Iron Roughneck Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437234 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Iron Roughneck Market Size

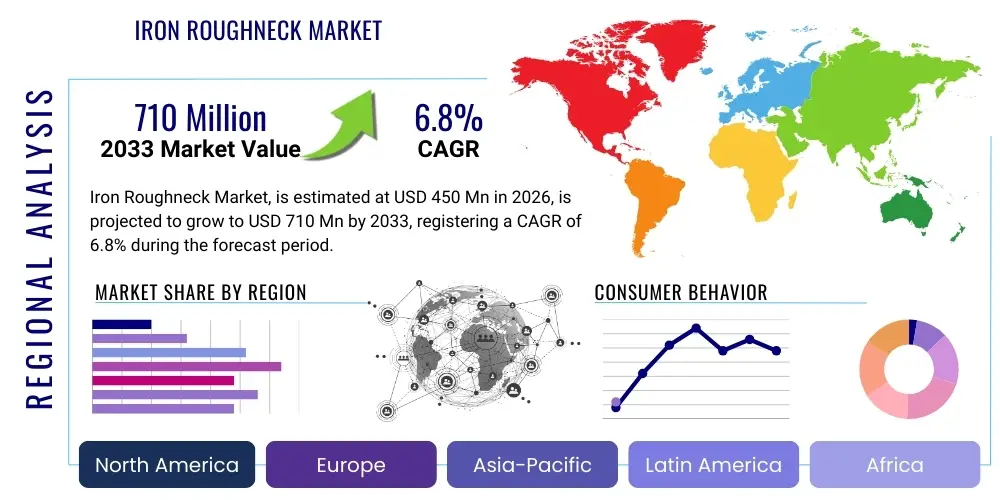

The Iron Roughneck Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 710 Million by the end of the forecast period in 2033.

Iron Roughneck Market introduction

The Iron Roughneck (IRN) is a sophisticated piece of automated hydraulic machinery designed specifically for the handling of drilling tubulars—drill pipe, drill collars, and casing—on drilling rigs, both onshore and offshore. Its primary function is to mechanically make up and break out pipe connections, replacing the hazardous, manual labor previously performed by the floor crew (the "roughnecks"). This automation significantly enhances operational safety by removing personnel from the critical path of heavy, moving machinery, a paramount concern in the volatile oil and gas extraction sector. The equipment integrates powerful hydraulic wrenches and spinners, often mounted on a rail or carriage system, providing precise torque control and consistent joint integrity, which are vital for deep drilling applications and challenging reservoir environments.

The core product description centers on high-precision robotics capable of repetitive, high-stress tasks. Modern Iron Roughnecks feature advanced control systems that allow for preset torque values, ensuring reliable connections and reducing the risk of equipment failure downhole. Major applications span across deepwater drilling platforms, ultra-deep onshore rigs, and mobile offshore drilling units (MODUs), where operational efficiency and reliability are non-negotiable. The relentless global pursuit of hydrocarbon resources in remote and demanding locations, coupled with stringent international safety regulations, continually drives the necessity for automated systems like the IRN. Furthermore, the longevity and ruggedness of these systems, capable of operating in extreme temperatures and corrosive marine environments, contribute to their high value proposition in capital-intensive drilling operations.

Key benefits derived from the adoption of Iron Roughnecks include a dramatic reduction in Non-Productive Time (NPT) due to faster and more consistent pipe handling cycles, optimization of manpower requirements, and substantial improvement in overall drilling safety metrics. The driving factors behind market expansion are multifaceted, encompassing the increasing global demand for energy, necessitating faster drilling speeds; the continuous push towards rig automation and digitalization (Rig of the Future concept); and the imperative to comply with elevated occupational health and safety (OHS) standards set by international bodies. These systems represent a critical nexus between mechanical engineering strength and advanced digital control, ensuring efficient tubular management throughout the complex drilling process.

Iron Roughneck Market Executive Summary

The Iron Roughneck Market is characterized by robust business trends anchored in the oil and gas industry’s accelerating transition towards automation and high-specification rigs. Key market trends include the deployment of next-generation, compact IRNs suitable for smaller footprint operations, the integration of advanced sensors for real-time monitoring of connection integrity, and enhanced communication protocols enabling seamless data transfer to drilling control centers. Capital expenditure (CapEx) in the deepwater segment, particularly in areas like the Gulf of Mexico and the North Sea, is stimulating demand for high-capacity, heavy-duty Iron Roughnecks. Furthermore, the rise of managed pressure drilling (MPD) techniques necessitates consistent, high-quality tubular connections, reinforcing the value of automated torque systems provided by IRNs, driving substantial incremental growth and technological refinement within the competitive landscape.

Regional trends indicate that North America, driven by the intense activity in unconventional plays (shale) and the sustained exploration efforts in the Gulf of Mexico, remains the largest revenue contributor. However, the Asia Pacific region, specifically emerging economies like China and India, along with Australia's sustained liquefied natural gas (LNG) projects, is projected to exhibit the highest Compound Annual Growth Rate (CAGR), fueled by new rig construction and modernization initiatives. The Middle East and Africa (MEA) region also presents significant opportunities, supported by massive national oil company (NOC) investment programs aimed at maximizing field output and adhering to higher operational safety standards mandated by international partners. Europe’s market stability is primarily maintained through maintenance, repair, and overhaul (MRO) services for existing high-spec North Sea fleets.

Segmentation trends highlight that the Hydraulic Actuated Iron Roughneck segment currently dominates the market due to its proven reliability and power delivery, essential for large-diameter casings and drill pipes used in deep wells. Nevertheless, the electrically driven and hybrid segments are gaining traction, aligning with industry goals to reduce hydraulic fluid complexity and improve energy efficiency, supporting ESG (Environmental, Social, and Governance) mandates. By application, offshore drilling remains the premier segment due to the extreme operational complexities and high cost associated with deepwater rig time, making the efficiency gains of automated tubular handling most impactful. The onshore segment, while characterized by higher volume deployments, typically utilizes lower-specification IRNs, although the shift toward multi-well pad drilling is increasing demand for highly mobile and efficient units.

AI Impact Analysis on Iron Roughneck Market

Users frequently inquire about how Artificial Intelligence (AI) can move the Iron Roughneck from an automated machine to a truly autonomous system. Key questions revolve around Predictive Maintenance (PM), real-time torque optimization based on lithology and pipe fatigue, and full closed-loop drilling optimization integrating IRN operation with other rig functions (e.g., drawworks and top drive). There is high expectation that AI will eliminate torque parameter guesswork, drastically reducing equipment wear, preventing catastrophic failures related to connection integrity, and minimizing the need for specialized human oversight. Users are particularly concerned with data integration standards and the cybersecurity vulnerabilities associated with interconnected, AI-managed drilling equipment, seeking clarity on how AI enhances decision-making accuracy under dynamic operational conditions while maintaining robust system security and reliability.

- AI-Driven Predictive Maintenance: Utilizing machine learning algorithms to analyze sensor data (vibration, temperature, current draw) from the IRN to predict component failure, scheduling maintenance preemptively, thereby minimizing unscheduled downtime (NPT).

- Torque Optimization Algorithms: Implementing AI to dynamically adjust make-up torque settings based on real-time factors such as thread compound properties, pipe type, environmental temperature, and downhole conditions, ensuring optimal joint integrity and preventing thread damage.

- Autonomous Operation Integration: Enabling the Iron Roughneck to operate as a completely autonomous subsystem, integrating its sequencing and timing seamlessly with the automated drill floor processes (e.g., tripping speed optimization), requiring minimal human intervention.

- Enhanced Safety Protocols: Using AI vision systems and proximity sensors to verify the exclusion zone status around the IRN, automatically halting operations if unauthorized personnel or objects are detected, significantly exceeding current static safety interlocks.

- Anomaly Detection in Tubular Handling: Employing neural networks to detect subtle deviations in the tubular handling process—such as pipe slip or incorrect stabbing—that human operators or basic automation might miss, ensuring quality control for every connection.

- Optimization of Power Consumption: AI models can manage the hydraulic and electrical loads on the IRN, optimizing pump cycling and motor speed to reduce overall energy consumption during cyclical operations, aligning with broader industry sustainability goals.

DRO & Impact Forces Of Iron Roughneck Market

The Iron Roughneck Market dynamics are fundamentally shaped by the interplay of significant drivers related to safety and efficiency, counterbalanced by restraints stemming from high initial capital outlay and operational complexity, generating opportunities through technological advancements and expansion into new geographical frontiers. The overwhelming industry drive toward zero-incident safety culture acts as a powerful catalyst for IRN adoption, making the elimination of manual tubular handling a prerequisite for modern drilling programs. Simultaneously, the persistent volatility of oil prices necessitates continuous efficiency improvements, pushing operators to invest in automation that promises faster drilling speeds and reduced crew sizes, directly influencing profitability and return on capital employed (ROCE). These powerful drivers create an inescapable momentum for automation, despite macroeconomic headwinds often associated with commodity markets.

Key drivers include stringent regulatory frameworks, particularly in mature markets like the North Sea and Gulf of Mexico, where health, safety, and environment (HSE) compliance is rigorously enforced, making automated tubular handling mandatory for high-spec rigs. Furthermore, the diminishing pool of experienced manual roughnecks necessitates reliance on automated equipment capable of maintaining consistent operational performance regardless of human factors. The restraints primarily involve the substantial upfront investment required to purchase and integrate high-end IRNs onto new or existing rigs, creating a barrier to entry for smaller drilling contractors or those operating older fleet assets. Operational complexity, including the requirement for highly skilled technicians for maintenance and sophisticated software management, also acts as a constraint, particularly in remote operating locations where technical support infrastructure is underdeveloped.

Opportunities for market expansion are abundant, centered around the rapid proliferation of automated drilling rigs globally, requiring advanced IRN systems as core components. The growth in Extended Reach Drilling (ERD) and Ultra-Deepwater drilling demands higher torque capacity and reliability than standard equipment can offer, creating a niche for premium, heavy-duty IRNs. The significant impact forces governing the market are primarily regulatory pressure towards automation, technological displacement of manual labor, and the economic imperative to reduce Non-Productive Time (NPT). These forces collectively ensure that the lifecycle cost benefits—derived from reduced insurance premiums, lower accident rates, and improved drilling metrics—outweigh the initial capital expenditure, cementing the Iron Roughneck as essential infrastructure for competitive, modern drilling operations.

Segmentation Analysis

The Iron Roughneck Market is meticulously segmented based on key differentiators including the type of actuation mechanism, the specific application environment (onshore vs. offshore), and the maximum torque capacity provided, reflecting the diverse requirements across the global drilling landscape. This granular segmentation allows manufacturers to target specific operational niches, ranging from low-cost, high-volume hydraulic systems used in land rigs to highly specialized, heavy-duty electric models required for deepwater installations. Analyzing these segments provides crucial insights into technological adoption rates and geographic market maturity, showcasing the industry’s shift toward performance, efficiency, and safety across all operational tiers.

The segmentation by actuation type—Hydraulic, Electric, and Hybrid—is pivotal. Hydraulic systems, traditionally dominant, are valued for their raw power and robustness, critical for making up large-diameter casing strings under high tension. Electric systems, conversely, offer superior precision, better energy efficiency, and reduced environmental impact due to the elimination of hydraulic fluid leaks, aligning perfectly with modern sustainability mandates (ESG criteria). Hybrid systems, combining the best features of both, are emerging as a versatile solution for rigs seeking a balance between power, precision, and efficiency, gradually gaining market share, particularly in highly regulated offshore environments where space and weight constraints are significant considerations.

Furthermore, segmentation by application—Onshore and Offshore—demonstrates fundamentally different market needs. Offshore applications, including fixed platforms, drillships, and semi-submersibles, require IRNs designed for continuous, high-intensity use in harsh, corrosive environments, justifying premium pricing and advanced features. Onshore applications, ranging from conventional vertical drilling to complex horizontal shale plays, demand systems that are highly mobile, robust against temperature fluctuations, and often simpler in design to facilitate easier maintenance and faster deployment across diverse land rig locations, driving volume demand in regions like North America and the Middle East.

- By Actuation Type

- Hydraulic Iron Roughnecks

- Electric Iron Roughnecks

- Hybrid Iron Roughnecks

- By Application

- Onshore Drilling

- Offshore Drilling

- Shallow Water

- Deepwater

- Ultra-Deepwater

- By Rig Type

- Land Rigs (Vertical and Horizontal)

- Jack-up Rigs

- Drillships

- Semi-submersibles

- Platform Rigs

- By Torque Capacity

- Low Capacity (Up to 70,000 ft-lbs)

- Medium Capacity (70,000 ft-lbs to 120,000 ft-lbs)

- High Capacity (Above 120,000 ft-lbs)

Value Chain Analysis For Iron Roughneck Market

The value chain for the Iron Roughneck market begins with extensive upstream activities encompassing the sourcing of high-grade raw materials such as specialized steel alloys for load-bearing components, precision hydraulics (pumps, motors, valves), and advanced electronic components for control systems (PLCs, sensors, drives). Key upstream players include specialized component manufacturers who supply hydraulic systems certified for hazardous environments and advanced robotics providers. The efficiency and quality of these upstream inputs directly dictate the reliability and performance capacity (e.g., maximum torque output) of the final IRN assembly. Manufacturers must maintain strict quality control and forge strategic, long-term relationships with key suppliers to ensure component availability and minimize lead times, especially given the global nature of modern drilling operations.

The manufacturing and assembly stage involves high-precision engineering, welding, and system integration, converting raw components into a fully functional drilling rig tool. This midstream phase is characterized by sophisticated testing and certification processes (e.g., API standards) to ensure the equipment meets rigorous safety and performance specifications. Distribution channels for Iron Roughnecks are complex, often involving direct sales to major international drilling contractors (e.g., Transocean, Nabors, Seadrill) and large National Oil Companies (NOCs) that operate proprietary rig fleets. Indirect distribution often involves specialized equipment distributors and integrated service providers (like Schlumberger or Halliburton) who incorporate the IRN into broader rig packages or drilling automation solutions marketed worldwide.

Downstream activities center on installation, commissioning, training, and the crucial after-sales support segment, which includes maintenance, repair, and overhaul (MRO) services, spare parts provision, and software upgrades. Given the critical role of the IRN in drilling operations, MRO services are a continuous revenue stream and a vital aspect of customer retention. Direct channels are generally preferred for high-value offshore units where manufacturers provide expert field technicians and personalized service contracts. Indirect channels are more prevalent in regional markets or for older equipment where local third-party maintenance specialists handle routine repairs. The ability to provide fast, reliable technical support globally is a key differentiator in this highly specialized, service-intensive downstream market segment.

Iron Roughneck Market Potential Customers

The primary customers for Iron Roughnecks are international drilling contractors who own and operate large fleets of drilling rigs, necessitating high levels of automation to remain competitive and compliant with global safety standards. These companies are focused on maximizing drilling efficiency, reducing operational costs through labor displacement, and minimizing the risk profile of their operations. Major customers include publicly traded drilling giants operating high-specification drillships and semi-submersibles for deepwater exploration, where Non-Productive Time (NPT) costs can exceed $500,000 per day, making the reliability of the Iron Roughneck a critical economic factor.

A second major customer segment consists of National Oil Companies (NOCs) and large integrated energy companies that manage their own drilling operations, particularly in regions like the Middle East (e.g., Saudi Aramco, ADNOC) and Asia (e.g., Sinopec, ONGC). These entities often undertake massive, long-term field development programs requiring the rapid deployment of numerous high-efficiency land and offshore rigs. Their purchasing decisions are driven not only by efficiency but also by national mandates to implement best-in-class technology, enhancing their internal safety records and technological capabilities across the entire drilling value chain.

The tertiary, but growing, customer base includes specialized service companies that offer integrated drilling packages or rig modernization services, often acting as intermediaries for smaller independent oil and gas operators. These service providers purchase IRNs as components to be fitted onto existing rigs during refurbishment or upgrading processes, targeting operational enhancements that allow older assets to meet modern performance benchmarks. Ultimately, the end-user/buyer profile is characterized by organizations with significant capital expenditure capacity and a high intolerance for safety incidents and operational downtime, viewing the Iron Roughneck as a crucial productivity and safety investment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 710 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | NOV Inc., Schlumberger Limited, Weatherford International, Huisman Equipment B.V., Bentec GmbH Drilling and Oilfield Systems, Honghua Group Limited, TSC Group Holdings Limited, Yantai Jereh Oilfield Services Group Co., Ltd., China Oilfield Services Limited (COSL), Cameron (Schlumberger Company), Offshore Group (OG), Epiroc AB, Drillmec S.p.A., National Energy Services Reunited Corp. (NESR), Challenger Deepwater, Drillform Technical Services, Canrig Drilling Technology Ltd., Loadtec Engineered Systems, Precision Drilling Corporation, Helmerich & Payne Inc. (H&P). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Iron Roughneck Market Key Technology Landscape

The technological landscape of the Iron Roughneck market is dominated by advancements in high-reliability automation, specifically focusing on mechatronics, sensor integration, and control software designed for hazardous environments. A core technological aspect is the implementation of advanced hydraulic and electric drive systems capable of delivering extremely high, yet precisely controlled, torque. Modern IRNs utilize proportional control valves and variable frequency drives (VFDs) to manage the power output smoothly, preventing shock loading and minimizing wear on the tubular connection threads. Furthermore, the mechanical design incorporates sophisticated counter-balance and positioning systems, often utilizing complex linear motion kinematics, ensuring accurate alignment (stabbing) of the pin into the box, a critical step for preventing costly downhole issues.

Key technologies driving differentiation include advanced sensor arrays and data acquisition capabilities. New IRN systems are equipped with high-resolution encoders, load cells, and pressure sensors that provide real-time feedback on torque, turn count, and breakout force. This data is fed into the rig's control system, where sophisticated algorithms monitor the signature of each connection, verifying its integrity against established standards (e.g., API specifications). This transition from simple mechanical automation to intelligent, data-driven control systems is paramount, enabling drilling engineers to ensure premium connections are properly made up, which is crucial for deep, high-pressure, high-temperature (HPHT) wells where joint failure is unacceptable.

The integration of digital twins and remote diagnostics represents another critical technological trend. Leading manufacturers are offering digital models of their Iron Roughnecks, allowing operators to simulate maintenance procedures, train personnel virtually, and predict component lifespan. Furthermore, the use of industrial internet of things (IIoT) frameworks facilitates remote monitoring and troubleshooting. These connectivity features allow experts located thousands of miles away to diagnose performance issues, upload software patches, and optimize operational parameters, drastically improving mean time between failures (MTBF) and overall operational availability. Future technological advancements are expected to focus heavily on AI integration for fully autonomous tubular handling sequences and the development of lighter, more robust materials to decrease system footprint and maintenance complexity.

Regional Highlights

The global distribution of the Iron Roughneck market reveals stark differences in maturity, technological adoption, and investment patterns across key regions. North America holds the largest market share, driven primarily by the high concentration of advanced drilling rigs operating in the U.S. Gulf of Mexico and the rigorous application of automation in the Permian Basin’s high-density unconventional operations. The region benefits from stringent safety regulations and a competitive market environment that prioritizes cutting-edge technology to maintain efficiency gains. Sustained investment in high-spec, automated land rigs and continued deepwater exploration ensures North America remains the dominant revenue generator, often acting as the proving ground for next-generation IRN technologies before global rollout.

Asia Pacific (APAC) is poised to experience the fastest growth, largely due to significant capital investments by China, India, and Australia into new offshore platforms and gas field development. Countries in Southeast Asia are also modernizing their aging rig fleets to meet rising energy demands and stricter international standards. This region's growth is characterized by a high volume of new rig construction, creating strong demand for original equipment manufacturer (OEM) installations of Iron Roughnecks, often prioritizing cost-effective, robust hydraulic models, though demand for high-end electric models is rising in deepwater Australian projects.

The Middle East and Africa (MEA) represent a strategically vital market, driven by massive upstream investment programs led by national oil companies (NOCs) focusing on long-term oil production sustainability and enhanced safety records. The deployment of automated drilling equipment, including IRNs, is a core element of these modernization strategies. In Europe, the market is mature, centered around the North Sea basin. Demand here is dominated by the replacement and refurbishment (MRO) of existing high-specification equipment, with a strong preference for electric and hybrid systems that adhere to the region’s strict environmental and safety regulations, emphasizing low noise pollution and minimal risk of hydraulic fluid spills.

- North America (Dominant Market): High adoption in US and Canadian shale plays; extensive deepwater activity in the Gulf of Mexico; focus on automation integration and high-speed tripping capabilities.

- Europe (Mature Market): Stable demand driven by MRO and modernization of North Sea rigs; strong regulatory preference for low-emission and electric/hybrid Iron Roughnecks.

- Asia Pacific (Fastest Growth): Driven by new rig orders in China, South Korea, and Singapore; increasing exploration in the South China Sea and Australian deep gas fields; demand for both land and offshore units.

- Middle East & Africa (Strategic Investment): Significant CapEx by NOCs in Saudi Arabia, UAE, and Qatar; primary focus on enhancing safety and efficiency across large land rig fleets and shallow-water operations.

- Latin America (Recovery Market): Market dynamics linked closely to Brazilian pre-salt development and Mexican state oil company (PEMEX) activity; gradual shift toward automated drilling units following economic recovery and specific deepwater projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Iron Roughneck Market.- NOV Inc. (National Oilwell Varco)

- Schlumberger Limited

- Weatherford International

- Huisman Equipment B.V.

- Bentec GmbH Drilling and Oilfield Systems

- Honghua Group Limited

- TSC Group Holdings Limited

- Yantai Jereh Oilfield Services Group Co., Ltd.

- China Oilfield Services Limited (COSL)

- Cameron (A Schlumberger Company)

- Offshore Group (OG)

- Epiroc AB

- Drillmec S.p.A.

- National Energy Services Reunited Corp. (NESR)

- Challenger Deepwater

- Drillform Technical Services

- Canrig Drilling Technology Ltd. (A Nabors Industries Company)

- Loadtec Engineered Systems

- Precision Drilling Corporation

- Helmerich & Payne Inc. (H&P)

- Saipem S.p.A. (Through Rig Systems Division)

- KCA Deutag

- Bauer AG (Drilling Equipment Division)

- Transocean Ltd. (As a major user and design collaborator)

Frequently Asked Questions

Analyze common user questions about the Iron Roughneck market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary safety benefit of utilizing an Iron Roughneck in drilling operations?

The primary safety benefit is the complete removal of human personnel from the red zone, the area immediately beneath the rotary table where heavy tubulars are handled and high-energy connections are made, drastically reducing the risk of catastrophic accidents, crush injuries, and long-term strain injuries associated with manual pipe handling.

How does the implementation of an Iron Roughneck affect a drilling rig's overall efficiency?

Iron Roughnecks significantly enhance efficiency by standardizing the tubular connection process, providing faster and more consistent make-up and break-out times compared to manual methods. This consistency minimizes Non-Productive Time (NPT) and ensures repeatable torque application, which is vital for maintaining drilling consistency and maximizing Rate of Penetration (ROP).

What is the difference between Hydraulic and Electric Iron Roughnecks?

Hydraulic IRNs are valued for their raw power output and robustness, suitable for heavy-duty applications. Electric IRNs offer superior precision, better energy efficiency, lower maintenance complexity due to fewer fluid components, and reduced environmental impact, aligning with modern green rig specifications and high-tolerance connection requirements.

Which geographical region leads the demand for Iron Roughnecks and why?

North America currently leads the demand due to the intensive activity in shale gas and oil fields requiring high-speed, automated land rigs, combined with substantial deepwater exploration activities in the Gulf of Mexico. This environment demands the highest level of automation for safety compliance and economic efficiency.

Are Iron Roughnecks capable of handling all types of drilling tubulars?

Yes, modern Iron Roughnecks are highly versatile, capable of handling a wide range of tubulars, including drill pipe, heavy-weight drill pipe, drill collars, and various sizes of casing, often utilizing interchangeable jaws and software adjustments to accommodate different diameters and connection types required for complex well designs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager