Isobornyl Acrylate Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438446 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Isobornyl Acrylate Market Size

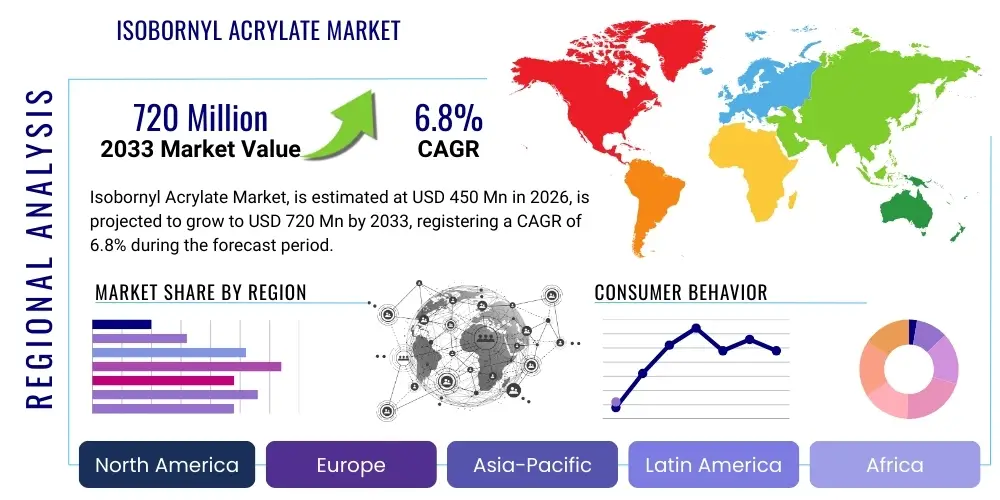

The Isobornyl Acrylate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 720 Million by the end of the forecast period in 2033.

Isobornyl Acrylate Market introduction

Isobornyl Acrylate (IBOA) is recognized globally as a foundational chemical component within the advanced polymer and specialty chemicals sectors, serving primarily as a highly effective reactive diluent. This monofunctional acrylic monomer is characterized by its rigid cyclic structure derived from isobornyl alcohol, which imparts unique performance attributes to cured polymer networks. Specifically, IBOA excels in reducing the viscosity of complex formulation systems, a critical requirement for high-speed industrial coating and printing applications, without introducing volatile organic compounds (VOCs). The low viscosity property allows formulators to achieve desirable flow and leveling characteristics in 100% solids UV and electron beam (EB) curable systems. The molecular rigidity of IBOA significantly contributes to enhanced surface hardness, superior scratch resistance, and exceptional resistance to various chemicals, solvents, and environmental degradation, making it indispensable for high-durability finishes on substrates such as wood, plastic, and metal. The synthesis involves the controlled esterification of acrylic acid, a process requiring stringent quality control to ensure high purity necessary for sophisticated electronic and optical applications. The burgeoning demand for high-performance, environmentally compliant coatings in rapidly industrializing regions underscores the strategic importance of IBOA in modern chemical manufacturing.

The applicability of Isobornyl Acrylate extends across a wide spectrum of manufacturing activities, fundamentally transforming surface finishing and bonding processes. In the printing and graphics industry, IBOA enables the formulation of high-reactivity UV-curing inks, ensuring instantaneous drying and high definition print quality, critical for modern packaging, labeling, and commercial printing presses operating at maximum speed. For the automotive sector, IBOA is incorporated into protective clear coats and headlamp coatings, providing crucial resistance against UV radiation damage, yellowing, and physical abrasion. Within the electronics domain, high-purity IBOA is utilized in optical fiber coatings and encapsulants due to its low shrinkage upon curing and excellent dielectric stability. The transition away from traditional, solvent-heavy formulations, driven by global environmental mandates and heightened worker safety standards, acts as a powerful catalyst for the adoption of IBOA-based technologies. This global shift towards solvent-free solutions positions IBOA as a key enabler for sustainable industrial growth, aligning chemical production with ecological responsibility and operational efficiency across multinational value chains.

Key benefits derived from Isobornyl Acrylate include superior adhesion across challenging substrates, especially plastics like polycarbonate and PVC, due to its low molecular weight and penetration capability. The rapid polymerization kinetics facilitated by IBOA allow for extremely high throughput rates in manufacturing lines, dramatically reducing curing time from minutes to mere seconds, translating directly into operational cost savings and increased production capacity for end-users. Driving factors for the market expansion include the sustained growth of the flexible packaging industry, the mainstreaming of additive manufacturing technologies (3D printing), and continuous infrastructure investments globally demanding durable protective coatings for exposed materials. The synergistic effect of IBOA’s unique blend of physical properties—low viscosity, high reactivity, and structural rigidity—ensures its continued preference over other reactive diluents, securing its central role in the future trajectory of radiation-curable chemistry. Market dynamics are heavily influenced by feedstock availability and the strategic investments made by leading chemical manufacturers to optimize production processes and secure supply chains in major consuming regions, predominantly Asia Pacific.

Isobornyl Acrylate Market Executive Summary

The Isobornyl Acrylate market analysis confirms a trajectory of significant growth, underpinned by the structural evolution towards radiation-cured polymer systems replacing conventional solvent-based alternatives across high-volume industrial applications. Business trends are characterized by fierce competition among global chemical conglomerates, focusing strategically on capacity expansion, particularly in lower-cost, high-demand geographies such as Southeast Asia, to maximize market reach and cost efficiencies. A paramount strategic initiative observed across the industry is the intensive focus on R&D for developing specialized IBOA grades that possess enhanced attributes, such as ultra-low impurity levels for sensitive electronic applications or improved flexibility characteristics necessary for advanced film coatings and complex 3D printing resins. Furthermore, consolidation activities, including mergers and acquisitions, are shaping the competitive landscape as companies seek to integrate vertically or acquire specialized formulation expertise, thus securing a more resilient position against volatile raw material pricing and fluctuating energy costs integral to the synthesis process. Manufacturers are also increasingly prioritizing compliance with global chemical registration mandates, necessitating significant investment in product stewardship and detailed hazard communication to maintain market access across strict regulatory regimes like the European Union's REACH framework.

Regionally, the market exhibits a clear bifurcation, with the Asia Pacific region dominating both current consumption volume and projected growth rate. This APAC leadership is intrinsically linked to the monumental scale of its downstream industries—specifically, consumer electronics assembly, high-speed food and non-food packaging production, and vast automotive manufacturing hubs. The increasing affluence and urbanization across economies like India, Vietnam, and Indonesia are directly correlating with heightened demand for durable consumer goods and high-quality printed materials, creating a powerful demographic and economic driver for IBOA consumption. Conversely, North America and Europe, while slower in volume growth, lead in the consumption of high-value, specialized IBOA grades. These mature markets are driven by stringent environmental compliance, high labor costs necessitating automated, rapid-cure processes, and significant expenditure in cutting-edge technological fields such as medical devices and defense aerospace components. The regional dynamics dictate tailored marketing and supply chain strategies, focusing on cost optimization in APAC and technical expertise and regulatory support in Western markets.

Segment-wise, the market is primarily driven by the Coatings application segment, which utilizes IBOA as a critical reactive diluent in everything from UV-cured wood varnishes, providing superior resistance to abrasion and household chemicals, to protective coatings on industrial machinery. The Inks segment follows closely, benefiting from IBOA’s ability to stabilize pigment dispersions and accelerate cure speeds in flexographic and inkjet formulations used for flexible packaging. A notable trend is the disproportionately high growth rate projected for the 3D Printing Resins segment, where IBOA's properties are ideal for achieving the low viscosity required for vat polymerization and contributing mechanical strength post-curing. This segment represents a significant diversification opportunity away from traditional industrial markets. Overall, the executive assessment reveals that the market's resilience and future prosperity are inextricably linked to continued regulatory support for low-VOC technologies and the successful commercialization of high-purity IBOA grades tailored for emerging, high-specification applications, ensuring robust market performance throughout the forecast period.

AI Impact Analysis on Isobornyl Acrylate Market

The integration of Artificial Intelligence (AI) and Machine Learning (ML) into the Isobornyl Acrylate value chain is transitioning from theoretical exploration to practical implementation, primarily focusing on enhancing R&D efficiency, optimizing manufacturing processes, and stabilizing complex supply logistics. Common user inquiries frequently center on the feasibility of AI-driven material informatics for discovering novel IBOA derivatives with improved properties, such as reduced skin sensitization potential or enhanced bio-compatibility for medical device applications. Users also express high interest in predictive analytical tools capable of forecasting demand fluctuations tied to macroeconomic indicators, geopolitical instability, and seasonal variations in key end-user sectors like construction and consumer electronics. The chemical industry recognizes that the traditional, iterative process of formulating coatings and adhesives is time-consuming and expensive; thus, the expectation is that AI will dramatically reduce the reliance on empirical testing by accurately modeling the chemical kinetics and polymer network formation of IBOA-containing systems under various conditions, thereby accelerating product commercialization cycles and maintaining competitive edge in a fast-paced market environment.

In the domain of chemical manufacturing, AI is becoming instrumental in achieving unparalleled operational efficiency and consistency in Isobornyl Acrylate production. AI models analyze real-time data streams from reactors, including temperature, pressure, catalyst concentration, and flow rates, to dynamically adjust reaction parameters, ensuring optimal conversion yield and product purity while minimizing energy consumption and byproduct generation. This prescriptive approach to manufacturing, often referred to as Industry 4.0, allows IBOA producers to rapidly scale up or down production in response to accurate demand forecasts generated by other ML models, reducing inventory holding costs and mitigating risks associated with highly reactive chemical storage. Furthermore, AI systems are pivotal in maintaining the integrity of the specialized equipment used for IBOA synthesis and purification, employing predictive maintenance algorithms to anticipate equipment failures before they occur. This proactive approach ensures continuous, high-quality output, which is crucial for high-specification end-users demanding absolute consistency in monomer characteristics like refractive index and viscosity.

Looking downstream, the application of AI extends into formulation science and quality assurance for IBOA-based products. Coating and ink manufacturers are deploying AI to optimize the complex relationships between IBOA concentration, oligomer selection, photoinitiator type, and final film properties, such as gloss retention, chemical spot resistance, and flexibility. By analyzing large datasets of historical formulation failures and successes, ML models can suggest optimal starting points for new product development, significantly reducing the R&D expenditure required for custom formulations. For quality control, computer vision systems, powered by AI, are rapidly inspecting cured films for surface defects, haze, or inconsistencies in thickness, ensuring that IBOA-containing products meet stringent industry standards, especially in regulated sectors like aerospace and medical packaging. This comprehensive AI integration across synthesis, logistics, and formulation reinforces the competitive advantages of companies that successfully leverage data science to navigate the technical and economic complexities of the Isobornyl Acrylate market, establishing new benchmarks for purity, performance, and operational scalability.

- AI-driven optimization of chemical reaction conditions in IBOA synthesis, leading to enhanced purity and reduced manufacturing energy footprint.

- Machine learning models for predictive pricing of petrochemical feedstocks (isobornyl alcohol and acrylic acid), stabilizing manufacturer margins.

- Implementation of computational material design to screen and validate new IBOA molecular modifications for specific performance improvements (e.g., lower dermal irritation).

- Use of deep learning for automated quality control of finished UV coatings, ensuring consistency in gloss, color, and scratch resistance.

- Deployment of supply chain analytics powered by AI to optimize inventory levels and logistics routes for IBOA, particularly across international borders.

- Development of AI-assisted formulation platforms that predict the curing kinetics and final mechanical properties of IBOA/oligomer blends, minimizing laboratory experimentation.

- Integration of smart sensors and AI in UV curing equipment (Industry 4.0) to dynamically adjust irradiation dose based on IBOA concentration and substrate type, maximizing cure efficiency.

- Predictive modeling of regulatory compliance risks based on evolving chemical safety profiles and substance classifications globally.

DRO & Impact Forces Of Isobornyl Acrylate Market

The Isobornyl Acrylate market dynamic is governed by a robust structure of Drivers, Restraints, and Opportunities (DRO), collectively forming the fundamental Impact Forces dictating market trajectory over the forecast period. The single most compelling driver is the accelerating global mandate for environmental sustainability, specifically the pervasive requirement for industries to drastically reduce Volatile Organic Compound (VOC) emissions. UV and EB curing systems, which utilize IBOA as a solvent-free reactive diluent, offer an immediate and compliant solution to these regulatory pressures, particularly the tightening standards in Europe (REACH) and North America (EPA/CARB). This regulatory push is compounded by the inherent technical advantages of IBOA-based systems, including instantaneous curing, which translates to massive operational efficiency gains and reduced floor space requirements for drying equipment. Furthermore, the monomer's ability to confer superior physical attributes, such as high abrasion resistance and chemical inertness, makes it the preferred component in high-durability applications in the electronics, automotive protective films, and architectural wood coating markets, ensuring sustained, high-value demand.

Significant restraints challenge the market's full potential, primarily stemming from the complex, volatile upstream supply chain. Isobornyl alcohol, a key precursor, is derived from petrochemical sources, making the price of IBOA highly susceptible to the global fluctuations in crude oil and natural gas markets. This cost instability introduces uncertainty in manufacturing costs for IBOA producers and downstream formulators, often necessitating complex procurement and hedging strategies to maintain stable pricing structures. Another key restraint is the high initial capital investment required by end-users to transition from established thermal or solvent-based curing methods to UV/EB radiation curing infrastructure. While the long-term operational costs of UV systems are lower, the initial expenditure on specialized curing lamps, conveyors, and safety protocols can deter small-to-medium enterprises (SMEs) from rapid adoption. Moreover, continuous attention is required concerning the potential for skin sensitization associated with handling uncured acrylate monomers, necessitating strict occupational health measures and the ongoing development of less irritating derivatives, which adds to R&D complexity and production costs.

Opportunities for market penetration and growth are substantial and primarily focused on technological advancement and geographic expansion. The most significant opportunity lies within the exploding Additive Manufacturing sector; IBOA is a critical ingredient in many photopolymer resins for 3D printing (SLA, DLP). The increasing industrialization of 3D printing across aerospace, medical, and consumer prototyping presents a high-growth, high-value application trajectory for specialty IBOA. Geographic opportunities are concentrated in emerging APAC economies where infrastructure and packaging industries are rapidly modernizing and adopting solvent-free technologies for the first time. Strategic product development focused on bio-based IBOA derived from renewable resources, aligning with corporate sustainability goals, offers a differentiating competitive edge. By leveraging these opportunities through targeted investment in R&D and securing long-term feedstock contracts, manufacturers can effectively mitigate the restraints and fully capitalize on the overwhelming drivers pushing the adoption of radiation-curable Isobornyl Acrylate systems globally.

Segmentation Analysis

The Isobornyl Acrylate market is meticulously delineated into distinct segments based on application scope, required grade purity, and utilized curing technology, allowing for granular analysis of demand trends and customized product strategy development. This segmentation framework is essential because IBOA’s performance requirements vary dramatically across end-uses; for example, an IBOA used in a commercial printing ink requires high reactivity and adhesion, while the same monomer used in an optical display coating requires exceptional purity, UV stability, and minimal residual color. The Application segment remains the most influential dimension, dictating the volume demands and setting the functional specifications for the raw monomer. The dominance of coatings and inks reflects the widespread industrial need for efficient, durable surface treatment, while the high growth observed in 3D Printing signifies a forward-looking shift in technological consumption patterns. Analyzing these segments helps stakeholders understand where market value is concentrated and where future disruptive technologies are likely to emerge, requiring proactive product portfolio adjustments.

Segmentation by Grade Type, specifically distinguishing between Industrial Grade and Specialty/High-Purity Grade, highlights the varying value propositions within the market. Industrial grade IBOA serves high-volume, cost-sensitive applications like general wood coatings and bulk printing inks where absolute minimum yellowing or ultra-low impurity levels are less critical than cost-effectiveness and rapid supply. Conversely, specialty grade IBOA, often subjected to multiple purification steps, commands a premium price and is vital for sophisticated end-uses such as medical device encapsulation, advanced optical films, and high-performance electronics where even trace impurities can compromise functionality, clarity, or dielectric properties. This grade differentiation is crucial for manufacturers to allocate resources effectively, balancing high-volume, low-margin production with low-volume, high-margin specialty chemical manufacturing. The increasing sophistication of consumer electronics and medical requirements continually pushes the boundaries of acceptable impurity levels, driving the continuous innovation within the high-purity segment.

Furthermore, segmentation by Technology (UV Curing versus Electron Beam Curing) is important as it influences the required formulation components, although IBOA is highly compatible with both. UV curing, utilizing medium-pressure mercury lamps or LED arrays with photoinitiators, represents the vast majority of IBOA consumption due to its lower cost and easier integration into existing lines. EB curing, while requiring no photoinitiator, offers superior penetration depth and faster, more complete curing, making it preferred for very thick films or highly pigmented coatings, though its adoption is limited by higher capital investment and complexity. Understanding the regional adoption rates of these technologies is pivotal, as North America and Europe show high rates of UV LED adoption, necessitating IBOA grades optimized for specific LED wavelengths (e.g., 365 nm or 395 nm), whereas APAC utilizes both UV and EB for mass production. This multi-layered segmentation analysis provides a comprehensive framework for market participants to define their strategic focus and product development roadmaps effectively.

- By Application:

- Coatings (Wood, Plastic, Metal, Automotive Refinish, Industrial Protective Coatings, Aerospace Coatings)

- Inks (Printing, Digital Inkjet, Flexographic, Gravure, Screen Printing)

- Adhesives (Pressure Sensitive Adhesives, Structural Bonding Adhesives, Medical Adhesives)

- 3D Printing Resins (SLA, DLP, Inkjet-based AM)

- Others (Optical Materials, Electronic Components Encapsulation, Fiber Optics Coatings)

- By Grade Type:

- Industrial Grade (Standard purity for high-volume applications)

- Specialty/High-Purity Grade (Ultra-low impurity, minimal yellowing for optical and electronic uses)

- By Technology:

- UV Curing (LED UV, Mercury Lamp UV)

- Electron Beam (EB) Curing

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, UK, France, Italy, Spain)

- Asia Pacific (China, Japan, India, South Korea)

- Latin America (Brazil, Argentina)

- Middle East & Africa (GCC Countries, South Africa)

Value Chain Analysis For Isobornyl Acrylate Market

The Isobornyl Acrylate value chain commences with the critical upstream segment involving the production of key petrochemical derivatives: Isobornyl Alcohol and Acrylic Acid. Isobornyl alcohol is synthesized typically from camphor or camphene, or increasingly through synthetic routes optimized for yield and purity, while acrylic acid is derived from propylene oxidation. Stability and cost-effectiveness at this fundamental stage are paramount, as raw material costs constitute the largest proportion of IBOA's final manufacturing cost. Major chemical producers often pursue vertical integration, ensuring a captive supply of these precursors to mitigate supply chain risks and achieve superior cost control, thereby providing a significant competitive advantage over less integrated rivals. Disruptions in the global oil and gas supply or refinery operations can rapidly translate into price volatility for IBOA, necessitating careful risk management and long-term supply agreements between intermediate chemical manufacturers and feedstock suppliers.

The midstream process is centered around the specialized chemical synthesis of IBOA via esterification, followed by complex purification procedures, which involve multi-stage distillation and often proprietary stabilization techniques to ensure long shelf life and prevent premature polymerization. The primary manufacturers operate large, continuous-flow chemical plants, focusing on maximizing throughput and maintaining exacting quality standards, especially for specialty grades. Once synthesized, the bulk IBOA is transported via robust distribution channels. These channels include direct distribution to large multinational coating and ink corporations that purchase thousands of tons annually, or indirect distribution through a network of specialized chemical distributors (like Brenntag or Univar Solutions) who handle smaller volumes, regional logistics, and critical technical support for smaller downstream formulators. Effective distribution requires adherence to strict safety protocols for handling and storage of reactive monomers, including temperature control and oxygen exclusion.

The downstream segment involves the formulators—the coatings, inks, adhesives, and 3D printing resin manufacturers—who are the direct customers of IBOA. These companies utilize IBOA as a crucial reactive diluent to tailor the viscosity and performance of their complex polymer systems. Their innovation focuses on blending IBOA with various oligomers, photoinitiators, and additives to create proprietary, high-performance formulations suited for specific end-user equipment and substrate needs. The finished formulated products (e.g., UV-cured varnish, high-tack PSA) are then supplied to the ultimate end-users, such as automotive assembly plants, electronic component makers, furniture manufacturers, and large commercial printers. Direct channels dominate when custom-formulated solutions are required, while indirect channels (retail distribution, specialized application contractors) service the maintenance and smaller industrial markets. The value realized at the end of the chain is the superior performance and low environmental impact offered by the IBOA-enabled final product.

Isobornyl Acrylate Market Potential Customers

Potential customers for Isobornyl Acrylate are diverse, spanning multiple manufacturing sectors that rely on high-speed, durable surface modification and assembly processes. The primary end-users are formulators specializing in UV-curable coatings, who utilize IBOA extensively to reduce the viscosity of their formulations, enabling precise application methods (such as spraying or roller coating) while contributing to the final hardness and chemical resistance of the cured film. These formulators supply finished goods to industries like wood panel manufacturing (for scratch-resistant flooring and furniture) and plastic component manufacturers (for protective topcoats on consumer electronics). Their purchasing decisions are highly influenced by monomer purity, consistency of supply, and technical support regarding formulation compatibility and curing kinetics.

A second major customer base includes manufacturers of printing inks and varnishes, particularly those involved in high-speed flexible packaging and digital printing. IBOA ensures excellent adhesion to non-porous substrates and rapid cross-linking critical for continuous, high-volume operations. Furthermore, the burgeoning 3D printing industry represents a high-growth segment, with resin manufacturers purchasing IBOA to formulate photopolymer resins used in additive manufacturing techniques like SLA and DLP, requiring precise rheological control and rapid photopolymerization rates to achieve intricate geometries and strong final parts. The electronic component assembly sector also consumes IBOA-based adhesives and encapsulation materials due to their excellent dielectric properties and dimensional stability.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 720 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Arkema S.A., Dairen Chemical Corporation, Shin-Nakamura Chemical Co. Ltd., Mitsubishi Chemical Corporation, BASF SE, Sartomer (TotalEnergies), Jiangsu Sanmu Group Co. Ltd., IGM Resins, Osaka Organic Chemical Industry Ltd., KH Neochem Co., Ltd., Eternal Materials Co., Ltd., Allnex GmbH, Miwon Commercial Co., Ltd., Gantrade Corporation, Nippon Shokubai Co., Ltd., Double Bond Chemical Ind. Co. Ltd., Fuzhou Jinghui Chemical Co. Ltd., Wanhua Chemical Group Co. Ltd., Hitachi Chemical Co. Ltd., Evonik Industries AG |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Isobornyl Acrylate Market Key Technology Landscape

The technological landscape surrounding the Isobornyl Acrylate market is dynamically influenced by advancements in radiation chemistry, polymerization engineering, and environmental stewardship requirements. The foundational technology remains the formulation science of UV-curable systems, which dictates the performance envelope of IBOA. A significant technological shift is the increasing adoption of LED-UV curing systems, replacing traditional mercury vapor lamps. LED technology, while highly energy efficient and generating minimal heat, operates at narrower wavelength bands (e.g., 365, 385, 395, or 405 nm), which necessitates the development of specialized IBOA formulations and corresponding photoinitiators optimized for these specific energy inputs. Manufacturers are investing in R&D to fine-tune IBOA’s compatibility with these next-generation initiation systems to ensure rapid, through-cure polymerization, crucial for industrial speed. Furthermore, precision purification technologies, such as advanced fractional distillation and chromatographic separation, are critical for producing the ultra-high-purity IBOA grades required by the microelectronics and optical industries, where even parts-per-million impurities can compromise optical transmission or electrical performance.

In terms of monomer production, technology development is focused on improving the efficiency and sustainability of the esterification process. Chemical engineering advancements aim to utilize novel, recyclable catalytic systems that enhance the reaction yield of Isobornyl Alcohol and Acrylic Acid conversion while reducing energy requirements and the generation of undesirable byproducts. Process analytical technology (PAT) and real-time monitoring, often incorporating AI for data interpretation, are integrated into manufacturing lines to ensure continuous process optimization and rapid detection of deviations, thereby guaranteeing batch-to-batch consistency—a non-negotiable requirement for large industrial customers. The technology of stabilization is also vital; effective inclusion of inhibitors (like MEHQ or BHT) is necessary to prevent premature thermal polymerization during storage and transport, extending the shelf life of IBOA without negatively impacting its ultimate reactivity during the curing stage. Technological superiority in stabilization techniques translates directly into supply chain reliability and customer confidence.

A cutting-edge technological area heavily reliant on IBOA is the development of advanced resins for additive manufacturing. IBOA is often the primary diluent in photocurable resins used in SLA and DLP 3D printers. The technological challenge here is formulating a resin that maintains extremely low viscosity for layer-by-layer precision, cures rapidly and uniformly upon light exposure, and results in a final part with excellent mechanical properties (e.g., impact strength, heat distortion temperature). This technological demand pushes IBOA manufacturers to explore modified acrylic structures that offer controlled flexibility or higher glass transition temperatures (Tg) upon curing, often achieved through blending with specialty oligomers. The technology landscape is thus characterized by a convergence of chemical synthesis refinement, process automation (Industry 4.0), and application-specific material innovation, all leveraging IBOA's foundational chemical structure to achieve superior performance metrics in modern manufacturing techniques.

Regional Highlights

Asia Pacific (APAC) stands as the undeniable epicenter of the Isobornyl Acrylate market, dictating global supply and demand dynamics due to its overwhelming manufacturing capacity and rapid industrial growth. The region's market dominance is primarily centered in East Asia, encompassing China, South Korea, and Japan, which together host the world's largest production facilities for consumer electronics, automotive components, and mass-market packaging. The rapid and continuing investment in advanced, high-speed printing and coating lines in countries like China and India fuels a voracious appetite for IBOA as the preferred low-VOC reactive diluent. Furthermore, government initiatives in several APAC nations promoting modernization and environmental compliance, though initially less stringent than Western counterparts, are increasingly compelling industries to adopt solvent-free UV-curing technology, further solidifying the regional market's robust growth trajectory. Manufacturers strategically locate production assets here to benefit from lower operational costs and proximity to high-volume end-users, minimizing logistics complexity and strengthening regional market penetration.

The European market for Isobornyl Acrylate is highly sophisticated and characterized by stringent regulatory oversight, particularly by the European Union’s REACH framework. This has created a demand landscape that favors high-quality, fully compliant UV and EB curable systems, where IBOA's 100% reactive status is a core advantage against solvent-based competition. Key consuming industries include high-end automotive refinish, protective coatings for industrial infrastructure, and specialized wood coatings for furniture and architectural applications, driven by robust aesthetic and durability requirements. Europe also leads in the adoption of certain niche, high-value applications, such as specialized aerospace coatings and industrial floor coatings that require maximum chemical and mechanical resistance. The market growth, while lower in volume compared to APAC, is characterized by higher average selling prices (ASP) for specialty and custom-formulated IBOA derivatives, reflecting the demand for superior technical support and guaranteed regulatory adherence.

North America maintains a strong position, driven by continuous technological innovation and robust industrial base, particularly in the United States. The region is a global leader in additive manufacturing (3D printing), which represents a high-growth, high-value application sector for IBOA-based resins. Furthermore, the North American market benefits from strong demand in electronic assembly, medical device manufacturing (requiring high-purity, bio-compatible materials), and strict environmental regulations at the state level (like California’s CARB) that champion low-VOC systems. The Latin American and Middle East & Africa (MEA) regions represent the emerging frontiers. LATAM, led by Brazil and Mexico, is seeing increased IBOA use tied to the expansion of its domestic packaging and printing industries. MEA's demand is accelerating in tandem with large-scale oil and gas, construction, and infrastructure projects requiring high-durability protective coatings, offering substantial long-term market potential as industrial sophistication increases across these developing geographies.

- Asia Pacific (APAC): Highest volume consumer and producer, driven by electronics manufacturing, packaging growth, and increasing adoption of UV-curing systems in China, India, and ASEAN nations. Focus on cost efficiency and mass production.

- Europe: High-value market focused on regulatory compliance (VOC reduction), demanding specialty IBOA grades for high-performance automotive, wood, and industrial protective coatings; strong adoption of UV LED technology.

- North America: Market growth significantly supported by rapid expansion in 3D printing and advanced photopolymer resin development, alongside strong traditional demand from the electronic and high-end industrial sectors under stringent environmental rules.

- Latin America (LATAM): Emerging market characterized by accelerating modernization in printing and flexible packaging, leading to increased demand for IBOA-based inks and adhesives in Brazil and Mexico.

- Middle East & Africa (MEA): Growth stimulated by massive infrastructure and construction investments, increasing the requirement for durable protective and industrial coatings, gradually shifting from conventional solvent-based systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Isobornyl Acrylate Market.- Arkema S.A.

- Dairen Chemical Corporation

- Shin-Nakamura Chemical Co. Ltd.

- Mitsubishi Chemical Corporation

- BASF SE

- Sartomer (TotalEnergies)

- Jiangsu Sanmu Group Co. Ltd.

- IGM Resins

- Osaka Organic Chemical Industry Ltd.

- KH Neochem Co., Ltd.

- Eternal Materials Co., Ltd.

- Allnex GmbH

- Miwon Commercial Co., Ltd.

- Gantrade Corporation

- Nippon Shokubai Co., Ltd.

- Double Bond Chemical Ind. Co. Ltd.

- Fuzhou Jinghui Chemical Co. Ltd.

- Wanhua Chemical Group Co. Ltd.

- Hitachi Chemical Co. Ltd.

- Evonik Industries AG

Frequently Asked Questions

Analyze common user questions about the Isobornyl Acrylate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Isobornyl Acrylate (IBOA) and its primary function in industrial applications?

Isobornyl Acrylate (IBOA) is a key monofunctional reactive acrylic monomer. Its primary industrial function is serving as a low-viscosity reactive diluent in 100% solids UV and electron beam (EB) curable formulations. It effectively reduces the viscosity of complex coatings and inks, enabling high-speed application while ensuring that the final cured film exhibits superior attributes such as exceptional hardness, high scratch resistance, and robust chemical durability, which are critical for protective topcoats and high-performance adhesives.

Which end-use industries drive the majority of demand for Isobornyl Acrylate?

The majority of Isobornyl Acrylate demand is consistently driven by the Coatings industry, which includes wood, plastic, and metal surface protection, followed closely by the Printing Inks and Adhesives sectors. However, the fastest-growing application segment is currently the Additive Manufacturing (3D Printing) industry, where high-purity IBOA is essential for formulating photopolymer resins used in advanced stereolithography (SLA) and Digital Light Processing (DLP) technologies.

How do fluctuations in crude oil prices impact the Isobornyl Acrylate market?

Fluctuations in crude oil prices have a direct and significant impact on the Isobornyl Acrylate market because its key raw materials, isobornyl alcohol and acrylic acid, are predominantly derived from petrochemical feedstocks. Higher crude oil prices translate directly into increased manufacturing costs for IBOA producers, often leading to upward price adjustments for the monomer, which subsequently affects the profitability and formulation costs for downstream ink, coating, and adhesive manufacturers.

Why is IBOA particularly favored over other reactive diluents in UV-curing systems?

IBOA is favored due to its unique combination of low viscosity and the structural rigidity contributed by its isobornyl group. This combination allows formulators to significantly lower the viscosity of high-solids systems without sacrificing crucial final film properties like hardness, flexibility, and resistance to environmental stress. This balance is difficult to achieve with standard linear alkyl acrylates, making IBOA the preferred choice for demanding, high-performance applications that require exceptional durability.

What is the significance of the shift toward UV LED curing technology for IBOA producers?

The shift to UV LED curing technology is highly significant as LEDs operate at narrower, specific wavelengths compared to broadband mercury lamps. This technological change requires IBOA producers and formulators to develop specialty IBOA grades and photoinitiator packages optimized for these narrow spectral outputs (e.g., 395 nm). While challenging, this shift drives innovation toward more efficient, lower-energy curing processes and high-purity IBOA, supporting advanced, sustainable manufacturing practices globally.

What are the key environmental advantages of using Isobornyl Acrylate formulations?

The primary environmental advantage of IBOA formulations is their characteristic as 100% reactive monomers in radiation-curing systems. This means they cure entirely upon exposure to UV or EB energy, resulting in minimal to zero emission of volatile organic compounds (VOCs). This inherent solvent-free nature allows end-users to comply with increasingly strict global air quality regulations and significantly improves workplace safety by reducing exposure to harmful solvent vapors.

Which geographic region demonstrates the strongest growth rate for IBOA consumption?

The Asia Pacific (APAC) region consistently demonstrates the strongest growth rate for IBOA consumption. This rapid growth is driven by massive governmental and private investments in industrial capacity, particularly in the manufacturing of electronics, high-speed packaging, and consumer goods in economies such as China, India, and Southeast Asia, all of which are rapidly adopting modern, high-throughput UV-curing technologies.

How does Isobornyl Acrylate contribute to the durability of wood coatings?

In wood coatings, Isobornyl Acrylate contributes significantly to durability by introducing structural rigidity into the cured polymer network. This rigidity translates directly into high surface hardness and excellent abrasion resistance, protecting wood flooring, furniture, and cabinetry from daily wear, scratches, and damage caused by cleaning chemicals. Its low viscosity also allows for uniform application on complex wood surfaces.

What is the role of IBOA in the performance of pressure-sensitive adhesives (PSAs)?

In pressure-sensitive adhesives (PSAs), IBOA is used to adjust the tack and adhesion performance. It acts as a cross-linking agent that, when cured, enhances the cohesive strength and temperature resistance of the adhesive bond. Its low volatility also ensures that the adhesive formulation remains reactive until curing, crucial for high-performance applications in medical or electronic device assembly where precise bond strength is mandatory.

What steps are manufacturers taking to address the skin sensitization concerns associated with IBOA?

Manufacturers are addressing skin sensitization concerns through multiple approaches, including developing ultra-high-purity IBOA grades that minimize residual impurities and formulating products with optimized polymerization inhibitors. Furthermore, chemical companies are investing in R&D to create modified IBOA derivatives or safer blend alternatives with reduced dermal irritation potential, while simultaneously promoting stringent industrial hygiene and safe handling protocols for end-users.

What is the key technological challenge in using IBOA for 3D printing resins?

The key technological challenge in 3D printing resins using IBOA is balancing viscosity control with final part mechanical performance. IBOA provides the necessary low viscosity for precise printing layer resolution (especially in SLA/DLP), but formulators must ensure that the resultant polymer network achieves high strength, flexibility, and dimensional stability post-cure, requiring complex blending with specialized oligomers and photoinitiators, often optimized for specific printer light sources.

In what way does IBOA impact the viscosity of UV-curable formulations?

IBOA is highly effective at reducing the overall viscosity of UV-curable formulations due to its low molecular weight and liquid state. This function is essential because the primary binding agents (oligomers) in these systems are often highly viscous, making application difficult. By acting as a reactive diluent, IBOA allows the formulation to be easily applied via spraying, roller coating, or inkjet printing, while ensuring it fully integrates into the cured polymer structure rather than evaporating like a traditional solvent.

How do Electron Beam (EB) curing systems differ from UV curing systems when utilizing IBOA?

Both EB and UV systems utilize IBOA, but they differ fundamentally in their initiation mechanisms. UV curing requires the addition of a photoinitiator chemical that absorbs UV light and starts the polymerization. EB curing, conversely, uses highly energetic electrons to initiate polymerization directly, eliminating the need for photoinitiators. EB curing is often faster and achieves a deeper cure, making it suitable for thick or highly pigmented IBOA-based coatings, although it requires higher capital investment.

What is the role of IBOA in developing coatings for plastic substrates like polycarbonate?

IBOA is crucial for coatings applied to plastic substrates, especially polycarbonate, because it provides exceptional adhesion and enhances the substrate's susceptibility to scratching or chemical attack. Its low shrinkage upon curing minimizes internal stress, preventing cracking or delamination on flexible plastic films, while the resulting high cross-link density provides the necessary mechanical protection for surfaces exposed to harsh conditions, such as automotive headlamps or electronic display screens.

What are the primary drivers for the growth of the specialty/high-purity grade IBOA segment?

The growth of the specialty/high-purity grade IBOA segment is primarily driven by the expansion of sensitive high-tech applications such as advanced electronics, optical fiber coatings, and medical device assembly. These applications demand IBOA with ultra-low impurity levels to ensure superior optical clarity, minimal yellowing over time, and consistent dielectric properties, requiring manufacturers to employ sophisticated purification and quality control technologies that command premium pricing.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Isobornyl Acrylate Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Isobornyl Acrylate Market Statistics 2025 Analysis By Application (Reactive Diluent, Resin Synthesis), By Type (Isobornyl Acrylate, Isobornyl Methacrylate), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager