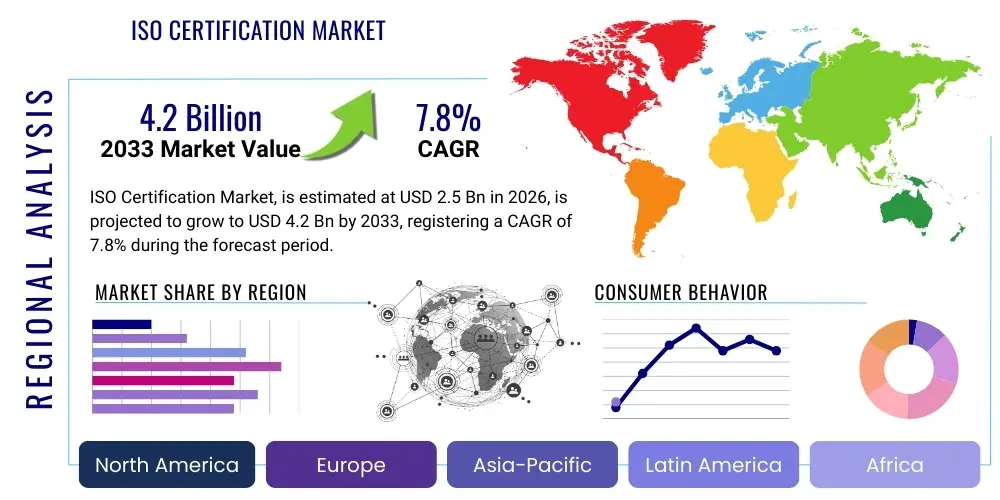

ISO Certification Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439030 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

ISO Certification Market Size

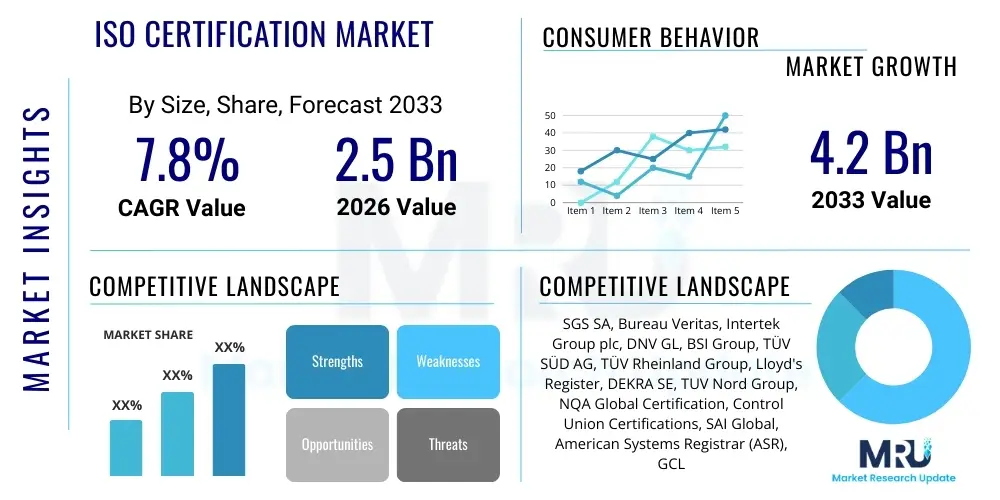

The ISO Certification Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at $2.5 Billion USD in 2026 and is projected to reach $4.2 Billion USD by the end of the forecast period in 2033. This robust expansion is primarily fueled by increasing globalization, stringent international trade regulations that mandate standardized compliance, and the critical need for supply chain integrity across diverse industries. The growth trajectory reflects a shift towards digital auditing methods and specialized certifications addressing modern risks such as information security (ISO 27001) and business continuity (ISO 22301).

ISO Certification Market introduction

The ISO Certification Market encompasses the comprehensive range of services provided by Certification Bodies (CBs) to organizations seeking formal validation of their management systems against standards developed by the International Organization for Standardization (ISO). These services include initial audits, surveillance audits, recertification, and associated training and consulting, enabling organizations to demonstrate conformance to globally recognized benchmarks such as ISO 9001 (Quality Management), ISO 14001 (Environmental Management), and ISO 27001 (Information Security Management). The core product of this market is the formal certificate and the accompanying rigorous audit process that validates an organization's adherence to best practices, ensuring operational efficiency and stakeholder confidence.

Major applications span virtually every economic sector, including manufacturing, IT and telecommunications, healthcare, finance, construction, and government services, driven by the universal need for improved processes, risk mitigation, and access to international markets. The certification process serves as a vital tool for competitive differentiation, often being a prerequisite for governmental contracts or inclusion in large corporate supply chains. Key benefits realized by certified organizations include enhanced product quality, reduced operational waste, increased compliance with legal and regulatory requirements, and greater consumer trust, which collectively drive stronger market performance and long-term sustainability.

The principal driving factors include escalating global trade barriers that necessitate harmonized standards, growing consumer awareness regarding environmental and ethical performance (boosting demand for ISO 14001 and ISO 45001), and the accelerated digitalization of business operations, making information security (ISO 27001) certification mandatory rather than optional for many organizations. Furthermore, the mandatory nature of many certifications for participation in high-value supply chains, particularly in automotive and aerospace sectors, sustains high market demand, positioning the ISO certification ecosystem as a critical pillar of modern industrial governance and trade facilitation.

ISO Certification Market Executive Summary

The ISO Certification Market is characterized by steady growth underpinned by macro-level trends focusing on enterprise risk management, sustainability, and technological integration. Business trends indicate a strong shift toward integrated management systems (IMS) where multiple standards, such as Quality (9001), Environment (14001), and Occupational Health (45001), are audited simultaneously, improving efficiency for multinational corporations. Furthermore, there is a pronounced focus on specialized standards, particularly in digital compliance (ISO 27001 for cybersecurity and ISO 20000 for IT service management), reflecting the increasing threat landscape and regulatory complexity faced by organizations globally. Competition remains high among major international Certification Bodies (CBs), leading to innovations in service delivery, primarily through remote auditing and digital platform integration, aimed at reducing operational costs and enhancing audit quality.

Regional trends highlight the Asia Pacific (APAC) region as the fastest-growing market, largely due to rapid industrialization, stringent governmental mandates concerning quality and safety in developing economies like China and India, and increasing participation in global supply chains. North America and Europe, while mature markets, maintain high revenue share due to the early adoption of standards, robust regulatory oversight, and consistent demand for complex certifications, particularly in regulated industries such as aerospace and medical devices. European markets demonstrate high compliance maturity, particularly driven by directives like the European Green Deal, amplifying demand for sustainability and environmental certifications.

Segment trends reveal that based on standard type, ISO 9001 remains the foundation, holding the largest market share, but ISO 27001 is exhibiting the highest Compound Annual Growth Rate (CAGR) due to pervasive data breaches and global privacy regulations (e.g., GDPR, CCPA). In terms of services, auditing services dominate revenue, but training and consulting services are becoming increasingly critical as small and medium-sized enterprises (SMEs) seek expert guidance to navigate the complexities of multiple certifications. End-use segment analysis shows the IT and Telecommunication sector, followed by the Manufacturing sector, leading the adoption curve, necessitating continuous certification to maintain security posture and operational excellence in a globalized, highly digitized environment.

AI Impact Analysis on ISO Certification Market

User queries regarding the impact of Artificial Intelligence (AI) on the ISO Certification Market primarily revolve around four key themes: the automation of the auditing process, the application of AI in maintaining continuous compliance, the development of new ISO standards specifically addressing AI ethics and governance, and the regulatory challenges AI poses to existing management systems like ISO 27001 and ISO 9001. Users express both excitement about the potential for faster, data-driven audits and concern regarding the potential loss of human judgment and interpretation, which is crucial in subjective audit areas. They seek clarity on how AI-powered tools will integrate with traditional audit practices and if AI can reliably detect complex non-conformities.

The analysis indicates a strong user expectation that AI will transition compliance from reactive annual checks to proactive, real-time monitoring. Specifically, users are interested in AI algorithms analyzing large datasets generated by operational technology (OT) and information technology (IT) systems to predict compliance failures or identify weak controls before an external audit occurs. This shift necessitates that certification bodies (CBs) adopt AI-literate auditors capable of validating AI models used by client organizations, leading to a demand for new auditor training modules focused on algorithmic transparency and bias detection, particularly relevant for emerging standards like ISO/IEC 42001 (AI Management System).

Ultimately, the consensus among prospective clients is that AI will redefine efficiency, transforming the audit into a less intrusive, continuous assurance process, thereby mitigating the costs associated with traditional physical audits. However, stakeholders are keenly focused on ensuring that the use of AI tools adheres to strict ISO guidelines for impartiality and objectivity. The most pressing challenge identified is establishing accredited frameworks for validating the trustworthiness and ethical deployment of AI systems, a task anticipated to significantly drive the adoption and structure of forthcoming AI-specific ISO standards.

- AI enhances risk assessment by analyzing massive data sets for predictive compliance failure indicators.

- Implementation of Continuous Compliance Monitoring (CCM) replacing traditional snapshot audits.

- New standards development, such as ISO/IEC 42001, governing AI management and ethics.

- Automation of documentation review and internal audit tasks, increasing speed and reducing human error.

- Increased need for auditors trained in algorithmic governance and data integrity verification.

- Blockchain integration with AI for immutable certification tracking and supply chain verification.

DRO & Impact Forces Of ISO Certification Market

The ISO Certification Market is propelled by robust Drivers (D), constrained by persistent Restraints (R), and offers significant Opportunities (O), all interacting under the influence of various Impact Forces. The primary driver is the accelerating pressure from global supply chains, where multinational corporations increasingly mandate ISO certification (especially 9001, 14001, and 27001) as a non-negotiable prerequisite for partnership, thereby creating a cascading requirement down to small and medium-sized enterprises (SMEs). Regulatory harmonization efforts across trade blocs also contribute significantly, as standardized compliance reduces barriers to international market access. Furthermore, heightened public awareness concerning corporate social responsibility and environmental sustainability mandates the adoption of standards such as ISO 14001 and ISO 45001, pushing companies to formalize their governance frameworks.

Restraints primarily involve the substantial costs associated with obtaining and maintaining certification, particularly for SMEs, covering consultation fees, internal resource dedication, and the audit fees themselves. Coupled with this is the complexity and bureaucracy inherent in managing multiple standards simultaneously, which can lead to certification fatigue and difficulty in consistently interpreting non-conformance across different geographical regions. Another restraint is the issue of accreditation body proliferation and occasional instances of quality variance among certification bodies, which can undermine the overall credibility of the ISO certificate in certain regional markets, necessitating stronger regulatory oversight and integrity checks within the ecosystem.

Opportunities reside predominantly in the expansion of specialized, niche standards addressing modern societal and technological challenges, such as ISO 27001 (Information Security), ISO 22301 (Business Continuity), and the emerging ISO 42001 (AI Management System). The shift towards remote auditing, accelerated by global events, presents an opportunity for Certification Bodies (CBs) to improve efficiency, reduce travel costs, and expand their geographical reach into previously underserved markets. Moreover, the integration of digital tools like GRC (Governance, Risk, and Compliance) software platforms and blockchain technology for secure certificate issuance and verification offers significant potential for market modernization and value enhancement. These dynamic elements define the market's current momentum and future trajectory.

Segmentation Analysis

The ISO Certification market is comprehensively segmented across Standard Type, Service Type, and End-use Industry, reflecting the varied compliance needs of global organizations. Analysis of the standard type segment confirms that general management systems, such as ISO 9001 (Quality) and ISO 14001 (Environmental), maintain foundational market dominance due to their widespread applicability across all sectors. However, the highest growth is concentrated in specific standards addressing contemporary risks: Information Security (ISO 27001), Occupational Health and Safety (ISO 45001), and emerging standards related to energy management (ISO 50001) and specialized industry requirements (e.g., ISO/TS 16949 for Automotive). This growth pattern signifies a market evolution from baseline quality assurance to specialized risk mitigation.

Service segmentation highlights the ecosystem necessary to support certification adoption. While certification and auditing services represent the core revenue stream, training and consulting services are critical ancillary markets. Consulting services show accelerating demand as organizations, especially SMEs, lack the in-house expertise to develop and implement complex management systems that adhere to multiple ISO standards simultaneously. The growing complexity of integration, such as aligning ISO 27001 with global data privacy laws like GDPR, necessitates specialized consulting, driving high-value service contracts and contributing significantly to the overall market valuation. Remote auditing methodologies are also redefining service delivery efficiency.

- By Standard Type:

- ISO 9001 (Quality Management System)

- ISO 14001 (Environmental Management System)

- ISO 27001 (Information Security Management System)

- ISO 45001 (Occupational Health and Safety Management System)

- ISO 22301 (Business Continuity Management System)

- ISO 13485 (Medical Devices Quality Management System)

- ISO 50001 (Energy Management System)

- Other Specialized Standards (e.g., ISO/TS 16949, ISO 20000)

- By Service Type:

- Certification and Audit Services

- Training Services

- Consulting and Advisory Services

- Implementation Services

- Surveillance and Recertification Services

- By End-use Industry:

- Manufacturing

- IT and Telecommunication

- Healthcare and Medical Devices

- Energy and Utilities

- Construction and Infrastructure

- Transportation and Logistics

- Financial Services

- Government and Public Sector

Value Chain Analysis For ISO Certification Market

The ISO Certification market value chain is structured as a multi-tiered regulatory and service framework designed to ensure impartiality and competence throughout the certification process. The chain begins with the International Organization for Standardization (ISO), which develops and publishes the standards, followed by National Accreditation Bodies (NABs) (e.g., UKAS, ANAB), which sit at the top of the chain. NABs perform upstream analysis by accrediting Certification Bodies (CBs) after verifying their technical competence, impartiality, and adherence to ISO/IEC 17021 standards. This accreditation process is crucial as it underpins the global acceptance and trustworthiness of the final certification.

The Certification Bodies (CBs) constitute the core operational segment of the midstream market, serving as the main interface between the standard setters and the end-user organizations. CBs conduct the actual audit, surveillance, and recertification processes. Downstream analysis focuses heavily on the consulting and training firms, which provide preparatory services to client organizations, assisting them in system implementation and internal auditing before the external CB audit takes place. These consultants act as crucial facilitators, especially for SMEs, translating complex standards into actionable business processes, significantly influencing the client's readiness and success rate during the audit phase.

Distribution channels are categorized into direct and indirect routes. Direct distribution involves CBs engaging directly with large multinational clients, often offering bundled services including audits across multiple geographical locations and standards. Indirect distribution primarily involves partnerships with independent consultants and specialized training providers who refer clients to specific accredited CBs, especially in localized markets. The trend towards digital distribution is strong, involving the use of online platforms and secure digital certificates, streamlining the process and reducing administrative friction for both the CBs and the end-user organizations globally, enhancing the efficiency of the entire value chain.

ISO Certification Market Potential Customers

The primary potential customers and end-users of ISO Certification services span a broad spectrum of organizations, defined by their strategic need to manage risk, ensure quality, and access global markets. Large multinational corporations (MNCs) are consistent high-volume consumers, driven by the mandate to impose standardized management systems across their global subsidiaries and complex supply chains. These organizations typically seek certifications across multiple disciplines, often pursuing integrated management systems (IMS) combining ISO 9001, 14001, and 45001 to demonstrate comprehensive governance to investors, regulators, and consumers.

Small and Medium-sized Enterprises (SMEs) represent a vast, high-growth segment of potential customers. While often deterred by initial costs, SMEs are increasingly compelled to obtain certification, particularly ISO 9001 and ISO 27001, as it becomes a non-negotiable gateway requirement to participate as suppliers to larger corporations or government entities. For SMEs, certification provides credibility and access to markets that were previously inaccessible, making the investment a strategic imperative for expansion and demonstrating commitment to security and quality, especially within the digitized service economy.

Sector-specific customers, particularly those operating in regulated industries such as Healthcare (ISO 13485), Aerospace (AS9100), and Finance (ISO 27001), constitute another critical segment. The public sector, including government agencies and municipal services, is also emerging as a significant buyer, using ISO standards to improve efficiency, transparency, and public service quality, often seeking certifications such as ISO 9001 and specialized anti-bribery standards (ISO 37001) to bolster public trust and institutional integrity.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.5 Billion USD |

| Market Forecast in 2033 | $4.2 Billion USD |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SGS SA, Bureau Veritas, Intertek Group plc, DNV GL, BSI Group, TÜV SÜD AG, TÜV Rheinland Group, Lloyd's Register, DEKRA SE, TUV Nord Group, NQA Global Certification, Control Union Certifications, SAI Global, American Systems Registrar (ASR), GCL International, Advanced Certification, Eurofins Scientific, CQC (China Quality Certification Centre), Perry Johnson Registrars (PJR), QAI Global. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

ISO Certification Market Key Technology Landscape

The ISO Certification Market is undergoing a rapid technological transformation, fundamentally shifting the methodology from resource-intensive, physical audits to highly efficient, data-driven assurance processes. The key technology underpinning this evolution is the deployment of secure, cloud-based auditing platforms. These platforms enable Certification Bodies (CBs) to conduct remote audits using secure video conferencing, shared digital documentation repositories, and real-time data access, significantly reducing travel costs and audit duration. Furthermore, integrated Governance, Risk, and Compliance (GRC) software suites are crucial for potential customers, allowing them to manage their documentation, internal audits, and control frameworks seamlessly, ensuring continuous readiness for external audits and providing CBs with auditable evidence instantaneously.

Another major technological advancement involves the integration of advanced data analytics and Artificial Intelligence (AI) tools. AI is being utilized to analyze large volumes of client performance data, internal audit reports, and non-conformance trends to predict areas of high risk, allowing auditors to focus their limited time on critical, high-impact processes rather than routine checks. This targeted approach enhances the quality and effectiveness of the audit. Furthermore, technologies leveraging the Internet of Things (IoT) sensors are being deployed in manufacturing and utilities to provide continuous, unbiased performance data directly feeding into compliance reports, automating the verification of standards like ISO 14001 and ISO 50001 (Energy Management).

Crucially, the market is beginning to adopt Blockchain technology for certification issuance and verification. Utilizing an immutable distributed ledger ensures the authenticity and traceability of ISO certificates, preventing fraud and providing instant verification for supply chain partners globally. This technology addresses growing concerns about fraudulent certificates, particularly prevalent in developing markets. The combination of remote auditing, AI-driven risk analysis, and blockchain-based verification is essential for maintaining the integrity and global acceptance of ISO certifications in the increasingly complex, digitized international trade environment.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to exhibit the highest growth rate during the forecast period, driven by rapid industrialization, stringent environmental regulations in countries like China and India, and the rising prominence of regional manufacturers in global supply chains. The region sees massive demand for baseline certifications (ISO 9001 and 14001) alongside specialized standards (ISO 27001) due to the booming IT and manufacturing sectors. Government initiatives promoting quality and export competitiveness in nations such as South Korea, Japan, and Australia further solidify APAC's dominance in market expansion.

- North America: North America holds a significant market share, characterized by high maturity and deep regulatory compliance, particularly in highly regulated sectors like aerospace, defense, medical devices (ISO 13485), and finance. The market is primarily driven by the ongoing need for advanced certifications, especially ISO 27001 (due to high exposure to cyber threats and data privacy laws like CCPA) and specialized management systems required by government contracting and complex industrial procurement mandates.

- Europe: Europe is a mature and highly influential market, demanding strong adherence to rigorous standards, particularly concerning environmental management (ISO 14001) and occupational health and safety (ISO 45001), heavily influenced by EU directives such as the Green Deal and labor safety laws. High adoption rates for specialized standards in the automotive (IATF 16949) and IT (ISO 20000, 27001) sectors, coupled with a focus on ethical governance (ISO 37001), ensure sustained, albeit stable, growth in the region.

- Latin America (LATAM): The LATAM market is poised for moderate growth, primarily spurred by increased foreign direct investment and the necessity for local firms to adopt international standards to participate in global trade agreements. Brazil and Mexico are leading the adoption, focusing on ISO 9001 and ISO 14001 to standardize manufacturing and export processes and enhance industrial competitiveness.

- Middle East and Africa (MEA): Growth in the MEA region is driven by large infrastructure projects, government mandates (especially in the Gulf Cooperation Council states), and significant investment in oil, gas, and renewable energy sectors. Demand is strong for quality management (ISO 9001), environmental standards (ISO 14001), and energy management (ISO 50001) as nations diversify their economies and seek international recognition for their operational integrity.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the ISO Certification Market.- SGS SA

- Bureau Veritas

- Intertek Group plc

- DNV GL (DNV)

- BSI Group (British Standards Institution)

- TÜV SÜD AG

- TÜV Rheinland Group

- Lloyd's Register Group Limited

- DEKRA SE

- TUV Nord Group

- NQA Global Certification

- Control Union Certifications

- SAI Global (Intertek)

- American Systems Registrar (ASR)

- GCL International

- Advanced Certification Limited

- Eurofins Scientific SE

- CQC (China Quality Certification Centre)

- Perry Johnson Registrars (PJR)

- QAI Global

Frequently Asked Questions

Analyze common user questions about the ISO Certification market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the ISO Certification Market?

The ISO Certification Market is projected to exhibit a robust Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033, driven by regulatory mandates and the global requirement for supply chain assurance.

Which ISO standard is currently driving the highest market growth?

While ISO 9001 maintains the largest volume share, ISO 27001 (Information Security Management System) is experiencing the highest growth rate due to escalating global cybersecurity threats and stringent data privacy regulations like GDPR and CCPA.

How is Artificial Intelligence (AI) impacting the future of ISO certification audits?

AI is transforming the market by enabling Continuous Compliance Monitoring (CCM) and predictive risk analysis. It facilitates faster, data-driven remote audits, allowing auditors to focus on high-risk areas identified through algorithmic analysis, rather than routine checks.

Which geographical region is anticipated to see the fastest growth in ISO certification adoption?

The Asia Pacific (APAC) region is forecasted to experience the fastest market growth, fueled by rapid industrialization, increasing export competitiveness, and mandatory compliance in countries like China and India to meet global trade prerequisites.

What are the primary constraints affecting the widespread adoption of ISO certification among smaller businesses?

The main constraints for Small and Medium-sized Enterprises (SMEs) include the significant initial investment required for consulting, implementation, and audit fees, along with the administrative complexity and internal resource dedication necessary to maintain the management systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager