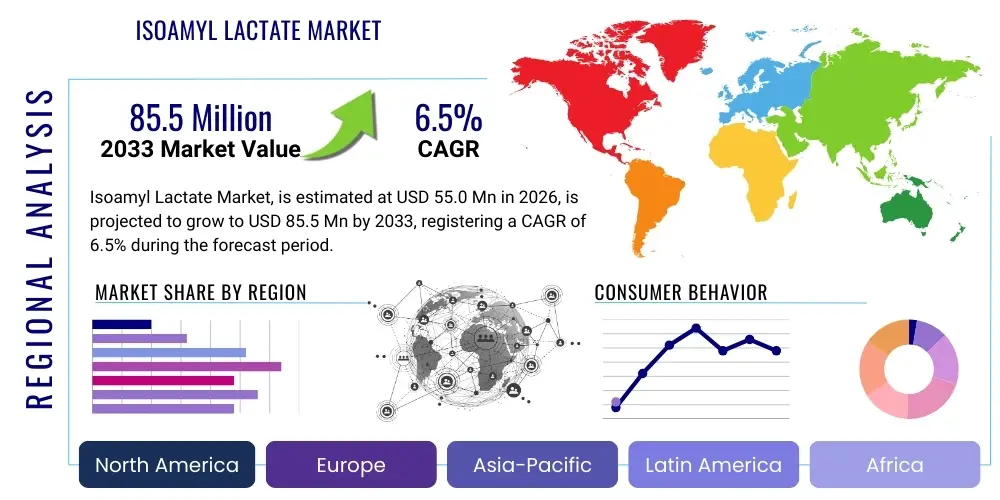

Isoamyl Lactate Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436780 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Isoamyl Lactate Market Size

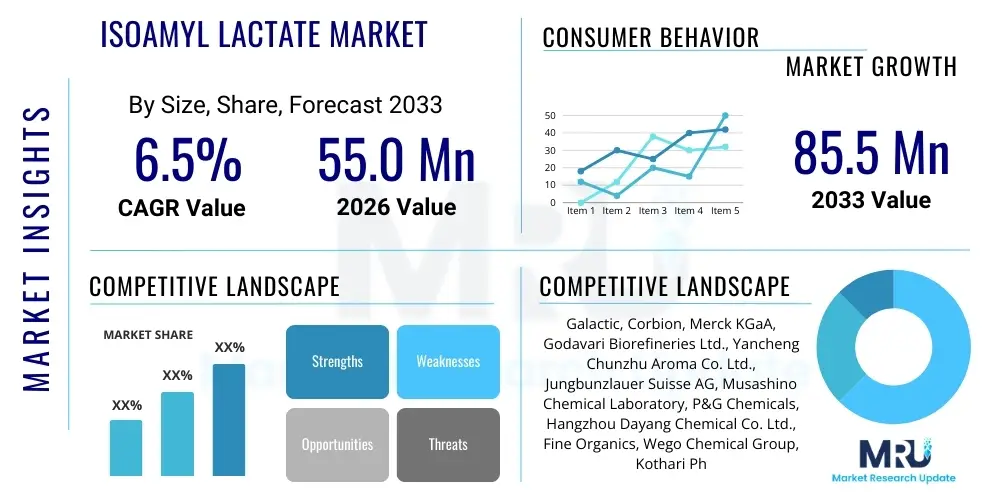

The Isoamyl Lactate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at $55.0 Million USD in 2026 and is projected to reach $85.5 Million USD by the end of the forecast period in 2033.

Isoamyl Lactate Market introduction

Isoamyl Lactate, an organic ester derived from lactic acid and isoamyl alcohol, serves as a pivotal chemical compound across numerous industrial applications, primarily valued for its outstanding solvency characteristics, low toxicity profile, and pleasant, mild fruity odor. Classified chemically as an aliphatic ester, it exhibits excellent compatibility with various resins and polymers, making it an ideal choice for high-performance coatings, printing inks, and specialized cleaning formulations. The market is fundamentally driven by the global shift towards greener, sustainable solvents that comply with increasingly stringent environmental regulations, particularly concerning Volatile Organic Compound (VOC) emissions. Furthermore, its inherent biodegradability and non-hazardous nature position it favorably against traditional, harsher petrochemical solvents, reinforcing its adoption in eco-sensitive applications within personal care and industrial sectors.

The product's versatility is a key differentiator. In the flavor and fragrance industry (F&F), Isoamyl Lactate functions as a reliable fixative and solvent, contributing to the stability and longevity of various scent compositions, often imparting subtle fruity or creamy notes. Simultaneously, its role in the cosmetics and personal care domain extends to acting as an emollient and conditioning agent, enhancing product texture and feel in items such as nail polish removers, skin lotions, and hair treatments. The chemical synthesis of Isoamyl Lactate typically involves esterification, requiring precise control over temperature and catalytic agents to yield high purity grades necessary for pharmaceutical and food-grade uses. The demand for higher purity grades, essential for direct consumer applications, is intensifying, driving manufacturers to invest in advanced purification and distillation technologies to meet escalating regulatory standards.

Major applications of Isoamyl Lactate span industrial cleaning, where it efficiently dissolves greases and oil residues; specialized coatings, where it improves flow and leveling properties; and agricultural formulations, where it functions as a highly effective adjuvant to enhance pesticide performance. Benefits driving market growth include its non-corrosive nature, high flash point, which improves safety during handling and storage, and its favorable regulatory status in key markets like the EU and North America. The burgeoning demand from the Asia Pacific region, fueled by rapid industrialization and rising consumer preference for premium, sustainable personal care products, is set to significantly shape the future market trajectory, compelling global suppliers to optimize supply chain logistics and expand localized production capacities.

Isoamyl Lactate Market Executive Summary

The Isoamyl Lactate market demonstrates robust growth, primarily propelled by global regulatory pressures favoring low-VOC and biodegradable solvents, positioning this ester as a critical component in the transition towards sustainable industrial practices. Business trends indicate a strong focus on capacity expansion, particularly in high-growth economies, alongside strategic partnerships aimed at securing consistent feedstock supply (lactic acid and isoamyl alcohol). Key industry participants are heavily investing in R&D to develop novel formulations that leverage Isoamyl Lactate's properties in advanced materials and specialized cleaning products, leading to product differentiation based on purity and grade specifications. Market dynamics are further influenced by volatility in raw material costs, necessitating efficient synthesis processes and robust procurement strategies to maintain competitive pricing structures across various application segments.

Regionally, Asia Pacific (APAC) is emerging as the fastest-growing market, driven by expanding manufacturing bases for automotive coatings, electronics, and personal care products in countries like China and India, alongside increasing environmental consciousness leading to demand for green solvents. North America and Europe, while mature, maintain significant market shares due to strict environmental compliance (e.g., REACH regulations in Europe) which mandate the substitution of traditional solvents with eco-friendly alternatives like Isoamyl Lactate. These regions are characterized by a high penetration rate of sophisticated consumer goods, where the use of premium, sustainable ingredients is a crucial marketing element. This geographic segmentation highlights a dual market strategy: focusing on capacity and volume in APAC, and innovation and compliance in Western markets.

Segment trends reveal that the solvent application segment dominates the market volume due to its widespread use in industrial degreasing, paint stripping, and specialty coatings, benefiting from the compound's high solvency power and reduced environmental footprint. Concurrently, the flavor and fragrance (F&F) segment is experiencing the highest growth rate, supported by rising consumer expenditure on premium cosmetic and personal care products and the inherent demand for natural-like, milder scent profiles in consumer goods. Furthermore, the segmentation by purity grade highlights an increasing consumer and industrial preference for high-purity (99%+) Isoamyl Lactate, particularly within the sensitive pharmaceutical and food-grade sectors, pushing manufacturers towards advanced multi-stage distillation and purification techniques to meet these exacting specifications and capture higher profit margins.

AI Impact Analysis on Isoamyl Lactate Market

User queries regarding AI's influence on the Isoamyl Lactate market predominantly focus on optimization of chemical synthesis, predictive modeling for raw material sourcing, and automation of quality control processes. Users are concerned with how AI-driven laboratory systems can accelerate the discovery and testing of new lactate ester derivatives, and how machine learning (ML) algorithms can be employed to minimize energy consumption and waste generation during the complex esterification process. A key theme revolves around supply chain resilience, with specific questions about using AI for real-time demand forecasting and mitigating price volatility associated with key precursors like lactic acid. Furthermore, there is significant interest in AI's role in regulatory compliance, particularly in swiftly adapting product formulations to meet rapidly changing international chemical registration requirements, ensuring market entry speed for new Isoamyl Lactate applications.

- AI optimizes reaction conditions (temperature, pressure, catalyst concentration) in the esterification process, reducing synthesis time and increasing yield purity.

- Machine Learning (ML) algorithms predict fluctuations in lactic acid and isoamyl alcohol supply, enabling proactive procurement strategies and price risk mitigation.

- Automated quality assurance systems, powered by computer vision and sensor data, monitor product purity in real-time during distillation, ensuring high-grade output for F&F and pharmaceutical applications.

- AI-driven simulation tools accelerate the development of new Isoamyl Lactate-based solvent blends, predicting solvency parameters and compatibility with novel coating resins.

- Predictive maintenance analytics applied to production equipment minimize downtime and operational expenditure, increasing overall manufacturing efficiency and output stability.

- Natural Language Processing (NLP) assists manufacturers in rapidly analyzing complex global chemical regulations (e.g., REACH, TSCA) to ensure compliant labeling and formulation adjustments.

DRO & Impact Forces Of Isoamyl Lactate Market

The Isoamyl Lactate market is significantly influenced by a dynamic interplay of drivers, restraints, and opportunities, collectively shaping its trajectory and competitive landscape. The primary driver is the pervasive global mandate for environmental sustainability, compelling industries to transition from traditional petroleum-based solvents to bio-based, biodegradable alternatives like Isoamyl Lactate. This transition is heavily reinforced by governmental policies and consumer preference for eco-friendly products, especially within the rapidly growing sectors of green cleaning and high-performance sustainable coatings. Furthermore, the recognition of Isoamyl Lactate’s superior performance characteristics—such as its high coupling activity, effective solvency for diverse chemistries, and compatibility with waterborne systems—solidifies its position as a preferred additive in diverse industrial applications, driving consistent demand growth across all major geographies.

However, the market faces notable restraints, chiefly the volatility and availability of raw material feedstocks, particularly lactic acid, which is often derived from fermentation processes susceptible to agricultural commodity price fluctuations and seasonal variations. The capital intensity required for constructing and operating high-purity production facilities also acts as a barrier to entry for smaller manufacturers, concentrating market power among established chemical producers. Additionally, although Isoamyl Lactate offers strong performance, the market faces substitution threats from other bio-based solvents, such as ethyl lactate and various glycol ethers, which may occasionally offer a more cost-effective solution for specific, less demanding applications. Regulatory complexities, specifically the need to secure separate certifications and registrations across numerous countries for food and cosmetic applications, add to the operational cost and complexity for global players.

The overarching opportunity for market expansion lies in the untapped potential within emerging economies, coupled with intensified R&D focus on novel applications in niche markets. Specific opportunities include developing Isoamyl Lactate derivatives for advanced drug delivery systems, exploiting its non-toxic nature for use in medical devices, and expanding its application in specialty agrochemical formulations to enhance penetration and efficacy of active ingredients. The increasing adoption of 3D printing technologies also presents a significant growth avenue, as Isoamyl Lactate can serve as an effective, low-odor solvent in specialized photopolymer resins. Successful mitigation of raw material cost volatility through long-term supply agreements and forward-integrated production methods will be crucial for companies seeking to capitalize on these high-growth opportunities and secure a dominant market position throughout the forecast period.

Segmentation Analysis

The Isoamyl Lactate market is segmented extensively based on purity grade, application type, and geographic region, reflecting the diverse end-use requirements of this versatile chemical compound. Segmentation by purity grade is crucial, differentiating between Technical Grade (typically 95-98% purity, used primarily in industrial solvents and coatings) and High Purity Grade (99%+ purity, required for sensitive applications in flavors, fragrances, cosmetics, and pharmaceuticals). This division highlights the critical need for advanced purification processes, influencing manufacturing costs and final product pricing. The application segmentation reveals the dominant industrial use cases versus the high-growth consumer-facing sectors, offering key insights into demand elasticity and regulatory sensitivity across the market.

Analysis by application demonstrates that industrial solvents and coatings currently constitute the largest volume segment, owing to the high consumption rates in manufacturing processes, paint removal, and electronic cleaning. However, the flavors and fragrances and the personal care segments are rapidly increasing their market share due to the rising global demand for premium consumer products incorporating sustainable, low-irritation ingredients. Manufacturers strategically focus their sales and marketing efforts toward these high-value segments, which often tolerate higher pricing reflective of the enhanced purity and compliance requirements. Geographic segmentation further underscores the disparity in market maturity, with established environmental regulations in North America and Europe driving compliance-led demand, contrasting with the volume-driven, rapidly expanding industrial demand originating from the Asia Pacific region.

Understanding these segments is essential for market strategists, allowing them to tailor production capabilities and distribution channels effectively. For instance, catering to the pharmaceutical segment requires rigorous adherence to GMP (Good Manufacturing Practices) and extensive documentation, distinct from the requirements for the bulk industrial solvent market. The ongoing trend toward customization and specialized formulations further reinforces the importance of this granular segmentation, enabling manufacturers to develop bespoke Isoamyl Lactate blends (often combined with other lactates or bio-solvents) designed specifically for complex industrial challenges, such as specialized aerospace cleaning or precision optics manufacturing, thereby securing premium pricing and long-term supply contracts.

- By Purity Grade:

- Technical Grade (95% - 98%)

- High Purity Grade (99%+ and Food/Cosmetic Grade)

- By Application:

- Industrial Solvents and Coatings

- Flavors and Fragrances (F&F)

- Personal Care and Cosmetics (Including Nail Polish Removers)

- Printing Inks and Dyes

- Agrochemical Formulations (as Adjuvants)

- Pharmaceuticals and Healthcare

- By End-Use Industry:

- Automotive and Transportation

- Electronics and Semiconductors

- Chemical Manufacturing

- Food and Beverage

- Cosmetics and Personal Care

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, U.K., France, Italy, Spain)

- Asia Pacific (China, India, Japan, South Korea)

- Latin America (Brazil, Argentina)

- Middle East and Africa (MEA)

Value Chain Analysis For Isoamyl Lactate Market

The value chain for the Isoamyl Lactate market begins with the upstream sourcing of key raw materials, primarily Lactic Acid and Isoamyl Alcohol. Lactic acid is derived mainly from the fermentation of carbohydrates (sugars), linking the upstream chain closely to the agricultural sector, where volatility in sugar pricing and crop yields can directly impact production costs. Isoamyl alcohol, conversely, can be sourced synthetically or as a byproduct of fusel oil, providing diversified procurement options but introducing potential variability in quality and supply consistency. Efficient and sustainable upstream management is crucial, requiring strong partnerships with bio-refineries and chemical suppliers to secure high-quality, cost-effective feedstock necessary for subsequent high-purity esterification processes, often constituting the largest component of the final product cost structure.

The midstream phase involves the core manufacturing process: the esterification of the raw materials, followed by complex purification steps, including fractional distillation and filtration, to achieve the specific purity grades demanded by sensitive end-use applications (e.g., F&F and pharmaceutical grades). This phase is capital intensive, necessitating specialized reactors and energy-efficient separation technology. Manufacturers must adhere to stringent quality control standards, such as ISO certifications and specific regulatory compliance protocols (like FDA or European Pharmacopoeia standards), particularly for products destined for direct consumer contact. Competition in this segment centers on process efficiency, yield optimization, and the ability to consistently produce specialized, high-purity batches, which dictates market competitiveness and profit margins.

The downstream segment encompasses distribution and final application. Isoamyl Lactate is typically transported via specialized chemical tankers, drums, or intermediate bulk containers (IBCs). Distribution channels are bifurcated: direct sales channels handle large-volume orders to major industrial consumers (like coatings or industrial cleaning formulators), ensuring customized logistical solutions and technical support. Indirect channels, utilizing specialized chemical distributors, cater to smaller batch requirements and reach fragmented markets, such as small-scale cosmetic manufacturers or specialized research labs. The ultimate downstream buyers are the formulators who incorporate Isoamyl Lactate into their final products, relying heavily on the compound’s technical specifications, consistent supply, and associated regulatory documentation to meet their manufacturing needs and market demands.

Isoamyl Lactate Market Potential Customers

Potential customers for Isoamyl Lactate span a broad spectrum of industries, primarily centered around sectors requiring effective, environmentally friendly solvents, non-toxic additives, and sustainable ingredient alternatives. The primary consumers are industrial coating and paint manufacturers, especially those focusing on low-VOC, high-solids, or waterborne systems, where Isoamyl Lactate acts as an efficient coalescing agent and flow improver for automotive, architectural, and aerospace applications. A second major customer group includes manufacturers of industrial and specialized cleaning products, such as degreasers for heavy machinery, graffiti removers, and precision cleaning solutions for electronics, valuing its high solvency and favorable EH&S (Environmental, Health, and Safety) profile, enabling safe use in confined industrial environments.

In the consumer domain, key buyers include large multinational cosmetic and personal care corporations, who utilize it extensively in nail polish removers, where it offers a less harsh, milder-smelling alternative to acetone, and in various skin and hair care formulations as an emollient or solvent for active ingredients. Furthermore, flavor and fragrance houses represent a growing customer base, using Isoamyl Lactate as a carrier or fixative to stabilize complex scent and flavor profiles in perfumes, household products, and foodstuffs, contributing a clean, fruity undertone. The demand is particularly sensitive to consumer trends favoring "clean label" and bio-based ingredients, making these customer segments highly profitable.

Niche but high-value customers include pharmaceutical companies, which utilize the high-purity grade as a safe excipient or solvent in certain drug formulations or in the manufacturing processes of medical devices where residual solvent toxicity must be rigorously controlled. Agrochemcial companies also represent a significant customer group, incorporating Isoamyl Lactate as an adjuvant or penetrant in pesticide and herbicide formulations to enhance the effectiveness of the active ingredients, providing better leaf surface spread and deeper penetration. This diverse customer landscape necessitates tailored sales strategies and highly specific product documentation focusing on technical performance data, regulatory compliance clearances, and proof of sustainable sourcing.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $55.0 Million USD |

| Market Forecast in 2033 | $85.5 Million USD |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Galactic, Corbion, Merck KGaA, Godavari Biorefineries Ltd., Yancheng Chunzhu Aroma Co. Ltd., Jungbunzlauer Suisse AG, Musashino Chemical Laboratory, P&G Chemicals, Hangzhou Dayang Chemical Co. Ltd., Fine Organics, Wego Chemical Group, Kothari Phytochemicals & Industries Ltd., Haihang Industry Co., Ltd., Hefei TNJ Chemical Industry Co., Ltd., Shandong Jingshang Chemical Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Isoamyl Lactate Market Key Technology Landscape

The technology landscape for Isoamyl Lactate is dominated by advancements in chemical synthesis and purification techniques aimed at maximizing yield, minimizing energy consumption, and crucially, achieving ultra-high purity grades required by consumer-facing industries. The core production technology remains catalytic esterification, typically involving a reactive distillation setup. Recent innovations focus on heterogeneous catalysis, utilizing solid acid catalysts instead of traditional mineral acids. This shift reduces corrosion, simplifies separation (as the catalyst does not need neutralization or removal via washing), and enhances the environmental footprint of the process by reducing the generation of liquid waste streams. Continuous flow reactors are also gaining traction, replacing traditional batch processes, thereby enabling better temperature control, increased throughput, and improved consistency in large-scale manufacturing operations, particularly vital for meeting the high volume demands of the coatings market.

Significant technological investment is being directed towards downstream purification, which is paramount for competitive advantage. Multi-stage fractional distillation, often performed under vacuum to prevent degradation, is standard practice. Advanced technologies include membrane separation and supercritical fluid extraction (SFE) techniques, which are employed for the final polishing steps to remove trace impurities, unreacted starting materials, and color bodies. This technological sophistication is necessary to meet the stringent odor and toxicity profiles required for the flavor and fragrance industry, where purity standards can exceed 99.5%. Furthermore, process analytical technology (PAT), incorporating inline spectroscopic monitoring (such as Near-Infrared or Raman spectroscopy), is being integrated into production lines to enable real-time quality assurance and immediate process adjustments, significantly enhancing operational efficiency and reducing off-specification batches.

Sustainability-focused technological developments are also reshaping the market. Research efforts are exploring bio-catalytic routes (enzymatic esterification) as a potentially milder, lower-energy alternative to traditional chemical synthesis. While currently challenged by cost and scalability, enzymatic synthesis promises highly selective reactions, potentially leading to purer products with fewer byproducts, aligning perfectly with the industry's green chemistry objectives. Furthermore, advanced analytical techniques, including high-resolution Gas Chromatography-Mass Spectrometry (GC-MS), are becoming standard for quality control, not just for confirming purity but also for tracking trace contaminants, providing customers with comprehensive documentation necessary for global regulatory submission and product safety assurance, thus strengthening trust and reliability in the supply chain.

Regional Highlights

Regional dynamics play a crucial role in the Isoamyl Lactate market, dictated by environmental policies, industrial concentration, and consumer spending power. North America and Europe currently hold substantial market shares, primarily driven by stringent environmental protection legislation (like the EU's Industrial Emissions Directive and VOC limitations), which mandates the replacement of conventional solvents with bio-based alternatives. These regions exhibit high demand for high-purity grades in premium personal care and pharmaceutical manufacturing, characterized by high adoption rates of advanced, specialized formulations and a willingness to pay a premium for certified sustainable ingredients.

The Asia Pacific (APAC) region is forecasted to exhibit the fastest growth over the projection period. This growth is underpinned by rapid industrial expansion, particularly in manufacturing sectors like automotive coatings (driven by increasing vehicle production), electronics manufacturing (requiring precision cleaning agents), and a burgeoning cosmetics industry. China and India are key contributors, experiencing parallel growth in both industrial output and consumer purchasing power, leading to escalating demand for domestically sourced solvents and internationally compliant F&F ingredients. Investment in chemical production capacity is heavily concentrated here, focusing on efficient, large-scale production to serve both domestic consumption and export markets, although regulatory frameworks are rapidly evolving to catch up with Western standards.

Latin America and the Middle East & Africa (MEA) represent emerging markets with significant untapped potential. In Latin America, industrial growth, especially in Brazil and Mexico's coatings and agricultural sectors, is boosting local consumption. In MEA, the demand is largely concentrated in the GCC nations, driven by construction booms requiring specialized paints and coatings, and the development of local personal care and home care manufacturing bases. However, these regions often rely heavily on imports, and market penetration is highly sensitive to international logistics costs and currency fluctuations. The future growth here will depend on increasing domestic manufacturing capabilities and the establishment of harmonized regional quality standards for specialty chemicals.

- North America: Market maturity defined by strict VOC regulations; strong adoption in high-performance coatings and cosmetics; dominance in R&D for novel formulations.

- Europe: Driven by REACH compliance and sustainability mandates; high demand for certified bio-based solvents; strong presence of major flavor and fragrance houses requiring ultra-pure grades.

- Asia Pacific (APAC): Highest growth region; driven by industrialization in China, India, and South Korea; increasing domestic consumption of personal care products; focus on scale and cost-efficient production.

- Latin America (LATAM): Growing market, primarily in automotive coatings and agrochemicals (as adjuvants); market growth sensitive to macroeconomic stability.

- Middle East and Africa (MEA): Emerging market; demand driven by construction and local consumer goods manufacturing; high reliance on imports of specialty chemicals.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Isoamyl Lactate Market.- Galactic

- Corbion

- Merck KGaA

- Godavari Biorefineries Ltd.

- Yancheng Chunzhu Aroma Co. Ltd.

- Jungbunzlauer Suisse AG

- Musashino Chemical Laboratory

- P&G Chemicals

- Hangzhou Dayang Chemical Co. Ltd.

- Fine Organics

- Wego Chemical Group

- Kothari Phytochemicals & Industries Ltd.

- Haihang Industry Co., Ltd.

- Hefei TNJ Chemical Industry Co., Ltd.

- Shandong Jingshang Chemical Co., Ltd.

- Vimal Life Sciences

- Chiral Technologies, Inc.

- Triveni Interchem Pvt. Ltd.

- Parchem fine & specialty chemicals

- BASF SE

Frequently Asked Questions

Analyze common user questions about the Isoamyl Lactate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers of growth for the Isoamyl Lactate Market?

The primary growth drivers are stringent global environmental regulations mandating the replacement of traditional petroleum-based solvents with low-VOC, biodegradable, bio-based alternatives, coupled with rising consumer demand for sustainable and non-toxic ingredients in cosmetics and personal care products.

In which application segment is Isoamyl Lactate used most extensively?

Isoamyl Lactate is most extensively used in the Industrial Solvents and Coatings segment due to its superior solvency power and efficacy as a highly effective coalescing agent and flow modifier in high-performance, low-odor coating formulations, including automotive and architectural paints.

How does the purity grade of Isoamyl Lactate affect its market price and end-use?

Purity grade significantly affects pricing; High Purity Grade (99%+) requires advanced purification techniques, commanding a premium price, and is essential for sensitive applications such as Flavors & Fragrances (F&F), food additives, and pharmaceuticals, where strict odor and toxicity profiles are mandatory.

Which geographical region is expected to demonstrate the fastest growth rate?

The Asia Pacific (APAC) region is anticipated to record the fastest growth, driven by rapid industrialization, expanding electronics and coatings manufacturing bases, and increasing consumer affluence supporting the demand for premium, sustainable personal care products across countries like China and India.

What raw materials are required for the synthesis of Isoamyl Lactate and are they subject to price volatility?

Isoamyl Lactate is synthesized from Lactic Acid and Isoamyl Alcohol. Lactic acid, often bio-derived via fermentation, is subject to price volatility linked to agricultural commodity markets (e.g., sugar prices), while Isoamyl alcohol supply tends to be more stable, sourced from synthetic processes or fusel oil byproducts.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager