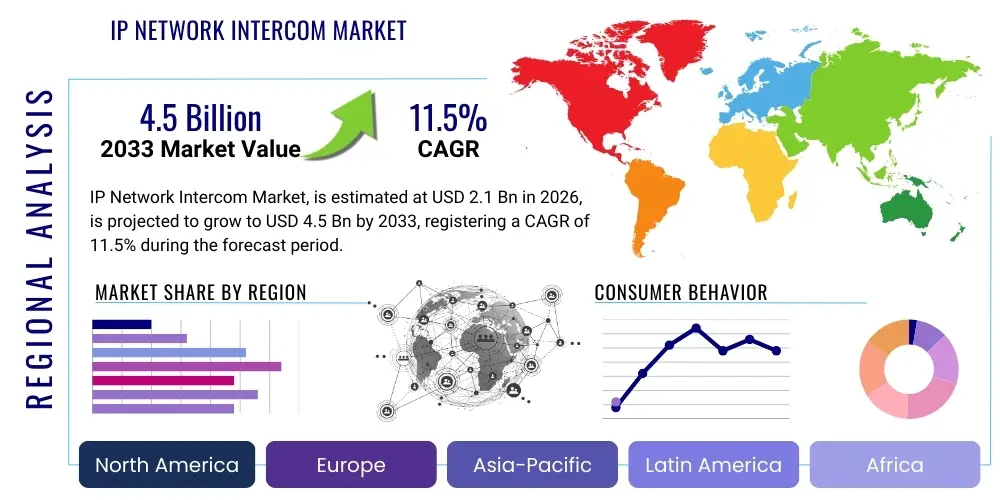

IP Network Intercom Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438123 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

IP Network Intercom Market Size

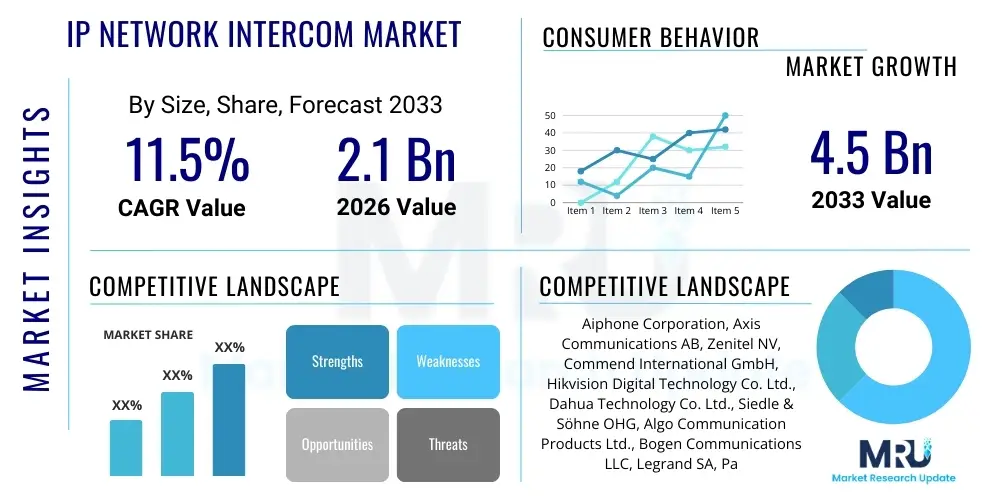

The IP Network Intercom Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 2.1 Billion in 2026 and is projected to reach USD 4.5 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the accelerating global adoption of smart building technologies, coupled with the increasing demand for high-definition audio-visual security and unified communication systems across various sectors, including commercial real estate, industrial facilities, and large residential complexes. The shift from traditional analog systems to digitally integrated IP-based platforms offers superior scalability, remote management capabilities, and integration flexibility with existing IT infrastructure and security protocols, making it a pivotal investment for modern enterprises prioritizing robust security frameworks and operational efficiency.

The market valuation reflects significant investment in cybersecurity enhancements and cloud-based intercom solutions. As enterprises increasingly migrate critical infrastructure services to centralized, network-managed platforms, the robustness and reliability offered by IP intercoms become paramount. Growth is further catalyzed by mandatory regulatory standards in certain geographies, particularly those concerning access control, emergency notification systems, and compliance with stringent data protection policies. Key stakeholders, including system integrators and equipment manufacturers, are focusing heavily on developing Power over Ethernet (PoE) enabled devices, which simplify installation and reduce overall deployment costs, thereby accelerating market penetration across small and medium enterprises (SMEs) that previously found traditional systems cost-prohibitive. This technological convergence with IT networks solidifies the market's trajectory toward high-value, digitally transformative solutions.

IP Network Intercom Market introduction

The IP Network Intercom Market encompasses sophisticated communication and access control systems that operate using Internet Protocol (IP) networks, leveraging existing local area networks (LANs) and wide area networks (WANs) for data transmission, power, and connectivity. These systems facilitate two-way communication, video streaming, and access verification, replacing legacy analog systems with high-definition digital alternatives. Products range from simple door entry phones and vandal-resistant stations to complex enterprise-level unified communication terminals and public address systems integrated across large campuses or multi-site organizations. Major applications span corporate offices, hospitals, educational institutions, manufacturing plants, and critical infrastructure environments where secure, instantaneous communication and precise access management are essential operational requirements.

The core benefit of migrating to IP network intercom solutions is the significant enhancement in functionality, security, and total cost of ownership (TCO). IP systems inherently support features such as remote diagnostics, centralized management software, seamless integration with CCTV, video management systems (VMS), and security information and event management (SIEM) platforms, offering unparalleled situational awareness and operational control. Furthermore, these systems provide superior audio quality (often leveraging wideband codecs) and high-resolution video streams, which are critical for accurate facial recognition and visual identification, bolstering security efficacy. The inherent scalability of IP infrastructure allows organizations to easily expand their communication network without requiring extensive rewiring, providing a future-proof solution.

Driving factors for market growth include the global expansion of IoT and smart city initiatives, which necessitate interconnected and centrally managed communication endpoints. The increasing convergence of physical security systems (access control, surveillance) onto the IT network backbone is a primary catalyst, reducing complexity and increasing efficiency. Additionally, heightened security concerns globally, particularly in densely populated urban areas and critical infrastructure sites, drive the demand for advanced, tamper-proof, and resilient communication tools. The proliferation of affordable, high-speed networking components (like PoE switches) further lowers the barrier to entry, accelerating the replacement cycle of older, proprietary intercom technologies with standardized, open-protocol IP solutions.

IP Network Intercom Market Executive Summary

The IP Network Intercom Market is defined by intense technological innovation, focusing primarily on seamless integration with cloud services, advanced cybersecurity features, and AI-driven analytics for enhanced access control. Business trends indicate a strong move towards subscription-based software-as-a-service (SaaS) models for intercom management and hosting, particularly appealing to SMEs due to lower upfront capital expenditure and simplified maintenance. Strategic partnerships between established network equipment providers and specialized security communication firms are becoming common, aimed at delivering unified security stacks. Furthermore, sustainability is emerging as a critical trend, with manufacturers prioritizing energy-efficient, PoE-powered devices and reducing the environmental footprint of physical installations, aligning with global corporate social responsibility (CSR) goals.

Regionally, North America and Europe maintain market leadership due to stringent regulatory environments concerning public safety and high rates of adoption of smart infrastructure technologies. However, the Asia Pacific (APAC) region is projected to register the fastest growth rate, fueled by rapid urbanization, massive infrastructure projects (smart cities, industrial parks), and increasing foreign direct investment in commercial real estate development, particularly in emerging economies like China, India, and Southeast Asian nations. This regional dynamic is pushing manufacturers to develop localized, cost-effective solutions that cater to the diverse infrastructure landscapes present across APAC, including robust solutions for challenging environmental conditions.

In terms of segmentation, the Hardware segment, specifically network-enabled video intercoms, dominates revenue generation, driven by the escalating demand for visual verification alongside audio communication. Concurrently, the Software segment is expanding rapidly, led by advancements in centralized management platforms and mobile applications that enable remote access and monitoring capabilities. The end-user analysis highlights the Commercial segment (including corporate and retail) as the largest consumer, seeking integrated solutions for employee safety and visitor management. However, the Industrial sector, particularly oil and gas, utilities, and manufacturing, is showing accelerated adoption due to the critical need for reliable emergency communication systems compliant with industrial safety standards, representing a high-growth vertical.

AI Impact Analysis on IP Network Intercom Market

Common user questions regarding AI’s impact on the IP Network Intercom Market frequently center on practical applications like enhanced security, data privacy, and operational efficiency. Users are primarily concerned with how AI can move intercom systems beyond simple communication to become proactive security components. Key themes include the implementation of deep learning for accurate facial recognition in access control, the use of predictive analytics to flag unusual communication patterns (potential intrusions or unauthorized access attempts), and the effectiveness of AI in filtering out background noise for clear voice communication in industrial environments. A prevalent concern involves the ethical implications and data requirements associated with deploying complex biometric AI models on network-connected devices, prompting inquiries into secure edge processing capabilities and compliance with regulations like GDPR or CCPA. Overall, users anticipate that AI will transform intercoms into intelligent, self-monitoring security hubs, but they require robust assurances regarding data security and system reliability.

The integration of Artificial Intelligence (AI) is transforming the functionality and security profile of modern IP network intercom systems. AI algorithms are primarily leveraged for advanced video analytics, enabling intercoms equipped with cameras to perform real-time identification and verification of individuals based on facial recognition or behavioral patterns. This drastically improves the efficiency of access control, moving beyond simple credential checks to provide a layered security approach. Furthermore, AI-driven noise cancellation and voice authentication technologies are being embedded into audio modules to ensure ultra-clear communication even in high-noise environments, critical for industrial safety and emergency response coordination. This shift is leading to a new generation of smart endpoints that contribute directly to broader smart building ecosystems, providing actionable security data rather than just serving as communication devices.

The strategic deployment of AI within the intercom architecture is migrating toward edge computing models, where data processing occurs locally on the intercom device itself before potentially being transferred to a central server. This distributed intelligence approach addresses major concerns related to network latency, bandwidth consumption, and data privacy, as sensitive biometric data can be securely processed and stored at the point of capture. Manufacturers are focusing on developing system-on-chips (SoCs) optimized for AI tasks, capable of running complex neural networks efficiently. This technological advancement positions the IP intercom as a pivotal component in sophisticated security strategies, enabling automated response protocols, proactive threat detection, and highly personalized user experiences in both commercial and high-end residential installations.

- AI-Enhanced Access Control: Utilization of deep learning for rapid, highly accurate facial recognition and biometric verification, replacing traditional keypad entry or RFID cards.

- Predictive Maintenance: AI algorithms analyze intercom usage data, performance metrics, and network traffic patterns to predict potential hardware failures or communication bottlenecks, minimizing downtime.

- Intelligent Noise Reduction: Implementation of advanced digital signal processing (DSP) and AI to filter out ambient noise (traffic, machinery) during calls, ensuring voice clarity and critical communication reliability.

- Behavioral Anomaly Detection: Systems use machine learning to identify unusual or unauthorized attempts to access premises or tamper with the device, triggering immediate security alerts.

- Improved Voice Authentication: AI verifies speaker identity through voice biometrics, adding an extra layer of security beyond visual or credential-based methods, particularly in high-security environments.

DRO & Impact Forces Of IP Network Intercom Market

The IP Network Intercom Market is influenced by a dynamic interplay of driving forces, restraints, and opportunities that collectively define its growth trajectory. Key drivers include the pervasive trend of digital transformation across global enterprises, necessitating the convergence of all physical security onto unified IP platforms, coupled with the increasing emphasis on employee and public safety regulations mandating robust communication infrastructure. However, growth is significantly tempered by restraints such as high initial installation costs associated with infrastructure upgrades (especially for older buildings), and persistent, critical concerns regarding cybersecurity vulnerabilities, as every network-connected device represents a potential attack surface. Opportunities primarily revolve around the expansion into emerging markets, the integration of advanced IoT features, and the shift towards cloud-managed, service-oriented intercom solutions that offer recurring revenue streams and lower TCO for end-users, transforming the intercom from a static device into a managed service.

Driving forces center on the need for scalable and flexible solutions that traditional analog systems cannot provide. IP systems facilitate remote management, centralized configuration, and high-quality video integration, which are non-negotiable requirements for modern facility management and security operations centers (SOCs). The proliferation of Power over Ethernet (PoE) technology is also a significant driver, drastically reducing wiring complexity and power infrastructure requirements, making system deployment faster and less expensive. Furthermore, regulatory compliance, particularly in regulated industries like healthcare and finance, mandates secure, traceable communication logs, a feature inherently supported by network-based systems, thus accelerating adoption.

The primary constraints remain the high capital expenditure required for network infrastructure overhaul and the persistent threat of cyberattacks targeting IP endpoints. Security professionals must continually update firmware and manage complex network segmentation to protect intercoms from being leveraged as entry points into the broader corporate network. The steep learning curve associated with configuring and managing sophisticated IP systems also poses a restraint, requiring specialized IT skills that are not always available, particularly in smaller organizations. Conversely, the market opportunity lies in developing user-friendly, plug-and-play solutions and integrating these devices seamlessly with mobile platforms, leveraging 5G connectivity for enhanced remote video capabilities and real-time alerts, opening up new deployment scenarios outside traditional wired environments.

Segmentation Analysis

The IP Network Intercom Market is meticulously segmented across key dimensions including Component, Technology, Product Type, Application, and End-User, reflecting the diverse functional requirements and deployment scales globally. Component segmentation distinguishes between the physical hardware (stations, servers, power devices) and the essential software (management platforms, firmware, mobile applications) that governs system functionality and centralized control. The Product Type segmentation categorizes devices based on form factor and environmental resilience, spanning from simple indoor stations to ruggedized, weather-proof outdoor units necessary for industrial and public-facing applications. Technology segmentation typically focuses on networking standards (e.g., SIP protocol utilization) and connectivity modes (wired vs. wireless/5G-enabled solutions), defining the system's integration capabilities and bandwidth requirements. This granular breakdown allows vendors to tailor product offerings precisely to specific end-user needs and regional infrastructural maturity levels.

Application-based segmentation divides the market based on the core function performed, such as general public address and notification (PA/GA), residential entry security, or critical emergency communication (e.g., help points in tunnels or public transportation). The diversity in application drives the specification requirements, particularly concerning reliability, video quality, and redundancy features. For instance, emergency applications demand high levels of fault tolerance, while residential systems prioritize user-friendliness and aesthetic integration. Analyzing these segmentations provides critical insight into the prevailing growth pockets, highlighting the increasing traction of video-enabled systems across commercial and residential sectors seeking enhanced visual verification capabilities as a primary deterrent and security measure.

Furthermore, End-User segmentation provides a comprehensive view of market consumption across major vertical industries, including Commercial (corporate offices, retail), Government & Public Sector (prisons, military bases), Healthcare (hospitals, clinics), Residential (multi-tenant units, smart homes), and Transportation (airports, railway stations). The varying security compliance needs, environmental factors, and budget cycles inherent to each end-user segment dictate product adoption rates and technology preferences. For example, the Healthcare sector is driven by the need for quiet, reliable patient-to-staff communication and strict access control to sensitive areas, pushing demand for integrated, sterile-friendly IP endpoints, contrasting with the robustness and high-volume communication required in the Industrial segment.

- Component:

- Hardware (Master Stations, Substations/Door Stations, Network Switches, Servers, Peripherals)

- Software & Services (Central Management Software, Mobile Applications, Cloud Services, Maintenance Contracts)

- Technology:

- Voice over IP (VoIP)

- Session Initiation Protocol (SIP)

- Proprietary Protocols

- Product Type:

- Video Intercom Systems

- Audio-only Intercom Systems

- IP Video Door Phones

- Emergency Help Points/Stanchions

- Application:

- Access Control & Visitor Management

- Public Address & General Notification

- Emergency Communication Systems (ECS)

- Inter-Office/Internal Communication

- End-User:

- Commercial (Corporate, Retail, Hospitality)

- Residential (Single-family, Multi-Tenant Units - MTUs)

- Industrial (Manufacturing, Oil & Gas, Utilities)

- Government & Public Sector (Defense, Education, Healthcare)

- Transportation & Logistics (Ports, Railways, Airports)

Value Chain Analysis For IP Network Intercom Market

The value chain for the IP Network Intercom Market begins with upstream activities involving component manufacturing and core technology development. Upstream players include semiconductor producers providing specialized chips for audio/video processing and networking, software developers creating proprietary operating systems and AI algorithms, and specialized hardware manufacturers producing robust enclosures and display components. Strong bargaining power often resides with the suppliers of specialized SoCs and high-quality wide-angle camera modules, as these components dictate the performance and feature set of the final intercom unit. Innovation at this stage focuses on miniaturization, enhanced processing capabilities for edge analytics, and maximizing energy efficiency, particularly for PoE applications.

Midstream activities encompass the core manufacturing, assembly, and integration processes carried out by Original Equipment Manufacturers (OEMs) and branded vendors. This stage involves integrating the hardware components with proprietary or open-source SIP-based software, rigorous quality assurance, and system certification to meet international safety and communication standards (e.g., ONVIF compliance). The strategic focus here is cost optimization through streamlined manufacturing, efficient inventory management, and maximizing the reliability and ruggedness of the finished product, especially for outdoor or industrial environments. Competitive advantage is gained through proprietary system architecture and the ability to offer seamless integration interfaces with third-party security platforms.

Downstream analysis focuses on market delivery, installation, and post-sale support, which are dominated by system integrators, value-added resellers (VARs), and specialized distribution channels. Direct sales channels are typically utilized for large-scale, high-value corporate or government contracts, ensuring specialized consulting and direct technical liaison. Indirect channels, involving national distributors and local installers, are crucial for reaching smaller commercial clients and the burgeoning residential market. System integrators play a pivotal role as they manage the complex process of networking the intercom system with existing IT infrastructure, CCTV, and access control platforms. The increasing demand for managed services and remote diagnostics further positions the service providers at the high-value end of the downstream segment, offering long-term maintenance contracts and software subscriptions.

IP Network Intercom Market Potential Customers

Potential customers for IP Network Intercom systems are highly diverse, spanning any entity requiring secure access control, reliable internal communication, and centralized facility management capabilities. The primary end-users fall into distinct categories, each motivated by specific needs. Commercial property owners and facility managers in high-rise offices and retail complexes represent major buyers, driven by the need for efficient visitor management, rapid emergency notification across large areas, and standardized security protocols. Their purchasing decisions prioritize scalability, integration with Building Management Systems (BMS), and aesthetic design that aligns with modern architectural standards. These customers frequently opt for advanced video intercoms with AI features for visitor authentication and detailed audit logs.

Another significant customer base includes the Industrial and Manufacturing sectors, particularly facilities characterized by high operational noise, hazardous environments, or geographically dispersed sites (e.g., power plants, chemical refineries). These buyers require ruggedized, vandal-resistant, and potentially explosion-proof intercom stations that offer crystal-clear, reliable communication for safety and operational coordination. For this segment, compliance with occupational safety regulations and system redundancy are paramount purchasing criteria. The integration of intercoms into industrial Public Address and General Alarm (PA/GA) systems often drives large-scale procurement decisions within this vertical.

The third major group comprises government and public sector entities, including educational institutions, hospitals, and critical infrastructure operators (transport hubs). Schools and universities are increasing investment in IP intercoms for enhancing lockdown procedures and providing emergency call points accessible to students and staff. Hospitals utilize these systems for internal departmental communication and strictly controlled access to wards and pharmacies. These customers typically demand highly secure, standardized, and easily managed systems, often procured through established governmental contracting frameworks, emphasizing long-term reliability and secure network architecture.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.1 Billion |

| Market Forecast in 2033 | USD 4.5 Billion |

| Growth Rate | CAGR 11.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Aiphone Corporation, Axis Communications AB, Zenitel NV, Commend International GmbH, Hikvision Digital Technology Co. Ltd., Dahua Technology Co. Ltd., Siedle & Söhne OHG, Algo Communication Products Ltd., Bogen Communications LLC, Legrand SA, Panasonic Corporation, Honeywell International Inc., Genetec Inc., 2N Telekomunikace (Axis subsidiary), MOBOTIX AG, Faraday Future (FF), Teledoor Systems GmbH, TCS AG, Televes Corporation, Barox Communication AG |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

IP Network Intercom Market Key Technology Landscape

The IP Network Intercom market is characterized by rapid technological advancements centered on interoperability, security, and smart features. A cornerstone technology is the widespread adoption of the Session Initiation Protocol (SIP), which serves as the standard signaling protocol for establishing, modifying, and terminating real-time multimedia sessions, ensuring that IP intercoms can seamlessly integrate with Voice over IP (VoIP) phone systems, Private Branch Exchanges (PBXs), and unified communications platforms. This standardization dramatically lowers integration hurdles and reduces proprietary lock-in. Furthermore, Power over Ethernet (PoE) and PoE+ standards are crucial, allowing devices to receive electrical power through the same network cables that carry data, simplifying installation, enhancing reliability (especially during power outages if connected to a UPS), and reducing overall infrastructure complexity and cabling costs across deployments.

High-definition (HD) video capabilities, utilizing advanced compression standards such as H.264 and H.265, are now standard in video intercom stations, enabling clear visual verification necessary for robust security and facial recognition applications. Concurrently, cybersecurity protocols are evolving, moving beyond simple password protection to incorporate robust measures like 802.1X network authentication, encryption (TLS/SRTP) for communication streams, and regular firmware updates to patch vulnerabilities. Manufacturers are also increasingly focusing on Open Network Video Interface Forum (ONVIF) compliance, which guarantees seamless integration of video-enabled intercoms with broader surveillance and video management systems (VMS) from various vendors, fostering a highly flexible, vendor-agnostic security ecosystem.

The emerging technological front involves the integration of edge computing capabilities and the Internet of Things (IoT) connectivity. Edge computing allows for local processing of complex data, such as biometric verification or video analytics, directly on the intercom device, reducing reliance on central servers and minimizing network latency—critical for real-time access control decisions. IoT integration facilitates the intercom's role in smart building automation, allowing it to trigger actions in other systems, such as unlocking doors, adjusting lighting, or initiating climate control sequences based on authenticated access events. The deployment of 5G connectivity is also beginning to impact the market, particularly for remote or temporary installations requiring high-speed wireless backhaul, bypassing the need for fixed infrastructure.

Regional Highlights

- North America (USA and Canada): North America leads the market due to the high adoption rate of sophisticated security systems, stringent regulatory requirements (especially in finance and critical infrastructure), and the mature presence of major technology vendors and system integrators. Investment is driven by upgrading commercial real estate to smart building standards and the widespread acceptance of cloud-based security management solutions.

- Europe (Germany, UK, France, Scandinavia): Europe is a strong contender, characterized by high demand for quality, robust, and aesthetically integrated systems, particularly in the residential and commercial sectors. Driven by GDPR compliance, there is a strong emphasis on data privacy features and secure, end-to-end encrypted communication solutions. Scandinavia is notable for early and rapid adoption of IP-based smart home systems.

- Asia Pacific (APAC) (China, India, Japan, South Korea): APAC is the fastest-growing region, fueled by massive urbanization, burgeoning smart city projects, and significant government investment in infrastructure development. While price sensitivity remains a factor, the rapid expansion of multi-tenant residential complexes (MTUs) and new commercial construction is driving mass adoption, particularly for large-scale, cost-effective SIP-based solutions.

- Latin America (Brazil, Mexico): This region exhibits steady growth, primarily focused on improving security in public transportation and commercial centers due to increasing security challenges. Market adoption is gradual, focusing initially on cost-efficient and reliable audio-video door entry systems, often bundled with broader building security packages.

- Middle East and Africa (MEA) (GCC countries, South Africa): MEA is witnessing high growth driven by large-scale infrastructure projects, especially in the Gulf Cooperation Council (GCC) nations, focusing on developing world-class smart cities and highly secure corporate campuses. The region demands premium, customized solutions integrated with advanced video management systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the IP Network Intercom Market.- Aiphone Corporation

- Axis Communications AB

- Zenitel NV

- Commend International GmbH

- Hikvision Digital Technology Co. Ltd.

- Dahua Technology Co. Ltd.

- Siedle & Söhne OHG

- Algo Communication Products Ltd.

- Bogen Communications LLC

- Legrand SA

- Panasonic Corporation

- Honeywell International Inc.

- Genetec Inc.

- 2N Telekomunikace (Axis subsidiary)

- MOBOTIX AG

- Indigovision (Motorola Solutions)

- Teledoor Systems GmbH

- TCS AG

- Televes Corporation

- Barox Communication AG

Frequently Asked Questions

Analyze common user questions about the IP Network Intercom market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of IP intercoms over traditional analog systems?

The primary advantage of IP intercoms is superior scalability, integration capabilities (with CCTV, access control, and IT networks), high-definition video/audio quality, and centralized remote management via software, offering a lower long-term Total Cost of Ownership (TCO) compared to complex analog wiring and maintenance.

How does Power over Ethernet (PoE) impact IP Network Intercom deployment?

PoE significantly simplifies deployment by transmitting both power and data over a single standard Ethernet cable. This reduces installation time, eliminates the need for nearby electrical outlets, and increases system reliability, especially when connected to a centralized uninterruptible power supply (UPS).

Which end-user segment is experiencing the fastest growth in the IP Intercom Market?

The Residential segment, specifically Multi-Tenant Units (MTUs) and smart homes, alongside the Transportation and Infrastructure sectors (driven by smart city initiatives), are experiencing the fastest growth due to increasing demand for secure, network-enabled door entry and emergency communication points.

What role does AI play in modern IP Network Intercom security?

AI primarily enhances security through advanced facial recognition for secure, hands-free access control, behavioral anomaly detection to flag suspicious activities, and intelligent noise cancellation for reliable, clear voice communication in challenging environments.

What are the main cybersecurity concerns related to IP Intercom Systems?

The main concerns involve unauthorized network access, as an IP intercom can serve as an endpoint vulnerability; Man-in-the-Middle (MITM) attacks on communication streams; and data privacy issues related to the capture and storage of biometric and video data. Proper network segmentation and strong encryption are essential mitigation strategies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager