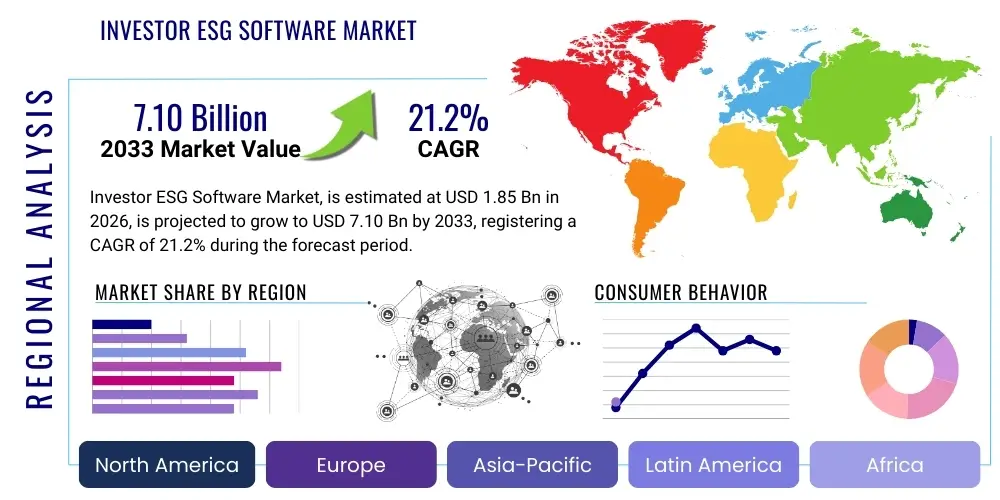

Investor ESG Software Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438727 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Investor ESG Software Market Size

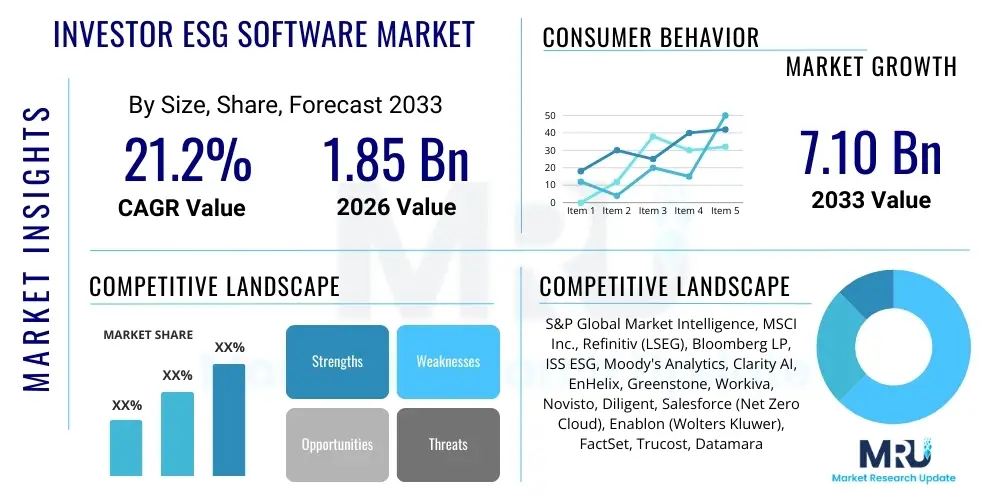

The Investor ESG Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 21.2% between 2026 and 2033. The market is estimated at $1.85 Billion in 2026 and is projected to reach $7.10 Billion by the end of the forecast period in 2033.

Investor ESG Software Market introduction

The Investor ESG Software Market encompasses sophisticated digital platforms and analytical tools designed to help investors, asset managers, and financial institutions integrate Environmental, Social, and Governance (ESG) criteria into their investment decisions, portfolio management, and regulatory compliance reporting. This specialized software facilitates the collection, standardization, verification, and analysis of vast amounts of non-financial data, transforming complex sustainability metrics into actionable insights for risk assessment and value creation. The rising global emphasis on sustainable finance, coupled with stringent regulatory mandates from bodies like the SEC, EU (SFDR, CSRD), and others, is fundamentally driving the demand for these integrated software solutions. These tools enable stakeholders to monitor portfolio companies' performance against sustainability targets, conduct advanced scenario analysis, and demonstrate fiduciary responsibility through robust data provenance.

Products within this market range from basic data aggregation modules to comprehensive, AI-powered platforms that offer predictive modeling for climate transition risks and social impact quantification. Key applications include pre-investment due diligence, real-time portfolio screening for controversial holdings, customized ESG rating generation, proxy voting guidance, and automated report generation compliant with global frameworks such as GRI, SASB, and TCFD. The intrinsic benefits of adopting investor ESG software are manifold: enhanced risk management by identifying latent environmental and social liabilities, improved investment transparency leading to higher investor trust, and the ability to attract the burgeoning capital allocated to sustainable and impact funds. Furthermore, these systems provide a standardized mechanism for tracking performance indicators (KPIs) related to decarbonization pathways and diversity goals, which is crucial for mandate fulfillment.

The market is predominantly driven by the unprecedented shift in institutional investor focus towards responsible investment mandates, often compelled by stakeholder pressure and shifting demographics that favor sustainability. Regulatory harmonization efforts globally, while creating complexity, concurrently necessitate technological standardization in reporting, thus boosting software adoption. Technological advancements, particularly in integrating Machine Learning (ML) and Natural Language Processing (NLP) to parse unstructured data (like news feeds and corporate filings), are making these software tools more efficient and accurate in surfacing material ESG risks, solidifying their role as indispensable components of modern financial infrastructure. The demand spans across various investor types, including pension funds requiring long-term sustainability alignment and private equity firms focused on value enhancement through targeted governance improvements.

Investor ESG Software Market Executive Summary

The Investor ESG Software Market is currently experiencing exponential growth, fueled by convergent global business trends centered on sustainability and accountability. A pivotal trend involves the integration of ESG data beyond simple exclusionary screening into complex financial modeling, requiring platforms that support deep analysis of financial materiality and transition risk. Investment managers are moving away from relying solely on third-party rating agencies and are increasingly demanding proprietary data collection and customizable scoring methodologies, driving vendors to offer highly flexible, modular, and open-architecture platforms. Business trends also highlight significant consolidation, where major financial technology providers are acquiring specialized ESG software firms to offer end-to-end solutions spanning core accounting, risk, and sustainability management, streamlining the workflow for large institutional clients.

Regionally, Europe maintains its leadership in market maturity and adoption, primarily due to the stringent legislative framework established by the European Green Deal, the Sustainable Finance Disclosure Regulation (SFDR), and the upcoming Corporate Sustainability Reporting Directive (CSRD). This regulatory environment necessitates immediate and comprehensive software solutions for compliance and reporting, driving high expenditure on advanced analytics tools. North America, while initially lagging, is rapidly catching up, propelled by increasing pressure from pension beneficiaries, shareholder activism, and recent regulatory actions by the SEC focusing on climate-related disclosures and greenwashing prevention. Asia Pacific is emerging as the fastest-growing region, driven by governmental net-zero commitments (e.g., Japan, South Korea) and rising interest from institutional investors in markets like Singapore and Australia seeking to align capital with regional sustainability agendas and combat localized climate vulnerabilities, stimulating substantial investment in localized ESG data sources and software.

Segmentation trends indicate a strong preference for Cloud-Based deployment models due to scalability, lower upfront costs, and ease of integration with existing asset management systems, particularly among smaller to mid-sized firms. By component, the demand is shifting from generic "Software Platforms" towards highly specialized "Modules" focusing on specific regulatory reporting (e.g., SFDR PAI metrics) or thematic areas (e.g., biodiversity impact analysis). Among investor types, Asset Managers represent the largest adoption segment due to the vast volume of portfolios requiring ESG integration, but Private Equity Firms are showing the fastest growth rate, utilizing specialized ESG software to conduct thorough due diligence and manage portfolio company performance improvements before exit. This strategic utilization underscores the software's transition from a compliance tool to a core value creation instrument.

AI Impact Analysis on Investor ESG Software Market

User inquiries regarding AI's impact frequently center on how machine learning can overcome the notorious challenges of ESG data quality—specifically, data scarcity, inconsistency, and lack of standardization. Common questions revolve around the efficacy of Natural Language Processing (NLP) in extracting material ESG signals from unstructured data (e.g., 10-K filings, news articles, social media), how AI can detect instances of "greenwashing" by comparing corporate claims against real-world performance indicators, and whether predictive AI models can accurately forecast climate transition risks and their financial implications. Users are also highly concerned about the governance implications of algorithmic bias in ESG scoring, demanding transparency on how AI weightings are applied. The summary theme is clear: users expect AI to fundamentally transform ESG software from a historical reporting mechanism into a real-time, forward-looking risk management and alpha generation engine, emphasizing automation, enhanced data coverage, and predictive accuracy.

The advent of sophisticated AI and generative models is serving as the primary catalyst for market innovation within the Investor ESG Software domain. AI technologies, including advanced machine learning algorithms, are crucial for tackling the inherent complexity and volume associated with non-financial data, allowing software platforms to ingest, normalize, and reconcile disparate data formats from thousands of sources simultaneously. This automation capability significantly reduces the manual burden on investment analysts and minimizes the latency in receiving critical information. For instance, specialized ML models can automatically assign materiality scores to ESG factors based on industry sector and geographical location, providing context-specific risk assessments that traditional rules-based systems cannot match.

Furthermore, AI-driven solutions are instrumental in elevating the analytical sophistication available to investors. Generative AI is increasingly used for synthesizing complex regulatory texts and customizing reports, translating broad mandates (like TCFD scenarios) into concrete, portfolio-level exposure metrics. NLP is vital for monitoring sentiment and controversy, offering early warnings on social and governance risks that are often embedded within unstructured text. The ongoing incorporation of these advanced capabilities ensures that ESG software remains competitive and essential, shifting its value proposition from mere compliance fulfillment to strategic decision support, offering capabilities like stress-testing portfolios against various climate pathways or identifying hidden alignment with Sustainable Development Goals (SDGs) through text analysis of corporate communication.

- AI-Powered Data Extraction: NLP for parsing unstructured text (regulatory filings, sustainability reports, news) to extract material ESG metrics, greatly improving data coverage and timeliness.

- Greenwashing Detection: Machine learning models compare self-reported company data against external, contextual signals to identify inconsistencies and potential exaggerations of sustainability efforts.

- Predictive Risk Modeling: AI algorithms simulate financial impacts of climate transition scenarios (e.g., carbon pricing, stranded assets) directly on portfolio valuations.

- Automated Alignment Scoring: Use of ML to automatically map company activities and products to global frameworks like the UN SDGs or the EU Taxonomy.

- Enhanced Data Quality and Normalization: Algorithms clean, standardize, and fill data gaps (imputation) caused by incomplete corporate disclosures, thereby improving reliability.

DRO & Impact Forces Of Investor ESG Software Market

The Investor ESG Software Market is characterized by powerful drivers related to global regulatory pressures and investor demand, restrained by significant data challenges and high implementation costs, yet poised for expansive growth through technological innovation and market maturation. The overarching impact force is the mandatory shift toward sustainable capital allocation, transforming ESG considerations from optional best practice into fundamental financial requirements. Drivers include the global regulatory push (SFDR, CSRD, SEC mandates), the institutionalization of sustainability investing (fiduciary duties expanding to include climate risk), and the democratization of ESG data through better availability. Restraints largely center on the non-standardized nature of ESG disclosures, data latency issues, and the need for highly skilled talent to interpret and manage complex software. Opportunities arise from applying AI to solve data gaps and expanding into underserved regions (APAC, MEA), while providing specialized tools for niche asset classes (private markets, infrastructure). These forces collectively ensure sustained high growth, prioritizing vendors who offer robust data governance and analytical depth.

Key drivers are anchored in the regulatory environment and evolving investor expectations. The increasing global regulatory fragmentation means that large, multinational investors require single software solutions capable of handling reporting mandates across multiple jurisdictions seamlessly. This regulatory stick complements the financial carrot, as growing evidence suggests that strong ESG performance correlates with reduced volatility and enhanced long-term returns, attracting massive capital flows into ESG-aligned funds. Consequently, investors require sophisticated tools not just for compliance but for achieving competitive advantage and demonstrating impact. This confluence creates a perpetual demand cycle for continuous software upgrades and expanded functional capabilities that keep pace with regulatory amendments and evolving best practices, such as integrating biodiversity metrics alongside traditional carbon data.

Conversely, market restraints pose hurdles that limit rapid adoption, particularly among smaller financial entities. The primary challenge remains the heterogeneity and lack of reliable, auditable ESG data, forcing software providers to allocate substantial resources toward data aggregation and cleaning, often increasing the total cost of ownership. Implementation complexity, requiring deep integration with existing portfolio management and accounting systems, can be time-consuming and resource-intensive. Furthermore, the market suffers from a shortage of professionals possessing the dual expertise required—deep financial knowledge combined with technical proficiency in ESG metrics and data science—making software deployment and utilization less effective if adequate training and support are not provided. Overcoming these restraints necessitates modular, user-friendly interfaces and greater standardization efforts led by industry bodies and regulators.

Segmentation Analysis

The Investor ESG Software Market is segmented based on the components purchased (Software vs. Services), the manner of deployment, the type of investor utilizing the tools, and the specific industries they serve. This segmentation provides a granular view of market dynamics, revealing that adoption patterns vary significantly based on the user's size, operational complexity, and regulatory domicile. The Cloud-Based deployment model dominates due to its efficiency and scalability, catering especially to Asset Managers who require flexible solutions to manage diverse global portfolios. Specialized services, particularly consulting and integration, are essential components, driven by the need for customized implementation and ongoing support for complex regulatory reporting frameworks.

- By Component:

- Software (Platforms, Modules, Analytics Tools)

- Services (Consulting, Implementation and Integration, Managed Services, Support and Maintenance)

- By Deployment Model:

- Cloud-Based

- On-Premise

- By Investor Type:

- Institutional Investors (Pension Funds, Sovereign Wealth Funds, Insurance Companies)

- Asset Managers and Fund Managers

- Private Equity and Venture Capital Firms

- Hedge Funds

- Wealth Managers and Family Offices

- By End-User Industry (where capital is directed):

- Financial Services and Banking

- Real Estate and Infrastructure

- Energy and Utilities

- Manufacturing and Industrials

- Technology and Telecommunications

Value Chain Analysis For Investor ESG Software Market

The value chain for Investor ESG Software is intricate, starting with upstream activities focused heavily on data sourcing and processing, moving through core platform development, and culminating in downstream distribution and advisory services. Upstream analysis involves Data Providers (e.g., MSCI, Refinitiv, Bloomberg) gathering raw corporate disclosures, utilizing specialized data collection technology (AI/NLP) to standardize disparate datasets, and packaging them into normalized feeds. This critical step addresses the fundamental challenge of data scarcity and heterogeneity. Software vendors then leverage these feeds, along with proprietary algorithms, to build the core platform architecture and specialized analytical modules (e.g., carbon footprint calculators, SFDR compliance modules), representing the main phase of value creation.

The distribution channel involves both direct and indirect models. Direct sales are common for enterprise-level contracts with large institutional investors or tier-one banks, where customized integration and high-touch support are required. Indirect channels involve partnerships with system integrators, management consultants, and specialized financial service providers who embed ESG software tools into broader advisory or technological implementation projects. Downstream analysis focuses on the end-user interaction and value delivery, specifically how investors utilize the software outputs for strategic decisions—portfolio rebalancing, shareholder engagement, and mandated public reporting. The efficiency and accuracy of this downstream output determine the perceived value of the entire solution.

A crucial dynamic in this value chain is the increasing convergence between data providers and software vendors. Historically separate, many software platforms now integrate proprietary data capabilities (e.g., scraping, survey tools), reducing dependency on third-party data feeds, thereby capturing more value. Conversely, traditional financial data terminal providers are expanding their software and analytics offerings. The differentiation relies heavily on the quality of proprietary algorithms and the integration support provided. The ultimate success of a vendor depends on its ability to manage the high volume of complex data flows (upstream) and effectively translate technical outputs into practical, regulatory-compliant reports and investment decisions (downstream), ensuring efficient flow through both direct distribution channels and robust, certified partner networks.

Investor ESG Software Market Potential Customers

The primary customers for Investor ESG Software are sophisticated financial entities responsible for managing large pools of capital and adhering to fiduciary duties that increasingly incorporate sustainability considerations. The core demand originates from institutional investors, notably large public and corporate pension funds and insurance companies, who require robust solutions for long-term risk management and mandate fulfillment, often dictated by governmental or beneficiary requirements concerning climate risk and social impact. These buyers need highly secure, auditable platforms capable of handling multi-asset class data and advanced scenario modeling to meet multi-decade liabilities. They prioritize integration depth and regulatory coverage across global markets.

Asset Managers, including mutual fund complexes, ETFs providers, and segregated account managers, form the largest volume segment of the customer base. Their need is driven by the necessity to launch and manage a growing array of sustainable and impact-labeled products (e.g., SFDR Article 8 and 9 funds), requiring software for real-time portfolio screening, customized benchmarking, and comprehensive investor reporting demonstrating alignment with fund objectives. Private Equity (PE) and Venture Capital (VC) firms represent a high-growth segment, utilizing ESG software not just for compliance, but as a strategic tool during due diligence (pre-acquisition screening) and value creation (post-acquisition monitoring and improvement of portfolio company ESG performance) to ensure profitable exits. These buyers seek tools focusing on operational data collection and sector-specific risk metrics.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.85 Billion |

| Market Forecast in 2033 | $7.10 Billion |

| Growth Rate | 21.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | S&P Global Market Intelligence, MSCI Inc., Refinitiv (LSEG), Bloomberg LP, ISS ESG, Moody's Analytics, Clarity AI, EnHelix, Greenstone, Workiva, Novisto, Diligent, Salesforce (Net Zero Cloud), Enablon (Wolters Kluwer), FactSet, Trucost, Datamaran, Position Green, ESG Book, Sustainable Business Toolkit (SBT). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Investor ESG Software Market Key Technology Landscape

The technological landscape of the Investor ESG Software Market is rapidly evolving, driven by the need for scalability, accuracy, and real-time data processing. Central to this evolution is the dominant reliance on cloud computing architecture, typically utilizing major providers like AWS, Azure, or Google Cloud, to ensure the flexibility and computational power required to handle petabytes of structured and unstructured sustainability data across global portfolios. Modern platforms leverage Microservices Architecture (MSA) to enable modularity, allowing investors to select specific features (e.g., climate risk module, PAI reporting tool) and integrate them seamlessly with their existing proprietary systems, ensuring high system uptime and rapid deployment of regulatory updates without disrupting core operations. Furthermore, APIs (Application Programming Interfaces) are crucial for facilitating two-way data flow between the ESG software and internal systems (e.g., trading platforms, CRM), as well as external data vendors.

The analytical backbone of these solutions is increasingly powered by Artificial Intelligence (AI) and Machine Learning (ML). Specifically, Natural Language Processing (NLP) is a cornerstone technology, enabling the automated scraping and interpretation of vast quantities of unstructured textual data—such as company sustainability reports, regulatory filings, litigation documents, and news feeds—to extract latent risk signals and verify corporate claims. Machine learning algorithms are then applied for data imputation (filling missing data points based on peer averages or historical trends), scoring model optimization, and generating forward-looking, predictive risk insights, particularly concerning climate transition and physical risk modeling. Advanced visualization techniques are also key, translating complex, multidimensional ESG data into accessible dashboards and interactive reports for portfolio managers and stakeholder communication.

Blockchain technology, while still nascent in widespread adoption, is emerging as a potential solution for enhancing data provenance and transparency. By providing an immutable ledger for corporate sustainability disclosures, blockchain could significantly reduce the risk of greenwashing and enhance the auditability of ESG claims, addressing a major industry pain point. Furthermore, specialized Geographic Information System (GIS) tools are integrated, particularly in climate risk modules, to map the physical assets of portfolio companies against climate hazard overlays (e.g., flood zones, wildfire risks), offering investors granular, location-specific physical risk exposure analysis. The overall technological direction favors integrated platforms that combine robust data infrastructure, scalable cloud deployment, and advanced cognitive technologies to deliver actionable insights.

Regional Highlights

- Europe: The undisputed leader in ESG software adoption, driven by landmark legislation such as the Sustainable Finance Disclosure Regulation (SFDR), the EU Taxonomy, and impending Corporate Sustainability Reporting Directive (CSRD). European asset managers and institutional investors are mandated to disclose Principal Adverse Impacts (PAIs) and demonstrate sustainable investments, creating an acute demand for sophisticated compliance and reporting tools. The market is mature, characterized by high-volume transactions and demand for niche solutions focused on deep impact assessment and climate scenario analysis. Germany, the UK, and France are the largest national markets.

- North America: Experiencing rapid acceleration, particularly in the United States, following increased regulatory focus from the SEC concerning standardized climate disclosures and heightened scrutiny of fund labeling practices. Institutional investors, driven by fiduciary duty and powerful shareholder activism, are prioritizing software that supports robust risk management and transparency. While historically reliant on voluntary frameworks, the shift toward mandatory reporting is dramatically increasing software expenditure, especially among large pension funds and investment banks seeking to manage litigation risk.

- Asia Pacific (APAC): The fastest-growing regional market, characterized by diversity in regulatory maturity. Markets like Australia, Japan, and Singapore are leading adoption, driven by sovereign wealth fund mandates, stock exchange requirements (e.g., HKEX, SGX), and national net-zero commitments. The key demand in APAC is for flexible software that can handle localized regulatory frameworks and diverse data sources, often requiring solutions tailored for emerging market disclosures and specific regional environmental risks (e.g., water scarcity, air pollution).

- Latin America (LATAM): An emerging market where adoption is primarily concentrated among large pension funds and multinational asset managers operating within the region. Demand is gradually increasing due to localized voluntary sustainability initiatives and rising interest in green bonds. The market requires solutions that can function effectively with limited data availability and often necessitates customized data collection services integrated with the software.

- Middle East and Africa (MEA): Currently the smallest but showing substantial growth potential, particularly in the Middle East, driven by sovereign wealth funds (SWFs) aiming to diversify investments away from fossil fuels and align with global sustainability standards. ESG software adoption is focused on managing international investments and providing transparency for global capital partners, requiring tools that emphasize governance and social factors unique to the region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Investor ESG Software Market.- S&P Global Market Intelligence

- MSCI Inc.

- Refinitiv (LSEG)

- Bloomberg LP

- ISS ESG

- Moody's Analytics

- Clarity AI

- EnHelix

- Greenstone

- Workiva

- Novisto

- Diligent

- Salesforce (Net Zero Cloud)

- Enablon (Wolters Kluwer)

- FactSet

- Trucost (S&P Global)

- Datamaran

- Position Green

- ESG Book

- Sustainable Business Toolkit (SBT)

Frequently Asked Questions

Analyze common user questions about the Investor ESG Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Investor ESG Software and why is it essential for financial institutions?

Investor ESG Software comprises platforms and tools designed to collect, analyze, and report on Environmental, Social, and Governance data, allowing investors to integrate sustainability factors into their portfolio construction, risk management, and regulatory disclosures. It is essential because it operationalizes compliance with mandatory frameworks (like SFDR and SEC rules) and enables data-driven sustainable investment decisions.

How does AI contribute to the improvement of ESG data quality and analysis?

AI, primarily through Natural Language Processing (NLP) and Machine Learning (ML), significantly improves ESG data quality by automating the extraction of material information from unstructured corporate documents, normalizing inconsistent data formats, filling data gaps through imputation, and providing advanced predictive modeling for complex risk analysis (e.g., climate change scenarios).

Which segmentation of the Investor ESG Software Market is experiencing the fastest growth?

The Private Equity and Venture Capital Firms segment, categorized under Investor Type, is experiencing the fastest adoption growth. These firms are increasingly utilizing specialized ESG software tools for due diligence, monitoring portfolio companies' operational sustainability improvements, and optimizing reporting to ensure higher valuations upon exit.

What are the primary regional drivers influencing market adoption rates?

The primary regional driver in Europe is stringent mandatory regulation (SFDR, CSRD), while in North America, the drivers are accelerating SEC oversight and strong shareholder pressure. In the Asia Pacific, growth is largely fueled by government-led net-zero commitments and increasing maturity of national financial regulatory bodies.

What challenges restrain the expansion of the Investor ESG Software Market?

Key restraints include the critical challenge of non-standardized and often incomplete corporate ESG disclosures, which necessitates significant data cleaning efforts. Other constraints involve the high cost and complexity of integrating enterprise-level software and a persistent shortage of financial professionals skilled in advanced ESG data science and analytics.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager