Inverter Microwave Ovens Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437959 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Inverter Microwave Ovens Market Size

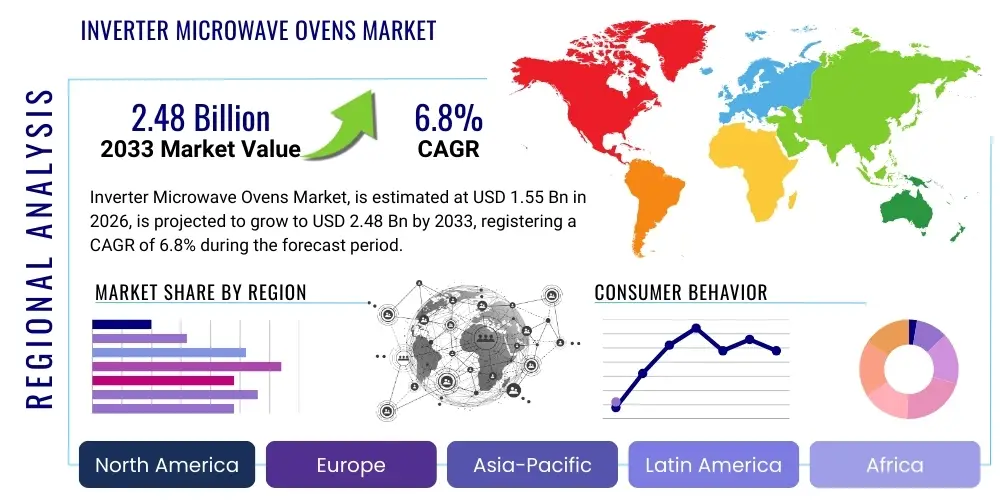

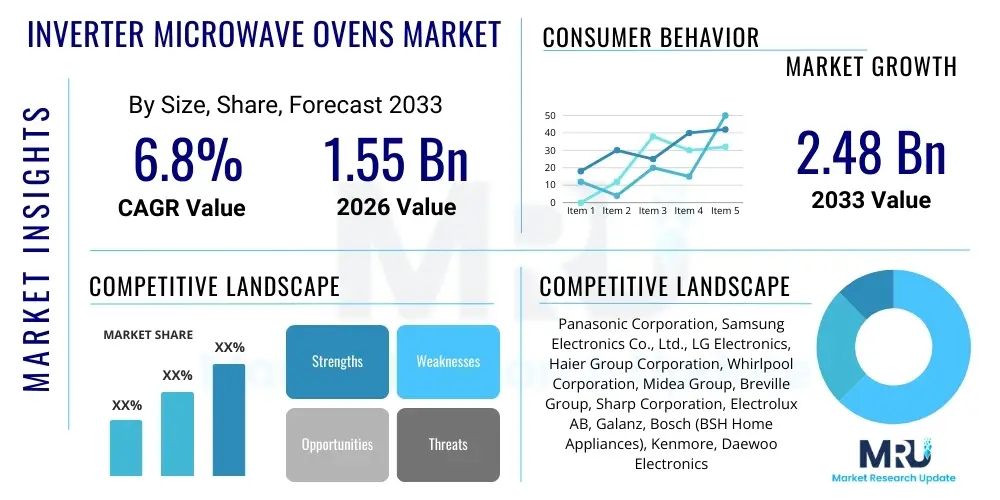

The Inverter Microwave Ovens Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.55 Billion in 2026 and is projected to reach USD 2.48 Billion by the end of the forecast period in 2033.

Inverter Microwave Ovens Market introduction

The Inverter Microwave Ovens Market encompasses advanced cooking appliances utilizing inverter technology to provide a continuous, precisely controlled stream of power, unlike traditional microwave ovens that rely on pulsing power at full capacity. This technological distinction significantly enhances cooking performance, allowing for more even heating, precise temperature management, and superior retention of food nutrients and texture. The core product provides exceptional efficiency in defrosting, reheating, and intricate cooking processes, making it a staple appliance in modern residential kitchens and increasingly within commercial settings.

Major applications of inverter microwave ovens span rapid meal preparation, sophisticated cooking techniques that require consistent, low-level power (such as simmering or poaching), and professional-grade defrosting operations where maintaining food integrity is crucial. The primary benefits driving market adoption include substantial energy efficiency compared to standard magnetron-based microwaves, faster cooking times, and superior culinary results, eliminating the common issue of cold spots or unevenly cooked food. Furthermore, these units often integrate advanced features like sensor cooking, pre-set menus, and streamlined control interfaces, aligning with consumer demands for convenience and reliability in kitchen appliances.

The market is currently being driven by several macro and micro factors. Key driving forces include the global trend towards smart kitchen integration and home automation, where high-efficiency appliances are preferred. Rising disposable incomes, particularly in emerging economies, are enabling consumers to upgrade from basic models to premium inverter technology. Additionally, increasing consumer awareness regarding the health benefits derived from better nutrient preservation during cooking, coupled with manufacturers’ continuous innovation in design and connectivity features, are propelling sustained growth across all major geographical regions, solidifying the inverter microwave oven's position as a premium kitchen essential.

Inverter Microwave Ovens Market Executive Summary

The global Inverter Microwave Ovens Market is characterized by robust business trends centered on premiumization and digital integration. Manufacturers are heavily investing in integrating IoT capabilities, allowing ovens to connect with smart home ecosystems, voice assistants, and personalized recipe databases. A significant trend involves the shift towards built-in models, especially in North America and Europe, catering to aesthetic preferences for seamless, integrated kitchen design. The competitive landscape is intensely focused on energy efficiency ratings and advanced sensor technology, pushing companies to differentiate their offerings through superior performance and extended warranty services. E-commerce platforms are playing an increasingly vital role, providing extensive reach and detailed product information that accelerates consumer adoption, particularly for high-value appliances.

Regionally, the market exhibits divergent growth patterns. The Asia Pacific (APAC) region currently holds the largest market share, driven by rapid urbanization, substantial growth in the middle-class population, and increasing penetration of modern household appliances, notably in China and India. North America and Europe are mature markets, demonstrating slower volume growth but higher revenue generation per unit due to the strong demand for high-capacity, feature-rich, and aesthetically refined built-in units. Conversely, Latin America and the Middle East & Africa (MEA) are emerging markets showing promising future growth, stimulated by improving economic conditions and increased accessibility to global consumer electronics brands, often favoring affordable, high-performing countertop inverter models.

Segment-wise, the high-power output (1200W and above) segment is experiencing the fastest growth, favored by consumers seeking professional-grade speed and performance for complex cooking tasks. Furthermore, the residential segment remains the dominant application area, but the commercial segment, including small cafes, quick-service restaurants (QSRs), and corporate breakrooms, is showing significant expansion due to the need for efficient, consistent reheating capabilities. The trend is moving towards multi-functional inverter appliances that combine microwave operation with convection baking or grilling capabilities, offering consumers consolidated utility and maximizing kitchen space efficiency, thereby maximizing value proposition across various consumer demographics.

AI Impact Analysis on Inverter Microwave Ovens Market

User queries regarding AI in inverter microwave ovens primarily revolve around achieving perfect cooking results, automating complex recipes, and enhancing the overall user experience through predictive technologies. Users frequently ask about the role of machine learning in adapting cooking cycles based on food weight, type, and humidity, and how AI might integrate with dietary apps to recommend and execute healthy meals. Concerns often focus on data privacy related to connected appliances and the reliability of fully automated cooking processes. The general expectation is that AI will transform the microwave from a simple heating device into a smart cooking assistant, capable of personalization and error minimization, significantly improving consistency and reducing food wastage.

The practical application of AI in this domain centers on sophisticated sensor technology that continuously monitors the cooking environment. AI algorithms process this data (temperature, moisture, weight changes) in real-time to adjust power levels and cooking duration dynamically, a capability seamlessly supported by the continuous power delivery of inverter technology. This shift allows for the development of "cognitive cooking" features, where the appliance learns user preferences over time and optimizes settings for specific dish types or ingredients, offering unparalleled precision and convenience. This integration moves the market toward highly differentiated, premium smart kitchen offerings that justify a higher price point by delivering demonstrably superior, effortless results.

- AI-driven sensor cooking optimization ensures precise power delivery, eliminating cold spots.

- Machine learning algorithms personalize cooking profiles based on user history and food input.

- Integration with voice assistants (Alexa, Google Assistant) enables hands-free operation and recipe execution.

- Predictive maintenance alerts identify potential component failures (e.g., magnetron life cycle) before they occur.

- AI supports energy management features by optimizing power consumption based on grid load and cooking requirement.

- Automated recipe suggestions linked to ingredient databases enhance dietary tracking and meal planning.

DRO & Impact Forces Of Inverter Microwave Ovens Market

The Inverter Microwave Ovens Market is primarily driven by the superior efficiency and performance capabilities inherent in the technology, counterbalanced by persistent challenges related to consumer education and initial cost outlay. Key drivers include the demand for faster cooking processes in time-constrained modern lifestyles, coupled with the desire for energy-efficient appliances to reduce utility bills and environmental impact. Restraints often manifest as the higher manufacturing cost of the inverter power supply compared to conventional technology, leading to elevated retail prices that can deter budget-conscious consumers, particularly in developing regions. Furthermore, a lack of comprehensive consumer understanding about the distinct advantages of inverter technology over traditional models acts as a latent barrier to mass adoption, requiring significant marketing investment in education.

Opportunities for growth are abundant, particularly through aggressive adoption of IoT and smart connectivity features, transforming the microwave into a central hub for meal preparation guided by sensor feedback and algorithmic control. Emerging markets present a strong opportunity as consumer buying power increases, coupled with urbanization driving demand for compact, multi-functional appliances. Strategic partnerships between appliance manufacturers and smart home technology providers will be crucial for capturing market share through seamless ecosystem integration. Addressing the restraint of cost through scaling up production and optimizing supply chains, potentially using modular designs, will open up larger mass-market penetration, capitalizing on the long-term cost-saving benefits of the technology.

The market impact forces indicate strong bargaining power of buyers due to numerous competitive offerings, although differentiation through superior technology like continuous power delivery helps manufacturers maintain margins. The threat of substitutes, while present from conventional microwaves and speed ovens, is mitigated by the specific performance advantages of inverter technology in delicate cooking tasks. Supplier power is moderate, influenced heavily by the availability of specialized semiconductor components required for the inverter circuit. Competitive rivalry remains high, particularly among major global electronics conglomerates who continuously introduce newer models with enhanced smart features and competitive pricing strategies to capture the premium segment, forcing smaller players to specialize or focus on niche high-performance applications.

Segmentation Analysis

The Inverter Microwave Ovens Market is comprehensively segmented based on several critical dimensions, including product type, application, and power output, which reflects diverse consumer needs and usage scenarios across global demographics. The segmentation analysis provides essential insights into where specific technological advantages are most valued and where competitive efforts should be concentrated. Analyzing these segments helps manufacturers tailor marketing strategies, optimize product portfolios, and manage distribution channels effectively, ensuring alignment between technological capabilities and specific end-user demands, ranging from a quick residential reheat to professional commercial use requiring high performance and durability.

By product type, the market is categorized into Countertop and Built-in models. The Countertop segment dominates in volume due to lower cost, versatility, and ease of installation, particularly favored in rental properties and smaller kitchens globally. However, the Built-in segment commands higher average selling prices (ASPs) and is rapidly growing, especially in developed markets, driven by the increasing consumer preference for modern, integrated kitchen aesthetics. The application segmentation differentiates between Residential (the largest segment) and Commercial use. While residential demand focuses on convenience, multi-functionality, and design, commercial use prioritizes high-throughput capacity, durability, and consistent performance across multiple usage cycles, utilizing the inverter's consistent output to avoid errors in professional food preparation.

Furthermore, segmentation by power output (e.g., Low, Medium, High) is critical as it directly correlates with efficiency and price. High-power models (1200W and above) are highly sought after in premium residential settings and commercial environments where speed and consistency are paramount, demonstrating the strongest revenue growth. This granular segmentation allows industry stakeholders to understand the shift in consumer value perception—moving away from merely heating food to demanding sophisticated cooking results that only precise, continuous power delivery can achieve, driving demand for technologically advanced and highly specified units.

- By Product Type:

- Countertop

- Built-in

- By Application:

- Residential

- Commercial (QSRs, Hotels, Cafes)

- By Power Output:

- Low (Below 1000W)

- Medium (1000W – 1199W)

- High (1200W and above)

Value Chain Analysis For Inverter Microwave Ovens Market

The value chain for Inverter Microwave Ovens begins with the upstream activities centered on raw material sourcing, particularly specialized electronic components like IGBTs (Insulated Gate Bipolar Transistors) and microcontrollers critical for the inverter circuitry, alongside standard materials such as sheet metal, plastic resins, and glass. The complexity here lies in procuring high-quality, reliable inverter components, which often require specialized suppliers, contributing to the higher initial manufacturing cost. Subsequent manufacturing and assembly processes involve precise integration of the inverter power unit and the sensor systems, which demands higher quality control standards compared to traditional microwave oven production, optimizing for energy efficiency and operational reliability.

Moving downstream, the distribution channel is highly diversified. Direct sales often target large commercial clients or utilize specialized brand stores. However, indirect channels dominate the residential market, relying heavily on large electronics retailers, hypermarkets, and increasingly, powerful e-commerce platforms. E-commerce has proven particularly effective for inverter models as it allows manufacturers to provide detailed technical comparisons and educational content explaining the value proposition of continuous power delivery, overcoming the consumer knowledge barrier associated with this premium technology. Effective logistics management, ensuring safe transport of sensitive electronics, is a vital competitive element in this phase.

The final stage involves reaching the end-user. Direct channels often facilitate personalized customer service, installation support for built-in models, and professional warranties, establishing strong brand loyalty. Indirect channels, while offering wide accessibility and competitive pricing, necessitate robust after-sales support provided through authorized service centers to manage warranty claims and technical issues inherent in complex appliances. The interaction between manufacturers, distribution partners, and service providers defines the overall customer experience, emphasizing the need for a cohesive and high-quality service network to support the premium positioning of inverter microwave ovens.

Inverter Microwave Ovens Market Potential Customers

The primary customer base for Inverter Microwave Ovens is affluent residential households, particularly those located in urban centers across developed and rapidly developing economies. These consumers prioritize kitchen technology, seamless aesthetics (driving demand for built-in models), and demonstrable efficiency benefits, viewing the purchase not merely as a replacement but as an upgrade investment in smart, convenient, and healthy cooking. They are often digitally savvy, seeking appliances that integrate well within existing smart home ecosystems, leveraging features like voice control and app connectivity to enhance meal preparation efficiency and precision.

A rapidly growing segment of potential customers includes small to medium-sized commercial establishments such as independent cafes, boutique hotels, and corporate dining facilities (break rooms). In these environments, the consistency and speed afforded by inverter technology are crucial for maintaining food quality standards and high-volume throughput during peak hours. Unlike large-scale industrial kitchens that might use dedicated industrial heating equipment, these smaller commercial users require a versatile, durable, and highly reliable appliance that can manage diverse heating and cooking tasks with minimal variation in output power, reducing errors and ensuring customer satisfaction.

Furthermore, early adopters and technology enthusiasts represent a crucial niche market. These consumers are always seeking the latest advancements, often influenced by environmental consciousness and energy efficiency metrics. They are highly receptive to the core benefits of inverter technology—namely, precise power control resulting in better-tasting, healthier food through enhanced nutrient preservation. Targeting these highly engaged buyers allows manufacturers to gather crucial feedback on new features, refine designs, and build positive brand perception that eventually filters down to the broader mass market, thereby securing continuous product development investment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.55 Billion |

| Market Forecast in 2033 | USD 2.48 Billion |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Panasonic Corporation, Samsung Electronics Co., Ltd., LG Electronics, Haier Group Corporation, Whirlpool Corporation, Midea Group, Breville Group, Sharp Corporation, Electrolux AB, Galanz, Bosch (BSH Home Appliances), Kenmore, Daewoo Electronics, Toshiba, Hisense, GE Appliances (Haier), Amica Group, Vestel Group, Tovala, Cuisinart |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Inverter Microwave Ovens Market Key Technology Landscape

The core technological advancement defining this market is the inverter circuit itself, which replaces the large, bulky transformer and magnetron configuration found in conventional microwaves. The inverter power supply converts AC input directly into DC power, then utilizes high-frequency switching technology, often involving IGBTs and sophisticated microcontrollers, to precisely modulate the microwave energy output. This allows the oven to operate at any power level (e.g., 50% power) continuously, rather than cycling full power on and off, which results in even heat distribution, prevents nutrient degradation caused by sudden high heat spikes, and significantly reduces energy consumption compared to older models.

Beyond the core power delivery system, the market is characterized by rapid advancements in sensor technology. Humidity and temperature sensors, often infrared or resistive, are integrated to monitor food conditions in real-time. These sensors communicate data back to the oven’s processing unit, allowing for automatic adjustments to the cooking time and power level (sensor cooking), eliminating the need for manual estimation. This technology ensures that items are cooked perfectly regardless of their starting temperature or initial moisture content, a massive leap in user convenience and a key differentiator in the premium segment, directly supporting the continuous and refined power capability of the inverter system.

Furthermore, IoT connectivity is now a standard feature in high-end inverter models, driving the integration of these appliances into the broader smart kitchen ecosystem. Utilizing Wi-Fi or Bluetooth modules, modern inverter ovens can be controlled remotely via smartphone apps, receive software updates, and interact with voice assistant platforms for seamless operation. This connectivity also enables sophisticated features like internal diagnostics and predictive maintenance alerts. Material science is also critical, with continuous innovation in cavity materials (e.g., ceramic enamel or stainless steel interiors) designed to enhance durability, improve cleaning ease, and maximize microwave reflection efficiency, thereby contributing to faster and more even cooking outcomes.

Regional Highlights

- Asia Pacific (APAC): Dominates the global market both in volume and revenue due to rapid economic development, high population density, and surging adoption of modern kitchen appliances. China, South Korea, and Japan are key markets, benefiting from strong local manufacturing bases and a high consumer acceptance rate for energy-efficient technologies. India and Southeast Asia offer substantial growth potential, driven by rising disposable incomes and aggressive penetration strategies by major global and regional players. The region often favors mid-capacity, feature-rich inverter models that offer exceptional value.

- North America: Characterized by high market maturity and a strong preference for large-capacity, high-wattage inverter models, often integrated with convection and grilling functions. The US market is heavily focused on premium, built-in appliances that align with custom kitchen designs and smart home integration trends. Consumer demand is driven by convenience, high performance, and advanced connectivity features, supporting high average selling prices in this region.

- Europe: Exhibits steady growth, propelled by stringent energy efficiency regulations and a cultural emphasis on high-quality, long-lasting kitchen appliances. Western European countries (Germany, UK, France) show strong demand for sophisticated built-in inverter ovens that meet high aesthetic standards. Eastern Europe is emerging, with growth stimulated by increased consumer expenditure and modernization of kitchen infrastructure. Sustainability and multi-functionality are primary purchase motivators across the continent.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions represent emerging opportunities. Growth is spurred by urbanization, rising middle-class populations, and improved retail infrastructure. While often price-sensitive, consumers are increasingly recognizing the long-term benefits of energy-efficient inverter technology. Demand in MEA is often concentrated in high-income urban centers, while LATAM shows increasing demand for versatile, reliable countertop units.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Inverter Microwave Ovens Market.- Panasonic Corporation

- Samsung Electronics Co., Ltd.

- LG Electronics

- Haier Group Corporation

- Whirlpool Corporation

- Midea Group

- Breville Group

- Sharp Corporation

- Electrolux AB

- Galanz

- Bosch (BSH Home Appliances)

- Kenmore

- Daewoo Electronics

- Toshiba

- Hisense

- GE Appliances (Haier)

- Amica Group

- Vestel Group

- Tovala

- Cuisinart

Frequently Asked Questions

Analyze common user questions about the Inverter Microwave Ovens market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of an inverter microwave oven over a standard model?

Inverter microwave ovens use continuous, consistent power delivery, resulting in more even heating, faster cooking times, superior defrosting capability, and better preservation of food texture and nutrients. Standard models cycle power on and off at full strength, often leading to uneven cooking.

Is inverter technology more energy-efficient than traditional microwave technology?

Yes, inverter technology is significantly more energy-efficient. By using a sophisticated power supply that delivers precise, regulated energy, it minimizes standby power consumption and uses the required wattage more effectively during operation compared to older, transformer-based designs.

How does the high initial cost of inverter microwaves impact consumer adoption globally?

The higher initial cost acts as a barrier in price-sensitive emerging markets. However, in developed markets, consumers often perceive the cost as justified due to the long-term savings from energy efficiency, superior cooking performance, and integrated smart features, leading to steady adoption in the premium segment.

Which geographical region exhibits the highest growth potential for inverter microwave ovens?

The Asia Pacific (APAC) region, driven by countries like China and India, shows the highest overall growth potential due to rapid urbanization, expanding middle-class demographics, and a strong preference for technologically advanced and space-saving kitchen appliances.

What is the role of sensor cooking in modern inverter microwave ovens?

Sensor cooking utilizes advanced sensors (humidity/temperature) to monitor food condition in real-time, automatically adjusting the inverter's power output and cooking duration. This process eliminates guesswork, ensuring food is cooked consistently and perfectly without manual intervention, maximizing the benefit of the continuous power supply.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager