IQF Food Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434322 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

IQF Food Market Size

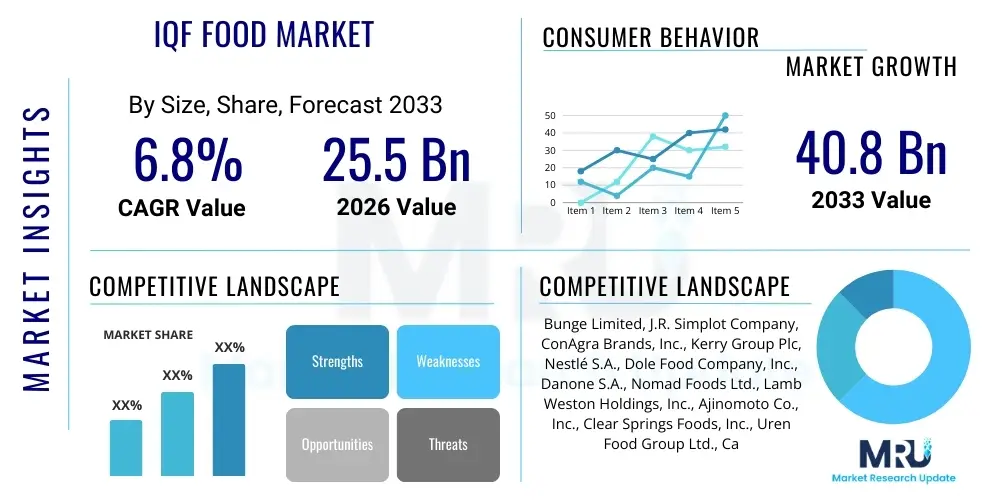

The IQF Food Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 25.5 Billion in 2026 and is projected to reach USD 40.8 Billion by the end of the forecast period in 2033.

IQF Food Market introduction

The Individually Quick Frozen (IQF) Food Market encompasses products processed using a technology that flash-freezes individual pieces of food rapidly, preventing them from clumping together. This distinct freezing method ensures superior quality retention, preserving the cell structure, texture, color, and nutritional value of delicate products such as berries, vegetables, seafood, and meat pieces better than conventional block freezing. The fundamental principle revolves around achieving rapid crystallization, minimizing the size of ice crystals formed within the food structure, thereby reducing cellular damage upon thawing. This technology is critical for maintaining high food quality standards demanded by modern consumers and industrial users.

Major applications of IQF foods span across the entire food processing industry, including ready-to-eat meals, soups, sauces, baked goods, and institutional catering. The inherent convenience offered by pre-portioned, non-clumping ingredients makes IQF products highly valuable for both food service operators seeking efficiency and busy consumers prioritizing minimal preparation time. Key driving factors propelling market expansion include rising global demand for convenience foods due to hectic lifestyles, increasing awareness regarding reducing food waste at the household level, and the expanding cold chain infrastructure, particularly in developing economies. Furthermore, the ability of IQF technology to extend the shelf life of seasonal produce allows for consistent global supply throughout the year, stabilizing ingredient costs for major food manufacturers.

The versatility of the IQF technique allows for its application across diverse product categories, significantly benefiting the global supply chain. For producers, IQF ensures flexibility in harvesting and processing, enabling them to capitalize on peak seasonal quality. For consumers, the benefits are tangible: precise portion control, ease of handling, and superior organoleptic properties compared to traditionally frozen goods. The increasing focus on clean labels and minimal processing also favors IQF products, as the freezing process itself serves as a natural preservative, often reducing the need for artificial additives. These combined factors solidify the IQF method as an essential component of modern food preservation and distribution systems worldwide.

IQF Food Market Executive Summary

The IQF Food Market is characterized by robust growth, driven primarily by evolving global consumer preferences toward health, convenience, and reduced food waste. Current business trends indicate a significant push towards automation in processing facilities to enhance efficiency and maintain stringent quality controls, particularly concerning microbial safety and product uniformity. Investment in advanced sorting technologies, often integrated with optical sensors, is becoming standard practice among key players to ensure only the highest quality product enters the freezing tunnel. Furthermore, market expansion is heavily influenced by the rising penetration of e-commerce and specialized cold-chain logistics providers, making frozen foods more accessible to urban and semi-urban populations globally, especially in regions with previously underdeveloped cold storage capabilities.

Regional trends highlight Asia Pacific (APAC) as the fastest-growing market, primarily fueled by rapid urbanization, increasing disposable income, and the adoption of Western dietary habits that favor processed and convenience foods. Europe maintains a strong market share, characterized by high consumer expenditure on premium, organic, and ethically sourced IQF products, underpinned by strict food safety regulations that encourage technological adoption among processors. North America exhibits maturity but continues growth through innovation in plant-based IQF meat alternatives and specialty frozen bakery items. These geographical dynamics necessitate tailored market strategies focused either on volume and infrastructure development in APAC or high-value, niche offerings in North America and Europe.

Segment trends reveal that the IQF fruits and vegetables segments dominate the market size, largely due to their perennial use in the beverage, bakery, and dairy industries, alongside growing consumer adoption of frozen produce for at-home cooking. However, the IQF prepared foods and seafood segments are demonstrating the highest growth velocity, driven by increased demand for protein-rich, pre-cooked, and easy-to-prepare meal components. The rise of flexitarian and vegan diets has specifically spurred innovation in IQF legumes and plant-based protein pieces. Companies are increasingly focusing on developing custom IQF blends and mixes tailored to the specific needs of B2B customers, such as industrial bakers and ready-meal manufacturers, thereby ensuring sustained demand across various vertical segments within the food industry.

AI Impact Analysis on IQF Food Market

User queries regarding the impact of Artificial Intelligence (AI) on the IQF Food Market frequently center on themes of precision quality control, predictive maintenance of complex cold chain machinery, and optimization of supply chain logistics to minimize energy waste and spoilage. Users are particularly concerned with how AI can enhance food safety through automated inspection systems capable of detecting foreign materials or substandard product pieces faster and more accurately than human intervention or traditional mechanical sorters. Another key area of interest revolves around leveraging AI for highly accurate demand forecasting, ensuring that perishable raw materials are processed efficiently, thus minimizing inventory holding costs and food waste, which is a major sustainability objective for the industry. Expectations are high for AI to transform the traditionally energy-intensive freezing process into a smarter, more sustainable, and less resource-heavy operation.

AI’s influence is rapidly extending across the entire IQF value chain, starting from the farm level through to consumer delivery. In the processing plant, machine learning algorithms are trained on vast datasets of product images to identify defects, size variations, and discoloration with unparalleled speed, enabling real-time, high-speed sorting and grading before freezing. This ensures consistent product quality batch after batch, drastically reducing the risk of recalls and improving customer satisfaction. Furthermore, AI-powered systems are crucial for optimizing the performance of critical equipment like spiral freezers and conveyor belts. By monitoring temperature fluctuations, vibration patterns, and energy consumption in real-time, AI can predict potential equipment failures hours or days in advance, allowing for scheduled maintenance rather than costly, disruptive emergency shutdowns, thereby maximizing operational uptime and cold chain integrity.

In logistics and inventory management, AI algorithms analyze market volatility, seasonality, promotional campaigns, and historical sales data to generate sophisticated demand forecasts. These forecasts guide procurement decisions for raw materials and optimize the storage and distribution network, ensuring products are moved efficiently through the cold chain. By predicting consumer behavior with greater precision, companies can avoid overproduction of seasonal IQF items or understocking high-demand prepared meals. The integration of AI with blockchain technology is also emerging, offering immutable records of temperature history and handling procedures throughout the supply chain, significantly boosting traceability and enhancing consumer trust in the safety and quality of IQF products. This multifaceted application of AI is instrumental in elevating the IQF industry standard for both operational excellence and sustainability goals.

- AI-driven optical sorting enhances defect detection and quality grading of individual pieces (fruits, vegetables, seafood).

- Predictive maintenance uses sensor data (vibration, temperature) to forecast equipment failure in freezing tunnels, improving uptime.

- Machine learning optimizes freezer operation parameters to minimize energy consumption and maintain precise freezing profiles.

- Advanced demand forecasting reduces inventory spoilage and ensures optimal stock levels across distributed cold storage facilities.

- AI integrated with traceability systems (like blockchain) monitors cold chain integrity from harvesting to point of sale.

- Automated robotic picking and packing systems, guided by vision AI, increase throughput and reduce labor costs in the processing phase.

DRO & Impact Forces Of IQF Food Market

The IQF Food Market is shaped by a confluence of accelerating drivers, structural restraints, and transformative opportunities that collectively determine its trajectory. A primary driver is the pervasive consumer demand for foods that combine health benefits with ultimate convenience, where IQF products fit perfectly by offering minimal preparation time while retaining high nutritional content and texture. Additionally, global efforts to combat food waste strongly favor IQF technology, as freezing extends the usable life of perishable ingredients, minimizing waste both in the supply chain and at the consumer level. Opportunities lie significantly in expanding the product portfolio into specialized, high-growth segments such as organic produce, exotic fruits, and sophisticated plant-based protein alternatives, targeting affluent consumer groups in emerging markets and capitalizing on the rising trend of professional home cooking accelerated by global events.

Restraints, however, pose critical challenges to widespread market expansion. The high initial capital expenditure required for setting up advanced IQF processing lines, including specialized freezers, conveyor systems, and optical sorting machinery, presents a significant barrier to entry for smaller or new market players. Furthermore, maintaining the integrity of the cold chain is paramount and logistically complex; any disruption in temperature control during storage, transit, or distribution can lead to irreversible quality degradation and product spoilage, incurring heavy financial losses. Energy consumption is another major restraint, as freezing processes are inherently energy-intensive, leading to high operational costs and posing environmental sustainability concerns that companies must address through continuous investment in energy-efficient technologies.

The impact forces influencing this market relate strongly to regulatory standards and geopolitical stability affecting agricultural trade. Stricter global food safety regulations necessitate continuous investment in sophisticated traceability systems and process verification, which acts both as a driver for high-tech adoption and a restraint due to compliance costs. Climate change and fluctuating commodity prices represent powerful external forces, impacting the consistent supply and cost of raw materials—from seafood quotas to fruit yields. However, the overarching positive impact force is the undeniable demographic shift towards urban living and dual-income households globally, cementing the essential role of quick-preparation, high-quality ingredients like IQF foods in the modern diet, guaranteeing sustained structural demand irrespective of short-term economic fluctuations.

Segmentation Analysis

The IQF Food Market segmentation provides a granular view of product penetration and consumer adoption across various food categories and distribution channels. The market is primarily segmented based on the type of product (e.g., fruits, vegetables, seafood), the specific freezing technology employed (e.g., fluidized bed, plate freezers), and the channel through which the product reaches the end-user (e.g., retail, foodservice). Analyzing these segments helps stakeholders understand areas of high growth, competitive intensity, and the specific technological requirements necessary for processing different food matrices, ranging from delicate soft fruits to dense poultry pieces.

The dominance of the IQF fruits and vegetables segment reflects the universal appeal and versatility of frozen produce in both industrial and household applications, offering seasonal consistency and ease of use in baking, smoothies, and ready meals. Conversely, the rapid expansion of the IQF seafood and meat segments is linked to the increasing consumer demand for high-quality, pre-portioned protein sources that minimize preparation time and cooking complexity. The adoption rate varies significantly by geography; for instance, European markets show strong preferences for organic IQF vegetables, while North America drives innovation in IQF prepared meals and snack components. Understanding these segmented dynamics is crucial for developing targeted marketing and production strategies tailored to specific consumer pain points and preferences.

Furthermore, segmentation by technology highlights the ongoing shift towards more energy-efficient and high-throughput freezing systems. Fluidized bed freezing remains dominant for smaller, uniform products like peas or corn, ensuring complete separation and rapid freezing. Emerging technologies like cryogenic freezing, while more costly, are gaining traction for high-value, delicate products that require ultra-fast freezing to maintain cellular integrity, such as specialized herbs or gourmet seafood. The distribution channel split, primarily between retail (supermarkets, convenience stores) and foodservice (restaurants, institutional buyers), dictates packaging requirements, volume capacity, and margin expectations, underscoring the necessity for manufacturers to optimize their operational scale based on their primary sales channels.

- By Product Type:

- Fruits (Berries, Tropical Fruits, Citrus)

- Vegetables (Peas, Corn, Carrots, Potatoes, Mixed Vegetables)

- Seafood & Meat (Shrimp, Fish Fillets, Poultry Pieces, Beef/Pork Dice)

- Prepared Foods (Pasta, Rice, Bakery Items, Ready Meals Components)

- By Freezing Technology:

- Fluidized Bed Freezing

- Cryogenic Freezing

- Impeller Freezing

- Belt Freezing

- By Distribution Channel:

- Retail (Supermarkets/Hypermarkets, Convenience Stores, Online Retail)

- Foodservice (Hotels, Restaurants, Cafes, Institutional Catering)

Value Chain Analysis For IQF Food Market

The IQF Food market value chain is intensive, starting with raw material sourcing (upstream) and extending through sophisticated processing, cold logistics, and final distribution (downstream). The upstream segment involves efficient and timely procurement of fresh, high-quality agricultural produce, livestock, or seafood. This stage is highly vulnerable to seasonal variations, climate change, and price volatility. Success at the upstream level hinges on establishing robust contractual relationships with growers and suppliers, ensuring rapid transport to the processing facility to minimize deterioration, as the quality of the IQF product is directly dependent on the initial freshness of the raw material.

The midstream segment constitutes the core of the value chain, dominated by the processing activities: washing, sorting, cutting, blanching (for vegetables), and the actual IQF freezing process. This stage requires substantial capital investment in specialized machinery, including high-capacity freezers, advanced optical sorters, and high-speed packaging equipment. Distribution channels, both direct and indirect, play a pivotal role. Direct distribution is common for large-scale industrial customers (e.g., large ready-meal producers), allowing for tighter quality control and customized bulk orders. Indirect distribution, leveraging third-party logistics (3PL) providers specialized in cold chain management, is essential for reaching dispersed retail and small foodservice outlets, necessitating highly reliable monitoring systems to ensure temperature compliance.

Downstream analysis focuses on marketing, sales, and end-user consumption. Products reach consumers primarily through two major channels: retail (supermarkets and online grocery) and foodservice. The success of the downstream operation relies on effective cold storage capacity at the point of sale and sophisticated marketing that highlights the convenience and quality preservation benefits of the IQF technology. The reliance on indirect distribution via third-party logistics firms means that supply chain visibility and risk management against cold chain breaks are critical operational priorities, making the logistical segment arguably the most vulnerable link in the entire IQF food value chain.

IQF Food Market Potential Customers

The primary customers and end-users of IQF food products are highly diverse, spanning both business-to-business (B2B) industrial buyers and direct-to-consumer (D2C) retail purchasers. Industrial food manufacturers constitute a significant customer base, relying on IQF ingredients for the consistent and efficient production of packaged goods, including ready-to-eat meals, frozen pizzas, snacks, sauces, and baked items. These manufacturers prioritize bulk availability, uniform sizing, and year-round supply stability, utilizing IQF fruits and vegetables to ensure their finished products maintain ingredient integrity and nutritional declarations, regardless of seasonality.

The Food Service sector, encompassing Hotels, Restaurants, and Cafes (HORECA), along with institutional buyers such as schools, hospitals, and corporate cafeterias, represents another major segment. HORECA operators value IQF products for their labor-saving attributes, precise portion control, and reduced preparation time, minimizing skilled labor requirements in busy kitchen environments. For institutional settings, IQF foods help meet stringent hygiene standards and facilitate large-scale menu planning with standardized ingredients. The consistency and ease of use offered by pre-cut, pre-portioned IQF products significantly streamline kitchen operations and minimize waste associated with fresh produce handling.

Finally, the growing segment of direct consumers purchasing through retail channels, including online grocery platforms, drives significant volume. This segment primarily consists of busy working individuals, small families, and health-conscious consumers who seek convenient, nutritious, and easy-to-store ingredients. The rise of meal kit delivery services and direct-to-consumer frozen meal brands also positions these companies as high-growth potential customers, utilizing IQF components to ensure ingredient freshness and rapid assembly in their packaged offerings. Targeting these diverse end-users requires tailored packaging formats, from industrial bulk bags for manufacturers to consumer-friendly resealable pouches for retail.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 25.5 Billion |

| Market Forecast in 2033 | USD 40.8 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bunge Limited, J.R. Simplot Company, ConAgra Brands, Inc., Kerry Group Plc, Nestlé S.A., Dole Food Company, Inc., Danone S.A., Nomad Foods Ltd., Lamb Weston Holdings, Inc., Ajinomoto Co., Inc., Clear Springs Foods, Inc., Uren Food Group Ltd., Capricorn Food Products India Ltd., Pinnacle Foods Inc., SunOpta Inc., General Mills, Inc., Inventure Foods, Inc., Greenyard NV, C.P. Group, and Eurofrits S.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

IQF Food Market Key Technology Landscape

The technological landscape of the IQF Food Market is continually evolving, driven by the imperatives of energy efficiency, improved product quality retention, and higher throughput capacity. The core technology involves various types of freezers, primarily mechanical and cryogenic systems. Mechanical freezers, such as fluidized bed freezers and impingement freezers, remain the industry standard due to their high volume capacity and lower operating costs compared to cryogenic systems. Fluidized bed technology, essential for small, uniform products like peas and berries, uses upward airflow to separate and freeze individual pieces rapidly. Continuous innovation in mechanical systems focuses on optimizing air circulation patterns and heat exchange surfaces to reduce freezing time and minimize dehydration (weight loss) of the product, thereby increasing yield and profitability.

Cryogenic freezing, utilizing liquid nitrogen or carbon dioxide, represents a specialized technology gaining traction for premium and delicate products. Although these systems involve higher utility costs, they achieve ultra-rapid freezing rates, which is crucial for preserving the cell structure of high-value items like specialized seafood or certain exotic fruits. This superior preservation minimizes drip loss upon thawing, significantly improving the thawed product's texture and overall perceived quality. Parallel advancements in pre-treatment technologies, such as advanced blanching methods and vacuum impregnation prior to freezing, are also pivotal. These steps prepare the product optimally for freezing, enhancing color stability and mitigating enzymatic deterioration during long-term storage, extending the commercial viability of the IQF ingredients.

Beyond the core freezing equipment, automation and digitalization are transforming the processing environment. Modern IQF lines integrate sophisticated technologies like high-resolution optical sorters equipped with machine vision and deep learning algorithms capable of detecting subtle defects, foreign materials, and variations in product maturity or size at high throughput speeds. Furthermore, the integration of Industrial Internet of Things (IIoT) sensors across the processing line and cold chain logistics enables real-time monitoring of critical parameters like temperature, humidity, and energy usage. This data connectivity supports predictive maintenance and allows processors to maintain an unbroken cold chain record, enhancing regulatory compliance and providing greater assurance to customers regarding product quality and safety, positioning technology as a key differentiator in a competitive market.

Regional Highlights

Geographically, the IQF Food Market is segmented into North America, Europe, Asia Pacific (APAC), Latin America, and Middle East & Africa (MEA), with each region displaying unique consumption patterns and drivers. North America, encompassing the United States and Canada, holds a substantial share, primarily characterized by high per capita consumption of convenience foods, including frozen meals and specialized ingredient mixes. The market here is mature but driven by constant innovation, particularly in the health and wellness segment, focusing on organic, non-GMO, and plant-based IQF products. Retail infrastructure is highly developed, supported by robust cold chain logistics, which facilitates easy access for consumers, maintaining steady demand.

Europe represents another dominant region, distinguished by stringent food safety and quality regulations, which push manufacturers towards adopting the highest technological standards in IQF processing. Western European countries, particularly Germany, the UK, and France, exhibit strong demand for both conventional IQF products and niche segments like sustainable, regionally sourced, and artisanal frozen goods. Sustainability concerns are pronounced, leading to increasing demand for energy-efficient IQF technologies and biodegradable packaging solutions. The influence of large supermarket chains and well-established foodservice distributors ensures broad market penetration across the continent.

The Asia Pacific (APAC) region is forecasted to be the fastest-growing market globally. This rapid expansion is attributed to massive demographic shifts, including surging urbanization, a burgeoning middle class with greater disposable incomes, and the modernization of cold chain infrastructure, particularly in countries like China, India, and Southeast Asian nations. While IQF penetration started primarily in seafood and basic vegetables for export, domestic consumption is accelerating across all product categories, driven by the convenience factor and increasing reliance on pre-prepared ingredients in household cooking and the booming local food processing industry. Government initiatives supporting cold chain development further underpin this significant regional growth trajectory.

Latin America and MEA markets are considered emerging but promising. Growth in Latin America is fueled by export demand for IQF tropical fruits and specialty ingredients, alongside domestic urbanization trends increasing demand for affordable, safe frozen protein sources. The MEA region, particularly the GCC countries, sees increasing adoption due to reliance on imported goods and a climate that necessitates effective preservation techniques, making IQF products crucial for food security and modern retail formats. However, market expansion in these regions is often constrained by inconsistent energy supply and underdeveloped logistical networks, necessitating focused infrastructure investment.

- North America: High consumption of ready meals, strong demand for organic and plant-based IQF ingredients, driven by convenience and health trends.

- Europe: Dominated by strict quality standards, emphasis on sustainable sourcing, high penetration of IQF fruits and specialized vegetables in retail.

- Asia Pacific (APAC): Fastest growth due to urbanization, rising middle class, significant modernization of cold chain infrastructure, high demand for IQF seafood and poultry.

- Latin America: Emerging market focused on IQF tropical fruit exports and domestic demand for affordable, reliable frozen staples.

- Middle East & Africa (MEA): Growth driven by necessity for preservation due to climate, reliance on imports, and expansion of modern retail outlets.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the IQF Food Market.- Bunge Limited

- J.R. Simplot Company

- ConAgra Brands, Inc.

- Kerry Group Plc

- Nestlé S.A.

- Dole Food Company, Inc.

- Danone S.A.

- Nomad Foods Ltd.

- Lamb Weston Holdings, Inc.

- Ajinomoto Co., Inc.

- Clear Springs Foods, Inc.

- Uren Food Group Ltd.

- Capricorn Food Products India Ltd.

- Pinnacle Foods Inc.

- SunOpta Inc.

- General Mills, Inc.

- Inventure Foods, Inc.

- Greenyard NV

- C.P. Group

- Eurofrits S.A.

Frequently Asked Questions

Analyze common user questions about the IQF Food market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between IQF freezing and conventional freezing methods?

IQF (Individually Quick Frozen) technology freezes individual food pieces rapidly and separately, typically within minutes. This speed prevents the formation of large ice crystals, minimizing cellular damage. Conventional freezing methods freeze food in large blocks, resulting in larger crystals that rupture cell walls, leading to poorer texture, color, and higher 'drip loss' upon thawing.

Does IQF processing affect the nutritional value of foods?

No, IQF processing is highly effective at retaining nutritional value. Because the freezing process is extremely fast and occurs immediately after harvest (at peak freshness), vitamins, minerals, and antioxidants are largely locked in. Studies often show that frozen IQF fruits and vegetables can be nutritionally equivalent, or in some cases superior, to fresh produce that has spent several days traveling and sitting on store shelves.

Which product segment holds the largest share in the IQF Food Market?

The IQF Fruits and Vegetables segment currently holds the largest market share. This dominance is driven by the wide range of applications, including use in industrial baking, yogurt and dairy products, smoothies, and general household cooking, combined with consistent consumer demand for year-round availability of seasonal produce.

What are the main sustainability challenges facing the IQF industry?

The main sustainability challenges relate to the high energy consumption required for continuous freezing operations and maintaining the cold chain. The industry is responding by investing heavily in energy-efficient freezer designs (such as advanced ammonia and CO2 systems), optimizing production schedules, and utilizing AI to reduce food waste through precision sorting and better demand forecasting.

How does AI contribute to improving safety and quality in IQF production?

AI significantly improves safety and quality by powering high-speed optical sorting machines. These systems use machine vision to instantaneously detect and remove foreign materials, substandard pieces, or contaminated items based on pre-trained visual data, ensuring an exceptionally high level of product uniformity and mitigating major food safety risks before packaging.

What role do logistics and the cold chain play in the success of the IQF Market?

Logistics and cold chain integrity are fundamentally critical to the IQF Market. Success depends entirely on maintaining a consistent, unbroken temperature environment (typically below -18°C) from the processing plant to the point of consumption. Failures in the cold chain lead directly to quality degradation, product spoilage, and substantial financial losses, emphasizing the need for advanced monitoring and refrigerated transport infrastructure.

Which emerging regions show the highest growth potential for IQF foods?

The Asia Pacific (APAC) region, particularly emerging economies like China, India, and Southeast Asian nations, exhibits the highest growth potential. This growth is underpinned by rapidly expanding retail networks, significant government investment in modern cold storage infrastructure, and increasing consumer adoption of processed, convenient, and safe packaged foods due to changing lifestyles and urbanization.

What is the significance of the shift towards plant-based IQF products?

The shift towards plant-based IQF products is highly significant, reflecting global dietary trends prioritizing health, sustainability, and reduced meat consumption (flexitarianism). IQF technology allows manufacturers to produce and distribute innovative plant-based components, such as meat alternatives, pre-seasoned vegetable mixes, and functional ingredients, with optimal texture and extended shelf life, catering directly to this booming consumer segment.

Are IQF products more expensive than conventionally frozen or fresh products?

IQF products often carry a higher initial price tag than conventionally frozen goods due to the higher capital investment in specialized equipment and the energy costs associated with rapid freezing. However, their superior quality, zero preparation waste, and portion control often translate into better overall value and reduced operational costs for industrial and foodservice users compared to handling bulk frozen blocks or fresh produce with inherent spoilage rates.

How is the IQF market adapting to increasing consumer demand for clean labels?

The IQF market adapts to clean label demand by positioning freezing as a natural preservation method, reducing or eliminating the need for chemical preservatives and artificial colors often found in non-frozen processed foods. Manufacturers are increasingly emphasizing single-ingredient products and transparent sourcing, utilizing the IQF process itself to assure consumers of minimal processing and ingredient integrity.

What role does automation play in IQF processing efficiency?

Automation is crucial for IQF processing efficiency, handling high volumes of product consistently while minimizing human contact and maximizing throughput. Automated systems include optical sorters, robotic palletizers, and continuous belt freezers, which collectively reduce labor costs, enhance hygiene standards, and ensure uniform product quality across large production batches, directly impacting the scalability of operations.

What are the primary segments within IQF Seafood and Meat?

The primary segments within IQF Seafood and Meat include pre-portioned fish fillets (like salmon and cod), individually separated shrimp and prawns, diced poultry pieces (chicken and turkey), and pre-cut beef or pork cubes. These products are popular in foodservice and retail for their convenience, hygiene, and ease of cooking from frozen without thawing.

How do fluctuations in commodity prices affect the IQF Market?

Fluctuations in the prices of raw agricultural commodities (e.g., fruit harvests, livestock feed costs) directly impact the input costs for IQF processors. Since processing involves high fixed energy costs, volatility in raw material prices can significantly compress profit margins, requiring companies to engage in advanced futures contracting and supply chain optimization to stabilize operational expenses.

Why is the preservation of cellular structure important in IQF technology?

Preserving the cellular structure is paramount because intact cells prevent the loss of internal moisture and nutrients when the food is thawed. The rapid freezing in IQF minimizes the size of ice crystals, preventing them from piercing cell walls. This results in superior product quality, reduced 'weeping' or 'drip loss,' and better texture compared to slowly frozen products.

How are environmental concerns driving innovation in IQF technology?

Environmental concerns are driving innovation primarily through the push for energy-efficient freezing systems and environmentally benign refrigerants. Manufacturers are investing in systems that use natural refrigerants like CO2 and ammonia, optimizing heat recovery, and integrating sensors and AI to minimize electricity consumption per pound of frozen product, aligning with global sustainability mandates.

What are the main hurdles for market entry in the IQF industry?

The main hurdles for market entry are the high initial capital investment required for specialized IQF equipment (freezers, sorters) and the necessity of establishing a fully integrated and reliable cold chain logistics network. Furthermore, meeting stringent international food safety certifications and achieving economies of scale pose significant barriers to new or smaller players.

Which freezing technology is preferred for delicate fruits like raspberries?

Delicate fruits like raspberries often utilize fluidized bed freezers, but with careful optimization of airflow to prevent bruising, or, increasingly, advanced cryogenic freezers. Cryogenic freezing offers the necessary speed to freeze the fruit rapidly without clumping or damaging its fragile structure, ensuring maximum retention of shape and quality.

How do private label brands influence the IQF Market?

Private label brands, often owned by large retailers, significantly influence the market by driving price competition and increasing overall market penetration. They enable retailers to offer high-quality IQF products at competitive prices, expanding the consumer base and forcing national brands to focus heavily on product differentiation, premiumization, and niche segment innovation.

What is the role of blanching in the IQF process for vegetables?

Blanching is a critical pre-treatment step for most IQF vegetables, involving brief exposure to hot water or steam. Its role is to deactivate natural enzymes (like lipase and oxidase) that cause flavor, color, and texture degradation over time, thereby maximizing the long-term shelf stability and quality of the frozen vegetable product.

What is the current trend regarding IQF food packaging?

The current trend in IQF food packaging is heavily focused on sustainability and convenience. This includes a move toward resealable, stand-up pouches for consumer use, offering better portion control and storage ease, and a significant shift toward recyclable, compostable, or bio-based plastic alternatives to minimize environmental impact without compromising product integrity.

What impact does increasing global trade in fresh produce have on IQF demand?

While increased global trade in fresh produce presents competition, it ironically often boosts IQF demand by highlighting its reliability. IQF foods offer consistent quality and guaranteed year-round availability regardless of seasonal or geopolitical disruptions, making them an essential buffer ingredient for large industrial buyers who require predictable supply chains.

How is the HORECA sector utilizing IQF prepared foods?

The HORECA (Hotel, Restaurant, Catering) sector utilizes IQF prepared foods to manage labor shortages and maintain quality standardization. Products such as IQF pasta, rice, pre-cooked vegetables, and sauces allow kitchens to reduce complex preparation steps, minimize training time, and offer consistent menu items with predictable portion and cost controls.

What regulations primarily govern the IQF Food Market in Europe?

The IQF Food Market in Europe is primarily governed by stringent EU regulations, including the General Food Law (Regulation 178/2002), specific temperature requirements for frozen foods (like Regulation 852/2004), and strict regulations on maximum residue levels (MRLs) for pesticides, necessitating robust testing and traceability protocols throughout the supply chain.

What are the advantages of using blockchain technology in the IQF supply chain?

Blockchain technology offers tamper-proof, decentralized ledger records of product movement, origin, and cold chain temperature history. This provides unprecedented transparency, enhancing consumer trust, streamlining audit processes, and allowing rapid identification and isolation of contaminated batches during a recall, significantly reducing food safety risks and liability.

How does the IQF process mitigate the risk of microbial contamination?

The IQF process itself does not eliminate existing microbial contamination, but the rapid temperature drop dramatically slows or halts microbial growth, preventing spoilage during storage. Combined with mandatory pre-treatment steps (like washing and blanching) and automated, hygienic processing environments, the risk of contamination spreading during processing is minimized compared to manual handling.

Why are mixed IQF vegetable packs highly popular in the retail segment?

Mixed IQF vegetable packs are highly popular in the retail segment because they offer ultimate convenience, combining multiple ingredients ready for immediate use without washing or chopping. They facilitate easy incorporation into meals, support diverse nutrient intake, and cater to consumers seeking minimal effort while maximizing nutritional value.

What are the differences between fluidized bed and belt freezing in IQF?

Fluidized bed freezing uses vertical airflow to float and rapidly freeze small, uniform products, ensuring superior separation. Belt freezing uses a conveyor belt to move product through the freezing tunnel, relying on cold air circulation; it is generally used for larger, irregularly shaped items or those that cannot withstand intense agitation, such as larger fruit pieces or prepared meal components.

How is demographic change influencing demand for IQF foods globally?

Demographic changes, particularly the growth of small household units (single or two-person households) and increasing participation of women in the workforce, drive demand for IQF foods. These groups prioritize convenience, smaller portion sizes, and reduced cooking time, making IQF products, which require no thawing and offer simple preparation, ideal for their modern lifestyles.

What investments are crucial for companies expanding IQF operations in APAC?

Companies expanding IQF operations in APAC must prioritize investments in robust, localized cold chain infrastructure, including refrigerated storage facilities and transport vehicles. Crucial investments also include adapting processing lines to handle high-volume local produce and securing partnerships with regional distributors to navigate complex, varied retail landscapes efficiently.

What is the expected long-term impact of COVID-19 on the IQF Market?

The long-term impact of COVID-19 is an accelerated structural shift towards frozen food consumption. The pandemic highlighted the advantages of frozen foods—longer shelf life, reliable inventory, and reduced trips to the grocery store—cementing frozen products, particularly IQF items, as a perceived safer and more reliable pantry staple globally.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager