IP PBX and Cloud PBX Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438171 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

IP PBX and Cloud PBX Market Size

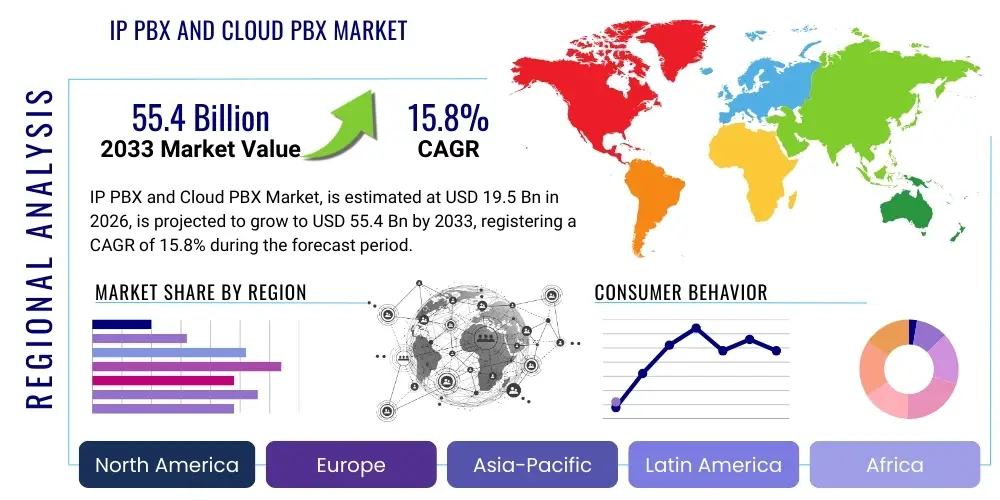

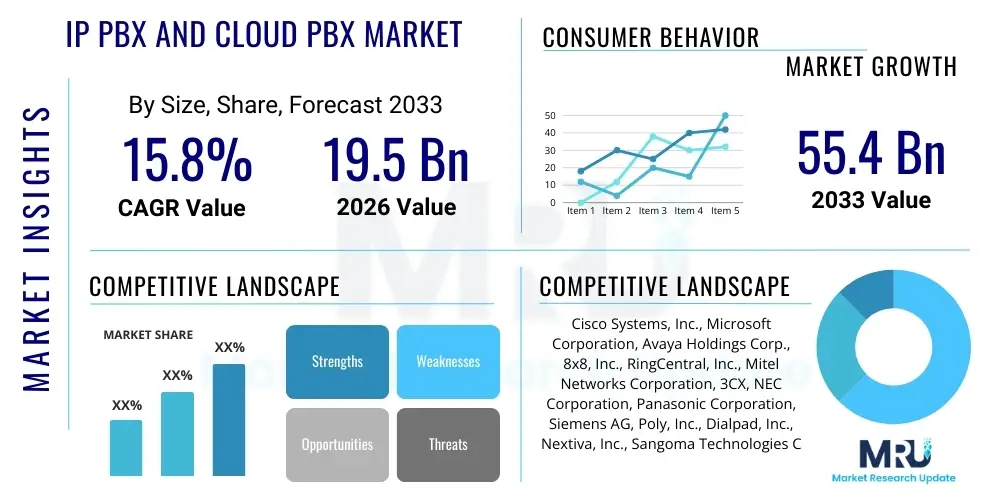

The IP PBX and Cloud PBX Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.8% between 2026 and 2033. The market is estimated at USD 19.5 Billion in 2026 and is projected to reach USD 55.4 Billion by the end of the forecast period in 2033.

IP PBX and Cloud PBX Market introduction

The IP PBX and Cloud PBX market encompasses voice communication solutions utilizing the Internet Protocol (IP) network infrastructure for managing internal and external telecommunications. IP PBX systems, whether deployed on-premise or accessed via the cloud (Cloud PBX or Hosted PBX), offer significant improvements over traditional analog systems, primarily focusing on enhanced functionality, scalability, and reduced operational expenditure. These systems are foundational components of Unified Communications as a Service (UCaaS), integrating voice, video, messaging, and collaboration tools into a single platform. The rapid global shift towards digital transformation, coupled with the increasing need for flexible, remote-work-enabled communication infrastructure, is fundamentally driving the accelerated adoption of these modern telephony solutions across various enterprise sizes.

Product descriptions within this market focus on key features such as Voice over Internet Protocol (VoIP) capabilities, auto-attendants, call routing optimization, conferencing features, and seamless integration with existing Customer Relationship Management (CRM) and Enterprise Resource Planning (ERP) systems. Cloud PBX solutions, in particular, eliminate the need for significant capital investment in hardware, offering consumption-based models (OpEx) that appeal strongly to Small and Medium-sized Enterprises (SMEs). Major applications span across critical business functions including customer service centers, internal corporate communications, field operations, and remote worker connectivity, providing essential continuity and efficiency in a globally distributed business environment. The inherent agility and disaster recovery capabilities of cloud-based solutions further cement their status as preferred communication tools.

Driving factors propelling market expansion include the ubiquitous availability of high-speed internet, the obsolescence of legacy Public Switched Telephone Network (PSTN) infrastructure, and the continuous innovation in communication protocols such as Session Initiation Protocol (SIP). The benefits derived by end-users, such as reduced long-distance charges, improved mobility, simplified system management, and superior scalability tailored to dynamic business growth, make the transition to IP PBX and Cloud PBX solutions an economic necessity rather than a mere technological upgrade. Regulatory environments promoting VoIP adoption and standardization also contribute positively to market maturity and vendor competition.

IP PBX and Cloud PBX Market Executive Summary

The IP PBX and Cloud PBX market is undergoing a structural transformation characterized by a definitive migration from traditional on-premise deployments (IP PBX) towards flexible, subscription-based cloud delivery models (Cloud PBX). Key business trends reveal intense competitive strategies centered on delivering comprehensive Unified Communications as a Service (UCaaS) packages, emphasizing integration capabilities with AI-driven contact center features and advanced security protocols. Enterprise adoption rates are accelerating, driven by the permanent shift towards hybrid and remote work models, necessitating robust, scalable, and globally accessible communication platforms. Furthermore, strategic mergers and acquisitions among established technology firms and agile SaaS providers are shaping the competitive landscape, aiming to consolidate market share and offer unified service portfolios.

Regional trends indicate North America maintains its leadership position, benefiting from early technology adoption, high broadband penetration, and a large presence of technology-savvy enterprises demanding advanced UC features. However, the Asia Pacific (APAC) region is demonstrating the most substantial growth trajectory, fueled by rapid industrialization, burgeoning SME segments in countries like India and China, and government initiatives promoting digital infrastructure investment. Europe is characterized by stringent data sovereignty regulations, influencing the deployment strategies, often favoring regional cloud hosting providers. Segments trends highlight the dominance of the Cloud PBX segment due to its lower Total Cost of Ownership (TCO) and rapid deployment cycle, particularly appealing to SMEs who prioritize OpEx models. Large enterprises, while slower to migrate due to existing infrastructure investments, are increasingly adopting hybrid models to leverage existing assets while testing cloud scalability.

Specific segment growth is pronounced in the BFSI (Banking, Financial Services, and Insurance) and Healthcare sectors, where regulatory compliance, high-volume secure communication, and efficient patient/client interaction are paramount. Technology segmentation shows increasing reliance on WebRTC for browser-based communication and sophisticated Application Programming Interfaces (APIs) that allow deep integration of voice capabilities into custom business workflows. Overall, the market's executive summary points to robust growth, shifting value concentration towards service and software delivery over hardware provision, and a clear strategic emphasis on mobility, security, and AI-powered operational enhancements designed to improve both agent productivity and customer experience.

AI Impact Analysis on IP PBX and Cloud PBX Market

Common user questions regarding AI's impact on the IP PBX and Cloud PBX market revolve around three central themes: automation capability, security enhancement, and future product viability. Users are primarily concerned with how Artificial Intelligence can automate routine communication tasks, such as initial call routing, generating transcription summaries, and providing proactive support (often termed AIOps). There is significant interest in AI's role in enhancing cybersecurity within VoIP networks, particularly concerning anomaly detection and fraud prevention. Furthermore, enterprises seek to understand whether current PBX investments will remain relevant as conversational AI and generative models increasingly take over customer interaction, leading to expectations that future PBX systems must function as intelligent communication hubs rather than just simple voice switches.

The integration of AI is fundamentally transforming the value proposition of modern communication systems, moving them beyond basic connectivity towards intelligent operational assets. AI-powered capabilities, such as advanced Natural Language Processing (NLP) and machine learning algorithms, are being embedded directly into Cloud PBX platforms to drastically improve efficiency. This includes sophisticated call center features like predictive dialing, sentiment analysis during live calls, and automated quality assurance monitoring. For instance, AIOps utilizes data analytics to predict network congestion or potential service failures, enabling system administrators to address issues proactively before they impact user experience or business continuity. This shift enhances system reliability and reduces the burden on IT staff, thereby lowering the overall cost of management.

Moreover, AI is pivotal in reshaping the customer interaction landscape. Conversational AI agents and intelligent virtual assistants (IVAs) are increasingly handling the first layer of customer inquiries, routing complex issues seamlessly to human agents equipped with real-time AI-generated insights. This fusion of voice infrastructure with intelligent automation creates a truly Unified Communications and Collaboration (UCC) environment. For the IP PBX and Cloud PBX market, AI integration is not just a feature addition but a mandate for continued relevance, driving innovation in areas like biometric voice authentication for enhanced security and personalized user experiences based on communication history and organizational roles.

- AI-driven Predictive Maintenance: Utilizing machine learning to monitor network performance and predict hardware or software failures in advance.

- Conversational AI and IVAs: Automated handling of standard inquiries, drastically reducing call queue times and operational costs.

- Real-time Sentiment Analysis: Monitoring customer tone and emotion during calls to provide agents with immediate guidance and improve service quality.

- Enhanced Security through Biometrics: Implementing voice recognition and behavioral analysis to prevent unauthorized access and toll fraud.

- Automated Call Transcription and Summarization: Generating searchable text logs and concise summaries for improved compliance and knowledge management.

- Intelligent Call Routing: Utilizing machine learning to route calls based on agent skill sets, availability, and customer history, optimizing resolution rates.

DRO & Impact Forces Of IP PBX and Cloud PBX Market

The trajectory of the IP PBX and Cloud PBX market is heavily influenced by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO), which collectively constitute the impact forces shaping vendor strategies and end-user adoption patterns. A primary driver is the accelerating global migration of businesses towards the cloud, driven by the desire for operational flexibility and capital expenditure reduction. This is strongly supported by the pervasive implementation of hybrid and remote work models globally, making scalable and mobile communication tools indispensable. Simultaneously, the inherent security concerns associated with transferring sensitive voice data over the public internet and the complexity of integrating new VoIP systems with diverse legacy infrastructure act as significant restraints, particularly for highly regulated sectors like banking and government. However, these restraints are counterbalanced by vast opportunities arising from the development of 5G networks, enabling superior mobile communication quality, and the expansion of the UCaaS ecosystem, which positions PBX functionality as a core component of holistic collaboration suites.

Key drivers include the demonstrable cost savings achieved through the elimination of traditional phone line rental fees and reduced hardware maintenance costs associated with Cloud PBX models. Furthermore, the inherent scalability of cloud architecture allows enterprises to rapidly adjust communication capacity based on seasonal demands or business expansion without substantial lead time or physical installation. The impact forces surrounding digital transformation mandates that businesses adopt modern communication protocols to remain competitive, pushing organizations away from obsolete copper-wire systems. Conversely, a major restraint involves data residency requirements and jurisdictional regulations (like GDPR in Europe), complicating multi-national cloud deployments and requiring service providers to offer segmented regional data centers, increasing deployment complexity and operational overhead for vendors.

The most compelling opportunities stem from continuous technological advancements, particularly the widespread adoption of SIP Trunking for consolidated network management and the maturation of WebRTC, which facilitates voice and video communication directly within web browsers, enhancing application integration. The market is also seeing robust opportunities in servicing underserved geographical regions and vertical markets, such as small municipal governments and specialized medical practices, which are now seeking affordable, feature-rich communication solutions. Furthermore, the convergence of Contact Center as a Service (CCaaS) and UCaaS platforms presents a massive opportunity for PBX providers to expand their service offering into sophisticated customer engagement tools, cementing their role as essential technology partners for business continuity and customer relations management.

- Drivers:

- Increasing adoption of hybrid and remote working models globally.

- Significant reduction in operational and capital expenditures offered by Cloud PBX.

- The widespread availability and reliability of high-speed internet infrastructure (fiber and mobile broadband).

- End-of-life status and increasing maintenance costs associated with legacy PSTN and analog systems.

- Demand for integrated Unified Communications features (voice, video, messaging, presence).

- Restraints:

- Concerns regarding VoIP security vulnerabilities, including potential toll fraud and eavesdropping risks.

- Complexity and cost associated with integrating new IP PBX systems with existing legacy IT and networking infrastructure.

- Data sovereignty regulations and compliance requirements (e.g., HIPAA, GDPR) affecting cloud deployment.

- Dependence on consistent, high-quality internet connectivity for reliable voice service.

- Opportunities:

- Expansion into the rapidly growing UCaaS market, offering bundled collaboration solutions.

- Deployment acceleration supported by 5G network rollouts, improving mobile VoIP quality and reliability.

- Emergence of vertical-specific communication solutions tailored for healthcare, education, and finance.

- Integration of advanced AI and Machine Learning capabilities for operational efficiency and enhanced customer experience.

Segmentation Analysis

The IP PBX and Cloud PBX market is segmented based on deployment model, enterprise size, component, and vertical application, reflecting the diverse needs of modern businesses. The segmentation by deployment model, comprising On-Premise IP PBX and Hosted/Cloud PBX, remains the most critical differentiator, heavily influencing pricing strategies and infrastructural requirements. While on-premise systems retain relevance in highly security-sensitive environments requiring complete control over hardware and data, the Hosted PBX segment is witnessing explosive growth due to its subscription-based flexibility, rapid deployment, and minimal IT overhead. Understanding the adoption curve across different enterprise sizes, from Small and Medium-sized Enterprises (SMEs) to Large Enterprises, is vital; SMEs predominantly drive the cloud migration, whereas large enterprises often opt for hybrid solutions balancing control and scalability.

Component segmentation categorizes the offerings into hardware (IP phones, PBX servers, gateways), software (call management applications, collaboration tools), and services (installation, maintenance, managed services, and professional consulting). The market's value proposition is increasingly shifting from tangible hardware sales towards recurring revenue streams generated through software subscriptions and managed services, optimizing the revenue model for providers. Application segmentation delineates demand across key industry verticals, with IT and Telecom consistently being major consumers, followed closely by the BFSI and Healthcare sectors, each having unique demands for regulatory compliance, security, and high-volume communication capacity. This detailed segmentation allows vendors to tailor their marketing and product development efforts to specific user requirements, ensuring maximized market penetration and solution relevance in specialized fields.

The strategic analysis of these segments confirms that future growth will predominantly be led by the Cloud PBX component within the services sub-segment, driven by global SMEs seeking cost-effective, scalable, and mobile-friendly communication solutions. The shift towards OpEx models reduces financial barriers to entry, enabling faster adoption. Furthermore, the integration complexity for large multinational corporations continues to spur demand for hybrid models and professional consulting services, ensuring that even traditional on-premise components remain relevant within complex, multi-site network environments requiring seamless integration of legacy systems with modern cloud services.

- By Deployment Model:

- Cloud/Hosted PBX (Leading Segment)

- On-Premise IP PBX

- Hybrid PBX

- By Enterprise Size:

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

- By Component:

- Hardware (IP Phones, Media Gateways, Routers)

- Software (UC applications, Call management software)

- Services (Managed Services, Installation, Professional Services)

- By Application/Vertical:

- BFSI (Banking, Financial Services, and Insurance)

- IT and Telecom

- Healthcare

- Retail and E-commerce

- Government and Public Sector

- Manufacturing

- Education

Value Chain Analysis For IP PBX and Cloud PBX Market

The value chain of the IP PBX and Cloud PBX market is complex, encompassing hardware manufacturing, software development, network infrastructure provision, and service delivery. The upstream segment involves the production of essential network components such as IP endpoints (phones, headsets), media gateways, and specialized servers necessary for hosting PBX software. This stage is dominated by established hardware manufacturers focused on technological quality, cost efficiency, and compliance with industry standards like SIP. Key activities include component sourcing, manufacturing, and initial software loading, emphasizing the reliability and interoperability of the physical equipment that forms the backbone of the communication system.

Moving downstream, the value chain shifts significantly towards software development and service provisioning. Software providers develop the core PBX applications, UC platforms, and integration APIs that define system functionality and user experience. The distribution channel is bifurcated into direct sales models, where large vendors handle large enterprise contracts directly, and indirect sales, which relies heavily on channel partners, Value-Added Resellers (VARs), Managed Service Providers (MSPs), and telecom carriers. These indirect channels are critical for reaching SMEs and geographically dispersed customers, providing essential localized installation, maintenance, and ongoing support services, effectively acting as the primary interface between the technology developers and the final end-users.

The final stage involves end-user adoption and maintenance, where the focus is on optimizing system usage, ensuring quality of service (QoS), and managing compliance. Cloud PBX heavily relies on the internet service providers (ISPs) and data center operators who provide the necessary bandwidth and hosting infrastructure. The increasing demand for UCaaS means that service delivery often requires complex integration with third-party applications (CRM, ERP), placing significant emphasis on the role of system integrators and consultants who specialize in merging disparate communication technologies into a cohesive, functional enterprise ecosystem. This reliance on a robust partner network highlights the indirect nature of the modern Cloud PBX market.

IP PBX and Cloud PBX Market Potential Customers

Potential customers for IP PBX and Cloud PBX solutions span virtually all commercial and non-commercial entities requiring robust, multi-channel communication infrastructure. The primary end-users or buyers are categorized by enterprise size and specific industry vertical, reflecting tailored requirements concerning security, regulatory compliance, and call volume management. Small and Medium-sized Enterprises (SMEs) represent a major customer base for Cloud PBX due to its affordability and scalability, allowing them to access enterprise-grade features without massive upfront investment. Conversely, Large Enterprises, including multinational corporations, are key buyers for hybrid and sophisticated on-premise IP PBX systems, prioritizing data control, deep integration with legacy systems, and high levels of customization necessary for complex, global operations.

Vertical industries constitute a substantial portion of potential customers, with the BFSI sector demanding high security, comprehensive audit trails, and reliable disaster recovery capabilities for secure client communication and transaction verification. Healthcare organizations are increasingly adopting these systems to manage appointment scheduling, telemedicine communications, and internal staff coordination, adhering strictly to patient confidentiality regulations (e.g., HIPAA). Additionally, governmental bodies and educational institutions seek these platforms for reliable, high-volume internal communication and emergency notification systems, often driven by procurement rules favoring open-source or highly cost-effective cloud solutions.

The continuous growth of call centers and Business Process Outsourcing (BPO) firms globally ensures sustained demand, as these operations require highly reliable, scalable, and feature-rich PBX systems capable of handling massive concurrency and offering sophisticated analytics. Furthermore, the burgeoning segment of retail and e-commerce companies utilizes these platforms for omnichannel customer service, integrating voice communication seamlessly with chat, social media, and internal inventory management systems, underscoring the broad and diversified demand profile across the global economy.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 19.5 Billion |

| Market Forecast in 2033 | USD 55.4 Billion |

| Growth Rate | 15.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Cisco Systems, Inc., Microsoft Corporation, Avaya Holdings Corp., 8x8, Inc., RingCentral, Inc., Mitel Networks Corporation, 3CX, NEC Corporation, Panasonic Corporation, Siemens AG, Poly, Inc., Dialpad, Inc., Nextiva, Inc., Sangoma Technologies Corporation, Unify (Atos SE), ALE International (Alcatel-Lucent Enterprise), Evolve IP, Intermedia, Google (Google Voice), Vonage (Ericsson). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

IP PBX and Cloud PBX Market Key Technology Landscape

The IP PBX and Cloud PBX market relies on a robust set of underlying technologies that enable efficient, high-quality, and secure voice communication over IP networks. Session Initiation Protocol (SIP) remains the cornerstone protocol, responsible for initiating, maintaining, and terminating voice and video sessions, standardizing interoperability across diverse vendor equipment. SIP Trunking, the technique of replacing traditional fixed telephone lines with IP-based connectivity, is fundamentally driving cost reduction and network consolidation for enterprises. Furthermore, the evolution of proprietary systems towards open-standard protocols is critical for fostering a competitive ecosystem and accelerating feature development, supporting the integration of third-party applications necessary for modern UC environments. High-Definition (HD) Voice codecs (like Opus and G.722) are also essential, ensuring superior audio quality comparable to, or exceeding, traditional telephone networks, addressing historical performance concerns related to VoIP.

Another pivotal technology is Web Real-Time Communication (WebRTC), which enables real-time communication capabilities—including voice, video, and data transfer—to function directly within standard web browsers without requiring additional plug-ins or software installations. WebRTC integration is fundamentally changing how contact centers operate and how internal teams collaborate, offering seamless click-to-call functionality and instant video conferencing embedded within business applications. Alongside these, proprietary and open-source operating systems, such as Asterisk and FreePBX, continue to power a significant portion of the IP PBX installed base, particularly in smaller deployments and for vendors seeking customization flexibility. These systems provide the foundational code necessary for managing complex call logic, auto-attendants, and voicemail services, allowing for deep control over telephony infrastructure.

The future technology landscape is heavily invested in security technologies, specifically Transport Layer Security (TLS) and Secure Real-time Transport Protocol (SRTP), which encrypt signaling and media traffic, respectively, addressing critical user concerns about data security over the internet. Furthermore, the development of sophisticated Application Programming Interfaces (APIs) and Software Development Kits (SDKs) is central to the ongoing trend of "Communications Platform as a Service" (CPaaS), allowing businesses to embed PBX functionalities, such as automated dialing or IVR menus, directly into custom applications. This technological convergence ensures that IP PBX and Cloud PBX platforms are evolving from isolated communication tools into deeply integrated, programmable business assets capable of automating complex organizational workflows and enhancing overall productivity.

Regional Highlights

Regional dynamics within the IP PBX and Cloud PBX market vary significantly, reflecting differences in economic maturity, regulatory environment, internet penetration, and the pace of digital transformation across major geographic areas. North America, encompassing the United States and Canada, remains the largest and most mature market segment. This dominance is attributable to high IT spending, the presence of major technological innovation hubs, extensive broadband infrastructure, and the early, aggressive adoption of cloud services and UCaaS solutions across all enterprise sizes. North American enterprises are consistently pushing the boundaries for advanced features, including deep AI integration and comprehensive mobile UC capabilities, positioning the region as a trendsetter in deployment strategy.

Europe, characterized by its strict data privacy regulations (GDPR), demonstrates steady growth, particularly in Western economies like Germany, the UK, and France. Adoption in Europe is often influenced by the necessity of local data residency, leading to a strong preference for localized cloud hosting solutions and hybrid models that maintain some data control on-premise. Central and Eastern Europe are rapidly catching up, fueled by economic convergence and increasing broadband penetration, driving demand for cost-effective Cloud PBX solutions. The market here is highly competitive, with local telecom providers aggressively challenging global giants by offering localized service packages that emphasize compliance and regional support.

The Asia Pacific (APAC) region is projected to register the fastest growth rate throughout the forecast period. This rapid expansion is primarily driven by massive infrastructure investments, the proliferation of SMEs in economies like India, Southeast Asia, and China, and government initiatives promoting digitalization. The sheer scale of population and the explosive growth in mobile connectivity are accelerating the adoption of cloud-based communication systems, often bypassing traditional on-premise setups entirely. Latin America and the Middle East & Africa (MEA) represent emerging markets, with demand driven by urbanization, high mobile penetration, and the need for scalable communication tools in sectors like oil & gas (MEA) and large-scale manufacturing (LATAM). Economic volatility and variable regulatory frameworks, however, occasionally temper the speed of cloud transition in these regions, leading to cautious but sustained adoption of flexible IP solutions.

- North America: Market leader; early and rapid adoption of UCaaS; high demand for AI-driven features; strong presence of key market vendors.

- Europe: Growth influenced by stringent regulatory frameworks (GDPR); strong emphasis on regional data centers and compliance-focused hybrid solutions; steady migration from traditional ISDN lines.

- Asia Pacific (APAC): Highest CAGR; driven by immense SME growth, government digitalization programs, and high mobile connectivity penetration across emerging economies (China, India).

- Latin America: Increasing investment in telecommunication infrastructure; focused adoption in large urban centers; demand driven by cost-efficiency of Cloud PBX over legacy systems.

- Middle East and Africa (MEA): Emerging market; growth concentrated in major economic hubs (UAE, Saudi Arabia, South Africa); driven by diversification mandates and necessity for secure, cross-border communication.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the IP PBX and Cloud PBX Market.- Cisco Systems, Inc.

- Microsoft Corporation

- Avaya Holdings Corp.

- 8x8, Inc.

- RingCentral, Inc.

- Mitel Networks Corporation

- 3CX

- NEC Corporation

- Panasonic Corporation

- Siemens AG

- Poly, Inc.

- Dialpad, Inc.

- Nextiva, Inc.

- Sangoma Technologies Corporation

- Unify (Atos SE)

- ALE International (Alcatel-Lucent Enterprise)

- Evolve IP

- Intermedia

- Google (Google Voice)

- Vonage (Ericsson)

Frequently Asked Questions

Analyze common user questions about the IP PBX and Cloud PBX market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between IP PBX and Cloud PBX?

IP PBX (Internet Protocol Private Branch Exchange) typically refers to an on-premise system where hardware and software are hosted internally, giving the organization complete control. Cloud PBX, or Hosted PBX, is a subscription-based service managed entirely by the vendor and accessed via the internet, offering superior scalability and lower capital expenditure (CapEx).

How is the adoption of UCaaS influencing the IP PBX market?

Unified Communications as a Service (UCaaS) is driving the consolidation of voice, video, messaging, and collaboration tools onto a single platform. This influence shifts the market focus from standalone PBX units towards integrated, feature-rich cloud solutions, making the traditional PBX system a foundational component of a larger UCaaS offering.

What are the key security concerns associated with VoIP and Cloud PBX deployment?

Major security concerns include toll fraud (unauthorized calls), denial of service (DoS) attacks targeting IP endpoints, and the interception of voice data. Providers mitigate these risks through mandatory encryption protocols (SRTP/TLS), strong authentication methods, and continuous network monitoring for anomalous traffic patterns.

Which deployment model (Cloud vs. On-Premise) is most suitable for SMEs?

Cloud PBX is generally most suitable for Small and Medium-sized Enterprises (SMEs). It offers rapid deployment, minimal IT staff requirements, OpEx budgeting predictability, and instant scalability, which aligns perfectly with the growth needs and limited resources typical of the SME segment.

How does AI improve the functionality of modern PBX systems?

AI integration introduces features like intelligent call routing, real-time voice sentiment analysis, automated call transcription and summarization, and predictive maintenance (AIOps). These capabilities significantly enhance operational efficiency, improve customer service quality, and reduce the labor intensity of managing high-volume communications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager