ISO 27001 Certification Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438595 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

ISO 27001 Certification Market Size

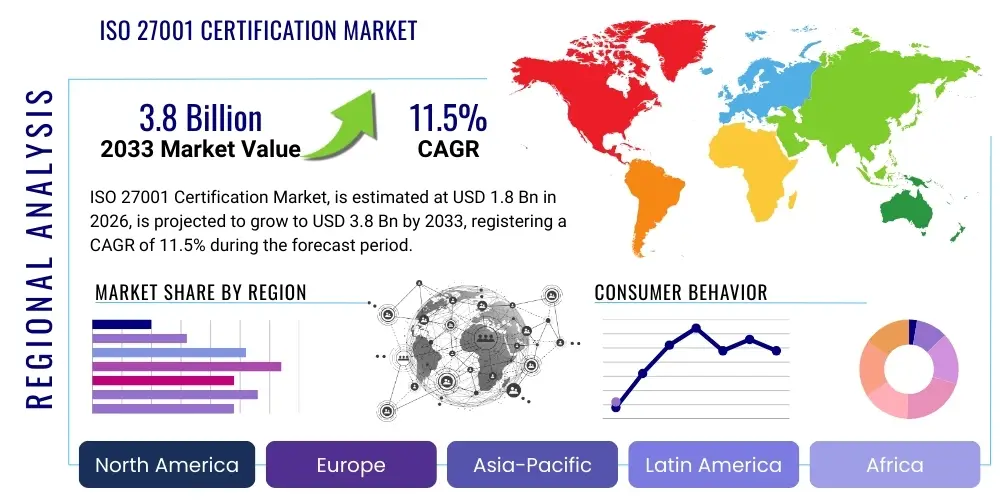

The ISO 27001 Certification Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 3.8 Billion by the end of the forecast period in 2033.

ISO 27001 Certification Market introduction

The ISO 27001 Certification Market centers on the assessment, implementation, and auditing services required for organizations to achieve and maintain certification for the internationally recognized standard for Information Security Management Systems (ISMS). This standard, published by the International Organization for Standardization (ISO) and the International Electrotechnical Commission (IEC), provides a framework of policies and procedures encompassing legal, physical, and technical controls involved in an organization's information risk management processes. Given the exponential rise in cyber threats, increasingly stringent regulatory environments like GDPR, CCPA, and evolving industry-specific compliance requirements, the adoption of ISO 27001 has become a critical business imperative, moving beyond mere compliance to becoming a foundational element of organizational resilience and trust.

The primary services driving this market include initial gap analysis, implementation support, internal audit preparation, formal external certification audits, and subsequent surveillance audits. Major applications span across almost every industry, particularly those handling sensitive customer data, financial transactions, or critical infrastructure, such as Banking, Financial Services, and Insurance (BFSI), Information Technology (IT) and Telecom, Healthcare, and governmental bodies. Key product offerings involve advisory services to tailor the ISMS framework to specific organizational needs and accredited certification services provided by registrars. The benefits derived from certification are substantial, including enhanced security posture, improved legal compliance, competitive advantage in B2B transactions requiring proof of security, and significant reduction in potential data breach liabilities, thereby increasing organizational reputation and stakeholder confidence.

Driving factors propelling this market expansion include the continuous digital transformation across industries, making data assets more voluminous and distributed; the escalating sophistication and frequency of ransomware and advanced persistent threats (APTs); and global regulatory harmonization pushing for standardized information security practices. Furthermore, supply chain risk management is increasingly demanding that vendors demonstrate certified security controls, leading to a cascading requirement for ISO 27001 certification among Small and Medium-sized Enterprises (SMEs) that serve larger corporations. The necessity to demonstrate proactive risk management to insurance carriers to obtain favorable cyber insurance premiums further solidifies the essential nature of this certification in the contemporary business environment.

ISO 27001 Certification Market Executive Summary

The ISO 27001 Certification Market is characterized by robust growth, driven primarily by the global shift toward standardized risk management and the imperative to meet evolving regulatory mandates such as data residency requirements and privacy regulations. Current business trends indicate a strong move from traditional, reactive security measures towards integrated, proactive ISMS frameworks, often incorporating technologies like advanced threat detection and cloud-native security controls, which enhances the scope and complexity of the certification process. Service providers are increasingly specializing in vertical-specific compliance, offering tailored ISO 27001 implementation roadmaps for sectors like FinTech and MedTech, where regulatory overlap is significant. This specialization is fostering consolidation among smaller consulting firms and driving major players to enhance their digital audit capabilities, leveraging technology to streamline assessment and surveillance activities, particularly for globally distributed clients.

Regional trends demonstrate North America and Europe retaining dominant market shares due to early and stringent regulatory environments (e.g., HIPAA in the US, GDPR in the EU) and high organizational maturity regarding cybersecurity investment. However, the Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) due to rapid digitalization, burgeoning technological adoption in developing economies, and the initiation of comprehensive data privacy laws in countries like India, China, and Australia. The Middle East and Africa (MEA) market is showing accelerated adoption, largely influenced by government-led digital initiatives and significant investments in critical national infrastructure security, necessitating international benchmarks like ISO 27001 to ensure interoperability and trust.

Segmentation analysis highlights that the Audit & Certification Services segment holds the largest revenue share, reflecting the non-negotiable requirement for external verification by accredited bodies. In terms of Organization Size, Large Enterprises remain the primary revenue source due to complexity and scale of operations, yet the SME segment is the fastest growing, spurred by supply chain pressure and the accessibility of tailored, modular certification packages. Industry Vertical analysis confirms the dominance of the IT & Telecom sector, given their core business revolving around data processing and storage, followed closely by the BFSI sector, where regulatory scrutiny on financial data protection is exceptionally high. Future segment growth is expected to concentrate heavily within cloud service providers and the nascent Internet of Things (IoT) ecosystem, where establishing trust through certified controls is paramount to widespread adoption.

AI Impact Analysis on ISO 27001 Certification Market

User inquiries regarding AI's impact on ISO 27001 certification often revolve around three core themes: the challenge of integrating AI ethics and data bias into the ISMS framework, the use of AI tools to automate and enhance the auditing process, and the necessary updates to Annex A controls (A.14 System acquisition, development, and maintenance) to govern AI models securely. Users are keen to understand if current ISO 27001 controls are sufficient to manage the inherent risks associated with algorithmic decision-making, the security of training data, and the potential for model poisoning attacks. Expectations are high that AI will significantly streamline the continuous monitoring aspect of ISMS, moving organizations beyond static annual audits to real-time risk assessments. However, concern remains about certifying the trustworthiness and explainability of AI systems themselves, necessitating guidance on defining "secure AI implementation" within the context of the standard.

The rise of Generative AI (GenAI) introduces new dimensions of risk, particularly concerning intellectual property leakage through prompts and the potential for advanced social engineering attacks powered by deepfakes, which mandates a reassessment of organizational policies (A.6 Organizational Information Security) and operational controls (A.12 Operations Security). Certifying bodies and auditors are investigating how to leverage AI tools, specifically Natural Language Processing (NLP) and Machine Learning (ML), to analyze vast policy documents and identify non-conformities faster, potentially reducing audit duration and human error. This technological shift is compelling certification providers to rapidly upskill their audit teams in AI governance, data science ethics, and model risk management, ensuring that the integrity of the ISMS certification process keeps pace with technological evolution.

Ultimately, AI is acting as both a critical risk factor that organizations must control under ISO 27001 (requiring updates to risk treatment plans) and a transformative tool for the market itself. The market will see a bifurcation of services: implementation consultants will focus on creating specialized AI governance frameworks compliant with emerging AI regulations (like the EU AI Act) and integrating them seamlessly into the core ISMS; simultaneously, audit service providers will adopt AI-driven continuous compliance monitoring tools, enabling predictive identification of control failures before they manifest as critical vulnerabilities. This duality ensures that the relevance and stringency of ISO 27001 are maintained even as information security threats become increasingly automated and complex.

- AI integration necessitates specific risk treatment plans for model governance, training data security, and algorithmic bias.

- Generative AI introduces new attack vectors, requiring policy updates related to prompt engineering and intellectual property protection.

- AI tools accelerate audit efficiency by automating policy review and non-conformity detection, enhancing continuous monitoring capabilities.

- New ISO 27001 guidance (potentially within the ISO 27000 family) is required to define secure development and deployment lifecycles for AI systems.

- The market is adapting by offering specialized AI-centric ISMS implementation and assurance services.

DRO & Impact Forces Of ISO 27001 Certification Market

The ISO 27001 Certification Market is primarily driven by the escalating global cybersecurity landscape, where the financial and reputational costs associated with data breaches far outweigh the investment in certification. Increased regulatory pressure globally, especially in sectors like finance and healthcare, mandates verifiable security controls, positioning ISO 27001 as the preferred international benchmark. However, this growth is constrained by significant barriers, notably the high initial investment required for implementing comprehensive ISMS controls, which can disproportionately impact SMEs, and a persistent global shortage of qualified cybersecurity professionals needed to manage and maintain the certified system. Opportunities are abundant, fueled by the accelerating adoption of cloud technologies, demanding certification for cloud security providers and users, and the emerging field of operational technology (OT) security, where convergence with IT security necessitates a unified framework like ISO 27001.

The key restraining force remains the complexity and time commitment involved in maintaining the ISMS, which requires continuous organizational commitment and resource allocation, often perceived as a bureaucratic overhead rather than a strategic asset by some leadership teams. Furthermore, market confusion arising from overlapping regional standards and the proliferation of complementary frameworks (e.g., SOC 2, NIST) can complicate the decision-making process for organizations seeking international coverage. Despite these restraints, the opportunity to integrate ISO 27001 compliance with other quality management systems (like ISO 9001) is attracting organizations seeking integrated governance, risk, and compliance (GRC) solutions, enhancing the certification value proposition and streamlining audit cycles, thereby mitigating some of the resource strain.

The impact forces are fundamentally centered around digital trust and supply chain assurance. As global commerce becomes increasingly interconnected, large organizations are mandating ISO 27001 certification for their entire third-party vendor ecosystem, pushing market penetration rapidly down the supply chain. This supply chain pressure acts as a powerful, non-regulatory driver. Additionally, the increasing demand for data sovereignty and resilience in the face of geopolitical instability positions ISO 27001, with its robust risk assessment methodology, as a crucial tool for business continuity and disaster recovery planning. These impact forces ensure that demand for certification services is not cyclical but rather sustained and foundational to global economic activity.

The following summarizes the major forces shaping the market trajectory:

Drivers:

- Escalating Frequency and Sophistication of Cyber Attacks: The constant threat of ransomware, phishing, and zero-day exploits necessitates a structured, globally recognized defense framework.

- Expansion of Data Privacy Regulations (GDPR, CCPA, etc.): Legal mandates require organizations to demonstrate due diligence and verifiable security controls over personal data, with ISO 27001 often fulfilling these evidence requirements.

- Supply Chain Risk Management Imperatives: Major corporations require their vendors and third parties to hold ISO 27001 certification to ensure inherited risks are minimized.

- Growing Adoption of Cloud Services: Cloud Service Providers (CSPs) and users require certified security frameworks to ensure multi-tenant and data security controls are rigorously maintained.

Restraints:

- High Initial Implementation and Maintenance Costs: The financial burden of documentation, control implementation, and continuous monitoring can deter Small and Medium-sized Enterprises (SMEs).

- Shortage of Skilled ISMS Professionals and Auditors: Difficulty in finding and retaining internal personnel and external consultants proficient in implementing and auditing the complex standard.

- Perceived Bureaucracy and Documentation Overhead: The extensive requirements for documentation and evidence collection can be viewed as administratively heavy, diverting resources from core business activities.

Opportunities:

- Integration with GRC Platforms and Automation Tools: Leveraging technology to automate monitoring, evidence collection, and internal auditing processes, reducing human resource dependency.

- Demand for OT/IoT Security Certification: Applying the ISO 27001 framework to secure Industrial Control Systems (ICS) and widespread IoT deployments as these systems increasingly connect to corporate networks.

- Market Penetration in Emerging Economies: Rapid digitalization in APAC and MEA generates a massive, untapped market for initial certification services.

Impact Forces:

- Digital Trust as a Competitive Differentiator: Certification moves beyond compliance, becoming a necessary tool for building stakeholder confidence and securing competitive bids.

- Cyber Insurance Requirements: Insurers increasingly require robust, certified ISMS evidence (like ISO 27001) to offer favorable premiums or coverage, institutionalizing the need for the standard.

Segmentation Analysis

The ISO 27001 Certification Market is primarily segmented based on the type of service offered, the size of the organization seeking certification, and the industry vertical to which the organization belongs. The segmentation reflects the diverse needs and maturity levels of global organizations tackling information security management. The Type segment provides insight into the revenue generated from advisory services versus formal auditing, showcasing the continuous demand for both foundational support (implementation) and external assurance (certification). Organization Size highlights the crucial distinction between the resource intensive, large-scale ISMS deployment required by global enterprises and the modular, accelerated certification path increasingly sought by resource-constrained SMEs.

The Industry Vertical segmentation is critical as information security requirements vary dramatically across sectors; for instance, Healthcare requires extreme emphasis on patient data confidentiality, while BFSI demands robust controls over financial transaction integrity and resilience. Consulting and certification providers are tailoring their offerings to address sector-specific regulatory overlays (e.g., PCI DSS for Retail, HIPAA for Healthcare), creating specialized sub-segments within the broader market. This market structure allows service providers to optimize their delivery models, offering high-touch, customized consulting for large, regulated entities and standardized, scalable solutions for the booming SME market driven by supply chain mandates.

The growth trajectory within these segments indicates a future focus on continuous compliance and integration services, moving away from purely point-in-time audit services. As organizations achieve initial certification, the demand shifts towards surveillance, re-certification, and services focused on integrating new technologies (like cloud and AI governance) into the existing ISMS framework, sustaining revenue streams for market players throughout the forecast period. The increasing standardization of security requirements globally reinforces the central role of ISO 27001 as a universal security language, underpinning these segmented service offerings.

- By Type:

- Gap Analysis & Assessment Services

- Implementation & Advisory Services

- Audit & Certification Services

- Surveillance & Re-certification Services

- By Organization Size:

- Small & Medium-sized Enterprises (SMEs)

- Large Enterprises

- By Industry Vertical:

- IT & Telecom

- Banking, Financial Services, and Insurance (BFSI)

- Healthcare and Pharmaceuticals

- Government and Public Sector

- Retail and E-commerce

- Manufacturing and Industrial

- Energy and Utilities

- Others (Education, Media)

Value Chain Analysis For ISO 27001 Certification Market

The value chain for the ISO 27001 Certification Market commences with upstream analysis involving the development of the standard itself by the ISO/IEC JTC 1/SC 27 committee, followed by the accreditation bodies (like UKAS, ANAB) that ensure the competence and impartiality of certification bodies (CBs). The upstream phase is characterized by knowledge creation, standardization, and regulatory oversight, ensuring uniformity and reliability across the global certification landscape. Key activities in this phase include maintaining the accreditation of auditors and defining the scope and rules of the ISMS standard, which dictates the quality and credibility of the downstream services.

The midstream segment involves the implementation and advisory services provided by independent consultants, systems integrators, and software vendors. Consultants assist organizations (the eventual certified entity) in performing gap analysis, defining the ISMS scope, drafting policies, implementing controls, and conducting internal audits. This phase is crucial for tailoring the generic ISO 27001 requirements to the specific operational and risk environment of the client. Distribution channels are varied, including direct engagement between consulting firms and clients, and indirect channels such as partnerships where IT service providers bundle ISO 27001 readiness services with other enterprise solutions.

The downstream stage is centered on the formal certification process, where accredited Certification Bodies (CBs) execute the external Stage 1 and Stage 2 audits, issue the certificate, and conduct mandatory surveillance audits over the typical three-year cycle. These services are delivered almost exclusively via direct channels by the accredited CBs to maintain audit integrity and impartiality. Downstream analysis also includes the end-users (the certified organizations) who leverage the certification for marketing, compliance demonstration, and risk reduction. The continuous feedback loop from auditors to the standards committee helps refine the standard, making the value chain cyclical and ensuring relevance against evolving threats and technologies.

ISO 27001 Certification Market Potential Customers

Potential customers for ISO 27001 certification services encompass any organization that relies on information assets for its operational viability, particularly those that handle sensitive or regulated data. End-users span the full spectrum of the economy, ranging from global technology firms managing vast cloud infrastructure to local hospitals protecting patient records. The primary buyers are typically Information Security Managers, Chief Information Security Officers (CISOs), Compliance Officers, and sometimes Chief Financial Officers (CFOs) or Chief Risk Officers (CROs), depending on the organizational prioritization of security and compliance, recognizing the certification as a core risk management investment.

The fastest-growing cohort of buyers is comprised of SMEs operating within the supply chain of large, regulated corporations. These smaller entities often require certification not for direct regulatory compliance, but because their key business contracts mandate it as a prerequisite for partnership or vendor status. Additionally, governmental agencies globally are major consumers, using ISO 27001 as a benchmark for securing critical infrastructure and citizen data, often requiring contractors to adhere to similar standards. The decision to purchase certification services is often triggered by a critical event, such as a major data breach in their industry, a new regulatory deadline, or the need to enter a new, highly-regulated geographical market, making the perceived risk reduction the central purchasing driver.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 3.8 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BSI Group, LRQA, SGS, Intertek, TUV SUD, DNV GL, Bureau Veritas, NQA, ISO Quality Services, Alcumus, Schellman & Co., A-LIGN, Coalfire, ControlCase, Secureworks, EY, KPMG, Deloitte, PwC, Grant Thornton, Control Risks. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

ISO 27001 Certification Market Key Technology Landscape

The technology landscape supporting the ISO 27001 certification market is increasingly characterized by automation, integration, and continuous compliance monitoring tools. Organizations are moving away from manual, spreadsheet-driven ISMS management towards specialized Governance, Risk, and Compliance (GRC) software platforms designed specifically to map organizational controls directly to the ISO 27001 Annex A requirements, automating evidence collection and internal audit functions. These platforms centralize documentation, risk registers, incident response data, and policy distribution, significantly reducing the administrative burden associated with maintaining the ISMS and preparing for surveillance audits. Adoption of such GRC tools is critical for large enterprises managing multiple certifications or complex, geographically dispersed scopes.

Furthermore, the emergence of AI and Machine Learning (ML) technologies is impacting both the delivery of services and the controls themselves. On the service delivery side, certification bodies are leveraging automated compliance checkers and security posture dashboards fed by continuous configuration auditing (CCA) tools to provide auditors with real-time risk indicators, shifting the audit focus from paper trail verification to operational effectiveness verification. Organizations, in turn, are deploying advanced Security Information and Event Management (SIEM) and Security Orchestration, Automation, and Response (SOAR) platforms, which, while not strictly part of ISO 27001, are essential technical controls (A.12, A.14) that must be documented and maintained within the ISMS scope, driving technological investment.

Cloud management technologies and DevSecOps tools also play a pivotal role, particularly for organizations using public cloud infrastructure. Tools providing cloud security posture management (CSPM) and ensuring 'infrastructure as code' security are crucial for demonstrating compliance with ISO 27001 controls related to change management, development security, and operational security in cloud environments. The technological emphasis is shifting towards proving continuous compliance through integrated tools that automatically generate audit trails, rather than relying solely on periodic human intervention, enhancing both the security outcome and the efficiency of the certification process.

Regional Highlights

The global market for ISO 27001 certification demonstrates significant regional variance driven by regulatory maturity, digitalization rates, and the density of highly regulated industries.

- North America: This region maintains a substantial market share, not primarily driven by ISO 27001 mandates, but by the business necessity to meet extensive security requirements imposed by domestic regulations (e.g., HIPAA, SOC 2, various state-level data privacy acts) and by the high concentration of technology and financial services companies. Organizations often pursue ISO 27001 certification strategically to provide a unified framework that encompasses multiple domestic compliance obligations, especially for multinational operations. The high maturity level means the market focuses heavily on re-certification, integration services, and advanced controls related to cloud security and operational resilience.

- Europe: Europe represents a highly mature and leading market, largely due to the pervasive influence of the General Data Protection Regulation (GDPR). GDPR’s requirement for organizations to demonstrate appropriate technical and organizational measures for data protection has directly fueled the adoption of ISO 27001 as the most credible demonstrative mechanism. Furthermore, regional frameworks like the NIS Directive (Network and Information Systems) and impending European Union legislation on AI governance (EU AI Act) will continue to push critical infrastructure providers and technology firms towards standardized ISMS frameworks, ensuring consistent, high growth driven by mandatory compliance across the continent.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region. This explosive growth is attributed to rapid economic digitalization, massive foreign investment, and the recent introduction of sophisticated data privacy and cybersecurity laws across major economies (e.g., Singapore’s PDPA, India’s Digital Personal Data Protection Act, and stricter Chinese cybersecurity laws). These developments are forcing domestic companies to quickly align with international security standards to compete globally. Japan, South Korea, and Australia remain high-maturity markets, while Southeast Asia and India present vast opportunities for initial certification and implementation services, often targeting the growing SME sector facing multinational supply chain demands.

- Latin America: This region is characterized by steady, moderate growth, primarily concentrated in economic hubs like Brazil and Mexico. The adoption is driven by increasing regional data privacy focus (e.g., Brazil's LGPD) and the need for organizations to align with US and European trade partners' security expectations. Certification demand is strong in the BFSI and telecommunications sectors, but market penetration is constrained by varying levels of regulatory enforcement and economic volatility.

- Middle East and Africa (MEA): Growth in MEA is accelerating, driven by large-scale government digital transformation projects (Vision 2030 in Saudi Arabia and UAE) and significant investment in critical national infrastructure, including energy and finance. Governments often mandate ISO 27001 certification for contractors and national entities to secure digital assets. While South Africa and the Gulf Cooperation Council (GCC) countries lead the adoption, the market is characterized by substantial untapped potential across the wider African continent, where data protection laws are still emerging but rapidly gaining traction.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the ISO 27001 Certification Market.- BSI Group

- LRQA (Lloyd's Register Quality Assurance)

- SGS SA

- Intertek Group plc

- TUV SUD

- DNV GL

- Bureau Veritas

- NQA (National Quality Assurance)

- ISO Quality Services Ltd

- Alcumus Group

- Schellman & Co.

- A-LIGN

- Coalfire Systems, Inc.

- ControlCase

- Secureworks

- EY (Ernst & Young)

- KPMG International

- Deloitte Touche Tohmatsu Limited

- PwC (PricewaterhouseCoopers)

- Grant Thornton International Ltd

Frequently Asked Questions

Analyze common user questions about the ISO 27001 Certification market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver of ISO 27001 market growth globally?

The primary driver is the accelerating frequency and severity of global cyberattacks, coupled with increasingly stringent data privacy regulations (like GDPR and CCPA) that mandate demonstrable, internationally recognized security controls.

How does ISO 27001 certification benefit Small and Medium-sized Enterprises (SMEs)?

ISO 27001 provides SMEs with a crucial competitive advantage by enabling them to meet the mandatory security requirements imposed by larger corporate partners and government contracts, thereby securing their position in the global supply chain.

What role does AI technology play in the future of ISO 27001 auditing?

AI is increasingly used to automate continuous monitoring and evidence collection for ISMS compliance, enabling auditors to focus on risk-based assessments and enhancing the efficiency and real-time validity of the certification process.

Which service segment holds the largest revenue share in the market?

The Audit & Certification Services segment holds the largest revenue share, as external verification by accredited Certification Bodies (CBs) is a mandatory, non-discretionary component of achieving and maintaining ISO 27001 compliance over time.

What are the main regional growth opportunities for ISO 27001 services?

The Asia Pacific (APAC) region presents the strongest growth opportunities due to rapid digitalization, significant foreign investment, and the recent implementation of comprehensive national data protection acts across major emerging economies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager