Irrigation and Industrial Water Filters Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433067 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Irrigation and Industrial Water Filters Market Size

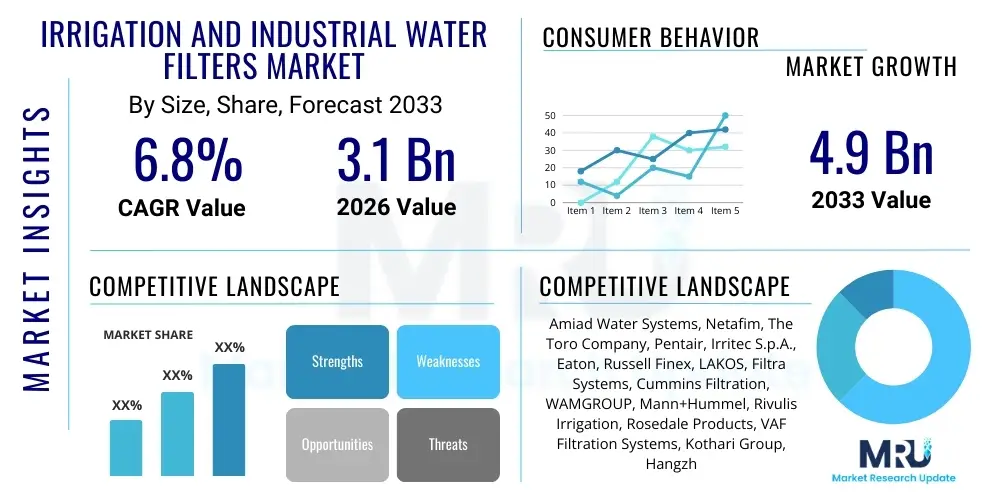

The Irrigation and Industrial Water Filters Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 3.1 Billion in 2026 and is projected to reach USD 4.9 Billion by the end of the forecast period in 2033.

Irrigation and Industrial Water Filters Market introduction

The Irrigation and Industrial Water Filters Market encompasses a diverse range of filtration systems designed to remove suspended solids, organic matter, and contaminants from water sources used in agricultural irrigation and various industrial processes. These filters are crucial for protecting sensitive downstream equipment, such as drip emitters, spray nozzles, pumps, heat exchangers, and sensitive manufacturing machinery, ensuring optimal operational efficiency and longevity. The fundamental product categories include screen filters, disc filters, media filters (sand/gravel), and specialized automated self-cleaning systems, each tailored to specific water quality challenges and flow requirements. Adoption of advanced filtration technologies is particularly critical in regions facing water scarcity or utilizing non-conventional water sources like recycled or brackish water, where contaminant loads are typically high.

The primary applications of industrial water filters span across sectors such as power generation (cooling tower filtration), pharmaceuticals, food and beverage processing, mining, chemical manufacturing, and oil and gas, where maintaining high water purity standards is non-negotiable for product quality and regulatory compliance. In agriculture, irrigation filters are vital for micro-irrigation systems (drip and micro-sprinkler) which offer superior water efficiency but are highly susceptible to clogging. The benefits derived from deploying these filtration solutions are multifaceted, including significant reductions in system maintenance costs, improved energy efficiency by minimizing scaling and fouling, consistent water flow, and ultimately, enhanced agricultural yields or industrial product quality assurance.

The market is primarily driven by escalating global water scarcity, the imperative for water reuse and recycling in water-intensive industries, and stringent environmental regulations mandating the treatment of discharged or recirculated water. Furthermore, the rapid expansion of precision agriculture globally, which relies heavily on high-efficiency drip irrigation systems, serves as a powerful accelerator for the demand for effective and reliable irrigation filters. Technological advancements, such as the integration of sensor-based monitoring and automation in self-cleaning filters, are also contributing to market growth by offering higher performance and reduced operational oversight.

Irrigation and Industrial Water Filters Market Executive Summary

The Irrigation and Industrial Water Filters Market is experiencing robust growth fueled by converging pressures from climate change, industrial modernization, and the global push towards sustainable water management. Business trends indicate a strong shift towards automated, self-cleaning filtration systems that reduce manual labor and downtime, thereby increasing the Return on Investment (ROI) for end-users. Key manufacturers are focusing on developing modular and scalable solutions that can be easily integrated into existing infrastructure, particularly relevant in aging industrial plants and large-scale agricultural enterprises transitioning from traditional methods. Mergers and acquisitions are also a noticeable trend, as major players consolidate their technological portfolios, especially in specialized areas like ultrafiltration membranes suitable for treating highly challenging wastewater streams. Furthermore, digital integration, leveraging IoT and cloud-based diagnostics for predictive maintenance, is rapidly becoming a competitive necessity.

Regionally, Asia Pacific is anticipated to remain the dominant and fastest-growing market, largely driven by massive infrastructure investments, rapid industrialization in countries like China and India, and the widespread adoption of modern irrigation techniques to boost agricultural output to support large populations. North America and Europe, while mature, exhibit strong demand for highly specialized and energy-efficient systems, driven by strict environmental discharge regulations and the critical need for optimizing operational expenses in high-cost labor environments. Latin America and the Middle East & Africa (MEA) are emerging as significant markets, specifically due to large-scale infrastructure projects, expansion of mining operations, and government initiatives promoting water conservation in arid and semi-arid zones, necessitating reliable filtration technologies for utilizing non-potable or recycled sources.

In terms of segmentation, the Disc Filter and Screen Filter segments continue to hold substantial market share due to their cost-effectiveness and versatility in basic irrigation applications, while the Media Filter segment remains crucial for high-flow industrial pretreatment processes and effective removal of organic solids. Industrially, the Power Generation and Food & Beverage sectors represent the largest consumer bases, requiring continuous high-volume filtration to prevent fouling and comply with sanitary standards. There is a discernible trend toward hybrid systems that combine multiple filtration methods (e.g., centrifugal separators followed by disc filters) to achieve superior treatment efficacy, reflecting a move away from single-technology solutions toward comprehensive water management suites tailored to complex contaminant profiles.

AI Impact Analysis on Irrigation and Industrial Water Filters Market

Users frequently inquire about how Artificial Intelligence (AI) can revolutionize the efficiency and maintenance of water filtration systems, often focusing on questions related to predictive fault detection, dynamic backwash scheduling, and optimization of energy consumption in large filtration plants. Key concerns revolve around the cybersecurity risks associated with networked filtration infrastructure and the initial capital investment required for implementing AI-driven monitoring and control systems. Users expect AI to minimize human error, significantly extend filter lifecycles, and enable real-time quality adjustments based on varying inlet water conditions. The overarching theme is the transition from reactive maintenance schedules to highly efficient, predictive, and autonomous filtration operations, particularly appealing in remote agricultural settings or complex industrial water loops where continuous, reliable performance is paramount.

- AI-driven Predictive Maintenance: Utilizing machine learning algorithms to analyze flow rates, pressure differentials, and water quality data to accurately predict potential system failures or the optimal time for filter cleaning, thereby minimizing downtime.

- Dynamic Backwash Optimization: Employing AI to adjust backwash cycles based on real-time contamination levels rather than fixed schedules, leading to significant savings in operational water usage and energy consumption.

- Automated System Calibration: AI systems autonomously adjust pump speeds, valve positions, and flow parameters to maintain consistent water quality output regardless of fluctuations in the source water quality.

- Resource Efficiency Improvement: Optimizing chemical dosage (if applicable) and energy use across the entire filtration plant, aligning operational expenditures with immediate treatment requirements.

- Advanced Water Quality Monitoring: Integrating AI with sensor data to identify and classify subtle shifts in contamination types, allowing the filter system to respond with the most appropriate treatment protocol instantly.

DRO & Impact Forces Of Irrigation and Industrial Water Filters Market

The Irrigation and Industrial Water Filters Market is strongly influenced by interconnected market dynamics—Drivers (D), Restraints (R), Opportunities (O), and Impact Forces. The primary drivers include global mandates for efficient water use, rapid infrastructural expansion in developing economies, and the necessity to protect high-value, sensitive industrial equipment from fouling and corrosion. These forces compel industries and agriculture to invest in reliable filtration. Conversely, the market faces restraints such as the high initial capital expenditure associated with advanced self-cleaning and specialized filtration systems, and a lack of standardized maintenance protocols in some emerging agricultural markets, which can undermine system effectiveness and adoption rates. Furthermore, the reliance on continuous power supply for automated systems poses a challenge in remote locations.

Significant opportunities are emerging through technological advancements, specifically in membrane filtration (e.g., UF and MF for recycling), which opens new avenues for treating highly polluted industrial effluent for reuse, addressing critical supply chain vulnerabilities associated with water availability. The growing adoption of sustainable practices and the increasing focus on achieving net-zero water goals by large corporations present lucrative opportunities for providers of closed-loop water treatment solutions. Additionally, government subsidies and incentives focused on promoting water-saving irrigation techniques in agriculture serve as powerful market enablers, particularly for adoption of disc and screen filtration systems.

The impact forces currently shaping the market trajectory include regulatory compliance—as governments worldwide tighten restrictions on water abstraction and wastewater discharge, thereby forcing industries to install superior filtration and treatment systems. Economic volatility affects the timing and scale of industrial CapEx spending, acting as a moderate dampener in certain regions. However, the irreversible impact force is climate change, which drives unpredictable weather patterns and increased reliance on non-traditional water sources, making high-performance, robust filtration essential rather than optional. The competitive landscape is also an impact force, driving innovation toward more compact, energy-efficient, and fully automated solutions, pushing older, labor-intensive technologies out of the mainstream industrial segment.

Segmentation Analysis

The Irrigation and Industrial Water Filters Market is comprehensively segmented based on product type, application, cleaning mechanism, and end-use industry, providing a granular view of demand distribution and technological preferences across various sectors. The product segmentation dictates the operational capability and particulate removal efficiency, while the end-use industry segmentation highlights the critical demand points, often characterized by specific flow requirements and contaminant profiles (e.g., oil droplets in petrochemicals versus biological solids in agriculture). The cleaning mechanism—manual, semi-automatic, or fully automatic (self-cleaning)—is increasingly becoming a crucial differentiator, especially in labor-intensive or remote installations where maintenance access is limited or costly.

Technologically, filters range from simple screen or mesh systems used for large particle removal in primary irrigation, up to highly complex and effective media filters utilized for industrial cooling water pretreatment and tertiary wastewater polishing. The market trend indicates a higher growth rate for automated and hybrid systems due to the rising cost of labor and the desire for consistent, reliable performance with minimal human intervention. Geographically, segmentation reveals distinct market maturation levels, with developed economies favoring advanced disc and membrane technologies, while developing nations exhibit high volume demand for economical screen and sand filtration solutions, thereby affecting the overall market value distribution.

- By Product Type:

- Screen Filters

- Disc Filters

- Media Filters (Sand, Gravel, Activated Carbon)

- Centrifugal Filters (Hydrocyclones)

- Automatic Self-Cleaning Filters

- Specialty Filters (Bag Filters, Cartridge Filters)

- By Application:

- Irrigation Water Filtration (Drip, Micro-sprinkler, Pivot)

- Industrial Water Filtration (Pretreatment, Cooling Towers, Process Water)

- Wastewater Recycling and Reuse

- By End-Use Industry:

- Agriculture

- Chemical & Petrochemical

- Power Generation

- Food & Beverage

- Mining & Metals

- Pharmaceuticals & Life Sciences

- Textiles & Pulp & Paper

- By Mechanism:

- Manual Filters

- Semi-Automatic Filters

- Automatic (Self-Cleaning) Filters

Value Chain Analysis For Irrigation and Industrial Water Filters Market

The value chain for the Irrigation and Industrial Water Filters Market commences with the raw material suppliers, predominantly providing polymers, specialized metals (stainless steel, corrosion-resistant alloys), and filtration media (sand, carbon, specialized membranes). The upstream analysis reveals that stability in the price and supply of these essential raw materials, particularly plastics used in disc and screen housing and high-grade stainless steel required for large industrial filter bodies, significantly impacts manufacturing costs. Manufacturers then engage in precision engineering and assembly, transforming raw materials into sophisticated filtration units, focusing heavily on R&D to enhance filter efficiency, minimize pressure loss, and improve automated cleaning mechanisms.

The distribution channel plays a pivotal role in connecting manufacturers to diverse end-users. Direct sales channels are typically employed for large, custom industrial filtration projects where highly specialized engineering consultation and after-sales support are necessary, often involving Original Equipment Manufacturers (OEMs) or specialized engineering procurement and construction (EPC) firms. Indirect distribution relies on an extensive network of regional distributors, dealers, and agricultural equipment suppliers who manage inventory, installation, and localized servicing, particularly critical for standardized irrigation filter products sold to small and medium-sized farms. Effective supply chain management is crucial, ensuring timely delivery of spare parts and replacement media, which forms a significant part of the aftermarket revenue.

The downstream analysis focuses on the installation, integration, and operational phases. End-users require systems that are easy to install, reliable, and minimize maintenance complexity. The service component, including regular maintenance contracts, retrofitting services, and system optimization consultancy, adds considerable value post-sale. The value chain is characterized by a high degree of integration between system design and application, necessitating close collaboration between manufacturers and end-users to tailor filtration solutions (especially flow rates and filtration degrees) precisely to specific water quality and process requirements. Profit margins tend to be higher in the specialized industrial and self-cleaning segments compared to high-volume, commoditized screen filters for standard irrigation.

Irrigation and Industrial Water Filters Market Potential Customers

Potential customers for Irrigation and Industrial Water Filters span a broad spectrum of sectors characterized by high water consumption, sensitivity to particulate contamination, and regulatory requirements for water quality. In agriculture, large-scale commercial farms, vineyard operations, greenhouse enterprises, and specialized high-value crop growers utilizing drip or micro-sprinkler irrigation are primary buyers, as filtration is essential for protecting their investment in micro-irrigation infrastructure. These agricultural users prioritize reliability, minimal pressure loss, and ease of field maintenance, often opting for robust disc or self-cleaning screen filters.

The industrial end-users are segmented by their need for process water purity. Power generation facilities, particularly coal and nuclear plants, are major consumers for cooling tower side-stream filtration to control scaling and biofouling. Food and beverage processors require high-grade filtration to meet stringent hygiene and quality control standards. Furthermore, the chemical, pharmaceutical, and electronics industries utilize highly specialized, high-efficiency filtration to ensure product integrity, often demanding cartridge or membrane-level filtration solutions. Municipalities involved in non-potable water reuse schemes and golf course or park management also represent substantial buyers, seeking efficient ways to utilize treated effluent or surface water for landscape irrigation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.1 Billion |

| Market Forecast in 2033 | USD 4.9 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Amiad Water Systems, Netafim, The Toro Company, Pentair, Irritec S.p.A., Eaton, Russell Finex, LAKOS, Filtra Systems, Cummins Filtration, WAMGROUP, Mann+Hummel, Rivulis Irrigation, Rosedale Products, VAF Filtration Systems, Kothari Group, Hangzhou Cobetter Filtration Equipment, Parker Hannifin, Veolia Water Technologies, Suez Water Technologies & Solutions |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Irrigation and Industrial Water Filters Market Key Technology Landscape

The technology landscape of the Irrigation and Industrial Water Filters Market is characterized by continuous refinement aimed at increasing efficiency, reducing water waste, and facilitating autonomous operation. A central technological focus remains on developing self-cleaning mechanisms, moving away from manually intensive systems. Disc filter technology, for example, has advanced significantly, utilizing sophisticated compression and sequential backwashing techniques that use minimal flush water and require lower system pressures to initiate the cleaning cycle. Similarly, automatic screen filters incorporate specialized suction scanners that clean the mesh element while maintaining filtration flow, ensuring continuous industrial operation without production halts. These advancements are crucial for sectors like power generation and petrochemicals where uninterrupted operation is non-negotiable.

Beyond mechanical filtration, there is growing integration of sensor and control technologies. Modern filtration systems are equipped with differential pressure sensors, flow meters, and turbidity probes that communicate data in real-time to centralized control units. These controllers utilize sophisticated algorithms, increasingly incorporating basic AI routines, to monitor fouling rates and automatically optimize backwash frequency, maximizing water and energy savings. Furthermore, modular design principles are increasingly favored, allowing end-users to scale their filtration capacity easily or swap out filter media (e.g., transitioning from sand to activated carbon) based on evolving water quality requirements or regulatory changes, enhancing system flexibility and future-proofing investments.

The specialization in media filtration is also expanding, especially with the use of advanced synthetic media and layered filtration beds designed for highly specific contaminant removal, such as heavy metals or fine colloidal particles that traditional sand media cannot capture effectively. In the agricultural sector, the focus is on robust, low-maintenance polymers for filter housing that can withstand harsh outdoor environments and resist chemical corrosion from fertigation additives. The competitive edge in this market is shifting toward providers who can successfully integrate physical filtration hardware with digital services, offering end-to-end water management platforms that provide remote monitoring, performance diagnostics, and predictive maintenance alerts.

Regional Highlights

- Asia Pacific (APAC): APAC is the engine of market growth, driven by rapid industrialization, massive investments in manufacturing and infrastructure development, and the urgent need for modernizing vast agricultural sectors in countries like India, China, and Southeast Asia. Regulatory efforts to control water pollution and promote industrial water reuse are accelerating the adoption of industrial filters. The region also sees a high demand for cost-effective, high-volume irrigation filters to support large rice, wheat, and cash crop operations.

- North America: Characterized by technological maturity and high industrial standards, North America is a key market for automated, high-efficiency, and specialized filtration solutions. The demand is heavily focused on replacing aging infrastructure, optimizing water consumption in oil and gas, mining, and power sectors, and meeting stringent environmental standards. High labor costs strongly favor self-cleaning and remote-monitored systems.

- Europe: Driven primarily by strict EU water directives (e.g., Water Framework Directive) and a strong commitment to circular economy principles, the European market prioritizes high-performance filtration for wastewater recycling and resource recovery. Germany, France, and the UK are major consumers, particularly in the food and beverage and chemical industries, where precision filtration is critical for both compliance and product quality. Emphasis is placed on energy-efficient designs.

- Latin America: This region is witnessing steady growth due to the expansion of large-scale mining operations (Chile, Peru), agricultural modernization (Brazil, Argentina), and urban infrastructure projects. Demand is driven by the need for robust, reliable filters capable of handling highly turbid water sources common in the region, with significant growth potential in sectors related to copper, iron ore, and specialized crop irrigation.

- Middle East and Africa (MEA): Facing extreme water scarcity, MEA countries are investing heavily in non-conventional water sources, including desalination pretreatment and treated wastewater reuse for irrigation and industrial cooling. This drives substantial demand for robust, high-tolerance filtration systems, particularly media and automatic screen filters capable of handling saline and highly contaminated input water. UAE, Saudi Arabia, and Israel are leaders in adopting these advanced technologies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Irrigation and Industrial Water Filters Market.- Amiad Water Systems

- Netafim

- The Toro Company

- Pentair

- Irritec S.p.A.

- Eaton

- Russell Finex

- LAKOS

- Filtra Systems

- Cummins Filtration

- WAMGROUP

- Mann+Hummel

- Rivulis Irrigation

- Rosedale Products

- VAF Filtration Systems

- Kothari Group

- Hangzhou Cobetter Filtration Equipment

- Parker Hannifin

- Veolia Water Technologies

- Suez Water Technologies & Solutions

Frequently Asked Questions

Analyze common user questions about the Irrigation and Industrial Water Filters market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Industrial Water Filters Market?

Market growth is predominantly driven by increasing global water scarcity, compelling industries to adopt water reuse and recycling practices, and the necessity to protect highly sensitive and expensive industrial equipment (like heat exchangers and pumps) from fouling, scaling, and corrosion caused by unfiltered water, ensuring regulatory compliance.

How do self-cleaning filters enhance operational efficiency in irrigation systems?

Self-cleaning filters, particularly automatic screen and disc models, utilize backwash or suction mechanisms to clean the filter element without manual intervention or system shutdown. This drastically reduces maintenance labor costs, minimizes system downtime, and ensures consistent water flow, which is crucial for maximizing crop yields in precision irrigation.

Which product type currently holds the largest market share in the overall filtration sector?

Screen and Disc Filters collectively hold a substantial market share, particularly due to their widespread use in the high-volume agricultural irrigation sector for efficient removal of medium to coarse particles, coupled with their low initial cost and relative ease of maintenance compared to more specialized industrial systems like media or cartridge filters.

What role does digitalization (IoT and AI) play in modern water filtration systems?

Digitalization allows for remote monitoring of critical performance parameters (pressure, flow, water quality) and utilizes AI/IoT algorithms to implement predictive maintenance. This means backwash cycles are optimized based on real-time fouling conditions, reducing water and energy waste and enabling quicker fault detection before system failure occurs.

Which end-use industries are the major consumers of advanced industrial filtration technology?

The largest industrial consumers include Power Generation (for cooling tower filtration and boiler feed water pretreatment), the Food and Beverage sector (requiring high purity for processing and cleaning), and the Chemical and Petrochemical industries, which require robust filtration to maintain process integrity and handle contaminated wastewater.

The market analysis presented within this report underscores a critical global dependency on effective water management infrastructure, positioning the Irrigation and Industrial Water Filters sector as a non-cyclical, essential industry. The integration of smart technologies, coupled with the rising imperative for sustainability, is transforming product development from simple mechanical barriers into complex, data-driven water purity management solutions. Future expansion will be highly concentrated in areas balancing rapid industrial growth with acute water stress, particularly across Asia Pacific and the Middle East, necessitating continuous innovation in filter media and automation capabilities to meet increasingly stringent operational and environmental performance benchmarks.

In the industrial sphere, the shift from conventional water sources to recycled and non-potable water streams fundamentally dictates the complexity and capacity requirements of the filters used. This trend drives higher demand for specialized media filtration and membrane pretreatment systems that can handle elevated levels of Total Suspended Solids (TSS) and biological load without frequent replacement or excessive backwash. Companies that can offer integrated solutions—combining pretreatment, primary filtration, and post-filtration monitoring—will capture greater market value, moving beyond component sales to offering comprehensive water system consulting and long-term service contracts. This strategic transition solidifies the market's trajectory toward value-added services and predictive analytics as competitive differentiators in a highly essential global resource management domain.

The agricultural segment, driven by governmental policies supporting micro-irrigation, will continue to standardize its filtration requirements around cost-effective, durable, and highly efficient screen and disc filters. The challenge in this sector remains educating end-users about proper maintenance and filter sizing relative to the source water quality, ensuring maximum system longevity and water use efficiency. Manufacturers are responding by designing filters that are easier to disassemble, clean, and maintain in the field, recognizing that user-friendliness is a critical adoption factor for farm operators. As precision agriculture adopts more sophisticated sensing and automation technologies, the filter system's ability to communicate with and adapt to the larger farm management platform will become increasingly important, paving the way for further IoT integration in basic irrigation components.

Addressing the inherent restraints, particularly the high initial investment for advanced filtration, manufacturers are exploring financing models and leasing options that ease the financial burden on small and medium enterprises (SMEs) and farms. Furthermore, the development of localized manufacturing capabilities in regions like APAC and Latin America is crucial for reducing logistical costs and making specialized filtration technology more accessible. The market structure strongly favors companies that demonstrate not only technological leadership but also a robust global distribution and service network capable of supporting the long lifespan and maintenance needs of filtration equipment. These factors collectively ensure the market sustains its projected growth rate throughout the forecast period, driven by both necessary infrastructure upgrades and technological evolution.

Specific attention is being paid to the use of polymer engineering in filter housing and components. The longevity and chemical resistance of these materials are paramount, particularly when dealing with aggressive industrial effluents or agricultural fertilizers injected through the irrigation system (fertigation). Innovation in materials science seeks to create lighter, more robust, and corrosion-resistant filtration units that can operate effectively under high pressure and variable temperature conditions typical of large industrial cooling circuits. This focus on material quality directly influences the filter’s Mean Time Between Failure (MTBF), a key performance indicator for industrial end-users seeking maximal uptime.

Another crucial area of technological advancement is the miniaturization and efficiency of specialty filtration, such as bag and cartridge filters. While traditionally used for polishing steps, these filters are being optimized for higher flow rates and longer service life through novel media pleated designs and hybrid layer compositions. This refinement allows them to be incorporated into smaller, decentralized industrial applications or used as highly effective final barriers against ultra-fine particulates before water enters sensitive pharmaceutical or electronics manufacturing processes. The efficiency gains in cartridge technology make replacement cycles less frequent and disposal less burdensome, addressing both operational cost and environmental impact concerns.

The role of regulatory bodies in accelerating the market cannot be overstated. Government mandates requiring zero liquid discharge (ZLD) or extremely low-level contaminant discharge effectively force industries to adopt the highest level of filtration and separation technology available. This regulatory pressure acts as a consistent market driver, insulating the advanced filtration segment from typical economic downturns, as compliance spending remains necessary regardless of immediate operational profits. Moreover, public awareness and corporate social responsibility (CSR) initiatives regarding water footprint reduction further incentivize large multinational corporations to invest in state-of-the-art filtration systems, often exceeding minimal regulatory requirements to enhance their public and environmental standing.

Geopolitical stability, particularly concerning water rights and access, also subtly influences the market. In regions facing interstate or international water disputes, investments in self-sufficiency through water recycling and highly efficient filtration infrastructure become strategic national priorities. This strategic demand often translates into government-backed projects and large-scale public tenders for water treatment facilities, representing high-value opportunities for major filtration system providers. The global trend toward urbanization also contributes, as denser populations place greater strain on centralized water resources, increasing the reliance on treated municipal wastewater for industrial and landscape irrigation, requiring sophisticated filtration barriers to ensure safety and reliability.

Finally, the competitive landscape is rapidly evolving with the entry of digital solution providers and software companies specializing in water informatics. These companies are partnering with traditional hardware manufacturers to create integrated "Water-as-a-Service" models. This shift means the revenue streams are diversifying from upfront equipment sales to recurring subscription services for performance monitoring, predictive diagnostics, and system optimization. This service-oriented approach improves customer retention and provides a more stable, long-term revenue base for market participants, fundamentally altering the traditional sales and service ecosystem of the Irrigation and Industrial Water Filters Market.

The integration of advanced materials, such as specific polymers resistant to UV degradation and chemical leaching, is vital for filters destined for open-air agricultural use where environmental exposure is intense. Manufacturers are also focusing on improving the sustainability profile of the filters themselves. This includes designing components for easier disassembly and recycling at the end of their operational life, aligning with global efforts to reduce industrial waste and promote circular material economies. This commitment to 'green engineering' is becoming a distinguishing factor, particularly when tendering for municipal or large corporate contracts where environmental procurement criteria are strictly enforced.

Furthermore, energy consumption efficiency remains a high priority, especially for automatically backwashing systems which use pumps extensively. Innovations in hydraulic design are aimed at minimizing head loss and optimizing the geometry of the filtration element to maintain required flow rates with reduced pumping energy. This focus on minimizing energy inputs provides a tangible economic benefit to end-users, thereby increasing the attractiveness of newer, more expensive automated systems over older, less efficient models. The cumulative effect of these small energy savings across thousands of installations contributes significantly to the overall reduction of the industrial sector's carbon footprint.

The role of standardization and certification is also gaining prominence. As industrial processes become more interconnected globally, the demand for filters that meet internationally recognized standards (such as ISO, ASME, or country-specific certifications like NSF) is increasing. Compliance reassures customers in sensitive sectors (e.g., pharmaceuticals, aerospace) that the filtration equipment adheres to strict manufacturing quality and performance criteria. Companies investing early in comprehensive global certifications are positioned to capitalize on multinational project opportunities and gain a competitive edge in mature markets like North America and Europe where regulatory scrutiny is highest.

The market faces segmentation challenges due to the vast difference in water quality requirements between irrigation and high-purity industrial applications. Irrigation filtration typically involves removing particles above 80–100 microns, whereas industrial ultrafiltration often targets particles below 0.01 micron. This divergence necessitates that market players either specialize deeply in one segment (e.g., Amiad in irrigation) or possess a wide technological portfolio covering the entire spectrum (e.g., Veolia or Suez). The trend towards modular systems is an attempt to bridge this gap, offering customizable platforms that can handle vastly different levels of water treatment simply by changing the internal filter media or cartridge configuration.

Finally, the growing threat of cyber-physical attacks on critical water infrastructure is influencing the security features built into modern networked filtration systems. As AI and IoT control mechanisms become standard, manufacturers are integrating robust cybersecurity protocols and encrypted communication channels to protect the operational integrity of the filtration assets. The perceived vulnerability of water treatment systems, if compromised, necessitates that system providers invest heavily in securing their digital platforms, which is now considered a vital, non-negotiable element of the technology landscape in the industrial segment.

The influence of climate patterns on market dynamics is becoming more pronounced. Extended drought periods, particularly in key agricultural regions across the US, Australia, and Southern Europe, drive emergency spending on water-saving equipment, including advanced filtration for drip systems. Conversely, regions experiencing increased flooding and turbidity spikes require filtration systems capable of handling sudden and severe swings in source water quality. This environmental volatility favors robust, versatile, and high-capacity media filters capable of handling significant contaminant loads over prolonged periods, shifting purchasing decisions away from cheap, less resilient solutions toward durable, engineered systems.

Labor dynamics further shape the market segmentation. In economies where skilled labor for maintenance and operation is scarce or expensive, the move towards fully automated, remote-diagnosed systems accelerates. This is evident in North American and Western European industrial settings. Conversely, in developing economies with lower labor costs, manually operated or semi-automatic systems still maintain high market penetration due to their lower initial CapEx, though this trend is gradually shifting as automation becomes more accessible and reliable, proving its long-term cost-effectiveness in terms of water and energy savings.

In terms of strategic opportunities, the market for retrofitting existing industrial infrastructure is immense. Many older manufacturing plants operate with outdated or inefficient filtration units, offering a significant opportunity for manufacturers to provide modern, compact, and energy-efficient replacement systems. These retrofitting projects often involve complex engineering but yield substantial long-term savings for the customer through improved water quality, reduced maintenance, and lower energy bills, making them a high-value segment for focused sales efforts.

The final element sustaining market interest is the ongoing R&D into bio-fouling control. Biological growth inside industrial pipes and filters is a persistent problem, significantly reducing efficiency and necessitating chemical intervention. Innovations in surface treatments, such as anti-microbial coatings or specialized flow designs that minimize stagnant water zones, are being developed to passively reduce bio-fouling, offering cleaner, more sustainable filtration solutions that reduce reliance on costly and environmentally sensitive chemical biocides.

The competitive rivalry in the Irrigation and Industrial Water Filters Market is intense, characterized by a few global giants (like Pentair and Veolia) providing comprehensive industrial solutions and numerous niche players dominating specialized segments (e.g., specific filter types or regional agricultural markets). Price wars are common in the commoditized screen and disc filter segments, forcing manufacturers to differentiate through superior material quality or integration with digital services. For long-term viability, companies must continuously invest in R&D to launch proprietary technologies, especially in the high-margin, specialized industrial filtration area, ensuring they remain ahead of generic competitors.

The expansion of the food and beverage industry, particularly in emerging economies, represents a consistently growing demand driver. Water used in bottling, washing, and production processes must meet stringent potable water standards, even if the final product is not water itself. This necessitates multi-stage filtration trains, often including robust pretreatment filters (like media and disc) followed by high-grade polishing filters (cartridge or membrane), creating a cumulative demand for various filter types within a single industrial facility. The stringent audit requirements of this sector ensure that filtration quality and reliability are prioritized over minimal cost, favoring premium solution providers.

In summary, the Irrigation and Industrial Water Filters Market is undergoing a rapid, technology-driven evolution, moving toward smart, sustainable, and highly specialized systems. The confluence of environmental pressures, regulatory mandates, and technological readiness ensures that this essential market segment will continue its trajectory of strong growth, defined by automation and comprehensive service offerings.

The continuous optimization of filtration media materials, including the development of new polymers and composites for media beds, allows for higher flow rates and better capture efficiencies without compromising the structural integrity of the filter. This technical refinement is particularly important for industrial applications involving highly corrosive liquids or high-temperature operations, extending the operational envelope of standard filtration systems. This relentless pursuit of material superiority underpins the ability of market leaders to secure contracts in critical infrastructure projects.

Furthermore, the focus on sustainable water use has pushed the development of zero-waste filtration solutions. While backwash is necessary for cleaning, innovative designs are seeking ways to treat and recycle the backwash water itself, minimizing the overall water footprint of the filtration process. This closed-loop approach is becoming highly desirable for industries operating under strict water discharge limits or those purchasing water at high costs, demonstrating the intrinsic link between filtration technology and core business sustainability metrics.

The growing industrial interest in treating produced water from oil and gas extraction, which often contains complex emulsions and high levels of Total Dissolved Solids (TDS) and TSS, requires specialized filtration techniques that go beyond conventional methods. This niche but high-value segment demands customized solutions, often involving advanced media filtration combined with chemical injection, representing a significant revenue opportunity for companies capable of engineering bespoke, heavy-duty filtration trains capable of maintaining efficacy under extreme operating conditions. This diversification into complex fluid handling positions filter manufacturers as key technology enablers in resource extraction and energy sectors.

The agricultural segment's demand is gradually moving toward more durable and higher-performing plastic-based filters capable of resisting the harsh chemicals used in fertigation. Manufacturers are designing UV-resistant and chemically inert filtration housings and elements that withstand year-round outdoor exposure without performance degradation. This durability focus ensures a lower replacement rate and reduces the total cost of ownership for farmers, aligning filtration solutions with the long-term investment horizon required for modern agricultural equipment.

Ultimately, the market's robust future is secured by the fundamental and increasing global shortage of clean water resources. As populations grow and industrial activity expands, efficient filtration is not merely an improvement but an absolute necessity for economic activity and environmental health. The market is positioned for sustained growth, driven by both the need for new installations in emerging economies and the imperative for technological upgrades and optimization in mature markets.

The global regulatory push for treating microplastics in discharged water is expected to become a substantial driver for fine filtration technologies, particularly in textile and wastewater treatment industries. Current filtration standards may not be sufficient to capture these microscopic contaminants, prompting R&D efforts towards ultra-fine mesh materials and specialized cartridge designs. This regulatory evolution creates a new, high-growth subset within the specialty filters segment, potentially requiring substantial capital investment from end-users to upgrade existing tertiary treatment facilities across various industrial domains.

The education and training component within the market value chain is vital yet often overlooked. Ensuring that operators in industrial plants and agricultural fields correctly install, operate, and maintain complex filtration equipment directly impacts system longevity and performance reliability. Leading manufacturers are increasingly offering detailed training programs and digital manuals accessible via mobile platforms, leveraging augmented reality (AR) for maintenance guidance, aiming to minimize operator error, especially in geographically dispersed installations common in large-scale agriculture.

In summary, the market exhibits a healthy blend of mass-market demand in agriculture and high-value, bespoke demand in industry. The competitive strategy for success hinges on technological sophistication, a robust global service network, and the ability to integrate hardware with predictive digital intelligence, ensuring filters are viewed not just as equipment, but as vital, self-optimizing components of a sustainable water management ecosystem.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager