IT Asset Management (ITAM) Software Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432883 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

IT Asset Management (ITAM) Software Market Size

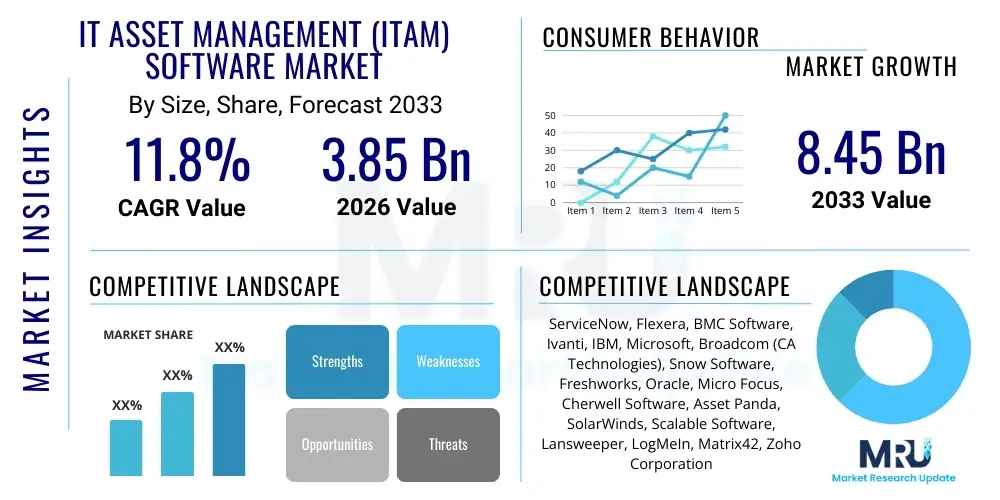

The IT Asset Management (ITAM) Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.8% between 2026 and 2033. The market is estimated at $3.85 Billion in 2026 and is projected to reach $8.45 Billion by the end of the forecast period in 2033.

IT Asset Management (ITAM) Software Market introduction

The IT Asset Management (ITAM) Software market encompasses the tools and processes required to manage the hardware and software assets of an organization throughout their lifecycle, from procurement to disposal. These solutions are critical for maintaining compliance, optimizing expenditure, and enhancing operational efficiency within complex enterprise IT environments. The functionality of modern ITAM platforms has expanded beyond mere inventory tracking to include sophisticated features like license optimization, cloud asset governance, contract management, and security vulnerability identification associated with specific assets. The increasing complexity introduced by hybrid IT infrastructure, the proliferation of SaaS applications, and the continuous necessity for regulatory adherence are fundamental drivers propelling the adoption of advanced ITAM solutions across diverse industrial sectors.

Product descriptions within the ITAM sphere typically highlight modular approaches, covering Software Asset Management (SAM), Hardware Asset Management (HAM), and increasingly, Cloud Asset Management (CAM). Major applications span financial management, risk mitigation, and strategic decision-making regarding technology investments. ITAM software provides real-time visibility into asset utilization, preventing wasteful spending on underutilized licenses and hardware. Benefits derived from robust ITAM implementation include significant cost savings through effective license harvesting, reduced risk of legal penalties associated with non-compliance (particularly for major software vendors like Microsoft or Oracle), and improved security posture by tracking end-of-life assets and unauthorized software installations. This integrated approach ensures that IT resources are aligned with business goals.

Key driving factors accelerating market growth include the global trend toward digital transformation, which necessitates stringent control over rapidly evolving IT portfolios. Furthermore, the shift towards subscription-based software models (SaaS) and the widespread migration to multi-cloud environments have created new complexities that traditional asset tracking methods cannot handle, thus demanding specialized, automated ITAM solutions. Economic pressures demanding operational efficiencies and the continuous stream of stringent data privacy regulations (such as GDPR and CCPA) further solidify the imperative for organizations to implement comprehensive, auditable ITAM strategies. The inherent capability of these tools to deliver demonstrable return on investment (ROI) through cost avoidance remains a core market stimulant.

IT Asset Management (ITAM) Software Market Executive Summary

The IT Asset Management (ITAM) Software market is experiencing dynamic growth, driven primarily by evolving business trends centered around hybrid cloud adoption and the increasing scrutiny of technology expenditures. Organizations, particularly large enterprises, are moving away from siloed asset tracking toward integrated ITAM platforms that combine hardware, software, and cloud license optimization capabilities. A significant business trend is the incorporation of ITAM functions into broader IT Service Management (ITSM) and Configuration Management Database (CMDB) ecosystems, promoting a unified operational view. Furthermore, the rise of specialized SaaS ITAM tools catering specifically to managing complex vendor license agreements (VLA) and optimizing cloud spending (FinOps convergence) represents a critical strategic shift among vendors.

Regionally, North America maintains market dominance, propelled by the early adoption of advanced IT solutions, the presence of major ITAM vendors, and strict corporate governance standards necessitating meticulous compliance reporting. However, the Asia Pacific (APAC) region is projected to exhibit the highest growth rate, fueled by rapid industrialization, massive investments in digital infrastructure, and the expansion of the SME sector which is increasingly adopting cloud-based ITAM solutions for scalability and affordability. European markets are characterized by stringent regulatory environments, particularly around data privacy and software compliance, maintaining steady demand for sophisticated, audit-ready ITAM solutions.

Segment trends highlight the dominance of the Cloud deployment model, showing accelerated growth compared to on-premise solutions, largely due to its flexibility, lower Total Cost of Ownership (TCO), and suitability for managing geographically distributed assets. In terms of component segments, Services (including consulting, integration, and managed ITAM services) are growing faster than the core software segment, reflecting the complexity of implementing and maintaining these systems, particularly in multi-vendor environments. Large enterprises currently hold the largest market share, but the Small and Medium-sized Enterprises (SMEs) segment is forecast to be the fastest-growing end-user category, driven by accessible SaaS models and the realization that even smaller entities face significant compliance risks if assets are not managed effectively.

AI Impact Analysis on IT Asset Management (ITAM) Software Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the IT Asset Management (ITAM) software market commonly revolve around the automation of complex compliance processes, predictive capacity for hardware failure and software demand, and the ability of AI to govern highly dynamic cloud environments. Key themes emerging from these questions include whether AI can replace manual auditing, how machine learning (ML) can optimize license usage in real-time across fluctuating user bases, and the security implications of using AI to analyze asset configuration data. Users express high expectations for AI to solve the perennial challenges of 'shadow IT' and accurately forecast IT needs, minimizing both overspending and resource shortages. The primary concern is often the integration complexity and the trustworthiness of AI-driven compliance recommendations.

AI is fundamentally transforming ITAM from a reactive tracking function into a proactive strategic component. AI and Machine Learning algorithms are being deployed to analyze vast datasets pertaining to asset utilization, maintenance logs, contract terms, and user behavior. This advanced analytical capability allows ITAM tools to automatically identify instances of license misuse, flag potential audit risks, and generate highly accurate consumption predictions. Furthermore, predictive maintenance capabilities, driven by ML models analyzing hardware telemetry, enable organizations to replace assets before critical failures occur, significantly reducing downtime and improving overall IT service continuity.

The integration of Natural Language Processing (NLP) is also improving the efficiency of contract management by automatically extracting key clauses, renewal dates, and usage restrictions from complex vendor agreements, streamlining the process of compliance verification. Ultimately, AI-driven automation minimizes the administrative burden on IT staff, allowing them to focus on strategic asset planning rather than manual reconciliation. This shift toward intelligent automation is paramount for managing hyperscale cloud environments where assets are ephemeral and consumption rates change moment-to-moment, requiring constant, automated optimization to control costs effectively.

- Automated License Optimization: AI algorithms continuously monitor application usage and reallocate licenses in real-time, preventing financial waste.

- Predictive Maintenance: Machine Learning models forecast hardware failures based on historical data and operational metrics, enabling proactive replacement planning.

- Anomaly Detection: AI identifies unusual usage patterns indicative of 'shadow IT,' unauthorized software, or potential security breaches tied to assets.

- Enhanced Cloud FinOps: Intelligent analysis of cloud consumption data automatically recommends cost-saving measures, rightsizing instances, and optimizing reserved instances.

- Contract and Compliance Processing: NLP extracts critical terms from vendor agreements, significantly accelerating compliance checks and audit readiness.

DRO & Impact Forces Of IT Asset Management (ITAM) Software Market

The IT Asset Management (ITAM) software market is fundamentally shaped by a robust interplay of Drivers (D) necessitating control over IT sprawl, Restraints (R) related to implementation complexity, and Opportunities (O) arising from technological advancements. Primary drivers include the continuous growth of digital transformation initiatives, stringent regulatory and compliance pressures requiring auditable IT records, and the pervasive shift towards complex multi-cloud and SaaS consumption models that defy traditional asset tracking methods. These market forces collectively compel enterprises to invest in comprehensive, automated ITAM solutions to mitigate financial risk and ensure operational stability. The immediate impact force is the necessity to reduce IT spend volatility, which ITAM effectively addresses by identifying underutilized resources.

However, the market faces significant restraints. A major impediment is the inherent complexity associated with integrating ITAM software across disparate enterprise systems, including CMDBs, procurement tools, and existing ITSM platforms. Furthermore, the lack of standardized metrics and definitions for software licensing across major vendors creates perpetual challenges in compliance management, requiring highly specialized expertise which can be costly. Organizational inertia and resistance to change, coupled with the initial high cost of large-scale ITAM deployment, particularly for on-premise solutions, also act as substantial dampeners on rapid adoption in some segments. These barriers necessitate vendors to focus on simplified, cloud-native deployments and enhanced professional services.

Conversely, significant opportunities exist, primarily driven by the convergence of ITAM with adjacent disciplines such as Cybersecurity Asset Management (CSAM) and Financial Operations (FinOps). The increasing enterprise focus on environmental, social, and governance (ESG) reporting also presents an opportunity, as ITAM tools can track the energy consumption and disposal lifecycle of IT assets. Moreover, the massive, untapped potential within the Small and Medium-sized Enterprise (SME) segment, facilitated by accessible SaaS platforms, promises future market expansion. The strategic incorporation of AI and ML into ITAM workflows to deliver proactive, predictive insights will serve as the most impactful long-term force, redefining the value proposition of ITAM from a cost center to a strategic enabler of business efficiency and regulatory resilience.

Segmentation Analysis

The IT Asset Management (ITAM) software market is segmented based on key structural elements including Component, Deployment Mode, Organization Size, and End-Use Industry, each reflecting distinct user needs and procurement patterns. This segmentation is crucial for understanding the varying degrees of sophistication and scalability required across different market verticals. The analysis shows a pronounced shift towards service-oriented offerings and cloud-based platforms, reflecting user preference for outsourced expertise and agile, OpEx-friendly solutions. Organizations are increasingly demanding comprehensive platforms that seamlessly integrate Hardware Asset Management (HAM) and Software Asset Management (SAM) functionalities, alongside emerging requirements for Cloud Asset Governance, driving growth in the unified software segment.

The division by deployment mode—Cloud vs. On-premise—is particularly telling, illustrating the industry’s acceleration towards cloud environments. While On-premise solutions still dominate highly regulated sectors or organizations with legacy infrastructure and strict data residency requirements, the Cloud segment is experiencing exponential growth due to the flexibility, automatic updates, and reduced infrastructure overhead it offers. This shift is democratizing advanced ITAM capabilities, making them accessible to SMEs that historically could not afford comprehensive, in-house solutions. Simultaneously, the organization size segmentation confirms that Large Enterprises remain the primary revenue generator due to the sheer volume and complexity of their asset portfolios, yet the future trajectory is heavily influenced by SME adoption.

Segmentation by End-Use Industry demonstrates heterogeneous demand influenced by regulatory burdens and the sheer scale of IT dependency. Sectors like Banking, Financial Services, and Insurance (BFSI), alongside IT and Telecommunications, exhibit the highest need for advanced SAM capabilities due to strict financial regulations and complex, high-value software licensing agreements. Conversely, industries like manufacturing and healthcare increasingly prioritize HAM and IoT asset tracking as their operational technologies become interconnected. Analyzing these segments provides vendors with strategic insights to tailor solutions that address specific industry compliance needs and operational challenges, optimizing their market penetration strategy across different vertical markets.

- By Component:

- Software/Platform

- Services (Professional Services, Managed Services)

- By Deployment Mode:

- On-premise

- Cloud (SaaS)

- By Organization Size:

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

- By End-Use Industry:

- Banking, Financial Services, and Insurance (BFSI)

- IT & Telecom

- Healthcare

- Retail and Consumer Goods

- Government and Public Sector

- Manufacturing

- Other Industries (Education, Media)

Value Chain Analysis For IT Asset Management (ITAM) Software Market

The value chain of the IT Asset Management (ITAM) software market starts with upstream activities involving core intellectual property (IP) development, specialized data integration frameworks, and the continuous enhancement of discovery and inventory technologies. Upstream players, primarily software developers and technology providers, focus heavily on R&D to incorporate cutting-edge capabilities such as AI-driven reconciliation, complex license entitlement modeling, and integrations for new cloud platforms (AWS, Azure, GCP). The efficiency and accuracy of asset discovery mechanisms—the ability to identify and map all connected hardware and software across diverse networks—are paramount at this stage, setting the foundation for the entire ITAM process. Strategic alliances with hardware manufacturers and major software vendors are crucial upstream activities to ensure compatibility and access to necessary API data.

Moving downstream, the value chain encompasses implementation, integration, and ongoing service delivery. This stage is dominated by system integrators, managed service providers (MSPs), and professional services arms of the ITAM vendors themselves. Downstream activities involve customizing the ITAM platform to fit the client’s unique organizational structure, integrating it with existing ITSM systems and financial management tools, and providing training and ongoing maintenance. Given the highly specialized nature of license compliance and optimization, the consulting services component within the downstream segment captures significant value by offering expertise that translates raw asset data into actionable financial and compliance intelligence.

Distribution channels for ITAM software are predominantly mixed, utilizing both direct sales and an extensive indirect partner ecosystem. Direct channels are typically reserved for large enterprise contracts requiring bespoke implementations and high-touch consultative sales. Indirect channels, which include VARs (Value-Added Resellers), system integrators, and strategic alliances with cloud providers, are increasingly important, especially for reaching the SME market and expanding geographical presence. Cloud-based ITAM solutions often leverage marketplaces (like AWS Marketplace) as effective distribution points, reducing the friction associated with procurement. This dual distribution strategy ensures broad market reach while maintaining quality control for complex, customized deployments, effectively balancing scale and specialization within the market.

IT Asset Management (ITAM) Software Market Potential Customers

Potential customers for IT Asset Management (ITAM) software span virtually every industry sector that relies on significant information technology infrastructure, but the key buyers are large enterprises and regulated entities facing substantial compliance and cost pressures. End-users, or buyers, of ITAM solutions are typically C-level executives (CFOs, CIOs), IT procurement managers, compliance officers, and heads of infrastructure and operations. These buyers seek solutions that provide verifiable ROI through cost avoidance (license optimization), minimized risk (compliance auditing), and enhanced operational efficiency (accurate inventory data feeding into ITSM). The urgency for adoption is highest in organizations undergoing rapid digital transformation or those anticipating audits from major software publishers.

Specifically, the Banking, Financial Services, and Insurance (BFSI) sector represents a critical customer base due to its stringent regulatory landscape (e.g., Basel III, internal audit mandates) and massive expenditure on high-value, complex software licenses, making SAM a core priority. Similarly, the IT and Telecommunications sector, characterized by dynamic scaling and frequent hardware refresh cycles, requires robust HAM and sophisticated cloud asset management capabilities to manage vast and fluctuating IT estates effectively. These sectors are prepared to invest heavily in top-tier ITAM platforms that offer guaranteed audit defense capabilities and integrate seamlessly with specialized financial systems.

Furthermore, government and public sector organizations are rapidly emerging as significant buyers, driven by public accountability standards, the necessity for transparent expenditure management, and large-scale modernization initiatives. While SMEs constitute a large volume of potential buyers, their purchasing decisions are often weighted towards simplified, affordable SaaS offerings with minimal implementation overhead. The healthcare industry is another growing market, primarily driven by the need to manage interconnected medical devices (IoT assets) and comply with patient data privacy regulations (e.g., HIPAA), necessitating integrated ITAM solutions that track assets relevant to security and operational uptime.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $3.85 Billion |

| Market Forecast in 2033 | $8.45 Billion |

| Growth Rate | 11.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ServiceNow, Flexera, BMC Software, Ivanti, IBM, Microsoft, Broadcom (CA Technologies), Snow Software, Freshworks, Oracle, Micro Focus, Cherwell Software, Asset Panda, SolarWinds, Scalable Software, Lansweeper, LogMeIn, Matrix42, Zoho Corporation, EZ Cloud |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

IT Asset Management (ITAM) Software Market Key Technology Landscape

The IT Asset Management (ITAM) software market is characterized by a rapid evolution of enabling technologies, focusing heavily on automation, real-time data integration, and predictive analytics. Core to the modern ITAM landscape is the reliance on robust Discovery and Inventory Tools, which utilize agent-based and agentless technologies to accurately map assets across complex enterprise networks, including both physical endpoints and virtualized resources. These tools employ network scanning techniques, often leveraging protocols like SNMP and WMI, to gather granular configuration details, ensuring the accuracy of the Configuration Management Database (CMDB) which serves as the central authoritative source for IT assets. The quality of this foundational data is essential for subsequent compliance and optimization processes, necessitating technologies capable of handling massive, heterogeneous data streams in real time.

A second major technological development involves advanced Software License Optimization (SLO) engines. These engines incorporate complex algorithms to interpret thousands of unique vendor licensing models (e.g., CPU core counts, virtual machine capacity, user access types) and automatically reconcile actual usage data against purchased entitlements. SLO technology often utilizes built-in Product Use Rights (PUR) libraries specific to vendors like SAP, Oracle, and IBM, enabling automated calculation of true license positions and identifying areas of non-compliance or over-licensing. Furthermore, the increasing prominence of Cloud Asset Governance tools leverages API-based integration with major hyperscalers (AWS, Azure, Google Cloud) to monitor consumption of ephemeral resources, enabling FinOps principles through automated monitoring and cost optimization recommendations.

The future technology landscape is heavily invested in Artificial Intelligence (AI) and Machine Learning (ML). These capabilities are being applied to automate the reconciliation process, which traditionally requires significant manual effort, and to predict hardware failures or future software demand based on trend analysis. Integration standards, specifically the deepening alignment with IT Service Management (ITSM) platforms and Enterprise Resource Planning (ERP) systems via web services and modern APIs, ensure ITAM data is utilized across the broader operational and financial ecosystem. The adoption of blockchain technology is also being explored by vendors to create immutable, secure records of asset ownership and transfer history, enhancing audit trails and data integrity, particularly for high-value physical assets.

Regional Highlights

- North America: This region holds the largest market share, driven by a high concentration of sophisticated IT organizations, early adoption of emerging technologies like cloud computing and AI, and strict corporate governance standards (e.g., Sarbanes-Oxley Act) that mandate detailed IT asset tracking. The presence of major ITAM vendors and a highly competitive software market further solidifies its leading position. Demand here focuses heavily on managing complex vendor audits and optimizing substantial cloud expenditures (FinOps).

- Europe: Europe represents a mature market characterized by robust regulatory requirements, notably the General Data Protection Regulation (GDPR), which necessitates precise tracking of where data resides, often tied to specific IT assets. Countries such as the UK, Germany, and France are significant contributors, with a strong emphasis on Software Asset Management (SAM) due to frequent and challenging software vendor audits. The growing focus on sustainability and ESG reporting is also driving demand for advanced ITAM capabilities related to asset lifecycle and disposal management.

- Asia Pacific (APAC): APAC is forecast to be the fastest-growing region, fueled by rapid digital transformation across developing economies like India and Southeast Asia, and massive enterprise investment in cloud infrastructure in countries like China and Australia. The market growth is particularly pronounced in the SME segment adopting affordable, cloud-based ITAM solutions. Increasing global manufacturing activity also necessitates improved Hardware Asset Management (HAM) and tracking of Operational Technology (OT) assets.

- Latin America (LATAM): This region is exhibiting steady growth, primarily driven by economic stabilization and increasing foreign investment, leading to modernization of IT infrastructure in key sectors like BFSI and Telecommunications. Adoption is often localized, with preference for integrated solutions that offer flexibility in licensing and robust professional services support to navigate diverse local compliance environments.

- Middle East and Africa (MEA): Growth in MEA is largely concentrated in the GCC states (UAE, Saudi Arabia) due to large-scale government-backed digital initiatives and infrastructure projects. Investments in smart city projects and cybersecurity capabilities are fueling demand for ITAM solutions integrated with security features. The market here is scaling up from rudimentary tracking toward comprehensive, cloud-enabled asset governance frameworks.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the IT Asset Management (ITAM) Software Market.- ServiceNow

- Flexera

- BMC Software

- Ivanti

- IBM

- Microsoft

- Broadcom (CA Technologies)

- Snow Software

- Freshworks

- Oracle

- Micro Focus

- Cherwell Software (Acquired by Ivanti)

- Asset Panda

- SolarWinds

- Scalable Software

- Lansweeper

- LogMeIn

- Matrix42

- Zoho Corporation

- EZ Cloud

Frequently Asked Questions

Analyze common user questions about the IT Asset Management (ITAM) Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the ITAM Software Market?

The IT Asset Management (ITAM) Software Market is projected to experience substantial growth, with a Compound Annual Growth Rate (CAGR) estimated at 11.8% between the forecast years of 2026 and 2033, driven by increasing cloud complexity and compliance demands.

Which segment is currently driving the highest demand in the ITAM software market?

The Services component segment, including professional consultation and managed ITAM services, is experiencing rapid demand growth, as organizations require specialized expertise to implement, integrate, and maintain compliance across complex multi-cloud and multi-vendor licensing environments.

How is cloud computing influencing the deployment models in the ITAM market?

Cloud (SaaS) deployment is the fastest-growing model, offering superior agility, lower TCO, and ease of scalability compared to traditional on-premise solutions. This shift is crucial for managing the dynamic and ephemeral nature of assets in hybrid and multi-cloud environments, enabling real-time FinOps optimization.

What role does AI play in modern IT Asset Management solutions?

AI and Machine Learning are utilized to automate complex compliance tasks, provide predictive insights for hardware maintenance and license demand forecasting, and enhance security by identifying anomalous asset usage patterns, transforming ITAM into a proactive, strategic function.

Which industry is the primary end-user segment for high-end ITAM software?

The Banking, Financial Services, and Insurance (BFSI) and the IT & Telecom sectors are the primary end-users for sophisticated ITAM solutions, due to their vast, complex software portfolios, high regulatory scrutiny, and critical need for rigorous license compliance and audit defense capabilities.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager