Isolated Interfaces Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439976 | Date : Jan, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Isolated Interfaces Market Size

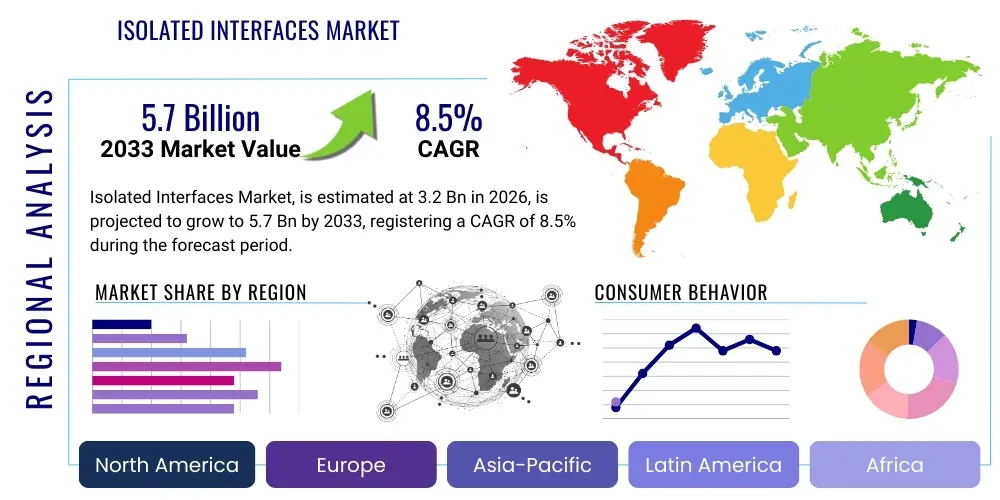

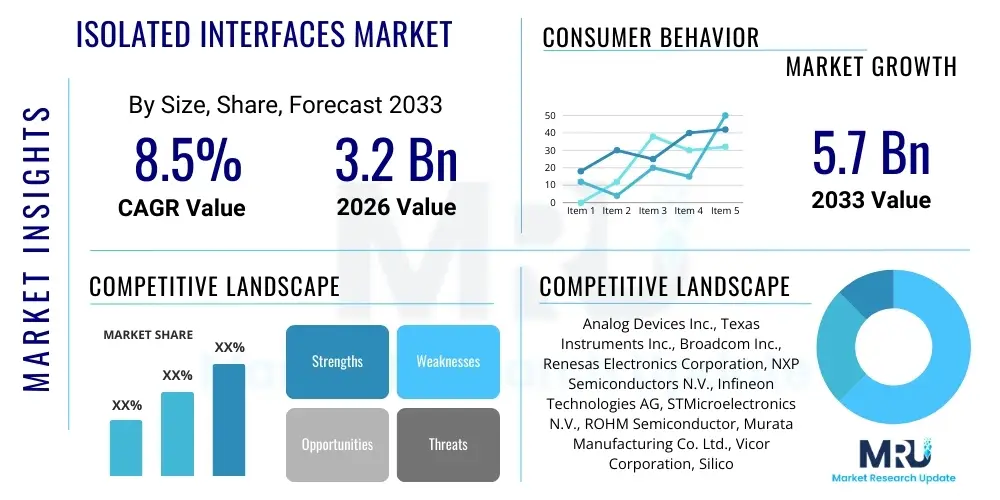

The Isolated Interfaces Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 3.2 Billion in 2026 and is projected to reach USD 5.7 Billion by the end of the forecast period in 2033. This robust growth is primarily driven by the increasing need for enhanced safety, reliability, and precision in sensitive electronic systems across a multitude of industries.

Isolated Interfaces Market introduction

The Isolated Interfaces Market encompasses a critical segment within the broader semiconductor and electronics industry, focusing on components and technologies designed to electrically separate different parts of an electronic system while still allowing data and power to be transferred. This electrical isolation is paramount for ensuring safety, preventing ground loops, mitigating noise interference, and protecting sensitive components from high voltage transients or common-mode voltage differences. Products range from basic optocouplers to advanced digital isolators, isolated amplifiers, and isolated transceivers, each serving specific isolation requirements based on voltage levels, data rates, and environmental conditions. The core principle involves breaking the galvanic connection between circuits using optical, capacitive, or magnetic coupling mechanisms, thus safeguarding operators, equipment, and data integrity.

Major applications for isolated interfaces span an extensive array of sectors, highlighting their indispensable role in modern technology. In industrial automation, they are vital for protecting programmable logic controllers (PLCs), motor drives, and sensor interfaces from harsh industrial environments characterized by electrical noise and high voltages. Automotive applications leverage isolated interfaces in electric vehicle (EV) battery management systems (BMS), on-board chargers, and powertrain control units to ensure occupant safety and system reliability. Furthermore, the healthcare sector utilizes these components in medical devices such as patient monitoring systems, defibrillators, and imaging equipment, where patient safety against electrical shock is a non-negotiable requirement. Their integration also extends to telecommunications infrastructure, power generation and distribution, renewable energy systems, and high-end consumer electronics.

The benefits derived from employing isolated interfaces are multifaceted and profound. They significantly enhance system reliability by preventing transient overvoltages from propagating between circuits, thereby extending the lifespan of sensitive electronic components. Safety is a primary driver, particularly in applications involving human interaction or high voltages, as isolation acts as a protective barrier. Furthermore, isolated interfaces improve signal integrity by eliminating ground loops, which can introduce noise and degrade system performance, especially in precision measurement and control applications. Key driving factors for market growth include the escalating demand for industrial automation and control systems, the rapid proliferation of electric vehicles and associated charging infrastructure, and the increasingly stringent safety and regulatory standards mandated across various industries, pushing manufacturers to adopt higher levels of isolation in their designs.

Isolated Interfaces Market Executive Summary

The Isolated Interfaces Market is experiencing dynamic growth, propelled by robust business trends emphasizing automation, electrification, and connectivity across diverse industries. There is a perceptible shift towards higher integration and smaller form factors in isolation technology, enabling more compact and efficient system designs. Market participants are increasingly focusing on developing solutions that offer higher data rates, enhanced common-mode transient immunity (CMTI), and lower power consumption to meet the evolving demands of advanced applications. Furthermore, the convergence of operational technology (OT) and information technology (IT) in industrial settings, often referred to as Industry 4.0, is driving the need for reliable isolated communication links, fostering innovation in areas like robust isolated Ethernet solutions and sensor interfaces. Companies are strategically investing in research and development to introduce next-generation isolation products that support emerging communication protocols and power delivery requirements.

Regional trends indicate significant market expansion in Asia Pacific, driven by rapid industrialization, the booming automotive manufacturing sector, and large-scale investments in renewable energy infrastructure, particularly in countries like China, India, and Japan. North America and Europe continue to be strong markets, characterized by stringent regulatory environments that mandate high safety standards, thereby sustaining demand for isolated interfaces in medical, industrial, and aerospace applications. These regions are also at the forefront of adopting advanced manufacturing technologies and electric vehicle technologies, which inherently require sophisticated isolation solutions. Latin America and the Middle East & Africa regions, while smaller in market share, are demonstrating promising growth potential, fueled by ongoing infrastructure development projects, increasing industrialization, and a growing emphasis on renewable energy initiatives that necessitate robust isolated power and signal transfer components.

Segmentation trends within the Isolated Interfaces Market highlight key areas of innovation and demand. Digital isolators are rapidly gaining market share over traditional optocouplers due to their superior performance characteristics, including higher data rates, better reliability, and longer operational life. Within digital isolators, capacitive and inductive coupling technologies are dominating, offering distinct advantages for different applications. The demand for isolated amplifiers and isolated transceivers is particularly strong in high-precision measurement systems and communication networks, respectively. From an end-use industry perspective, industrial automation remains the largest segment, but automotive applications, especially those related to electric and hybrid vehicles, are poised for the fastest growth. Healthcare and energy & power segments also represent significant and expanding opportunities, driven by increasing regulatory requirements for safety and the growing complexity of electronic systems within these critical infrastructures. Manufacturers are responding by offering application-specific isolation solutions tailored to the unique challenges of each segment, such as high-temperature tolerant isolators for automotive under-hood applications or low-leakage current isolators for medical devices.

AI Impact Analysis on Isolated Interfaces Market

The advent and widespread integration of Artificial Intelligence (AI) are poised to significantly transform the Isolated Interfaces Market, primarily by driving the need for more sophisticated, high-performance, and reliable isolation solutions. Common user questions related to AI's impact often revolve around how AI systems will influence the design and requirements of isolated interfaces, specifically concerning data throughput, power efficiency, and the need for enhanced fault tolerance in AI-powered edge devices and industrial control systems. Users frequently inquire about the role of isolated interfaces in protecting AI hardware from electrical disturbances and ensuring uninterrupted operation, especially in safety-critical applications. Furthermore, there is considerable interest in how AI's demand for real-time data processing will necessitate faster and more robust isolated communication channels, moving beyond traditional isolation paradigms. Expectations are high for isolation technologies that can seamlessly integrate with AI accelerators and sensor fusion architectures, providing both electrical separation and high-bandwidth data transfer without compromising system performance or adding excessive latency. The market anticipates that AI will push the boundaries of isolation technology towards more intelligent, adaptive, and power-optimized solutions, crucial for the deployment of scalable AI at the edge and in highly distributed environments.

AI's influence on the Isolated Interfaces Market will be multifaceted, fundamentally reshaping product development and application requirements. As AI algorithms become more embedded in edge devices—ranging from smart sensors and industrial robots to autonomous vehicles—the underlying hardware requires greater protection from the harsh electrical environments they operate in. This drives demand for isolated interfaces that can withstand higher transient voltages, exhibit superior common-mode rejection, and maintain signal integrity over extended periods. The need for compact, energy-efficient AI processing units at the edge necessitates isolation components with reduced power consumption and smaller footprints, aligning with the overall trend towards miniaturization in electronics. Moreover, the increasing complexity of AI systems, especially those performing critical functions, mandates highly reliable isolation to prevent cascading failures due to electrical faults, thereby enhancing the overall resilience of AI-powered infrastructures.

The impact of AI also extends to the design and testing phases of isolated interfaces. AI-driven simulation tools can optimize isolation barrier designs for specific operating conditions, predicting performance under various fault scenarios and accelerating product development cycles. Furthermore, AI-powered predictive maintenance for critical systems, such as industrial machinery or power grids, relies heavily on accurate sensor data, which often requires isolated signal conditioning. This creates a feedback loop where AI itself drives the need for better isolation to ensure the quality and reliability of data that feeds AI models. The increasing proliferation of AI in diverse sectors, including medical diagnostics, autonomous driving, and advanced robotics, will continue to expand the addressable market for isolated interfaces, particularly for solutions offering enhanced safety certifications, higher levels of integration, and robust performance in extreme operational conditions, making them indispensable components in the AI-driven future.

- Increased demand for high-speed isolated data transfer for AI edge processing.

- Greater emphasis on robust isolation for protecting sensitive AI hardware in noisy environments.

- Requirement for lower power isolation solutions to support energy-efficient AI at the edge.

- Driving innovation in highly integrated isolation devices for compact AI system designs.

- Enhanced need for reliable and fail-safe isolation in safety-critical AI applications (e.g., autonomous vehicles, industrial robotics).

- Stimulating development of isolation components compatible with advanced AI communication protocols.

- AI-driven optimization in the design and testing of isolated interfaces for improved performance.

DRO & Impact Forces Of Isolated Interfaces Market

The Isolated Interfaces Market is shaped by a complex interplay of drivers, restraints, and opportunities, collectively forming the impact forces that dictate its trajectory. A primary driver is the accelerating trend of industrial automation across manufacturing sectors, where PLCs, motor control systems, and robotic arms rely heavily on robust isolation to ensure safe, reliable, and precise operation in electrically noisy environments. The burgeoning electric vehicle (EV) market constitutes another significant growth engine, as isolated interfaces are critical for battery management systems, on-board chargers, and power conversion units, ensuring high-voltage safety and efficient power flow. Moreover, the stringent regulatory landscape, particularly in medical and industrial applications, mandates high levels of electrical isolation for patient and operator safety, compelling manufacturers to integrate advanced isolation technologies into their designs. The proliferation of IoT devices and connected systems across smart homes, smart cities, and industrial IoT (IIoT) further amplifies demand, as these devices often require isolation to protect sensitive microcontrollers and ensure reliable communication across diverse voltage domains. These forces together create a powerful impetus for market expansion and technological advancement.

Despite these strong tailwinds, the market faces several notable restraints. The relatively high initial investment costs associated with advanced isolated interfaces, especially digital isolators, can be a deterrent for some smaller manufacturers or cost-sensitive applications, leading them to opt for less sophisticated or non-isolated solutions. The inherent complexity in designing and integrating isolated components into intricate electronic systems presents another challenge, requiring specialized engineering expertise and adding to development timelines. Furthermore, performance limitations in extreme operating environments, such as very high temperatures or under severe electromagnetic interference (EMI), can constrain their applicability in certain niche markets, necessitating ongoing research into more resilient materials and architectures. The technical challenge of achieving ultra-low power consumption while maintaining high isolation voltage and data rates also acts as a restraint, especially for battery-powered or energy-harvesting applications where power budgets are extremely tight. These factors require manufacturers to continuously innovate, balancing performance, cost, and ease of integration.

Opportunities for growth are abundant and diverse within the Isolated Interfaces Market. The emergence of wide-bandgap (WBG) semiconductors, such as Silicon Carbide (SiC) and Gallium Nitride (GaN), in power electronics is opening new avenues for high-efficiency and high-power density systems, which in turn require sophisticated, high-performance isolated gate drivers and measurement solutions. Miniaturization trends in electronics continue to push for smaller, more integrated isolation packages, enabling their deployment in space-constrained applications and portable devices. Furthermore, the expansion into new application frontiers, particularly in advanced medical diagnostics, aerospace and defense, and renewable energy sectors like solar inverters and wind turbine controls, presents significant growth prospects. The continuous evolution of communication protocols (e.g., Industrial Ethernet, CAN FD) and the increasing demand for higher data rates are driving innovation in isolated transceivers and digital isolators capable of supporting these advanced standards. Strategic partnerships and collaborations between isolation technology providers and system integrators can further unlock market potential by creating tailored solutions for specific industrial and commercial challenges. The ongoing global push for energy efficiency and decarbonization also fuels demand for robust isolation in power conversion and management systems, solidifying the long-term growth outlook for this critical market segment.

Segmentation Analysis

The Isolated Interfaces Market is meticulously segmented to provide a clear understanding of its diverse components, application areas, and technological approaches. This segmentation helps in analyzing market trends, identifying key growth drivers within specific niches, and understanding the competitive landscape. The market is primarily segmented by type of isolation technology, the number of channels, supported data rates, and crucial end-use industries, reflecting the varied requirements across different applications. Each segment possesses distinct characteristics concerning performance, cost, and adoption rates, influenced by technological advancements, regulatory pressures, and application-specific demands. For instance, the choice between an optocoupler and a digital isolator often depends on the required data rate, lifespan, and immunity to common-mode transients, while the end-use industry dictates the necessary safety certifications and environmental robustness of the isolation solution. Understanding these segment dynamics is critical for market participants to tailor their product offerings and strategic investments effectively.

The segmentation by type illustrates the technological evolution in isolation, from traditional optocouplers to more advanced digital and magnetic technologies. Optocouplers, while mature and cost-effective, are increasingly being supplanted by digital isolators in new designs due to their superior performance metrics. Digital isolators, utilizing capacitive or inductive coupling, offer higher speeds, better reliability, and lower power consumption, making them ideal for modern high-performance systems. Isolated amplifiers are crucial for precision analog signal conditioning in electrically noisy environments, whereas isolated transceivers facilitate robust communication across isolated domains for various industrial and automotive networks. Further segmentation by channel count (single-channel vs. multi-channel) reflects integration needs, and data rate categories (low, medium, high) cater to applications ranging from simple status signaling to high-bandwidth data links. The end-use industry segmentation provides insight into the major verticals driving demand, each with its unique isolation challenges and regulatory requirements, such as medical safety standards or automotive functional safety standards. Analyzing these segments not only reveals current market share but also highlights future growth opportunities for innovation and specialization within the isolated interfaces domain.

- By Type:

- Digital Isolators

- Capacitive Digital Isolators

- Inductive Digital Isolators

- Giant Magnetoresistance (GMR) Isolators

- Optocouplers (Optical Isolators)

- Isolated Amplifiers

- Isolated Transceivers (e.g., CAN, RS-485, USB Isolators)

- Digital Isolators

- By Channel:

- Single-Channel Isolators

- Multi-Channel Isolators

- By Data Rate:

- Low Data Rate Isolators (< 1 Mbps)

- Medium Data Rate Isolators (1 Mbps - 50 Mbps)

- High Data Rate Isolators (> 50 Mbps)

- By End-Use Industry:

- Industrial Automation & Control (e.g., PLCs, Motor Drives, Robotics)

- Automotive (e.g., EVs/HEVs, BMS, On-board Chargers)

- Healthcare (e.g., Medical Devices, Patient Monitoring)

- Telecommunications (e.g., Base Stations, Network Infrastructure)

- Energy & Power (e.g., Solar Inverters, Wind Turbines, Smart Grids)

- Consumer Electronics (e.g., Appliances, Audio Systems)

- Aerospace & Defense

Value Chain Analysis For Isolated Interfaces Market

The value chain for the Isolated Interfaces Market is a complex ecosystem involving several stages, from raw material sourcing to end-user consumption, each adding value and contributing to the final product. Upstream analysis begins with the procurement of critical raw materials and components, which include specialized semiconductor wafers, packaging materials, lead frames, molding compounds, and precise optical components (for optocouplers) or magnetic materials (for inductive isolators). Key suppliers in this segment are typically large chemical companies, material science firms, and specialized component manufacturers. The quality and availability of these foundational materials significantly impact the performance, reliability, and cost-effectiveness of the final isolated interface products. Advanced semiconductor manufacturing processes, including wafer fabrication, etching, and deposition, are also crucial upstream activities, often handled by dedicated foundries or integrated device manufacturers (IDMs) with extensive capital investments and technological expertise. Innovation in material science, particularly for insulation barriers and high-temperature-resistant packaging, is a continuous driver of value at this initial stage.

Moving downstream, the value chain encompasses the design, manufacturing, assembly, and testing of isolated interface devices. Integrated device manufacturers (IDMs) like Analog Devices, Texas Instruments, and Infineon Technologies often manage many of these steps internally, from chip design and fabrication to assembly and final testing. Fabless semiconductor companies, on the other hand, outsource manufacturing to specialized foundries (fabs) and focus primarily on design and marketing. The assembly and packaging phase is critical for ensuring the isolation barrier's integrity, often involving advanced techniques like mold encapsulation and hermetic sealing to meet stringent safety standards. Rigorous testing and quality assurance procedures are implemented at various stages to verify electrical isolation, data integrity, and environmental robustness, ensuring compliance with industry standards such. The distribution channel then plays a pivotal role in connecting manufacturers with end-users. This involves a mix of direct and indirect channels. Direct channels include manufacturers selling directly to large original equipment manufacturers (OEMs) who require significant volumes and often customized solutions, allowing for closer collaboration and technical support. This approach fosters strong relationships and ensures tailored product development based on specific application needs.

Indirect distribution channels are equally vital for reaching a broader customer base, especially small to medium-sized enterprises (SMEs) and specialized niche markets. These channels primarily involve a network of authorized distributors, value-added resellers (VARs), and online marketplaces. Distributors, such as Arrow Electronics, Avnet, and Future Electronics, provide extensive logistical support, inventory management, and regional sales coverage, making isolated interfaces readily available globally. VARs may offer specialized integration services, bundling isolated components with other electronic systems to provide comprehensive solutions to end-users. The choice of distribution channel often depends on the target market, product complexity, and required level of customer support. After-sales support, technical documentation, and application notes also form an important part of the value delivery, ensuring proper implementation and troubleshooting for end-users. This intricate network of upstream suppliers, manufacturers, and downstream distribution channels collaboratively ensures that the isolated interfaces market effectively serves the diverse and demanding needs of various industries, continuously adapting to technological advancements and evolving market requirements.

Isolated Interfaces Market Potential Customers

Potential customers for isolated interfaces are widespread across virtually every industry that relies on electronic systems, particularly where safety, reliability, and signal integrity are paramount considerations. The industrial automation sector represents a vast segment of end-users, including manufacturers of programmable logic controllers (PLCs), human-machine interfaces (HMIs), motor drives, robotics, and various sensor and actuator systems. Companies engaged in process control, factory automation, and industrial machinery manufacturing consistently require isolated interfaces to protect their control systems from high voltages, ground loops, and electrical noise inherent in industrial environments. These customers are driven by the need for robust, long-lasting solutions that comply with industry standards like IEC 61131 for PLCs and functional safety standards, ensuring uninterrupted operation and worker safety in harsh operational settings. The emphasis here is on components that offer high common-mode transient immunity (CMTI) and wide operating temperature ranges.

Another significant customer base lies within the automotive industry, particularly with the rapid proliferation of Electric Vehicles (EVs) and Hybrid Electric Vehicles (HEVs). Automotive OEMs and Tier 1 suppliers developing battery management systems (BMS), on-board chargers (OBCs), DC-DC converters, inverters, and powertrain control units are critical buyers. In these applications, isolated interfaces are indispensable for separating high-voltage domains from low-voltage control circuits, protecting occupants from electric shock, and ensuring the reliable operation of critical vehicle functions. The demand from this sector is characterized by a need for compact, highly efficient, and AEC-Q100 qualified components that can withstand extreme automotive environmental conditions. Furthermore, the healthcare sector comprises medical device manufacturers creating patient monitoring equipment, defibrill diagnostic imaging systems, and surgical tools. For these customers, isolated interfaces are non-negotiable due to the absolute necessity of patient safety against electrical leakage currents and shock hazards, complying with stringent medical standards like IEC 60601. They seek ultra-low leakage, high reliability, and biocompatible packaging options.

Beyond these core industries, a broad spectrum of other sectors also represent key potential customers. Telecommunications equipment manufacturers, for instance, utilize isolated interfaces in base stations, network routers, and power over Ethernet (PoE) applications to ensure signal integrity and protection against lightning strikes and power surges. The energy and power sector, including developers of solar inverters, wind turbine control systems, smart grid infrastructure, and power supplies, relies on isolation for safe and efficient power conversion and distribution, particularly where high voltages are present. Even the consumer electronics industry, though typically more cost-sensitive, employs isolated interfaces in high-end audio equipment to eliminate ground loops and improve sound quality, and in some appliances for enhanced safety. Specialized industries like aerospace and defense also procure isolated interfaces for avionics, radar systems, and military communication equipment, prioritizing extreme reliability, radiation tolerance, and high-performance under demanding conditions. The diversity of these end-user needs underscores the foundational importance and versatility of isolated interface technologies across the entire electronic landscape.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.2 Billion |

| Market Forecast in 2033 | USD 5.7 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Analog Devices Inc., Texas Instruments Inc., Broadcom Inc., Renesas Electronics Corporation, NXP Semiconductors N.V., Infineon Technologies AG, STMicroelectronics N.V., ROHM Semiconductor, Murata Manufacturing Co. Ltd., Vicor Corporation, Silicon Labs, Skyworks Solutions Inc., Panasonic Corporation, Littelfuse Inc., Toshiba Corporation, ON Semiconductor, TDK Corporation, Knowles Corporation, Würth Elektronik, Maxim Integrated (now part of Analog Devices). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Isolated Interfaces Market Key Technology Landscape

The Isolated Interfaces Market is underpinned by a dynamic and evolving technology landscape, characterized by continuous innovation aimed at improving performance, reducing size, and lowering power consumption. The fundamental technologies employed for electrical isolation include optical, capacitive, and magnetic coupling. Optocouplers, representing the most mature technology, use light-emitting diodes (LEDs) and photodetectors to transfer signals across an isolation barrier. While robust and cost-effective for many applications, their limitations in terms of speed, power consumption, and aging effects have paved the way for more advanced alternatives. Digital isolators, which utilize either capacitive or inductive coupling, have emerged as dominant solutions. Capacitive digital isolators transmit data by modulating an electric field across a high-voltage dielectric barrier, offering high data rates, excellent common-mode transient immunity (CMTI), and long operational lifetimes. Inductive digital isolators, conversely, use on-chip transformers to transmit data magnetically, providing similar benefits with robust performance in noisy environments, often favored for their superior ability to handle very high-speed signals.

Beyond core isolation mechanisms, the technology landscape extends to advanced packaging and integration techniques. Multi-channel isolators, isolated power supplies, and integrated isolated transceivers are examples of how manufacturers are integrating more functionality into single packages, reducing board space and simplifying design for end-users. The development of specialized materials for insulation barriers, such as silicon dioxide (SiO2) and polyimide, is crucial for achieving higher breakdown voltages and enhanced reliability under harsh thermal and electrical stresses. Furthermore, the integration of isolation functionality directly into microcontrollers or power management ICs is an emerging trend that promises further miniaturization and system-level cost reduction. Innovations in wide-bandgap (WBG) semiconductors like SiC and GaN are also profoundly impacting the isolation market, as they require specialized isolated gate drivers and current/voltage sensors that can operate at much higher switching frequencies and temperatures, pushing the boundaries of existing isolation technology to accommodate these next-generation power systems. The quest for higher integration also involves incorporating features like fault detection, diagnostic capabilities, and robust EMI suppression techniques directly into isolation components, providing more intelligent and resilient solutions.

The drive for improved performance in isolated interfaces is also evident in advancements related to data rates, power efficiency, and common-mode transient immunity (CMTI). Modern digital isolators can support data rates up to hundreds of megabits per second, essential for high-speed industrial communication protocols and data-intensive automotive applications. Simultaneously, significant efforts are being made to reduce the power consumption of isolation components, particularly for battery-powered or energy-sensitive devices at the edge of IoT networks. Achieving high CMTI, which is the ability of an isolator to reject large, fast-changing voltage transients between the isolated grounds, remains a critical design challenge and a key differentiator, especially in industrial settings. Moreover, the landscape is seeing increasing adoption of regulatory compliance and certification standards, such as UL, CSA, VDE, and AEC-Q100 for automotive applications, influencing design choices and driving demand for pre-certified solutions. The interplay of these technological advancements – from fundamental coupling methods to advanced integration, material science, and performance optimization – collectively defines the highly sophisticated and rapidly evolving key technology landscape of the isolated interfaces market, ensuring its continued relevance and growth in an increasingly electrified and interconnected world.

Regional Highlights

- North America: A mature market characterized by stringent regulatory standards, particularly in medical devices and industrial safety. Strong demand from the automotive sector (EVs), aerospace and defense, and significant investment in industrial automation. Early adoption of advanced technologies drives innovation and high-performance isolation solutions.

- Europe: Similar to North America, driven by strict safety regulations and a robust industrial manufacturing base (Industry 4.0 initiatives). High adoption in renewable energy (solar, wind), automotive (EVs), and healthcare sectors. Germany and the Nordic countries are key contributors to market growth and technological advancements.

- Asia Pacific (APAC): The fastest-growing market, propelled by rapid industrialization, massive investments in manufacturing, and booming consumer electronics and automotive (EV) industries in countries like China, India, Japan, and South Korea. Government initiatives promoting domestic manufacturing and infrastructure development further fuel demand for isolated interfaces.

- Latin America: An emerging market with growing industrialization and infrastructure development projects. Increasing adoption of renewable energy and automotive manufacturing contribute to market expansion. Brazil and Mexico are leading the demand, driven by their respective industrial bases.

- Middle East and Africa (MEA): Demonstrating nascent but significant growth, primarily driven by investments in energy infrastructure, smart city projects, and diversification of economies away from oil. The region's growing industrial base and adoption of automation solutions present long-term opportunities for isolated interfaces.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Isolated Interfaces Market.- Analog Devices Inc.

- Texas Instruments Inc.

- Broadcom Inc.

- Renesas Electronics Corporation

- NXP Semiconductors N.V.

- Infineon Technologies AG

- STMicroelectronics N.V.

- ROHM Semiconductor

- Murata Manufacturing Co. Ltd.

- Vicor Corporation

- Silicon Labs

- Skyworks Solutions Inc.

- Panasonic Corporation

- Littelfuse Inc.

- Toshiba Corporation

- ON Semiconductor

- TDK Corporation

- Knowles Corporation

- Würth Elektronik

- Maxim Integrated (now part of Analog Devices)

Frequently Asked Questions

What are isolated interfaces and why are they critical in modern electronic systems?

Isolated interfaces are electronic components that electrically separate two parts of a circuit while allowing signals or power to be transferred. They are critical because they prevent damaging common-mode voltages and ground loops, protect sensitive components from high-voltage transients, ensure human safety, and improve signal integrity by reducing noise, making them indispensable in applications requiring reliability and safety across different voltage potentials.

How do digital isolators differ from traditional optocouplers, and which technology is preferred today?

Digital isolators use capacitive or inductive coupling to achieve isolation, offering higher data rates, better reliability (no LED degradation), lower power consumption, and superior common-mode transient immunity compared to optocouplers, which rely on light transmission. Due to these performance advantages, digital isolators are increasingly preferred in new designs for high-speed and demanding applications over traditional optocouplers.

What are the primary industries driving the growth of the Isolated Interfaces Market?

The primary industries driving market growth include industrial automation, due to the need for robust control systems; the automotive sector, especially with the rapid expansion of electric vehicles (EVs) for battery management and power electronics; healthcare, for patient and device safety in medical equipment; and energy and power systems, such as solar inverters and smart grids, for efficient and safe power management.

What impact do strict safety regulations have on the Isolated Interfaces Market?

Strict safety regulations, such as IEC 60601 for medical devices or functional safety standards for industrial and automotive applications, profoundly impact the market by mandating the use of certified isolated interfaces. These regulations compel manufacturers to adopt higher-performance, more reliable isolation technologies, driving innovation in component design, testing, and compliance, thereby significantly contributing to market expansion and technological advancement.

What is the role of isolated interfaces in electric vehicle (EV) battery management systems?

In EV battery management systems (BMS), isolated interfaces are crucial for several reasons. They provide vital electrical separation between the high-voltage battery pack and the low-voltage control circuitry, ensuring occupant safety and protecting sensitive electronics. They enable reliable communication for monitoring individual cell voltages and temperatures, facilitating precise battery control and enhancing the overall efficiency and lifespan of the EV's power system by preventing ground loops and noise interference.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager