iPad and Covers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432100 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

iPad and Covers Market Size

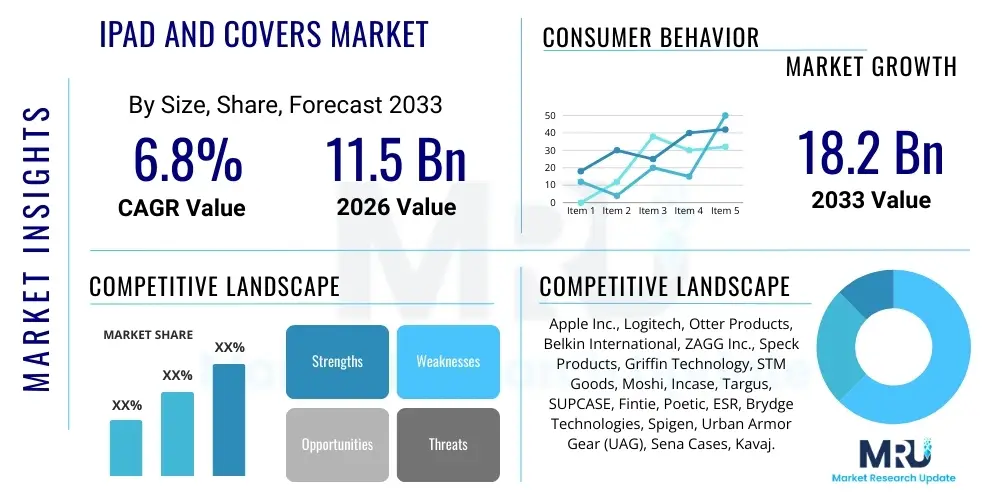

The iPad and Covers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 11.5 billion in 2026 and is projected to reach USD 18.2 billion by the end of the forecast period in 2033. This consistent growth trajectory is primarily fueled by the sustained global demand for portable computing solutions, particularly in education and enterprise sectors, where the iPad’s ecosystem integration and enhanced productivity features drive adoption. Furthermore, the accessory market, especially protective and functional covers, experiences parallel growth, driven by consumer desire to safeguard premium devices and enhance their usability through features like integrated keyboards and smart functionality.

The market expansion is heavily influenced by Apple’s consistent innovation cycle, introducing new iPad models with advanced processing power, refined display technologies, and compatibility with sophisticated peripheral devices. As the device portfolio diversifies—spanning the high-end iPad Pro to the entry-level standard iPad—the Total Addressable Market (TAM) for compatible accessories expands proportionally. Accessory manufacturers must continually adapt their product offerings to accommodate new form factors, camera alignments, and magnetic connection standards, ensuring that the ancillary covers market remains dynamic and responsive to hardware updates and evolving consumer ergonomic requirements.

iPad and Covers Market introduction

The iPad and Covers Market encompasses the global sales, distribution, and consumption of Apple's tablet devices and the wide array of protective, functional, and aesthetic accessories designed for them. The iPad, serving as a versatile bridge between smartphones and laptops, offers users a powerful mobile operating system (iPadOS) coupled with touch input precision, making it suitable for content consumption, professional creative tasks, and educational applications. This market is highly synergistic; the premium positioning of the iPad necessitates high-quality protective measures, thereby bolstering the demand for third-party and proprietary covers, keyboard cases, and ruggedized protection solutions globally. Market penetration is closely tied to digital transformation initiatives across corporate and academic environments.

Major applications of the iPad include digital learning and remote education, corporate workflow management, healthcare record keeping, graphic design, and media production. The continuous improvement in the device’s capabilities, such as support for the Apple Pencil and powerful processing units (M-series chips), positions it as a genuine alternative to traditional PCs for many professionals. Benefits derived from the market include enhanced portability, superior battery life, intuitive user experience, and access to a robust application ecosystem. The accessories segment provides crucial value by extending the functionality of the device, offering features like physical keyboards for intensive typing tasks, stands for hands-free viewing, and enhanced durability against physical damage, justifying the investment in premium protection.

Driving factors for sustained market growth include the post-pandemic acceleration of remote work and hybrid learning models, which necessitates reliable and flexible computing tools like the iPad. Furthermore, the rising disposable income in emerging economies increases the affordability of premium electronic devices. Technological advancements, such as enhanced magnetic connectors (Smart Connector, Magic Keyboard integration) and improved material science leading to thinner yet more protective cases, further stimulate consumer upgrades and new purchases. The replacement cycle for both the devices and their frequently utilized covers—which suffer wear and tear—contributes significantly to the recurring revenue stream within this specialized technology market.

iPad and Covers Market Executive Summary

The iPad and Covers Market is currently undergoing a structural transformation characterized by increased hardware sophistication and a corresponding surge in demand for specialized, high-value accessories. Business trends indicate a robust shift toward integrating iPads into complex enterprise environments, moving beyond simple content consumption to critical operational roles in fields like aviation, manufacturing, and retail. This enterprise adoption drives the demand for ruggedized cases and productivity-focused accessories, specifically those featuring integrated security mechanisms and compliance with corporate IT standards. Geographically, Asia Pacific is emerging as the fastest-growing region, driven by expanding middle classes, rapid digitalization in education, and aggressive marketing strategies by both Apple and key accessory manufacturers targeting highly populated urban centers.

Regional trends highlight North America and Europe as mature markets characterized by high Average Selling Prices (ASPs) for both devices and premium accessories. In these regions, the focus is less on volume growth and more on feature differentiation, such as environmentally sustainable materials and advanced integration with the iPad ecosystem (e.g., precise battery monitoring via accessories). Conversely, developing regions show a strong preference for affordability, leading to increased competition among third-party cover manufacturers offering value-based products. These regional dynamics necessitate tailored distribution strategies, leveraging both official Apple channels and extensive third-party e-commerce platforms.

Segmentation trends reveal that keyboard cases, particularly those incorporating trackpads and full magnetic connectivity (like the Magic Keyboard alternatives), are experiencing the fastest growth rate within the cover segment due to the 'laptop replacement' narrative pushed by Apple. Within the device segment, the iPad Pro and iPad Air continue to drive revenue due to their high price point and superior technical capabilities, catering primarily to creative professionals and corporate users. Furthermore, sustainability is becoming a non-negotiable segment requirement, pushing manufacturers to utilize recycled plastics, biomaterials, and minimize packaging waste, influencing purchasing decisions among environmentally conscious consumers.

AI Impact Analysis on iPad and Covers Market

Common user questions regarding AI’s impact on the iPad and Covers market center on whether Artificial Intelligence will fundamentally change how users interact with the hardware, rendering certain accessories obsolete, and if AI-enhanced functionalities will become native features of iPadOS, thereby influencing the requirements for physical interaction points. Users are concerned about the longevity of existing accessories versus future AI-optimized designs and how AI could personalize device protection and functionality. The general consensus analyzed from these inquiries suggests a high expectation for AI to improve device efficiency, enhance creative workflows (e.g., generative design on the iPad Pro), and drive demand for accessories that support extended, intensive AI-driven tasks, such as improved thermal dissipation or specialized input methods optimized for machine learning interaction.

- AI integration in iPadOS enhances performance for complex creative applications, increasing demand for high-end devices (Pro/Air) that require premium, form-fitting covers.

- Generative AI tools accelerate professional content creation on iPads, leading to higher usage hours and consequently boosting the market for durable, ergonomic protective covers.

- AI-driven optimization of power management extends battery life, but intensive AI workloads necessitate accessories with superior passive cooling features to prevent throttling and device damage.

- Demand for specialized input accessories (e.g., advanced haptic pens, redesigned keyboard layouts) may arise as AI features require new methods of interaction beyond traditional touch and stylus input.

- AI algorithms can be utilized by manufacturers to predict failure points in materials and optimize cover designs for maximum resilience and material efficiency, improving product longevity.

- Integration of smart sensing capabilities into covers (e.g., environmental monitoring, posture correction alerts) driven by localized AI chips could introduce a new high-value sub-segment.

- Supply chain optimization using AI enables manufacturers to rapidly respond to new iPad form factor releases, ensuring faster time-to-market for compatible accessory lines.

DRO & Impact Forces Of iPad and Covers Market

The market dynamics are governed by a complex interplay of enabling factors, limiting constraints, and significant opportunities, which collectively determine the overall market trajectory. Driving factors are primarily technological, focusing on the continuous evolution of iPad hardware and the subsequent creation of opportunities for high-margin accessory innovation. Restraints include the market's heavy reliance on Apple's product lifecycle decisions and intense price competition, particularly in the mass-market cover segment, which can erode profit margins for smaller players. Opportunities lie in expanding geographical penetration, particularly in emerging Asian and Latin American markets, and capitalizing on niche markets such as medical-grade protection and certified accessibility accessories.

Impact forces currently shaping the market are predominantly related to technological obsolescence and supply chain resilience. The frequent hardware updates (e.g., changes in camera bump size, speaker placement, or magnetic connections) necessitate constant research and development expenditure from accessory makers to maintain compatibility, creating high switching costs and barriers to entry. Furthermore, the global semiconductor shortage and geopolitical trade tensions impact the cost and availability of components required for smart accessories (like keyboard cases and charging sleeves), influencing pricing strategies and inventory management across the value chain. Consumer sentiment regarding sustainability also acts as a critical force, compelling companies to invest in eco-friendly materials and ethical manufacturing processes.

The market also faces inherent cyclical constraints tied to global economic health; as the iPad is generally considered a non-essential premium electronic device, macroeconomic downturns can immediately impact discretionary spending, reducing replacement cycles and dampening new accessory purchases. However, the move towards hybrid work and digitalization in education continues to provide structural market support, mitigating some of the cyclical volatility. Strategic investment in licensed or certified accessories (Made for iPad programs) remains a crucial differentiating factor, signaling quality and compatibility, thereby strengthening the competitive position of authorized manufacturers against generic, low-quality competitors.

Segmentation Analysis

The iPad and Covers Market is highly diversified and segmented across device type, cover function, distribution channel, and end-user application, reflecting the broad utility of the iPad platform. Effective market segmentation allows manufacturers to tailor marketing strategies, pricing models, and product features to specific consumer needs, ranging from the price-sensitive student requiring basic protection to the corporate executive demanding integrated security and high-end productivity features. The primary segmentation by product type—the iPad device itself—drives the accessory market, as each model (Pro, Air, Mini) possesses unique dimensions and feature sets that require customized cover solutions, ensuring a perpetual demand for specific, non-interchangeable products across the device lifecycle.

Further segmentation by the type of accessory reveals crucial trends. Functional accessories, such as keyboard cases and holders for the Apple Pencil, command a premium due to the added utility they provide, directly enhancing the iPad’s productivity potential. Conversely, basic protective sleeves and silicone cases appeal to the mass market, focusing primarily on defense against scratches and minor drops at a lower price point. Distribution channel segmentation highlights the ongoing importance of official retail stores and authorized resellers for premium accessories, while the explosive growth of dedicated e-commerce platforms (Amazon, third-party sites) dominates the volume sales of generic and value-oriented covers, emphasizing a multi-channel approach for comprehensive market coverage.

- By Product Type (Device):

- iPad Pro (11-inch and 12.9-inch)

- iPad Air

- iPad Mini

- Standard iPad (9th/10th Generation)

- By Accessory Type (Covers):

- Keyboard Cases (Integrated Bluetooth/Smart Connector)

- Smart Covers and Folio Cases

- Rugged and Heavy-Duty Protection Cases

- Sleeves and Pouches

- TPU/Silicone Cases

- Leather and Premium Material Cases

- By Distribution Channel:

- Online Retail (E-commerce Platforms, Brand Websites)

- Offline Retail (Apple Stores, Consumer Electronics Stores, Carrier Stores)

- By End-User Application:

- Education (K-12 and Higher Education)

- Business and Enterprise

- Consumer/Personal Use

- Healthcare and Medical

- Creative Professionals (Design, Media)

Value Chain Analysis For iPad and Covers Market

The value chain for the iPad and Covers Market is segmented into upstream material sourcing, manufacturing, logistics, and downstream distribution and retail. Upstream activities involve the procurement of specialized materials, including high-grade polycarbonate, TPU, genuine and synthetic leather, and electronic components (for smart covers, hinges, and connectivity modules). The reliance on specific patents and high-quality synthetic polymer blends often necessitates complex contractual relationships with specialized material suppliers, particularly those that meet Apple’s stringent material and environmental standards, influencing the final product quality and manufacturing cost structures.

Manufacturing constitutes the core transformation phase, where design specifications are translated into mass-produced items. This phase is characterized by sophisticated precision molding, material cutting, assembly of electronic components (especially for keyboard cases), and rigorous quality control testing (e.g., drop testing, thermal management testing). Due to the high volume and speed required to launch accessories concurrently with new iPad models, manufacturing is heavily concentrated in specialized facilities, primarily located in East Asia, leveraging economies of scale and expertise in electronics assembly. Efficient logistics are critical to ensure timely delivery to global distribution hubs, especially given the short window following an iPad launch where accessory demand peaks.

Downstream distribution channels are bifurcated into direct and indirect routes. Direct sales occur through the brands' proprietary e-commerce sites and physical retail locations (Apple Stores), providing maximum control over branding and customer experience. Indirect distribution, dominated by large third-party e-commerce giants (Amazon, Alibaba) and major consumer electronics retailers (Best Buy, Walmart), accounts for the vast majority of volume sales, especially for competitively priced items. Authorized resellers and enterprise distributors play a vital role in B2B and educational sales, bundling accessories with devices to provide comprehensive solution packages, making channel partnership management a critical strategic element for market penetration and sustained revenue generation.

iPad and Covers Market Potential Customers

The potential customer base for the iPad and Covers Market is exceptionally broad, spanning multiple demographic and professional categories, necessitating a tiered product strategy from manufacturers. End-users can be broadly categorized into consumers seeking entertainment and basic productivity, students requiring affordable, durable tools for digital learning, and high-value corporate clients demanding enhanced security, enterprise-grade functionality, and seamless fleet management compatibility. The consumer segment represents the largest volume market, driven by personal usage, media consumption, and general web browsing, typically prioritizing aesthetic design and moderate protection levels for their devices.

The education sector stands as a substantial institutional buyer, particularly K-12 and university systems investing in 1:1 device programs. These buyers prioritize ruggedized protection solutions, often mandating military-grade drop protection (MIL-STD) and asset tagging compatibility, ensuring device longevity in active learning environments. Procurement decisions here are often volume-based and highly cost-sensitive, favoring manufacturers who can provide reliable bulk supply and extended warranties. Furthermore, the increasing adoption of the iPad as a point-of-sale (POS) terminal or mobile data entry device in retail, hospitality, and healthcare sectors creates a highly lucrative B2B niche demanding specialized ergonomic, lockable, and easily sanitized case designs.

Another high-value customer segment is the professional and creative community, including graphic designers, architects, and film editors who utilize the high processing power of the iPad Pro. These users demand accessories that maximize productivity, such as low-latency keyboard cases, ergonomic stands, and covers designed to accommodate the Apple Pencil during intensive usage periods. This segment typically exhibits low price sensitivity but high demands regarding material quality, functionality integration, and premium aesthetics, making it a critical driver of innovation and high ASP products within the covers market, where branding and perceived durability significantly influence purchasing behavior.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 11.5 billion |

| Market Forecast in 2033 | USD 18.2 billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Apple Inc., Logitech, Otter Products, Belkin International, ZAGG Inc., Speck Products, Griffin Technology, STM Goods, Moshi, Incase, Targus, SUPCASE, Fintie, Poetic, ESR, Brydge Technologies, Spigen, Urban Armor Gear (UAG), Sena Cases, Kavaj. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

iPad and Covers Market Key Technology Landscape

The technology landscape for the iPad and Covers Market is defined by the critical interface between the accessory and the device, heavily leveraging proprietary Apple technologies and advanced material science. Core technologies include the Smart Connector, which allows for immediate power and data transfer for keyboard cases without relying on Bluetooth pairing or independent charging, significantly enhancing the seamless user experience. This technology ensures low latency and reliability, distinguishing premium keyboard accessories from traditional Bluetooth options. Furthermore, magnetic alignment systems, crucial for both basic covers and complex stands, utilize precise magnet placement and strength to ensure secure attachment, auto-wake/sleep functionality, and flexible viewing angles, which requires highly accurate manufacturing tolerances.

In terms of materials, the focus is increasingly shifting towards sustainable and high-performance composites. Advanced materials technology involves the use of recycled Ocean Plastic, bio-based polymers, and durable synthetic textiles that offer enhanced protection while reducing the environmental footprint. Ruggedized cases utilize proprietary shock-absorbing materials, often involving multi-layer construction (e.g., rigid polycarbonate shells coupled with flexible TPU inner layers) designed to meet or exceed military standard drop specifications (MIL-STD-810G). The integration of antimicrobial additives into case materials is also a burgeoning technology, particularly relevant for accessories used in shared environments like schools and healthcare facilities, addressing growing consumer focus on hygiene.

The development of ultra-thin, low-profile keyboard components, including optimized scissor mechanisms and integrated trackpads that mimic laptop functionality, continues to drive the high-end segment. Furthermore, ancillary technologies such as wireless charging pass-through capabilities integrated into non-Apple certified covers, and specialized battery management systems for accessories requiring external power, are key areas of technological differentiation. The ongoing push for seamless integration necessitates continuous investment in electromagnetic shielding and ensuring compliance with rapidly evolving electronic compatibility and safety standards globally.

Regional Highlights

Regional dynamics significantly influence the iPad and Covers Market, driven by factors such as economic maturity, digitalization rates, and consumer purchasing power. North America holds the largest market share, characterized by high consumer spending on premium electronics, strong penetration of the Apple ecosystem, and significant corporate and educational procurement cycles. The focus in this region is on high-margin products, including Magic Keyboard alternatives, ruggedized accessories for field workers, and designer leather cases. Innovation in retail experience and strong e-commerce infrastructure further solidify this region's dominance.

Asia Pacific (APAC) represents the fastest-growing region globally, fueled by demographic shifts, increasing middle-class disposable incomes, and widespread government investment in digital education platforms (e.g., in India, China, and Southeast Asian nations). While price sensitivity is higher in many APAC countries, the sheer volume of device sales, particularly standard iPads and iPad Airs, drives massive demand for mid-range and value-based protective covers. Accessory manufacturers often localize their product offerings and distribution strategies, leveraging major regional e-commerce marketplaces to capitalize on the rapid mobile technology adoption.

Europe exhibits steady growth, with a strong emphasis on sustainability and aesthetic design. European consumers frequently prioritize eco-friendly and recycled material covers, driving market innovation in biomaterials and ethical sourcing. Regulatory pressures regarding e-waste and material transparency also influence product design and marketing strategies across major European markets like Germany, the UK, and France. Latin America and the Middle East & Africa (MEA) are emerging regions experiencing increased penetration, often characterized by demand for robust, entry-level protection and basic functionality, presenting long-term growth opportunities contingent on economic stability and expanding retail infrastructure.

- North America: Dominant market share; emphasis on premium keyboard cases, rugged protection for enterprise, high ASP for accessories, driven by corporate and educational bulk purchases.

- Asia Pacific (APAC): Highest growth rate; large volume market for standard and mid-range devices, strong e-commerce penetration, and increasing educational sector adoption driving demand for protective covers.

- Europe: Mature market focusing on sustainability, eco-friendly materials, and premium, design-centric accessories; strict adherence to environmental and quality standards.

- Latin America (LATAM): Emerging market characterized by increasing digitalization and growing adoption of iPads in retail; demand focused on essential protection and competitive pricing.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the iPad and Covers Market.- Apple Inc. (Ecosystem Owner and Smart Accessory Manufacturer)

- Logitech

- Otter Products

- Belkin International

- ZAGG Inc. (Including mophie and InvisibleShield)

- Speck Products

- Griffin Technology

- STM Goods

- Moshi

- Incase

- Targus

- SUPCASE

- Fintie

- Poetic

- ESR

- Urban Armor Gear (UAG)

- Brydge Technologies

- Spigen

- Sena Cases

- Kavaj

Frequently Asked Questions

Analyze common user questions about the iPad and Covers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the current demand for premium iPad keyboard cases?

The primary driver is the positioning of the iPad Pro and iPad Air as true laptop replacements, fueled by the powerful M-series chips and the sophisticated capabilities of iPadOS. Users require keyboard cases with trackpads and Smart Connector compatibility to facilitate complex productivity tasks, remote work, and intense creative workflows.

How is the accessories market addressing the shift towards device sustainability?

Accessory manufacturers are increasingly using recycled plastics, bio-based polymers, and certified sustainable materials (such as recycled PET or responsibly sourced leather) in the production of covers and cases. This shift addresses growing consumer environmental concerns and complies with increasing global sustainability mandates.

Which geographical region exhibits the fastest growth rate for iPad accessories?

The Asia Pacific (APAC) region is projected to register the fastest growth rate, driven by significant government investments in educational digitalization, the rapid expansion of the middle class, and strong growth in e-commerce adoption across emerging economies like India and Southeast Asia.

What role does the Smart Connector technology play in market segmentation?

The Smart Connector defines the high-end functional segment of the covers market. Accessories utilizing this technology (primarily keyboard cases) command a premium price due to their seamless, low-latency power and data transfer capabilities, offering superior performance compared to standard Bluetooth accessories.

What are the main challenges faced by third-party accessory manufacturers?

Key challenges include maintaining rapid product development cycles to align with frequent changes in Apple's hardware form factors, navigating the intense price competition from generic brands, and ensuring compliance with stringent certification requirements (e.g., MFi licensing or Smart Connector standards) necessary for full compatibility and trust.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager