Ion Chromatography Systems Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440275 | Date : Jan, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Ion Chromatography Systems Market Size

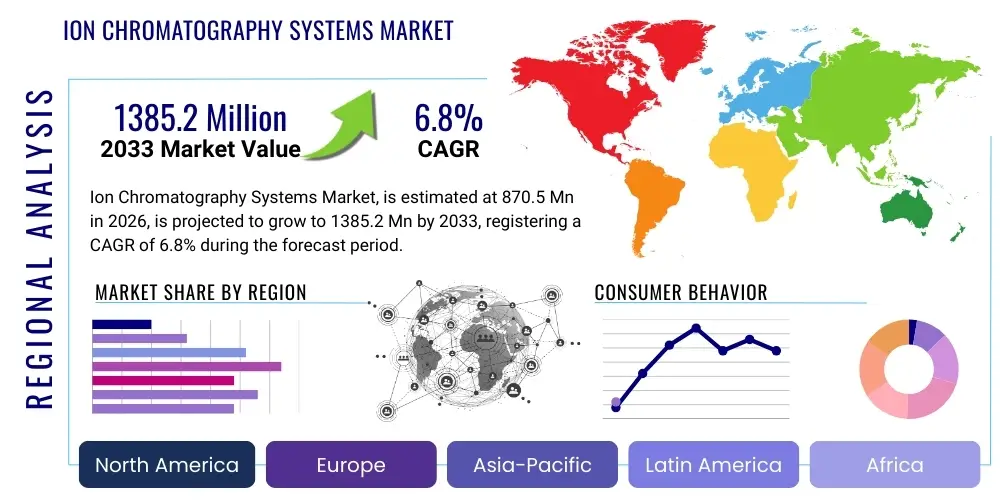

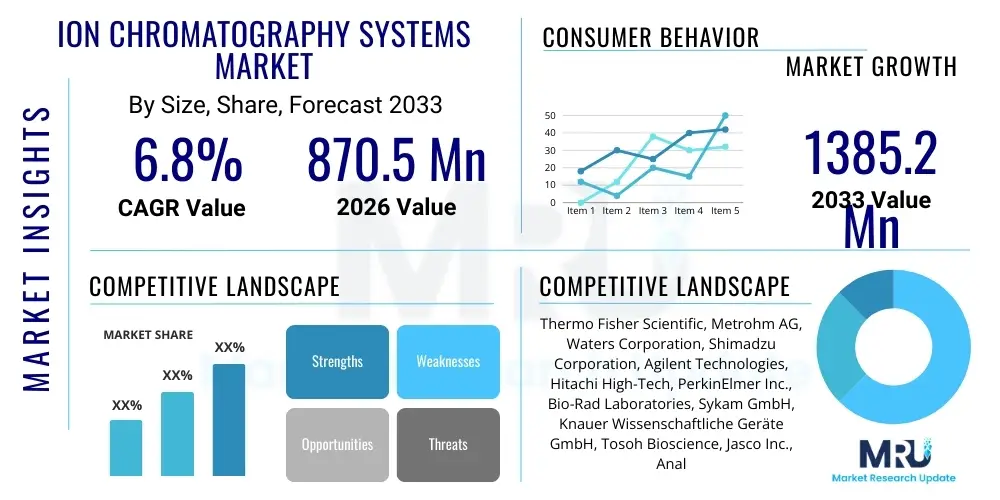

The Ion Chromatography Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 870.5 Million in 2026 and is projected to reach USD 1385.2 Million by the end of the forecast period in 2033.

Ion Chromatography Systems Market introduction

Ion Chromatography (IC) systems are advanced analytical instruments designed for the separation, identification, and quantification of ions and polar molecules in a wide range of complex matrices. These systems leverage the principles of liquid chromatography, specifically ion-exchange mechanisms, to achieve high-resolution separations. The core components typically include a pump for mobile phase delivery, an injector for sample introduction, an ion-exchange column for separation, a suppressor to reduce background conductivity, and a detector, most commonly a conductivity detector. The versatility and high sensitivity of IC make it an indispensable tool across numerous scientific and industrial applications, from environmental monitoring to pharmaceutical quality control.

The primary function of an Ion Chromatography system is to provide precise and accurate analysis of inorganic anions and cations, organic acids, and amines. This capability is crucial for ensuring product quality, adhering to regulatory standards, and advancing scientific research. For instance, in environmental science, IC is vital for monitoring water quality by detecting pollutants such such as nitrates, nitrites, sulfates, and halides. In the food and beverage industry, it verifies authenticity and safety through the analysis of additives, preservatives, and nutrient content. Pharmaceutical companies rely on IC for quality assurance of raw materials, intermediates, and finished products, detecting impurities and active pharmaceutical ingredients (APIs).

The benefits of utilizing Ion Chromatography systems are extensive, encompassing high sensitivity, excellent selectivity, and robust quantitative capabilities. These systems offer significantly lower detection limits compared to many traditional wet chemistry methods, enabling the analysis of trace components. Their ability to separate complex mixtures into individual ionic components ensures minimal interference and higher accuracy. Driving factors for the market include the increasing global demand for precise analytical techniques in various industries, stringent regulatory requirements for product safety and environmental protection, and continuous advancements in IC technology, such as miniaturization, automation, and enhanced detector technologies, which broaden their applicability and improve operational efficiency.

Ion Chromatography Systems Market Executive Summary

The Ion Chromatography Systems Market is experiencing robust growth driven by escalating analytical demands across diverse sectors and technological innovation. Key business trends indicate a significant shift towards automated and integrated IC systems that offer enhanced throughput, reduced manual intervention, and improved data accuracy. Manufacturers are increasingly focusing on developing user-friendly interfaces and software solutions that streamline method development and data analysis, making these sophisticated instruments accessible to a broader range of users. Furthermore, there is a growing demand for compact and portable IC systems, particularly for field applications and smaller laboratories with space constraints, reflecting a trend towards greater flexibility and efficiency in analytical operations. The competitive landscape is characterized by continuous research and development efforts, leading to the introduction of novel column chemistries, detector technologies, and sample preparation modules, all aimed at expanding the analytical capabilities and application spectrum of IC.

Regionally, the market exhibits varied growth patterns and drivers. Asia Pacific is emerging as a dynamic growth hub, fueled by rapid industrialization, increasing investments in pharmaceutical and biotechnology research, and rising environmental concerns leading to stringent regulatory frameworks. Countries like China and India are witnessing a surge in demand for IC systems due to expanding manufacturing bases and a growing emphasis on quality control and environmental monitoring. North America and Europe, while mature markets, continue to demonstrate steady demand, primarily driven by strict regulatory mandates in food safety, pharmaceutical quality, and environmental protection, coupled with substantial government and private sector funding for advanced scientific research. Latin America, the Middle East, and Africa are also showing promising growth, albeit from a smaller base, as industrial and research infrastructures develop and regulatory landscapes evolve.

In terms of segment trends, the market for ion chromatography systems is observing notable shifts. The demand for advanced detectors, such as mass spectrometry (MS) and electrochemical detectors, coupled with IC systems is on the rise, enabling more comprehensive and sensitive analyses of complex samples. This trend highlights the increasing need for hyphenated techniques that combine the separation power of IC with the identification capabilities of other analytical methods. Additionally, there is a sustained demand for consumable components like columns, reagents, and suppressors, which form a significant recurring revenue stream for manufacturers. Application-wise, environmental testing, pharmaceutical analysis, and food and beverage testing remain the dominant segments, each driven by specific regulatory pressures and consumer safety concerns. The growing adoption of IC in emerging applications such as clinical diagnostics and life sciences further underscores its versatile and expanding role in modern analytical science.

AI Impact Analysis on Ion Chromatography Systems Market

User inquiries regarding AI's impact on Ion Chromatography systems frequently revolve around themes of enhanced data analysis, automation, predictive capabilities, and optimization of operational workflows. Users are keen to understand how AI can improve the accuracy and speed of results interpretation, particularly for complex chromatograms, and how it can contribute to more efficient method development by predicting optimal parameters. Concerns often include the learning curve associated with AI integration, data security, and the reliability of AI-driven recommendations in critical applications. Expectations are high for AI to reduce human error, enable advanced diagnostic insights, and facilitate the transition towards more autonomous laboratory environments, ultimately aiming for increased productivity and cost efficiency in analytical processes.

- Enhanced data processing and interpretation, allowing for faster and more accurate analysis of complex chromatograms.

- Automated method development and optimization, predicting optimal separation conditions and reducing experimental trial-and-error.

- Predictive maintenance for IC instruments, identifying potential failures before they occur, minimizing downtime and servicing costs.

- Improved quality control and troubleshooting through real-time data monitoring and anomaly detection.

- Facilitation of laboratory automation and integration with LIMS (Laboratory Information Management Systems) for seamless data management.

DRO & Impact Forces Of Ion Chromatography Systems Market

The Ion Chromatography Systems Market is significantly influenced by a confluence of driving forces, restraining factors, and emerging opportunities, all of which shape its growth trajectory and competitive landscape. A primary driver is the escalating global demand for stringent quality control and assurance across various industries, including pharmaceuticals, food and beverage, environmental monitoring, and chemicals. Regulatory bodies worldwide are continuously tightening standards for product safety, contaminant levels, and environmental emissions, compelling industries to adopt highly sensitive and reliable analytical techniques like IC. This regulatory push mandates meticulous analysis of ionic components, driving the adoption of advanced IC systems. Furthermore, increasing investments in research and development activities, particularly in biotechnology and life sciences, contribute substantially to the market's expansion as IC plays a vital role in separating and characterizing biomolecules and understanding complex biological systems. Technological advancements, such as miniaturization, enhanced detection limits, and improved automation capabilities, also serve as significant drivers, making IC systems more accessible and efficient.

Despite the strong growth drivers, the market faces several notable restraints. The high initial capital investment required for purchasing advanced Ion Chromatography systems and their associated consumables (columns, reagents, suppressors) can be a significant barrier, especially for small and medium-sized laboratories or those in developing economies with limited budgets. This cost factor can lead to slower adoption rates in certain segments. Moreover, the operation and maintenance of IC systems demand skilled personnel with specialized training in analytical chemistry and instrument operation. The scarcity of such expertise in some regions or sectors can impede market growth, necessitating investments in training programs. Competition from alternative analytical techniques, such as High-Performance Liquid Chromatography (HPLC) for non-ionic species or atomic absorption spectroscopy for specific metals, also presents a restraint, although IC retains its unique advantages for ionic analysis.

Opportunities within the Ion Chromatography Systems Market are primarily driven by geographical expansion and technological innovation. Emerging economies, particularly in Asia Pacific and Latin America, present significant untapped potential as industrialization progresses and regulatory frameworks mature. These regions are witnessing increased government spending on environmental protection and public health initiatives, opening new avenues for IC applications. The trend towards miniaturization and portability of analytical instruments creates opportunities for developing compact IC systems suitable for on-site analysis and mobile laboratories, enhancing efficiency and reducing turnaround times. Furthermore, the integration of IC with other advanced analytical techniques, forming hyphenated systems like IC-MS (Ion Chromatography-Mass Spectrometry), offers enhanced specificity and sensitivity for complex sample analysis, unlocking new application areas in proteomics, metabolomics, and forensic science. The increasing focus on process analytical technology (PAT) in manufacturing also creates opportunities for online and at-line IC systems for real-time process monitoring and control.

Segmentation Analysis

The Ion Chromatography Systems market is intricately segmented based on several key parameters, each reflecting distinct characteristics of product offerings, application areas, and end-user requirements. This comprehensive segmentation allows for a detailed understanding of market dynamics, growth drivers, and competitive strategies within specific niches. Analyzing these segments provides valuable insights into consumer preferences, technological trends, and investment opportunities across the varied landscape of analytical chemistry.

- Product Type

- Ion Chromatography Instruments

- Ion Chromatography Columns

- Detectors (Conductivity Detectors, Amperometric Detectors, UV/Vis Detectors, Mass Spectrometry Detectors)

- Auto Samplers

- Reagents and Standards

- Software

- Accessories and Consumables (Suppressors, Pumps, Degassers, Valves, Tubing)

- Separation Mode

- Ion-Exchange Chromatography (IEC)

- Ion-Exclusion Chromatography (IEX)

- Ion-Pair Chromatography (IPC)

- Ligand-Exchange Chromatography (LEC)

- Application

- Environmental Testing (Water, Soil, Air Quality)

- Pharmaceutical & Biotechnology

- Food & Beverage Analysis

- Chemical & Petrochemical Industry

- Life Sciences & Research

- Academia & Government

- Clinical Diagnostics

- End User

- Pharmaceutical & Biotechnology Companies

- Environmental Agencies

- Food & Beverage Companies

- Research Laboratories

- Academic & Research Institutes

- Chemical & Manufacturing Companies

- Hospitals & Diagnostic Centers

- Column Type

- Anion Exchange Columns

- Cation Exchange Columns

- Size Exclusion Columns

- Reverse Phase Columns

Value Chain Analysis For Ion Chromatography Systems Market

The value chain for the Ion Chromatography Systems Market encompasses a series of interconnected activities, starting from the procurement of raw materials and extending through manufacturing, distribution, and ultimate end-user utilization. This intricate chain highlights the flow of components, knowledge, and services, revealing where value is added at each stage. At the upstream end, the process begins with the sourcing of highly specialized raw materials and components, including high-purity polymers for columns, electronic components for detectors and pumps, and specialized chemicals for reagents and mobile phases. Key upstream players include manufacturers of specialty plastics, high-precision machined parts, sensor technologies, and chemical suppliers. Their ability to provide consistent quality and innovative materials directly impacts the performance and reliability of the final IC systems. Research and development activities also form a crucial upstream component, driving innovation in column chemistries, detector technologies, and software solutions that define the next generation of IC instruments.

Midstream activities primarily involve the design, assembly, and rigorous testing of the complete Ion Chromatography systems. This stage is dominated by the major analytical instrument manufacturers who integrate various components into functional and robust systems. Manufacturing processes involve precision engineering, cleanroom assembly, and comprehensive quality control protocols to ensure instrument accuracy, sensitivity, and longevity. This phase also includes the development of proprietary software for instrument control, data acquisition, and analysis, which are critical for user experience and analytical performance. After manufacturing, the products move into the downstream segment of the value chain, which focuses on market reach and customer support. This involves diverse distribution channels designed to effectively deliver the systems to end-users globally, ensuring accessibility and timely availability of both instruments and consumables.

Downstream activities are critical for market penetration and customer satisfaction, primarily involving distribution, sales, and post-sales support. Distribution channels for Ion Chromatography systems are typically multifaceted, often combining direct sales forces with a network of authorized distributors, resellers, and channel partners. Direct sales are common for large corporate accounts or specialized research institutions where direct technical consultation and customized solutions are paramount. Indirect channels, through distributors, are crucial for reaching a broader customer base, especially in diverse geographical regions where local presence and support are vital. These distributors often provide localized sales, technical support, training, and maintenance services. The advent of e-commerce and digital marketing also plays an increasingly important role, facilitating access to consumables, spare parts, and information. Post-sales services, including installation, calibration, preventive maintenance, technical troubleshooting, and application support, are essential for ensuring optimal instrument performance and customer loyalty, thus completing the value chain by delivering comprehensive value to the end-user.

Ion Chromatography Systems Market Potential Customers

The potential customers for Ion Chromatography systems represent a broad and diverse spectrum of industries and research institutions, all sharing a common need for precise and reliable analysis of ionic components. Pharmaceutical and biotechnology companies stand as significant end-users, where IC is indispensable for a myriad of applications, including raw material testing, quality control of active pharmaceutical ingredients (APIs) and excipients, stability studies, impurity profiling, and the analysis of biopharmaceuticals. The stringent regulatory environment in this sector, requiring detailed characterization and quantification of drug components and potential contaminants, drives a constant demand for advanced IC systems. Furthermore, research and development in drug discovery and development also heavily rely on IC for separating and analyzing complex mixtures of compounds, making these companies a cornerstone of the market's customer base.

Environmental testing laboratories and governmental agencies form another critical segment of potential customers. With growing global concerns over pollution and water quality, there is an increasing demand for sophisticated analytical tools to monitor anions (e.g., fluoride, chloride, nitrate, sulfate) and cations (e.g., sodium, potassium, calcium, magnesium) in drinking water, wastewater, soil, and air samples. Regulatory compliance mandates the use of highly sensitive and accurate methods for environmental monitoring, making IC an essential technology for ensuring public health and ecological integrity. Municipal water treatment plants, private environmental consultancies, and national environmental protection agencies are all key clients within this segment, utilizing IC to detect pollutants, assess treatment effectiveness, and enforce environmental regulations.

The food and beverage industry also represents a substantial customer base, leveraging Ion Chromatography for various quality control and safety applications. This includes the analysis of nutrients such as vitamins and amino acids, detection of food additives and preservatives (e.g., sulfite, nitrite), verification of product authenticity, and the identification of contaminants that could pose health risks. From breweries and dairies to soft drink manufacturers and food processing plants, IC systems are employed to ensure product consistency, comply with food safety standards, and meet consumer expectations for quality. Academic and research institutes, alongside chemical and manufacturing companies, further expand the customer landscape. Universities and research centers use IC for fundamental scientific studies and method development, while chemical industries rely on it for process control, product characterization, and quality assurance of various chemical compounds, highlighting the pervasive utility of Ion Chromatography across a multitude of scientific and industrial endeavors.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 870.5 Million |

| Market Forecast in 2033 | USD 1385.2 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Thermo Fisher Scientific, Metrohm AG, Waters Corporation, Shimadzu Corporation, Agilent Technologies, Hitachi High-Tech, PerkinElmer Inc., Bio-Rad Laboratories, Sykam GmbH, Knauer Wissenschaftliche Geräte GmbH, Tosoh Bioscience, Jasco Inc., Analytik Jena (Endress+Hauser Group), Cecil Instruments, ELGA LabWater (Veolia Water Technologies), General Electric Company (GE Healthcare), Merck KGaA, Restek Corporation, Phenomenex (Danaher Corporation) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ion Chromatography Systems Market Key Technology Landscape

The technological landscape of the Ion Chromatography Systems market is characterized by continuous innovation aimed at enhancing analytical performance, increasing automation, and expanding application versatility. A foundational aspect of this landscape is the advancement in suppressor technology, which has significantly improved the signal-to-noise ratio and detection limits in conductivity detection, making IC a more sensitive technique. Modern suppressors, including electrolytic and chemical suppressors, are designed for robustness, ease of use, and minimal maintenance, thereby contributing to the overall efficiency and reliability of IC systems. Beyond suppressors, breakthroughs in ion-exchange column chemistries, particularly the development of high-capacity and high-efficiency columns, allow for faster separations, better resolution of complex mixtures, and improved longevity, catering to the increasing demand for high-throughput analysis in various industries.

Another pivotal area of technological advancement lies in detection methodologies. While conductivity detection remains the most common, the integration of advanced detectors significantly expands the capabilities of IC systems. Mass spectrometry (MS) detectors, when coupled with IC (IC-MS), provide unparalleled specificity and sensitivity for identifying unknown compounds, confirming peak identities, and analyzing trace components in complex matrices. This hyphenated technique is gaining substantial traction in pharmaceutical, environmental, and metabolomics research. Electrochemical and UV/Vis detectors also play a crucial role, offering selective detection for specific classes of analytes, further broadening the applicability of IC. The development of miniaturized detectors and flow cells also contributes to more compact and efficient instrument designs, aligning with the trend towards smaller analytical footprints and reduced reagent consumption.

Beyond hardware, software advancements and automation capabilities are transforming the operational paradigm of Ion Chromatography. Modern IC systems are equipped with sophisticated software platforms that offer intuitive user interfaces, advanced data processing algorithms, and robust instrument control. These software solutions enable automated method development, real-time data monitoring, comprehensive reporting, and seamless integration with laboratory information management systems (LIMS) for streamlined data management and compliance. Automation features, such as intelligent autosamplers with pre-concentration capabilities, automated eluent generation (AEG), and online sample preparation modules, significantly reduce manual labor, minimize human error, and enhance sample throughput. These technological innovations collectively contribute to more powerful, versatile, and user-friendly Ion Chromatography systems, driving their adoption across a widening array of analytical challenges and reinforcing their position as indispensable tools in modern laboratories.

Regional Highlights

The Ion Chromatography Systems Market exhibits diverse growth trajectories and influences across key geographic regions, each shaped by unique economic, regulatory, and industrial dynamics. North America and Europe, representing mature markets, continue to be significant revenue contributors due to well-established pharmaceutical and biotechnology sectors, stringent environmental regulations, and robust government funding for scientific research. These regions are characterized by a strong emphasis on quality control and adherence to international standards, driving consistent demand for advanced analytical instrumentation. However, the most rapid growth is anticipated from emerging economies.

- North America: Dominant market share driven by strong R&D expenditure, advanced healthcare infrastructure, and stringent environmental protection regulations (e.g., EPA standards) in the US and Canada.

- Europe: High adoption rates fueled by a strong pharmaceutical industry, strict food safety regulations (e.g., EFSA), and significant investments in environmental monitoring and water quality analysis across Western European countries.

- Asia Pacific (APAC): Fastest-growing market due to rapid industrialization, increasing investments in environmental monitoring (especially in China and India), expanding pharmaceutical and biotechnology industries, and rising awareness of food safety.

- Latin America: Emerging market with growing potential, driven by developing industrial bases, increasing government focus on infrastructure and public health, and expanding academic research.

- Middle East & Africa (MEA): Gradually growing market, supported by expanding oil and gas industry (for water analysis), increasing investments in research and healthcare, and growing environmental concerns in Gulf Cooperation Council (GCC) countries.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ion Chromatography Systems Market.- Thermo Fisher Scientific

- Metrohm AG

- Waters Corporation

- Shimadzu Corporation

- Agilent Technologies

- Hitachi High-Tech

- PerkinElmer Inc.

- Bio-Rad Laboratories

- Sykam GmbH

- Knauer Wissenschaftliche Geräte GmbH

- Tosoh Bioscience

- Jasco Inc.

- Analytik Jena (Endress+Hauser Group)

- Cecil Instruments

- ELGA LabWater (Veolia Water Technologies)

- General Electric Company (GE Healthcare)

- Merck KGaA

- Restek Corporation

- Phenomenex (Danaher Corporation)

Frequently Asked Questions

Analyze common user questions about the Ion Chromatography Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary applications of Ion Chromatography Systems?

Ion Chromatography Systems are primarily used for separating and quantifying ions and polar molecules across various fields. Key applications include environmental monitoring (water, air, soil quality), pharmaceutical quality control (impurity analysis, API characterization), food and beverage analysis (additives, nutrients, contaminants), and chemical analysis in industrial processes and research laboratories.

How do Ion Chromatography Systems differ from HPLC?

While both are liquid chromatography techniques, Ion Chromatography (IC) specifically focuses on the separation of ions and polar molecules using ion-exchange mechanisms, often paired with conductivity detection. High-Performance Liquid Chromatography (HPLC), conversely, is generally used for non-ionic or weakly ionic molecules, employing various separation modes like reversed-phase or normal-phase, typically with UV/Vis or mass spectrometry detection.

What key factors are driving the growth of the Ion Chromatography Systems market?

The market's growth is primarily driven by increasing global demand for stringent quality control and assurance, especially in the pharmaceutical and food industries, coupled with rising environmental concerns and stricter regulatory frameworks. Technological advancements leading to improved sensitivity, automation, and portability of IC systems also significantly contribute to market expansion.

What are the main types of detectors used in Ion Chromatography?

The most common detector in Ion Chromatography is the conductivity detector, which measures changes in eluent conductivity after analyte separation. Other important detectors include amperometric (electrochemical) detectors for oxidizable or reducible analytes, UV/Vis detectors for chromophoric ions, and mass spectrometry (MS) detectors for high specificity and structural identification in hyphenated IC-MS systems.

What challenges does the Ion Chromatography Systems market face?

Key challenges for the Ion Chromatography Systems market include the high initial capital investment required for purchasing advanced instruments, which can be a barrier for smaller laboratories. Additionally, the need for skilled personnel for operation and maintenance, along with competition from alternative analytical techniques, can somewhat restrain market growth.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager