive control to proactive prevention, particularly within the horticulture and aquaculture sectors.

Segmentation trends highlight the increasing prominence of biological control methods, driven by environmental mandates seeking alternatives to chemical treatments, especially in ecologically sensitive areas. The service segment dominates the market revenue, as the complexity of eradication and control often necessitates specialized consulting and implementation expertise. By application, the agricultural sector remains a vital consumer, focused on minimizing crop loss, while the public utility and conservation sectors are rapidly expanding their spending on terrestrial and aquatic management services to protect critical natural resources and maintain infrastructure integrity.

AI Impact Analysis on Invasive Species Management Market

User inquiries regarding AI's impact on Invasive Species Management frequently center on the potential for autonomous detection, improved prediction accuracy of spread pathways, and optimizing resource allocation for treatment efforts. Users are concerned about the reliability of AI models in diverse environmental conditions, data requirements for training complex ecological models, and the initial capital investment necessary for deploying AI-integrated hardware, such as smart traps and drone surveillance systems. Key expectations revolve around AI enabling a critical shift from reactive management—identifying and treating established infestations—to predictive biosecurity, wherein high-risk entry points and vulnerable habitats are monitored continuously and prioritized based on real-time risk scores generated by machine learning algorithms, thus maximizing the efficiency of limited conservation budgets.

Artificial intelligence, particularly through machine learning (ML) and deep learning (DL), is fundamentally transforming the capabilities within the Invasive Species Management market. ML algorithms can analyze massive datasets derived from satellite imagery, drone footage, sensor networks, and environmental metadata (e.g., temperature, soil type) to identify subtle spectral signatures or patterns indicative of early-stage invasions far earlier than traditional field surveys. This predictive capability dramatically shortens the response time, which is crucial since early detection is the most cost-effective factor in successful species eradication efforts, reducing the eventual scope and complexity of the necessary intervention.

Moreover, AI is deployed for optimizing treatment strategies. Algorithms can simulate various intervention scenarios (chemical dosage, biological agent release points, mechanical removal scheduling) against predicted species spread models to determine the most effective and least environmentally harmful approach. This optimization includes minimizing the application of chemicals by guiding precision spraying equipment (drones, robotic vehicles) directly to the target area, thereby reducing costs, labor requirements, and ecological non-target effects, enhancing the sustainability and efficiency of management operations.

- Enhanced Early Detection and Identification: AI algorithms process geospatial data (satellite and drone) to spot nascent outbreaks based on spectral or morphological anomalies, significantly improving surveillance efficacy.

- Predictive Spread Modeling: Machine learning predicts potential invasion pathways and future distribution based on climate change scenarios, trade flows, and habitat suitability, guiding proactive biosecurity efforts.

- Optimized Resource Allocation: AI determines the optimal timing, location, and method for control operations, minimizing costs and maximizing the efficacy of treatment resources (e.g., chemical, biological agents).

- Autonomous Surveillance Systems: Integration of AI with robotics and IoT sensors enables continuous, low-labor monitoring of vast, remote, or hazardous areas, such as large wetlands or dense forests.

- Improved Data Standardization and Reporting: AI tools automate the collection, categorization, and analysis of field data, providing standardized metrics for regulatory compliance and effectiveness assessment.

DRO & Impact Forces Of Invasive Species Management Market

The Invasive Species Management market is influenced by a dynamic interplay of factors. Key drivers include the global acceleration of biodiversity loss, necessitating urgent intervention; increasing governmental biosecurity regulations and funding commitments aimed at protecting agriculture and native ecosystems; and significant technological progress in remote sensing and genomics allowing for precise species identification and targeted control. These drivers are fundamentally expanding the market reach and scope of management activities beyond localized interventions to regional and national preventative strategies. Furthermore, the rising economic cost associated with invasive species damage—estimated globally in the hundreds of billions of dollars annually—compels both public and private sectors to invest proactively in management and mitigation services to protect critical infrastructure and economic output.

However, the market faces notable restraints. High initial costs associated with advanced monitoring technology (drones, AI platforms) and specialized labor can hinder adoption, particularly in developing economies or smaller governmental departments. Regulatory complexities and the stringent approval process required for new biological control agents or chemical treatments often slow down the introduction of innovative solutions. Additionally, public resistance to certain control methods, such as large-scale chemical treatments or the introduction of non-native biological agents, creates political and operational challenges for widespread implementation. The inherent difficulty in managing species across political borders and diverse land ownership profiles also complicates large-scale, coordinated eradication efforts, limiting the overall market velocity.

Opportunities for growth are concentrated in the development and commercialization of species-specific and environmentally benign control methods, such as gene drive technology (though heavily regulated) and advanced sterile insect techniques (SIT). The growing necessity for climate-resilient management strategies, tailored to shifting environmental envelopes that favor new invaders, presents a significant consulting and services opportunity. Furthermore, the expansion of biosecurity requirements within global supply chains, requiring certified pest-free goods and packaging, creates a substantial market for preventative inspection, monitoring, and certification services, transforming the management approach from reactive cleanup to integrated global risk mitigation. The demand for integrated data platforms capable of aggregating global monitoring data offers substantial potential for software and services providers.

Segmentation Analysis

The Invasive Species Management market is highly segmented based on the methods employed, the types of species targeted, the environments in which management occurs, and the end-user utilizing the services. Understanding these segments is crucial for market stakeholders to tailor technological offerings and service portfolios effectively. The market structure reflects the complexity and diversity of invasive threats worldwide, necessitating specialized approaches for different taxa and habitats. The primary segmentation dimensions include the type of control method (chemical, biological, mechanical, regulatory), the target organism (plants, animals, pathogens), and the application environment (terrestrial, aquatic).

The control method segment is critical, as it dictates the regulatory landscape and environmental sensitivity of operations. While chemical control remains dominant for rapid response and large-scale applications, the fastest growth is seen in biological and preventative methods, driven by sustainability goals and regulatory pressure to reduce chemical footprints. The end-user segmentation reveals that government agencies (federal, state, and local conservation bodies) are the largest consumers of management services, followed closely by the agricultural sector, where prevention of crop pests is a paramount concern for food security and economic viability. Infrastructure and utility sectors also represent a growing segment, requiring specific management solutions to prevent damage to power lines, pipelines, and transportation networks caused by encroaching invasive vegetation or burrowing animals.

- Control Method:

- Chemical Control (Herbicides, Pesticides, Molluscicides)

- Biological Control (Introduction of Natural Enemies, Sterile Insect Technique)

- Mechanical and Physical Removal (Trapping, Netting, Manual Extraction)

- Regulatory and Preventative Measures (Quarantine, Inspection, Education)

- Target Species:

- Invasive Plants (Weeds, Aquatic Vegetation)

- Invasive Animals (Vertebrates, Insects, Mollusks)

- Invasive Microorganisms (Pathogens, Fungi)

- Application Environment:

- Terrestrial (Forests, Rangelands, Agriculture)

- Aquatic (Freshwater, Marine, Estuaries)

- End-User:

- Government and Conservation Agencies

- Agriculture and Forestry

- Infrastructure and Utility Sector

- Private Land Owners and Homeowners

Value Chain Analysis For Invasive Species Management Market

The value chain for the Invasive Species Management Market begins with upstream activities focused on research, development, and supply of core inputs. This includes R&D organizations, universities, and specialized biotech firms responsible for identifying and developing new chemical formulations, synthesizing specific biological control agents, and manufacturing advanced surveillance hardware like specialized sensors and drones. The viability of the downstream services heavily depends on the efficacy and regulatory compliance of these upstream products. Regulatory agencies play a critical role at this stage, setting standards for safety and environmental impact for all commercial products, particularly novel biological controls which require extensive testing and authorization before market entry.

The midstream component involves the integration, distribution, and implementation services. This segment is dominated by specialized environmental consulting firms, pest control operators, and dedicated land management service providers. These entities deploy the products and technologies, offering crucial services such as species identification, geospatial mapping, risk assessment, treatment planning, and monitoring/verification services. This operational phase often requires substantial logistical capabilities and highly skilled labor trained in applying integrated pest management (IPM) techniques specific to the ecological context and regulatory requirements of the affected area. Training and continuous education for field personnel are vital elements within this service delivery mechanism.

The downstream flow leads to the end-users and the various distribution channels. Direct channels are common when government conservation agencies or large agricultural enterprises contract directly with specialized service providers for large, ongoing projects requiring tailored expertise. Indirect distribution involves the sale of chemical products, traps, and detection kits through wholesale distributors, agricultural supply stores, or online platforms to smaller entities, private landowners, or general pest control companies. Effective management of this value chain requires seamless collaboration between research, regulation, implementation, and the end-user to ensure rapid response and successful long-term eradication or control of invasive species across diverse geographical and regulatory landscapes.

Invasive Species Management Market Potential Customers

The primary customers for Invasive Species Management products and services are governmental and quasi-governmental bodies responsible for environmental stewardship, public health, and biosecurity. This includes national and regional conservation departments, environmental protection agencies, border control and quarantine services, and infrastructure maintenance bodies such as departments of transportation and public works. These customers require comprehensive, large-scale, and often long-term integrated management programs addressing national security threats posed by invasive organisms, such as threats to critical water infrastructure or forested natural parks.

The second major cohort comprises the agricultural, forestry, and aquaculture industries. These sectors are highly vulnerable to economic damage from invasive pests and weeds, leading to a consistent demand for preventative monitoring, rapid identification services, and effective, species-specific control solutions that minimize impact on cash crops or livestock. Private corporations within these sectors invest heavily in management to ensure compliance with export standards and maintain yield productivity, particularly relying on precision agriculture technologies and biological controls to sustain ecologically sound practices and meet consumer demands for sustainable sourcing.

A burgeoning segment of potential customers includes utility companies and large private landholders, such as mining operations or large real estate developers. Utility companies require vegetation management services to maintain access to power lines, pipelines, and dams, often dealing with fast-growing invasive plants that compromise structural integrity or operational continuity. Private landholders, particularly those near ecologically sensitive areas, increasingly seek professional consultation and management services to restore native habitats and comply with local environmental protection ordinances, driving demand for specialized ecological restoration and removal services.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $20.5 Billion |

| Market Forecast in 2033 | $32.4 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, Bayer AG, Syngenta AG, Corteva Agriscience, Eco-Tech Consultants Inc., Rentokil Initial plc, The Davey Tree Expert Co., Dow AgroSciences, FMC Corporation, Nufarm Limited, Liphatech Inc., Marrone Bio Innovations, Inc., Certis Biologicals, PBI-Gordon Corporation, Terramac LLC, SePRO Corporation, ADAMA Ltd., Rainbow Ecoscience, Invasive Plant Control Inc., Clarke Aquatic Services. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Invasive Species Management Market Key Technology Landscape

The technological landscape of the Invasive Species Management market is rapidly evolving, driven by the necessity for increased precision, reduced environmental impact, and expanded surveillance capabilities. A foundational technology involves Geographic Information Systems (GIS) and remote sensing, utilizing high-resolution satellite imagery, fixed-wing aircraft, and specialized Unmanned Aerial Vehicles (UAVs or drones). These tools provide accurate, real-time spatial data on infestation boundaries, vegetation health, and habitat conditions. Integration of multispectral and hyperspectral sensors allows operators to detect invasive plant species based on unique light reflectivity signatures, often before visual symptoms are apparent, enhancing the effectiveness of early detection and rapid response protocols.

Precision application technology represents another crucial area of innovation. This includes robotics and drone-based spraying systems equipped with GPS/GNSS and variable rate technology (VRT). These systems utilize mapping data to apply herbicides or biological agents only to the identified target areas, minimizing overspray and reducing the overall volume of chemicals released into the environment. Furthermore, advanced trapping and monitoring technologies, such as smart traps equipped with automated species recognition (using integrated cameras and AI) and chemical lures specific to target insects, provide continuous monitoring data with reduced labor intensity, particularly beneficial in vast or inaccessible ecological preserves.

Biotechnology and genomics are playing an increasingly significant role in the market's future. Next-generation sequencing and metabarcoding are used for rapid and definitive identification of cryptic or early-stage invaders, including pathogens and minute insects, directly from environmental DNA (eDNA) samples collected from water or soil. Furthermore, research into novel control mechanisms, such as gene drive technology for insect control or highly specific RNA interference (RNAi) treatments targeting critical biological processes in pests, holds immense promise for highly targeted, self-sustaining eradication efforts, although their commercial application is currently constrained by extensive regulatory scrutiny and public perception concerns regarding gene editing.

Regional Highlights

- North America: North America holds a commanding share of the global market, characterized by significant governmental investment in biosecurity, highly advanced agricultural systems, and robust environmental regulations protecting expansive national forests and aquatic resources. The region, particularly the U.S. and Canada, leads in the adoption of high-tech solutions, including AI-driven monitoring, drone surveillance, and sophisticated GIS mapping. Major challenges include managing widespread forest pests (e.g., emerald ash borer) and aquatic species (e.g., zebra mussels) that cause major infrastructure damage.

- Europe: The European market is mature and heavily focused on integrated pest management (IPM) strategies, emphasizing biological controls and regulatory measures (quarantine, inspection) to mitigate cross-border transfers of invasive species. Stringent environmental protection policies drive the demand for eco-friendly solutions, limiting the use of traditional chemical agents. Countries like Germany and the Netherlands are leaders in research and development of sustainable control technologies and are significant consumers of specialized consulting services for ecological restoration.

- Asia Pacific (APAC): APAC is anticipated to be the fastest-growing region, fueled by rapid expansion in agriculture, intensive aquaculture practices, and increasing international trade volumes that elevate the risk of invasion. While chemical control is currently prevalent, growing environmental concerns and regulatory mandates in countries like China, Japan, and Australia are driving a shift toward biological and preventative measures. Australia, with its strict biosecurity protocols, serves as a global benchmark for early detection and quarantine management practices.

- Latin America (LATAM): The LATAM market is growing, driven by the critical need to protect expansive agricultural output (soybeans, coffee, timber) from invasive pests and pathogens. Brazil, Mexico, and Argentina are key markets prioritizing cost-effective management solutions, often relying on traditional methods but showing increasing interest in satellite monitoring and biological agents to manage vast agricultural territories efficiently.

- Middle East and Africa (MEA): This region presents specific challenges related to managing invasive species in arid and semi-arid environments, often impacting sensitive rangelands and water resources. Growth is driven by environmental protection initiatives and infrastructural projects, particularly in the Gulf Cooperation Council (GCC) countries, focusing on urban greenery protection and desert ecosystem restoration using targeted mechanical and chemical methods.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Invasive Species Management Market.- BASF SE

- Bayer AG

- Syngenta AG

- Corteva Agriscience

- Eco-Tech Consultants Inc.

- Rentokil Initial plc

- The Davey Tree Expert Co.

- Dow AgroSciences

- FMC Corporation

- Nufarm Limited

- Liphatech Inc.

- Marrone Bio Innovations, Inc.

- Certis Biologicals

- PBI-Gordon Corporation

- Terramac LLC

- SePRO Corporation

- ADAMA Ltd.

- Rainbow Ecoscience

- Invasive Plant Control Inc.

- Clarke Aquatic Services

Frequently Asked Questions

Analyze common user questions about the Invasive Species Management market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers of growth in the Invasive Species Management Market?

The market is primarily driven by escalating global biodiversity loss, increasing economic costs associated with ecological damage, stricter government biosecurity regulations, and technological advancements in remote sensing and precision application techniques that enable more effective and targeted interventions.

How does technological innovation impact the efficiency of invasive species control?

Technology, particularly the integration of AI, GIS, and drones, allows for enhanced early detection of nascent outbreaks, improves the accuracy of spread prediction, and optimizes resource allocation, leading to species-specific treatment plans and significantly reduced environmental harm compared to traditional broad-spectrum methods.

Which control method segment is exhibiting the fastest growth?

The Biological Control segment is experiencing the fastest growth, driven by stringent environmental mandates worldwide that encourage the use of natural enemies and specialized biotech solutions over chemical treatments, particularly in ecologically sensitive areas and for long-term sustainable control.

Which geographical region dominates the invasive species management industry?

North America currently dominates the market due to substantial governmental and institutional funding for conservation, advanced technological infrastructure, and robust regulatory frameworks supporting large-scale, high-technology biosecurity and management projects across diverse habitats.

What is the role of government agencies in the invasive species management value chain?

Government agencies serve as the largest end-users and critical regulatory bodies. They fund large-scale eradication projects, establish biosecurity and quarantine rules, and regulate the development and deployment of all control methodologies, ensuring safety and efficacy before market commercialization.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager