Isopropyl Palmitate Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436112 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Isopropyl Palmitate Market Size

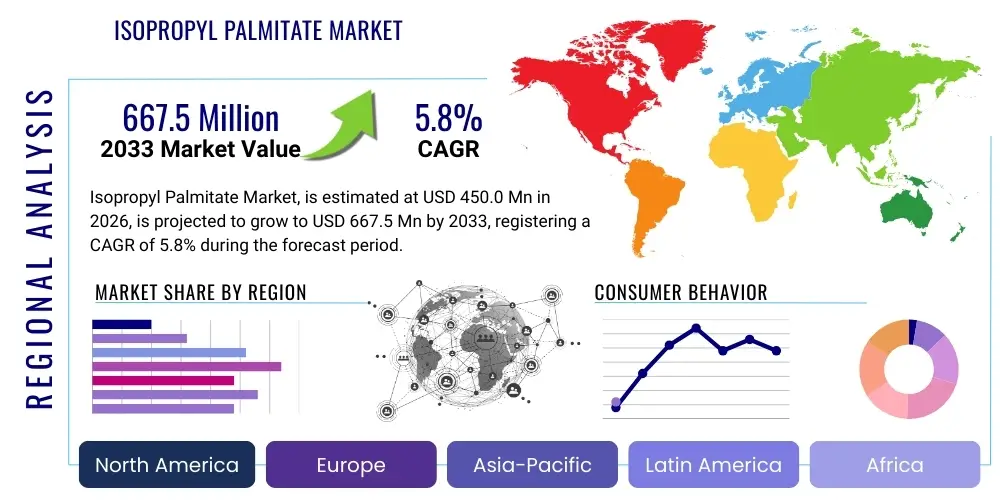

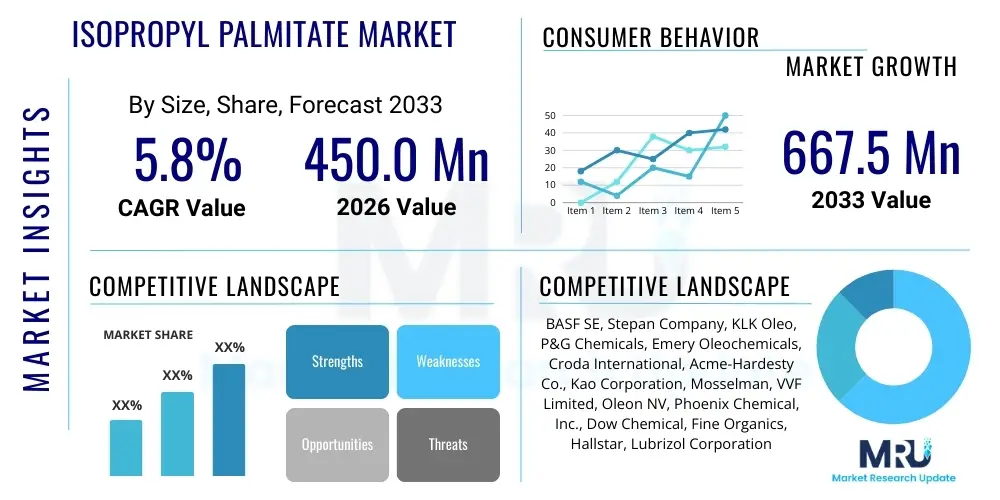

The Isopropyl Palmitate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 450.0 million in 2026 and is projected to reach USD 667.5 million by the end of the forecast period in 2033. This substantial growth is fundamentally underpinned by the escalating demand for high-performance emollients and non-occlusive skin conditioning agents across the global cosmetic and personal care industry. Isopropyl Palmitate (IPP) serves a crucial function in formulations, enhancing spreadability, reducing greasiness, and acting as an excellent solvent for active ingredients, which are key requirements for modern, consumer-preferred beauty products.

Furthermore, the market expansion is driven by the pharmaceutical sector, where IPP is utilized as a solvent and vehicle for topical drug delivery systems, particularly in dermatological preparations. Its low toxicity profile and exceptional skin penetration capabilities make it an indispensable excipient. The shift in consumer preference toward natural and naturally derived ingredients is simultaneously influencing the supply side, encouraging manufacturers to invest in bio-based Isopropyl Palmitate derived from sustainable palm oil or other vegetable oil sources, which is increasingly capturing market share from synthetic alternatives and commanding premium pricing, thereby bolstering overall market value.

Regional dynamics, particularly robust industrial growth in Asia Pacific (APAC) coupled with rising disposable incomes, contribute significantly to the forecast positive trajectory. Manufacturers are focusing on optimizing production processes using green chemistry principles, improving purity standards, and ensuring compliance with stringent regulatory frameworks like REACH and FDA guidelines. This technological evolution and focus on sustainability are positioning the IPP market for resilient and stable growth throughout the projection period, despite potential volatility in raw material pricing.

Isopropyl Palmitate Market introduction

The Isopropyl Palmitate (IPP) Market encompasses the global production, distribution, and consumption of the ester derived from isopropyl alcohol and palmitic acid. This clear, colorless, and odorless liquid is primarily valued in the industry for its exceptional emollient, solvent, and thickening properties. IPP is classified as a light-textured, non-greasy emollient, making it highly desirable in cosmetic formulations where fast absorption and a smooth skin feel are critical. Its chemical structure allows it to effectively solubilize lipophilic active pharmaceutical ingredients (APIs) and disperse pigments in makeup products, establishing its role as a versatile functional ingredient.

Major applications of IPP span across several sectors, including personal care (lotions, creams, sunscreens, antiperspirants), color cosmetics (foundations, lipsticks), and pharmaceuticals (topical ointments, patches). Key benefits driving its widespread adoption include its ability to enhance the sensory profile of products, improve the stability of oil-in-water emulsions, and function as a binding agent. Additionally, its high spreadability coefficient allows for efficient application and better coverage in large-surface topical treatments. The market is increasingly segmented based on the source of the raw material, with significant focus now placed on bio-based sources to meet sustainability mandates imposed by major corporate end-users.

Driving factors for the IPP market include the booming global beauty and personal care industry, particularly in developing economies, the continued innovation in sun protection formulations requiring efficient solvent systems, and the rising global prevalence of skin conditions necessitating effective dermatological vehicles. Furthermore, advancements in esterification technology ensuring higher purity and lower residual solvent content are making IPP the preferred choice over traditional mineral oils in premium product lines. The shift towards moisturizing products that cater to diverse skin types further solidifies IPP's market position as a standard ingredient for skin conditioning.

Isopropyl Palmitate Market Executive Summary

The Isopropyl Palmitate Market is characterized by robust business trends centered on sustainability and functional purity, with strong demand emanating from the cosmetic and pharmaceutical industries. A notable trend involves the rapid transition toward bio-based IPP, driven by corporate environmental, social, and governance (ESG) mandates and consumer demand for natural ingredients, prompting major suppliers to secure certified sustainable sources, often linked to RSPO standards for palm oil. Geographically, Asia Pacific dominates both in terms of manufacturing capacity and consumption growth, fueled by mass-market personal care production in China and India, although North America and Europe remain crucial for high-value, specialty pharmaceutical formulations and premium cosmetic brands.

Segment trends reveal that the Cosmetics and Personal Care application segment holds the largest market share, specifically benefiting from the proliferation of high-end moisturizers, anti-aging creams, and advanced sun care products where IPP's non-greasy feel is essential. Within the segmentation by type, synthetic IPP still accounts for a significant volume, but the bio-based segment is recording a superior Compound Annual Growth Rate (CAGR), indicating a pivotal shift in sourcing strategies. Innovation is also focused on developing IPP alternatives or derivatives that offer enhanced stability and reduced comedogenicity, catering to sensitive skin product lines and further diversifying the market landscape.

The competitive environment is moderately fragmented, with large integrated chemical manufacturers competing alongside smaller, specialized oleochemical companies, particularly those focused on sustainable sourcing. Key market strategies involve securing long-term supply agreements for fatty acid feedstock, enhancing operational efficiency through continuous processing, and strategic regional expansions to capture emerging market demand. Overall, the market remains healthy, propelled by consistent underlying demand for emollients in daily consumer products and technological improvements aimed at sustainability and high purity, ensuring sustained profitability for stakeholders across the value chain.

AI Impact Analysis on Isopropyl Palmitate Market

Users frequently inquire about how Artificial Intelligence (AI) and Machine Learning (ML) can optimize the typically resource-intensive production of Isopropyl Palmitate, especially concerning raw material volatility and regulatory compliance. Key concerns revolve around using AI to predict fluctuations in palm oil or fatty acid prices, optimize complex esterification reaction parameters to maximize yield and purity, and accelerate the development of sustainable, non-palm-derived IPP alternatives. Users also express expectations regarding AI's ability to streamline the highly complex global supply chain, ensuring just-in-time inventory management for cosmetic manufacturers and improving traceability from source to finished product, thereby strengthening compliance and addressing ethical sourcing concerns.

AI's primary influence centers on operational efficiency and predictive analytics within the manufacturing process. By deploying ML algorithms, producers can analyze multivariate data from reactors—temperature, pressure, catalyst concentration, and reaction time—to precisely optimize yields while minimizing energy consumption and by-product formation. This optimization is crucial for maintaining competitive pricing amidst fluctuating feedstock costs. Furthermore, AI-powered predictive quality control systems can analyze spectroscopic data during purification, ensuring the final IPP product meets stringent pharmaceutical-grade requirements consistently, minimizing batch failures and associated waste.

Beyond manufacturing, AI significantly impacts the R&D landscape by modeling the structure-activity relationship of emollients. This capability allows chemists to rapidly screen and design novel, structurally similar esters that might offer superior sensory profiles or lower environmental impact than traditional IPP. Supply chain risk management benefits immensely, as AI systems aggregate global climate, geopolitical, and agricultural data to forecast disruptions in palm oil supply, enabling proactive sourcing decisions and inventory hedging, thereby stabilizing the input costs for the entire downstream market.

- AI optimizes esterification reaction parameters for maximum yield and energy efficiency.

- Machine Learning predicts feedstock price volatility (e.g., palm oil) aiding proactive procurement strategies.

- AI enhances quality control through real-time spectroscopic analysis, ensuring high-purity, pharmaceutical-grade IPP.

- Predictive maintenance models reduce downtime in continuous processing plants, improving operational reliability.

- AI algorithms accelerate R&D for novel, bio-based emollient alternatives to Isopropyl Palmitate.

- Advanced analytics improve supply chain traceability and compliance with sustainable sourcing mandates (e.g., RSPO tracking).

DRO & Impact Forces Of Isopropyl Palmitate Market

The Isopropyl Palmitate market is driven primarily by the relentless expansion of the global personal care and cosmetic industry, which relies heavily on IPP for its superb sensory attributes and functional versatility as an emollient and solvent. Significant opportunities arise from the increasing demand for sustainable, certified bio-based IPP, particularly in environmentally conscious markets in Europe and North America, offering manufacturers a pathway for differentiation and premiumization. However, the market faces constraints mainly related to the dependence on palm oil derivatives, which introduces volatility in feedstock pricing and exposes the supply chain to complex ethical and environmental scrutiny regarding deforestation. Regulatory pressures regarding ingredient safety and sustainability further amplify the complexities of market operation, acting as a crucial impact force determining market entry and product acceptability.

Drivers are strongly influenced by consumer trends favoring moisturizing and anti-aging products, where IPP provides the necessary skin conditioning without leaving a heavy residue, making it a staple ingredient in high-volume production. The development of specialized IPP grades for sensitive or pharmaceutical applications also expands the addressable market. Restraints often manifest through tight regulatory standards, particularly concerning residual contaminants like residual solvents or specific impurities, which necessitate advanced, costly purification steps. Furthermore, the availability of synthetic or petroleum-derived alternatives, while facing consumer backlash, still presents a competitive challenge, especially in price-sensitive industrial applications.

The impact forces are predominantly shaped by globalization and sustainability mandates. Environmental pressures force the entire value chain—from palm plantation owners to chemical manufacturers—to adopt transparent and certified sustainable practices, driving up compliance costs but simultaneously opening opportunities for innovative green chemistry solutions. Technological advancements in enzymatic esterification offer a lower-energy, more sustainable production route, which is expected to become a key differentiator, influencing long-term market structure and competitive positioning. Ultimately, the market trajectory is determined by the balance between meeting high-volume cosmetic demand and navigating complex, often unpredictable, sustainability and sourcing challenges.

Segmentation Analysis

The Isopropyl Palmitate Market is comprehensively segmented based on its source material (Type), its intended use (Application), and the geographic consumption patterns (Region). The source segmentation differentiates between synthetic IPP, derived from petroleum-based isopropyl alcohol and chemically synthesized palmitic acid, and bio-based IPP, derived primarily from natural palmitic acid obtained from vegetable oils such as palm oil, coconut oil, or even emerging sources like algal oil. Application segmentation clearly delineates the primary end-user industries, with Personal Care and Cosmetics consuming the largest volume due to IPP's foundational role as an emollient and solvent in daily-use products. The remaining segments, Pharmaceutical and Industrial, require specialized, high-purity grades for drug delivery and industrial lubrication/solvent purposes, respectively.

The segmentation structure is vital for understanding market dynamics, as pricing and growth rates vary significantly between the segments. For instance, the bio-based IPP segment commands a premium due to sustainability certifications and is experiencing faster growth than the synthetic segment, reflecting corporate sourcing policies and consumer preferences. Furthermore, within the Cosmetics segment, sub-applications such as sun care and anti-aging creams are key growth drivers, relying heavily on IPP for optimal formulation stability and sensory characteristics. Analyzing these segments helps stakeholders tailor production, marketing, and distribution strategies to meet specific, localized market needs, ensuring optimal resource allocation and maximizing market penetration across diverse end-use domains.

- Type

- Synthetic Isopropyl Palmitate

- Bio-based Isopropyl Palmitate (Natural Source)

- Application

- Cosmetics and Personal Care

- Skin Care (Lotions, Moisturizers)

- Hair Care

- Sun Care

- Color Cosmetics (Makeup)

- Deodorants and Antiperspirants

- Pharmaceuticals (Topical Vehicles, Excipients)

- Industrial and Chemical Applications (Lubricants, Solvents)

- Cosmetics and Personal Care

- Region

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Isopropyl Palmitate Market

The value chain for Isopropyl Palmitate begins with the upstream sourcing of raw materials, primarily palmitic acid, which is typically derived from fractionated and hydrogenated palm oil or palm kernel oil, alongside the petrochemical derivative isopropyl alcohol. Sustainability considerations are paramount at this stage, with certified sourcing (e.g., RSPO certification) heavily influencing upstream supplier selection. The core manufacturing process involves the esterification of these two components, followed by purification and distillation steps to achieve the desired grade (cosmetic or pharmaceutical). Manufacturers leverage technology such as continuous processing or enzymatic synthesis to enhance efficiency and product purity, positioning them as key value enhancers in the midstream.

Moving downstream, the distribution channel plays a critical role in connecting specialized chemical manufacturers with diverse end-user industries. Distribution is predominantly indirect, utilizing large, regional chemical distributors who manage inventory, logistics, and regulatory documentation for thousands of small to large cosmetic and pharmaceutical formulators globally. Direct distribution is usually reserved for very large-volume transactions or highly specialized grades required by major multinational corporations with stringent supply chain requirements. Distributors also often provide technical support and smaller packaging sizes, catering effectively to the broad needs of the personal care industry, which relies on consistent supply and technical application guidance.

The final stage involves the incorporation of IPP into finished products by end-users. Cosmetic formulators integrate IPP as a primary emollient and solvent, significantly impacting the final product's texture and efficacy. The value addition here is through formulation expertise, combining IPP with other ingredients to create consumer-attractive products. The efficiency of the entire chain relies heavily on stable relationships between chemical manufacturers and feedstock suppliers, alongside the reliability of distributors to ensure timely delivery of high-purity materials, ultimately driving consumer product innovation and market acceptance.

Isopropyl Palmitate Market Potential Customers

The primary potential customers for Isopropyl Palmitate are concentrated within industries that require high-quality, versatile emollients and solvent carriers, predominantly the global Personal Care and Cosmetics manufacturing sectors. Large multinational corporations such as Estée Lauder, L'Oréal, and Procter & Gamble are major buyers, integrating IPP into their extensive product portfolios, including moisturizers, foundations, and sunscreens, valuing its non-greasy feel and efficient spreading properties. Small to medium-sized private label cosmetic manufacturers also represent a significant customer base, often purchasing through specialized chemical distributors who can provide smaller batch sizes and technical formulation support, catering to localized market demands and trends like organic or vegan beauty lines.

Another crucial customer segment is the Pharmaceutical industry, particularly companies specializing in topical dermatological formulations, transdermal patches, and veterinary medicines. These customers require ultra-high purity, certified grades of IPP that comply with Pharmacopeial standards (USP/EP). They utilize IPP as a vehicle to enhance the percutaneous absorption of active drug ingredients, making its solubility and skin permeability characteristics critical purchase criteria. Companies like Pfizer and Johnson & Johnson, involved in dermatology, are key targets for high-grade IPP suppliers, prioritizing quality consistency and comprehensive regulatory documentation over marginal cost savings.

Finally, the Specialty Chemical and Industrial sector represents a potential, albeit smaller, customer segment. These buyers utilize IPP as a high-performance, low-residue solvent in specialized industrial cleaning agents, specific lubricant formulations, and as an additive in certain plastics and textile processing aids. While volume consumption in this segment is generally lower than in personal care, the demand for highly specific performance attributes ensures a steady requirement for standard industrial grades of Isopropyl Palmitate.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.0 million |

| Market Forecast in 2033 | USD 667.5 million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, Stepan Company, KLK Oleo, P&G Chemicals, Emery Oleochemicals, Croda International, Acme-Hardesty Co., Kao Corporation, Mosselman, VVF Limited, Oleon NV, Phoenix Chemical, Inc., Dow Chemical, Fine Organics, Hallstar, Lubrizol Corporation, Lonza Group, Evonik Industries, Ecogreen Oleochemicals, Wilmar International |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Isopropyl Palmitate Market Key Technology Landscape

The technological landscape of the Isopropyl Palmitate market is undergoing a significant evolution driven primarily by sustainability requirements and the need for enhanced product purity. Traditional production involves high-temperature, acid-catalyzed esterification, which is energy-intensive and can lead to unwanted side products. Current technological focus is shifting toward cleaner and more efficient processes. A major advancement is the utilization of enzymatic esterification, employing highly selective lipases as catalysts. This method allows the reaction to proceed at lower temperatures and atmospheric pressure, significantly reducing energy consumption and minimizing the formation of dark colors or odors, resulting in a purer, more environmentally friendly product, often categorized under "green chemistry" principles.

In terms of purification, advanced distillation and fractionation technologies are crucial for meeting the stringent quality requirements of pharmaceutical-grade IPP. Techniques such as molecular distillation or advanced wiped-film evaporators ensure the effective removal of trace impurities, heavy metals, and residual alcohols or unreacted acids, which are critical for dermatological safety. Furthermore, continuous flow chemistry systems are being increasingly adopted over traditional batch reactors. Continuous processing offers better control over reaction kinetics, enhanced safety, and greater consistency in large-scale production, enabling manufacturers to handle high-volume demand while maintaining tight quality specifications for the global supply chain.

Innovation also extends to the sourcing of palmitic acid feedstock. While palm oil remains dominant, research is intensifying into alternative, non-food competing sources, such as microbial fermentation or oil derived from specific genetically modified yeast or algae. Although nascent, these bio-technology approaches promise a fully traceable, highly sustainable, and non-land-intensive supply chain for palmitic acid, offering a future-proof solution against ethical concerns associated with conventional palm derivatives. Overall, the technology landscape is characterized by a strong push for greener manufacturing, higher purity, and diversified, sustainable sourcing methods.

Regional Highlights

The Isopropyl Palmitate market exhibits distinct regional dynamics heavily influenced by manufacturing capability, regulatory frameworks, and consumer purchasing power in the cosmetics sector. Asia Pacific (APAC) dominates the global market, not only as the largest regional consumer but also as the primary manufacturing hub. This dominance is attributed to the presence of large-scale oleochemical producers in Southeast Asia (Malaysia, Indonesia), which have direct access to palm oil feedstock, coupled with massive, rapidly expanding consumer markets in China and India. The regional emphasis is on high-volume production for mass-market personal care items, driving price competitiveness and continuous expansion of production capacity.

Europe and North America represent mature, high-value markets, characterized by stringent regulatory environments (such as REACH in Europe and FDA oversight in the US) that necessitate high-purity IPP grades and detailed ingredient transparency. These regions focus heavily on premium and specialty cosmetic formulations, including organic and natural certifications, driving the demand for sustainably sourced, bio-based IPP. Innovation in these regions revolves around product differentiation, utilizing IPP in advanced anti-aging and sensitive skin products, thus commanding higher profit margins per volume compared to APAC.

Latin America and the Middle East & Africa (MEA) are emerging markets displaying significant growth potential. Latin America, particularly Brazil and Mexico, is witnessing strong demand fueled by an expanding middle class and localized cosmetic production. The MEA region, boosted by infrastructure investments and rising consumption in the Gulf Cooperation Council (GCC) countries, is increasingly relying on imported high-quality cosmetic ingredients, including IPP. While currently smaller in volume, these regions are critical for future market expansion, presenting opportunities for direct investment and localized distribution partnerships to circumvent complex logistical challenges.

- Asia Pacific (APAC): Largest market share; manufacturing hub for oleochemicals; highest growth driven by mass market cosmetics in China and India.

- Europe: High demand for sustainable, certified bio-based IPP; stringent regulatory requirements (REACH); focus on premium cosmetic and pharmaceutical grades.

- North America: Stable demand driven by advanced sun care and anti-aging product development; strong emphasis on pharmaceutical-grade excipients and formulation innovation.

- Latin America (LATAM): Emerging market with high growth potential, particularly in Brazil, driven by domestic cosmetic production and increasing disposable income.

- Middle East and Africa (MEA): Growth driven by rising consumer demand for imported personal care products, concentrated primarily in the GCC countries.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Isopropyl Palmitate Market.- BASF SE

- Stepan Company

- KLK Oleo

- P&G Chemicals

- Emery Oleochemicals

- Croda International

- Acme-Hardesty Co.

- Kao Corporation

- Mosselman

- VVF Limited

- Oleon NV

- Phoenix Chemical, Inc.

- Dow Chemical

- Fine Organics

- Hallstar

- Lubrizol Corporation

- Lonza Group

- Evonik Industries

- Ecogreen Oleochemicals

- Wilmar International

Frequently Asked Questions

Analyze common user questions about the Isopropyl Palmitate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Isopropyl Palmitate primarily used for in commercial products?

Isopropyl Palmitate (IPP) is primarily used in the Cosmetics and Personal Care industry as a highly effective emollient, moisturizer, and non-greasy solvent, crucial for improving the texture and spreadability of lotions, creams, and makeup formulations.

Is the Isopropyl Palmitate market facing supply chain challenges related to sustainability?

Yes, a major challenge is the sourcing of palmitic acid, often derived from palm oil. The market is increasingly pressurized by environmental and ethical concerns, leading to a strong shift toward certified sustainable (RSPO) bio-based IPP variants and the exploration of non-palm alternatives.

Which application segment holds the largest share in the IPP market?

The Cosmetics and Personal Care application segment holds the dominant market share, driven by high-volume usage in skin care products, sunscreens, and color cosmetics globally due to IPP's excellent skin conditioning properties.

What is the projected Compound Annual Growth Rate (CAGR) for the Isopropyl Palmitate Market?

The Isopropyl Palmitate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033, fueled by sustained demand from the personal care and pharmaceutical sectors.

How is technology impacting the production of Isopropyl Palmitate?

Technology is focused on improving sustainability and purity, primarily through the adoption of enzymatic esterification (a green chemistry method) and advanced continuous processing, resulting in lower energy consumption and higher quality, pharmaceutical-grade product output.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager