Ion Beam Polisher Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436945 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Ion Beam Polisher Market Size

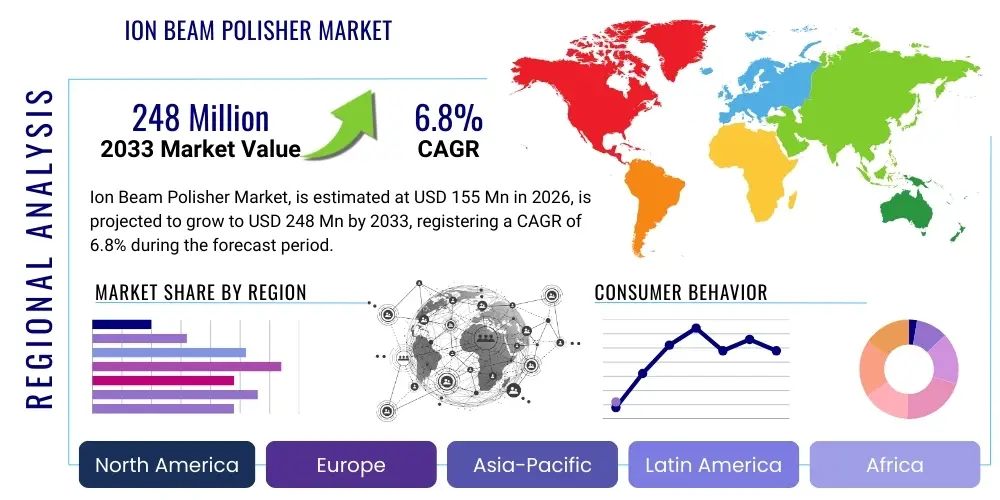

The Ion Beam Polisher Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $155 million in 2026 and is projected to reach $248 million by the end of the forecast period in 2033.

Ion Beam Polisher Market introduction

The Ion Beam Polisher (IBP) Market encompasses sophisticated equipment designed for ultra-precise material removal and surface preparation using controlled beams of ions, typically Argon, Xenon, or other inert gases. These systems are indispensable in modern material science and semiconductor manufacturing, offering damage-free, atomic-level polishing and etching capabilities far superior to conventional mechanical techniques. Key applications include preparing cross-sections for Transmission Electron Microscopy (TEM) and Scanning Electron Microscopy (SEM), thinning samples for advanced materials characterization, and localized material modification in microelectronic devices. The primary benefits include exceptional surface flatness, minimal surface damage, and the ability to process diverse material types, driving demand across high-technology sectors requiring stringent quality control and nanoscale precision for advanced research and manufacturing processes. Driving factors center on the continuous miniaturization in semiconductor fabrication, the burgeoning field of nanotechnology, and the necessity for superior sample preparation in failure analysis and quality assurance protocols for complex electronic components.

Ion Beam Polisher Market Executive Summary

The Ion Beam Polisher Market exhibits robust growth propelled by secular business trends, including the global expansion of advanced semiconductor foundries, escalating R&D investments in new composite materials, and the increasing complexity of devices requiring atomic-level defect analysis. Regionally, Asia Pacific maintains market dominance, driven by massive investments in wafer fabrication (fabs) in countries like South Korea, Taiwan, and China, solidifying its role as the primary consumer base for high-throughput IBP systems. North America and Europe, characterized by mature research infrastructure and pioneering material science labs, focus heavily on developing advanced, high-precision focused ion beam (FIB) and broad beam systems for niche applications. Segment trends indicate a rising preference for combined Broad Beam and Focused Ion Beam systems, which offer enhanced versatility in sample preparation, accommodating both large area thinning and site-specific micro-machining. Furthermore, the End-User segment shows rapid adoption within Failure Analysis laboratories, underscoring the critical role IBP plays in maintaining reliability and performance standards for next-generation electronics and quantum computing hardware. Market stakeholders are focusing on integrating automation and Artificial Intelligence to improve beam stability, optimize polishing parameters, and enhance overall system throughput, reflecting a shift towards smarter, highly reliable instrumentation.

AI Impact Analysis on Ion Beam Polisher Market

User inquiries frequently center on how Artificial Intelligence (AI) and Machine Learning (ML) can automate the complex and often time-consuming processes associated with ion beam polishing, specifically querying improvements in operational precision, throughput, and consistency. Users are keen to understand if AI can autonomously optimize beam parameters, such as ion dose, angle of incidence, and beam current, based on real-time sample characteristics detected via integrated imaging systems. Key themes highlight the expectation that AI integration will mitigate human error, particularly when preparing fragile or multi-layered semiconductor samples for high-resolution analysis. Furthermore, there is significant interest in using predictive algorithms for maintenance scheduling and diagnosing component wear in high-vacuum systems, ensuring maximum uptime and reducing cost of ownership for high-volume fabrication facilities and major research centers.

The implementation of machine learning algorithms within Ion Beam Polishing systems is transforming traditional sample preparation by enabling predictive modeling of material removal rates and surface roughness. This predictive capability allows the IBP system to adjust parameters dynamically during the polishing cycle, compensating for variations in material hardness, crystal orientation, and initial surface geometry, which is particularly vital when dealing with complex semiconductor architectures like FinFETs and Gate-All-Around (GAA) structures. The shift toward AI-driven control ensures reproducible results across different operators and instruments, a prerequisite for standardized high-volume testing and quality control procedures in the electronics sector.

Beyond process optimization, AI is heavily influencing the post-processing analysis phase. Integrating AI-powered image recognition into the system’s in-situ microscopy helps identify endpoint criteria accurately, stopping the polishing process precisely when the target thinness or cross-section is achieved, thereby preventing over-etching or sample damage. This convergence of automated preparation and intelligent endpoint detection significantly reduces cycle time, enhances the yield of high-quality TEM lamella samples, and elevates the overall technical capability of IBP instruments, making them essential tools for developing next-generation microelectronic and photonic devices.

- AI-driven optimization of ion beam parameters (angle, current, dose) for atomic-level precision.

- Machine learning integration for predictive modeling of material removal rates across heterogeneous samples.

- Automated endpoint detection using computer vision to prevent sample damage during thinning.

- Enhanced system calibration and predictive maintenance scheduling based on sensor data analysis.

- Faster development of novel preparation recipes for new complex materials and semiconductor stacks.

DRO & Impact Forces Of Ion Beam Polisher Market

The Ion Beam Polisher Market is driven primarily by the escalating demand for highly accurate failure analysis (FA) in advanced electronics and the necessity of preparing pristine samples for nanoscale characterization required by the semiconductor industry’s continuous scaling efforts. However, market growth is restrained by the high initial capital investment required for IBP systems and the need for highly skilled technicians to operate and maintain these complex, high-vacuum instruments. Significant opportunities arise from the proliferation of new materials (e.g., ceramics, composites, advanced alloys) across aerospace, automotive, and energy sectors, requiring advanced preparation techniques, alongside emerging applications in quantum computing research where defect-free surfaces are paramount. The market is heavily impacted by technological advances in ion source design, leading to higher current densities and beam stability, alongside global semiconductor spending cycles which dictate the investment pace in new research and fabrication infrastructure globally.

The primary driver influencing market dynamics is the inherent limitations of mechanical polishing methods for preparing modern nanoscale samples. As semiconductor feature sizes drop below 10 nanometers, traditional polishing introduces significant subsurface damage, smearing, and contamination, rendering samples unsuitable for high-resolution analysis needed for R&D and quality control. IBP systems, utilizing low-angle, gentle ion milling, overcome these challenges by offering controlled, atomic-level material removal, making them non-negotiable tools for advanced TEM and SEM preparation, particularly in complex layered materials or thermally sensitive compounds. This technical necessity solidifies IBP systems as essential infrastructure components rather than optional equipment in advanced research and manufacturing environments.

Conversely, market restraints are pronounced, mainly revolving around the substantial operational expenditures. These systems require specialized high-vacuum environments and often use expensive, high-purity gases (like Xenon) as ion sources. Furthermore, the learning curve associated with optimizing polishing parameters for diverse materials is steep; suboptimal settings can quickly lead to sample artifacts or destruction, emphasizing the reliance on experienced operators. This complexity creates a barrier to entry, particularly for smaller research labs or academic institutions with limited operational budgets, slowing the widespread adoption outside of major industrial and governmental research centers.

The opportunity landscape is characterized by diversification beyond traditional semiconductor applications. The push for lightweight, high-performance materials in sectors like electric vehicles (EVs) and renewable energy (e.g., specialized battery materials and advanced solar cells) generates a continuous need for structural and chemical analysis at the microstructural level. IBP provides the necessary precision to prepare cross-sections of these delicate and heterogeneous interfaces. Moreover, the global focus on enhancing microelectromechanical systems (MEMS) reliability and the burgeoning field of nanofabrication for biosensors and specialized optical components present expansive avenues for IBP system deployment, providing growth resilience irrespective of short-term fluctuations in the semiconductor capital equipment market.

Segmentation Analysis

The Ion Beam Polisher Market is systematically analyzed based on technology type, application area, and end-user vertical, reflecting the varied requirements of the scientific and industrial communities. Segmentation by technology delineates between broad beam systems, suitable for large area thinning, and focused ion beam (FIB) systems, crucial for site-specific preparation and micro-machining, with hybrid systems gaining traction for versatility. Application analysis highlights the critical role of IBP in semiconductor failure analysis and fundamental material science research, while the end-user segmentation clearly distinguishes between large-scale industrial consumers (semiconductor foundries) and academic or governmental research institutions.

- By Type:

- Broad Beam Polishing Systems

- Focused Ion Beam (FIB) Polishing Systems

- Combined/Hybrid Systems

- By Application:

- Semiconductor Manufacturing and Failure Analysis

- Material Science Research (Metallurgy, Polymers, Ceramics)

- MEMS and NEMS Fabrication

- Optical Components Finishing

- Geological and Biological Sample Preparation

- By End-User:

- Research Institutes and Universities

- Semiconductor Foundries (IDMs and Foundries)

- Electronics Manufacturers (OEMs)

- Aerospace and Defense Sector

- Contract Research Organizations (CROs)

Value Chain Analysis For Ion Beam Polisher Market

The Ion Beam Polisher value chain is highly specialized, beginning with sophisticated upstream suppliers providing ultra-high vacuum components, ion sources (such as plasma sources or liquid metal ion sources), and precision motion control systems, all of which demand exceptionally high quality and reliability. Manufacturing and assembly, the core of the chain, involve highly controlled integration of complex vacuum chambers, advanced electronics, and software for precise beam control. Downstream activities involve distribution, typically handled by specialized representatives or direct sales teams due to the technical nature of the equipment, providing installation, training, and ongoing technical support. Direct sales channels are predominant for large semiconductor clients, ensuring seamless integration and customized service, whereas indirect channels, including regional distributors, often serve academic and smaller industrial research labs.

Upstream complexity is defined by the necessity for highly reliable and specialized components, crucial for the system's performance. For instance, the quality of the ion source determines beam stability and achievable current density, directly impacting polishing speed and resolution. Suppliers of high-grade materials, such as specialized ceramics and high-purity metals required for vacuum seals and chamber construction, exert considerable influence on the final product cost and durability. Furthermore, the integration of advanced diagnostic systems, including mass spectrometers and integrated imaging detectors, sourced from specialized technology vendors, adds significant value and complexity early in the chain.

Midstream activities focus on the systems integration and rigorous quality assurance. The manufacturing process is highly skilled and involves integrating complex software algorithms for process automation, crucial for AEO/GEO optimization of the end-user workflow. The distribution and service phase, representing the downstream segment, is critical for competitive differentiation. Because IBP systems require regular calibration, vacuum maintenance, and software updates, robust post-sales support, including remote diagnostics and rapid response times, is a core determinant of customer satisfaction and long-term market share. This high requirement for specialized service makes the distribution channel a key bottleneck and opportunity point for major manufacturers.

Ion Beam Polisher Market Potential Customers

Potential customers for Ion Beam Polisher systems are predominantly entities engaged in advanced research, high-volume manufacturing, or quality assurance of materials and microelectronic devices where surface integrity and ultra-thinning precision are non-negotiable requirements. The largest purchasing segment includes multinational semiconductor foundries and Integrated Device Manufacturers (IDMs) utilizing IBP equipment for critical failure analysis and process monitoring of cutting-edge logic and memory chips. Other key buyers include academic institutions and national research laboratories focused on fundamental material science, crystallography, and nanotechnology development, leveraging the technology for preparing pristine TEM and SEM samples across diverse fields from metallurgy to biological samples requiring artifact-free cross-sectioning.

Beyond the core semiconductor and academic sectors, demand is expanding significantly within specialized industrial domains. Aerospace and defense contractors represent a growing customer base, requiring IBP for analyzing novel composite materials, testing the integrity of protective coatings, and performing failure analysis on microelectronic components exposed to harsh environments. Similarly, companies specializing in advanced battery technology (Li-ion, solid-state) and fuel cell development increasingly rely on IBP to prepare cross-sections of electrode interfaces and material boundaries to understand degradation mechanisms and optimize performance, representing a high-growth customer segment driven by the energy transition.

A third significant customer segment involves third-party contract service providers, specifically commercial failure analysis labs and specialized material characterization facilities. These labs purchase IBP systems to offer high-precision sample preparation services to smaller electronics firms, startups, or companies that cannot justify the substantial capital investment for in-house equipment. These service providers prioritize throughput and versatility, often favoring hybrid IBP systems capable of handling a wide variety of sample sizes and materials with rapid changeover times, thereby spreading the operational costs across a diverse client portfolio.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $155 million |

| Market Forecast in 2033 | $248 million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | JEOL, Hitachi High-Tech, Raith, Oxford Instruments, ZEISS, Leica Microsystems, Gatan (Ametek), South Bay Technology, Inc., Fischione Instruments, Mager Scientific, Ted Pella, Inc., Cressington Scientific Instruments, PVD Products, Inc., NanoFocus, Ltd., Vaxcel, Inc., Nanolab Technologies, Inc., Evactron, Plasma Etch, Inc., SELA Technology. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ion Beam Polisher Market Key Technology Landscape

The technological landscape of the Ion Beam Polisher Market is defined by continuous innovation aimed at enhancing beam control, optimizing material removal efficiency, and minimizing sample damage. Modern systems leverage advanced ion sources, moving beyond conventional Argon sources to include Xenon or even Gallium (in FIB systems), offering improved milling rates and reduced beam-induced artifacts. A significant technological advancement is the development of ultra-low angle polishing stages, allowing the ion beam to strike the sample almost parallel to the surface (angles often less than 1 degree), which is crucial for achieving defect-free thinning of crystalline materials and highly sensitive interfaces, a necessity for critical analysis in advanced materials research.

Furthermore, integration of sophisticated in-situ monitoring and automated control systems is central to competitive differentiation. High-resolution imaging systems, coupled with real-time process monitoring via advanced detectors, allow operators to precisely track the polishing progression and adjust parameters dynamically. The shift towards automated sample handling and recipe-driven operation reduces reliance on highly specialized manual intervention, boosting throughput and reproducibility in industrial settings. These advancements align with Industry 4.0 principles, ensuring that IBP systems function as highly integrated, intelligent components within the broader semiconductor fabrication and characterization workflow.

The market is also witnessing increasing demand for differential polishing capabilities, where software and hardware combine to selectively adjust parameters across heterogeneous samples, accommodating materials with vastly different sputtering rates (e.g., metals adjacent to polymers or sensitive oxides). Manufacturers are focusing on developing hybrid systems that merge the site-specific precision of FIB technology with the large-area thinning capability of Broad Beam Polishing, offering a comprehensive solution for preparing complex, multi-scale samples. This technological convergence is paving the way for IBP systems to address the rigorous requirements of novel applications such as additive manufacturing analysis and characterization of stacked 3D NAND memory devices.

Regional Highlights

Regional dynamics heavily influence the Ion Beam Polisher Market due to the concentrated nature of semiconductor manufacturing and advanced scientific research worldwide. Asia Pacific (APAC) stands as the dominant market, driven by massive capital expenditure in wafer fabrication facilities and R&D centers in mainland China, South Korea, Taiwan, and Japan, which are the global hubs for microelectronics production and advanced packaging. The sheer volume of semiconductor output necessitates high-throughput IBP systems for process control and failure analysis.

North America and Europe maintain strong positions, characterized by high-value, specialized market segments. North America, especially the United States, drives innovation, focusing on high-precision IBP systems for academic research, government defense applications, and leading-edge fields like quantum computing and advanced materials synthesis. Europe, driven by countries like Germany, France, and the UK, emphasizes IBP utilization within the automotive, aerospace, and general material science sectors, supported by robust governmental funding for scientific infrastructure and industrial R&D projects.

The Middle East & Africa (MEA) and Latin America currently represent smaller, nascent markets, primarily limited to major governmental universities and specialized energy sector research centers. However, anticipated growth in electronics assembly and local manufacturing initiatives in countries such as Saudi Arabia and Brazil are expected to gradually increase the adoption of IBP systems over the forecast period, driven by foreign direct investment and technology transfer in localized semiconductor development and energy infrastructure analysis.

- Asia Pacific (APAC): Dominant market share fueled by extensive semiconductor manufacturing investments and the density of electronics OEMs; key demand drivers include high-volume failure analysis and advanced packaging R&D in Taiwan, South Korea, and China.

- North America: Leader in technology innovation and research applications, focusing on high-end, customized IBP systems for defense, aerospace, and pioneering nanoscale research in major universities and national labs.

- Europe: Strong uptake in industrial material science, automotive component analysis, and advanced academic research; demand supported by key players in Germany and the UK focused on metallurgy and industrial quality control.

- Latin America: Emerging market driven by governmental funding for material science centers and nascent electronics assembly industries, with Brazil and Mexico leading regional adoption.

- Middle East and Africa (MEA): Growth opportunities linked to increasing investment in specialized oil and gas material characterization and the development of regional academic research hubs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ion Beam Polisher Market.- JEOL Ltd.

- Hitachi High-Tech Corporation

- Raith GmbH

- Oxford Instruments plc

- Carl Zeiss AG (ZEISS)

- Leica Microsystems (Danaher Corporation)

- Gatan Inc. (Ametek)

- South Bay Technology, Inc.

- Fischione Instruments, Inc.

- Mager Scientific Inc.

- Ted Pella, Inc.

- Cressington Scientific Instruments Ltd.

- PVD Products, Inc.

- NanoFocus, Ltd.

- Vaxcel, Inc.

- Nanolab Technologies, Inc.

- Evactron

- Plasma Etch, Inc.

- SELA Technology

Frequently Asked Questions

Analyze common user questions about the Ion Beam Polisher market and generate a concise list of summarized FAQs reflecting key topics and concerns.What distinguishes Ion Beam Polishing (IBP) from traditional mechanical polishing methods?

IBP utilizes focused or broad beams of ions (typically Argon or Xenon) to achieve atomic-level material removal, resulting in ultra-smooth, artifact-free surfaces essential for high-resolution electron microscopy (TEM/SEM). Traditional mechanical polishing often introduces subsurface damage, smearing, and contamination, making it unsuitable for nanoscale sample preparation required in advanced semiconductors and delicate materials.

In which applications are Focused Ion Beam (FIB) polisher systems preferred over Broad Beam polisher systems?

FIB systems are preferred for site-specific, targeted material removal, typically used to prepare precise cross-sections or thin lamellae at exact locations (e.g., specific defect sites in a microchip) for subsequent TEM analysis. Broad beam systems are used when large-area thinning or uniform surface etching is required, such as preparing large sample areas for generalized material characterization.

What is the role of Xenon vs. Argon ions in modern Ion Beam Polishing systems?

Xenon ions (Xe+) are increasingly utilized because their higher mass results in faster sputtering (material removal) rates compared to lighter Argon ions (Ar+), significantly improving system throughput. While Argon remains common for general thinning, Xenon is favored in industrial settings where speed is critical, and for samples requiring extremely low-damage polishing due to better energy transfer dynamics.

How is the Ion Beam Polisher Market influenced by the demand for advanced battery technology analysis?

Advanced battery R&D, particularly for solid-state and specialized lithium-ion chemistries, requires ultra-precise cross-sectioning to analyze electrode/electrolyte interfaces and understand degradation mechanisms at the nanoscale. IBP is essential for preparing these delicate, multi-material samples without introducing thermal or mechanical artifacts, directly linking market growth to battery innovation and EV market expansion.

What impact does Artificial Intelligence have on the operational efficiency of Ion Beam Polishers?

AI significantly enhances IBP operational efficiency by automating complex parameter optimization, enabling real-time adjustments to beam characteristics based on sample feedback, and ensuring automated endpoint detection. This results in reduced sample preparation time, improved reproducibility, lower dependence on operator skill, and maximization of instrument uptime through predictive maintenance features.

The Ion Beam Polisher Market, valued at $155 million in 2026, is poised for substantial expansion, reaching $248 million by 2033, driven by a 6.8% CAGR, fueled by the relentless technological demands of the semiconductor industry. The introduction of high-efficiency ion sources, such as Xenon, and the integration of advanced automation and AI-driven control systems are key drivers mitigating the primary restraint of high operational complexity. Asia Pacific remains the engine of market growth, investing heavily in IBP systems for critical failure analysis and process control within its sprawling microelectronics fabrication centers. The market evolution emphasizes hybrid systems, combining the speed of broad beam techniques with the precision of focused ion beams, cementing IBP technology as foundational infrastructure for nanoscale materials characterization and the development of quantum and advanced energy technologies. Key market players, including JEOL, Hitachi High-Tech, and Gatan, are strategically focusing on software enhancements and improved vacuum technologies to deliver higher throughput and superior sample quality, ensuring continued relevance in an increasingly miniaturized and complex technological landscape.

Investment trends highlight a strategic pivot toward systems capable of handling multi-layer, heterogeneous materials, a characteristic requirement for modern electronic packaging and composite structures in aerospace. This diversification beyond monolithic materials ensures market resilience against cyclical fluctuations in the traditional semiconductor capital equipment market. The educational and research sectors, particularly those investigating novel materials for sustainable energy and environmental science, represent a stable demand segment, prioritizing IBP’s unique capability for artifact-free sample preparation. The overall trajectory suggests a highly specialized market where technological leadership in vacuum integrity, beam stability, and intelligent software integration will be the determining factors for competitive advantage. Manufacturers prioritizing ease of use and reduced total cost of ownership through automation are best positioned to capture market share across both high-volume industrial and specialized academic applications globally.

Further analysis of the value chain reveals that stringent quality control in the upstream supply of ultra-high vacuum components is paramount, as system reliability directly impacts sample integrity—a critical metric in failure analysis. Downstream customer engagement relies heavily on technical support and application expertise, necessitating direct sales models or highly trained regional distributors to address sophisticated user needs. The emerging use of IBP in novel sectors, such as micro-robotics and advanced optics manufacturing, introduces new customer segments that demand customized process recipes and specialized sample holders, requiring manufacturers to maintain agile R&D capabilities to rapidly address evolving material preparation challenges. This market is characterized by high barriers to entry due, not only to cost, but also to the proprietary knowledge required for achieving superior polishing results.

Technological advancement is not limited to hardware; the development of proprietary software suites that offer comprehensive recipe management, beam drift compensation, and enhanced visualization tools is a critical aspect of product differentiation. These software solutions often incorporate data analytics to monitor instrument health and performance metrics, directly contributing to AEO by providing clear, measurable operational benefits. The move toward integrating IBP systems with other analytical instruments (like SEM or EDS) through shared vacuum platforms or automated transfer systems represents the future direction of sample preparation workflow, aiming for a unified, highly efficient lab environment. This integration focus underscores the market’s responsiveness to user demands for faster turnaround times and minimized sample contamination risks throughout the analysis process.

The strategic importance of Ion Beam Polishing in maintaining the integrity of fundamental scientific research cannot be overstated. From validating theoretical models of material strength to pinpointing fabrication defects that compromise device performance, IBP provides the necessary foundation for high-fidelity data acquisition. The global intellectual property landscape surrounding ion source design and low-angle stage mechanics remains intensely competitive, with key players investing heavily to secure patent positions that offer technological leverage in specific market niches, particularly ultra-low voltage polishing for sensitive materials. The future success of market participants will hinge on their ability to balance high-precision capability with industrial robustness and integration ease, catering effectively to both the meticulous requirements of fundamental research and the high-throughput demands of mass production environments.

The convergence of material science and electronic device scaling ensures a stable, long-term growth trajectory for the Ion Beam Polisher market. As devices become smaller and materials become more complex—involving exotic alloys, complex heterostructures, and sensitive biological coatings—the need for non-destructive, high-precision preparation techniques will only intensify. This necessity is reflected in steady investments by government bodies in scientific infrastructure upgrades globally. Furthermore, the push towards achieving atomic-scale control in manufacturing, particularly relevant in fields like catalysis and quantum dots, drives continuous refinement in IBP beam control and alignment systems, demanding stability down to the picometer level. This pursuit of ultimate precision necessitates highly reliable vacuum technology and sophisticated feedback mechanisms, ensuring that the IBP system remains a critical bottleneck and quality gatekeeper in the advanced technology workflow.

Geographically, while APAC commands volume, North America dictates technological premium and pricing for specialized, high-performance systems. European manufacturers often differentiate themselves through modular designs and adherence to stringent quality and environmental standards, appealing to diverse industrial applications. The competitive environment requires firms to offer flexible maintenance contracts and specialized training programs to overcome the operational complexity restraint, thereby improving overall customer value proposition. Successfully navigating this market requires not only technical excellence but also robust global service networks capable of deploying specialized field engineers quickly across high-demand regions.

The Ion Beam Polisher market is evolving from purely sample preparation equipment to integrated analytical tools. Advanced IBP systems now feature built-in analysis capabilities, such as integrated energy-dispersive X-ray spectroscopy (EDS) detectors or elemental mapping features, allowing simultaneous thinning and compositional analysis. This multifunctionality adds substantial value, streamlining the overall workflow for material scientists and failure analysis engineers by reducing the need to transfer fragile samples between multiple high-vacuum instruments. This shift toward integration is a critical trend for maximizing laboratory throughput and data correlation integrity, reinforcing the system's centrality in the modern analytical laboratory.

Finally, the sustainable operation of IBP systems is becoming an increasingly important purchasing criterion. Manufacturers are addressing this by focusing on energy-efficient vacuum pumps and designing systems to minimize the consumption of expensive process gases, aligning with global corporate sustainability goals. While not currently the primary driver, environmental footprint considerations are expected to grow in importance, particularly in Europe, influencing procurement decisions in major industrial and public sector organizations. Companies offering demonstrable reductions in operating costs related to utilities and consumables will gain a competitive edge by appealing to the total cost of ownership perspective of large-scale users like semiconductor foundries.

The Ion Beam Polisher Market is intricately linked to capital investment cycles in the global high-tech sector. When semiconductor companies embark on new technology nodes (e.g., transitioning from 7nm to 5nm or 3nm), the accompanying surge in R&D and failure analysis requirements directly drives IBP sales. The ability of IBP to produce cross-sections free from artifacts is non-negotiable for inspecting these minute, complex structures, reinforcing its inelastic demand in critical phases of technology development. This cyclical dependency means that accurate forecasting of the semiconductor industry’s capital spending is essential for market participants planning production capacities and inventory levels for IBP systems and associated consumables.

Furthermore, the opportunity for market expansion is highly pronounced in the domain of advanced memory technologies, specifically 3D NAND and new generation DRAM. These vertically integrated structures present unprecedented challenges for sample preparation due to the extreme height-to-width aspect ratios and the sheer number of interfaces that must be exposed without damage. IBP, particularly low-angle broad beam thinning, provides the only viable solution for preparing large, representative cross-sections of these memory stacks, confirming its role as an enabler for the ongoing data storage revolution. The precision required here pushes the technological envelope for system stability and alignment repeatability.

The restraints concerning the requirement for highly skilled operators are being addressed through specialized training programs and remote support services offered by manufacturers. Companies are investing heavily in augmented reality (AR) and virtual reality (VR) tools to simulate IBP operation, allowing technicians to gain experience without risking expensive samples or consuming valuable machine time. This commitment to reducing the operational skill ceiling broadens the potential customer base to include smaller research facilities and less centralized manufacturing sites, contributing to geographic market penetration outside of traditional high-tech hubs.

Competition in the Ion Beam Polisher Market is primarily based on two axes: performance metrics (e.g., achievable surface roughness, thinning rate, maximum sample size) and lifetime service support. Key differentiation strategies involve offering unique features such as liquid nitrogen cooling stages for analyzing thermally sensitive polymers and biological samples, or integrating specialized corrosive gas etching capabilities within the IBP platform for selective material removal. These specialized capabilities allow manufacturers to capture high-margin, niche applications where general-purpose systems fail to meet the scientific requirements, thus providing strategic insulation from general market competition.

Finally, regulatory environments, particularly those governing the disposal of vacuum fluids and high-purity gases, impact the total cost of ownership and operation in various regions. Manufacturers who design systems that minimize hazardous waste generation or simplify safe disposal procedures gain favor, particularly in regions with strict environmental regulations like Europe. Adherence to international standards for electrical safety and electromagnetic compatibility (EMC) is non-negotiable, further defining the landscape of approved suppliers and technical specifications within this highly specialized segment of capital equipment manufacturing.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager