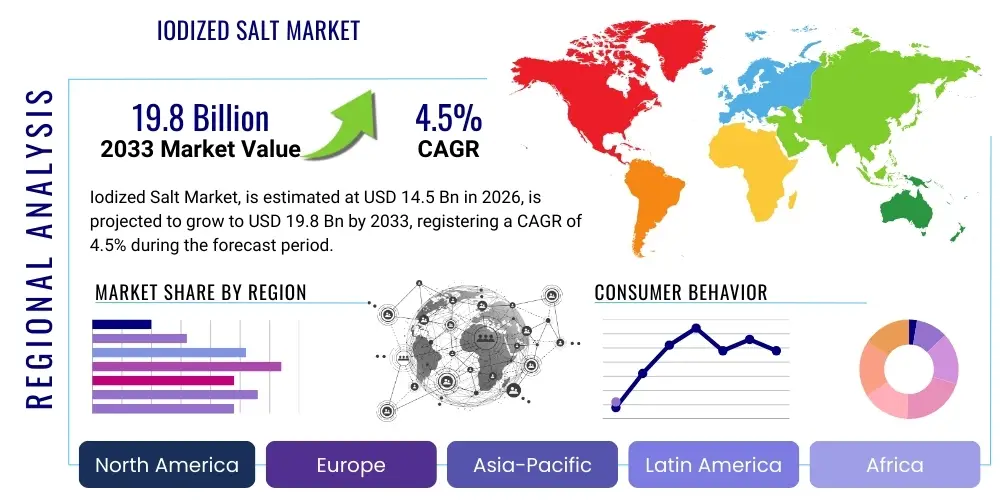

Iodized Salt Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437998 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Iodized Salt Market Size

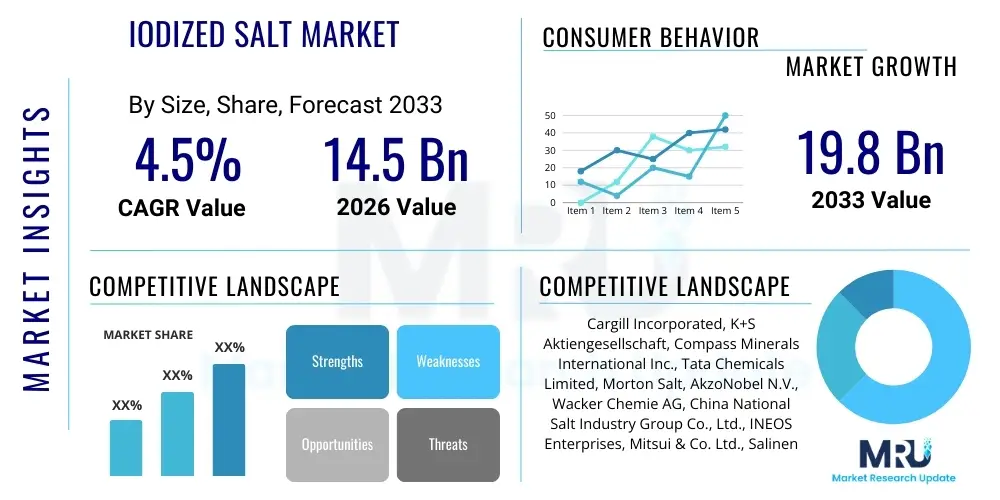

The Iodized Salt Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 14.5 Billion in 2026 and is projected to reach USD 19.8 Billion by the end of the forecast period in 2033.

Iodized Salt Market introduction

Iodized salt, a fundamental component of global public health strategies, refers to common table salt (sodium chloride) fortified with trace amounts of iodine compounds, predominantly potassium iodide or potassium iodate. This fortification process is mandated in over 120 countries through Universal Salt Iodization (USI) programs, serving as the most effective and low-cost intervention to combat Iodine Deficiency Disorders (IDD), which pose severe threats to neurological development, particularly in vulnerable populations. The market structure is highly unique, being resilient to standard economic cycles as demand is underpinned by governmental policy rather than discretionary consumer spending. The effectiveness of the market is measured not just in sales volume but in public health outcomes, making regulatory adherence and consistent quality control the paramount operational priorities for all market participants.

The product portfolio within the market encompasses several distinct grades. These range from high-purity, standardized crystalline salt destined for industrial food manufacturing and large-scale bakery operations to fine-grain, packaged salt intended for direct household use. Major applications are segmented into residential consumption, which constitutes a significant volume base; commercial food service operations, including institutional kitchens and restaurants; and specialized industrial applications where salt acts as a processing agent. The critical benefits delivered by this market extend far beyond culinary use, encompassing the prevention of goiter, cretinism, and developmental delays, positioning iodized salt as a cornerstone of preventive global nutrition initiatives. Manufacturers must continually adapt their production methods to ensure iodine stability, especially when salt is distributed across diverse environmental conditions, including high humidity and extreme temperatures which accelerate iodine loss.

Market growth is predominantly propelled by the aggressive expansion and reinforcement of USI mandates in densely populated developing regions, notably South Asia and Sub-Saharan Africa. The continued commitment of international bodies, such as the WHO and UNICEF, through funding, monitoring, and technical assistance, ensures the long-term viability of these programs. Furthermore, the global shift towards centrally processed, packaged foods indirectly boosts the demand for bulk, standardized iodized salt inputs required by industrial manufacturers. However, persistent challenges include managing the commodity's high volume and low value, resulting in proportionally high logistical costs, and overcoming the resistance from traditional or small-scale salt producers who may lack the technology or adherence incentive to implement effective iodization protocols uniformly. These dynamics necessitate highly efficient production and distribution networks integrated closely with governmental regulatory frameworks to sustain compliance and growth.

Iodized Salt Market Executive Summary

The Iodized Salt market is characterized by stable growth driven by non-discretionary demand and increasing compliance rates globally. Business trends show a strategic focus on vertical integration, where major international salt producers control the process from raw salt extraction to final packaging, enhancing quality control and cost efficiency necessary for competing in a low-margin environment. There is a discernible trend toward the utilization of advanced blending technologies, such as fluid-bed systems and continuous flow mixers, which guarantee micro-level homogeneity of iodine distribution, crucial for passing stringent regulatory audits. Additionally, companies are investing in developing premium or specialized products, including salts enriched with other micronutrients (dual fortification) or low-sodium alternatives using potassium chloride, targeting increasingly health-aware urban consumers in developed nations, offering marginal opportunities for value-added pricing.

Regional trends distinctly highlight the Asia Pacific region as the dominant volume center, underpinned by high baseline population consumption and mandatory enforcement across nations like India and Indonesia. While North America and Europe demonstrate market maturity, stability is ensured by strict food safety laws and robust industrial demand, necessitating consistent, high-purity inputs. The Middle East and Africa (MEA) region is identified as the prime area for future volume expansion, witnessing rapid increases in government commitment to IDD eradication, translating into accelerated institutional procurement and expanding distribution infrastructure. This regional growth often relies heavily on public-private partnerships to overcome infrastructural hurdles and ensure last-mile availability of fortified salt.

Segment analysis reveals that the Food Processing and Manufacturing segment is outpacing residential growth, reflecting global dietary shifts towards convenience and processed foods. Potassium Iodate (KIo3) remains the overwhelmingly preferred iodizing agent due to its superior chemical resilience against humidity and temperature, mitigating post-production iodine loss, which is a major regulatory concern. Distribution channel trends indicate that while traditional wholesale and government procurement channels maintain dominance in volume, modern organized retail and targeted B2B direct sales are gaining traction, demanding higher standards in packaging presentation and supply chain traceability. These trends collectively underscore a market prioritizing efficiency, compliance, and strategic technological investment to manage immense volumes under public health scrutiny.

AI Impact Analysis on Iodized Salt Market

Common user questions regarding AI in the Iodized Salt market focus heavily on automating quality assurance, optimizing complex logistics for a low-value commodity, and leveraging predictive analytics to target nutritional interventions. Users are keenly interested in how machine learning can interpret real-time sensor data from production lines to immediately detect and correct deviations in iodine concentration (PPM levels), minimizing waste and guaranteeing legal compliance, a critical bottleneck in large-scale operations. Furthermore, there is strong demand for AI systems capable of integrating climate data, transportation network performance, and regional demand volatility to optimize inventory placement and reduce transit times, thereby protecting the integrity of the iodine content.

AI's influence is extending beyond mere operational efficiency into strategic public health applications. Machine learning models are now being deployed by NGOs and government health ministries to analyze vast datasets encompassing demographic profiles, consumption habits, environmental risk factors (e.g., altitude, soil content), and historical deficiency prevalence. These models provide highly accurate geo-spatial mapping of iodine deficiency risk, allowing for preemptive policy adjustments, such as localized increases in mandated iodization levels or targeted subsidy programs in high-risk zones. This analytical capability transforms reactive interventions into proactive, data-driven public health strategy, directly influencing the quantity and regional distribution requirements for the iodized salt industry.

Operationally, AI contributes significantly to predictive maintenance in large salt refining facilities, minimizing unexpected downtime of expensive processing equipment used for crushing, washing, and blending. Computer vision systems are increasingly utilized in packaging lines to verify package integrity and ensure correct labeling regarding iodine content and expiry dates, which is especially important where local languages and diverse regulatory stamps must be recognized quickly. In logistics, advanced routing algorithms calculate the most efficient, temperature-controlled transit methods, particularly for exports across long distances, ensuring the final consumer receives a product that still meets the minimum mandated iodine levels, thereby closing the gap between production standards and consumer health outcomes.

- Supply Chain Optimization: AI algorithms enhance logistics planning, predictive maintenance of production equipment, and inventory management for high-volume salt distribution. Predictive models minimize transportation costs and time, crucial for maintaining low operational margins.

- Automated Quality Control (AQC): Machine learning and vision systems ensure real-time, precise monitoring of iodine levels (Potassium Iodate/Iodide concentration) during processing, ensuring compliance with strict national parts-per-million (PPM) standards.

- Predictive Health Modeling: AI analyzes demographic, consumption, and environmental data to identify populations vulnerable to Iodine Deficiency Disorders (IDD), guiding highly targeted fortification policies and resource allocation.

- Demand Forecasting: Advanced analytics accurately predict regional consumption patterns, minimizing overstocking and preventing waste, while ensuring timely supply in logistically challenging remote areas.

- Operational Efficiency: Use of AI in salt purification and washing stages to optimize resource use, particularly water and energy consumption in evaporation and crystallization processes, directly reducing overall production costs and environmental footprint.

- Regulatory Compliance Monitoring: AI systems track batch-specific quality data throughout the supply chain, providing auditors with tamper-proof records demonstrating adherence to varying international and domestic iodization standards.

- Optimized Blending Techniques: Use of real-time sensor data feedback loops and AI to fine-tune the droplet application of iodization solution onto salt crystals, maximizing homogeneity and adherence stability.

DRO & Impact Forces Of Iodized Salt Market

The operational landscape of the Iodized Salt market is profoundly influenced by a unique set of Drivers, Restraints, and Opportunities (DRO) which operate under the constant weight of public health priorities. The fundamental driver remains the legislative momentum created by Universal Salt Iodization (USI) mandates, which ensures an essentially inelastic and recurring global demand base. This regulatory environment insulates the market from typical discretionary purchasing volatility but concurrently imposes strict compliance costs. Opportunities for growth are centered around specialized product innovation, such as low-sodium formulations, and the geographic expansion into fast-developing, undersaturated markets where USI programs are aggressively being rolled out, particularly across Africa and certain parts of Southeast Asia, offering untapped volume potential.

Conversely, the market faces significant Restraints inherent to its commodity status. These include the extremely low profit margin per unit volume, which mandates rigorous cost control and high capital efficiency. Transportation and logistics expenses are disproportionately high relative to the salt’s inherent value, complicating distribution to remote areas. A persistent technological challenge is maintaining iodine stability—potassium iodate, while stable, can still degrade under high heat and moisture, leading to non-compliance at the consumer level and requiring costly packaging and storage solutions. Furthermore, the market faces internal pressure from small, often unregulated salt producers who bypass iodization requirements, creating unfair competition and undermining public health goals.

Drivers: Mandatory Universal Salt Iodization (USI) programs globally, underpinned by national health legislation and international conventions to eradicate Iodine Deficiency Disorders (IDD); rising global awareness regarding the critical neurological and metabolic benefits of iodine consumption, particularly for maternal and child health; increased reliance on high-volume processed and packaged foods, necessitating standardized industrial inputs of iodized salt; sustained financial and technical backing from global health organizations (e.g., WHO, UNICEF, World Bank) ensuring infrastructure development for fortification in developing nations; and consistent global population growth, which intrinsically expands the consumer base for this dietary staple.

Restraints: Significant iodine loss (volatilization) during storage and transportation in high-humidity or poorly managed warehouses, necessitating expensive packaging barriers and reducing product efficacy; strict governmental price controls and potential subsidies that compress profit margins, thereby limiting investment in innovation and infrastructure upgrade; high operational expenditure for setting up and maintaining advanced, automated iodization plants and independent third-party quality control testing laboratories; market leakage due to the prevalence of unfortified non-iodized salt (such as traditional sea salts, gourmet salts, or rock salts) used in certain cooking or specialty applications; and the necessity of managing large-volume logistics for a low-density, low-value commodity over long and challenging supply routes.

Opportunities: Development and commercialization of next-generation, highly stable iodizing compounds, such as microencapsulated iodine, which significantly improve shelf life and performance in severe environmental conditions; strategic penetration into large emerging markets in Sub-Saharan Africa and Asia where USI implementation and compliance levels are still scaling up, promising high volume growth; catering to evolving health preferences through the introduction of specialty iodized salts (e.g., low-sodium variants using mineral salts like potassium chloride, or triple-fortified salts including iron and folic acid); adoption of advanced IoT sensors and AI-driven monitoring systems to enhance supply chain transparency, quality verification, and regulatory compliance reporting; and strategic partnerships with regional governments to manage distribution logistics and institutional procurement tenders effectively.

Impact Forces: Regulatory enforcement acts as the principal impact force, creating an inelastic demand curve. Failure to meet governmental mandates (regarding PPM concentration or distribution coverage) results in immediate legal and commercial sanctions, making compliance paramount. Economic efficiency is another critical force; the necessity to produce and distribute massive volumes at the lowest possible cost drives intense vertical integration and automation among major players. Technological stability, specifically the ability to reliably maintain iodine levels throughout the distribution chain, dictates consumer trust and long-term public health success, placing pressure on R&D investment in packaging and blending techniques. These forces collectively shape a competitive environment where regulatory excellence and extreme cost management are the primary determinants of market success.

Segmentation Analysis

The segmentation of the Iodized Salt market is fundamental to understanding its complex operational requirements and diverse consumer needs. Segmentation by iodizing agent differentiates between Potassium Iodate (KIo3) and Potassium Iodide (KI). KIo3 dominates due to its superior chemical stability, a non-negotiable factor in tropical climates, reducing the risk of iodine degradation post-processing. Although KI is sometimes used, particularly in markets where salt is consumed rapidly, KIo3 provides the necessary robustness required for modern global supply chains and regulatory longevity, dictating equipment choice and blending complexity for manufacturers.

Segmentation by Application reveals the dichotomy between high-volume, functional industrial consumption and brand-driven household retail. The Food Processing segment, encompassing industries like bakery, canning, dairy, and snack production, demands vast quantities of uniformly granulated, high-purity iodized salt, often purchasing directly from producers under B2B contracts. This segment values consistency, certifications, and reliable bulk supply. Conversely, the Household segment, accessed via retail channels, requires varied packaging sizes, brand marketing, and competitive pricing, often being more susceptible to local cultural preferences regarding salt texture and additives.

Further segment refinement by Grade addresses evolving health concerns. The nascent but growing Low-Sodium Iodized Salt segment, substituting a portion of NaCl with KCl, caters to hypertensive or health-conscious consumers, representing a premium, value-added opportunity distinct from the standard commodity market. Effective market strategy requires tailoring production output, quality control processes, and distribution strategies to meet the specific requirements and stringent regulatory thresholds associated with each segment, balancing the cost pressures of the commodity market with the opportunity for value addition in niche clinical or specialty applications.

- By Iodizing Agent:

- Potassium Iodate (KIo3): Preferred globally due to high thermal and oxidative stability; crucial for long shelf life.

- Potassium Iodide (KI): Less stable; often requires stabilizers (e.g., dextrose) and is used primarily in developed markets with rapid consumption cycles.

- By Application (End-User):

- Household/Residential Consumption: High volume, highly price-sensitive, focus on retail packaging and branding.

- Industrial Use: Non-food applications (e.g., chemical, water softening); demands high purity and bulk logistics.

- Food Processing and Manufacturing: Fastest growing segment; requires consistent granulation, high-volume B2B supply, and specific certification standards.

- Commercial Use: Food service, restaurants, and institutional buyers; emphasizes bulk supply and regulatory compliance for large kitchens.

- By Grade/Type:

- Standard Grade Iodized Salt: The commodity benchmark; strictly adheres to national PPM limits.

- Low-Sodium Iodized Salt: Blended with substitutes like Potassium Chloride (KCl); targets consumers managing hypertension.

- Specialty/Mineral-Enriched Iodized Salt: Dual or triple fortification (e.g., iodine plus iron, zinc, or fluorine); higher margin product for niche health markets.

- By Distribution Channel:

- Retail Stores (Supermarkets, Hypermarkets, Groceries): Critical for urban household access; relies on organized logistics and shelf presence.

- Wholesale/Distributors: Dominant channel in developing economies; handles large volume bulk movement to fragmented retail networks.

- Direct Sales (B2B for Industrial/Food Processing): Preferred by large manufacturers for consistent quality control and supply reliability.

- Online Retail/E-commerce: Emerging channel for specialized or premium iodized salts; offers convenience but low volume share overall.

Value Chain Analysis For Iodized Salt Market

The value chain for iodized salt begins with extensive upstream activities dedicated to raw material sourcing and refinement. This phase involves the extraction of salt, predominantly through solar evaporation (common in coastal areas), mining (rock salt), or vacuum evaporation (for high-purity industrial grades). The initial purification stage is capital-intensive, requiring advanced washing, crushing, and drying technologies to achieve food-grade purity, removing impurities such as calcium sulfate and magnesium chloride. Efficiency in salt harvesting and energy usage during drying significantly determines the baseline production cost, which is critical since salt is a low-margin commodity.

The core midstream activity is the iodization process, where technological precision is paramount. This involves preparing the iodine compound solution, precisely metering the flow, and employing continuous spray-blending equipment to ensure uniform mixing into the salt matrix at specified PPM levels. Following iodization, stabilization processes (often involving additives or precise moisture control) are executed. Upstream analysis focuses on securing large, cost-effective salt reserves and employing energy-efficient purification methods, as the input cost of raw salt directly impacts competitive positioning in regional markets. Regulatory compliance begins here, with internal quality checks immediately following blending.

Downstream analysis covers packaging, distribution, and market penetration. Packaging requires specialized material technology (e.g., high-density polyethylene or multi-layer paper sacks with moisture barriers) to prevent hygroscopicity and subsequent iodine loss. Distribution channels are varied: direct channels manage large industrial contracts (B2B), ensuring quality consistency for high-volume users. Indirect channels utilize extensive wholesale networks, required for maximum penetration into millions of small, independent retailers and subsidized government distribution points, especially in rural areas. Successfully navigating this complex downstream structure—managing low margins against high logistical complexity—is essential for achieving Universal Salt Iodization coverage and overall market success. Traceability and inventory management systems are critical downstream tools for ensuring product quality at the point of sale.

Iodized Salt Market Potential Customers

The customer base for iodized salt is expansive and multi-tiered, dictated largely by public health requirements and industrial consumption mandates. The primary institutional customer segment comprises national governments and large non-governmental health organizations (NGOs) procuring salt under massive institutional tenders to supply subsidized or free iodized salt programs. These transactions prioritize strict adherence to national fortification standards, the supplier's capacity to deliver immense, consistent volumes, and the lowest possible long-term contracted pricing, often dominating market volume in developing nations where subsidies are necessary to maintain coverage.

The industrial sector represents the fastest-growing commercial consumer segment. This includes major multinational and regional companies specializing in food and beverage manufacturing, such as bakeries requiring high-consistency inputs for dough preparation, snack manufacturers needing specific crystal sizes for adhesion, and canning operations relying on purity and standardization. These industrial buyers function on a Business-to-Business (B2B) model, valuing consistent supply reliability, rigorous quality documentation (e.g., ISO and HACCP certification), and tailored granularity specifications suitable for automated production lines, often purchasing directly from integrated salt producers to minimize supply risk.

The final significant segment is the household consumer, purchasing packaged salt via traditional retail or modern organized grocery chains. This segment is characterized by brand loyalty, sensitivity to pricing, and demand for convenient packaging sizes (e.g., small 1kg or 500g bags). While purchasing is highly fragmented, successful outreach depends on effective consumer education about the health benefits of iodine. A growing niche customer base also includes medical facilities and specialized dietary manufacturers who require therapeutic-grade or low-sodium iodized salts for clinical nutrition, emphasizing purity and specific mineral composition over sheer volume.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 14.5 Billion |

| Market Forecast in 2033 | USD 19.8 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Cargill Incorporated, K+S Aktiengesellschaft, Compass Minerals International Inc., Tata Chemicals Limited, Morton Salt, AkzoNobel N.V., Wacker Chemie AG, China National Salt Industry Group Co., Ltd., INEOS Enterprises, Mitsui & Co. Ltd., Salinen Austria AG, Rio Tinto Group, Sanxia Salt Group, Dominion Salt Ltd., AGES Group, Cheetham Salt Limited, Italkali S.p.A., SQM S.A., United Salt Corporation, Zoutman NV. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Iodized Salt Market Key Technology Landscape

The technological core of the Iodized Salt market revolves around ensuring the precise, uniform, and stable inclusion of iodine into vast quantities of refined salt, balancing public health necessity with industrial scale. The current landscape is dominated by sophisticated continuous flow blending systems, primarily spray mixing and drip-feed technologies. In these systems, a calculated iodine solution (usually potassium iodate dissolved in water with stabilizing agents) is atomized and applied onto purified salt crystals passing through specialized rotating drums or conveyors. The technological innovation lies in the use of gravimetric feeders and mass flow sensors integrated with Programmable Logic Controllers (PLCs) to instantly adjust the iodine application rate in response to variations in salt flow, ensuring the PPM target remains constant, often within a narrow 5% tolerance mandated by regulations.

Advanced packaging technologies are also critical elements of the modern landscape. Due to the hygroscopic nature of salt and the volatility of iodine, high-barrier packaging materials—such as laminates incorporating aluminum foil or metallized film, or high-density polyethylene bags with thick gauges—are essential, particularly for products destined for long storage or humid climates. Research is continuously focused on improving the barrier properties while maintaining cost-effectiveness for bulk production. Furthermore, X-ray fluorescence (XRF) or advanced titration equipment is increasingly used for quality assurance, allowing for non-destructive, rapid, and accurate analysis of iodine concentration on the production line, a significant improvement over traditional, slower laboratory methods.

Future technological advancements are trending toward microencapsulation, a technique where the potassium iodate particles are coated with an inert, protective layer (e.g., starch or lipids). This microencapsulation technology offers the potential to drastically reduce iodine loss during storage and cooking, eliminating the need for traditional stabilizers and enhancing product stability throughout challenging supply chains. Furthermore, the integration of Internet of Things (IoT) sensors within storage facilities and transport vehicles is emerging, providing continuous environmental monitoring (temperature and humidity), allowing producers to remotely track conditions and ensure compliance with optimal preservation parameters, thereby reinforcing the integrity of the fortification process from factory gate to consumer cupboard.

Regional Highlights

Regional analysis is essential as regulatory frameworks and market maturity vary significantly, impacting operational strategies and volume potential across the globe. The Asia Pacific region is the global volume leader, driven by mandatory USI programs in high-consumption nations like India and China, which account for billions of potential consumers. The market in APAC is characterized by intense price competition and significant logistical challenges in reaching remote populations. Companies must manage both highly centralized, modern industrial sales and vast, fragmented rural distribution networks, necessitating locally adapted branding and packaging efforts.

North America and Europe represent mature, high-value markets. In North America, demand is stable, defined by stringent regulatory environments and a high proportion of salt consumed through processed foods, making B2B sales to industrial users the key revenue driver. European markets, while mature, are seeing niche growth in specialty iodized salts (e.g., Mediterranean sea salts or mineral salts) driven by consumer demand for premium, provenance-specific products, although overall growth is slow due to high USI saturation and stable population size. These regions require a focus on high-purity inputs and compliance with advanced traceability standards.

The Middle East and Africa (MEA) region presents the most significant opportunity for growth by volume and rate. Many African nations are actively scaling up USI implementation with international support, transforming previously nascent markets into areas of critical strategic investment. The challenges here are infrastructural—poor road networks, lack of reliable storage, and high humidity accelerate iodine loss—mandating the use of the most stable iodizing agents and robust packaging solutions. Latin America, with largely established iodization legislation, continues to show steady growth, primarily focused on maintaining consistent supply reliability and addressing the dual fortification trend (iodine plus iron) to tackle multiple micronutrient deficiencies simultaneously across key demographics.

- Asia Pacific (APAC): Dominant in volume, driven by massive USI programs in high-density countries (e.g., India, China). Key focus is on volume efficiency, low-cost production, and reaching fragmented rural markets. Fastest growth projected in Southeast Asian nations as compliance strengthens.

- North America: Stable, mature market defined by strict FDA regulations. Industrial/Food Processing segment dominates B2B sales. Focus on high purity, specialized granulation, and emerging demand for low-sodium variants.

- Europe: Mature market with high regulatory fragmentation across EU member states. Emphasis on high quality, sustainability sourcing, and premium packaged iodized salts. Slow volume growth but stable value due to high industrial standards.

- Middle East and Africa (MEA): Highest CAGR expected, fueled by accelerating USI implementation, particularly in Sub-Saharan Africa, backed by global aid initiatives. Challenges center on logistics, infrastructure development, and combating iodine instability in extreme climates.

- Latin America: Established mandatory iodization programs throughout most major economies. Focus is on supply consistency, government procurement efficiency, and diversification into dual-fortified salts to address multi-micronutrient public health issues.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Iodized Salt Market. These companies are actively involved in salt mining, refining, iodization technology, and global distribution.- Cargill Incorporated

- K+S Aktiengesellschaft

- Compass Minerals International Inc.

- Tata Chemicals Limited

- Morton Salt (K+S Group Subsidiary)

- AkzoNobel N.V. (Salt Specialties Division)

- Wacker Chemie AG (Specialty Chemicals Supplier for Fortification)

- China National Salt Industry Group Co., Ltd. (CNSIC)

- INEOS Enterprises

- Mitsui & Co. Ltd. (Trading and Distribution)

- Salinen Austria AG

- Rio Tinto Group (Salt Extraction Operations)

- Sanxia Salt Group

- Dominion Salt Ltd.

- AGES Group

- Cheetham Salt Limited

- Italkali S.p.A.

- SQM S.A. (Supplier of Key Chemical Inputs)

- United Salt Corporation

- Zoutman NV

- Mineral Resources Limited

- Hebei Huachen Pharmaceutical Co., Ltd. (Iodine Supplier)

- Inner Mongolia Lantai Industrial Co., Ltd.

- Bayer AG (Pharmaceutical Grade Iodine Fortification)

Frequently Asked Questions

Analyze common user questions about the Iodized Salt market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver for Iodized Salt Market growth?

The foremost driver is the mandatory enforcement and scaling of Universal Salt Iodization (USI) programs by governments worldwide, strongly supported by international public health efforts to eradicate Iodine Deficiency Disorders (IDD) and improve cognitive health outcomes.

What technological advancements are crucial for quality assurance in this market?

Crucial technologies include continuous flow blending systems with PLC controls for precise metering, high-barrier packaging materials to prevent iodine loss due to moisture, and automated analytical tools (like XRF) for real-time quality checks of iodine concentration.

How does AI contribute to the Iodized Salt supply chain?

AI is used for predictive maintenance of industrial equipment, optimizing logistics for high-volume transport, and creating detailed geo-spatial models to forecast deficiency risk, guiding the targeted distribution of fortified salt to vulnerable populations.

Which end-user segment is growing the fastest and why?

The Food Processing and Manufacturing segment is experiencing the fastest growth, driven by the increasing global consumption of processed and packaged foods, which necessitates large, consistent volumes of certified iodized salt as a non-negotiable input.

What are the main regional challenges faced by salt producers?

In developing regions (like MEA and APAC), the main challenges include high logistics costs relative to product value, ensuring continuous iodine stability in humid climates, and securing compliance from numerous small-scale, decentralized salt producers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Iodized Salt Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Mineral Halite, Rock Salt), By Application (Food, Chemical, Industrial, Medical), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Ordinary Iodized Salt Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Large particles, Small particles), By Application (Food Industry, Pharma Industry), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager