IT Cooling Systems Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439278 | Date : Jan, 2026 | Pages : 253 | Region : Global | Publisher : MRU

IT Cooling Systems Market Size

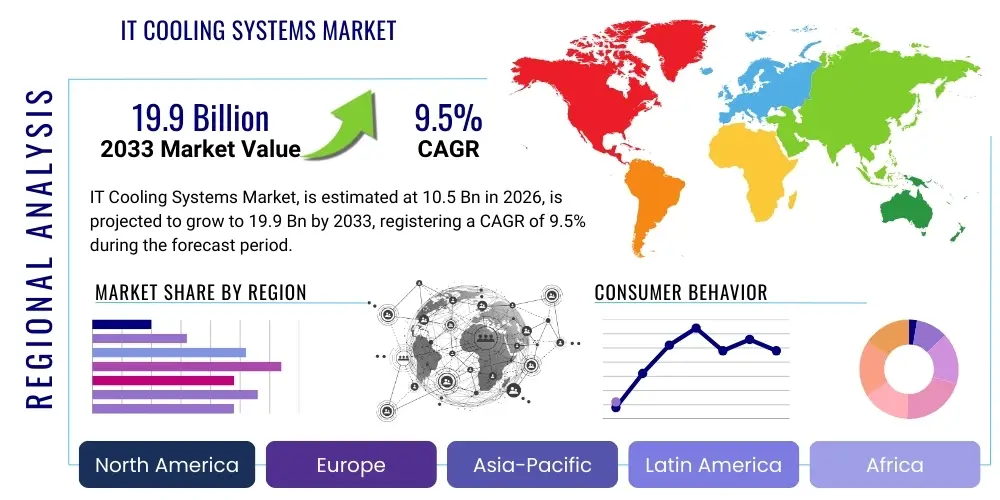

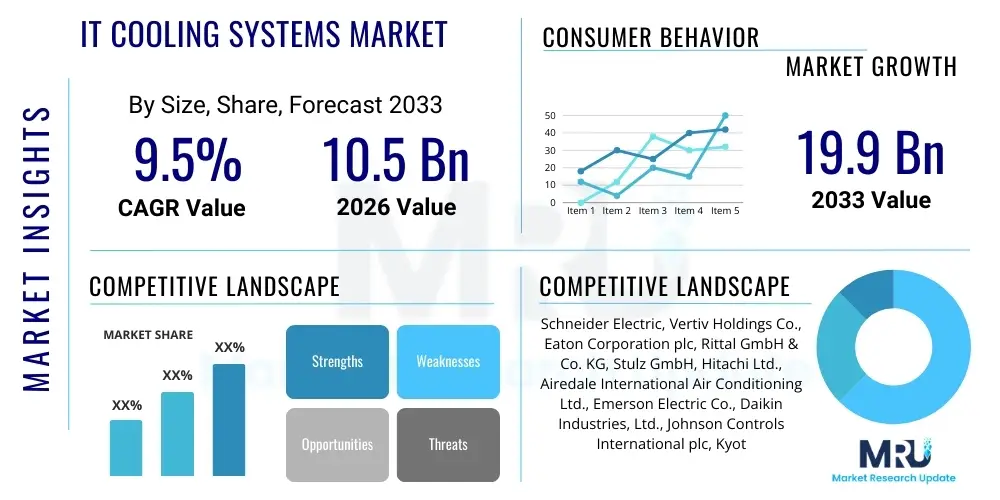

The IT Cooling Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 10.5 billion in 2026 and is projected to reach USD 19.9 billion by the end of the forecast period in 2033.

IT Cooling Systems Market introduction

The relentless expansion of digital infrastructure and data-intensive operations necessitates highly efficient IT cooling solutions. These systems are critical for managing substantial heat generated by servers, storage, networking equipment, and other electronic hardware within data centers and various computing environments. Effective cooling prevents overheating, which can lead to performance degradation, premature equipment failure, and significant operational disruptions. IT cooling systems encompass diverse technologies, from traditional air-based units like Computer Room Air Conditioners (CRACs) and Computer Room Air Handlers (CRAHs) to advanced liquid cooling, free cooling, and precision cooling solutions. The core objective is to maintain optimal operating temperatures and humidity, ensuring the reliability, longevity, and efficiency of mission-critical IT infrastructure across its lifecycle.

Major applications for IT cooling systems extend across hyperscale data centers, enterprise data centers, colocation facilities, burgeoning edge computing sites, and extensive telecommunications infrastructure. As organizations increasingly adopt high-density computing and virtualized environments, the thermal load within these facilities continues to escalate, making sophisticated cooling strategies indispensable. Key benefits of advanced IT cooling systems include enhanced equipment reliability and extended operational lifespan, substantial reductions in energy consumption and associated operational costs through improved Power Usage Effectiveness (PUE), compliance with stringent environmental sustainability objectives, and the critical ability to support higher processing densities without compromising performance integrity. Furthermore, effective cooling is paramount in mitigating the risk of system downtime, thereby safeguarding business continuity and protecting invaluable digital assets from thermal-related failures.

The market's expansion is fundamentally driven by several powerful factors. The explosive growth of data generated from ubiquitous cloud computing, advanced artificial intelligence (AI), machine learning (ML) algorithms, and the pervasive Internet of Things (IoT) demands increasingly powerful and densely packed servers, inherently amplifying heat output. Global digitalization efforts across all industrial sectors, coupled with the rapid deployment of 5G networks and distributed edge computing architectures, are creating new, geographically dispersed computing environments that critically require localized, highly efficient cooling. Moreover, a growing emphasis on energy efficiency and environmental sustainability, spurred by evolving regulatory frameworks and corporate social responsibility commitments, actively fosters innovation in advanced cooling technologies. Solutions that consume less power and utilize eco-friendly refrigerants are gaining traction, making the continuous demand for superior computing performance and reduced carbon footprints primary catalysts for sustained market growth.

IT Cooling Systems Market Executive Summary

The IT Cooling Systems Market is experiencing robust growth, primarily fueled by the accelerating expansion of global digital infrastructure and a sharpened industry focus on energy efficiency. Current business trends indicate a significant pivot towards modular and highly scalable cooling solutions, which provide organizations with the agility to rapidly adapt to fluctuating heat loads and future expansion demands without necessitating substantial upfront capital investments. The proliferation of hybrid cloud strategies and decentralized edge computing architectures is distributing IT infrastructure more widely, consequently driving demand for compact, resilient, and intelligently controlled cooling systems capable of performing optimally in diverse, often non-traditional IT environments. Additionally, substantial ongoing investments in next-generation data centers, particularly hyperscale facilities, continue to bolster the need for ultra-efficient and sustainable cooling technologies, encompassing advanced liquid cooling, immersive cooling, and innovative free cooling techniques leveraging ambient conditions. Strategic collaborations and mergers among prominent market players are also prevalent, aimed at broadening product portfolios and enhancing technological competencies to address complex and evolving market requirements.

Regionally, the market demonstrates varied growth patterns and strategic priorities. North America and Europe, as established markets, exhibit a strong inclination towards retrofitting existing data centers with upgraded, more efficient cooling technologies and investing heavily in cutting-edge sustainable solutions. These regions are also at the forefront of adopting AI-driven thermal management and predictive maintenance strategies for cooling infrastructure. Conversely, the Asia Pacific (APAC) region is emerging as a high-growth epicenter, propelled by rapid economic expansion, large-scale digital transformation initiatives, and the construction of numerous new data centers, particularly across nations like China, India, Japan, and Southeast Asian countries. Latin America, the Middle East, and Africa are experiencing significant, albeit nascent, market expansion driven by increasing internet penetration, rising cloud adoption rates, and the localized development of data center capacities. Government initiatives promoting digital economies and foreign direct investments in IT infrastructure are key factors accelerating market demand in these developing regions.

Segmentation trends within the market underscore continuous technological advancement and evolving end-user requirements. The liquid cooling segment, encompassing both direct-to-chip and full immersion cooling solutions, is witnessing exponential growth. This surge is primarily driven by the imperative to effectively cool extremely high-density servers housing powerful AI/ML processors and other advanced computing components that traditional air cooling methods often struggle to manage. Within the components segment, intelligent monitoring and control solutions, heavily leveraging IoT and AI technologies, are becoming indispensable for optimizing cooling performance and significantly reducing energy waste. While demand remains strong in hyperscale and enterprise data centers, the edge computing segment is rapidly emerging as a critical growth area, demanding specialized, compact, and highly robust cooling solutions tailored for non-traditional data center settings. Furthermore, a pronounced industry-wide shift towards sustainable practices is influencing segmentation, with a growing preference for solutions that minimize water usage, integrate renewable energy sources, and utilize environmentally friendly refrigerants, thereby shaping product development and market penetration strategies.

AI Impact Analysis on IT Cooling Systems Market

The integration of Artificial Intelligence (AI) is poised to fundamentally reshape the IT cooling systems market, ushering in unprecedented levels of efficiency, predictive capabilities, and autonomous operation. User interest is significantly focused on how AI can optimize energy consumption within data centers, substantially reduce operational costs, and enhance the overall reliability and resilience of critical cooling infrastructure. Common user questions frequently address the practical applications of AI in real-time thermal management, its specific role in preventing equipment failures through proactive measures, and the extent to which it can automate complex cooling processes. There is considerable anticipation regarding AI's capability to analyze vast datasets from an array of sensors and environmental controls to accurately predict heat fluctuations, pinpoint cooling inefficiencies, and dynamically adjust system parameters to maintain optimal temperatures with minimal human intervention. Users also express valid concerns regarding the initial investment required for sophisticated AI-powered cooling solutions, the inherent complexities of integrating these advanced technologies with existing legacy infrastructure, and the potential cybersecurity implications associated with networked smart cooling systems.

AI's influence transcends mere optimization, enabling a transformative shift from reactive problem-solving to proactive, predictive maintenance strategies. By employing advanced machine learning algorithms to meticulously analyze historical performance data, real-time environmental conditions, and intricate IT workload patterns, AI can effectively anticipate potential cooling system failures well before they manifest. This invaluable predictive capability empowers data center operators to schedule maintenance proactively, thereby minimizing unplanned downtime and significantly extending the operational lifespan of expensive cooling equipment. Furthermore, AI can orchestrate a more sophisticated and harmonious interplay among various cooling components, such as CRACs/CRAHs, chillers, and free cooling units, ensuring that cooling resources are allocated precisely where and when they are most needed. This intelligent resource management is critically important for hyperscale and high-density computing environments where even minor inefficiencies can translate into substantial energy waste and a larger carbon footprint. The overarching goal is to achieve an autonomous, self-optimizing cooling ecosystem that continuously adapts to dynamic IT demands and evolving environmental variables with remarkable precision.

The direct impact of AI on the IT cooling systems market is conspicuously evident in the accelerated development of more advanced control systems and the enhancement of existing product capabilities. AI-powered analytics platforms are increasingly being embedded directly into cooling units and sophisticated Data Center Infrastructure Management (DCIM) software, providing operators with profoundly actionable insights and automated recommendations. These intelligent systems possess the remarkable ability to learn from operational data over extended periods, continuously refine their underlying algorithms, and progressively improve overall cooling efficiency. For instance, AI can dynamically adjust fan speeds, chiller loads, and targeted airflow distribution based on real-time server temperatures and anticipated workloads, ensuring that cooling is delivered precisely to the hot spots where it is needed most, thereby avoiding wasteful overcooling and unnecessary energy expenditure. This level of granular control and adaptive learning is fundamentally transforming how data centers manage their thermal environment, pushing the boundaries of energy efficiency and operational resilience, while simultaneously addressing the rapidly escalating power demands of AI and high-performance computing (HPC) infrastructures themselves.

- Energy Optimization: AI algorithms analyze sensor data to dynamically adjust cooling parameters, preventing overcooling and optimizing airflow, significantly reducing energy consumption.

- Predictive Maintenance: Machine learning identifies patterns indicating potential equipment failure, enabling proactive intervention and minimizing costly downtime.

- Real-time Thermal Management: AI systems monitor and adjust temperature fluctuations across the data center, maintaining optimal conditions instantaneously.

- Enhanced PUE: Intelligent management of cooling infrastructure dramatically improves Power Usage Effectiveness (PUE) ratios, leading to operational savings.

- Automated Operations: AI facilitates autonomous decision-making in cooling systems, decreasing the need for manual intervention and reducing human error.

- Adaptive Cooling: Systems learn from changing IT workloads and environmental conditions, continuously refining cooling strategies for peak efficiency.

- Support for High-Density Racks: AI is crucial for managing complex thermal profiles in high-density racks, vital for modern AI/ML and HPC workloads.

- Optimized Resource Allocation: AI ensures cooling capacity is precisely matched to demand, avoiding wasteful deployment of resources.

- Sustainability Benefits: Reduced energy consumption from AI-driven cooling contributes directly to lower carbon footprints and greater environmental sustainability.

- Data-Driven Insights: Provides operators with deep, actionable insights through advanced analytics on cooling performance, energy usage, and potential efficiencies.

DRO & Impact Forces Of IT Cooling Systems Market

The IT Cooling Systems Market is intricately shaped by a dynamic interplay of internal and external factors, commonly categorized as Drivers, Restraints, and Opportunities (DRO). These fundamental forces collectively dictate the trajectory of market growth, catalyze innovation, and guide the strategic direction for all stakeholders. Among the most prominent drivers is the exponential increase in data center workloads, profoundly spurred by pervasive digital transformation initiatives, widespread cloud computing adoption, and the rapid proliferation of advanced technologies such as Artificial Intelligence (AI), Machine Learning (ML), and the Internet of Things (IoT). These technologies inherently demand higher-density computing environments, leading to significantly elevated heat loads that conventional cooling methods increasingly struggle to manage efficiently. Consequently, there is an urgent and growing need for more sophisticated, high-performance, and scalable cooling solutions. Furthermore, the global imperative for enhanced energy efficiency and environmental sustainability represents a formidable driver, compelling enterprises and data center operators to invest in innovative cooling technologies that substantially reduce power consumption and carbon emissions, influenced by both evolving regulatory pressures and increasingly vital corporate social responsibility objectives.

Despite the powerful and numerous growth drivers, the IT cooling systems market navigates several significant restraints that can impede its expansion and adoption. A major challenge involves the substantial capital expenditure required for implementing advanced cooling systems, particularly for state-of-the-art liquid cooling solutions or for retrofitting existing, often aging, data centers. This high upfront investment can act as a significant deterrent for smaller enterprises or organizations operating with more constrained budgets. The inherent operational complexity associated with managing sophisticated cooling infrastructure, including specialized maintenance requirements and the critical need for highly skilled technical personnel, also poses a considerable restraint. Additionally, a labyrinth of regulatory hurdles and growing environmental concerns pertaining to certain refrigerants or the extensive water usage in traditional cooling systems can decelerate adoption rates in specific regions. Physical space limitations within existing data centers further restrict the seamless deployment of larger, more efficient cooling units, often compelling operators to opt for more compact, yet frequently more expensive, solutions. Lastly, the inherently dynamic nature of IT workloads and the unpredictability of future thermal demands present a continuous architectural challenge in designing truly future-proof cooling infrastructures.

Opportunities within the IT Cooling Systems Market are both abundant and highly diverse, promising substantial avenues for sustained innovation and significant expansion. The rapid and pervasive expansion of edge computing, which strategically brings data processing closer to the sources of data generation, is creating an entirely new demand segment for compact, rugged, and exceptionally efficient cooling solutions. These solutions must be capable of operating reliably in often non-traditional data center environments with minimal local oversight. Immersion cooling and direct-to-chip liquid cooling technologies represent profound growth opportunities, particularly as processor power densities continue their steep escalation, largely driven by intensive AI and High-Performance Computing (HPC) applications. The ongoing development of intelligent, AI-powered thermal management systems offers a clear pathway to optimize energy usage, significantly reduce operational costs, and markedly enhance system reliability, presenting a compelling value proposition for data center operators. Furthermore, the accelerating trend towards modular and prefabricated data centers opens lucrative new markets for integrated, scalable cooling modules that simplify deployment. Lastly, the increasing global focus on circular economy principles and comprehensive green IT initiatives actively fosters opportunities for developing cooling solutions that harness renewable energy, feature advanced heat recovery mechanisms, and utilize environmentally friendly refrigerants, thereby aligning perfectly with global sustainability goals and attracting environmentally conscious customers.

Segmentation Analysis

The IT Cooling Systems market is meticulously segmented to offer a granular and comprehensive understanding of its diverse components, technologies, and applications, thereby enabling stakeholders to precisely identify specific growth areas and strategic opportunities. This detailed segmentation facilitates an in-depth analysis of market dynamics across various critical dimensions, encompassing the specific type of cooling solution deployed, the particular components utilized, the primary end-user verticals served, and the distinct deployment architecture within various IT environments. A thorough understanding of these segments is crucial for manufacturers to effectively tailor their product offerings, for service providers to target their clientele with precision, and for investors to make well-informed decisions regarding market penetration and long-term growth strategies. The continuously evolving technological landscape, profoundly influenced by the relentless pursuit of higher computing densities and increasingly stringent sustainability mandates, consistently reshapes the prominence, demand, and growth trajectory of these distinct market segments.

The intricate segmentation structure accurately reflects the profound technological diversity and specific application requirements inherent in modern IT infrastructure cooling paradigms. For instance, the fundamental distinction between traditional air-based and advanced liquid-based cooling systems highlights significant differences in thermal transfer efficiency, scalability, and applicability to varying heat loads generated by IT equipment. Within the components segment, the focused emphasis on cooling units, efficient power distribution mechanisms, and sophisticated monitoring solutions underscores the inherently integrated nature of truly effective thermal management strategies. The comprehensive end-user segmentation clearly reveals the divergent demands and priorities of different industrial sectors, ranging from hyperscale data centers requiring massive, ultra-efficient, and highly scalable systems to nascent edge computing sites demanding compact, robust, and resilient cooling solutions. Finally, application-based segmentation, such as room-based versus row-based or rack-based cooling, vividly illustrates the architectural choices data center operators make to optimize cooling delivery based on their specific infrastructure layout, density requirements, and operational objectives. Each segment, while distinct, often interacts dynamically with and influences others, collectively contributing to a holistic and vibrant market ecosystem.

- By Type:

- Computer Room Air Conditioners (CRACs)

- Computer Room Air Handlers (CRAHs)

- Chillers

- Evaporative Coolers

- Liquid Cooling Systems

- Direct-to-Chip Cooling

- Immersion Cooling (Single-phase, Two-phase)

- Rack-based Cooling

- Free Cooling (Air-side Economizers, Water-side Economizers)

- By Component:

- Cooling Units (Indoor, Outdoor)

- Rack Power Distribution Units (PDUs)

- Monitoring and Control Solutions (DCIM, Sensors, AI-based software)

- Services (Installation, Maintenance, Consulting, Energy Optimization)

- By End-User:

- Hyperscale Data Centers

- Colocation Data Centers

- Enterprise Data Centers

- Edge Computing Facilities

- Telecommunication Industry

- Government and Defense

- Healthcare

- Banking, Financial Services, and Insurance (BFSI)

- Manufacturing

- By Application:

- Room-based Cooling

- Row-based Cooling

- Rack-based Cooling

- Chip-level Cooling

Value Chain Analysis For IT Cooling Systems Market

The value chain for the IT Cooling Systems Market constitutes a sophisticated and interconnected network involving multiple critical stages, spanning from the initial sourcing of raw materials and meticulous component manufacturing to the final installation, ongoing operation, and continuous maintenance. This intricate process commences with upstream activities, which primarily involve the procurement of essential raw materials such as various metals (e.g., copper, aluminum), specialized plastics, refrigerants, and diverse electronic components from a global supply network. Subsequently, highly specialized manufacturers process these raw materials into critical sub-components, including advanced compressors, efficient heat exchangers, high-performance fans, precision pumps, sophisticated control systems, and an array of environmental sensors. The inherent efficiency, reliability, and quality of these foundational components directly and profoundly influence the ultimate performance and operational robustness of the complete IT cooling solutions. Key upstream players encompass manufacturers of HVAC components, industrial electronics, and highly specialized materials, all of whom supply essential parts to the primary cooling system integrators. Establishing robust supplier relationships, ensuring stringent quality control, and meticulously managing supply chain logistics are unequivocally crucial at this stage to guarantee cost-effectiveness, maintain product quality, and ensure the timely delivery of essential parts, particularly within a market characterized by rapid technological advancements and often fluctuating material costs.

Midstream activities within the value chain encompass the comprehensive design, precise assembly, and rigorous testing of complete IT cooling systems undertaken by original equipment manufacturers (OEMs) and expert system integrators. This pivotal stage frequently involves substantial investments in research and development (R&D) efforts, specifically aimed at innovating new, cutting-edge cooling technologies, optimizing existing solutions for superior energy efficiency, and ensuring broad compatibility with diverse and evolving IT infrastructures. OEMs are responsible for integrating various complex components to produce advanced Computer Room Air Conditioners (CRACs), Computer Room Air Handlers (CRAHs), high-capacity chillers, specialized liquid cooling units, and comprehensive thermal management solutions. Customization capabilities and inherent modularity are paramount considerations at this juncture, as different data center environments and IT deployments possess unique and often highly specific cooling requirements. Downstream activities then concentrate on the efficient distribution, strategic sales, expert installation, and comprehensive post-sales support for these sophisticated systems. Distribution channels can operate directly, where manufacturers engage in direct sales to large-scale data center operators or major enterprises, or indirectly, involving an expansive network of distributors, resellers, and value-added integrators (VAIs) who provide specialized expertise, localized support, and integrated solutions tailored to regional demands. The efficacy of these diverse channels is vital for achieving broad market penetration and reaching a wide-ranging customer base, especially across geographically dispersed markets and for highly differentiated customer segments.

The downstream segment also encompasses an array of critical services, including precise system installation, thorough commissioning, ongoing proactive maintenance, and specialized energy optimization consulting. These comprehensive services are indispensable for ensuring the optimal performance, extended longevity, and maximum efficiency of the cooling infrastructure, frequently contributing significantly to the total cost of ownership and overall customer satisfaction. Direct channels offer the distinct advantage of fostering deeper customer relationships and often facilitate highly tailored solutions for large-scale, complex projects, allowing for direct feedback loops and quicker response times to specific client needs. Indirect channels, conversely, through their extensive and established networks, provide broader market reach, specialized regional support, and frequently offer bundled IT infrastructure solutions, enhancing overall value proposition. The accelerating growth of managed services and the increasing trend of outsourcing data center operations further underscore the paramount importance of robust and well-defined service offerings across both direct and indirect models. Ultimately, the entire value chain is meticulously driven by the overarching end-user demand for reliable, highly efficient, and sustainable IT cooling solutions, with each distinct stage contributing significantly to the successful delivery of solutions that safeguard critical digital assets, ensure business continuity, and support continuous innovation within the dynamic digital landscape.

IT Cooling Systems Market Potential Customers

The potential customer base for IT cooling systems is extraordinarily vast and continuously expanding, propelled by the ubiquitous and critical need for robust digital infrastructure across virtually every sector of the global economy. At the forefront of this extensive customer landscape are hyperscale data centers, primarily operated by leading technology giants and prominent cloud service providers, which necessitate massive, ultra-efficient, and highly scalable cooling solutions to effectively manage the immense heat loads generated by tens of thousands of densely packed servers. Colocation data centers also represent a substantial and growing customer segment, as they provide shared infrastructure services for multiple tenants, thereby requiring highly flexible and high-capacity cooling systems capable of accommodating diverse client requirements. Enterprise data centers, whether managed on-premise or through private cloud models, constitute another core demographic, particularly as businesses aggressively pursue digital transformation initiatives and consolidate their IT operations, demanding reliable cooling to support their mission-critical applications and services. These large-scale operators consistently prioritize energy efficiency, unwavering reliability, and seamless integration capabilities with their existing infrastructure, frequently seeking advanced liquid cooling or intelligent air management systems to meet their demanding needs.

Beyond the realm of traditional large-scale data centers, the rapid and widespread emergence of edge computing facilities is actively creating a novel and highly dynamic customer segment. Edge data centers, characterized by their smaller physical footprint and strategically decentralized locations, are specifically designed to support applications requiring ultra-low latency, such as autonomous vehicles, smart city infrastructures, and sophisticated industrial IoT deployments. These customers demand compact, exceptionally robust, and often outdoor-rated cooling solutions that can operate efficiently and reliably in diverse environmental conditions with minimal local oversight and maintenance. The telecommunications industry, propelled by the extensive rollout of 5G networks and the escalating consumption of mobile data, represents another critical customer vertical, requiring robust cooling for their expansive network infrastructure, numerous base stations, and burgeoning edge hubs. Furthermore, vital sectors such as government and defense (for secure computing and data processing), healthcare (for advanced medical imaging and vast patient data management), and financial services (for high-frequency trading platforms and secure transactional data processing) also constitute significant end-users, each presenting unique compliance, security, and operational requirements that profoundly influence their specific IT cooling system choices. These remarkably diverse customer needs are a primary driver of innovation across the entire IT cooling market, spurring the development of specialized solutions meticulously tailored to specific operational contexts and industry verticals.

The fundamental common denominator uniting all these potential customer segments is the absolute critical need to prevent thermal runaway events and ensure the uninterrupted, continuous operation of their invaluable IT assets. As global data volumes continue to surge and processing power steadily escalates, the criticality of highly effective and reliable cooling solutions only intensifies. Customers are increasingly seeking out solutions that not only deliver superior thermal performance but also offer significant energy savings, possess a reduced environmental impact, and provide seamless integration capabilities with their existing Data Center Infrastructure Management (DCIM) platforms. The pronounced industry-wide shift towards greater sustainability is particularly influencing purchasing decisions, with a discernible and growing preference for cooling systems that incorporate innovative free cooling techniques, utilize environmentally friendly refrigerants, or support advanced heat recovery applications to achieve circular economy objectives. Therefore, a nuanced understanding of the specific operational challenges, ambitious sustainability goals, and inherent budget constraints of each distinct customer segment is paramount for vendors aspiring to capture substantial market share and deliver truly value-added IT cooling solutions within this fiercely competitive and rapidly evolving landscape.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 10.5 billion |

| Market Forecast in 2033 | USD 19.9 billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Schneider Electric, Vertiv Holdings Co., Eaton Corporation plc, Rittal GmbH & Co. KG, Stulz GmbH, Hitachi Ltd., Airedale International Air Conditioning Ltd., Emerson Electric Co., Daikin Industries, Ltd., Johnson Controls International plc, KyotoCooling, Condair Group AG, Envicool (Shenzhen Envicool Technology Co., Ltd.), CoolIT Systems Inc., Submer Technologies SL, Green Revolution Cooling Inc. (GRC), Fujitsu Limited, Dell Technologies Inc., Hewlett Packard Enterprise (HPE), IBM Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

IT Cooling Systems Market Key Technology Landscape

The IT Cooling Systems Market is profoundly shaped by a rapidly evolving technological landscape, driven by the incessant and escalating demand for greater energy efficiency, substantially higher cooling capacities, and more intelligent thermal management capabilities. While traditional air-based cooling systems, such such as Computer Room Air Conditioners (CRACs) and Computer Room Air Handlers (CRAHs), remain foundational components, they are undergoing significant evolutionary upgrades, incorporating advanced features like variable speed fans, sophisticated filtration systems, and improved compressor technologies to significantly enhance their overall efficiency and operational lifespan. However, the most transformative technological shifts are conspicuously occurring within the realm of liquid cooling, which is rapidly becoming an indispensable solution for effectively managing the extreme heat densities produced by cutting-edge high-performance computing (HPC), AI, and machine learning servers. Direct-to-chip liquid cooling solutions, which involve the precise circulation of specialized coolant directly over hot components like CPUs and GPUs, offer inherently superior heat extraction capabilities when compared to conventional air-based methods. Immersion cooling, wherein entire servers are completely submerged in non-conductive dielectric fluids, represents an even more radical and promising approach, offering unprecedented thermal management efficiency, significant noise reduction, and the potential for greater hardware reliability and longevity.

Beyond the core mechanisms of heat dissipation, the market is witnessing profound and widespread advancements in monitoring, control, and optimization technologies. Sophisticated Data Center Infrastructure Management (DCIM) software platforms are progressively integrating more powerful analytics, predictive capabilities, and real-time monitoring features, frequently powered by advanced Artificial Intelligence (AI) and machine learning algorithms. These intelligent systems possess the remarkable ability to meticulously analyze vast amounts of data streaming from an array of sensors strategically placed throughout the data center, enabling them to accurately predict potential hot spots, optimize airflow patterns, dynamically adjust cooling output in real-time, and promptly identify potential inefficiencies or incipient failures before they can adversely impact critical operations. The widespread adoption of IoT sensors and robust network connectivity further facilitates granular control and seamless remote management of individual cooling units, empowering operators to achieve significantly higher levels of Power Usage Effectiveness (PUE) and substantially reduce operational costs. Furthermore, the continuous development of free cooling technologies, which ingeniously leverage ambient outdoor air or water temperatures to cool data centers, is gaining significant traction, particularly in regions with favorable climates, offering considerable energy savings and a reduced environmental footprint by minimizing the reliance on energy-intensive mechanical refrigeration cycles.

Innovations also extend to the realm of modular and prefabricated cooling solutions, which provide critical advantages such as rapid deployment, inherent scalability, and enhanced operational flexibility for data centers, especially those strategically deploying at the edge of the network or requiring swift expansion capabilities. These modular units are delivered pre-integrated and factory-tested, significantly simplifying the installation process and reducing the overall time-to-market for new deployments. The industry is additionally exploring advanced heat recovery systems, where the substantial waste heat generated by IT equipment is efficiently captured and repurposed for other beneficial uses, such as building heating or industrial processes, thereby contributing to a more circular economy model and further improving overall energy efficiency. Moreover, a key technological trend, strongly driven by evolving environmental regulations and pressing sustainability initiatives, is the discernible shift towards more environmentally friendly refrigerants. This includes embracing natural refrigerants (e.g., CO2, ammonia, hydrocarbons) and developing low Global Warming Potential (GWP) synthetic refrigerants. Collectively, these diverse technological advancements aim to forge more resilient, exceptionally efficient, and ecologically responsible IT cooling infrastructures, fully capable of supporting the increasingly demanding and complex computing landscape of the future.

Regional Highlights

The global IT Cooling Systems Market exhibits significant regional variations in terms of adoption rates, technological preferences, and growth drivers. Each major geographical region presents unique opportunities and distinct challenges, profoundly influenced by local economic conditions, prevailing regulatory environments, and the overall maturity of its digital infrastructure. Understanding these specific regional nuances is absolutely critical for market players to develop highly targeted strategies and allocate resources effectively, thereby ensuring that product offerings and service models are precisely aligned with specific local demands, cultural preferences, and prevailing market conditions.

- North America: A dominant force in IT cooling, characterized by numerous hyperscale data centers, robust cloud adoption, and early embrace of advanced cooling and AI-driven thermal management solutions. Strong energy efficiency mandates drive consistent investment.

- Europe: A mature market with a strong emphasis on sustainability, stringent energy regulations (e.g., EU Green Deal), and a focus on data sovereignty. Leaders in free cooling, renewable energy integration, and DCIM, with significant retrofitting trends.

- Asia Pacific (APAC): The fastest-growing region, fueled by rapid digitalization, massive new data center infrastructure investments, and expanding cloud services across economies like China, India, Japan, and Southeast Asia. High demand for scalable, energy-efficient cooling for booming digital sectors.

- Latin America: Experiencing accelerating growth due to increasing internet penetration, widespread cloud adoption, and local data center establishment in countries like Brazil and Mexico. Demand focuses on cost-effective, reliable, and scalable solutions, with growing energy efficiency awareness.

- Middle East and Africa (MEA): A high-potential, diverse market driven by government digital transformation, smart city initiatives, and increasing cloud consumption. UAE, Saudi Arabia, and South Africa are key hubs, investing in modern data centers. Hot climates necessitate robust, high-efficiency cooling, including hybrid systems, with growing sustainability interest.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the IT Cooling Systems Market.- Schneider Electric

- Vertiv Holdings Co.

- Eaton Corporation plc

- Rittal GmbH & Co. KG

- Stulz GmbH

- Hitachi Ltd.

- Airedale International Air Conditioning Ltd.

- Emerson Electric Co.

- Daikin Industries, Ltd.

- Johnson Controls International plc

- KyotoCooling

- Condair Group AG

- Envicool (Shenzhen Envicool Technology Co., Ltd.)

- CoolIT Systems Inc.

- Submer Technologies SL

- Green Revolution Cooling Inc. (GRC)

- Fujitsu Limited

- Dell Technologies Inc.

- Hewlett Packard Enterprise (HPE)

- IBM Corporation

Frequently Asked Questions

Analyze common user questions about the IT Cooling Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of IT cooling systems in modern data centers?

IT cooling systems dissipate heat from servers and IT equipment, ensuring optimal operating temperatures. This prevents overheating, safeguards performance and reliability, and ultimately prevents costly downtime and data loss in critical IT environments.

How do liquid cooling systems differ from traditional air cooling, and why are they gaining traction?

Liquid cooling directly transfers heat using dielectric fluids, offering superior efficiency over air cooling. They are gaining traction for managing extreme heat loads of high-density servers, crucial for AI/ML workloads, enabling greater computing power in smaller footprints while often reducing energy use.

What role does AI play in optimizing IT cooling system efficiency?

AI optimizes cooling by analyzing real-time data to dynamically adjust parameters. This enables predictive maintenance, efficient airflow management, prevents overcooling, and significantly improves Power Usage Effectiveness (PUE), reducing energy consumption and operational costs.

What are the main drivers for growth in the IT Cooling Systems Market?

Key drivers include exponential data center and cloud computing growth, increased adoption of high-density computing for AI/ML and IoT, global demand for energy efficiency and sustainability in IT, and the expansion of edge computing infrastructure.

What are the key considerations for choosing an IT cooling system?

Considerations include IT equipment heat density, total power consumption, available space, budget, desired PUE, scalability, environmental sustainability goals, and seamless integration with Data Center Infrastructure Management (DCIM) for optimal control.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager