Isononyl Alcohol Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432245 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Isononyl Alcohol Market Size

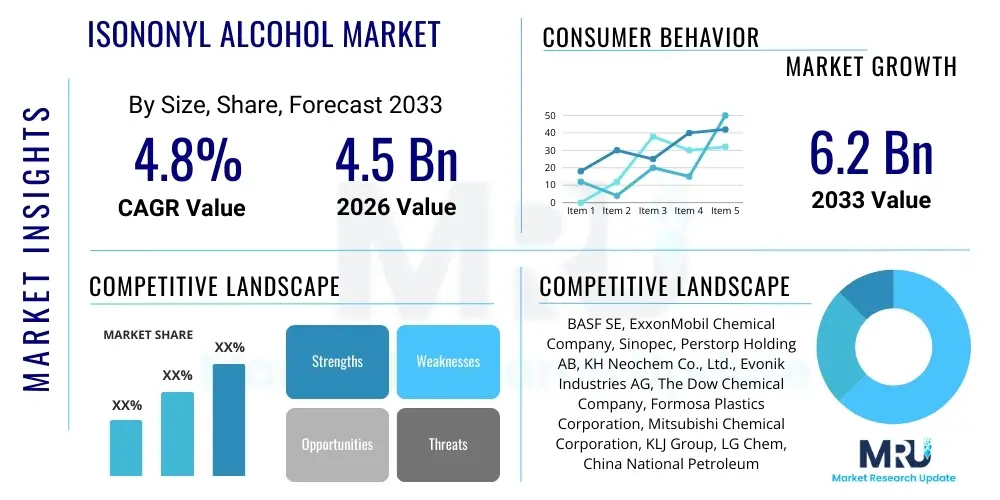

The Isononyl Alcohol Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 6.2 Billion by the end of the forecast period in 2033. This consistent expansion is predominantly driven by the robust demand from the plasticizer industry, where Isononyl Alcohol (INA) serves as a vital intermediate for producing Diisononyl Phthalate (DINP) and non-phthalate alternatives like Diisononyl Cyclohexane-1,2-Dicarboxylate (DINC), essential for enhancing the flexibility and durability of polyvinyl chloride (PVC) products across construction and automotive sectors. The mature industrial base in North America and Europe, coupled with the rapidly expanding manufacturing and infrastructure development activities in the Asia Pacific region, establishes a stable and accelerating growth trajectory for INA consumption.

Market valuation is directly correlated with the global production capacity of Oxo alcohols, particularly C9 alcohols, which are synthesized primarily through the hydroformylation of octenes. Fluctuations in crude oil and natural gas prices, which influence feedstock costs such as propylene and synthesis gas, present both volatility and strategic challenges to producers. Nevertheless, the sustained push toward high-performance materials in specialized applications, including wire and cable insulation and medical devices, mitigates some of the cost pressures, ensuring Isononyl Alcohol maintains its critical role within the downstream chemical industry value chain. Producers are increasingly investing in proprietary catalyst systems and process optimization to improve INA yield and purity, securing competitive advantages.

Furthermore, stringent environmental and health regulations, particularly concerning phthalates in consumer products, are simultaneously restraining the DINP segment and propelling the demand for INA in non-phthalate plasticizer formulations. This strategic pivot towards environmentally benign plasticizers, often facilitated by INA-derived intermediates, guarantees continued market relevance. The growth trajectory is therefore bifurcated: steady demand from established industrial applications and dynamic growth fueled by regulatory compliance and product innovation focused on high-specification, low-volatility derivatives required by modern construction and automotive standards.

Isononyl Alcohol Market introduction

Isononyl Alcohol (INA) is a higher alcohol characterized by its branched, nine-carbon structure (C9). It is a colorless, clear liquid primarily manufactured via the Oxo synthesis process, which involves the hydroformylation of octenes followed by subsequent hydrogenation. INA is fundamentally a crucial chemical intermediate, not typically used in its pure form, but rather as a primary building block for the synthesis of high-molecular-weight plasticizers, synthetic lubricants, and specialty coatings. Its chemical stability and excellent solvency properties make it indispensable in demanding industrial applications where performance and longevity are paramount.

The majority of INA produced globally, estimated at over 80%, is dedicated to the production of plasticizers, predominantly Diisononyl Phthalate (DINP), which imparts flexibility, weather resistance, and thermal stability to Polyvinyl Chloride (PVC). DINP is widely utilized in the construction industry for flooring, roofing, and window seals, and significantly in the automotive sector for interior components such as dashboards, door panels, and under-the-hood wiring harnesses. Beyond plasticizers, INA is also used as a specialty solvent in the coatings industry, particularly for high-solids paints and lacquers, and as an intermediate in the synthesis of agrochemicals and surfactants, showcasing its versatility across the chemical landscape.

The primary driving factors sustaining the Isononyl Alcohol market include the persistent growth of the global construction market, particularly in developing economies, necessitating large volumes of PVC compounds. Furthermore, the mandatory requirements for improved fuel efficiency and durability in the automotive industry necessitate advanced polymeric materials, maintaining high demand for flexible PVC stabilized by INA derivatives. Benefits derived from using INA-based plasticizers include enhanced processing capability of PVC resins, low volatility, superior extraction resistance, and good cold flex properties, making them preferred choices over traditional lower molecular weight alternatives, even amidst regulatory scrutiny regarding specific phthalate types.

Isononyl Alcohol Market Executive Summary

The Isononyl Alcohol market exhibits dynamic business trends, marked by significant geographic shifts in manufacturing and consumption, alongside a persistent transition towards sustainable and regulatory-compliant derivatives. Key business strategies currently emphasize backward integration among major chemical producers to secure consistent feedstock supply (octenes and syngas) and forward integration into specialty plasticizer production, enhancing margin control and responsiveness to end-user specifications, particularly in the demanding automotive and medical sectors. Furthermore, licensing of proprietary Oxo process technologies focused on high-purity INA yield is a major competitive differentiator, reflecting the technical complexity and high capital expenditure required for entry.

Regionally, the Asia Pacific (APAC) market, spearheaded by China and India, dominates both production capacity and consumption volume, driven by explosive infrastructure spending and rapid urbanization that fuels the construction and automotive sectors. North America and Europe, while representing mature markets, are leading the innovation curve, particularly in the shift from traditional phthalate plasticizers (like DINP) to INA-derived non-phthalate alternatives (like DINC and various trimellitates), largely in response to stringent regulations such as REACH in Europe and similar governmental oversight in the US. This regulatory environment makes these regions critical testing grounds for new, high-performance INA derivatives, influencing global product specifications.

In terms of segment trends, the dominance of the plasticizers application segment remains absolute, although its composition is evolving. While DINP constitutes the bulk, the fastest growth is observed in the non-phthalate plasticizer segment, driven by manufacturers seeking 'green chemistry' certifications and market acceptance in sensitive applications like toys and food contact materials. Within end-use segments, the automotive industry shows accelerated growth for INA derivatives due to increasing electrification and the subsequent need for specialized wire and cable insulation with high-temperature resistance and low migration properties, coupled with demand for low-odor, low-VOC interior materials, pushing segment specifications towards premium INA-based compounds.

AI Impact Analysis on Isononyl Alcohol Market

User queries regarding AI's impact on the Isononyl Alcohol market primarily revolve around operational efficiency, supply chain resilience, and chemical R&D acceleration. Common concerns include how AI-driven predictive maintenance can reduce downtime in high-capital Oxo synthesis plants, the efficacy of machine learning models in accurately forecasting fluctuating octene and propylene feedstock prices, and the role of computational chemistry in designing novel, safer non-phthalate plasticizers derived from INA. Users are keenly interested in the potential for AI algorithms to optimize complex reaction kinetics, thereby improving INA purity and yield, ensuring compliance with strict application standards, particularly for medical grade PVC.

The implementation of Artificial Intelligence and Machine Learning (ML) platforms is fundamentally transforming the manufacturing and commercial dynamics within the INA market. In manufacturing, AI algorithms analyze vast datasets streaming from sensors placed throughout the Oxo synthesis unit—monitoring pressure, temperature, catalyst concentration, and flow rates—to predict equipment failure hours or days in advance, substantially boosting asset utilization and reducing unforeseen costly outages. Commercially, ML models are utilized to integrate global economic indicators, regulatory updates, and real-time demand signals from major PVC compounders, enabling highly accurate short-term and long-term demand forecasting for both INA and its main derivatives, allowing producers to optimize inventory levels and hedging strategies for volatile feedstocks.

Furthermore, AI-driven process optimization is leading to tangible improvements in product quality and energy consumption. Computational fluid dynamics (CFD) simulations, managed by AI, model the intricate reactor environments to fine-tune operating parameters, maximizing the selectivity towards the desired C9 isomer and minimizing unwanted side products, thereby reducing refining costs and environmental footprint. This predictive capability extends into environmental compliance, where AI monitors effluent streams and gas emissions in real-time against regulatory thresholds, ensuring proactive adjustments rather than reactive corrections, which is crucial given the stringent environmental mandates governing petrochemical operations.

- AI-enabled Predictive Maintenance (PdM) reduces downtime and operating costs in high-pressure Oxo synthesis units.

- Machine Learning algorithms optimize feedstock procurement strategies by forecasting propylene and synthesis gas price volatility.

- Computational Chemistry accelerates the discovery and validation of novel, sustainable INA-based plasticizers (non-phthalate) with superior properties.

- AI-driven supply chain platforms enhance global logistics, managing the complex distribution of bulk liquid chemicals from production sites to global plasticizer manufacturers.

- Process optimization using ML improves reaction selectivity, maximizing INA yield and purity while minimizing energy consumption per ton of product.

- Automated quality control systems utilize image recognition and data analytics to ensure product conformity for specialized applications like automotive coatings.

DRO & Impact Forces Of Isononyl Alcohol Market

The Isononyl Alcohol market is shaped by a powerful interplay of drivers, restraints, and opportunities, culminating in significant impact forces on pricing and strategic direction. The primary driver is the accelerating global demand for durable and flexible PVC products in construction and automotive manufacturing, where INA derivatives are essential for performance characteristics like longevity and thermal stability. This demand is particularly pronounced in Asia Pacific’s expanding middle-class economies, necessitating rapid infrastructural development. However, the market faces significant restraints, chiefly stemming from evolving global regulatory landscapes—specifically the phasing out or limitation of specific phthalates (like DINP) in sensitive applications (e.g., children’s products) by bodies like the EU’s REACH and the US EPA, forcing costly reformulation and R&D expenditures.

Opportunities within the market largely revolve around innovation and market diversification. The shift away from restricted plasticizers opens vast potential for INA-based non-phthalate alternatives such as Diisononyl Adipate (DINA) and DINC, positioning INA as a key intermediate in the 'green chemistry' movement, which attracts premium pricing and offers long-term market stability insulated from phthalate bans. Additionally, specialty applications of INA, including its use in high-performance synthetic lubricants, hydraulic fluids, and specialty agrochemicals, offer avenues for market segmentation and higher-margin sales, reducing overall reliance on the highly competitive, bulk plasticizer segment. Investment in bio-based or renewable feedstock routes for Oxo synthesis also presents a strategic opportunity for long-term supply chain resilience and environmental compliance.

The major impact forces affecting this market are bifurcated into economic volatility and regulatory pressure. Economically, the cost of manufacturing INA is highly sensitive to the price of upstream petrochemical feedstocks (propylene and crude oil), leading to margin compression during periods of geopolitical instability or supply chain disruption; INA pricing often lags feedstock price movements due to long-term contract structures. Regulatory pressure, serving as a powerful impact force, dictates market direction by necessitating continuous product substitution and reformulation, favoring companies with advanced chemical synthesis capabilities and robust regulatory affairs divisions. The sustained growth in global automotive and construction output, particularly the post-pandemic recovery and emphasis on electrification, exerts a constant upward pressure on demand, ensuring INA remains a fundamental intermediate.

Segmentation Analysis

The Isononyl Alcohol market is critically segmented across several dimensions, primarily defined by application type, end-user industry, and manufacturing process, reflecting the specialized utility of INA derivatives. Understanding these segments is crucial for strategic market positioning and identifying high-growth niches. The segmentation by application reveals a strong concentration in plasticizers, which significantly overshadows other uses like solvents and chemical synthesis, yet the growth rates in non-plasticizer segments, though smaller in volume, are often higher due to increasing technological requirements in coatings and lubricants. The end-user perspective clearly highlights the dominance of the construction and automotive sectors, dictating major volume requirements, while the electrical and electronics sector demands stringent purity and low-migration properties, often commanding premium prices.

The most defining segment remains the plasticizer category, which can be further subdivided into phthalate (DINP) and non-phthalate derivatives (DINA, DINC). While DINP still accounts for the largest share by volume, its market share is under sustained pressure in regulated geographies. Consequently, investment and strategic focus are shifting towards non-phthalate alternatives derived from INA, which align with increasingly rigorous safety standards in medical and consumer goods. This structural change requires producers to diversify their intermediate product offerings and develop flexible manufacturing capabilities to handle various INA esterification processes.

Geographically, market segmentation is heavily influenced by regional consumption patterns and regulatory stringency. Asia Pacific, driven by its construction boom, demands high volume, cost-effective INA for DINP production. In contrast, Europe and North America prioritize compliance and performance, driving the demand for specialized, low-volatility, non-phthalate plasticizers essential for high-end vehicle interiors and sophisticated wire insulation. This regional segmentation necessitates tailored distribution strategies and product portfolios from global suppliers, balancing bulk supply efficiency with niche, high-specification product delivery.

- By Application:

- Plasticizers (Diisononyl Phthalate - DINP)

- Non-Phthalate Plasticizers (Diisononyl Adipate - DINA, Diisononyl Cyclohexane-1,2-Dicarboxylate - DINC)

- Chemical Intermediates

- Lubricants and Oil Additives

- Coating Solvents

- By End-User Industry:

- Construction (PVC pipes, flooring, roofing membranes)

- Automotive (Interior components, wire and cable sheathing, sealants)

- Electrical & Electronics (Cable insulation, compounds)

- Medical Devices (Tubing, bags)

- Consumer Goods (Toys, packaging)

Value Chain Analysis For Isononyl Alcohol Market

The Isononyl Alcohol value chain is fundamentally integrated within the broader petrochemical industry, commencing with the upstream sourcing and processing of core hydrocarbon feedstocks and culminating in the highly specialized distribution to end-user compounders. Upstream analysis focuses on securing the primary raw materials: propylene (which yields octene intermediates via oligomerization) and synthesis gas (CO and H2). The efficiency and stability of this upstream stage are critical, as feedstock costs typically constitute the largest portion of INA manufacturing expenses. Major petrochemical giants often possess fully integrated upstream operations, providing a substantial cost advantage and supply security compared to non-integrated producers who rely solely on fluctuating merchant markets for C8 olefins.

The midstream manufacturing phase involves the high-pressure, catalytic Oxo synthesis process where octenes are hydroformylated and subsequently hydrogenated to produce Isononyl Alcohol. This stage is characterized by high capital intensity, complex chemical engineering, and reliance on proprietary catalyst technology (often Rhodium- or Cobalt-based) to achieve high selectivity and energy efficiency. Purity standards for INA are rigorous, particularly for applications like non-phthalate plasticizers, necessitating sophisticated refining and distillation processes. Direct and indirect distribution channels play a critical role in moving INA, which, being a bulk liquid chemical, requires specialized handling and storage (ISO tanks, bulk tankers).

Downstream analysis centers on the transformation of INA into its final derivative products, primarily plasticizers (DINP, DINC). This involves esterification reactions with various anhydrides or acids. The final consumers are compounders and PVC processors who incorporate the INA derivatives into finished goods across the construction, automotive, and electrical sectors. Direct distribution channels are often employed for large-volume customers (major PVC manufacturers) to ensure technical support and reliable supply, while indirect channels, utilizing specialized chemical distributors, cater to smaller compounders and specialty chemical users globally. The efficacy of the downstream market is entirely dependent on the responsiveness of INA suppliers to evolving regulatory mandates regarding plasticizer safety and performance.

Isononyl Alcohol Market Potential Customers

The potential customers and primary end-users for Isononyl Alcohol are predominantly large-scale industrial consumers within the polymer and chemical manufacturing ecosystems, leveraging INA as a crucial intermediate rather than a final consumer product. The largest and most influential buyer segment consists of major Polyvinyl Chloride (PVC) compounders and plasticizer manufacturers, who purchase INA in bulk to synthesize high-volume plasticizers, such as DINP, DINA, and DINC. These companies are generally multinational chemical conglomerates and specialized polymer additive firms that supply flexible PVC formulations to global markets. Their purchasing decisions are highly sensitive to feedstock costs, regulatory risk associated with specific plasticizer types, and the required technical specifications for end-user applications.

A second significant segment comprises automotive original equipment manufacturers (OEMs) and their Tier 1 suppliers, although their purchase is indirect. These companies specify the exact type and performance characteristics of plasticizers used in interior applications (e.g., dashboard skins, door panels, seating upholstery) and under-the-hood components (e.g., wiring insulation, gaskets). Their stringent requirements regarding low volatility, fogging characteristics, heat stability, and compliance with low-VOC (Volatile Organic Compound) standards drive the demand for high-purity, specialized INA derivatives. As safety and longevity in vehicles become more critical, this segment dictates continuous innovation in INA-based products.

The third major segment includes manufacturers of specialty chemicals and synthetic lubricants. INA is used in esterification reactions to create high-performance synthetic ester lubricants (e.g., polyol esters) utilized in aviation lubricants, refrigeration compressors, and industrial hydraulic fluids, where superior thermal stability and lubricating properties are essential. Furthermore, coating and adhesive producers purchase INA for its excellent solvency characteristics, utilizing it in specialized high-solids formulations to meet evolving environmental regulations concerning solvent emissions. These customers prioritize technical support, consistent batch quality, and supply reliability over sheer volume, driving a distinct margin structure compared to bulk plasticizer sales.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.2 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, ExxonMobil Chemical Company, Sinopec, Perstorp Holding AB, KH Neochem Co., Ltd., Evonik Industries AG, The Dow Chemical Company, Formosa Plastics Corporation, Mitsubishi Chemical Corporation, KLJ Group, LG Chem, China National Petroleum Corporation (CNPC), Grupa Azoty, Eastman Chemical Company, INEOS Group, Hanwha Chemical, Puyang Shenghuade Chemical Co., Ltd., Zhejiang Jianye Chemical Co., Ltd., Sasol, OXEA GmbH (now part of Synthomer PLC) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Isononyl Alcohol Market Key Technology Landscape

The core technology driving the Isononyl Alcohol market is the Oxo Synthesis process, a complex and highly specialized method involving the catalytic hydroformylation of C8 olefins (octenes) derived from the oligomerization of propylene. The current technological landscape is characterized by continuous process refinement aimed at maximizing the yield and selectivity of the desired INA isomer while minimizing energy consumption and byproduct formation. Major producers predominantly utilize proprietary low-pressure Oxo (LPO) technologies, often employing advanced Rhodium-based catalyst systems, which offer significantly higher selectivity and operational efficiency compared to older Cobalt-based high-pressure processes. These catalysts are extremely expensive and sensitive, necessitating closed-loop recovery and meticulous process control, which defines the high barrier to entry in INA manufacturing.

Recent technological advancements focus heavily on reactor design and downstream purification. Innovations in reactor technology include improved mixing dynamics and heat transfer mechanisms to ensure uniform reaction conditions, critical for high purity output required by the non-phthalate plasticizer market. Furthermore, the development of sophisticated distillation and separation techniques is paramount. INA manufacturing produces various isomers and co-products, and the ability to cleanly separate the targeted Isononyl Alcohol isomer from these impurities is essential for meeting the stringent specifications demanded by end-users in automotive and medical applications. Technological leaders are investing heavily in molecular distillation and specialized membrane separation technologies to achieve purities exceeding 99.5%, which directly translates into superior performance characteristics for derived plasticizers.

Looking forward, the technology landscape is being influenced by sustainability mandates, pushing research into bio-based feedstock utilization and advanced catalyst recycling. While traditional INA relies entirely on petrochemical routes, research is progressing on utilizing bio-derived feedstocks that can be transformed into C8 olefins. Simultaneously, significant effort is being expended on developing more robust, longer-lasting, and non-precious-metal-based catalysts that can operate under milder conditions. This technological evolution aims not only to reduce dependency on volatile fossil fuel prices but also to lower the overall carbon footprint of INA production, ensuring long-term relevance in an increasingly environmentally conscious chemical industry.

Regional Highlights

- Asia Pacific (APAC): APAC is unequivocally the largest and fastest-growing market for Isononyl Alcohol, driven primarily by exponential growth in the construction sector and the burgeoning automotive manufacturing base, particularly in China and India. The region accounts for the majority of global PVC production, necessitating vast volumes of INA for plasticizer synthesis (both DINP and emerging non-phthalate substitutes). Governmental initiatives focused on infrastructure modernization, urbanization, and industrial output expansion guarantee sustained high demand. While environmental regulations are becoming stricter, particularly in coastal manufacturing hubs, the sheer scale of manufacturing output maintains APAC’s market dominance, compelling major global producers to establish large-scale manufacturing and compounding facilities within the region to minimize logistics costs and capitalize on local demand. Local competition is intense, focusing heavily on cost efficiency.

- Europe: The European market is characterized by high maturity, stringent regulatory control, and a strong emphasis on specialized, high-specification products. The primary regional dynamic is the comprehensive implementation of REACH regulations, which has severely restricted the use of certain high-volume phthalates and aggressively accelerated the transition toward INA-derived non-phthalate plasticizers (e.g., DINC). Consequently, European demand for INA is driven less by volume growth and more by the need for high-quality, traceable raw materials that guarantee compliance for sensitive applications like children's toys, food contact materials, and medical devices. This market commands premium pricing and rewards suppliers with robust regulatory affairs expertise and proven product stewardship. Innovation in sustainable chemistry is a key focus area.

- North America: North America presents a highly consolidated market where demand is stable and linked closely to the cyclical performance of residential and commercial construction, as well as the robust automotive industry. While regulatory pressures are present, particularly from state-level mandates and EPA advisories, the transition away from traditional phthalates has been more gradual than in Europe but is accelerating, particularly for consumer-facing goods. A significant segment driver in this region is the demand for specialized, low-volatility INA derivatives used in synthetic lubricants and high-performance fluids for industrial machinery and oil and gas operations. Strategic capacity decisions in North America are often tied to securing competitive natural gas-based feedstock supplies, providing a cost advantage over regions relying heavily on crude oil derivatives.

- Latin America (LATAM) and Middle East & Africa (MEA): These emerging regions exhibit nascent but rapidly expanding INA markets. LATAM's growth is tied to developing infrastructure projects and automotive assembly expansion in countries like Brazil and Mexico, creating increasing demand for flexible PVC products. The MEA region, particularly the GCC countries, benefits from significant petrochemical integration, often possessing captive feedstock supply and large-scale Oxo alcohol production capacity. While much of the produced INA is exported to high-consumption regions like APAC, domestic consumption is growing, driven by local construction booms and burgeoning plastics conversion industries. These regions serve both as key production hubs and emerging consumption centers, diversifying the global supply chain.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Isononyl Alcohol Market.- BASF SE

- ExxonMobil Chemical Company

- Sinopec

- Perstorp Holding AB

- KH Neochem Co., Ltd.

- Evonik Industries AG

- The Dow Chemical Company

- Formosa Plastics Corporation

- Mitsubishi Chemical Corporation

- KLJ Group

- LG Chem

- China National Petroleum Corporation (CNPC)

- Grupa Azoty

- Eastman Chemical Company

- INEOS Group

- Hanwha Chemical

- Puyang Shenghuade Chemical Co., Ltd.

- Zhejiang Jianye Chemical Co., Ltd.

- Sasol

- OXEA GmbH (now part of Synthomer PLC)

Frequently Asked Questions

Analyze common user questions about the Isononyl Alcohol market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver for Isononyl Alcohol demand in the coming years?

The primary driver is the accelerating global demand for PVC plasticizers in the construction and automotive sectors, coupled with the mandatory regulatory shift towards high-performance, INA-derived non-phthalate plasticizers like DINC, which ensures market stability and specialized growth.

How is regulatory pressure impacting the production and consumption of INA derivatives?

Regulatory pressure, particularly from the EU's REACH and similar standards, is reducing the use of traditional DINP in sensitive applications, compelling producers to focus R&D and manufacturing capacity on non-phthalate plasticizers, thereby ensuring INA's long-term critical role as a compliant chemical intermediate.

Which geographical region holds the largest market share for Isononyl Alcohol?

The Asia Pacific (APAC) region currently holds the largest market share for Isononyl Alcohol consumption and production, driven by massive infrastructure investment, urbanization, and the region's dominance in global polymer and automotive manufacturing output.

What are the key technical challenges facing Isononyl Alcohol manufacturers?

Key technical challenges include managing the high capital cost of Oxo synthesis plants, maintaining stringent product purity (especially for specialty lubricant and medical grades), optimizing expensive catalyst systems (Rhodium), and mitigating the volatility of upstream petrochemical feedstock prices.

Beyond plasticizers, what are the high-growth niche applications for Isononyl Alcohol?

High-growth niche applications include the synthesis of specialty high-performance synthetic ester lubricants for aviation and refrigeration, premium solvent formulations for low-VOC industrial coatings, and chemical intermediates used in advanced agrochemicals.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Isononyl Alcohol Market Statistics 2025 Analysis By Application (DINP, DINCH), By Type (C4 Chemicals Process, ExxonMobil Process), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Isononyl Alcohol and Isodecyl Alcohol Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Isononyl Alcohol, Isodecyl Alcohol), By Application (Chemical industry, Material industry, Agricultural), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager