Ion Implantation Machine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434702 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Ion Implantation Machine Market Size

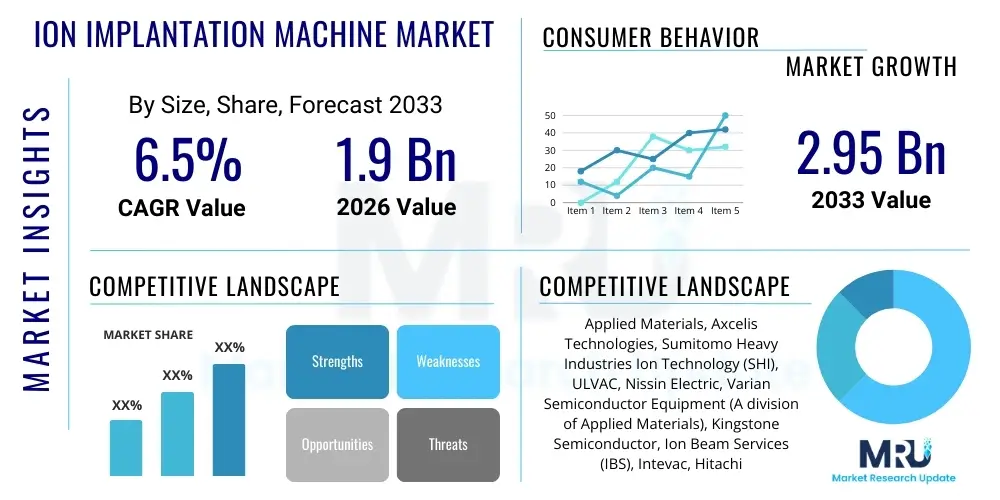

The Ion Implantation Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 1.9 Billion in 2026 and is projected to reach USD 2.95 Billion by the end of the forecast period in 2033.

Ion Implantation Machine Market introduction

Ion implantation machines are highly specialized equipment used extensively in the semiconductor manufacturing process to dope semiconductors. Doping involves introducing impurities (dopants) into a semiconductor material to modify its electrical properties, which is foundational for creating transistors, integrated circuits (ICs), and other advanced electronic devices. The technology enables precise control over the concentration, depth, and spatial distribution of the dopant species, which is critical for achieving the required performance parameters of modern microelectronic components.

The core product description centers around systems that generate a beam of ions, accelerate them to high energies, and direct them onto a target wafer. These systems are categorized based on the energy levels they deliver—low-current, medium-current, and high-current implanters—each serving different stages and requirements of wafer fabrication. Major applications span memory production (DRAM, NAND), logic devices (CPUs, GPUs), and the rapidly expanding Power Semiconductor and MEMS markets, underpinning the digital infrastructure globally.

The primary benefits of utilizing ion implantation include superior uniformity, high purity, precise dose control, and repeatability compared to older thermal diffusion methods. Driving factors for market growth include the relentless demand for smaller, faster, and more powerful electronic devices, the global expansion of 5G and 6G infrastructure, aggressive investment in new wafer fabrication facilities (Fabs), and the increasing adoption of wide-bandgap (WBG) materials like Silicon Carbide (SiC) and Gallium Nitride (GaN) which necessitate high-energy implantation techniques.

Ion Implantation Machine Market Executive Summary

The Ion Implantation Machine Market is experiencing robust growth fueled primarily by significant global expansion in semiconductor capital expenditures (CapEx). Business trends indicate a shift towards high-energy and high-current systems necessary for advanced node fabrication (below 7nm) and the production of complex, stacked 3D NAND memory structures. Strategic mergers and acquisitions among equipment providers, coupled with aggressive R&D spending focused on increasing system throughput and reducing defectivity, characterize the competitive landscape.

Regionally, Asia Pacific (APAC), led by China, Taiwan, and South Korea, remains the dominant market owing to the high concentration of leading semiconductor foundries and memory manufacturers. However, North America and Europe are exhibiting accelerated growth due to governmental initiatives aimed at restoring domestic semiconductor supply chain resilience, such as the U.S. CHIPS Act and the EU Chips Act, driving substantial investment in new fabrication plants and corresponding demand for advanced machinery.

Segment trends reveal that the High-Current Implanters segment holds the largest market share due to its widespread use in mass doping for logic and memory devices. Simultaneously, the High-Energy Implanters segment is projecting the fastest growth rate, directly correlated with the increasing complexity of advanced packaging and the specialized requirements of power electronics manufacturing based on SiC and GaN materials, where deep penetration doping is essential for device performance.

AI Impact Analysis on Ion Implantation Machine Market

User queries regarding the intersection of Artificial Intelligence (AI) and the Ion Implantation Machine Market primarily center on how AI enhances operational efficiency, predictive maintenance, and process control within sophisticated semiconductor fabrication environments. Users are keen to understand the shift from traditional statistical process control (SPC) to AI-driven process optimization. Key themes reflect expectations that AI will significantly reduce equipment downtime through failure prediction, improve throughput by dynamically adjusting beam parameters, and enable faster ramp-up times for new process nodes by accelerating recipe generation and tuning.

The integration of AI technologies, specifically machine learning and deep learning algorithms, into ion implantation systems is transforming equipment management and performance. AI models analyze vast amounts of sensor data—monitoring beam current, vacuum levels, temperature, and plasma stability—to identify subtle deviations that precede equipment failure, thereby enabling proactive maintenance scheduling rather than reactive fixes. This predictive capability is crucial in high-volume manufacturing (HVM) where even minor downtime leads to substantial financial losses and delays in product delivery.

Furthermore, AI is being deployed for process optimization. By analyzing the correlation between input parameters and measured wafer characteristics (such as sheet resistance and junction depth), AI systems can recommend optimal implantation recipes far more efficiently than human engineers or traditional experimental methods (Design of Experiments, DoE). This advanced tuning capability is indispensable for managing the tight process windows required for 3nm and 2nm node manufacturing, ensuring high yields and consistent device performance across millions of wafers.

- AI-enhanced Predictive Maintenance: Reduces unplanned downtime and increases equipment utilization rates (OEE).

- Real-time Process Control: Uses machine learning to dynamically stabilize ion beam characteristics and plasma conditions for superior uniformity.

- Automated Recipe Optimization: Accelerates the development and tuning of new doping processes, shortening time-to-market for advanced nodes.

- Defectivity Reduction: AI algorithms analyze imaging and sensor data to correlate process excursions with resulting wafer defects.

- Data-Driven Yield Management: Integrates implantation data with overall fab yield metrics to identify bottlenecks and process windows.

DRO & Impact Forces Of Ion Implantation Machine Market

The Ion Implantation Machine Market dynamics are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively constitute the Impact Forces shaping industry growth. The primary driving force is the foundational role ion implantation plays in semiconductor manufacturing, meaning any increase in global demand for electronic devices immediately translates into elevated demand for these machines. Technological innovation, particularly the transition to advanced nodes and WBG materials, necessitates continuous upgrade cycles and high CapEx spending by foundries.

Restraints primarily revolve around the immense capital cost associated with purchasing and maintaining these complex tools, creating high barriers to entry for new players and imposing substantial financial pressure on smaller foundries. Additionally, the increasing technical complexity of 3nm and 2nm node implantation processes, requiring ultra-high precision, zero contamination, and specialized beamline components, presents significant technological hurdles and extends R&D cycles for equipment manufacturers. Geopolitical tensions affecting global trade and supply chains for critical components also introduce volatility.

Opportunities are significant, stemming from emerging applications such as advanced packaging (e.g., heterogeneous integration), where ion implantation is utilized for stress engineering and wafer bonding preparation. Furthermore, the massive global push for electric vehicles (EVs) and renewable energy infrastructure is dramatically increasing the adoption of SiC and GaN power devices, creating a specialized, high-growth segment for high-energy implanters. The global shift toward localized manufacturing supply chains also presents opportunities for equipment suppliers in previously underdeveloped fabrication regions.

Segmentation Analysis

The Ion Implantation Machine Market is systematically segmented across several dimensions, including Type, Application, End-User, and Geography, providing a granular view of market dynamics. Segmentation by Type, distinguishing between high-current, medium-current, and high-energy implanters, is crucial as these categories serve distinct purposes in the wafer fabrication sequence. High-current machines dominate volume manufacturing, while high-energy systems are essential for deep well implants and WBG device fabrication.

Segmentation by Application highlights the crucial distinction between memory manufacturing (DRAM, NAND), logic manufacturing (Microprocessors, ASICs), and specialized application areas like power devices, solar cells, and MEMS. The rapid expansion of memory and logic manufacturing continues to drive bulk demand, but the fastest growth trajectory is observed within the power device application segment due to the electrification megatrend. This analysis is fundamental for equipment manufacturers to tailor their product development and marketing strategies to address specific industry requirements and technological roadmaps of major customers.

- Type:

- High-Current Implanters

- Medium-Current Implanters

- High-Energy Implanters

- Ultra-Low Energy (ULE) Implanters

- Application:

- Semiconductor Manufacturing (Logic, Memory)

- Power Device Manufacturing (SiC, GaN)

- Solar Cell Manufacturing

- Flat Panel Display (FPD) Manufacturing

- MEMS/Sensors

- End-User:

- Foundries (Pure-play and IDMs)

- OSATs (Outsourced Semiconductor Assembly and Test)

- Research & Development Labs

- Geography:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For Ion Implantation Machine Market

The value chain for the Ion Implantation Machine Market is highly specialized and spans from upstream component suppliers to sophisticated downstream semiconductor fabrication facilities. Upstream analysis involves suppliers of critical sub-systems and components, including ion source generators, vacuum pumps, high-voltage power supplies, beam scanning systems, and highly specialized materials such as high-purity gases and target elements used as dopants (e.g., Boron, Phosphorus, Arsenic). The performance and reliability of these upstream components directly dictate the uptime and precision of the final implantation system, making supplier qualification and control a vital competitive factor.

The midstream stage is dominated by the Original Equipment Manufacturers (OEMs) who design, integrate, assemble, and test the complex implantation systems. These OEMs engage in intense research and development to meet the ever-tightening specifications of semiconductor roadmaps, focusing on increasing beam purity, throughput, and minimizing wafer handling damage. Distribution channels are predominantly direct, involving long-term, high-value contracts negotiated directly between the OEM and the major Integrated Device Manufacturers (IDMs) or pure-play foundries (e.g., TSMC, Samsung, Intel).

Downstream analysis focuses on the end-users—the semiconductor fabrication plants. The indirect impact of the value chain is felt through the final electronic products consumer market, as demand for smartphones, automotive electronics, and data centers drives the initial capital expenditure decisions upstream. Due to the critical nature and high cost of ion implantation, third-party service providers often play a significant role in maintenance, parts supply, and operational support, representing an essential indirect distribution and support channel for sustaining system performance over the equipment's lifecycle.

Ion Implantation Machine Market Potential Customers

Potential customers for Ion Implantation Machines are concentrated within the high-technology manufacturing ecosystem, particularly those involved in front-end wafer processing. The largest end-users are the major Integrated Device Manufacturers (IDMs) like Intel, Samsung Electronics, and Micron Technology, which utilize these machines across various device platforms including advanced logic, microprocessors, and memory (DRAM and NAND flash). These customers require high-volume, highly reliable, and technologically advanced high-current and medium-current implanters.

Pure-play semiconductor foundries, such as TSMC, GlobalFoundries, and UMC, represent another core customer segment. As they produce chips for hundreds of fabless companies, their demand is constant and driven by the rapid introduction of new technology nodes requiring precise deep-doping and source/drain implantation steps. Their investment cycle directly tracks global chip CapEx trends, making them pivotal buyers of the latest generation of implantation technology, including Ultra-Low Energy (ULE) systems for highly scaled transistors.

A rapidly expanding customer base includes manufacturers specializing in specialized semiconductors, specifically power electronics and optical devices. Companies focused on Silicon Carbide (SiC) and Gallium Nitride (GaN) devices, crucial for EVs and industrial power management (e.g., Wolfspeed, Infineon, ON Semiconductor), are significant purchasers of high-energy implanters needed to create deep, precisely controlled doping profiles. Additionally, MEMS manufacturers and advanced photovoltaic (solar cell) producers represent niche but growing customer groups for customized implantation solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.9 Billion |

| Market Forecast in 2033 | USD 2.95 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Applied Materials, Axcelis Technologies, Sumitomo Heavy Industries Ion Technology (SHI), ULVAC, Nissin Electric, Varian Semiconductor Equipment (A division of Applied Materials), Kingstone Semiconductor, Ion Beam Services (IBS), Intevac, Hitachi High-Tech, S.E.T. Corporation, High Voltage Engineering Europa B.V. (HVE), Plasma-Therm, KLA Corporation, Tokyo Electron Limited (TEL). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ion Implantation Machine Market Key Technology Landscape

The technology landscape of the Ion Implantation Machine Market is characterized by continuous innovation aimed at addressing the fundamental challenges posed by highly scaled semiconductor manufacturing and emerging material platforms. A pivotal technological focus is on enhancing beam current and energy range simultaneously, enabling the high-dose, deep implants required for sophisticated power devices utilizing Silicon Carbide (SiC) and Gallium Nitride (GaN). These Wide-Bandgap (WBG) materials necessitate specialized implanters capable of operating at energies often exceeding 1 MeV to create conductive channels deep within the substrate, far beyond the capability of standard CMOS implanters.

Another crucial area of innovation is in minimizing beam induced damage and ensuring ultra-low defectivity, particularly for Ultra-Low Energy (ULE) systems used in the shallow junction formation of advanced logic nodes (e.g., 5nm and 3nm). ULE implanters incorporate advanced plasma flood systems and sophisticated wafer cooling/handling mechanisms to prevent thermal and crystalline damage during the implantation process. Furthermore, multi-beam implantation technology is gaining traction, allowing for parallel processing of multiple ion beams on a single wafer, dramatically increasing throughput and overall cost efficiency in high-volume manufacturing environments, a direct response to the massive investment in new fabrication capacity worldwide.

Process control and metrology integration define the cutting edge. Modern machines integrate real-time dose control systems that measure and adjust the beam flux during implantation to maintain highly uniform dose profiles across the entire wafer surface. The reliance on advanced simulation software for modeling ion trajectories and dopant profiles before actual processing is also standard practice. These integrated technologies—ranging from enhanced ion source efficiency and magnetic mass analysis to AI-driven system maintenance—ensure the precision, purity, and productivity required for the next generation of microelectronic devices.

Regional Highlights

The global market for Ion Implantation Machines exhibits pronounced regional variation driven by localized semiconductor manufacturing capacity and government technology policies.

- Asia Pacific (APAC): APAC is the unequivocally dominant market due to the concentration of the world’s largest foundries and memory manufacturers (South Korea, Taiwan, China). Countries like Taiwan (TSMC) and South Korea (Samsung, SK Hynix) lead in advanced node fabrication (sub-7nm), driving massive recurring capital expenditure for high-end, high-current, and ULE implanters. China is also rapidly expanding its domestic fabrication capabilities, driven by national self-sufficiency goals, leading to significant immediate demand for all classes of implantation equipment.

- North America: North America is experiencing a renaissance in semiconductor manufacturing investment, largely spurred by the CHIPS and Science Act. This region, spearheaded by companies like Intel and GlobalFoundries, is focusing on building cutting-edge fabrication facilities domestically. The demand here is concentrated on the most technologically advanced implanters, including high-energy systems crucial for developing next-generation SiC power devices and specialized R&D applications.

- Europe: Europe is a key region for specialized applications, particularly in automotive electronics, industrial control, and power semiconductors (e.g., Infineon, STMicroelectronics). The European Chips Act aims to double the region's global chip production share by 2030, fueling planned investments in new fabs, particularly those focused on WBG materials. This strategic focus translates into strong, targeted demand for high-energy ion implanters and dedicated medium-current systems.

- Latin America & Middle East/Africa (LAMEA): While smaller in terms of global fabrication volume, these regions present nascent growth opportunities. Demand is largely restricted to R&D institutions, specific packaging and test facilities, and specialized solar cell manufacturing operations. Future growth will be tied to foreign direct investment establishing local assembly or specialized component production hubs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ion Implantation Machine Market.- Applied Materials Inc. (Dominant player, owning Varian Semiconductor Equipment and offering a comprehensive portfolio across all current and energy ranges, critical for both logic and memory.)

- Axcelis Technologies Inc. (A pure-play ion implanter company known for its Purion platform, specializing in high-current and high-energy systems, with a strong focus on power device applications like SiC.)

- Sumitomo Heavy Industries Ion Technology Co., Ltd. (SHI) (A major Japanese player offering specialized ion implantation systems, including those tailored for high-dose and material modification applications beyond standard semiconductor use.)

- ULVAC, Inc. (Global vacuum and process technology company providing various semiconductor manufacturing equipment, including implantation systems for specialty applications like FPDs and MEMS.)

- Nissin Electric Co., Ltd. (Part of the Mitsubishi Electric Group, specializing in ion implantation and electron beam technologies, serving both semiconductor and industrial doping markets.)

- Varian Semiconductor Equipment Associates (Acquired by Applied Materials, its technologies remain foundational and are marketed under Applied Materials' system portfolio.)

- Kingstone Semiconductor Joint Stock Company (An emerging Chinese domestic supplier focusing on providing high-current and medium-current solutions to support the rapidly expanding domestic fabrication base in China.)

- Ion Beam Services (IBS) (Specializing in ion implantation services, equipment modernization, and sales, particularly focusing on mature technologies and R&D systems.)

- Intevac, Inc. (Known for their unique ion implant technologies used in specialized markets like advanced magnetic media and certain semiconductor applications.)

- Hitachi High-Tech Corporation (Offers a range of advanced process equipment, including ion implanters, leveraging their expertise in electron microscopy and precision manufacturing.)

- S.E.T. Corporation (A provider of ion beam processing equipment and services, catering to specific industrial and research applications requiring customized beam configurations.)

- High Voltage Engineering Europa B.V. (HVE) (Focuses on high-energy ion beam technology and accelerators, crucial for deep implants in power device research and manufacturing.)

- Plasma-Therm (While primarily known for etching and deposition, they sometimes intersect with ion-beam processing solutions for specialized material modifications.)

- KLA Corporation (Although not a direct manufacturer of implanters, KLA's metrology and process control systems are integral partners for optimizing implantation tool performance and yield management.)

- Tokyo Electron Limited (TEL) (A major global equipment supplier, while their primary focus is not ion implantation, they offer complementary systems (e.g., deposition, etching, cleaning) integrated closely with the implant process flow.)

- Advantest Corporation (Focuses on testing solutions, but their involvement in overall semiconductor productivity makes them an indirect but critical partner in the fabrication ecosystem.)

- ASM International (Provides deposition equipment that precedes or follows implantation steps, highlighting the highly integrated nature of the fabrication process.)

- SCREEN Holdings Co., Ltd. (Offers cleaning and lithography equipment vital for preparing wafers for the implantation process and subsequent steps.)

- Sumitomo Precision Products Co., Ltd. (Involved in specialized components, including vacuum equipment and high-purity components required for implanter systems.)

- Evans Analytical Group (EAG) (Provides material characterization and failure analysis services, often used by foundries to verify ion implantation profiles and quality control.)

Frequently Asked Questions

Analyze common user questions about the Ion Implantation Machine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of an Ion Implantation Machine in semiconductor fabrication?

The primary function of an ion implantation machine is to precisely dope semiconductor wafers. Doping involves introducing foreign atoms (dopants) into the crystalline structure of the wafer material, such as silicon or silicon carbide, to selectively alter its electrical conductivity. This controlled modification is essential for forming the active regions—sources, drains, gates, and wells—of transistors and integrated circuits, defining their operational characteristics and performance.

How are Ion Implanters segmented by Type, and which segment is driving the fastest growth?

Ion Implanters are segmented primarily by the energy and current capacity of the ion beam: High-Current, Medium-Current, High-Energy, and Ultra-Low Energy (ULE). While High-Current implanters hold the largest market share due to bulk doping requirements for memory and logic, the High-Energy Implanters segment is currently exhibiting the fastest growth rate. This rapid growth is driven by the global transition to Wide-Bandgap (WBG) materials like Silicon Carbide (SiC) and Gallium Nitride (GaN) used in high-power and electric vehicle (EV) applications, which require deep, high-energy doping profiles.

What role does the push for SiC and GaN power devices play in Ion Implantation Machine market demand?

The global push for SiC and GaN power devices is a critical demand driver, necessitating significant investment in high-energy ion implantation technology. SiC and GaN devices offer superior performance in high-voltage and high-temperature environments, making them ideal for EVs, solar inverters, and 5G base stations. Standard low-energy implanters cannot achieve the necessary deep penetration and high doses required for these materials. Therefore, the specialized requirement for Megavolt (MeV) scale high-energy implanters is directly fueling revenue growth in this specialized segment, offering a key differentiation point for equipment manufacturers.

Which geographical region dominates the Ion Implantation Machine Market, and why is this dominance expected to continue?

Asia Pacific (APAC), specifically encompassing Taiwan, South Korea, and Mainland China, dominates the global Ion Implantation Machine Market. This sustained dominance is attributed to the region housing the world’s largest fabrication capacity (Fabs) belonging to leading IDMs and pure-play foundries (e.g., TSMC, Samsung, SK Hynix). As these companies continue to lead the race to deploy sub-5nm and sub-3nm process nodes, their sustained capital expenditures on cutting-edge production equipment, including implantation tools, ensures APAC remains the largest consumer and innovation hub for this technology.

How does the integration of Artificial Intelligence (AI) benefit the operational performance of Ion Implanters?

AI integration significantly enhances Ion Implanter performance by enabling advanced predictive maintenance and real-time process optimization. AI algorithms analyze massive data streams from equipment sensors to anticipate component failures before they occur, drastically minimizing unplanned downtime and maximizing tool utilization (OEE). Furthermore, AI models are used to autonomously tune complex beam parameters, ensuring precise dose uniformity and stability across the wafer, accelerating the qualification of new processes and improving overall semiconductor yield in high-volume manufacturing environments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager