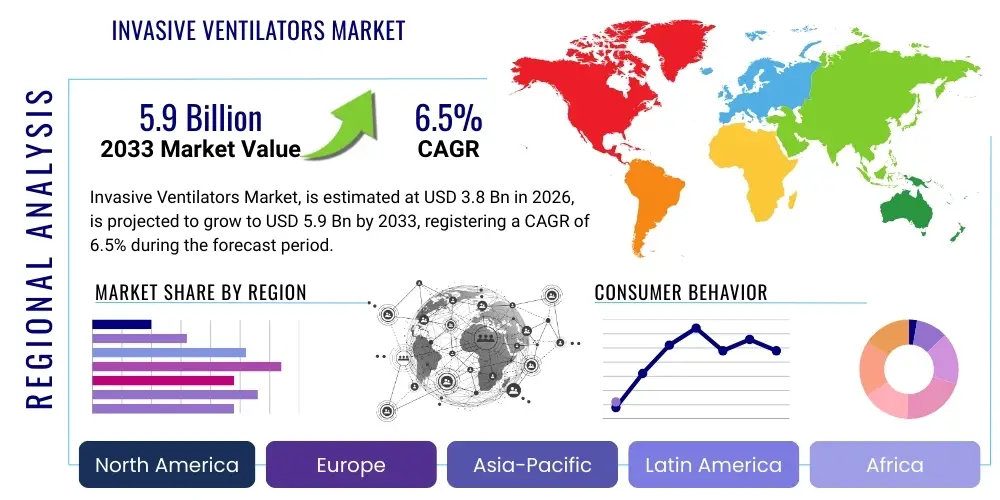

Invasive Ventilators Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437047 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Invasive Ventilators Market Size

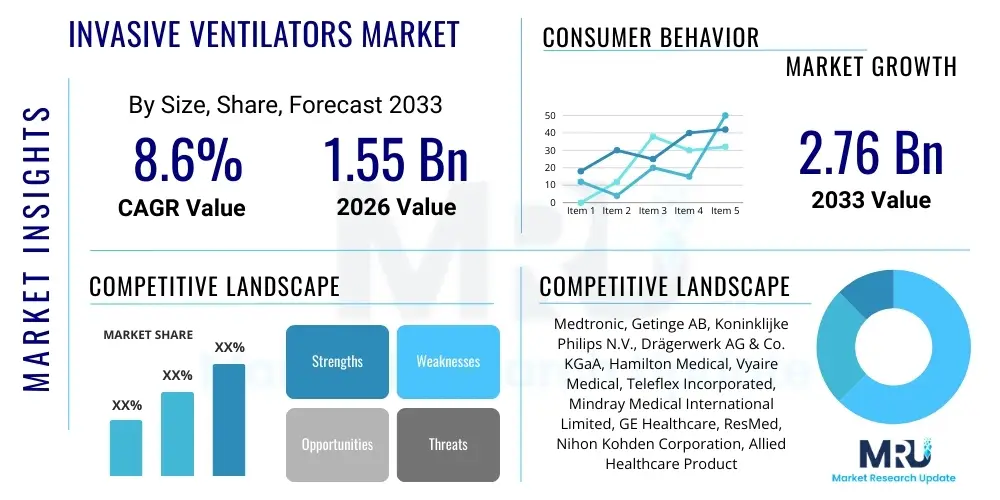

The Invasive Ventilators Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.65% between 2026 and 2033. The market is estimated at USD 1.55 Billion in 2026 and is projected to reach USD 2.76 Billion by the end of the forecast period in 2033.

Invasive Ventilators Market introduction

The Invasive Ventilators Market encompasses specialized medical devices designed to provide mechanical respiratory support to patients suffering from severe respiratory failure, chronic obstructive pulmonary disease (COPD), acute respiratory distress syndrome (ARDS), or complications arising from complex surgeries. These ventilators deliver precise volumes of oxygenated air directly into the patient's lungs via an endotracheal tube or tracheostomy, offering life-sustaining assistance in critical care settings. The core function of these sophisticated machines is to maintain adequate gas exchange, control tidal volume, and regulate respiratory rate when the patient's natural breathing mechanism is compromised or insufficient, necessitating precise monitoring and high reliability for patient safety.

The primary applications for invasive ventilators are concentrated within Intensive Care Units (ICUs), surgical recovery wards, and increasingly, specialized long-term acute care (LTAC) facilities. The demand for these devices is intrinsically linked to demographic trends, specifically the global increase in the aging population, which is more susceptible to chronic respiratory illnesses, and the recurring need for advanced critical care infrastructure, highlighted by recent global health crises. Benefits derived from modern invasive ventilation technology include improved patient outcomes through highly customizable ventilation modes—such as Pressure Regulated Volume Control (PRVC) and Adaptive Support Ventilation (ASV)—reduced risk of ventilator-induced lung injury (VILI), and enhanced monitoring capabilities that facilitate faster weaning protocols.

Key driving factors accelerating market expansion include significant advancements in technology, leading to the development of safer, more patient-centric, and portable devices. Furthermore, substantial investment by governments and private healthcare systems globally to upgrade critical care capacity, especially in emerging economies, plays a crucial role. The integration of advanced sensors and digital connectivity for remote monitoring and centralized data management is also boosting adoption rates. Regulatory standards requiring mandatory replacement of older, less efficient equipment further underpin sustained market growth across major geographical regions, making invasive ventilation a cornerstone of modern critical care medicine.

Invasive Ventilators Market Executive Summary

The Invasive Ventilators Market is characterized by robust growth driven primarily by increasing global hospitalization rates for chronic respiratory disorders and significant advancements in ventilator technology focused on patient safety and personalized treatment. Business trends indicate a strong focus on merger and acquisition activities among key players aiming to consolidate market share, gain access to specialized technology (particularly closed-loop ventilation and AI-enabled diagnostics), and expand geographical reach, especially into high-growth markets in Asia Pacific. Supply chain resilience, following the disruptions of recent years, is a critical strategic imperative, pushing manufacturers toward regionalizing production and optimizing inventory management for essential components. Furthermore, the shift towards smart, connected devices that integrate seamlessly with hospital Electronic Health Records (EHRs) is transforming the competitive landscape, prioritizing data integration capabilities alongside hardware reliability.

Regional trends reveal that North America and Europe maintain dominance due to established critical care infrastructure, high healthcare expenditure, and rapid adoption of cutting-edge technology. However, Asia Pacific is projected to register the fastest CAGR, fueled by massive population bases, improving healthcare accessibility, and substantial governmental investments aimed at tackling air pollution-related respiratory diseases and expanding ICU capacity. Latin America and the Middle East & Africa (MEA) are also showing promising growth, albeit from a lower base, largely driven by infrastructure development projects and increased access to sophisticated medical devices through favorable reimbursement policies and global aid programs. The varying regulatory environments across regions necessitate tailored market entry and compliance strategies for multinational corporations.

Segment trends highlight the critical care segment, encompassing high-end ventilators, as the largest revenue generator, demanding feature-rich devices capable of supporting the most complex patient conditions. Concurrently, there is a burgeoning demand for portable and mid-end ventilators, driven by the increasing need for intra-hospital transport, emergency preparedness, and the expansion of sub-acute care facilities and home mechanical ventilation programs. Technology segmentation shows a strong preference for micro-processor-controlled devices that offer advanced modes (like neurally adjusted ventilatory assist or NAVA) and comprehensive monitoring packages. End-user segmentation remains dominated by large public and private hospitals, though specialized clinics and ambulatory surgical centers are emerging as increasingly important adoption points for entry-level and mid-range invasive ventilation solutions, particularly in developed markets.

AI Impact Analysis on Invasive Ventilators Market

User inquiries regarding Artificial Intelligence (AI) in invasive ventilation predominantly center on three core themes: achieving truly personalized ventilation settings, improving early detection of critical events, and enhancing clinical workflow efficiency. Users frequently ask if AI can reduce the incidence of Ventilator-Induced Lung Injury (VILI) by autonomously optimizing positive end-expiratory pressure (PEEP) and tidal volume in real-time. There is also significant interest in AI's role in predicting weaning success or failure, allowing clinicians to initiate liberation protocols earlier and reducing patient dependence on mechanical support. Concerns often revolve around regulatory hurdles, data security when integrating machine learning models with patient physiological data, and the need for clear clinical evidence validating AI's superiority over traditional physician-led management, especially in complex, heterogeneous patient populations.

- AI-driven optimization of ventilation parameters: Enables real-time, patient-specific adjustments to minimize lung stress and maximize gas exchange efficiency.

- Predictive analytics for clinical deterioration: Utilizes machine learning to analyze waveform data and physiological signals, forecasting conditions like barotrauma or oxygen desaturation hours before manual detection.

- Enhanced weaning protocol management: AI models assess readiness for extubation with greater accuracy, potentially reducing the duration of mechanical ventilation and ICU stay.

- Automated alarm management: Reduces the high cognitive load on ICU staff by filtering out non-critical alarms and prioritizing urgent physiological alerts.

- Integration with Electronic Health Records (EHRs): Facilitates seamless data transfer and centralized visualization, improving decision support systems for intensivists.

- Development of closed-loop ventilation systems: AI acts as the central control algorithm, autonomously managing ventilation to maintain target blood gas levels, leading to true self-regulating devices.

- Support for tele-ICU models: Allows off-site specialists to monitor and manage patients remotely, using AI summaries and diagnostics to overcome geographical limitations in critical care access.

- Training and simulation tools: AI models assist in creating realistic virtual patient scenarios for training clinicians in complex ventilator management techniques.

DRO & Impact Forces Of Invasive Ventilators Market

The market for invasive ventilators is significantly influenced by a delicate balance of favorable drivers and limiting restraints, coupled with high-potential opportunities, all converging to determine the market's trajectory and competitive dynamics. Key drivers include the escalating global burden of chronic respiratory diseases, such as COPD and asthma, the rapid expansion of critical care infrastructure globally, and ongoing technological innovation that focuses on developing more precise, safer, and user-friendly ventilation devices. The increasing geriatric population, highly susceptible to respiratory infections and requiring mechanical support during acute exacerbations, further amplifies the demand, creating a sustained need for high-quality invasive ventilation solutions in hospitals and specialized care centers. This collective force ensures continuous investment in R&D and manufacturing capacity.

Conversely, the market faces notable restraints, primarily centered around the substantial capital investment required for purchasing high-end ventilators and the associated costs of maintenance, specialized accessories, and disposables. Furthermore, the lack of adequately trained respiratory therapists and critical care personnel in many developing and low-resource settings restricts the safe and effective utilization of advanced ventilation modes, leading to underutilization or preference for simpler, less effective devices. Regulatory complexity across different geographic markets poses a challenge for global market expansion, requiring extensive and costly compliance efforts before device approval. These high barriers to adoption, both financial and human resource related, temper the potential growth rate, particularly outside of Tier 1 metropolitan areas.

Opportunities for market players are substantial, stemming largely from the untapped potential in emerging economies, where healthcare infrastructure is rapidly developing and the prevalence of lifestyle and pollution-related respiratory illnesses is soaring. Miniaturization and increased portability of invasive ventilators present opportunities for expansion into non-traditional settings, such as transport medicine, home care, and military field hospitals. The accelerating adoption of software-as-a-medical-device (SaMD) solutions, focusing on predictive analytics, remote diagnostics, and enhanced connectivity, offers manufacturers pathways to differentiate their offerings and create recurring revenue streams. The impact forces acting upon the market are highly positive, primarily driven by technological advancement and demographic necessity, indicating a long-term, secular growth trend, provided manufacturers can address the cost and training barriers effectively.

Segmentation Analysis

The Invasive Ventilators Market segmentation provides a granular view of device types, clinical applications, and end-user profiles, crucial for understanding demand patterns and tailoring market strategies. The market is primarily segmented by Product Type (High-end, Mid-end, Basic/Portable), by Application (ICU, Emergency, Surgical, Home Care/Long-Term Care), and by End-User (Hospitals, Ambulatory Surgical Centers, and Home Care Settings). High-end ventilators, dominating revenue, offer complex closed-loop systems and extensive monitoring capabilities essential for critically ill patients in the ICU. Conversely, the portable segment is poised for rapid growth, driven by the requirement for patient mobility within and outside clinical environments, alongside the rising trend of chronic care management shifting from hospitals to community settings. Understanding these segments allows companies to allocate R&D resources effectively, focusing on areas with the highest unmet clinical needs and growth potential.

- Product Type: High-End Invasive Ventilators, Mid-End Invasive Ventilators, Basic/Portable Invasive Ventilators

- Application: Intensive Care Unit (ICU), Emergency Rooms and Transport, Surgical Procedures, Home Care and Long-Term Acute Care (LTAC)

- End-User: Hospitals and Clinics (Public & Private), Ambulatory Surgical Centers (ASCs), Specialty Clinics and Home Care Settings

- Technology: Software-as-a-Medical-Device (SaMD) Solutions, Microprocessor-Controlled, Closed-Loop Systems

Value Chain Analysis For Invasive Ventilators Market

The value chain for the Invasive Ventilators Market begins with upstream activities, focusing on the sourcing of high-precision components, including sophisticated microprocessors, specialized sensors (flow, pressure, oxygen), high-quality plastics for circuit components, and robust, sterile casing materials. Key suppliers include technology firms specializing in advanced control systems and materials science companies providing biocompatible and durable components. Upstream efficiency is paramount as quality control and regulatory compliance begin at this stage; disruptions in the supply of microchips or specialized sensors can significantly impact the manufacturing timeline, highlighting the need for diversified supplier networks and robust inventory management strategies, particularly for specialized medical-grade electronics necessary for precise performance.

The middle segment of the value chain involves the manufacturing, assembly, and rigorous quality assurance processes. Leading manufacturers perform complex assembly, integrate proprietary software, and subject each device to extensive calibration and testing protocols to ensure compliance with stringent international medical device standards (e.g., ISO 13485). Following manufacturing, the distribution channel is critical. Direct distribution is common for high-end, complex devices sold to large hospital networks, where manufacturers provide direct installation, training, and ongoing technical support, fostering deep customer relationships. Indirect distribution utilizes authorized distributors or regional partners, particularly in smaller markets or for basic/portable models, leveraging their local knowledge and established logistical networks to penetrate fragmented healthcare systems effectively.

Downstream activities center on end-user application, encompassing clinical use, maintenance, and the supply of consumable accessories (e.g., breathing circuits, filters, humidifiers). Post-sale service, including preventative maintenance contracts, emergency repairs, and software upgrades, represents a crucial revenue stream and a significant factor in purchasing decisions for hospitals. Potential customers—primarily hospitals and specialized critical care units—value devices not just for initial capabilities but also for long-term reliability and manufacturer support. The flow of value concludes with ongoing patient management, where efficient device performance directly translates into improved clinical outcomes and reduced healthcare costs, justifying the initial high capital expenditure.

Invasive Ventilators Market Potential Customers

The primary purchasers and end-users of invasive ventilators are institutions dedicated to critical and intensive care, requiring highly reliable, advanced life support equipment. Large public and private hospitals, particularly those with Level I or Level II trauma centers and expansive Intensive Care Units (ICUs), constitute the largest customer segment. These facilities require a mix of high-end ventilators capable of managing complex pathologies like ARDS and ECMO support, alongside mid-range models for general surgical recovery and step-down units. Their purchasing decisions are heavily influenced by clinical efficacy data, total cost of ownership, integration capabilities with existing IT infrastructure, and comprehensive after-sales service agreements ensuring minimal downtime and regulatory compliance. Hospitals often purchase in bulk through centralized procurement systems or Group Purchasing Organizations (GPOs).

A rapidly growing segment of potential customers includes specialized care facilities, such as Long-Term Acute Care (LTAC) hospitals and specialized respiratory rehabilitation centers. These customers focus on weaning patients off ventilation or managing chronic respiratory dependence over extended periods. Their demand leans towards mid-range to portable ventilators that prioritize patient comfort, ease of use for long-term care staff, and efficient air humidification and temperature control systems. Furthermore, transport medicine providers, including air ambulance services and specialized inter-hospital transport teams, represent a critical niche market, prioritizing robust, lightweight, and battery-powered portable invasive ventilators that maintain high performance reliability during dynamic movement.

Finally, the increasing trend of home mechanical ventilation for stable, chronic respiratory patients, often facilitated by home healthcare providers and durable medical equipment (DME) suppliers, expands the customer base beyond traditional institutional settings. These customers seek compact, quiet, and user-friendly devices that require minimal technical intervention from family caregivers or visiting nurses. Reimbursement policies and physician comfort levels with home-based management significantly drive demand in this segment. The increasing prevalence of respiratory issues across all demographics ensures that the demand for invasive ventilatory support remains robust across the entire spectrum of healthcare delivery.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.55 Billion |

| Market Forecast in 2033 | USD 2.76 Billion |

| Growth Rate | 8.65% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Medtronic, Getinge AB, Koninklijke Philips N.V., Drägerwerk AG & Co. KGaA, Hamilton Medical, Vyaire Medical, Teleflex Incorporated, Mindray Medical International Limited, GE Healthcare, ResMed, Nihon Kohden Corporation, Allied Healthcare Products, Schiller AG, ZOLL Medical Corporation, Shenzhen Comen Medical Instruments Co., Ltd., ACUTRONIC Medical Systems AG, Fisher & Paykel Healthcare, Penlon Limited, Becton, Dickinson and Company (BD), Smiths Medical (now part of ICU Medical) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Invasive Ventilators Market Key Technology Landscape

The technological evolution within the invasive ventilators market is focused on achieving greater physiological synchrony, reducing lung injury, and enhancing data connectivity for integrated patient management. A cornerstone of modern technology is the adoption of advanced, volume-assured pressure support modes, such as Pressure Regulated Volume Control (PRVC) and Volume Guarantee (VG), which combine the benefits of pressure control ventilation (better comfort and flow delivery) with the safety assurance of volume control (guaranteed tidal volume delivery). These modes utilize sophisticated algorithms to constantly monitor and adjust inspiratory pressures, optimizing oxygenation and ventilation while actively preventing dangerous peak pressures. Furthermore, the integration of non-invasive sensors, like Electrical Impedance Tomography (EIT), is gaining traction, offering real-time visualization of lung mechanics and regional ventilation distribution at the bedside, aiding clinicians in setting optimal PEEP levels and improving precision in patient management.

Another major technological trend is the proliferation of closed-loop ventilation systems, particularly those incorporating Artificial Intelligence or rule-based expert systems, such as Adaptive Support Ventilation (ASV) and IntelliVent-ASV. These systems minimize the need for frequent manual intervention by automatically adjusting parameters based on the patient's continuous respiratory feedback, driving towards true personalized medicine in critical care. Concurrently, improved humidification and temperature control technology, including active heated wire circuits and advanced water traps, are essential components, ensuring the delivered gas is optimally conditioned to prevent tracheal damage and reduce the risk of respiratory infections. This focus on ancillary features is crucial for improving patient tolerance and reducing complications, especially during extended ventilation periods in LTAC settings.

Connectivity and digital integration represent the third pillar of technological advancement. Modern invasive ventilators are designed as networked devices, capable of outputting high-fidelity waveform data and summarized respiratory metrics directly to central monitoring systems, hospital EHRs, and remote tele-ICU dashboards. This seamless data exchange supports centralized critical care management, facilitates real-time auditing of ventilation quality, and enables predictive maintenance for the device itself. The implementation of robust cybersecurity measures is becoming critical as devices become more connected, safeguarding sensitive patient data and ensuring the integrity of life support functions, necessitating significant investment in secure hardware and software development compliant with evolving global data protection regulations.

Regional Highlights

- North America (Dominance and High Adoption): North America holds the largest share of the Invasive Ventilators Market, primarily due to the presence of highly developed healthcare infrastructure, substantial public and private healthcare expenditure, and the rapid adoption of sophisticated medical technologies. The region benefits from robust regulatory frameworks, favorable reimbursement scenarios for critical care services, and a high incidence of chronic respiratory diseases and cardiovascular conditions requiring mechanical ventilation. The United States, in particular, drives market demand through continuous innovation, significant R&D investments by key domestic manufacturers, and the widespread implementation of advanced critical care management protocols, including tele-ICU systems utilizing connected ventilators. The market here is mature but characterized by high replacement cycles for high-end, feature-rich ventilation devices, driven by the commitment to minimizing ventilator-associated events and improving patient quality metrics.

- Europe (Strong Regulatory Environment and Technological Sophistication): Europe represents the second-largest market, distinguished by its high standards of critical care delivery, particularly in Western European countries like Germany, the UK, and France. The market growth is sustained by an aging population requiring support for age-related respiratory ailments and continuous government funding allocated to modernizing hospital equipment. European manufacturers are leaders in developing highly specialized ventilation modes and integrating connectivity solutions compatible with regional health data standards. The stringent medical device regulations (MDR) ensure high-quality devices but also necessitate thorough clinical data submission, shaping the competitive landscape. Focus remains on energy-efficient and portable units suitable for transport and decentralized care models.

- Asia Pacific (Fastest Growth and Infrastructure Expansion): The Asia Pacific region is poised to exhibit the highest CAGR during the forecast period. This accelerated growth is attributed to massive investments in healthcare infrastructure expansion, particularly the construction of new hospitals and ICUs in populous nations like China, India, and Southeast Asian countries. Rising disposable incomes, increasing health awareness, and the growing burden of respiratory illnesses stemming from high levels of air pollution are powerful demand drivers. While price sensitivity remains a factor, the demand for mid-range, reliable, and easily maintainable invasive ventilators is surging. Manufacturers are adapting their strategies to focus on local manufacturing and simplified user interfaces tailored for regions with varying levels of clinical expertise and resource availability.

- Latin America (Emerging Opportunities and Government Initiatives): Latin America presents significant emerging opportunities, fueled by increasing urbanization, improved access to basic healthcare, and government initiatives aimed at addressing chronic disease management. Countries such as Brazil and Mexico are leading the demand, driven by the need to upgrade critical care capabilities within large urban hospital centers. The market often favors cost-effective, reliable mid-range devices, though specialized centers are increasingly adopting high-end units. Economic instability and dependence on imported technology remain constraints, making local partnerships and favorable financing terms crucial for market penetration.

- Middle East and Africa (MEA) (Infrastructure Investment and Medical Tourism): The MEA region's growth is concentrated primarily in the Gulf Cooperation Council (GCC) countries, where substantial oil wealth facilitates massive investment in high-quality healthcare facilities, often catering to medical tourism. These facilities demand state-of-the-art, high-end invasive ventilators, mirroring technology standards found in North America and Europe. In contrast, the African market remains highly dependent on international aid and public health initiatives, driving demand for robust, easy-to-use, and durable entry-level ventilators suitable for challenging environments with limited technical support and sporadic power supply.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Invasive Ventilators Market.- Medtronic

- Getinge AB

- Koninklijke Philips N.V.

- Drägerwerk AG & Co. KGaA

- Hamilton Medical

- Vyaire Medical

- Teleflex Incorporated

- Mindray Medical International Limited

- GE Healthcare

- ResMed

- Nihon Kohden Corporation

- Allied Healthcare Products

- Schiller AG

- ZOLL Medical Corporation

- Shenzhen Comen Medical Instruments Co., Ltd.

- ACUTRONIC Medical Systems AG

- Fisher & Paykel Healthcare

- Penlon Limited

- Becton, Dickinson and Company (BD)

- Smiths Medical (now part of ICU Medical)

Frequently Asked Questions

Analyze common user questions about the Invasive Ventilators market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Invasive Ventilators Market?

The Invasive Ventilators Market is anticipated to grow at a robust CAGR of 8.65% from 2026 to 2033, driven by increasing critical care capacity globally and technological advancements in respiratory support systems.

How is Artificial Intelligence (AI) influencing the next generation of invasive ventilators?

AI is primarily used to create closed-loop systems that optimize ventilation settings, predict weaning success, and provide advanced decision support, enhancing patient safety and reducing the duration of mechanical ventilation.

Which region currently dominates the global Invasive Ventilators Market?

North America currently holds the largest market share, characterized by high critical care expenditure, sophisticated infrastructure, and rapid adoption of cutting-edge, high-end ventilator technology and advanced clinical protocols.

What are the primary factors restraining the growth of the Invasive Ventilators Market?

Key restraints include the high capital cost associated with purchasing and maintaining advanced ventilation units, coupled with a persistent global shortage of specialized and trained respiratory care personnel capable of operating complex devices.

Beyond traditional hospitals, what are the emerging end-user segments for invasive ventilators?

The emerging end-user segments include Long-Term Acute Care (LTAC) facilities, ambulatory surgical centers (ASCs), specialized transport medicine services, and home care settings for patients requiring chronic mechanical ventilation support.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager