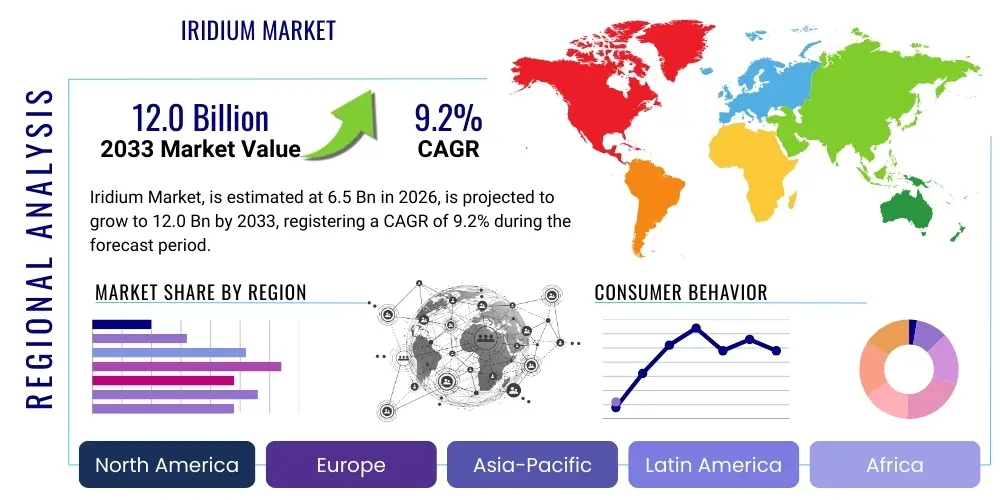

Iridium Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439769 | Date : Jan, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Iridium Market Size

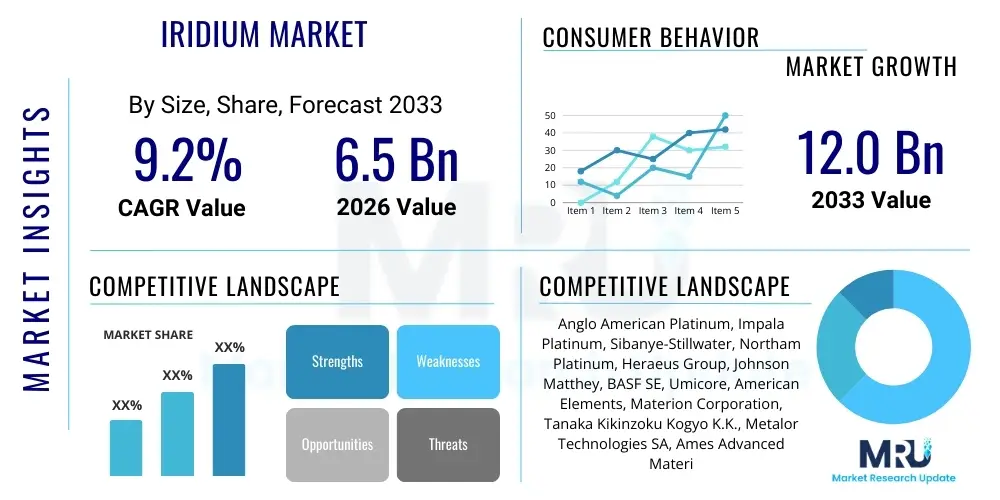

The Iridium Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.2% between 2026 and 2033. The market is estimated at USD 6.5 Billion in 2026 and is projected to reach USD 12.0 Billion by the end of the forecast period in 2033.

Iridium Market introduction

Iridium, a platinum group metal (PGM), stands out for its extreme density, corrosion resistance, and remarkably high melting point, making it the most corrosion-resistant metal known. These exceptional properties position iridium as a critical material in an array of high-performance and specialized applications where extreme durability and stability are paramount. Its rarity and the complex, energy-intensive extraction processes contribute to its high market value, driving continuous innovation in both its sourcing and application. The global demand for iridium is intrinsically linked to advancements in high-tech industries that require materials capable of withstanding harsh operating environments, pushing the boundaries of material science and engineering.

Major applications for iridium span critical sectors, including high-temperature crucibles for crystal growth in electronics manufacturing, electrodes for chlor-alkali production and proton exchange membrane (PEM) electrolyzers in the burgeoning hydrogen economy, and spark plugs in internal combustion engines. Its use as an alloying agent in platinum and osmium further enhances material strength and resilience, crucial for medical implants and aerospace components. The chemical industry also heavily relies on iridium compounds as highly efficient catalysts for various industrial processes, including the production of acetic acid and fine chemicals. The unique benefits of iridium, such as its unparalleled resistance to chemical attack, even at elevated temperatures, and its mechanical stability, ensure its irreplaceable status in these niche yet vital markets.

Several driving factors underpin the growth of the iridium market. The accelerating demand for advanced electronics, particularly in sectors requiring high-purity single crystals like sapphires for LED substrates and specialized optical components, directly fuels the need for iridium crucibles. Furthermore, the global pivot towards sustainable energy solutions, notably the expansion of the hydrogen economy through PEM electrolysis, is creating a significant and rapidly expanding demand for iridium as a catalyst material. Technological advancements in material processing, coupled with ongoing research and development into new catalytic applications and high-performance alloys, continue to broaden iridium's utility, ensuring its sustained relevance and growth within the specialized materials market.

Iridium Market Executive Summary

The iridium market is characterized by its niche, high-value applications and a unique set of business dynamics, largely influenced by its scarcity and the complex interplay of supply and demand from diverse high-tech industries. Current business trends indicate a heightened focus on supply chain resilience and diversification, driven by the concentrated nature of primary iridium production, predominantly as a by-product of platinum and nickel mining. Market participants are increasingly exploring recycling initiatives and secondary recovery methods to mitigate supply risks and stabilize prices, recognizing the metal's strategic importance. Additionally, investments in research and development are targeting enhanced material efficiency and the discovery of novel applications, particularly in emerging fields such as green hydrogen production and advanced electronics, shaping future demand landscapes.

Regional trends reveal a shifting demand landscape, with Asia Pacific emerging as a dominant growth hub, propelled by its robust electronics manufacturing sector, burgeoning automotive industry, and significant investments in renewable energy infrastructure, particularly in countries like China, Japan, and South Korea. North America and Europe, while maintaining mature markets in aerospace, medical devices, and high-performance industrial applications, are also witnessing growth fueled by innovation in advanced materials and the push towards decarbonization. These regions are actively investing in R&D to optimize iridium usage in cutting-edge technologies, further solidifying their positions as key consumers. The geographic distribution of primary production, primarily concentrated in South Africa, continues to dictate global supply dynamics and pricing stability.

Segmentation trends highlight distinct areas of market expansion and technological evolution. The application segment for crucibles, particularly in the growth of single crystals for LEDs and semiconductors, remains a significant and steadily expanding area. The most dynamic growth, however, is observed in the catalyst segment, largely due to the accelerating adoption of PEM electrolyzers for green hydrogen production, positioning iridium as a cornerstone for future energy technologies. The electronics and automotive sectors also present steady demand for iridium in specialized components, such as multi-layer ceramic capacitors (MLCCs) and high-performance spark plugs. The interplay between these segments underscores the diverse utility of iridium and its critical role across multiple industrial value chains, influencing market forecasts and investment strategies.

AI Impact Analysis on Iridium Market

Common user questions regarding AI's impact on the Iridium market often revolve around its potential to optimize extraction and refining processes, predict price fluctuations, discover new applications, and enhance material properties through advanced simulations. Users are keen to understand if AI can alleviate supply chain bottlenecks, improve resource efficiency given iridium's scarcity, or even identify alternative materials, thereby influencing future demand. The key themes that emerge from these inquiries include the potential for AI to introduce greater efficiency and sustainability into the iridium value chain, optimize its utilization in high-tech applications, and forecast market dynamics with improved accuracy, addressing concerns about supply security and price volatility in this strategic metal market.

AI's role in the iridium market is multifaceted, extending from the initial stages of mining and refining to the development of sophisticated end-products. In upstream operations, AI-driven analytics can optimize the identification of PGM-rich ore bodies, enhance processing efficiency, and reduce energy consumption during the complex extraction and separation of iridium from other PGMs. This optimization directly translates into lower production costs and improved yields, making the recovery of this rare metal more economically viable. Furthermore, AI algorithms can predict equipment failures in refining plants, enabling proactive maintenance and minimizing costly downtime, thereby ensuring a more consistent supply of iridium to the market.

In midstream and downstream applications, AI is proving invaluable for material discovery and property optimization. Generative AI and machine learning models can simulate the behavior of iridium in various alloys and compounds, accelerating the development of new materials with enhanced performance characteristics for applications in aerospace, medical implants, and catalysis. AI can also analyze vast datasets from experimental results to identify optimal catalyst formulations or ideal conditions for crystal growth using iridium crucibles, reducing trial-and-error and speeding up innovation cycles. Moreover, predictive analytics tools can forecast demand fluctuations across different end-use industries, enabling iridium suppliers and consumers to better manage inventory and respond to market changes, fostering a more stable and responsive supply chain.

- Enhanced efficiency in PGM mining and refining processes, leading to higher iridium recovery rates.

- Predictive maintenance for critical equipment in production facilities, minimizing operational disruptions.

- AI-driven material discovery and design, accelerating the development of new iridium alloys and compounds.

- Optimization of catalytic processes using iridium, leading to higher yields and reduced waste.

- Advanced demand forecasting for various iridium applications, improving supply chain management.

- Identification of new, niche applications for iridium through simulation and data analysis.

- Improved quality control and characterization of iridium products in manufacturing.

- Potential for AI-guided robotics in handling and processing iridium, reducing human exposure to high temperatures.

DRO & Impact Forces Of Iridium Market

The Iridium market is shaped by a unique combination of drivers, restraints, opportunities, and impactful forces that dictate its growth trajectory and price stability. Key drivers include the escalating demand from the electronics industry, particularly for high-purity single-crystal growth in LED and semiconductor manufacturing, where iridium crucibles are indispensable. Furthermore, the global push towards a hydrogen economy is significantly bolstering demand for iridium as a catalyst in proton exchange membrane (PEM) electrolyzers, critical for green hydrogen production. The metal's unparalleled corrosion resistance and high-temperature stability also ensure its continued use in aerospace components, medical implants, and specialized industrial catalysts, underscoring its strategic importance across multiple high-growth sectors. These applications benefit from iridium's unique properties, for which there are often no effective substitutes, making its supply crucial.

Despite its critical utility, the iridium market faces several significant restraints. Its extreme rarity and the fact that it is primarily a by-product of platinum and nickel mining lead to inherent supply limitations and price volatility, which can hinder long-term investment and application development. The geographical concentration of primary iridium production, predominantly in South Africa, exposes the market to geopolitical risks, labor disputes, and policy changes in a single region, impacting global supply. High extraction and refining costs, coupled with its intensive processing requirements, contribute to its elevated price, potentially encouraging research into alternative materials for less critical applications. These factors collectively create a delicate balance between the metal's indispensable value and the practical challenges of securing a stable and affordable supply.

However, substantial opportunities exist for market expansion and innovation. The burgeoning green hydrogen sector represents a monumental growth avenue, as the global energy transition accelerates the need for efficient and scalable electrolysis technologies, heavily reliant on iridium catalysts. Advances in material science and engineering are continuously uncovering new applications, particularly in high-performance coatings, advanced sensors, and emerging electrochemical processes. Improvements in recycling technologies and secondary recovery from spent catalysts and electronic waste also present a significant opportunity to diversify supply sources and enhance market sustainability, mitigating dependence on primary mining. Moreover, the increasing adoption of iridium in advanced medical devices, such as pacemakers and neurological probes, due to its biocompatibility and corrosion resistance, offers a stable and high-value segment. The interplay of these opportunities with strategic investments in R&D and supply chain optimization will be critical for the market's future growth.

Segmentation Analysis

The Iridium market is meticulously segmented to reflect its diverse applications, forms, and end-use industries, providing a comprehensive understanding of its complex demand and supply dynamics. This granular analysis allows for a detailed examination of market drivers and restraints specific to each segment, highlighting areas of high growth potential and identifying niche markets where iridium’s unique properties are most valued. The segmentation typically includes categories based on the metal's physical form, its primary function, and the specific industries that utilize it, offering insights into market structure and competitive landscapes across its entire value chain.

- By Form:

- Powder

- Sponge

- Wire

- Crucibles/Fabricated Parts

- Alloys

- Compounds

- By Application:

- Catalysts (e.g., in PEM electrolyzers, chemical synthesis)

- Crucibles (for crystal growth, high-temperature applications)

- Electrodes (e.g., chlor-alkali production, spark plugs)

- Alloying Agent (e.g., with platinum, osmium for jewelry, medical devices)

- Electronics (e.g., specialized contacts, thin films)

- Medical (e.g., pacemakers, radiotherapy)

- Aerospace and Defense

- Automotive (e.g., spark plugs, oxygen sensors)

- Others (e.g., jewelry, laboratory equipment)

- By End-Use Industry:

- Chemical & Petrochemical

- Electronics & Electrical

- Automotive

- Medical & Pharmaceutical

- Aerospace

- Energy (Hydrogen Production)

- Glass & Ceramics

- Jewelry

- Others

Value Chain Analysis For Iridium Market

The value chain for the Iridium market is intricate, reflecting the metal's journey from geological deposits to highly specialized end-use products. It begins with upstream activities, primarily the mining of platinum group metals (PGMs), where iridium is typically recovered as a by-product alongside platinum, palladium, rhodium, and ruthenium. This initial stage involves substantial capital investment in exploration, extraction, and beneficiation processes, often in geologically challenging regions. The refined ore then undergoes complex pyrometallurgical and hydrometallurgical separation processes to isolate iridium, which is highly energy-intensive and requires specialized chemical expertise due to the similar chemical properties of PGMs. Primary producers, therefore, play a pivotal role in dictating the global supply and initial pricing of raw iridium materials.

Midstream operations involve the further purification and fabrication of iridium into various forms, such as powder, sponge, wire, or specialized fabricated components like crucibles and electrodes. This stage requires advanced metallurgical capabilities and precision manufacturing techniques to meet the stringent quality and purity requirements of high-tech applications. Research and development institutions also form an integral part of this stage, focusing on developing new iridium alloys, compounds, and coating technologies to enhance performance and expand application possibilities. Companies specializing in PGM refining and advanced materials processing add significant value here, transforming raw iridium into forms ready for integration into end-products. These firms often work closely with end-users to tailor iridium products to specific functional requirements, ensuring optimal performance.

Downstream activities encompass the integration of iridium components into final products and their distribution channels. This involves a diverse range of end-use industries, including electronics manufacturers, automotive OEMs, chemical producers, medical device companies, and aerospace contractors. Distribution channels for iridium are typically specialized, involving direct sales from refiners to large industrial users, or through a network of specialized metal traders and distributors who serve a broader range of smaller-volume buyers. Both direct and indirect sales channels are critical. Direct sales facilitate long-term supply agreements for major consumers, ensuring consistent supply and price stability, while indirect channels provide flexibility and market access for niche applications and smaller enterprises. The efficiency of these distribution networks is paramount to ensuring timely delivery of this critical material to diverse global markets, bridging the gap between its limited supply and high-value demand.

Iridium Market Potential Customers

The Iridium market caters to a highly specialized and technically demanding customer base, comprising industries where the metal's unique properties are indispensable for performance, durability, and reliability. These potential customers are typically leaders in their respective fields, engaged in high-tech manufacturing, advanced research, or critical infrastructure development. Their need for iridium stems from its unparalleled resistance to corrosion, extreme temperatures, and chemical inertness, making it a non-substitutable material for their most critical applications. The market often involves long-term strategic partnerships between iridium suppliers and these specialized end-users, reflecting the material's strategic importance and limited availability.

Key end-user segments include electronics manufacturers, particularly those involved in producing single crystals for LED substrates, laser optics, and semiconductor components, where iridium crucibles are essential for achieving high purity and structural integrity. The automotive industry, especially manufacturers of high-performance vehicles, relies on iridium for long-life spark plugs due to its superior erosion resistance. Furthermore, the burgeoning hydrogen economy presents a significant customer base in the form of electrolyzer manufacturers, who use iridium catalysts to enhance the efficiency and lifespan of proton exchange membrane (PEM) electrolyzers, crucial for green hydrogen production. These industries represent sectors with high growth potential, driving sustained demand for iridium.

Beyond these core segments, medical device manufacturers constitute a vital customer group, utilizing iridium in pacemakers, neurological probes, and radiotherapy equipment due to its biocompatibility and radiopacity. Aerospace and defense contractors also procure iridium for specialized components requiring exceptional strength and corrosion resistance at extreme temperatures, such as turbine parts and rocket nozzles. Chemical companies employ iridium-based catalysts for various industrial processes, including the production of acetic acid and other fine chemicals, valuing its catalytic efficiency and stability. Research institutions and laboratories globally also serve as consistent buyers, driving innovation and exploring new applications for this versatile and highly valuable precious metal, ensuring a diversified and robust customer portfolio for the iridium market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.5 Billion |

| Market Forecast in 2033 | USD 12.0 Billion |

| Growth Rate | 9.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Anglo American Platinum, Impala Platinum, Sibanye-Stillwater, Northam Platinum, Heraeus Group, Johnson Matthey, BASF SE, Umicore, American Elements, Materion Corporation, Tanaka Kikinzoku Kogyo K.K., Metalor Technologies SA, Ames Advanced Materials, JX Nippon Mining & Metals Corporation, ESPI Metals, Alfa Aesar (Thermo Fisher Scientific), Reade Advanced Materials, Merck KGaA, ALB Materials Inc., G.F. Pforzheim. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Iridium Market Key Technology Landscape

The Iridium market's technological landscape is dominated by sophisticated processes for its extraction, refining, and specialized application, driven by the metal's unique properties and high value. Upstream, the primary technologies involve advanced pyrometallurgical and hydrometallurgical techniques for separating iridium from other platinum group metals (PGMs) found in complex ore bodies. These processes are highly specialized, requiring precise control over temperature, pressure, and chemical reagents to achieve the high purity levels demanded by end-users. Innovations in solvent extraction, ion exchange, and electrorefining continue to improve the efficiency and environmental footprint of iridium recovery, ensuring greater yields from increasingly complex PGM ores. Furthermore, geological exploration technologies utilizing artificial intelligence and machine learning are aiding in the identification of new, economically viable PGM deposits, indirectly influencing iridium supply dynamics.

In midstream processing, the key technologies focus on transforming purified iridium into various usable forms and enhancing its properties for specific applications. Advanced powder metallurgy techniques are crucial for producing high-purity iridium powder, which is then used in manufacturing processes such as hot isostatic pressing (HIP) to create dense, robust iridium components like crucibles. Alloying technologies are also significant, involving the precise blending of iridium with other metals like platinum or rhodium to impart enhanced mechanical strength, high-temperature stability, or specific electrical properties. Furthermore, additive manufacturing (3D printing) is emerging as a transformative technology, enabling the creation of complex iridium structures and components with reduced material waste and improved design flexibility, particularly for intricate parts in aerospace and medical applications. These fabrication technologies are continually evolving to meet more stringent performance requirements.

Downstream, the technological landscape is defined by the innovative application of iridium in high-tech end products. In the electronics sector, chemical vapor deposition (CVD) and physical vapor deposition (PVD) techniques are used to apply ultra-thin iridium films for specialized electrical contacts and sensors, leveraging its high melting point and inertness. For the burgeoning hydrogen economy, the development of advanced catalyst layers containing iridium nanoparticles for proton exchange membrane (PEM) electrolyzers is a critical area of technological focus, aiming to maximize hydrogen production efficiency and catalyst lifespan. Furthermore, advanced characterization techniques such as X-ray diffraction, electron microscopy, and spectroscopy are continuously refined to ensure the quality, purity, and structural integrity of iridium materials and components throughout the value chain, driving continuous improvement and enabling the exploration of novel applications in diverse industries.

Regional Highlights

- North America: This region holds a significant share in the Iridium market, primarily driven by its robust aerospace and defense industries, which demand high-performance materials for critical components. The medical sector, especially in the US and Canada, contributes substantially through the use of iridium in advanced medical devices and radiation therapies. Additionally, ongoing research and development in advanced materials and clean energy technologies, including hydrogen production, continue to foster innovation and demand for iridium.

- Europe: Europe is a key market for iridium, largely due to its advanced chemical industry, where iridium is critical as a catalyst, and its strong automotive sector, particularly for high-performance spark plugs. The region's increasing focus on renewable energy and the circular economy, with investments in green hydrogen production and recycling technologies, positions it for continued growth. Germany, France, and the UK are prominent consumers due to their industrial bases and R&D capabilities.

- Asia Pacific (APAC): APAC represents the fastest-growing region in the Iridium market, propelled by its booming electronics manufacturing sector, particularly in China, Japan, and South Korea, which heavily utilize iridium crucibles for crystal growth and in specialized electronic components. The region's rapidly expanding automotive production and significant investments in renewable energy infrastructure, including PEM electrolyzers, are major demand drivers. Industrial expansion and technological advancements across various sectors further solidify APAC's leading position.

- Latin America: While a smaller market, Latin America shows potential, primarily due to its emerging industrial base and some presence in automotive manufacturing. The region's resource-rich countries may also play a future role in the supply chain, though currently, consumption is moderate compared to other regions. Growth is expected to be steady, driven by infrastructure development and industrial modernization.

- Middle East and Africa (MEA): This region is crucial for the Iridium market due to South Africa's dominant position as the primary global source of iridium, recovered as a by-product of platinum group metal mining. The Middle East, with its increasing investments in diversified industrial sectors and ambitious hydrogen economy projects, presents emerging demand opportunities. Supply dynamics are heavily influenced by mining operations and geopolitical stability within the African continent.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Iridium Market.- Anglo American Platinum

- Impala Platinum

- Sibanye-Stillwater

- Northam Platinum

- Heraeus Group

- Johnson Matthey

- BASF SE

- Umicore

- American Elements

- Materion Corporation

- Tanaka Kikinzoku Kogyo K.K.

- Metalor Technologies SA

- Ames Advanced Materials

- JX Nippon Mining & Metals Corporation

- ESPI Metals

- Alfa Aesar (Thermo Fisher Scientific)

- Reade Advanced Materials

- Merck KGaA

- ALB Materials Inc.

- G.F. Pforzheim

Frequently Asked Questions

What is iridium primarily used for?

Iridium is primarily used in high-temperature crucibles for crystal growth (e.g., in electronics), as a catalyst in chemical processes and proton exchange membrane (PEM) electrolyzers for green hydrogen production, and in high-performance electrodes for spark plugs and industrial applications due to its extreme corrosion resistance and high melting point.

Why is iridium so expensive?

Iridium's high cost stems from its extreme rarity, with limited geological deposits, and the complex, energy-intensive process required to extract and refine it as a by-product of other platinum group metals like platinum and nickel. Supply chain concentration also contributes to price volatility.

How does the hydrogen economy impact iridium demand?

The burgeoning hydrogen economy significantly boosts iridium demand, as it is a critical catalyst in proton exchange membrane (PEM) electrolyzers, which are essential for efficient and scalable production of green hydrogen. Global decarbonization efforts are driving substantial investment in this sector.

Which regions are key consumers of iridium?

Key consumer regions for iridium include Asia Pacific (driven by electronics and automotive), North America (aerospace, medical, R&D), and Europe (chemical, automotive, green energy initiatives). These regions have advanced manufacturing and high-tech industries that rely on iridium's unique properties.

Can AI influence the iridium market?

Yes, AI can significantly influence the iridium market by optimizing PGM extraction and refining processes, improving demand forecasting, accelerating the discovery of new iridium alloys and applications, and enhancing the efficiency of iridium-based catalysts, thereby impacting supply, demand, and overall market dynamics.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Iridium Recycling Market Statistics 2025 Analysis By Application (Catalyst, Electronics), By Type (0.999, 0.9995), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Iridium Catalyst Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Grain, Powder), By Application (Petrochemicals, Medical, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Precious Metal Catalyst Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Iridium Catalysts, Palladium Catalysts, Platinum Catalysts, Ruthenium Catalysts, Rhodium Catalysts), By Application (Automobile, Pharmaceutical, Refinery), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Fluorescence-Guided Surgery Systems Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (SPY System, PDE System, VS3 Iridium System, Others), By Application (Head and Neck Cancer, Breast Cancer, Non-small-cell Lung Cancer, Colorectal Cancer, Bladder Cancer, Prostate Cancer, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager