Isononanoic Acid Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435831 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Isononanoic Acid Market Size

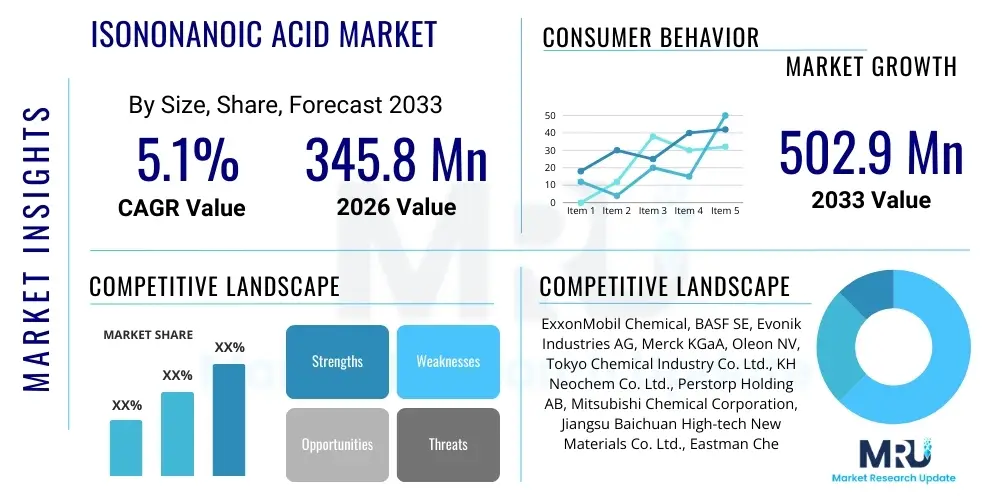

The Isononanoic Acid Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.1% between 2026 and 2033. The market is estimated at USD 345.8 million in 2026 and is projected to reach USD 502.9 million by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating demand for high-performance specialty chemicals across various industrial sectors, particularly in Asia Pacific, where robust manufacturing and infrastructure development necessitate advanced corrosion inhibitors and synthetic lubricants. Isononanoic acid (INA) is highly valued for its exceptional thermal stability, low volatility, and excellent oxidative resistance, characteristics that make it indispensable in formulating next-generation synthetic esters and performance fluids. The shift in the automotive industry toward electric vehicles (EVs) is also subtly influencing this market, as specialized lubricants and coolants requiring INA derivatives are becoming standard components, ensuring continued market momentum despite potential volatility in traditional internal combustion engine (ICE) related applications.

Isononanoic Acid Market introduction

Isononanoic acid (INA) is a saturated, branched-chain fatty acid predominantly derived from petrochemical feedstocks, often produced via the hydroformylation of octene followed by subsequent oxidation. Recognized chemically as a versatile C9 carboxylic acid, INA is characterized by its high purity, low odor, and ability to confer superior stability and lubricity to end-products. Its structure, featuring branching, prevents crystallization at low temperatures and enhances miscibility, making it an ideal precursor for synthetic polyol esters (POEs), which are crucial components in refrigeration lubricants, aviation turbine oils, and high-performance automotive transmission fluids. The intrinsic chemical properties of INA, including its resistance to hydrolysis and oxidative degradation, position it as a key building block for specialty chemical synthesis, driving its widespread use in formulating environmentally compliant products.

The major applications of Isononanoic Acid span diverse heavy-duty industrial sectors, including coatings, lubricants, plasticizers, and corrosion inhibitors. In the coatings industry, INA derivatives, such as vinyl esters of isononanoic acid (VeoVa), enhance the durability, weather resistance, and adhesion properties of waterborne paints and architectural coatings, supporting the global transition towards low-VOC (Volatile Organic Compound) and environmentally friendly formulations. Within the lubricants segment, INA is esterified with various alcohols to produce high-performance synthetic lubricants essential for modern industrial machinery, compressors, and hydraulic systems that operate under extreme pressure and temperature conditions. Furthermore, its role as a key intermediate in producing metalworking fluids and PVC plasticizers emphasizes its versatility across the materials science landscape.

Market growth is significantly propelled by the increasing global emphasis on enhancing efficiency and extending the lifespan of industrial assets, particularly within the energy and manufacturing sectors. The driving factors include the rapid industrialization across emerging economies, especially China and India, which are rapidly expanding their infrastructure and automotive manufacturing bases, thereby fueling demand for high-quality protective coatings and industrial fluids. The superior performance attributes of INA compared to conventional straight-chain fatty acids provide significant benefits, such as improved thermal stability and reduced maintenance costs, making it a preferred choice for specialized applications. Conversely, the market faces constraints related to the volatility of raw material prices (octenes and syn-gas) and the complexity of regulatory compliance associated with chemical intermediates, requiring constant innovation in production efficiency and supply chain management to maintain competitive pricing and stable supply.

Isononanoic Acid Market Executive Summary

The Isononanoic Acid market is poised for robust expansion, primarily steered by accelerating demand for synthetic esters utilized in modern refrigeration and automotive systems, particularly those employing newer, more environmentally friendly refrigerants like HFOs (hydrofluoroolefins) which require specialized Polyol Ester (POE) lubricants derived from INA. Business trends indicate a strong focus among key players on backward integration to secure stable feedstock supply (octene and propene) and forward integration into specialty ester production to capture higher value in the supply chain, moving beyond commodity chemical supply. Strategic partnerships centered on sustainable chemistry and bio-based sourcing of similar C9 structures are emerging, addressing regulatory pressures and corporate sustainability goals. Furthermore, the increasing adoption of high-solid and powder coatings in the construction and automotive sectors, where INA derivatives act as efficient curing agents and viscosity modifiers, is solidifying the market's trajectory.

Regionally, Asia Pacific (APAC) stands out as the predominant growth engine, fueled by massive investments in residential construction, public infrastructure projects, and the rapid expansion of the electric vehicle (EV) fleet, all requiring advanced coatings and thermal management fluids. China, in particular, is both a massive consumer and a significant producer, influencing global pricing dynamics and supply chain efficiency. Europe and North America, while mature, demonstrate stable, high-value demand focused heavily on regulatory compliance, low-VOC coatings, and premium synthetic lubricants for aerospace and high-end automotive applications. The stringent European REACH regulations often dictate innovation in synthesis pathways, pushing manufacturers toward optimized, greener processes, indirectly boosting the adoption of high-purity INA derivatives that minimize hazardous byproducts.

In terms of segmentation trends, the Synthetic Lubricants application segment, especially within the refrigeration and aviation sectors, maintains the largest market share due to the criticality of INA-derived POEs in system longevity and performance reliability. However, the Coatings and Paints segment is anticipated to register the highest growth rate, primarily due to the global regulatory pivot towards waterborne and high-solid coatings where INA esters serve critical functional roles. Segment analysis also highlights the increasing demand for INA as a Corrosion Inhibitor, particularly in metalworking fluids and coolant systems, driven by the need to protect expensive machinery from chemical degradation and extend tool life. This diverse end-use matrix ensures the market's resilience against fluctuations in any single sector, maintaining overall stable and profitable growth through the forecast period.

AI Impact Analysis on Isononanoic Acid Market

User queries regarding the impact of Artificial Intelligence on the Isononanoic Acid market frequently center on optimizing chemical synthesis processes, predicting raw material price fluctuations, and enhancing quality control in high-purity applications. Key concerns revolve around whether AI can significantly reduce dependence on volatile petroleum feedstocks by accelerating the discovery of novel bio-based INA alternatives, and how machine learning algorithms can streamline complex esterification reactions to maximize yield and purity, especially crucial for demanding applications like aerospace lubricants. The prevailing expectation is that AI integration will primarily revolutionize research and development (R&D) by simulating reaction pathways, enabling predictive maintenance in large-scale production plants, and optimizing intricate supply chain logistics, thereby stabilizing operational costs and improving overall market responsiveness to demand shifts. Furthermore, AI-driven process control promises to reduce energy consumption in manufacturing, aligning the industry with broader sustainability imperatives and making INA production more cost-effective and environmentally sound.

- AI optimizes complex catalyst selection and reaction parameters for INA synthesis, increasing yield and purity consistency.

- Machine learning algorithms predict fluctuations in C8 feedstock prices (octene), enabling proactive procurement and inventory management strategies.

- Predictive maintenance schedules for reactors and distillation columns, driven by sensor data and AI, minimize unplanned downtime and maximize production capacity.

- AI-enabled quality control systems utilize spectral analysis to ensure ultra-high purity INA required for aviation and refrigeration lubricants.

- Simulation of novel bio-based or circular economy pathways for C9 acid production, accelerating R&D toward sustainable INA alternatives.

DRO & Impact Forces Of Isononanoic Acid Market

The Isononanoic Acid market dynamics are principally shaped by the strong global transition towards high-performance synthetic lubricants and sustainable, high-solid coatings, offset by volatility in raw material sourcing and the complex interplay of environmental regulations. The primary drivers revolve around technological advancements in lubrication technology, specifically the rising adoption of Polyol Esters (POEs) in new generation refrigeration and air conditioning systems that require lubricants compatible with low Global Warming Potential (GWP) refrigerants. Opportunities emerge from the potential development of bio-based INA alternatives derived from sustainable sources, tapping into the growing consumer and industrial preference for green chemicals, potentially mitigating the restraints associated with fluctuating crude oil derivatives pricing. These internal market factors, combined with external macroeconomic forces like industrial expansion and stringent emission standards, create a highly competitive landscape where innovation in process efficiency and product formulation is paramount.

Drivers include the rapid expansion of the automotive sector, particularly the focus on electric vehicles (EVs), which necessitates specialized dielectric fluids and gearbox lubricants capable of managing extreme thermal conditions and electrical compatibility. Simultaneously, the global construction boom, particularly in the infrastructure sector of APAC, drives robust demand for high-durability protective and marine coatings formulated with INA derivatives for enhanced longevity and reduced maintenance costs. Restraints primarily involve the dependence on petrochemical feedstocks, making the market vulnerable to geopolitical instability and oil price volatility, which directly impacts production costs and profit margins. Moreover, increasingly stringent regulations concerning solvent use and residual organic components in coatings and plasticizers necessitate continuous investment in research and formulation adjustments, posing an ongoing operational challenge for smaller manufacturers.

Impact forces on the market manifest through intense competition among major producers striving for supply chain dominance and technological superiority in esterification processes. The bargaining power of buyers, especially large lubricant and coating formulators, remains high, requiring manufacturers to maintain competitive pricing and consistent product quality. Opportunities are substantial in niche applications, such as high-temperature heat transfer fluids and specialized plasticizers for medical devices, which demand ultra-pure INA products and offer significant premium pricing potential. Furthermore, the opportunity to replace traditional, less effective linear fatty acids in various applications due to INA's superior performance characteristics—including lower pour points, better thermal stability, and enhanced resistance to oxidation—continues to drive steady substitution effects across multiple end-use industries, ensuring a favorable long-term demand outlook.

Segmentation Analysis

The Isononanoic Acid market segmentation provides a granular view of consumption patterns, driven primarily by application type and end-use industry. The market is broadly categorized into applications such as Synthetic Lubricants (Polyol Esters, POEs), Plasticizers, Corrosion Inhibitors, and Coatings and Paints. The complexity of the INA structure allows for its utilization in producing high-performance intermediates tailored for specific functionalities, such as enhancing the flexibility of PVC or improving the rust protection capabilities of industrial coolants. Understanding these segments is crucial for manufacturers to align their production capabilities and R&D efforts with high-growth areas, particularly those demanding specialized, high-purity INA grades, which often command significant price premiums over technical-grade material.

The Synthetic Lubricants segment holds prominence, driven by the need for lubricants that operate efficiently in extreme environments, typical in aviation, refrigeration, and automotive high-performance engines. The increasing penetration of HFO refrigerants globally further cements the dominance of this segment, as POE lubricants are mandated for compatibility. Meanwhile, the Coatings and Paints segment is experiencing accelerated growth, propelled by environmental mandates pushing for the phase-out of traditional solvent-based systems in favor of waterborne formulations. INA-derived monomers and intermediates contribute significantly to the performance characteristics of these eco-friendly coating systems, providing vital properties such as hydrolytic stability and resistance to microbial attack, thereby extending the lifecycle of coated assets. The Plasticizers segment, although mature, remains stable, supported by continuous demand from the construction and automotive interior sectors, where flexible PVC components are widely used.

Geographical segmentation reveals Asia Pacific as the clear leader in both consumption and emerging manufacturing capacity, reflecting the region's explosive growth in automotive production and infrastructure development. North America and Europe prioritize innovation in product sustainability and quality, focusing heavily on specialized, low-toxicity INA applications. This detailed segmentation analysis enables market participants to effectively allocate resources, focusing on the most promising regional and application sectors, ensuring compliance with local regulations, and tailoring marketing strategies to address the distinct needs of end-users ranging from multinational chemical companies to specialized coating formulators operating in regional markets.

- By Application:

- Synthetic Lubricants (Polyol Esters, POEs)

- Plasticizers (DINP, DINA)

- Corrosion Inhibitors (Coolants, Metalworking Fluids)

- Coatings and Paints (VeoVa Monomers, Driers)

- Chemical Intermediates

- By Grade:

- High Purity Grade

- Technical Grade

- By End-Use Industry:

- Automotive and Transportation

- Construction

- Refrigeration and HVAC

- Chemical Manufacturing

- Industrial Machinery

Value Chain Analysis For Isononanoic Acid Market

The value chain of the Isononanoic Acid market is highly integrated, starting from the complex petrochemical upstream processes and extending through specialized chemical synthesis to diverse industrial end-users. Upstream activities are dominated by the secure sourcing of C8 feedstocks, primarily octene isomers, derived from steam cracking or catalytic oligomerization processes in the petrochemical industry. This stage is capital-intensive and subject to extreme raw material price volatility, necessitating long-term contracts and strategic partnerships between INA producers and major oil and gas companies or refineries to ensure supply stability. The key intermediate production involves the complex hydroformylation of the octenes to form nonanaldehyde, followed by oxidation to produce the final isononanoic acid. Efficiency and catalyst technology at this stage determine the final cost and purity of the INA, critical factors for subsequent high-performance applications.

Downstream activities involve the conversion of INA into various high-value derivatives, predominantly through esterification. Major downstream products include polyol esters (POEs) for lubricants, glycol esters for plasticizers, and vinyl esters for coatings (VeoVa technology). These specialty chemical conversion processes require precise formulation expertise and rigorous quality control to meet the demanding specifications of end-user industries such as aerospace, automotive, and refrigeration. Distribution channels are varied: large volume sales of technical-grade INA to plasticizer manufacturers often occur via direct contracts and bulk tankers. In contrast, smaller volume, high-purity grades for niche lubricant or pharmaceutical intermediate applications typically involve specialized chemical distributors with specific handling capabilities and strong technical support teams.

The distribution network for INA can be segmented into direct and indirect channels. Direct channels involve producers supplying INA or its derivatives (like POEs) directly to large multinational end-users (e.g., HVAC manufacturers, large automotive suppliers) under long-term supply agreements, ensuring optimal logistics and customized product specifications. Indirect channels rely heavily on regional and global chemical distributors who manage inventory, repackaging, and technical sales support for small to medium-sized formulators and specialty chemical blenders who require smaller, diverse batches. The trend toward digitalization in supply chain management is increasingly optimizing both direct and indirect routes, utilizing advanced inventory forecasting and tracking systems to minimize lead times and storage costs, enhancing the overall resilience and responsiveness of the global INA value chain.

Isononanoic Acid Market Potential Customers

The primary customers for Isononanoic Acid are large-scale chemical manufacturers specializing in the production of high-performance synthetic lubricants, followed closely by major multinational companies in the coatings and paints industry. Within the lubricant sector, key buyers are compressor and refrigeration system original equipment manufacturers (OEMs) and independent lubricant blenders who rely on INA-derived Polyol Esters (POEs) for their excellent thermal stability and compatibility with next-generation refrigerants. These customers prioritize product purity and consistent supply reliability, as disruptions can halt capital-intensive manufacturing lines. The stringent performance requirements of modern machinery mean that these buyers are often resistant to switching suppliers unless a competitive advantage in terms of sustainability or cost can be clearly demonstrated, highlighting the importance of long-term supply relationships.

Another significant customer base resides within the architectural and industrial coatings sector. Paint manufacturers utilize INA derivatives, such as the VeoVa family of vinyl esters, to formulate high-performance waterborne emulsions and resin systems. These customers are driven by market trends favoring low-VOC content, superior weatherability, and improved adhesion properties for applications ranging from exterior architectural paints to heavy-duty protective coatings for marine and infrastructure assets. Their purchasing decisions are highly influenced by regulatory compliance standards (e.g., environmental directives in Europe and North America) and the ability of INA derivatives to enhance the functional attributes of their final product formulations while reducing environmental footprint, leading to strong demand for specialized INA monomers.

Finally, the segment of chemical intermediates and plasticizer producers constitutes a stable, large-volume customer group. Companies manufacturing PVC compounds and flexible plastics purchase technical-grade INA for the synthesis of plasticizers like Diisononyl Phthalate (DINP) and Diisononyl Adipate (DINA). While DINP usage has faced regulatory scrutiny in certain regions, substitution into non-phthalate plasticizers derived from INA continues to support this segment. Additionally, manufacturers of metalworking fluids and corrosion inhibitors are consistent buyers, integrating INA into their formulations to provide superior anti-rust and lubricating properties to coolants and machinery process fluids. These end-users demand cost-effectiveness and excellent technical support from INA suppliers to optimize their proprietary formulations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 345.8 Million |

| Market Forecast in 2033 | USD 502.9 Million |

| Growth Rate | 5.1% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ExxonMobil Chemical, BASF SE, Evonik Industries AG, Merck KGaA, Oleon NV, Tokyo Chemical Industry Co. Ltd., KH Neochem Co. Ltd., Perstorp Holding AB, Mitsubishi Chemical Corporation, Jiangsu Baichuan High-tech New Materials Co. Ltd., Eastman Chemical Company, Jining Xingda Chemical Co. Ltd., TCI Chemicals, Jidosha Kiki Co. Ltd., Honeywell International Inc., Sigma-Aldrich (Merck KGaA), Wuxi South Chemical Co. Ltd., Sinopec Corporation, Chevron Phillips Chemical Company LLC, Formosa Plastics Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Isononanoic Acid Market Key Technology Landscape

The technology landscape for the Isononanoic Acid market is dominated by the established oxo synthesis process, which involves multi-step catalytic reactions starting from octenes. The primary technological focus for manufacturers lies in optimizing the hydroformylation step—converting octenes and syngas (carbon monoxide and hydrogen) into nonanaldehyde—as this step dictates the final yield, isomer distribution, and purity of the resulting INA. Advanced catalysts, particularly modified Rhodium (Rh) or Cobalt (Co) complexes, are crucial for enhancing selectivity towards desired isomers and minimizing undesirable byproducts. Recent technological advancements aim to improve the efficiency and sustainability of the oxidation process, often employing advanced air or oxygen oxidation catalysts that reduce reaction time and energy consumption while ensuring the high-purity requirements necessary for applications such as high-end synthetic polyol esters.

A major technological frontier involves the exploration and commercialization of bio-based Isononanoic Acid alternatives, responding directly to regulatory pressures and consumer demand for sustainable chemicals. Research efforts are concentrating on utilizing fermentation or enzymatic processes on renewable feedstocks, such as specific fatty acids or carbohydrates, to produce structurally similar C9 carboxylic acids. While commercially challenging due to high production costs and scalability issues compared to petrochemical routes, innovation in synthetic biology and process engineering is slowly bridging this gap. Companies investing in this area seek to secure a long-term competitive advantage by future-proofing their supply chains against petrochemical volatility and offering differentiated, certified-sustainable products to the market, particularly in Europe and North America where sustainability standards are highest.

Furthermore, technology is playing a vital role in quality assurance and process control. State-of-the-art analytical techniques, including advanced Gas Chromatography-Mass Spectrometry (GC-MS) and Nuclear Magnetic Resonance (NMR) spectroscopy, are essential for characterizing the precise isomer composition and ensuring the ultra-low impurity levels of INA required for demanding applications like aerospace lubricants, where performance tolerances are extremely narrow. Process monitoring technologies, leveraging IoT sensors and real-time data analysis, allow for precise control over reaction temperatures, pressures, and flow rates, optimizing conversion efficiency and guaranteeing batch-to-batch consistency. This technological vigilance ensures that INA meets the specialized technical specifications of highly regulated end-use sectors, maintaining market trust and supporting premium pricing for specialized grades.

Regional Highlights

The Isononanoic Acid market exhibits significant regional variation, heavily influenced by industrialization rates, environmental regulations, and local automotive production trends. Asia Pacific (APAC) currently dominates the global market both in terms of consumption volume and production capacity. This leadership is attributable to robust economic growth, coupled with massive infrastructure investments in countries like China, India, and Southeast Asian nations, generating exceptional demand for coatings, construction chemicals, and industrial lubricants. The rapid expansion of manufacturing hubs and the burgeoning automotive sector, including significant investment in EV manufacturing, directly fuels the demand for INA-derived specialty fluids and high-performance protective coatings, positioning APAC as the primary engine for future market growth.

Europe and North America represent mature but high-value markets characterized by stringent regulatory frameworks, particularly concerning environmental protection and chemical registration (e.g., REACH). Demand in these regions is heavily focused on premium, high-purity INA derivatives utilized in aerospace lubricants, refrigeration systems compatible with low-GWP refrigerants, and advanced, low-VOC architectural coatings. Innovation here is driven by sustainability requirements, leading to high adoption rates of bio-based alternatives and advanced, efficient formulations. European demand for specific non-phthalate plasticizers derived from INA remains robust in applications where strict safety standards are mandated, such as medical devices and sensitive consumer products, ensuring stable, albeit slower, growth compared to APAC.

Latin America (LATAM) and the Middle East & Africa (MEA) are emerging regions that present significant growth opportunities, particularly as industrialization progresses and regional manufacturing capabilities expand. The MEA region, supported by extensive oil and gas operations, shows strong demand for corrosion inhibitors and high-temperature lubricants, often imported or produced through local joint ventures. Brazil and Mexico, the key economies in LATAM, contribute to demand via their expanding automotive assembly and industrial production sectors. While these regions currently hold smaller market shares, they are expected to register above-average growth rates over the forecast period, contingent upon stable economic and political environments fostering sustained industrial investment and infrastructure development projects that necessitate INA-based specialty chemicals.

- Asia Pacific (APAC): Highest growth and volume market, driven by construction, automotive (especially EV fluids), and rapid industrial expansion in China and India.

- Europe: High-value market focused on premium synthetic lubricants, stringent regulatory compliance (REACH), and rapid adoption of low-VOC/waterborne coating technologies.

- North America: Stable demand primarily from the aerospace, refrigeration (POE lubricants), and high-performance industrial coatings sectors, emphasizing innovation and sustainability.

- Latin America (LATAM): Emerging market growth supported by automotive manufacturing and increasing infrastructure projects, requiring localized coating and lubricant solutions.

- Middle East and Africa (MEA): Growth driven by petrochemical industry expansion, demanding corrosion inhibitors, and high-specification lubricants for industrial machinery and energy infrastructure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Isononanoic Acid Market.- ExxonMobil Chemical

- BASF SE

- Evonik Industries AG

- KH Neochem Co. Ltd.

- Perstorp Holding AB

- Mitsubishi Chemical Corporation

- Oleon NV

- Eastman Chemical Company

- Jining Xingda Chemical Co. Ltd.

- Jiangsu Baichuan High-tech New Materials Co. Ltd.

- Merck KGaA

- TCI Chemicals

- Chevron Phillips Chemical Company LLC

- Formosa Plastics Corporation

- Honeywell International Inc.

- Wuxi South Chemical Co. Ltd.

- Sigma-Aldrich (Merck KGaA)

- Shandong Xianglong Chemical Co., Ltd.

- Zhejiang Huangyan Chemical Co., Ltd.

- Sinopec Corporation

Frequently Asked Questions

Analyze common user questions about the Isononanoic Acid market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary applications driving the demand for Isononanoic Acid (INA)?

The primary applications fueling INA demand are the production of high-performance Synthetic Lubricants, specifically Polyol Esters (POEs) used extensively in HVAC and aviation refrigeration systems, and its use in advanced Coatings and Paints to create durable, low-VOC waterborne formulations. INA is also vital in manufacturing Corrosion Inhibitors and specialized Plasticizers.

How is the Isononanoic Acid market influenced by the shift to Electric Vehicles (EVs)?

The shift to EVs is positively influencing the INA market. EVs require specialized thermal management fluids, dielectric coolants, and high-performance gearbox lubricants that must withstand higher operational temperatures and electrical stress. INA-derived esters are ideal components for these next-generation specialty fluids, ensuring continued growth in the automotive fluids segment despite changes in traditional engine oil demand.

What is the current status of bio-based Isononanoic Acid alternatives?

Bio-based INA alternatives are currently under intense R&D, driven by sustainability goals and the need to reduce reliance on volatile petrochemical feedstocks. While still challenging regarding cost parity and large-scale synthesis compared to conventional methods, advancements in fermentation and enzymatic technologies are accelerating their development, positioning them as a critical long-term growth opportunity, particularly in environmentally conscious markets like Europe.

Which geographical region holds the largest market share for Isononanoic Acid consumption?

Asia Pacific (APAC) holds the largest market share for Isononanoic Acid consumption. This dominance is primarily attributed to high rates of industrialization, rapid expansion in the regional construction sector, and significant growth in automotive production and supporting industrial machinery manufacturing across key economies like China and India.

What are the key technical advantages of Isononanoic Acid over straight-chain fatty acids?

INA offers superior technical advantages due to its branched structure, which includes excellent thermal and oxidative stability, resistance to hydrolysis, and a significantly lower pour point. These characteristics are crucial for high-performance applications like synthetic lubricants, where stability across a wide temperature range and resistance to degradation are mandatory for system longevity and efficiency.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager