Isooctyl Palmitate Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437744 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Isooctyl Palmitate Market Size

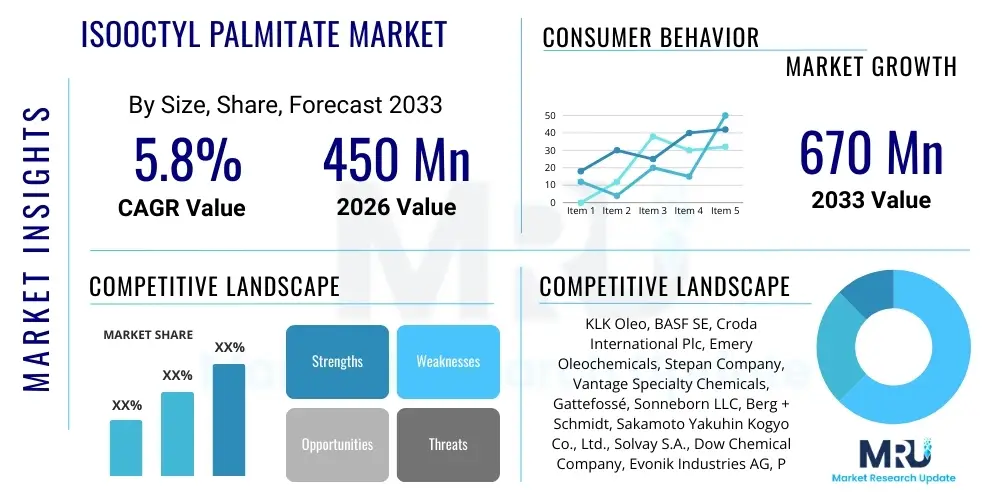

The Isooctyl Palmitate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 670 Million by the end of the forecast period in 2033.

Isooctyl Palmitate Market introduction

The Isooctyl Palmitate (IOP) Market comprises the synthesis, distribution, and application of the fatty acid ester 2-ethylhexyl palmitate. This compound serves predominantly as an advanced emollient, skin conditioning agent, solvent, and pigment wetting agent across the personal care and cosmetics industries. Characterized by its lightweight, non-greasy feel and exceptional spreadability, IOP is a vital component in formulations requiring a high degree of aesthetic elegance and performance, positioning it as a preferred alternative to traditional mineral oils and heavy emollients.

Major applications of Isooctyl Palmitate span skincare (lotions, creams, moisturizers), haircare (conditioners, serums), and color cosmetics (foundations, lipsticks). The inherent benefits of IOP, such as enhancing skin barrier function, improving the tactile feel of products, and aiding in the uniform dispersion of UV filters and pigments, significantly contribute to its market growth. Furthermore, its chemical stability and low irritation profile make it suitable for sensitive skin applications, driving demand particularly within the premium and clean beauty segments.

Key driving factors fueling the market expansion include the increasing global consumer expenditure on specialized cosmetic products, the rising demand for multi-functional ingredients that offer both hydration and improved texture, and the continuous technological advancements in esterification processes that yield higher purity IOP. The shift towards non-comedogenic and vegan cosmetic ingredients further solidifies the market position of Isooctyl Palmitate as a high-performance cosmetic raw material.

Isooctyl Palmitate Market Executive Summary

The Isooctyl Palmitate market exhibits robust growth driven by sustained innovation in personal care formulation science and expanding consumer base across emerging economies. Business trends highlight a strong focus on sustainable sourcing, particularly the derivation of palmitic acid from certified sustainable palm oil, addressing increasing consumer and regulatory scrutiny regarding environmental impact. Manufacturers are prioritizing vertical integration to manage volatility in feedstock prices and ensure consistent supply of high-grade IOP, essential for specialized applications like sun protection and advanced anti-aging creams. Strategic partnerships between chemical suppliers and major cosmetic houses are shaping product development, accelerating the launch of IOP derivatives optimized for enhanced sensory profiles and stability.

Regional trends indicate that the Asia Pacific (APAC) region remains the epicenter of market growth, fueled by rapid urbanization, significant expansion of the middle-class population, and the burgeoning local cosmetic manufacturing sector, particularly in China, India, and South Korea. North America and Europe, while mature, demonstrate stable growth, primarily through the adoption of high-ppurity cosmetic grade IOP, driven by stringent consumer preferences for premium and certified 'clean label' products. Regulatory alignment across these regions, particularly concerning ingredient safety and transparency, dictates product specifications and market entry strategies, favoring suppliers who can provide comprehensive toxicology and environmental data.

Segment trends underscore the dominance of the Cosmetic Grade segment due to its direct linkage with high-volume personal care production. Within applications, the Skincare segment holds the largest market share, sustained by daily use products such as moisturizers and body lotions. However, the Color Cosmetics segment is poised for the fastest growth, as IOP is crucial for improving the texture, longevity, and pigment dispersion of high-end makeup formulations. Furthermore, a growing opportunity exists in specialized industrial applications, though the core valuation remains anchored in the aesthetic appeal and functionality Isooctyl Palmitate offers to the burgeoning global beauty industry.

AI Impact Analysis on Isooctyl Palmitate Market

User queries regarding the impact of Artificial Intelligence (AI) on the Isooctyl Palmitate market frequently revolve around three core themes: optimization of chemical synthesis, predictive modeling for sustainable sourcing, and AI-driven personalized product formulation. Users are particularly concerned about how AI can mitigate the market’s reliance on volatile palm oil derivatives, enhance the efficiency of the esterification process, and accelerate the discovery of novel IOP variants with superior non-comedogenic or sensory properties. There is a high expectation that AI will be instrumental in creating digital twins of manufacturing facilities to reduce waste, lower energy consumption, and ensure batch-to-batch consistency, critical for high-purity cosmetic ingredients.

Furthermore, consumers and industry professionals seek clarification on how AI tools, particularly machine learning algorithms, can analyze vast datasets concerning skin interaction, safety profiles, and consumer feedback to rapidly develop customized cosmetic formulations incorporating IOP. This shift towards hyper-personalization, driven by genomics and localized environmental data analyzed by AI, promises to open new niche markets requiring tailored Isooctyl Palmitate content. The integration of AI in demand forecasting and inventory management is also a critical theme, allowing manufacturers to respond dynamically to fluctuating seasonal demands and supply chain disruptions, thereby stabilizing pricing and enhancing market responsiveness.

In essence, AI is viewed not merely as an incremental improvement but as a transformative tool capable of disrupting the traditional R&D and manufacturing paradigms of fatty acid esters. Its influence extends from the initial selection of sustainable, bio-based feedstocks through sophisticated chemical reaction optimization, culminating in targeted, efficient marketing and distribution strategies. The ability of AI to simulate complex chemical reactions and predict the stability and efficacy of IOP within intricate multi-component cosmetic systems is expected to significantly shorten the product development cycle and enhance ingredient validation processes, thus driving competitive advantage for early adopters.

- AI optimizes reaction parameters in esterification for higher yield and purity of Isooctyl Palmitate.

- Machine learning algorithms predict feedstock price volatility and optimize sourcing of sustainable palm derivatives.

- Predictive modeling aids in virtual screening of IOP derivatives for enhanced sensory characteristics and skin compatibility.

- AI-driven supply chain management ensures robust inventory control and reduces lead times for cosmetic manufacturers.

- Robotics and automated quality control systems, guided by AI, maintain stringent cosmetic grade standards.

- Personalized cosmetic platforms utilize AI to recommend optimal IOP concentrations based on individual skin profiles.

DRO & Impact Forces Of Isooctyl Palmitate Market

The Isooctyl Palmitate market is dynamically shaped by a critical interplay of Drivers, Restraints, and Opportunities (DRO), which collectively form the Impact Forces dictating market trajectory. A primary driver is the accelerating consumer demand for sophisticated personal care products, particularly those offering improved texture, non-greasiness, and enhanced sensorial experience, attributes where IOP excels. The global shift towards lightweight, high-performance emollients away from heavy petroleum-based ingredients provides a structural tailwind. Simultaneously, the rise of the ‘clean beauty’ movement, which values ingredient transparency and efficacy, encourages the use of established, well-studied esters like IOP in premium formulations. Regulatory approval across key markets further solidifies its position, provided the source material adheres to sustainability criteria.

However, the market faces significant restraints, primarily revolving around supply chain vulnerabilities. As Isooctyl Palmitate is largely derived from palmitic acid, a major component of palm oil, the market is exposed to severe fluctuations in palm oil pricing and availability, compounded by persistent international scrutiny regarding unsustainable harvesting practices. This volatility necessitates strategic sourcing and diversification, placing cost pressures on manufacturers. Furthermore, increasingly stringent cosmetic ingredient regulations, particularly in the European Union, demand continuous toxicological reassessment and documentation, creating compliance barriers for smaller manufacturers and adding to R&D overheads.

Despite these challenges, substantial opportunities exist, particularly in technological innovation and market expansion. The development of bio-fermented or non-palm derived alternatives for palmitic acid presents a massive opportunity to de-risk the supply chain and cater to the highest sustainability standards (Green Chemistry). Furthermore, expanding the application scope into niche dermatological areas, such as specialized sunscreens requiring excellent solvent properties for UV filters, and medicated skin treatments, promises high-margin growth. The increasing penetration into emerging markets, especially in Latin America and Southeast Asia, where disposable incomes are rising and local cosmetic consumption is soaring, represents a significant geographical opportunity for market penetration.

The impact forces generated by this DRO matrix push the market towards greater transparency and technological maturity. The constant tension between the demand for sustainable sourcing (Opportunity/Driver) and the price volatility of feedstock (Restraint) forces manufacturers to invest heavily in advanced supply chain resilience and biotechnological alternatives. This competitive pressure ultimately benefits end-users by ensuring a consistent supply of high-purity, environmentally compliant Isooctyl Palmitate, thereby reinforcing the market's long-term stability and growth prospects.

Segmentation Analysis

The Isooctyl Palmitate market segmentation provides a granular view of consumption patterns, delineating demand based primarily on Grade and Application. The Grade segment distinguishes between Cosmetic Grade IOP and Industrial Grade IOP, reflecting the purity requirements and intended end-use. Cosmetic Grade IOP, which constitutes the majority of the market value, requires rigorous quality control concerning heavy metal content, residual solvents, and odor profile, mandatory for direct contact applications on skin and hair. Industrial Grade IOP, conversely, is utilized in formulations such as lubricants, specialized solvents, and textile finishing agents, where the aesthetic requirements are less stringent but volume demand can be substantial, though its market valuation remains secondary to the high-value cosmetic sector.

Segmentation by Application is critical as it highlights the key growth engines for IOP. Skincare represents the largest application segment, driven by the ingredient's exceptional emollient and spreading properties, making it foundational in daily moisturizers, body oils, and anti-aging creams. The continued global emphasis on hydration, barrier repair, and sun protection reinforces demand in this category. The Haircare segment utilizes IOP primarily for conditioning, detangling, and adding shine, particularly in professional-grade serums and rinse-off conditioners, capitalizing on its ability to reduce friction without weighing down hair.

The fastest-growing application segment is Color Cosmetics, encompassing products like foundations, concealers, lipsticks, and eye makeup. Isooctyl Palmitate is invaluable here for its ability to uniformly wet and disperse pigments, ensuring vibrant, consistent color payoff and improving the overall texture and adherence of the makeup product. As consumers increasingly seek high-definition, long-wear cosmetic products, the demand for high-quality pigment dispersing agents like IOP is projected to accelerate significantly, making this segment a key focus for market players seeking high revenue growth in the coming forecast period.

- Grade:

- Cosmetic Grade

- Industrial Grade

- Application:

- Skincare Products (Lotions, Moisturizers, Sunscreens)

- Haircare Products (Conditioners, Serums, Shampoos)

- Color Cosmetics (Foundations, Lipsticks, Eyeshadows)

- Other Personal Care Products (Bath Oils, Fragrance Solvents)

- Industrial Applications (Lubricants, Chemical Intermediates)

- Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Isooctyl Palmitate Market

The value chain for Isooctyl Palmitate commences with the upstream sourcing of raw materials, primarily palmitic acid and 2-ethylhexanol. Palmitic acid is largely derived from natural sources, predominantly fractionated palm kernel oil or palm oil, meaning the upstream segment is heavily influenced by agricultural yields, commodity pricing, and sustainability certifications (like RSPO). Securing a stable, sustainably certified feedstock supply is the first and most critical hurdle. Subsequent manufacturing involves complex esterification processes where these two precursors are reacted, followed by extensive purification steps—including molecular distillation and deodorization—to achieve the necessary purity levels, especially for cosmetic applications. High-grade production requires significant capital investment in advanced reactor technology and purification infrastructure, establishing a steep barrier to entry.

The midstream activity centers on bulk chemical manufacturing and formulation. After production, the IOP is handled by major chemical distributors who manage warehousing, blending, and compliance documentation. These distributors play a vital role in bridging the gap between large-scale chemical producers and thousands of diverse, often smaller, cosmetic formulators globally. Distribution channels are categorized into direct sales (for major multinational cosmetic companies requiring bulk supply) and indirect sales (through regional specialized chemical distributors serving local and niche markets). Ensuring efficient, timely, and compliant logistics, especially across international borders, is crucial for maintaining product quality and market competitiveness.

The downstream sector involves the incorporation of Isooctyl Palmitate into finished consumer products. The primary end-users are cosmetic manufacturers (mass market and premium), who formulate the final products, followed by pharmaceutical companies (using it as a solvent or carrier) and industrial users. The choice between direct procurement from the manufacturer or relying on an indirect distributor often depends on the end-user's volume requirement and logistical capabilities. Ultimately, the value captured in the downstream segment is highly contingent on branding, marketing, and consumer acceptance of the final product, driven heavily by the sensory benefits conferred by the IOP ingredient.

Isooctyl Palmitate Market Potential Customers

The primary customers for Isooctyl Palmitate are manufacturers operating within the global personal care and cosmetics supply chain. This encompasses a broad range of companies, from multinational giants specializing in mass-market lotions and creams to boutique, high-end cosmetic laboratories focusing on niche, specialized formulations such as organic or vegan makeup lines. Their decision to purchase IOP is driven by its functional attributes—specifically its role as a non-occlusive emollient, a superior solvent for lipophilic ingredients (like sunscreens and vitamins), and an excellent pigment dispersant.

A second major customer segment includes contract manufacturers (CMOs) and private label developers who produce personal care products on behalf of brands. These entities require large, consistent volumes of functional ingredients like IOP to meet diverse client specifications and rapid product turnaround times. Furthermore, specialized chemical formulators and distributors who supply raw ingredients to smaller regional cosmetic houses also act as crucial intermediaries and potential high-volume buyers. These customers value reliability, regulatory compliance documentation, and competitive bulk pricing above all else.

Beyond personal care, potential customers extend into specialized industrial sectors. These include manufacturers of high-performance lubricants, particularly those used in demanding machinery where a stable, non-staining oil is necessary, and companies producing specialized chemical intermediates for specific industrial synthesis processes. While lower in volume compared to the cosmetic sector, these industrial end-users typically demand specific technical grades and stable, long-term supply contracts, adding another layer of demand resilience to the Isooctyl Palmitate market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 670 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | KLK Oleo, BASF SE, Croda International Plc, Emery Oleochemicals, Stepan Company, Vantage Specialty Chemicals, Gattefossé, Sonneborn LLC, Berg + Schmidt, Sakamoto Yakuhin Kogyo Co., Ltd., Solvay S.A., Dow Chemical Company, Evonik Industries AG, P&G Chemicals, Kao Corporation, Sino Lion, Jiangsu Jiatong Chemical, AkzoNobel |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Isooctyl Palmitate Market Key Technology Landscape

The technological landscape surrounding the Isooctyl Palmitate market is defined by advancements aimed at enhancing purity, optimizing yield, and ensuring sustainable sourcing of feedstocks. The core production technology remains catalytic esterification, but modern processes employ highly selective solid acid or immobilized enzyme catalysts, moving away from traditional, less efficient homogeneous catalysts. This shift improves reaction kinetics, reduces energy consumption, and significantly minimizes the formation of undesirable byproducts, which is crucial for achieving the ultra-high purity required for premium Cosmetic Grade IOP. Post-reaction purification techniques are equally critical; innovations in molecular distillation technology allow for the effective separation of the ester from unreacted raw materials and trace impurities under high vacuum and low temperatures, preserving the integrity and sensory profile of the final product.

A second pillar of technological innovation focuses on developing bio-based and sustainable alternatives to conventional palm-derived palmitic acid. This includes research into utilizing genetically modified yeast or algae through fermentation processes to produce fatty acids (including palmitic acid) that are structurally identical but ethically and environmentally superior. This bio-fermentation technology offers a pathway to mitigate supply chain risk associated with palm oil deforestation and price volatility, positioning firms that master this process for substantial market advantage in the sustainability-conscious European and North American markets. Furthermore, advances in continuous manufacturing systems, replacing traditional batch processes, offer improved scalability, consistency, and reduced operational costs.

Finally, the integration of computational chemistry and analytical instruments defines the quality assurance and formulation technology landscape. Techniques such as high-resolution Gas Chromatography-Mass Spectrometry (GC-MS) are essential for identifying and quantifying trace impurities, ensuring compliance with strict regulatory standards globally. In formulation science, high-throughput screening and rheological modeling are used to predict how IOP interacts with other cosmetic ingredients (such as emulsifiers and thickeners) at various temperatures and shear rates. This predictive capability allows formulators to efficiently design stable and aesthetically pleasing products, significantly reducing the time and cost associated with iterative physical testing, thus accelerating product commercialization.

Regional Highlights

The Isooctyl Palmitate market exhibits varied growth trajectories and consumption dynamics across key geographic regions, reflecting differences in economic development, regulatory environments, and consumer trends within the personal care sector.

- Asia Pacific (APAC): APAC dominates the global Isooctyl Palmitate market, driven by its status as the world's largest manufacturing hub for personal care products and its burgeoning consumer base. Countries like China, India, Japan, and South Korea exhibit soaring demand for high-end skincare and color cosmetics. The rapid urbanization, increasing disposable incomes, and the strong cultural emphasis on complex beauty routines (like K-Beauty) fuel the consumption of emollients like IOP. Furthermore, APAC houses significant raw material processing capabilities, contributing substantially to both production and consumption.

- North America: North America represents a mature and high-value market characterized by a strong consumer preference for premium, transparently sourced, and 'clean label' cosmetic ingredients. Demand for Isooctyl Palmitate here is robust, particularly in the high-performance sun care and anti-aging segments, where its excellent solvency and light texture are highly valued. Regulatory adherence, particularly to ingredient lists and safety assessments, drives demand for certified, high-purity cosmetic grade IOP.

- Europe: Europe is defined by stringent regulatory standards (such as REACH and EU Cosmetics Regulation), pushing manufacturers toward sustainable sourcing and comprehensive toxicological profiles. The European market demands certified sustainable Isooctyl Palmitate, prioritizing suppliers compliant with RSPO or similar environmental certifications. Key markets like Germany, France, and the UK exhibit stable growth, focusing on innovative formulations in specialized skin treatments and natural cosmetics.

- Latin America (LATAM): The LATAM region, particularly Brazil and Mexico, is emerging as a significant growth area. Rising middle-class consumers are increasing expenditure on personal grooming products. Local manufacturers are expanding production capacities, driving increased demand for functional ingredients. IOP is gaining popularity in body care and mass-market color cosmetics due to its cost-effectiveness and performance attributes compared to more expensive alternatives.

- Middle East and Africa (MEA): While currently the smallest market, MEA shows promising potential, largely concentrated in the GCC countries and South Africa. This growth is driven by rising luxury consumerism and the development of local cosmetic manufacturing hubs. Demand is focused on high-performance emollients suitable for hot, arid climates, where IOP’s light feel is advantageous over heavier oils.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Isooctyl Palmitate Market.- KLK Oleo

- BASF SE

- Croda International Plc

- Emery Oleochemicals

- Stepan Company

- Vantage Specialty Chemicals

- Gattefossé

- Sonneborn LLC

- Berg + Schmidt

- Sakamoto Yakuhin Kogyo Co., Ltd.

- Solvay S.A.

- Dow Chemical Company

- Evonik Industries AG

- P&G Chemicals

- Kao Corporation

- Sino Lion

- Jiangsu Jiatong Chemical

- AkzoNobel

Frequently Asked Questions

Analyze common user questions about the Isooctyl Palmitate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Isooctyl Palmitate and what are its primary functions in cosmetic products?

Isooctyl Palmitate (IOP), also known as 2-ethylhexyl palmitate, is a fatty acid ester derived from palmitic acid and 2-ethylhexanol. Its primary function in cosmetics is to act as a high-performance emollient, providing lightweight hydration, improving product spreadability, and serving as an excellent solvent and pigment wetting agent in foundations and lipsticks.

How does the sustainability of feedstock impact the Isooctyl Palmitate market?

Since IOP is often derived from palm oil (palmitic acid), the market is heavily influenced by sustainability concerns, particularly in European and North American markets. Consumers and regulators increasingly demand IOP sourced from certified sustainable palm oil (e.g., RSPO certified) to mitigate deforestation risk, driving manufacturers to invest in sustainable sourcing or explore bio-fermented alternatives.

Which application segment holds the largest share in the IOP market and why?

The Skincare Products segment commands the largest market share. This dominance is due to the indispensable role of IOP as a non-greasy emollient in high-volume, daily-use products such as facial moisturizers, body lotions, and sunscreens, where its smooth, luxurious skin feel is highly valued by consumers globally.

What are the main growth drivers for the Isooctyl Palmitate market in the Asia Pacific region?

The primary growth drivers in APAC include rapid consumer spending on personal care, high demand for sophisticated color cosmetics, the influence of K-Beauty trends requiring high-aesthetic emollients, and the region's strong local manufacturing capacity, positioning it as both a major producer and consumer of IOP.

Are there technological advancements emerging to reduce the reliance on palm oil for IOP production?

Yes, significant technological advancements are focused on developing alternative feedstocks. This includes utilizing synthetic processes or advanced biotechnology, such as microbial fermentation, to produce bio-based palmitic acid derivatives, offering a sustainable and price-stable alternative to traditional palm oil sourcing.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager