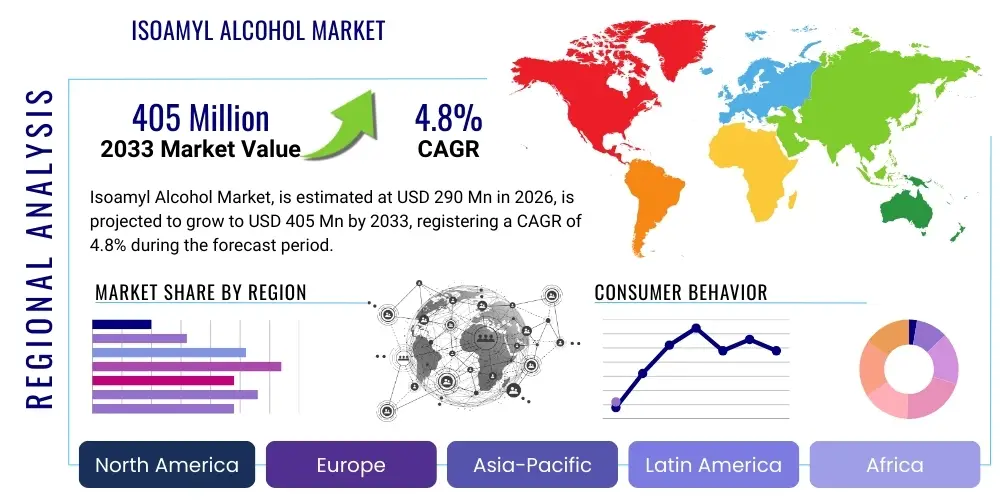

Isoamyl Alcohol Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439147 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Isoamyl Alcohol Market Size

The Isoamyl Alcohol Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at $290 Million USD in 2026 and is projected to reach $405 Million USD by the end of the forecast period in 2033.

Isoamyl Alcohol Market introduction

Isoamyl alcohol, also known as isopentyl alcohol or 3-methylbutan-1-ol, is an organic compound characterized by its colorless appearance and distinct, strong odor often described as pungent or alcoholic. It is a fundamental chemical intermediate derived primarily through fermentation processes, although synthetic routes are also employed depending on the required purity and scale of production. Its unique chemical structure makes it invaluable across diverse industries, acting as an effective solvent, an intermediate in the synthesis of complex chemical compounds, and a crucial component in various formulation blends. The primary commercial grade is often utilized in its ester form, isoamyl acetate, which is renowned for its characteristic banana or pear flavor, making it highly sought after in the food and beverage sectors.

The product's versatility extends significantly into non-food applications, including its role in the pharmaceutical industry as an extraction solvent for penicillin and other sensitive compounds. Furthermore, isoamyl alcohol is a key ingredient in the formulation of various laboratory reagents, essential for DNA and RNA purification protocols, thereby anchoring its demand within the rapidly expanding biotechnology and life sciences segments. Its excellent solvency properties also drive its utilization in the manufacture of lacquers, paints, and photographic chemicals, where controlled evaporation and dissolving power are paramount. Regulatory approvals and evolving safety standards related to volatile organic compounds (VOCs) are increasingly influencing production methods, pushing manufacturers towards greener, bio-based fermentation techniques to meet sustainability mandates.

Major applications driving market expansion include the burgeoning demand from the flavor and fragrance industry, particularly in emerging economies where disposable incomes are rising, leading to higher consumption of processed foods and personal care products. The compound's role as a defoaming agent in industrial fermentation processes and its use in cosmetic formulations, such as emollients and mask solvents, further solidifies its market position. Key driving factors encompass technological advancements in fermentation efficiency, growing consumer preference for natural or naturally-derived ingredients in food flavorings, and the sustained growth of the pharmaceutical manufacturing sector globally, which requires high-purity solvents for synthesis and extraction.

Isoamyl Alcohol Market Executive Summary

The Isoamyl Alcohol market is experiencing robust expansion, primarily fueled by sustained growth in its end-use sectors, notably the flavor and fragrance industry and pharmaceutical manufacturing. Business trends indicate a strategic shift among major producers towards vertical integration and capacity expansion, especially in the Asia Pacific region, which currently dominates both production and consumption due to concentrated chemical and consumer goods manufacturing bases. Manufacturers are focusing on optimizing bio-fermentation processes to reduce reliance on petrochemical feedstock, aligning with global sustainability goals and responding to increasing consumer demand for bio-derived solvents. Pricing stability remains moderate, though fluctuations in raw material costs, particularly molasses or other carbohydrate sources used in fermentation, occasionally impact short-term profitability margins.

Regionally, Asia Pacific (APAC) stands out as the epicenter of market growth, driven by rapid industrialization in countries like China and India, coupled with significant foreign investment in their chemical and food processing industries. North America and Europe, while mature markets, maintain high demand for high-purity isoamyl alcohol, especially within pharmaceutical and high-end cosmetic formulations, where stringent quality controls mandate premium inputs. These developed regions are characterized by a higher adoption rate of advanced analytical methods, where isoamyl alcohol serves as a standard laboratory reagent. Regulatory differences across these regions regarding food additives and VOC emissions significantly shape market strategies; for instance, European REACH regulations necessitate meticulous documentation and compliance, impacting product registration and market entry barriers.

Segment trends reveal that the solvent application segment retains the largest market share, owing to its widespread use in paints, lacquers, and extraction processes. However, the flavoring agent segment, driven by isoamyl acetate, is projected to register the fastest growth rate, propelled by the rising demand for processed foods and beverages across developing nations. Analysis by purity level indicates a growing premium on high-purity grades (99% and above), primarily utilized in sensitive applications like DNA extraction and pharmaceutical synthesis, reflecting a broader market shift towards specialized and value-added product categories. The development of greener, enzyme-catalyzed synthesis pathways presents a significant technological trend that promises enhanced yields and reduced environmental impact across all application segments in the forecast period.

AI Impact Analysis on Isoamyl Alcohol Market

The integration of Artificial Intelligence (AI) and Machine Learning (ML) technologies is poised to revolutionize the operational efficiency and R&D landscape within the Isoamyl Alcohol market. Common user inquiries center on how AI can optimize complex fermentation processes, predict raw material price volatility, and accelerate the discovery of novel flavoring esters utilizing isoamyl alcohol as a precursor. Users are particularly interested in AI's capacity to manage and interpret vast datasets generated during bioreactor monitoring, enabling real-time adjustments to temperature, pH, and nutrient levels to maximize yield and purity, thereby addressing key concerns regarding production cost and batch consistency. The primary expectation is that AI tools will significantly enhance predictive maintenance in manufacturing plants and streamline supply chain logistics, leading to reduced downtime and improved responsiveness to market demand fluctuations for high-purity solvents and flavor compounds.

- AI-driven optimization of bio-fermentation parameters (temperature, aeration, feedstock) for maximum Isoamyl Alcohol yield.

- Predictive modeling of raw material sourcing and logistics, mitigating supply chain risks and cost fluctuations.

- Automated quality control systems utilizing vision AI for real-time impurity detection in high-purity grades.

- Accelerated discovery and screening of novel flavor and fragrance esters derived from isoamyl alcohol using ML algorithms.

- Enhanced safety and regulatory compliance tracking through AI analysis of environmental monitoring and process data.

DRO & Impact Forces Of Isoamyl Alcohol Market

The market for Isoamyl Alcohol is shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively form the Impact Forces dictating market trajectory. A primary driver is the accelerating demand for bio-based and naturally derived flavor esters, particularly isoamyl acetate, in the rapidly expanding food and beverage industry globally. Furthermore, the sustained and critical requirement for high-purity solvents in advanced pharmacological synthesis and life science research, especially genetic material purification, provides a resilient baseline demand. Technological innovations aimed at increasing the efficiency of biological production methods, moving away from conventional synthesis, also act as a significant driving force, enabling manufacturers to meet strict sustainability criteria and improve cost structures, thus broadening the competitive landscape.

Conversely, the market faces notable restraints. Price volatility of key renewable raw materials, such as sugar cane molasses or corn syrup, which serve as feedstock for the bio-fermentation process, poses a considerable challenge to stable production costs and pricing strategies. Regulatory hurdles, especially in Western markets concerning the classification and permissible usage levels of solvents in specific applications (e.g., cosmetics and food contact materials), create administrative burdens and restrict market expansion in certain high-value sectors. Additionally, the availability of close substitutes in specific solvent applications, such as other branched-chain alcohols or specialty solvents, introduces competitive pressure, forcing manufacturers to continuously innovate on purity and cost-effectiveness to maintain market share.

Opportunities for growth are predominantly centered around the untapped potential in emerging markets in Latin America and Africa, where industrial development and consumer packaged goods consumption are poised for exponential growth. Significant technological opportunities exist in developing continuous fermentation processes and enzymatic synthesis routes, which promise higher throughput and lower energy consumption compared to traditional batch processes. Moreover, the increasing adoption of isoamyl alcohol in specialized high-value applications, such as advanced material synthesis and specialty chemical manufacturing requiring precision solvent properties, offers manufacturers pathways to premiumization and diversification away from bulk chemical markets, solidifying its medium to long-term growth prospects.

Segmentation Analysis

The Isoamyl Alcohol market is systematically segmented based on its source, grade of purity, key applications, and geographic region, allowing for granular analysis of demand patterns and strategic planning. The segmentation by source, primarily dividing the market into synthetic and bio-based production, reflects the industry’s push towards sustainability, with bio-based isoamyl alcohol gaining traction due to its favorable environmental profile and regulatory support. Purity level segmentation is critical as it dictates the end-use market, with high-purity grades fetching premium prices in pharmaceutical and analytic laboratory sectors, while lower grades are typically directed towards industrial solvent and defoamer applications. Application analysis highlights the domination of the solvent category, though the flavor and fragrance segment provides the primary impetus for high growth, driven by consumer lifestyle changes.

- By Source:

- Synthetic

- Bio-based (Fermentation)

- By Grade:

- Reagent Grade (High Purity > 99%)

- Technical Grade (Industrial Purity)

- By Application:

- Solvents (Paints, Lacquers, Varnishes)

- Flavoring and Fragrance Agents (Isoamyl Acetate)

- Chemical Intermediate

- Pharmaceutical Extraction and Purification

- Laboratory Reagents (DNA/RNA extraction)

- Defoaming Agents

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Isoamyl Alcohol Market

The value chain for the Isoamyl Alcohol market commences with the upstream analysis, focusing heavily on raw material procurement. For bio-based production, this involves securing consistent, high-quality carbohydrate sources, such as molasses, starch, or cellulosic biomass, necessitating strong relationships with agricultural suppliers and biorefinery partners. For synthetic production, raw material inputs include petroleum derivatives like C5 fraction components. The midstream involves the complex manufacturing processes—either chemical synthesis (less common today) or, more predominantly, specialized fermentation and subsequent distillation and purification stages. This manufacturing phase is capital-intensive, requiring specialized bioreactors and advanced separation technologies to achieve the stringent purity levels required by pharmaceutical and reagent markets.

Distribution channels represent a critical mid-to-downstream link. Direct distribution often involves large volume sales to multinational pharmaceutical corporations and major chemical manufacturers that require certified bulk supply and specific purity documentation. Indirect distribution relies heavily on regional chemical distributors and specialized solvent trading companies who manage smaller volumes and just-in-time inventory for smaller industrial users, research laboratories, and regional flavor houses. Efficient logistics, especially handling and transport of bulk flammable liquids, are crucial in this stage, demanding adherence to global hazard material safety regulations (e.g., IMO, ADR).

The downstream analysis focuses on the final end-user markets. The largest consumers are the specialty chemical sector and the food & beverage industry, which convert isoamyl alcohol into higher-value esters or use it as a crucial solvent base. The effectiveness of the value chain is largely determined by technological integration—the ability of producers to link biorefining efficiency (upstream) with high-specification purity standards (midstream) and rapid delivery networks (downstream). Successful companies focus on integrating their fermentation capabilities with in-house esterification processes to capture maximum value, thereby ensuring control over quality from feedstock to the final flavor product supplied to the end customer.

Isoamyl Alcohol Market Potential Customers

The potential customers for Isoamyl Alcohol span a wide spectrum of industrial and highly specialized sectors, driven by the need for its solvent properties, its role as a chemical building block, and its transformation into flavoring agents. Key end-users include manufacturers within the flavor and fragrance industry, where companies utilize isoamyl alcohol as a direct solvent or, more importantly, convert it into isoamyl acetate, the primary banana flavor ingredient, for application in candies, beverages, bakery goods, and tobacco products. The pharmaceutical industry constitutes another major purchasing cohort, requiring high-purity grades for complex extraction processes, particularly in the production of antibiotics like penicillin, and as a critical solvent in various reaction setups.

Furthermore, the chemical manufacturing sector, encompassing producers of paints, lacquers, and varnishes, represents a significant consumer base. These customers rely on isoamyl alcohol’s characteristic evaporation rate and solubility power to achieve desired product consistency and drying times. Biotechnology and life science research laboratories, including academic institutions and commercial genomic testing companies, are specialized buyers who require certified reagent-grade isoamyl alcohol for essential protocols like the phenol-chloroform extraction method used for purifying DNA and RNA samples, where purity levels are non-negotiable and directly impact research outcomes.

Other vital buyers include manufacturers of specialty chemicals and intermediates, who use isoamyl alcohol as a key hydroxyl-containing compound to synthesize a range of derivatives, including agrochemicals and specialized surfactants. The diversity of the customer base ensures market stability, mitigating risks associated with reliance on a single industry. Strategic focus is increasingly placed on capturing the high-value, low-volume pharmaceutical and biotechnology customers through rigorous quality control and certified manufacturing practices, while maintaining bulk supply efficiencies for the larger, more price-sensitive industrial solvent purchasers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $290 Million USD |

| Market Forecast in 2033 | $405 Million USD |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Merck KGaA, Avantor, BASF SE, Dow Inc., Sigma-Aldrich (Merck), Solvay S.A., Spectrum Chemical Manufacturing Corp., Penta Manufacturing Company, Kanto Chemical Co. Inc., Changzhou Tronly Chemical Co., Ltd., Nanjing Well Chemical Co., Ltd., Wego Chemical Group, TCI Chemicals (India) Pvt. Ltd., Tokyo Chemical Industry Co. Ltd., Hefei TNJ Chemical Industry Co., Ltd., Haihang Industry Co., Ltd., Finar Chemicals, Parchem fine & specialty chemicals, Central Drug House (CDH), and Shandong Xinhua Pharmaceutical Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Isoamyl Alcohol Market Key Technology Landscape

The technological landscape for Isoamyl Alcohol production is characterized by a significant transition from traditional synthetic routes to advanced bio-fermentation methods, driven by sustainability pressures and the increasing cost-effectiveness of biotechnology. Traditional synthesis typically involves the reaction of amylenes derived from petrochemical feedstocks, but this approach is increasingly sidelined due to environmental concerns and the requirement for high-purity end products needed for food and pharmaceutical applications. The prevailing and emerging technology is the microbial fermentation of renewable feedstocks, primarily utilizing genetically modified yeast strains (e.g., engineered Saccharomyces cerevisiae) or specific bacteria to convert sugars into isoamyl alcohol. This shift ensures a sustainable supply chain and allows manufacturers to label their products as bio-derived, offering a competitive advantage in environmentally conscious markets.

Current technological innovations are heavily focused on optimizing fermentation efficiency and downstream purification. For fermentation, research focuses on developing robust microbial strains capable of higher yields, faster conversion rates, and tolerance to higher product concentrations, which reduces separation costs. Techniques like continuous fermentation (as opposed to batch processing) and sophisticated bioreactor designs are being adopted to increase throughput and minimize operational expenditure. Furthermore, integrated separation techniques, such as continuous extractive fermentation, where the product is removed from the reaction mixture as it is produced, prevent product toxicity to the microorganism and drastically enhance overall process efficiency.

In the post-production phase, the key technology lies in advanced distillation and chromatographic purification methods. Achieving the stringent purity specifications required for reagent-grade isoamyl alcohol (often >99.5%) demands highly efficient fractional distillation columns and, for specialized grades, column chromatography to remove minute impurities. Manufacturers are also exploring membrane separation technologies and process intensification techniques (PITs) to reduce the energy consumption associated with thermal separation processes. The successful adoption of these technologies is pivotal for companies aiming to secure contracts in high-margin sectors like diagnostics and customized pharmaceutical synthesis, where purity and lot consistency are paramount differentiators in the fiercely competitive market.

Regional Highlights

The Isoamyl Alcohol market exhibits distinct demand and supply dynamics across key geographical regions, with Asia Pacific (APAC) playing the pivotal role in global growth. The APAC region commands the largest market share and is projected to register the fastest CAGR during the forecast period. This dominance is attributed to robust manufacturing sectors in China and India, encompassing high volume production of flavors, fragrances, pharmaceuticals, and industrial coatings. The region benefits from lower operating costs, abundant access to fermentable feedstocks, and rapidly expanding consumer markets for processed goods, driving intensive demand for both industrial solvents and food-grade derivatives.

North America and Europe represent mature, high-value markets characterized by stringent regulatory oversight and a preference for high-purity, certified products. In these regions, demand is heavily concentrated in the pharmaceutical, biotechnology (laboratory reagents), and specialized fine chemical sectors. European demand, in particular, is shaped by REACH regulations, which prioritize the use of environmentally friendly and traceable chemical inputs, favoring certified bio-based isoamyl alcohol. Although growth rates are moderate compared to APAC, the high average selling price (ASP) of products consumed here ensures significant revenue contribution.

Latin America (LATAM) and the Middle East & Africa (MEA) are emerging regions offering significant long-term growth opportunities. Market expansion in LATAM is closely linked to the development of the regional food processing and flavor industries, coupled with growing infrastructure projects driving demand for industrial solvents. In MEA, the petrochemical industry's focus on diversification, alongside urbanization and increasing consumer spending on cosmetics and packaged foods, is gradually building a stable demand base. Investment in local chemical production capabilities and improved distribution networks are essential for unlocking the full market potential across these developing geographies.

- Asia Pacific (APAC): Dominates the market due to massive chemical manufacturing capacity, low production costs, and high consumption of flavors and industrial solvents, led by China and India.

- North America: Strong demand concentrated in pharmaceutical extraction, biotechnology reagents, and high-end cosmetic formulations, focusing on premium, high-purity grades.

- Europe: Driven by strict regulatory adherence (REACH), favoring bio-derived sources; significant uptake in fine chemicals and specialized solvents.

- Latin America: Emerging market with growth potential driven by expanding food processing industries and increasing infrastructural development demanding industrial solvents.

- Middle East & Africa (MEA): Growth tied to diversification efforts in the petrochemical sector and rising demand for consumer packaged goods and local pharmaceutical production.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Isoamyl Alcohol Market.- Merck KGaA

- Avantor

- BASF SE

- Dow Inc.

- Sigma-Aldrich (Merck)

- Solvay S.A.

- Spectrum Chemical Manufacturing Corp.

- Penta Manufacturing Company

- Kanto Chemical Co. Inc.

- Changzhou Tronly Chemical Co., Ltd.

- Nanjing Well Chemical Co., Ltd.

- Wego Chemical Group

- TCI Chemicals (India) Pvt. Ltd.

- Tokyo Chemical Industry Co. Ltd.

- Hefei TNJ Chemical Industry Co., Ltd.

- Haihang Industry Co., Ltd.

- Finar Chemicals

- Parchem fine & specialty chemicals

- Central Drug House (CDH)

- Shandong Xinhua Pharmaceutical Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Isoamyl Alcohol market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary application driving the demand for Isoamyl Alcohol?

The primary application driving significant demand is its role as a precursor to isoamyl acetate, an essential ester used extensively in the flavor and fragrance industry for creating banana or pear flavor profiles in food, beverages, and cosmetic products. Additionally, its use as a specialized solvent in pharmaceutical extraction remains critical.

How does the bio-based production method differ from synthetic methods?

Bio-based production utilizes microbial fermentation, typically involving yeast strains and renewable carbohydrate feedstocks like molasses, offering a sustainable and environmentally preferred route. Synthetic methods traditionally rely on petrochemical derivatives (amylenes), which are increasingly being phased out due to environmental regulations and the need for higher purity required in food/pharma grades.

Which purity grade of Isoamyl Alcohol commands the highest market value?

The Reagent Grade (often >99.5% purity) commands the highest market value. This grade is essential for specialized, non-negotiable applications such as DNA/RNA purification in biotechnology laboratories and critical solvent use in high-end pharmaceutical synthesis, where impurities can compromise results or product quality.

What major regulatory factors influence the Isoamyl Alcohol market in Europe?

In Europe, the market is heavily influenced by the Registration, Evaluation, Authorisation, and Restriction of Chemicals (REACH) regulation, which imposes strict compliance requirements on chemical substance safety and environmental impact, driving a preference for certified bio-based products and careful monitoring of VOC emissions.

What is the projected Compound Annual Growth Rate (CAGR) for the Isoamyl Alcohol Market?

The Isoamyl Alcohol Market is projected to experience a Compound Annual Growth Rate (CAGR) of 4.8% between the forecast years of 2026 and 2033, driven by expansion in the flavor and pharmaceutical sectors, particularly in the Asia Pacific region.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager