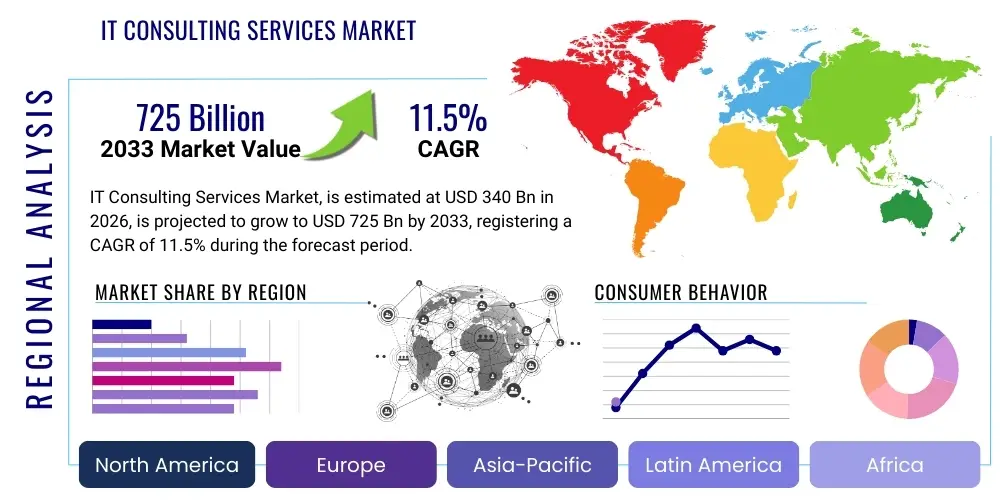

IT Consulting Services Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434893 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

IT Consulting Services Market Size

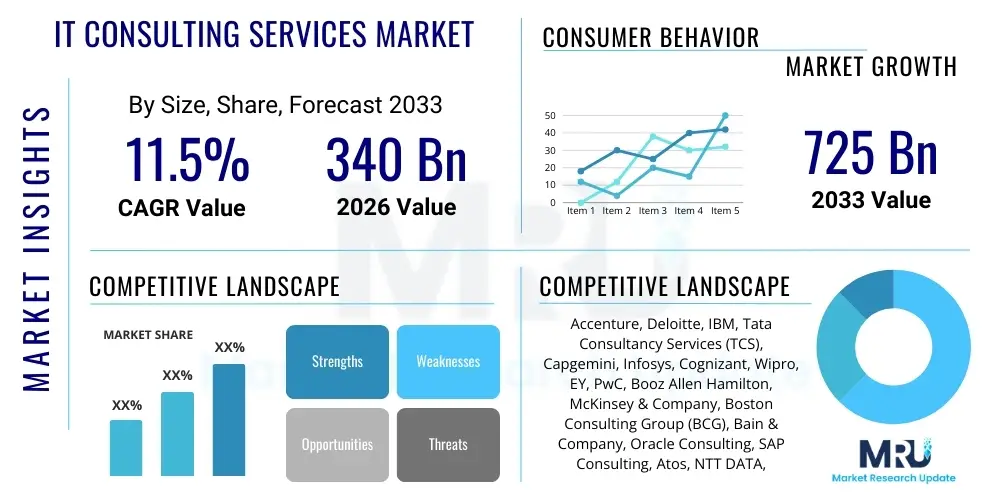

The IT Consulting Services Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at $340 Billion in 2026 and is projected to reach $725 Billion by the end of the forecast period in 2033. This significant expansion is primarily fueled by the global acceleration of digital transformation initiatives across virtually all industrial verticals, coupled with the increasing complexity of enterprise technology stacks requiring specialized external expertise. Organizations are heavily investing in cloud migration, cybersecurity resilience, and advanced data analytics, necessitating strategic guidance from specialized IT consultants to navigate these transitions effectively and ensure optimized operational outcomes.

IT Consulting Services Market introduction

The IT Consulting Services Market encompasses advisory and implementation services designed to help organizations leverage technology to achieve strategic business objectives, solve complex operational challenges, and improve overall performance efficiency. These services span strategy formulation, architecture planning, digital transformation roadmaps, system integration, software development lifecycle management, and infrastructure optimization. The core product offering is expert intellectual capital delivered through dedicated project teams, focusing on translating business needs into technical solutions. Major applications include modernizing legacy systems, implementing sophisticated Enterprise Resource Planning (ERP) solutions, optimizing cloud spending (FinOps), and establishing robust data governance frameworks necessary for regulatory compliance and competitive advantage.

Key benefits derived from engaging IT consulting services include accelerated innovation timelines, reduction in operational expenditure through process reengineering, enhanced cybersecurity posture, and specialized access to scarce technical skills (such as AI engineering and quantum computing readiness) that might not be cost-effective to maintain internally. Furthermore, consultants provide an objective third-party perspective, helping management overcome internal biases and identify critical bottlenecks in existing IT infrastructure or business processes. This objective analysis is crucial for large-scale change management, ensuring successful adoption of new technologies and methodologies like Agile and DevOps across the enterprise structure.

Driving factors sustaining the market’s robust growth include the pervasive need for hyper-personalization in customer experiences, mandatory compliance with evolving global data protection regulations (like GDPR and CCPA), and the persistent pressure on businesses to reduce time-to-market for new products and services. The complexity associated with multi-cloud environments, coupled with the necessity for scalable, resilient, and secure infrastructure, inherently drives organizations—particularly large enterprises and government entities—to seek expert advisory services. The shift towards outcome-based consulting models, where consultants are incentivized based on measurable business results rather than just hours billed, further accelerates market adoption by aligning vendor interests with client success.

IT Consulting Services Market Executive Summary

The IT Consulting Services Market Executive Summary highlights a pronounced shift towards advisory services focused on holistic digital transformation rather than purely technical implementations. Business trends indicate a consolidation within the market, driven by large players acquiring specialized boutique firms to enhance capabilities in niche areas like Generative AI, vertical-specific cloud solutions (e.g., FedRAMP compliant cloud for government), and environmental, social, and governance (ESG) technology reporting. Enterprise spending is prioritizing consulting engagement that promises measurable returns on investment (ROI) within short cycles, favoring agile methodologies and platform engineering expertise. Furthermore, the rise of "as-a-service" consumption models is forcing consulting firms to integrate managed services into their offerings, creating continuous engagement models rather than purely project-based ones.

Regionally, North America continues its dominance due to high technological maturity, significant spending on advanced infrastructure, and a robust financial services sector heavily investing in modernization and regulatory technology (RegTech). However, the Asia Pacific (APAC) region is demonstrating the highest growth trajectory, primarily fueled by rapid urbanization, massive government digitization initiatives (especially in countries like India and China), and the explosive growth of the SME sector adopting cloud-based business solutions for the first time. European growth is steady, driven largely by mandatory cybersecurity and data privacy compliance requirements, pushing organizations to seek specialized compliance consulting and resilience planning services to meet stringent EU directives.

Segment trends reveal that the Digital Transformation consulting service line is overwhelmingly the largest and fastest-growing segment, encompassing strategic advice on customer experience, workflow automation, and data monetization. Within organizational size, Large Enterprises remain the primary revenue generators due to the scale and complexity of their infrastructure and operations, necessitating long-term strategic partnerships. However, Small and Medium Enterprises (SMEs) are increasingly adopting IT consulting services, facilitated by modular, scalable cloud solutions and subscription-based consulting models offered by mid-tier and niche players, primarily seeking efficiency gains through integrated SaaS and PaaS solutions.

AI Impact Analysis on IT Consulting Services Market

User queries regarding AI's impact on IT Consulting typically revolve around themes of automation leading to job displacement among junior consultants, the necessity for new specialized AI governance and ethical AI consulting practices, and how firms are restructuring their core offerings to incorporate Generative AI (GenAI) into client solutions. Key concerns center on the speed at which AI tools can automate routine analysis and reporting tasks, thereby shifting the value proposition of consulting from data gathering to high-level strategic insight and implementation of complex AI systems. Users also frequently inquire about the role of consultants in mitigating AI bias, ensuring regulatory compliance for proprietary AI models, and optimizing the massive computational infrastructure required for advanced large language models (LLMs). The market is responding by rapidly upskilling existing personnel, acquiring AI-centric startups, and repositioning themselves as implementation partners for bespoke AI transformation rather than just advisory bodies.

- AI automates routine data processing and analysis tasks, shifting consultant focus to strategic problem-solving and domain-specific expertise.

- Generative AI tools accelerate content creation, code generation, and documentation, significantly reducing implementation timelines in software projects.

- New high-value consulting segments emerge focusing on AI strategy, governance, ethical deployment, and regulatory compliance (e.g., AI Act readiness).

- Increased demand for prompt engineering and specialized MLOps consulting services to manage the lifecycle of complex machine learning models.

- AI tools enhance market intelligence gathering, providing consultants with deeper, faster insights into competitive landscapes and industry trends.

- Consulting firms are restructuring delivery models, embedding AI into internal operations (e.g., internal knowledge management) to boost internal efficiency.

- Impact on pricing models, potentially moving towards value-based or outcome-based pricing linked to AI-driven productivity gains for clients.

- Requirement for consultants specializing in cloud infrastructure optimization and specialized hardware (GPUs, TPUs) required for training and deploying LLMs.

DRO & Impact Forces Of IT Consulting Services Market

The IT Consulting Services Market is significantly shaped by a powerful interplay of Drivers, Restraints, and Opportunities, leading to notable Impact Forces. Key drivers include the relentless technological obsolescence forcing continuous enterprise renewal, the pervasive digital transformation agenda necessitating strategic guidance, and the chronic global shortage of highly specialized IT talent (especially in areas like cybersecurity, cloud architecture, and data science). These drivers create an essential dependency on external consulting expertise to maintain competitive agility. Simultaneously, the opportunities for market expansion are vast, driven by emerging technologies such as Quantum Computing readiness assessments, the industrial Metaverse, and the need for advanced supply chain digitalization leveraging IoT and blockchain technologies. These advanced areas present entirely new revenue streams for consulting firms capable of providing early-stage advisory and implementation services, further strengthening market buoyancy.

However, the market faces several restraining factors that temper growth. High consulting fees and the perception of inconsistent return on investment (ROI) remain significant barriers, particularly for budget-sensitive SMEs who prefer standardized SaaS solutions over bespoke consulting engagements. Furthermore, the inherent risk associated with data security and confidentiality when entrusting sensitive corporate information to external consultants poses a major restraint. Companies are increasingly demanding stricter non-disclosure agreements and comprehensive liability coverage, complicating contract negotiations. Another structural restraint is the intense competition and market saturation in foundational consulting areas (like SAP or Oracle implementation), leading to margin compression and difficulty for smaller players to differentiate themselves based solely on technical capability.

The cumulative effect of these factors translates into significant impact forces. The competitive impact force is high, pushing firms towards specialization and vertical expertise (e.g., dedicated FinTech consulting). The technological impact force is extreme, mandating continuous innovation and rapid capability acquisition by consulting firms to stay ahead of client needs (e.g., training staff on new hyperscaler features immediately upon release). The regulatory impact force is also strong, particularly in sectors like healthcare and finance, where consultants must demonstrate deep knowledge of specific jurisdictional compliance requirements, transforming regulatory adherence into a high-value consulting service line and driving demand for specialized risk advisory services, thereby fueling growth in the GRC (Governance, Risk, and Compliance) segment.

Segmentation Analysis

The IT Consulting Services Market is critically segmented across several dimensions, including Service Type, Organization Size, and Industry Vertical, allowing firms to tailor highly specific value propositions to distinct client needs. The segmentation by Service Type is the most indicative of market maturity, differentiating between upstream strategy consulting (e.g., long-term vision and market entry advice) and downstream implementation consulting (e.g., system integration and outsourcing management). As businesses increasingly seek full-lifecycle partnerships, many firms are merging these segments into cohesive, end-to-end transformation packages, often utilizing proprietary methodologies and digital platforms to deliver services efficiently.

Furthermore, segmentation by Industry Vertical is key, reflecting the necessity for deep domain expertise, such as understanding clinical workflows in Healthcare or complex trading algorithms in the BFSI sector. Regulatory nuances and sector-specific digital priorities mandate this vertical specialization. The market exhibits different growth profiles across these segments; for instance, Manufacturing is currently driving demand for Industrial IoT and operational technology consulting, while Retail focuses heavily on optimizing omnichannel customer experiences and supply chain visibility through data analytics consulting services.

- Service Type

- Strategy Consulting (IT strategy, Enterprise Architecture planning)

- IT Implementation Consulting (System Integration, Software Development)

- Digital Transformation Consulting (Cloud Migration, Data Analytics, Customer Experience)

- Security and Privacy Consulting (GRC, Managed Security Services Advisory)

- Operational Consulting (Infrastructure Optimization, DevOps)

- Organization Size

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

- Industry Vertical

- Banking, Financial Services, and Insurance (BFSI)

- Healthcare and Life Sciences

- Telecommunications and IT

- Retail and E-commerce

- Manufacturing and Automotive

- Government and Public Sector

- Energy and Utilities

Value Chain Analysis For IT Consulting Services Market

The value chain for the IT Consulting Services Market is highly integrated and dynamic, commencing with Upstream Analysis centered on core capabilities and resource acquisition. This phase involves talent recruitment and training (securing experts in niche areas like quantum computing or specific regulatory frameworks), strategic partnerships with technology vendors (e.g., establishing Premier Partner status with major cloud providers like AWS, Azure, and GCP), and continuous investment in proprietary intellectual property (IP), such as industry benchmarks, implementation accelerators, and AI-driven predictive tools. The quality and availability of skilled personnel and proprietary tools directly dictate the premium pricing power and differentiation capability of the consulting firm in the market.

The middle stage involves Service Delivery and Project Execution, where the consulting firm transforms acquired knowledge and technology into client value. This stage includes initial scoping, solution architecture, agile development or system integration, change management, and quality assurance. The efficiency of the delivery model is crucial, with many large firms now relying on global delivery networks (GDCs) in lower-cost regions to maintain cost competitiveness while utilizing sophisticated project management platforms to ensure standardized service levels. Performance metrics, client feedback mechanisms, and adherence to project timelines are critical differentiators at this stage, establishing trust and facilitating follow-on business.

The Downstream Analysis focuses on distribution channels and client engagement models. The majority of consulting services are distributed via a Direct Model, relying heavily on existing client relationships, reputation, and direct sales teams supported by robust thought leadership content (white papers, webinars) crucial for lead generation. However, an Indirect Model is growing, where consulting firms partner with software vendors, system integrators, or value-added resellers (VARs). For instance, a consultant specializing in data governance might be referred to a client by a security software vendor as part of a joint solution offering. Post-engagement activities, including ongoing maintenance advisory, continuous improvement reviews, and cross-selling managed services, are vital for securing long-term annuity revenue and maximizing customer lifetime value in the highly competitive professional services sector.

IT Consulting Services Market Potential Customers

The potential customer base for the IT Consulting Services Market is exceptionally broad, spanning every industry vertical and government agency globally, though the primary End-Users/Buyers can be categorized based on their urgency, complexity of needs, and spending power. Large multinational corporations (MNCs) constitute the core customer segment, typically requiring complex, multi-year transformation projects across various geographies, often related to legacy system decommissioning, global ERP rollouts, or enterprise-wide cloud adoption. Their purchasing decisions are driven by strategic mandates, regulatory compliance deadlines, and the need for significant capital expenditure planning, often involving centralized procurement departments and multiple internal stakeholders, making the sales cycle lengthy but highly valuable.

The mid-market segment (SMEs generating between $50 million and $1 billion in annual revenue) represents a high-growth customer base. These buyers are often characterized by limited internal IT resources and a high need for speed in digital adoption to compete effectively with larger, more established players. They primarily seek consulting services focused on rapid implementation of scalable, cloud-native solutions, cybersecurity protection for growing operations, and advisory on leveraging basic data analytics to optimize customer acquisition. This segment favors simplified, packaged service offerings and measurable, quick-win results, often preferring regional or specialized niche consultants over the global Tier 1 firms.

Government and Public Sector entities represent a third critical segment. Their purchasing is driven by mandates for transparency, efficiency in public service delivery, and stringent budgetary controls. Consulting requirements here often focus on large-scale infrastructure projects, such as smart city initiatives, national digital ID programs, and modernization of defense and welfare systems. The complexity of procurement rules, lengthy vetting processes, and necessary security clearances distinguish these buyers, leading to a demand for consultants with specialized expertise in public sector compliance and complex stakeholder management, underscoring the necessity of vertical specialization within the consulting service provider landscape.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $340 Billion |

| Market Forecast in 2033 | $725 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Accenture, Deloitte, IBM, Tata Consultancy Services (TCS), Capgemini, Infosys, Cognizant, Wipro, EY, PwC, Booz Allen Hamilton, McKinsey & Company, Boston Consulting Group (BCG), Bain & Company, Oracle Consulting, SAP Consulting, Atos, NTT DATA, DXC Technology, Genpact |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

IT Consulting Services Market Key Technology Landscape

The technological landscape underpinning the IT Consulting Services Market is rapidly evolving, driven primarily by the maturation of cloud computing and the disruptive emergence of artificial intelligence. Consultants are primarily engaged in advising on and implementing advanced multi-cloud strategies, which involve complex hybrid architectures integrating public, private, and edge computing environments. This demands deep expertise in cloud governance, cost management (FinOps), and the utilization of containerization technologies like Kubernetes for scalable and portable application deployment. Furthermore, the pervasive threat landscape necessitates specialized consultation in next-generation cybersecurity solutions, including Zero Trust architecture implementation, threat intelligence platforms, and advanced security orchestration, automation, and response (SOAR) systems, ensuring enterprise resilience against sophisticated cyber threats.

Beyond core infrastructure technologies, the landscape is defined by the tools and platforms enabling rapid digital transformation and efficiency. Key technology areas include advanced Data & Analytics platforms, incorporating lakehouse architectures and real-time streaming processing capabilities, which form the foundation for client data monetization strategies. Furthermore, the adoption of DevOps and DevSecOps methodologies requires consultants to implement continuous integration/continuous delivery (CI/CD) pipelines, automated testing frameworks, and platform engineering practices, fundamentally changing how software is built and maintained. This focus on operational efficiency and speed is a central theme in modern consulting engagement, requiring deep familiarity with agile enterprise tooling.

Crucially, the consulting market is being redefined by AI and Machine Learning (ML). This involves not only advisory services on selecting appropriate ML models and platforms but also highly specialized implementation consulting for Large Language Models (LLMs), including fine-tuning proprietary models for industry-specific use cases (e.g., legal or medical research). Consultants are also focused on implementing enabling technologies such as robotic process automation (RPA) and intelligent automation (IA) to drive efficiency gains in back-office functions like finance and human resources. The successful deployment of these technologies requires integration with existing legacy systems, making system integration skills coupled with cutting-edge technology knowledge the highest value commodity in the contemporary IT consulting services landscape.

Regional Highlights

Geographically, the IT Consulting Services Market demonstrates distinct maturity levels and growth drivers across major regions. North America, encompassing the United States and Canada, remains the largest revenue generator globally, characterized by high spending power, early adoption of disruptive technologies (AI, Quantum), and significant regulatory complexity in sectors like finance and healthcare. The demand here is heavily skewed towards high-value strategic advisory services, cybersecurity resilience planning, and cloud-native application development, driven by large technology corporations and a robust venture capital ecosystem funding innovation, necessitating constant external expertise for scaling operations.

The Asia Pacific (APAC) region is projected to register the fastest growth rate, fueled by aggressive government investments in digitization, particularly in emerging economies like India and Southeast Asia, aimed at modernizing public services and developing digital infrastructure. Furthermore, the rapid growth of the consumer electronics, manufacturing, and BFSI sectors across China, Japan, and Australia creates immense demand for consulting services focused on operational efficiency, supply chain digitalization (Industry 4.0), and leveraging massive datasets for competitive advantage. Consulting firms in APAC are actively focusing on localized solutions and scaling implementation capacity to meet the diverse needs of this massive, heterogeneous market.

Europe represents a mature yet highly regulated market, where demand is consistently driven by legislative compliance, such as GDPR, the forthcoming AI Act, and various environmental reporting mandates. Western Europe (UK, Germany, France) prioritizes consulting related to core system modernization, sustainable IT practices, and establishing secure cross-border data transfer mechanisms. Eastern Europe, conversely, is emerging as a critical delivery hub and is witnessing growth in consulting for nearshore delivery model setup and scaling specialized technological capabilities, particularly in areas like embedded systems and high-performance computing necessary for the region's strong automotive and industrial sectors. The Middle East and Africa (MEA) region shows significant potential, driven by national diversification visions (e.g., Saudi Vision 2030), leading to mega-project investments in smart cities, renewable energy, and financial services digitalization, creating bespoke, large-scale consulting opportunities.

- North America: Dominates the market, driven by high spending on sophisticated AI implementation, cybersecurity, and financial technology modernization.

- Asia Pacific (APAC): Fastest-growing region, powered by rapid government digitalization, high mobile adoption rates, and robust manufacturing and banking sector spending on Industry 4.0.

- Europe: Stable growth anchored by regulatory compliance requirements (GDPR, AI Act) and large-scale enterprise resource planning (ERP) modernization projects in manufacturing and retail.

- Latin America (LATAM): Emerging market focused on cloud adoption, basic business process outsourcing optimization, and digital payment infrastructure development, showing high potential in Brazil and Mexico.

- Middle East and Africa (MEA): Growth driven by significant investments in smart city infrastructure and national economic diversification strategies requiring comprehensive technological roadmaps and specialized consultancy.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the IT Consulting Services Market.- Accenture

- Deloitte

- IBM

- Tata Consultancy Services (TCS)

- Capgemini

- Infosys

- Cognizant

- Wipro

- EY

- PwC

- Booz Allen Hamilton

- McKinsey & Company

- Boston Consulting Group (BCG)

- Bain & Company

- Oracle Consulting

- SAP Consulting

- Atos

- NTT DATA

- DXC Technology

- Genpact

Frequently Asked Questions

Analyze common user questions about the IT Consulting Services market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth trajectory of the IT Consulting Services Market?

The primary driver is the necessity for comprehensive Digital Transformation, particularly the accelerated migration to multi-cloud environments, coupled with the urgent need for enhanced enterprise cybersecurity resilience against increasingly sophisticated global threats. The scarcity of in-house expertise in areas like Generative AI and Quantum Computing readiness further necessitates external advisory services.

How is Generative AI expected to change the pricing models for IT consulting services?

Generative AI will shift pricing models away from time-and-materials (T&M) towards outcome-based or value-based pricing. As AI automates routine tasks (code generation, documentation), consulting firms must monetize the strategic insights and measurable productivity gains delivered to the client, tying fees directly to business results rather than hours spent on implementation.

Which industry vertical is projected to generate the highest demand for specialized IT consulting over the forecast period?

The Banking, Financial Services, and Insurance (BFSI) sector is projected to maintain high demand, driven by complex regulatory requirements (Basel IV, CECL), the need for fraud detection using advanced analytics, and mandatory legacy core system modernization to compete with nimble FinTech companies and maintain operational continuity.

What major challenges or restraints are currently impacting the adoption of IT consulting services by SMEs?

SMEs face challenges primarily related to the perception of high upfront costs and difficulty in measuring tangible return on investment (ROI) from strategic consulting engagements. They often prefer standardized, lower-cost SaaS solutions over bespoke consulting, although demand is increasing for modular, cloud-focused advisory packages tailored to smaller budgets.

What key technological skills are IT consulting firms currently prioritizing for talent acquisition and internal upskilling?

Firms are heavily prioritizing skills in Cloud Native Architecture (Kubernetes, Serverless), Advanced Data Engineering (Data Lakehouse implementation), MLOps/GenAI prompt engineering, and specialized industry-specific cybersecurity protocols (e.g., medical device security consulting or specific regional compliance expertise).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager