ISO and ANSI Pumps Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435564 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

ISO and ANSI Pumps Market Size

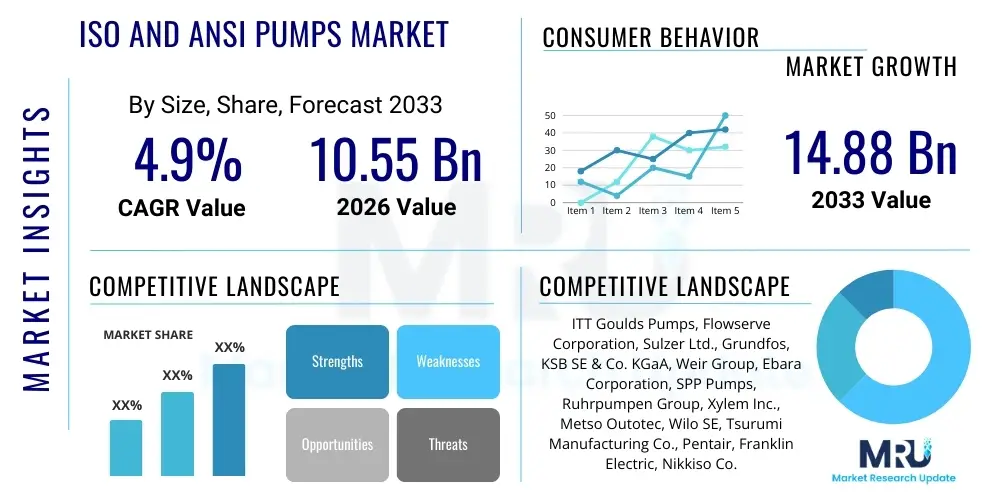

The ISO and ANSI Pumps Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.85% between 2026 and 2033. The market is estimated at USD 10.55 Billion in 2026 and is projected to reach USD 14.88 Billion by the end of the forecast period in 2033.

ISO and ANSI Pumps Market introduction

The ISO and ANSI Pumps market encompasses a broad range of centrifugal pumps manufactured according to stringent international (ISO 2858, ISO 5199) and American national standards (ANSI/ASME B73.1). These standardized specifications ensure dimensional interchangeability, robust performance, and reliability, making them the preferred choice across demanding industrial processes. ISO and ANSI pumps are predominantly single-stage, end-suction centrifugal pumps, designed specifically to handle various liquid media, including corrosive chemicals, hydrocarbons, and non-abrasive fluids, crucial for maintaining operational uptime in complex manufacturing environments.

The core product description revolves around their standardized construction, which facilitates ease of maintenance and replacement across diverse operational sites globally. Key features include back pull-out design for simplified servicing without disturbing piping or motor connections, and heavy-duty shaft and bearing assemblies capable of handling high loads and continuous operation. Major applications span critical infrastructure and process industries, including chemical processing, oil and gas refining, power generation, pharmaceutical manufacturing, and comprehensive water treatment facilities. Their standardization significantly reduces inventory requirements for spare parts and streamlines supply chain logistics for large industrial operators.

The primary benefits driving market adoption include enhanced operational efficiency, superior mean time between failures (MTBF), and lower total cost of ownership (TCO) resulting from robust design and materials like stainless steel, ductile iron, and specialized alloys tailored for specific fluid compatibility. Market growth is fundamentally driven by global infrastructure expansion, increasing demand for refined petroleum products and specialty chemicals, and stringent environmental regulations necessitating high-efficiency pumping solutions in municipal and industrial water management sectors. Furthermore, the inherent reliability of these standardized pumps supports the trend toward automated, continuous production processes.

ISO and ANSI Pumps Market Executive Summary

The ISO and ANSI Pumps market is characterized by robust resilience fueled by essential industrial demand, exhibiting significant business trends centered on technological integration and sustainability. A major trend involves the increased adoption of intelligent pumping systems, incorporating IoT sensors and Variable Speed Drives (VSDs) to optimize energy consumption and enable predictive maintenance, thereby aligning with global sustainability initiatives and lowering long-term operating costs for end-users. Consolidation among major original equipment manufacturers (OEMs) seeking to expand global service networks and specialized product portfolios remains a defining feature of the competitive landscape, pushing smaller players toward niche material or application specialization.

Regionally, the market dynamics are heavily skewed towards Asia Pacific (APAC), which serves as the leading growth engine due to rapid industrialization, large-scale infrastructure projects, particularly in chemical and power generation sectors, and substantial investments in municipal water infrastructure in emerging economies like China, India, and Southeast Asian nations. North America and Europe, while mature markets, emphasize replacement demand and compliance with strict energy efficiency standards (such as EU regulations concerning Minimum Efficiency Index – MEI), driving demand for retrofitting existing pump fleets with modern, energy-saving designs and digitized monitoring capabilities. The Middle East remains a key region, driven by capital expenditure in the oil and gas upstream and downstream processing sectors, requiring high-pressure, corrosion-resistant ANSI standard pumps.

Segmentation trends indicate accelerating demand for pumps constructed from exotic alloys, particularly Hastelloy and titanium, driven by the expanding specialty chemicals and high-purity pharmaceutical industries where extreme corrosion resistance is paramount. Furthermore, the centrifugal segment maintains overwhelming dominance due to the versatile and robust nature of standardized centrifugal pumps in high-flow applications. Service and maintenance contracts are also growing rapidly as industrial operators prioritize maximizing asset uptime and outsourcing complex preventative maintenance, shifting focus from initial pump purchase price to long-term reliability and service support packages provided by key market participants.

AI Impact Analysis on ISO and ANSI Pumps Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the ISO and ANSI Pumps Market frequently center on predictive maintenance capabilities, efficiency optimization, and design automation. Users are highly interested in how AI algorithms analyze complex operational data—such as vibration spectra, temperature fluctuations, and pressure readings—to predict component failure weeks or months in advance, minimizing unscheduled downtime which is highly costly in continuous process industries. Concerns often revolve around the security and integration complexity of large-scale AI-driven monitoring systems (Industrial IoT), and the necessary standardization of data protocols across disparate pump models and brands to ensure seamless interoperability.

The primary expectation is that AI will fundamentally transform the service and maintenance landscape, shifting the industrial paradigm from time-based maintenance to condition-based, predictive strategies. Furthermore, users anticipate that AI will aid in hydraulic performance optimization during the design phase, using computational fluid dynamics (CFD) enhanced by machine learning to model performance under varying operational conditions faster and more accurately than traditional methods. This analytical capability is expected to lead to the development of highly customized, yet still standards-compliant, pump designs that offer maximum efficiency for specific operational points, addressing the continuous industry pressure to reduce energy footprints and operational costs.

In the near term, AI implementation is also expected to significantly optimize manufacturing supply chains and inventory management. By analyzing global demand patterns, component lead times, and potential disruptions, AI systems can ensure that spare parts, particularly standardized ISO/ANSI components like mechanical seals and impellers, are optimally stocked and delivered precisely when needed. This logistical enhancement directly supports the promise of reduced TCO and improved asset reliability, solidifying AI as a critical enabler of the next generation of smart manufacturing and maintenance practices within the industrial pump ecosystem.

- AI enhances predictive maintenance by analyzing vibration and thermal signatures to anticipate pump failure.

- Machine Learning (ML) algorithms optimize operational efficiency by dynamically adjusting VSDs based on real-time process demand.

- AI-driven simulation tools accelerate the design and validation of hydraulically optimized impellers and casings, adhering to ISO/ANSI standards.

- Demand forecasting models, powered by AI, improve the accuracy of spare parts inventory management for standardized components.

- Automated fault diagnostics utilize expert systems to guide technicians through complex troubleshooting procedures, reducing repair time.

- Smart commissioning uses AI to analyze installation data and ensure pumps operate within the optimal performance envelope from day one.

DRO & Impact Forces Of ISO and ANSI Pumps Market

The ISO and ANSI Pumps Market is driven by several powerful dynamics, counteracted by inherent industry challenges, while significant long-term opportunities guide strategic investment. Key drivers include the global expansion of midstream and downstream oil and gas infrastructure, particularly in developing economies, which necessitates vast quantities of standardized, reliable pumps for fluid transfer and processing. Concurrent growth in the chemical processing industry, propelled by increasing demand for petrochemicals and specialty chemicals, further strengthens the market base. The primary restraint is the high initial capital expenditure associated with purchasing high-specification, standardized industrial pumps and the corresponding complexity and cost of maintaining large, diverse fleets, often requiring specialized skills and expensive proprietary spare parts. Furthermore, market sensitivity to volatility in crude oil prices and global economic cycles can temporarily suppress large capital projects, impacting new pump sales volumes.

Opportunities are predominantly found in the technological pivot toward energy efficiency and digitalization. The pressure to meet stringent global energy consumption targets provides a substantial opportunity for manufacturers offering advanced, high-efficiency hydraulic designs and integrating smart monitoring capabilities (IoT/Industry 4.0). Retrofitting aging pump infrastructure in mature industrial regions with VSDs and intelligent sensors presents a steady stream of non-cyclical revenue growth. The impact forces acting on the market are highly concentrated around regulatory frameworks, particularly those mandating minimum efficiency standards and environmental compliance (e.g., handling wastewater or toxic fluids), compelling end-users to upgrade to newer, compliant pump technologies, thus continually refreshing the installed base.

Another crucial opportunity lies in the burgeoning water and wastewater treatment sector, driven by increasing population density and stricter governmental mandates concerning water purity and sanitation worldwide. ISO and ANSI pumps are integral to every stage of municipal and industrial water cycles, from intake to discharge. The market's stability is underpinned by the essential, non-discretionary nature of these applications. However, challenges related to material science—specifically, developing cost-effective alloys capable of resisting highly abrasive or extremely corrosive media without compromising the standardization requirements—continue to exert pressure on research and development budgets within the manufacturing sector.

Segmentation Analysis

The ISO and ANSI Pumps market is segmented across several critical dimensions, including pump type, material of construction, application, and geographical region, reflecting the diverse industrial requirements globally. Centrifugal pumps, which include the vast majority of standardized ISO and ANSI designs, dominate the market share due to their high flow rate capabilities, robust design, and suitability for handling low viscosity fluids across almost all process industries. However, the positive displacement segment, while smaller, is critical for niche applications requiring high pressure or handling high-viscosity fluids or precise metering, often standardized indirectly to interface seamlessly with ISO/ANSI piping structures. Understanding these segment dynamics is essential for strategic planning, allowing manufacturers to tailor their production, marketing, and distribution strategies to specialized end-user needs and regional regulatory frameworks.

- By Standard:

- ANSI/ASME B73.1 (North American focused, typically chemical process pumps)

- ISO 2858/5199 (Global standard, typically heavy-duty process pumps)

- By Type:

- Centrifugal Pumps (End Suction, Horizontal, Vertical In-line)

- Positive Displacement Pumps (Gear, Screw, Diaphragm – used in auxiliary standardized systems)

- By Material:

- Cast Iron and Ductile Iron

- Stainless Steel (304, 316, Duplex)

- Exotic Alloys (Hastelloy, Titanium, Nickel Alloys)

- Non-metallic (PTFE Lined, Composites)

- By End-User Application:

- Chemical and Petrochemical Processing

- Oil and Gas (Upstream, Midstream, Downstream)

- Water and Wastewater Treatment

- Power Generation (Conventional and Nuclear)

- Pharmaceuticals and Food & Beverage

- General Industries (Pulp & Paper, Textiles)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LAMEA)

- Middle East & Africa (MEA)

Value Chain Analysis For ISO and ANSI Pumps Market

The value chain for the ISO and ANSI Pumps market begins with upstream activities focused heavily on raw material sourcing and precision component manufacturing. This stage involves the procurement of high-grade metals—specifically specialized stainless steels, ductile iron, and increasingly, nickel and titanium alloys—from foundries and primary metal suppliers. Quality control at this initial stage is paramount, as the materials must withstand extreme corrosion, abrasion, and high temperatures inherent in process industries. Key upstream suppliers include major metal producers and mechanical seal manufacturers, whose innovations directly influence pump reliability and performance metrics, particularly the Mean Time Between Failures (MTBF). The competitive dynamics at the upstream level are driven by material cost volatility and technological advancement in metal casting and machining.

Midstream activities are dominated by Original Equipment Manufacturers (OEMs) who design, assemble, and rigorously test the pumps according to ISO/ANSI standards. This phase involves extensive engineering capabilities, focusing on hydraulic design optimization, component standardization, and integration of modern technologies such as VSDs and IoT monitoring devices. Manufacturers utilize sophisticated assembly plants and large-scale testing facilities to ensure compliance with stringent performance curves and material traceability requirements. Downstream activities involve distribution channels, which are bifurcated into direct sales to major engineering, procurement, and construction (EPC) firms for large Greenfield projects, and indirect channels relying on extensive networks of industrial distributors, local agents, and system integrators for replacement sales and smaller maintenance contracts.

The distribution network is critical, particularly for the standardized nature of these pumps, where quick access to spare parts is a primary purchasing criterion. Direct channels manage complex relationships with global oil and gas supermajors and major chemical producers, offering customized service agreements and technical support. Indirect channels focus on delivering standardized, readily available units and offering local maintenance services, significantly impacting customer satisfaction and market reach, especially for maintenance, repair, and overhaul (MRO) activities. EPC firms often act as key gatekeepers, specifying pump types and brands during the construction of new plants, heavily influencing long-term market share for OEMs.

ISO and ANSI Pumps Market Potential Customers

Potential customers for ISO and ANSI pumps represent a highly specialized group of industrial entities that rely on continuous, reliable fluid handling for core operations. The primary end-users are large-scale process plant operators where pump failure results in catastrophic financial losses due to production shutdown. Key buyers include global chemical manufacturers requiring corrosion-resistant pumps for acids and solvents, major refineries and petrochemical complexes utilizing standardized pumps for hydrocarbon transfer under high-temperature conditions, and multinational pharmaceutical corporations demanding sanitary and precise pumping solutions, often based on standardized designs for operational uniformity across global sites.

Furthermore, government and private entities involved in critical infrastructure form a significant customer base. Municipal water treatment facilities, desalination plants, and industrial water management providers utilize large volumes of standardized pumps for intake, distribution, filtering, and effluent discharge, where reliability and energy efficiency are paramount due to the scale of operation. Engineering, Procurement, and Construction (EPC) companies also serve as crucial direct buyers, as they select and procure entire pump fleets during the construction phase of new industrial facilities, often prioritizing suppliers who can guarantee adherence to the specific ISO/ANSI standards required by the final plant operator.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 10.55 Billion |

| Market Forecast in 2033 | USD 14.88 Billion |

| Growth Rate | 4.85% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ITT Goulds Pumps, Flowserve Corporation, Sulzer Ltd., Grundfos, KSB SE & Co. KGaA, Weir Group, Ebara Corporation, SPP Pumps, Ruhrpumpen Group, Xylem Inc., Metso Outotec, Wilo SE, Tsurumi Manufacturing Co., Pentair, Franklin Electric, Nikkiso Co., Ltd., CECO Environmental, C.R.I. Pumps, Armstrong Fluid Technology, Baker Hughes (Pumping Solutions). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

ISO and ANSI Pumps Market Key Technology Landscape

The contemporary technology landscape within the ISO and ANSI Pumps market is rapidly evolving beyond core hydraulics, focusing significantly on digitalization and efficiency enhancement to meet Industry 4.0 requirements. A fundamental technological advancement is the integration of Variable Speed Drives (VSDs), which allow operators to dynamically match pump output to fluctuating process demands, leading to substantial energy savings compared to traditional fixed-speed operations. This shift is critical, considering that pumping systems account for a significant portion of industrial electricity consumption. Furthermore, advanced hydraulic modeling techniques, including Computational Fluid Dynamics (CFD), are continually being refined to design impellers and volutes that maximize efficiency while still conforming strictly to the dimensional envelopes dictated by ISO and ANSI standards, ensuring optimal head and flow characteristics.

The most transformative technology permeating this sector is the proliferation of Industrial Internet of Things (IIoT) sensors and robust communication platforms. These systems involve retrofitting or integrating vibration, temperature, pressure, and acoustic sensors directly onto standardized pump frames, often using non-intrusive methods. The data collected is transmitted via secure gateways to cloud-based or on-premise analytical platforms, which employ machine learning for advanced pattern recognition, moving beyond simple alarming to true predictive failure forecasting. This technological shift is driving the service-as-a-product model, where pump reliability is sold as a guaranteed metric rather than just the physical hardware.

Another crucial technological development involves material science and sealing technology. The increasing requirement to handle aggressive and environmentally sensitive fluids necessitates advancements in mechanical seal design, moving towards cartridge seals and dual-seal arrangements that minimize leakage and comply with increasingly strict environmental regulations (e.g., API 682). Simultaneously, the use of composite materials and advanced ceramic coatings is gaining traction, particularly in water and abrasive slurry applications, offering superior wear resistance and corrosion protection compared to traditional metallic construction, extending the operational life of the standardized pump components.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to exhibit the highest growth rate, primarily driven by massive government-led investments in infrastructure, particularly in China, India, and Indonesia. This region is witnessing rapid expansion in chemical manufacturing, refinery capacity upgrades, and establishing large-scale water distribution networks, necessitating standardized, cost-effective ISO and ANSI pumping solutions for both greenfield and brownfield projects.

- North America: This is a mature market characterized by high regulatory standards (especially concerning API and ANSI standards in the oil and gas sector) and a strong emphasis on maintenance and efficiency. Demand is largely driven by replacement cycles, modernization of aging infrastructure (particularly municipal water systems), and the continuous need for high-performance, digitally monitored pumps in the petrochemical and refining industries.

- Europe: The European market is highly regulated, focusing intensely on energy efficiency directives (such as the Minimum Efficiency Index - MEI). This drives sustained demand for premium, high-efficiency standardized pumps equipped with VSDs and intelligent control systems. Key sectors include pharmaceuticals, specialty chemicals (Germany, Switzerland), and stringent wastewater treatment projects.

- Middle East & Africa (MEA): Growth in the MEA region is intrinsically linked to capital expenditure in the oil and gas value chain, requiring extremely robust, standardized ANSI and ISO pumps built for high temperatures and pressures, adhering to stringent regional specifications. Significant investment in desalination and power generation projects across the Gulf Cooperation Council (GCC) countries also fuels demand for large-scale standardized pumping solutions.

- Latin America (LAMEA): This region presents moderate growth, tied to fluctuating commodity prices and infrastructure spending, particularly in Brazil and Mexico. Demand stems from the mining, oil extraction, and agricultural processing sectors, where reliable, easily serviceable standardized pumps are essential for minimizing downtime in remote or challenging operational environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the ISO and ANSI Pumps Market.- Flowserve Corporation

- ITT Goulds Pumps

- KSB SE & Co. KGaA

- Sulzer Ltd.

- Ebara Corporation

- Weir Group

- Grundfos

- Ruhrpumpen Group

- Xylem Inc.

- SPP Pumps

- Metso Outotec

- Wilo SE

- Tsurumi Manufacturing Co., Ltd.

- Pentair

- Franklin Electric

- Nikkiso Co., Ltd.

- CECO Environmental

- C.R.I. Pumps

- Armstrong Fluid Technology

- Baker Hughes (Pumping Solutions)

Frequently Asked Questions

Analyze common user questions about the ISO and ANSI Pumps market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between ISO and ANSI standardized pumps?

ISO (International Organization for Standardization, specifically ISO 2858 and 5199) standards are globally recognized, focusing heavily on performance, hydraulic design, and heavy-duty reliability. ANSI (American National Standards Institute, specifically ANSI/ASME B73.1) standards are predominantly focused on dimensional interchangeability and material construction for chemical process applications, ensuring any B73.1 pump can replace another without piping modification, making ANSI popular in North American chemical industries.

How is the efficiency of standardized pumps measured and regulated?

Pump efficiency is primarily measured through the Minimum Efficiency Index (MEI) in Europe and is increasingly regulated globally. High efficiency in standardized ISO and ANSI centrifugal pumps is achieved through advanced hydraulic design (CFD modeling), the application of VSDs, and stringent material specifications. Compliance with MEI and regional energy mandates is a critical factor driving replacement demand in mature markets.

Which industry applications drive the highest demand for specialized material ISO/ANSI pumps?

The chemical processing and specialty petrochemical industries drive the highest demand for specialized material pumps (e.g., exotic alloys like Hastelloy, Titanium, or PTFE-lined pumps). This is due to the need for extreme corrosion resistance and non-contamination when handling aggressive acids, solvents, and highly pure media, ensuring the pump’s structural integrity meets rigorous operational safety standards.

What role does digitalization play in lowering the Total Cost of Ownership (TCO) for industrial standardized pumps?

Digitalization, primarily through IIoT integration and AI-powered predictive maintenance, significantly lowers TCO by drastically reducing unplanned downtime and optimizing energy consumption. By accurately forecasting maintenance needs and running pumps at their most efficient operating point via VSD control, operating expenses and catastrophic failure risks are minimized.

What are the key growth opportunities for ISO and ANSI pump manufacturers in emerging economies?

Key opportunities in emerging economies, particularly in APAC and LAMEA, stem from new infrastructure buildout, including large-scale municipal water treatment projects, expansion of domestic oil refinery capacity, and the construction of new chemical manufacturing hubs. These markets prioritize robust, standardized designs that offer ease of procurement, local servicing support, and long-term operational reliability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager