Isopentane & Normalpentane Blend Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433855 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Isopentane & Normalpentane Blend Market Size

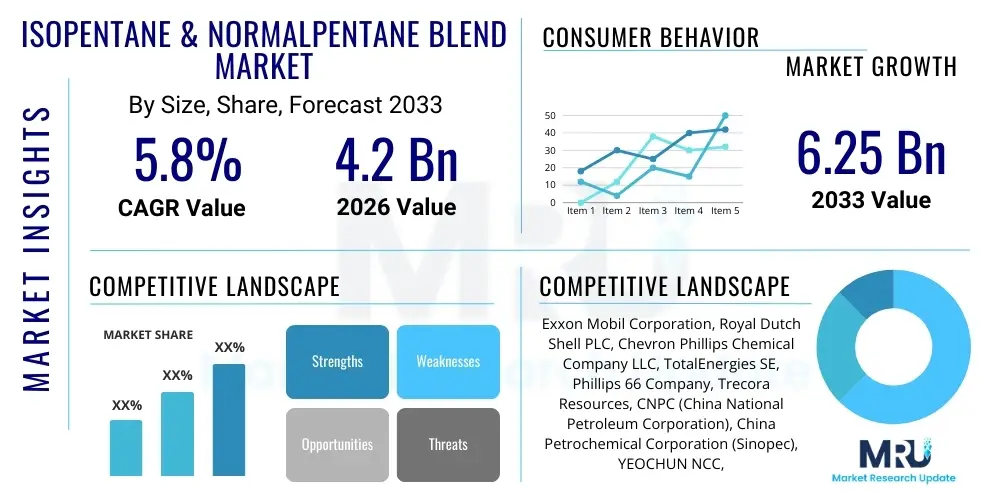

The Isopentane & Normalpentane Blend Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.2 Billion in 2026 and is projected to reach USD 6.25 Billion by the end of the forecast period in 2033.

Isopentane & Normalpentane Blend Market introduction

The Isopentane & Normalpentane blend, often referred to simply as pentane blend or N/IP mix, constitutes a crucial segment within the global specialty chemicals and petrochemical industry. This colorless, highly flammable liquid mixture is primarily derived from crude oil and natural gas processing, finding extensive use across various industrial applications due to its precise and controllable thermodynamic properties. The blend is strategically utilized to achieve specific vapor pressures and boiling points necessary for optimal performance, particularly in processes requiring high-efficiency foaming or solvent capabilities. Major applications span from serving as an eco-friendly blowing agent in the production of rigid polyurethane foam used in insulation, to being utilized as a high-octane gasoline blending component in the refining sector to enhance fuel quality and meet stringent environmental regulations. The increasing global demand for energy-efficient construction materials, spurred by tightening governmental mandates regarding thermal efficiency in buildings, remains a dominant driving force propelling market expansion, necessitating reliable supply chains for these blended hydrocarbons.

The product description details a precise stoichiometric mixture of two structural isomers of pentane: Isopentane (2-methylbutane) and Normalpentane (n-pentane). This blending allows manufacturers to tailor the physical properties, such as vapor pressure, volatility, and solubility, to specific industrial requirements, offering greater flexibility than using the pure components alone. For instance, increasing the proportion of Isopentane generally lowers the boiling point and increases volatility, which is highly desirable for fast-curing foaming processes, particularly in the production of advanced insulation panels and consumer appliance manufacture. The primary benefits of using these blends include their relatively low global warming potential (GWP) and zero ozone depletion potential (ODP), making them preferred substitutes for traditional chlorofluorocarbon (CFC) and hydrochlorofluorocarbon (HCFC) blowing agents, aligning with international environmental protocols like the Montreal Protocol and subsequent amendments. Furthermore, their inherent chemical stability and established production processes contribute to cost-effectiveness and operational reliability across varied manufacturing environments.

Key driving factors accelerating the adoption of Isopentane & Normalpentane blends include the relentless growth of the construction sector globally, particularly in emerging economies focused on large-scale infrastructure development and affordable housing projects requiring superior insulation. Regulatory shifts favoring hydrocarbon blowing agents (HCBAs) over fluorinated alternatives in developed markets further cement the blend's position as a sustainable choice. In the refining industry, the demand for high-performance, cleaner burning fuels is pushing refiners to utilize light hydrocarbons for octane enhancement, where Isopentane acts as a superior blending stock due to its high research octane number (RON). Additionally, the blend serves a niche but growing market in specialized solvents and aerosol propellants where mild solvency and rapid evaporation rates are required. The interplay of environmental regulation, infrastructure development, and refining needs collectively underscores the critical importance and positive growth trajectory of the Isopentane & Normalpentane Blend Market over the forecast period.

Isopentane & Normalpentane Blend Market Executive Summary

The Isopentane & Normalpentane Blend Market is characterized by robust commercial activity driven predominantly by the polyurethane foam insulation sector and stringent global energy efficiency standards. Current business trends indicate a significant consolidation among major producers focused on optimizing feedstock procurement, primarily relying on abundant natural gas liquids (NGLs) to maintain competitive pricing against synthetic alternatives. Strategic partnerships between chemical manufacturers and major construction material suppliers are becoming common, aimed at standardizing high-quality blowing agent mixtures tailored for specific R-values in insulation products. Furthermore, the market is experiencing technological evolution centered on enhancing blend purity and developing closed-loop systems for managing volatile organic compounds (VOCs) emissions during application, responding proactively to tightening industrial hygiene and safety regulations. The shift toward sustainable chemical sourcing and optimized logistics management across continents represents the core strategic imperatives for market participants aiming for sustainable growth and operational superiority in a moderately fragmented competitive landscape.

Regional trends reveal Asia Pacific (APAC) as the fastest-growing market, primarily fueled by massive urbanization, infrastructure investment in China and India, and the rising penetration of refrigerator and freezer manufacturing which utilizes these blends as effective refrigerants and foaming agents. North America and Europe, while mature, exhibit high replacement demand and strong regulatory incentives pushing the transition away from environmentally harmful substances, maintaining a steady requirement for high-purity blends. Specifically, European markets lead in the adoption of advanced vacuum insulation panels (VIPs) where pentane blends are integral. Segment trends show that the application segment comprising insulating materials (e.g., rigid polyurethane foam, PIR foam) dominates the market share due to its direct linkage with global climate goals and mandatory building codes promoting energy conservation. Within the product type segment, blends with a higher concentration of Isopentane are gaining traction owing to their superior performance characteristics in specific high-efficiency foam production processes, demanding premium pricing and fostering specialized production capabilities across key suppliers.

Overall, the market outlook remains highly favorable, largely insulated from typical economic volatility due to its essential role in meeting global environmental and energy-saving targets. The primary challenge lies in managing the price volatility of NGL feedstocks, which directly impacts production costs and profit margins. However, innovative process improvements, such as the implementation of advanced fractionation technologies and the utilization of AI/ML for demand forecasting and inventory management, are being adopted to mitigate these risks. Successful market participants are those who can consistently offer tailored blend compositions, ensure reliable supply logistics, and possess strong geographical presence in high-growth construction markets like Southeast Asia and the Middle East, capitalizing on the persistent, structural demand for high-performance, sustainable insulation solutions globally.

AI Impact Analysis on Isopentane & Normalpentane Blend Market

Common user questions regarding AI's influence in the Isopentane & Normalpentane Blend Market often revolve around operational efficiency, safety enhancement, and optimized resource allocation. Users frequently inquire about how machine learning algorithms can predict feedstock price fluctuations, whether AI can improve the precision of the blending ratio to meet strict customer specifications (e.g., specific foaming characteristics), and how AI-driven process control enhances safety standards in highly volatile chemical production environments. There is a strong interest in AI's role in predictive maintenance for specialized fractionation units and polymerization reactors that utilize these blends, ensuring minimal downtime. Furthermore, stakeholders seek clarification on AI's capacity to streamline complex international logistics and optimize inventory levels, especially considering the constraints associated with transporting highly flammable materials. The overarching theme is the expectation that AI and advanced analytics will transition the market from reactive management based on historical data to proactive, real-time optimization across the entire value chain, significantly improving margins and consistency.

AI's initial impact is most pronounced in refining and chemical processing, where advanced analytics are deployed for real-time monitoring and predictive quality control. By processing vast datasets from chromatography, temperature sensors, and pressure gauges, AI models can precisely detect deviations in the blend composition instantly, allowing operators to make micro-adjustments that maximize yield and ensure adherence to exacting purity standards required for specialized applications like semiconductor cleaning or high-performance refrigerants. This level of precision is critical for maintaining customer trust, especially where blending errors can compromise the end product, such as the R-value of insulation foam. Furthermore, AI-driven demand forecasting, integrating variables like seasonal construction activity, global NGL prices, and regional regulatory changes, allows manufacturers to optimize production schedules, reducing excess inventory costs and minimizing the storage of volatile products.

The secondary but equally vital impact involves safety and environmental compliance. AI-powered surveillance systems and sensor networks utilize deep learning to identify potential leak hazards, equipment failure precursors, or anomalous process conditions indicative of risk in storage and transportation. By providing early warnings, these systems prevent catastrophic failures and enhance worker safety, which is paramount when handling low-flashpoint hydrocarbons. Moreover, AI aids in optimizing energy consumption during the complex distillation and separation processes required to purify the component pentanes. By fine-tuning energy inputs based on real-time process dynamics, producers can reduce operational expenditures and lower the overall carbon footprint of the manufacturing process, contributing to the industry’s broader sustainability objectives and enhancing compliance with increasingly stringent environmental performance indicators (EPIs).

- AI enhances blending precision through real-time composition analysis.

- Machine learning optimizes feedstock procurement based on NGL price prediction models.

- Predictive maintenance schedules for fractionation equipment reduce unplanned downtime.

- AI-driven safety systems minimize leakage risks and ensure compliance in handling volatile materials.

- Advanced analytics improve logistics and inventory management for flammable chemical transportation.

DRO & Impact Forces Of Isopentane & Normalpentane Blend Market

The dynamics of the Isopentane & Normalpentane Blend Market are governed by a compelling mix of environmental drivers, supply chain constraints, and technological opportunities, collectively shaping the direction and pace of growth. The dominant Driver remains the global phase-out of traditional hydrochlorofluorocarbons (HCFCs) and certain hydrofluorocarbons (HFCs) under international climate agreements, strongly positioning hydrocarbon blends as the preferred, non-fluorinated alternatives, especially as efficient blowing agents and refrigerants. However, the Restraints largely center on the inherent volatility and flammability of the blends, which impose severe limitations on storage, transportation, and application, necessitating expensive infrastructure upgrades and specialized handling procedures, particularly in construction settings. Opportunities abound in emerging markets where rapid expansion of the cold chain and adoption of green building technologies create massive, latent demand for high-performance insulation. The Impact Forces emphasize regulatory pressure and technological innovation; strict mandates for thermal efficiency (Driver) necessitate R&D into enhanced foaming systems (Opportunity), while simultaneously intensifying safety scrutiny (Restraint). The successful navigation of this complex regulatory and operational environment dictates market leadership and sustained profitability.

Segmentation Analysis

The Isopentane & Normalpentane Blend Market is systematically segmented based on composition (purity level/blend ratio), application, and end-user industry. This granular analysis is essential for manufacturers to tailor their production capabilities and marketing strategies to meet diverse sectoral needs, ranging from highly sensitive pharmaceutical processes to large-volume construction materials production. The segmentation by composition is crucial as different ratios of Isopentane to Normalpentane impart unique physical properties; for instance, a higher Isopentane concentration is preferred where lower boiling points and faster evaporation are critical, such as in solvent applications or aerosol propellants. Conversely, a balanced mix might be utilized to achieve optimal thermodynamic performance in rigid foam manufacturing, ensuring proper cell structure and maximizing the insulating R-value of the final product. Understanding these nuances allows suppliers to optimize their feedstock sourcing, which usually involves distillation and purification from lighter fractions of crude oil or natural gas liquids.

Segmentation by application highlights the market's reliance on the insulation and foam sector. Rigid polyurethane (PU) and polyisocyanurate (PIR) foams, utilized in refrigeration, structural insulation panels, and piping, represent the single largest consuming category. This dominance is due to the blend’s effectiveness as a zero ODP and low GWP blowing agent, making it the industry standard under environmental regulations. Secondary applications, including specialized solvents, chemical intermediates, and aerosol propellants, provide diversification and stability to the market. For instance, in the electronics industry, high-purity pentane blends are used as effective cleaning solvents due to their rapid evaporation and low residue characteristics. The diversification across these applications mitigates risk associated with cyclical downturns in any single industrial segment, though the construction cycle remains the primary indicator of overall market health and growth potential.

The final layer of analysis, focusing on end-user industry, distinguishes between primary consumers such as Construction (insulation), Chemical/Petrochemical (intermediates and refining), and Appliances (refrigeration units). The chemical sector uses these blends as reliable octane boosters in gasoline blending, capitalizing on Isopentane's superior anti-knock properties to produce high-specification fuels. The appliance sector is a consistent consumer, utilizing the blend in the manufacturing process of domestic and commercial refrigeration equipment, where it serves the dual purpose of foaming the insulating walls and acting as a mild refrigerant. The growth in the Construction segment is intrinsically linked to global energy policies and mandatory green building codes, ensuring its enduring importance as the foundational pillar of demand for Isopentane & Normalpentane blends across all geographical regions.

- By Composition/Purity:

- High Purity Pentane Blends

- Technical Grade Pentane Blends

- Specific Isopentane/Normalpentane Ratios (e.g., 60/40, 70/30)

- By Application:

- Blowing Agent (Polyurethane and Polystyrene Foams)

- Refrigerants and Cooling Systems

- Aerosol Propellants

- Solvents and Cleaning Agents

- Octane Enhancer and Gasoline Blending

- Chemical Intermediate Production

- By End-User Industry:

- Construction and Infrastructure

- Appliance and Refrigeration Manufacturing

- Petroleum Refining and Fuel Production

- Specialty Chemicals and Pharmaceuticals

Value Chain Analysis For Isopentane & Normalpentane Blend Market

The value chain for the Isopentane & Normalpentane Blend Market commences with the upstream segment: the extraction and processing of Natural Gas Liquids (NGLs) and crude oil. NGLs, particularly the pentane fraction, are the primary feedstock. Key activities in this stage include drilling, separation, and initial fractionation at gas processing plants and refineries. Feedstock availability, largely dependent on global energy policies and geopolitical stability, directly influences the production cost and pricing of the final blended product. Major upstream players are integrated oil and gas companies who possess the infrastructure for large-scale NGL recovery and fractionation. The high capital expenditure required for sophisticated separation technology means that this stage is dominated by a few global giants, setting the foundation for the entire downstream market.

The core processing stage involves the refining and blending of the components. Raw pentane fractions must undergo purification processes, often involving molecular sieve filtration and multi-stage distillation, to separate Isopentane from Normalpentane and other heavier or lighter hydrocarbons, achieving the high purity levels required for specific industrial applications (like blowing agents). Producers then precisely blend the two isomers to meet specific customer requirements for volatility and vapor pressure. Distribution channels are critical, given the high flammability. Direct distribution typically involves long-term contracts for bulk supply to large polyurethane foam manufacturers, often transported via specialized tanker trucks, rail cars, or dedicated pipelines. Indirect distribution involves specialized chemical distributors who handle smaller volumes, manage regional inventory, and provide just-in-time delivery to smaller end-users in the construction or specialty solvent sectors.

The downstream segment includes the various end-user applications where the blend is consumed. The largest consumers are manufacturers of rigid insulation foam (used in walls, roofs, and cold storage) and appliance manufacturers (producing refrigerators and freezers). These end-users rely on the consistent quality of the blend for efficient foam expansion and superior insulation performance. The final step involves the consumer market, where the insulated products are ultimately utilized. The efficiency and reliability of the value chain—from stable NGL feedstock supply to highly controlled blending, and safe, efficient delivery—are paramount. Any disruption, particularly at the transportation or purification stage, can significantly impact global supply and the cost of critical construction and refrigeration materials, highlighting the strategic importance of secure, redundant supply routes for these volatile chemicals.

Isopentane & Normalpentane Blend Market Potential Customers

Potential customers for Isopentane & Normalpentane blends are highly diverse but primarily concentrated within industries focused on thermal management, chemical synthesis, and energy efficiency. The largest customer segment consists of rigid polyurethane foam manufacturers. These companies, such as Huntsman, BASF, and specialized insulation panel makers, utilize the blend extensively as a zero-ODP, low-GWP blowing agent to create the cellular structure of insulation materials (e.g., polyisocyanurate (PIR) panels, spray foam, and block foam). Their purchasing decisions are driven by the need for compliance with environmental regulations, the required R-value performance of the finished foam, and the consistency of the blend's composition, which affects process yield and quality control. As global mandates for building energy efficiency tighten, this customer base represents both the largest volume consumer and the most stable demand driver for the market.

A second major category includes appliance manufacturers, particularly those producing domestic and commercial refrigeration equipment. Companies like Whirlpool, Haier, and specialized cold storage providers purchase these blends for two distinct functions: as a refrigerant (R-601a or related mixtures) and more commonly, as the blowing agent for the insulation integral to the appliance shell. For this customer group, operational safety and supply reliability are critical, given the high volume production schedules typical in the consumer appliance sector. Their demand is highly sensitive to consumer spending cycles but is fundamentally supported by the global need to replace older, less energy-efficient cooling systems, particularly in rapidly expanding tropical and subtropical regions requiring robust cold chains for food and medicine preservation.

The third significant customer base resides in the petroleum refining and specialty chemicals sectors. Refineries utilize the high-octane component, Isopentane, for blending into gasoline to meet specific fuel standards and improve anti-knock performance without relying heavily on harmful additives. Specialty chemical companies and solvent producers purchase high-purity blends for use in laboratory analysis, industrial cleaning, and as a specialized carrier or solvent in polymerization processes. These customers often require customized blending ratios and extremely high purity levels, leading to premium pricing but relatively lower volume purchases compared to the construction sector. Their demand is driven by quality assurance, process precision, and the availability of non-polar solvents with specific, rapid evaporation profiles for sensitive applications like electronics cleaning.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.2 Billion |

| Market Forecast in 2033 | USD 6.25 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Exxon Mobil Corporation, Royal Dutch Shell PLC, Chevron Phillips Chemical Company LLC, TotalEnergies SE, Phillips 66 Company, Trecora Resources, CNPC (China National Petroleum Corporation), China Petrochemical Corporation (Sinopec), YEOCHUN NCC, SK Global Chemical Co., Ltd., Haltermann Carless GmbH, Shandong Runxin Chemical Co., Ltd., INEOS Group, Gevo, Inc., PTT Global Chemical Public Company Limited, Reliance Industries Limited, Calumet Specialty Products Partners, L.P., and Versalis S.p.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Isopentane & Normalpentane Blend Market Key Technology Landscape

The technology landscape for the Isopentane & Normalpentane Blend Market is dominated by advancements in separation science, blending precision, and application efficiency. At the manufacturing level, the critical technological focus is on enhancing the purity of the individual isomers before blending. This is typically achieved through highly efficient fractionation columns and specialized distillation processes that rely on precise temperature and pressure control to separate the closely boiling components. Innovations in this area include the use of dividing wall columns (DWC) and reactive distillation, which offer substantial energy savings and increased product yields compared to conventional distillation trains. The continuous improvement in molecular sieve technology also plays a crucial role in removing trace impurities, ensuring the technical-grade products meet the exacting specifications required for modern high-performance insulation systems, thereby maximizing the foam's long-term thermal integrity.

A second major technological area involves blending and quality assurance. Due to the high sensitivity of downstream applications—where slight variations in the n-pentane to isopentane ratio can drastically alter foaming time or solubility—advanced in-line mixing and monitoring technologies are indispensable. Key players utilize sophisticated flow meters, density analyzers, and real-time gas chromatography coupled with process control systems (often managed by AI/ML algorithms, as previously discussed) to achieve exact stoichiometric blends with minimum tolerance deviation. This high-precision blending capability allows manufacturers to offer customized compositions (e.g., 65/35 or 70/30 ratios) tailored for specific end-user equipment and ambient operating conditions, which is a major competitive differentiator in the specialty chemical segment. These technologies not only ensure product quality but also enhance operational safety by providing instantaneous feedback on process parameters.

Finally, application technologies, particularly within the polyurethane foam industry, are evolving rapidly to maximize the effectiveness and safety of using volatile hydrocarbon blowing agents. This includes the development of optimized metering equipment and specialized high-pressure spray foam machines designed to handle the low viscosity and high volatility of the pentane blends safely and efficiently. Research is also focused on developing blend formulations compatible with next-generation polyol and isocyanate systems, allowing for better foam cell structure development and superior thermal resistance. Furthermore, technology pertaining to fugitive emissions management, such as vapor recovery systems and advanced ventilation techniques at the point of application (e.g., construction sites), represents a crucial area of investment, ensuring environmental compliance and mitigating occupational hazards associated with the use of these highly flammable materials.

Regional Highlights

- Asia Pacific (APAC): APAC is recognized as the dominant and fastest-growing region, primarily fueled by unprecedented expansion in the construction and infrastructure sectors, especially in China, India, and Southeast Asia. The region’s burgeoning population and rapid urbanization drive massive demand for refrigerators, freezers, and energy-efficient building insulation. Governments in the region are increasingly adopting energy-saving mandates, pushing manufacturers away from older HCFC-based systems toward sustainable alternatives like pentane blends. Furthermore, robust investment in petrochemical refining capacity, particularly in China and South Korea, ensures a readily available feedstock supply, underpinning the market's strong growth trajectory.

- North America: The North American market is characterized by high replacement demand in the appliance sector and strict enforcement of the U.S. Environmental Protection Agency (EPA) regulations, particularly the Significant New Alternatives Policy (SNAP) program, which favors hydrocarbon blowing agents. While growth rates are more moderate compared to APAC, the market value remains substantial, driven by the requirement for high-R-value rigid insulation in residential and commercial retrofitting projects. The region benefits from abundant and cost-competitive NGL feedstock derived from domestic shale gas production, providing a significant competitive advantage to local producers.

- Europe: Europe is a mature but technologically advanced market, serving as a key global hub for specialized polyurethane manufacturing and green building standards (e.g., Passive House standards). Environmental consciousness and strong regulatory frameworks (like the European F-Gas Regulation) have driven early and widespread adoption of pentane blends over fluorinated gases. The focus here is less on volume growth and more on high-purity, custom-ratio blends for highly specialized applications such as district heating insulation and complex vacuum insulation panels (VIPs), maintaining Europe's position as a leader in high-value segment consumption.

- Latin America (LATAM): The LATAM market exhibits significant potential, driven by improving economic conditions and increased foreign investment in manufacturing. Brazil and Mexico are primary consumers, owing to their large domestic appliance manufacturing bases and growing construction sectors. Market growth is often volatile due to economic instability but long-term projections remain positive as the need for cold chain infrastructure, particularly in agricultural exports and vaccine distribution, accelerates the demand for reliable insulation.

- Middle East and Africa (MEA): The MEA region is expanding, fueled by large-scale infrastructure projects (e.g., Saudi Vision 2030, UAE projects) and the intense need for robust, high-performance building insulation to cope with extreme climate conditions. The region also benefits from being a major petrochemical production center, with several countries having access to abundant domestic NGL supplies. The growth is primarily concentrated in the Gulf Cooperation Council (GCC) countries, focusing heavily on commercial and high-end residential construction demanding premium insulation materials.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Isopentane & Normalpentane Blend Market.- Exxon Mobil Corporation

- Royal Dutch Shell PLC

- Chevron Phillips Chemical Company LLC

- TotalEnergies SE

- Phillips 66 Company

- Trecora Resources

- CNPC (China National Petroleum Corporation)

- China Petrochemical Corporation (Sinopec)

- YEOCHUN NCC

- SK Global Chemical Co., Ltd.

- Haltermann Carless GmbH

- Shandong Runxin Chemical Co., Ltd.

- INEOS Group

- Gevo, Inc.

- PTT Global Chemical Public Company Limited

- Reliance Industries Limited

- Calumet Specialty Products Partners, L.P.

- Versalis S.p.A.

- Huntsman Corporation (Integrated downstream consumer)

- BASF SE (Integrated downstream consumer)

Frequently Asked Questions

Analyze common user questions about the Isopentane & Normalpentane Blend market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver for the growth of the Isopentane & Normalpentane Blend Market?

The primary driver is the accelerating global regulatory transition away from high-Global Warming Potential (GWP) blowing agents, such as HCFCs and specific HFCs, mandated by international agreements. This shift firmly positions the hydrocarbon blends as the preferred, environmentally sustainable alternatives for high-efficiency insulation in construction and appliance manufacturing.

How do the blends function as a blowing agent in insulation foam production?

The blends are injected into the polyurethane mixture, where their controlled volatility causes them to vaporize during the chemical reaction (exotherm). This vaporization creates closed cell structures within the foam, trapping the pentane gas, which possesses excellent insulating properties (low thermal conductivity), thereby enhancing the final product’s thermal resistance or R-value.

What major risks are associated with the transportation and storage of Pentane Blends?

The major risks stem from their high volatility and low flash point, classifying them as highly flammable materials. This necessitates specialized, explosion-proof storage infrastructure, inert gas blanketing, and adherence to stringent, often costly, regulatory protocols for transportation via rail, truck, or marine vessels to ensure safety and mitigate fire hazards.

Which region currently leads the global consumption of Isopentane & Normalpentane Blends?

The Asia Pacific (APAC) region currently leads global consumption, driven by high volume demand from rapidly expanding appliance manufacturing sectors and massive infrastructure and residential construction projects across countries like China and India, where energy efficiency standards are increasingly being implemented.

How does Isopentane content affect the performance of the blend?

Increasing the Isopentane content (Isopentane being the branched isomer) generally lowers the blend’s boiling point and increases its vapor pressure and volatility. This is desirable for specific foam applications that require a faster, more aggressive blowing action, yielding foam with finer cell structures and improved dimensional stability post-expansion.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager