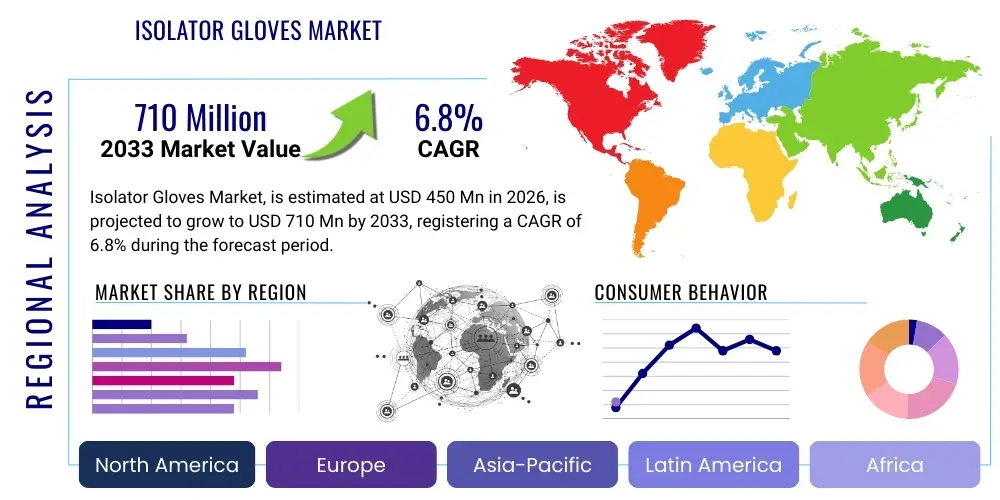

Isolator Gloves Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432052 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Isolator Gloves Market Size

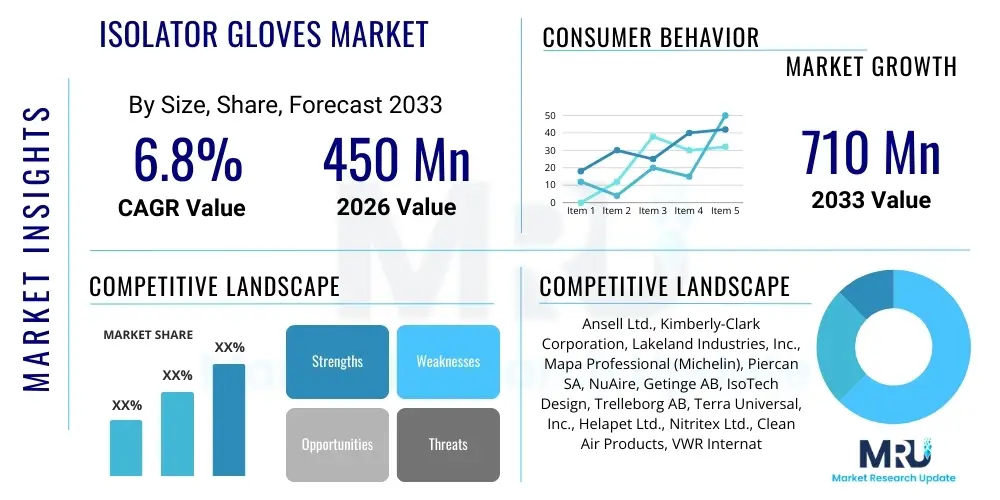

The Isolator Gloves Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 710 Million by the end of the forecast period in 2033. This consistent expansion is primarily fueled by the stringent regulatory landscape governing sterile manufacturing environments, particularly within the pharmaceutical and biotechnology sectors where contamination control is paramount. The increasing global production of injectable drugs, complex biologics, and sensitive vaccine materials necessitates the reliable performance of barrier isolation systems, making high-quality isolator gloves indispensable components.

Isolator Gloves Market introduction

The Isolator Gloves Market encompasses specialized hand protection systems designed to maintain a physical barrier between the sterile interior of an isolator or restrictive barrier system (RABS) and the external, non-sterile environment. These gloves are critical components in ensuring aseptic conditions during sensitive processes such as compounding sterile preparations, handling hazardous materials, or conducting quality control testing in cleanrooms. The primary products include various materials like Neoprene, Butyl rubber, EPDM, and Hypalon, selected based on their chemical resistance, flexibility, and durability against sterilization agents like Vaporized Hydrogen Peroxide (VHP).

Major applications of isolator gloves span across pharmaceutical manufacturing, especially in aseptic filling lines and potent compound handling; healthcare settings for compounding chemotherapy and TPN solutions; and advanced research facilities dealing with biological hazards or sensitive electronics. The inherent benefit of these systems lies in maximizing product protection and operator safety simultaneously, achieving higher sterility assurance levels (SALs) compared to conventional cleanroom practices. Furthermore, the ergonomic design advancements now offer improved dexterity, reducing user fatigue and enhancing precision during complex manipulations within the constrained isolator space.

The market is predominantly driven by the surging investment in pharmaceutical R&D, particularly for personalized medicine and high-value biologics, which require immaculate manufacturing environments. Regulatory bodies like the FDA and EMA consistently reinforce guidelines mandating advanced aseptic processing techniques, thus compelling manufacturers to upgrade legacy cleanroom facilities to modern isolator technology. This shift towards closed systems, combined with the increasing prevalence of highly potent active pharmaceutical ingredients (HPAPIs), establishes a persistent demand trajectory for robust, chemically resistant, and high-integrity isolator glove solutions globally.

Isolator Gloves Market Executive Summary

The Isolator Gloves Market is experiencing robust expansion driven by global trends emphasizing advanced aseptic processing and containment strategies. Business trends highlight a significant pivot toward synthetic rubber materials (Neoprene and Butyl) offering superior chemical resistance and longevity over traditional latex, mitigating concerns related to latex allergies and VHP compatibility. Key manufacturers are focusing intensely on developing enhanced ergonomics, including specialized wrist and finger designs, to address operator discomfort and improve operational efficiency. Strategic partnerships between glove manufacturers and isolator system providers are crucial for ensuring system compatibility and optimizing integrated performance, particularly in fully automated aseptic lines.

Regionally, North America and Europe dominate the market, primarily due to the stringent implementation of GMP regulations and the presence of major biopharmaceutical companies and advanced healthcare infrastructure. However, the Asia Pacific (APAC) region is projected to register the fastest growth rate, fueled by substantial foreign direct investment into pharmaceutical manufacturing hubs in China, India, and Southeast Asia, coupled with rapid development in local biotechnology sectors and increasing adoption of international quality standards. Latin America and the Middle East & Africa (MEA) represent emerging opportunities, stimulated by improvements in healthcare spending and the establishment of local vaccine production capabilities requiring high-level contamination control.

Segment-wise, the Synthetic Rubber segment, especially Butyl rubber, maintains the largest market share due to its excellent gas impermeability and resistance to aggressive cleaning agents, essential for critical sterility assurance. The Pharmaceutical & Biotechnology application segment remains the largest end-user, accounting for the majority of demand, particularly within sterile compounding and aseptic filling. Future trends point towards the increased adoption of real-time integrity testing technologies integrated into glove ports, enhancing overall process validation and ensuring instant detection of barrier failures, thereby solidifying the market's focus on proactive quality assurance rather than reactive failure mitigation.

AI Impact Analysis on Isolator Gloves Market

User queries regarding AI's influence on the Isolator Gloves Market often center on how automation and smart systems can reduce human interaction, predict glove failure, and optimize replacement cycles. Common themes include the integration of AI-powered vision systems for automated visual inspection of gloves for pinholes or tears, the use of machine learning algorithms to analyze glove usage data (e.g., exposure duration, chemical contact, sterilization cycles) to predict end-of-life, and the potential for AI to optimize the training protocols for operators interacting with complex isolator glove systems. Users are keenly interested in whether AI can extend glove lifespan or, conversely, if increased automation might eventually reduce the reliance on manual glove manipulation in highly automated filling lines. The consensus expectation is that AI will enhance quality control and predictive maintenance rather than fundamentally altering the product itself, ensuring higher levels of sterility assurance.

- AI-driven Predictive Maintenance: Utilizing sensor data and machine learning to forecast the precise time for glove replacement based on material stress, usage cycles, and exposure history, minimizing unexpected failures.

- Automated Quality Control (AQC): Implementation of AI-powered vision systems for rapid, highly accurate, non-destructive inspection of glove integrity, detecting micro-defects faster than human operators.

- Optimized Sterilization Cycles: AI algorithms fine-tuning VHP exposure parameters based on glove material type and historical degradation rates, potentially extending useful life while ensuring compliance.

- Ergonomics and Training Simulation: AI used to analyze operator interaction movements and stress points on the gloves, informing future ergonomic designs and providing personalized virtual reality (VR) training simulations for complex manipulations.

- Supply Chain Optimization: Machine learning models analyzing production schedules and regulatory demand to optimize the inventory and distribution of specialized glove materials globally, preventing critical stockouts.

DRO & Impact Forces Of Isolator Gloves Market

The market for isolator gloves is primarily propelled by critical regulatory drivers and the global expansion of high-purity manufacturing, while simultaneously facing significant constraints related to operational costs and material integrity challenges. The major driver is the worldwide shift towards adopting advanced barrier technologies (Isolators and RABS) mandated by bodies like the FDA and EMA for all new aseptic processing facilities, especially following revisions to Annex 1 of the EU GMP guidelines, which prioritize minimizing personnel intervention. Opportunities predominantly stem from the explosion in biological drug development, requiring dedicated, secure isolator environments for cell and gene therapy manufacturing, which demands highly specialized, non-leaching glove materials compatible with sensitive media and stringent sterility requirements.

However, the market faces notable restraints, chiefly the relatively high initial capital expenditure associated with high-performance isolator systems, including the cost of specialized gloves and their frequent, non-negotiable replacement. Furthermore, maintaining the integrity of the barrier system poses an ongoing technical challenge; pinholes, tears, and chemical degradation remain critical risks that necessitate frequent, meticulous integrity testing, adding complexity and operational downtime. The constant need for material compatibility testing against new cleaning agents and sterilants also acts as a restraint, forcing manufacturers into continuous, expensive R&D cycles to certify glove performance under evolving operating procedures.

Impact forces currently shaping the market dynamics include strong governmental enforcement of aseptic quality standards (driving demand), technological advancements in material science leading to enhanced glove flexibility and durability (mitigating restraints), and intense competitive pressure resulting in more cost-effective production methods (addressing cost constraints). The long-term trajectory is heavily influenced by the speed of adoption of automated aseptic processes; while full automation reduces the need for constant human manipulation, the remaining critical interventions still rely heavily on the impeccable function of the integrated isolator glove system, ensuring sustained demand for high-integrity products tailored for specialized tasks.

Segmentation Analysis

The Isolator Gloves Market segmentation provides a detailed structural breakdown based on material composition, intended application, and overall product type, reflecting the varied and highly specific requirements of different end-user environments. Material type segmentation, which is the most critical axis, dictates the chemical resistance, permeability, and mechanical properties of the glove, directly affecting its suitability for handling specific potent compounds, exposure to sterilization agents (like VHP or ozone), and required duration of use within the critical zone. End-user applications differentiate demand, with the pharmaceutical sector prioritizing regulatory compliance and sterility assurance, while the chemical and research segments focus more heavily on robust chemical resistance and thermal stability.

The ongoing trend shows material choice being dictated increasingly by regulatory scrutiny and operator comfort. While traditional materials offer robust protection, newer synthetic blends are being developed to strike a better balance between protection, dexterity, and resistance to environmental stress cracking, which is a major failure mode in high-cycle sterilization environments. This detailed segmentation allows manufacturers to target niche requirements, such as gloves optimized for use in hydrogen peroxide sterilizers or those designed specifically for handling high-shear filling needles, ensuring that the market responds effectively to specialized operational challenges inherent in modern aseptic processing.

Product type segmentation reflects system design, distinguishing between standard mounted gloves and specialized glove sleeves or half-suits used in larger, more complex isolator architectures. The diversity in product offering underscores the market's maturity and its ability to cater to both standard RABS systems and highly specialized, large-scale isolator containment units used in modern vaccine and biologic manufacturing facilities. Overall, the precise understanding of these segment dynamics is vital for stakeholders planning investments or product development in this highly regulated and technically demanding niche.

- Material Type:

- Natural Rubber (Latex)

- Synthetic Rubber (Neoprene, Butyl Rubber, EPDM, CSM/Hypalon)

- Polyurethane

- Application:

- Pharmaceutical & Biotechnology Manufacturing (Aseptic Filling, Potent Compound Handling)

- Hospitals & Healthcare (Pharmacy Compounding)

- Research & Academic Institutions

- Food & Beverage Industry (High-Purity Processing)

- Chemical & Electronics Industry

- Type:

- Standard Isolator Gloves (Single-piece gloves integrated into the glove port)

- Half-Suits/Glove Sleeves (Used for larger or highly hazardous isolators)

Value Chain Analysis For Isolator Gloves Market

The value chain for the Isolator Gloves Market commences with complex upstream activities involving the sourcing and refinement of specialized polymers and raw materials, such as specific grades of Butyl rubber or Neoprene optimized for barrier performance and VHP compatibility. These raw material suppliers, often specialized chemical companies, dictate the base quality and price volatility. Manufacturing involves highly technical processes, including precision molding, curing, and often multi-layer dipping, followed by rigorous testing protocols (e.g., permeation testing and physical integrity checks) to meet international standards. This specialized manufacturing expertise acts as a significant entry barrier, maintaining market control among a few large, technically proficient manufacturers.

The distribution channel is predominantly dual-pronged: direct sales to major pharmaceutical manufacturers who demand personalized service, technical support, and batch traceability, and indirect sales through specialized cleanroom consumables distributors and laboratory equipment suppliers. These distributors often bundle isolator gloves with other necessary cleanroom supplies, serving smaller compounding pharmacies, research institutions, and peripheral industries. The selection of the distribution route is crucial, as the highly technical nature of the product requires sales personnel to possess deep application knowledge regarding chemical resistance and regulatory requirements, emphasizing the importance of well-trained sales forces, especially for direct channels.

Downstream activities involve integration into complex isolator and RABS systems manufactured by specialized equipment vendors (e.g., sterilization and filling machinery providers). The end-users, primarily pharmaceutical and biotech companies, conduct final in-situ testing and validation to ensure the integrated glove system meets stringent process validation protocols. The successful execution of the downstream stage—characterized by periodic replacement schedules, rigorous cleaning, and integrity monitoring—is essential for maintaining the product’s core function of sterility assurance and hazard containment throughout its lifecycle. This cyclical replacement demand sustains the continuous revenue flow within the market.

Isolator Gloves Market Potential Customers

The primary customers for isolator gloves are large-scale pharmaceutical and biotechnology organizations engaged in the manufacturing of sterile injectable products, vaccines, and advanced therapeutics. These entities utilize isolator systems extensively in aseptic processing lines, particularly for critical steps such as formulation, filling, and lyophilization, where any breach in sterility could result in catastrophic batch loss or regulatory non-compliance. Their purchasing decisions are heavily influenced by regulatory compliance (FDA, EMA), validated material compatibility with cleaning agents (e.g., VHP), and documented product lifespan/durability.

A second significant customer base includes specialized compounding pharmacies and hospital systems, particularly in developed regions like North America and Europe, which employ isolators for high-risk sterile compounding, such as preparing chemotherapy drugs or total parenteral nutrition (TPN) solutions. These smaller end-users prioritize user-friendliness, rapid turnover capabilities, and cost-effectiveness while still requiring robust protection against highly potent or hazardous compounds. Academic and governmental research institutions represent another segment, utilizing isolators for high-containment research (e.g., BSL-3/4 facilities) or sensitive material handling, where flexibility and specific chemical resistance are paramount.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 710 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Ansell Limited, Kimberly-Clark Corporation, Lakeland Industries Inc., Mapa Professional (Groupe Hutchinson), Piercan S.A.S, Trelleborg AB, SHOWA Group, Valutek Inc., Riverstone Holdings Limited, Tronex International Inc., DuPont de Nemours Inc., Helapet Ltd., Nitritex Ltd., Terra Universal Inc., Clean Room Depot Inc., Sentry Sciences, S.M. Scientific Instruments Pvt. Ltd., Sempermed USA Inc., QRP, Inc., VWR International, LLC (Avantor). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Isolator Gloves Market Key Technology Landscape

The technology landscape for isolator gloves is characterized by advancements in material science, precision manufacturing, and integrated quality assurance systems. Core technological innovation focuses on developing specialized polymer blends, such as tailored Butyl or Neoprene formulations, that offer significantly improved resistance to VHP degradation, superior flexibility, and enhanced tactile sensitivity, addressing historical complaints regarding operator dexterity and premature material failure. Manufacturers are increasingly utilizing advanced multi-dip proprietary processes to create gloves with variable thickness across the hand, optimizing durability at high-wear points (e.g., fingertips) while maintaining flexibility in the palm area. This precision engineering minimizes stress cracking and maximizes the operational lifespan under rigorous sterilization schedules.

Another crucial technological development involves the integration of advanced testing methodologies. Non-destructive integrity testing technologies, such as automated pressure decay systems and acoustic emission testing, are becoming standard features in modern isolator setups, enabling quick, verifiable assessments of barrier integrity without removing the glove. Furthermore, the incorporation of embedded RFID or barcode technology into the cuff or port assembly allows for seamless tracking of glove usage history, sterilization cycles completed, and specific batch traceability. This digital integration facilitates compliant record-keeping and enhances predictive maintenance scheduling, aligning with Pharma 4.0 standards.

The manufacturing process itself is adopting robotics and automated inspection tools, often utilizing high-resolution cameras and AI algorithms to detect minute imperfections during the production phase. This focus on zero-defect manufacturing ensures that gloves entering the supply chain possess the highest level of physical integrity, crucial for maintaining aseptic environments where the barrier must not fail. Ergonomic modeling, driven by biomechanical analysis, also constitutes a technological advance, employing computational fluid dynamics and stress testing to design gloves that fit a wider range of hand sizes better, reducing fatigue and improving compliance with complex manual tasks within the isolator chamber.

Regional Highlights

The global market for isolator gloves displays distinct regional characteristics primarily influenced by regulatory maturity, concentration of pharmaceutical research and manufacturing, and healthcare expenditure levels. North America currently holds the largest market share, driven by the presence of a vast number of major pharmaceutical and biotechnology companies, exceptionally stringent FDA guidelines concerning aseptic manufacturing (CFR 210/211), and high adoption rates of advanced automated aseptic filling lines requiring continuous high-integrity barrier systems. The region's robust investment in cell and gene therapy manufacturing, which heavily relies on closed isolator technology, further reinforces its leading position.

Europe represents the second-largest market, exhibiting steady growth propelled by the rigorous enforcement of the EU GMP Annex 1 revisions, which strongly advocate for the use of barrier systems (Isolators/RABS) over traditional cleanroom practices. Countries like Germany, Switzerland, and the UK, with their strong heritage in chemical and pharmaceutical manufacturing, contribute significantly to demand, particularly for specialized glove materials resistant to various European-mandated disinfectants and sterilizing agents. The European market focuses heavily on standardization and validated material performance across multiple manufacturers.

Asia Pacific (APAC) is forecast to be the fastest-growing region during the forecast period. This rapid acceleration is attributed to the aggressive expansion of the generic and vaccine manufacturing sectors in countries like China and India, coupled with increasing foreign investment driving the adoption of global GMP standards. As local manufacturers in APAC upgrade their facilities from conventional cleanrooms to isolator technology to meet export requirements for regulated markets (US/EU), the demand for high-quality, import-compliant isolator gloves surges. Furthermore, the expansion of local research and diagnostic capabilities, especially in emerging economies, contributes to a broader application base beyond traditional pharmaceuticals.

- North America: Dominant market share due to stringent FDA regulations, massive biopharma R&D spending, and high adoption of automated aseptic processing, particularly in personalized medicine and biologics.

- Europe: High market maturity and consistent growth, mandated by EU GMP Annex 1 updates, focusing on standardized product validation and chemical compatibility with common European disinfectants.

- Asia Pacific (APAC): Fastest growing region; driven by manufacturing capacity expansion, rapid adoption of international quality standards for export compliance, and growing domestic pharmaceutical consumption in China and India.

- Latin America: Emerging market characterized by increasing healthcare investments and the modernization of local pharmaceutical production facilities, particularly in Brazil and Mexico, focusing on cost-effective, durable solutions.

- Middle East and Africa (MEA): Limited but increasing market activity, primarily confined to sophisticated hospital pharmacies and specialized vaccine/biotech facilities in countries like Saudi Arabia and South Africa, driven by efforts to localize drug production.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Isolator Gloves Market.- Ansell Limited

- Kimberly-Clark Corporation

- Lakeland Industries Inc.

- Mapa Professional (Groupe Hutchinson)

- Piercan S.A.S

- Trelleborg AB

- SHOWA Group

- Valutek Inc.

- Riverstone Holdings Limited

- Tronex International Inc.

- DuPont de Nemours Inc.

- Helapet Ltd.

- Nitritex Ltd.

- Terra Universal Inc.

- Clean Room Depot Inc.

- Sentry Sciences

- S.M. Scientific Instruments Pvt. Ltd.

- Sempermed USA Inc.

- QRP, Inc.

- VWR International, LLC (Avantor)

Frequently Asked Questions

Analyze common user questions about the Isolator Gloves market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for isolator gloves in the pharmaceutical industry?

The primary factor driving demand is the stringent global regulatory mandate, especially from the FDA and EMA (EU GMP Annex 1), requiring pharmaceutical manufacturers to use advanced barrier isolation systems (isolators/RABS) to achieve the highest level of sterility assurance and minimize human contamination risk during aseptic processing.

Which material type of isolator glove offers the best resistance to common VHP sterilization cycles?

Butyl rubber and specialized polymer blends like CSM (Chlorosulfonated Polyethylene, commonly known as Hypalon) are generally preferred for applications involving Vaporized Hydrogen Peroxide (VHP) sterilization due to their superior chemical resistance, low gas permeability, and reduced susceptibility to hardening or cracking compared to natural rubber or standard Neoprene.

How often do isolator gloves need to be replaced, and what causes their failure?

Replacement frequency varies significantly based on usage intensity, sterilization cycle count, and exposure to harsh chemicals. Failure is typically caused by mechanical stress (pinholes, tears), chemical degradation from repeated VHP exposure, and material fatigue, necessitating rigorous integrity testing protocols to determine the optimal service life.

What is the market growth forecast for the Isolator Gloves Market in the Asia Pacific region?

The Asia Pacific region is expected to exhibit the fastest growth, primarily driven by large-scale investments in pharmaceutical manufacturing upgrades, increasing adherence to global regulatory standards (GMP), and the expansion of local vaccine and biological production capabilities across key markets like China and India.

What role does ergonomics play in the selection of modern isolator gloves?

Ergonomics is critical, influencing operator productivity and reducing the risk of errors. Modern gloves feature advanced design elements, including variable wall thickness, anatomical shaping, and internal linings, to improve flexibility, reduce hand fatigue during long operations, and enhance dexterity for complex manual tasks within the restrictive isolator environment.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager