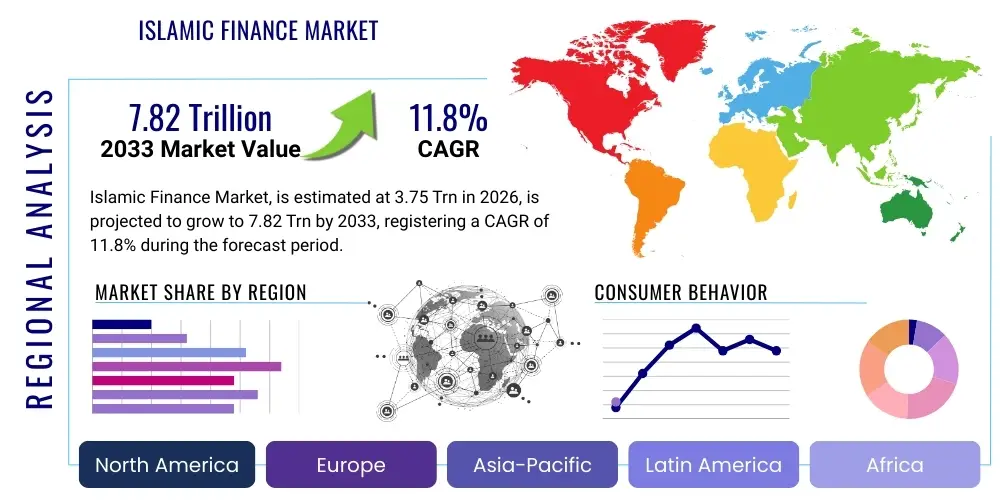

Islamic Finance Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439336 | Date : Jan, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Islamic Finance Market Size

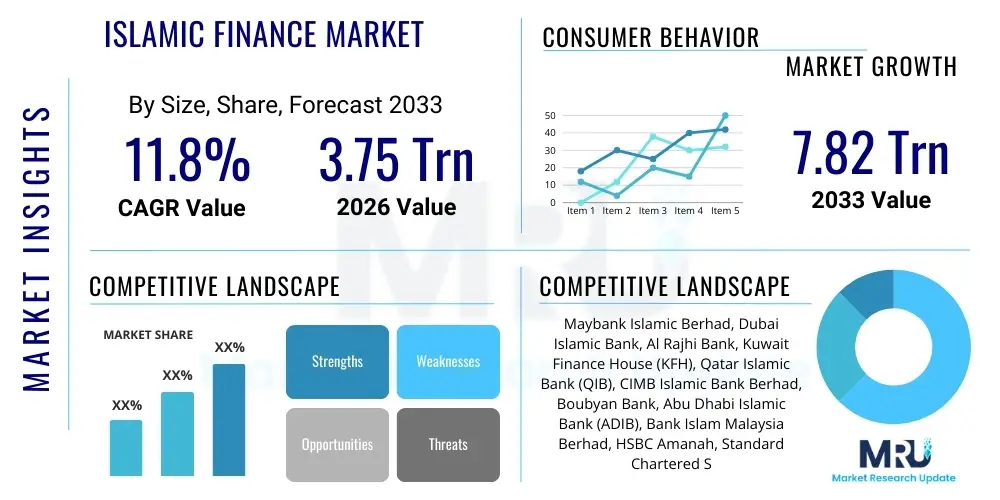

The Islamic Finance Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.8% between 2026 and 2033. The market is estimated at USD 3.75 Trillion in 2026 and is projected to reach USD 7.82 Trillion by the end of the forecast period in 2033.

Islamic Finance Market introduction

The Islamic Finance Market encompasses financial products and services compliant with Sharia (Islamic law) principles, primarily prohibiting interest (riba), excessive uncertainty (gharar), and speculative activities (maysir), while promoting ethical and socially responsible investments. Key products include Islamic banking (deposits, financing, trade finance), Sukuk (Islamic bonds), Takaful (Islamic insurance), and Islamic funds, all designed to foster real economic activity and equitable wealth distribution. These offerings cater to a growing global Muslim population and an increasing number of non-Muslims seeking ethical investment opportunities.

Major applications span retail banking for individuals, corporate financing for businesses, project finance, and government infrastructure funding through Sukuk issuances. Benefits include enhanced ethical transparency, risk-sharing mechanisms, and alignment with sustainability goals, making it attractive to a broader investor base. The market's growth is primarily driven by rising awareness of Sharia-compliant products, increasing disposable income in Muslim-majority countries, supportive regulatory frameworks, and a global demand for ethical and sustainable finance alternatives. The inherent stability and resilience demonstrated during economic downturns further bolster its appeal and expansion.

Islamic Finance Market Executive Summary

The Islamic Finance Market is experiencing robust growth, propelled by strong business trends such as product innovation, digital transformation, and increasing integration with fintech solutions, expanding its reach beyond traditional Islamic markets. Regional trends indicate significant expansion in the GCC, Southeast Asia, and North Africa, with emerging interest from Western markets and sub-Saharan Africa. Governments are actively supporting the sector through conducive regulatory environments and significant Sukuk issuances, further cementing its role in national economic development and infrastructure funding.

Segment-wise, Islamic banking remains the largest component, continuously evolving with new retail and corporate offerings, while Sukuk issuances are gaining traction as a preferred method for capital raising by both sovereign and corporate entities. The Takaful sector is also witnessing steady growth, driven by increasing awareness and demand for Sharia-compliant insurance products. Furthermore, Islamic funds are attracting attention due to their focus on ethical and socially responsible investments, aligning with global ESG (Environmental, Social, and Governance) trends, leading to diversification across asset classes and investment strategies.

AI Impact Analysis on Islamic Finance Market

User questions regarding AI's impact on Islamic Finance frequently explore its potential to enhance Sharia compliance, streamline operations, and introduce innovative products while adhering to ethical principles. Users are keen to understand how AI can be leveraged for more accurate risk assessment in Murabaha or Musharaka contracts, automate complex calculations for Zakat and profit distribution, and personalize financial advisory services. There is also significant interest in AI's role in fraud detection, regulatory reporting, and improving customer experience, alongside concerns about data privacy, algorithmic bias, and ensuring AI systems uphold the moral and ethical foundations of Islamic finance.

- Enhanced Sharia compliance verification through automated checks.

- Improved risk management models for Islamic contracts.

- Personalized Sharia-compliant financial product recommendations.

- Automated Zakat calculation and distribution.

- Streamlined operational efficiency in Islamic banks and Takaful companies.

- Advanced fraud detection and cybersecurity measures.

- Development of AI-powered ethical investment screening tools.

- Facilitation of new product innovation, such as AI-driven microfinance.

- Enhanced customer service through chatbots and virtual assistants.

- Optimization of investment portfolios for Islamic funds.

DRO & Impact Forces Of Islamic Finance Market

The Islamic Finance Market is propelled by several key drivers, including the vast underserved Muslim population seeking Sharia-compliant financial solutions, increasing governmental support through regulatory frameworks and fiscal incentives, and a growing global demand for ethical and sustainable investment options that align with Islamic principles. These drivers collectively foster an environment conducive to innovation and market expansion, drawing both Islamic and conventional financial institutions into the sector. The inherent resilience of Islamic finance models during economic downturns, attributed to its asset-backed nature and prohibition of excessive speculation, further reinforces its appeal and growth trajectory.

However, the market faces restraints such as a persistent lack of standardization across different jurisdictions, limited product diversity compared to conventional finance, and a shortage of skilled human capital with expertise in both finance and Sharia law. Opportunities abound in leveraging financial technology (fintech) to enhance accessibility and efficiency, expanding into new geographical markets, and integrating Islamic finance with the broader sustainable and green finance movements. Impact forces, including geopolitical stability, economic growth in key Muslim-majority regions, and technological advancements, significantly shape the market's trajectory, either accelerating or impeding its development and adoption globally.

Segmentation Analysis

The Islamic Finance Market is comprehensively segmented across various dimensions to provide a granular understanding of its structure and growth dynamics. These segmentations typically include product type, end-user, and distribution channels, each revealing distinct market behaviors and opportunities. Analyzing these segments is crucial for identifying areas of high growth, developing targeted strategies, and understanding the competitive landscape. The diversity within these segments reflects the evolving needs of both individual and institutional clients seeking Sharia-compliant financial services.

- Product Type

- Islamic Banking (Deposits, Financing, Trade Finance, Treasury)

- Sukuk (Sovereign Sukuk, Corporate Sukuk)

- Takaful (Family Takaful, General Takaful)

- Islamic Funds (Equity Funds, Fixed Income Funds, Mixed Funds, Real Estate Funds)

- Other Islamic Financial Services (e.g., Microfinance, Wealth Management)

- End-User

- Retail Customers

- Corporate & SMEs

- Governments & Public Sector

- High Net Worth Individuals

- Distribution Channel

- Branch Banking

- Online & Digital Platforms

- Direct Sales Agents

- Brokers & Intermediaries

Value Chain Analysis For Islamic Finance Market

The value chain for the Islamic Finance Market begins with upstream activities, primarily involving Sharia advisory boards, reputable scholars, and legal experts who ensure compliance with Islamic law, forming the fundamental bedrock of all product development. This stage also includes capital providers, such as institutional investors and high-net-worth individuals, who provide the initial funding for Islamic financial institutions. Research and development of innovative, Sharia-compliant products and services also constitute a critical part of the upstream segment, demanding deep understanding of both financial engineering and Islamic jurisprudence.

Midstream activities encompass the core operations of Islamic financial institutions, including product structuring (e.g., Murabaha, Ijarah, Musharaka, Mudarabah), risk management, asset origination, and investment management. Downstream activities focus on the distribution channels, which can be direct (e.g., through proprietary branches, online banking platforms, mobile apps, or direct sales forces) or indirect (e.g., via financial advisors, brokers, agents, or partnerships with conventional financial institutions). Customer service and relationship management are vital aspects of the downstream segment, ensuring client satisfaction and loyalty. The efficient flow across these stages, coupled with robust Sharia governance, defines the market's ability to deliver value to its stakeholders and end-users.

Islamic Finance Market Potential Customers

The primary potential customers for the Islamic Finance Market are individuals, businesses, and government entities seeking financial products and services that align with ethical and Sharia-compliant principles. This includes a vast global Muslim population, which constitutes a significant and growing demographic naturally inclined towards Islamic finance for religious adherence and ethical considerations. These retail customers typically seek Sharia-compliant banking services, financing for homes and education, Takaful insurance, and ethical investment opportunities for wealth accumulation.

Beyond the Muslim population, the market increasingly appeals to a broader base of socially conscious investors and businesses globally, irrespective of their religious background. These non-Muslim customers are attracted by the ethical framework, transparency, risk-sharing mechanisms, and focus on real economic activity inherent in Islamic finance, often viewing it as a robust alternative to conventional models. Businesses, ranging from small and medium-sized enterprises (SMEs) to large corporations, seek Sharia-compliant financing for operations, expansion, and trade, while governments utilize instruments like Sukuk for infrastructure projects and national development, underscoring the diverse and expanding customer base for Islamic finance products.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.75 Trillion |

| Market Forecast in 2033 | USD 7.82 Trillion |

| Growth Rate | 11.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Maybank Islamic Berhad, Dubai Islamic Bank, Al Rajhi Bank, Kuwait Finance House (KFH), Qatar Islamic Bank (QIB), CIMB Islamic Bank Berhad, Boubyan Bank, Abu Dhabi Islamic Bank (ADIB), Bank Islam Malaysia Berhad, HSBC Amanah, Standard Chartered Saadiq, NCB Capital, Al Baraka Banking Group, Bahrain Islamic Bank, Turk Ekonomi Bankasi (TEB) Katilim Bankasi, Bank Syariah Indonesia, Saudi National Bank, Wahed Invest, FWU AG (Takaful), Etiqa Takaful |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Islamic Finance Market Key Technology Landscape

The Islamic Finance Market is rapidly embracing a diverse array of technologies to enhance efficiency, extend reach, and ensure stringent Sharia compliance. Blockchain technology, for instance, is being explored for its potential to create transparent and immutable records for Sukuk issuance and trading, streamline Zakat distribution, and facilitate faster, more secure cross-border transactions under Islamic principles, reducing fraud and operational costs. Artificial Intelligence (AI) and Machine Learning (ML) are increasingly utilized for sophisticated risk assessment, personalized customer service through chatbots, automated Sharia compliance auditing, and optimizing investment strategies for Islamic funds, ensuring ethical alignment and enhanced performance.

Furthermore, digital platforms, including mobile banking applications and fintech solutions, are revolutionizing accessibility to Islamic financial services, particularly in emerging markets where conventional banking infrastructure may be limited. These platforms facilitate easier access to Islamic microfinance, digital wallets, and online Takaful services. Big data analytics provides crucial insights into customer behavior, market trends, and risk profiles, enabling Islamic financial institutions to develop more tailored and competitive Sharia-compliant products. The integration of these advanced technologies is not only driving operational excellence but also fostering innovation in product development, ensuring the Islamic finance sector remains competitive and relevant in the evolving global financial landscape, all while maintaining its core ethical integrity.

Regional Highlights

- Middle East & Africa (MEA): Dominant region, driven by large Muslim populations, government support for Islamic finance hubs (e.g., UAE, Saudi Arabia, Bahrain), and significant Sukuk issuances.

- Asia Pacific (APAC): Rapidly growing, led by Malaysia and Indonesia, which have established robust regulatory frameworks and diverse product offerings. Pakistan and Bangladesh also show significant potential.

- Europe: Emerging market with increasing interest, particularly in the UK and Luxembourg, which serve as key centers for Islamic finance transactions and asset management for global investors.

- North America: Niche but growing market, primarily catering to Muslim communities seeking Sharia-compliant mortgages, investment funds, and ethical financing options.

- Latin America: Nascent market with significant untapped potential, particularly in countries with growing trade ties to Islamic finance hubs and an interest in ethical investment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Islamic Finance Market.- Al Rajhi Bank

- Kuwait Finance House (KFH)

- Dubai Islamic Bank

- Maybank Islamic Berhad

- Qatar Islamic Bank (QIB)

- Abu Dhabi Islamic Bank (ADIB)

- Bank Islam Malaysia Berhad

- CIMB Islamic Bank Berhad

- Boubyan Bank

- HSBC Amanah

- Standard Chartered Saadiq

- Al Baraka Banking Group

- Saudi National Bank

- Bank Syariah Indonesia

- Wahed Invest

- FWU AG (Takaful)

- Etiqa Takaful

- Islamic Development Bank (IsDB)

- National Commercial Bank (NCB)

- Turk Ekonomi Bankasi (TEB) Katilim Bankasi

Frequently Asked Questions

What is Islamic Finance and how does it differ from conventional finance?

Islamic Finance adheres to Sharia principles, prohibiting interest (riba), excessive uncertainty (gharar), and speculative activities. It emphasizes ethical investments, risk-sharing, and asset-backed transactions, fostering real economic activity, unlike conventional finance which is primarily debt-based and interest-driven.

What are the primary drivers for the growth of the Islamic Finance Market?

Key drivers include the large and growing global Muslim population, increasing government support and regulatory frameworks, a global demand for ethical and socially responsible investments, and the perceived stability of Sharia-compliant financial models during economic fluctuations.

What are Sukuk and how are they used?

Sukuk are Sharia-compliant bonds representing ownership in a tangible asset or a business venture, rather than a debt obligation. They are used by governments and corporations to raise capital for projects, infrastructure, and general financing in a way that aligns with Islamic ethical investment principles.

How is technology, particularly AI, impacting the Islamic Finance Market?

AI is enhancing Sharia compliance verification, improving risk management models, personalizing financial advisory, automating Zakat calculations, and streamlining operational efficiency. It supports innovation in product development and fraud detection, all while striving to maintain ethical integrity.

Which regions are leading the growth in the Islamic Finance Market?

The Middle East and Africa (MEA), particularly the GCC countries, remain dominant. Asia Pacific, led by Malaysia and Indonesia, shows rapid growth and innovation. Europe and North America represent emerging markets with increasing interest in Sharia-compliant financial products.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager