IT Equipment Rental Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440133 | Date : Jan, 2026 | Pages : 241 | Region : Global | Publisher : MRU

IT Equipment Rental Market Size

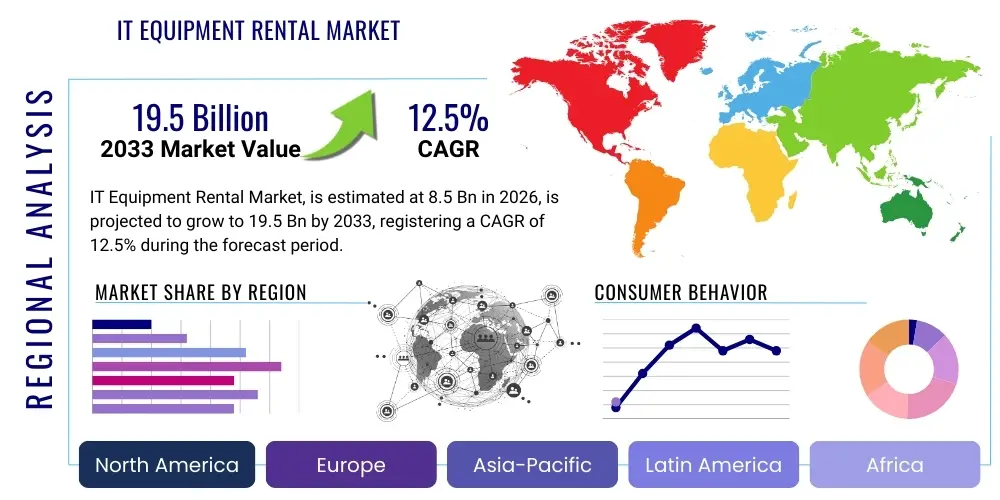

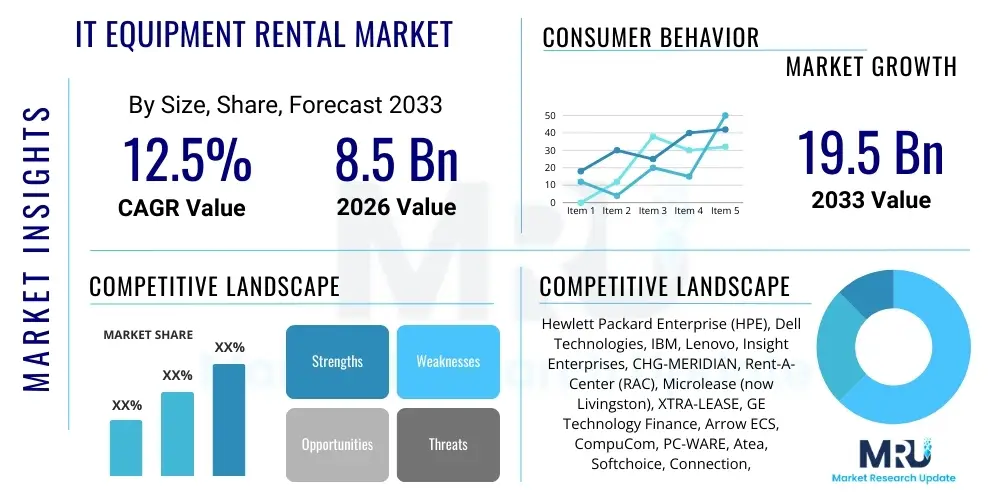

The IT Equipment Rental Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 8.5 Billion in 2026 and is projected to reach USD 19.5 Billion by the end of the forecast period in 2033. This robust expansion is fueled by an increasing demand for flexible, cost-effective IT infrastructure solutions across various industries, coupled with the accelerating pace of technological obsolescence. Businesses are increasingly recognizing the strategic advantages of renting IT equipment to manage capital expenditures, scale operations efficiently, and ensure access to the latest technologies without the burden of ownership and depreciating assets. This shift is particularly pronounced among small and medium-sized enterprises (SMEs) and project-based organizations that require agile IT resource allocation.

IT Equipment Rental Market introduction

The IT Equipment Rental Market encompasses the provision of various information technology hardware and software on a temporary basis, typically through leasing agreements or short-term rentals. This market offers a comprehensive range of products, including but not limited to laptops, desktops, servers, networking equipment, storage devices, projectors, and specialized peripherals, often bundled with associated software licenses and maintenance services. The primary aim is to allow businesses and individuals to access advanced IT solutions without significant upfront capital investment, offering an attractive alternative to outright purchase. The flexibility inherent in rental models allows organizations to procure specific technologies for defined periods, catering to project-specific requirements, seasonal demand fluctuations, temporary workforce expansions, or disaster recovery scenarios. The value proposition extends beyond mere hardware access, often including technical support, installation, configuration, and end-of-life management, thereby providing a holistic solution to clients' IT needs and reducing operational complexities. This comprehensive service model is a critical differentiator, enabling seamless integration and operation of rented assets within existing IT ecosystems, further driving market adoption.

Major applications of IT equipment rental span across diverse sectors, including corporate training, events and conferences, short-term projects, data center upgrades, product testing, and facilitating remote or hybrid work environments. For instance, businesses frequently rent laptops for new employee onboarding, servers for temporary development environments, or specialized workstations for graphic design projects. The benefits derived from IT equipment rental are multifaceted; they include significant cost savings by converting capital expenditure (CapEx) to operational expenditure (OpEx), enhanced financial flexibility, and the ability to frequently upgrade to the latest technological advancements without the hassle of asset disposal. Furthermore, it offers scalability, allowing organizations to rapidly adjust their IT infrastructure up or down based on evolving business demands, ensuring optimal resource utilization and avoiding over-provisioning or under-provisioning. The environmental benefit of extended equipment lifecycles through reuse and recycling by rental providers also contributes to sustainable business practices.

The market is primarily driven by several key factors. The escalating pace of technological innovation, leading to rapid obsolescence of IT hardware, makes rental an appealing option for businesses that need to stay current without constant large investments. The growing trend towards remote and hybrid work models has spurred demand for flexible IT setups, with rental solutions offering quick deployment and easy scaling of workstations. Moreover, the increasing focus on cost optimization and efficient capital management, particularly among SMEs and startups, positions IT equipment rental as a strategic financial tool. The rise of project-based work and the need for temporary IT infrastructure for events, training, and testing further fuel market growth. Additionally, the comprehensive service offerings from rental providers, including maintenance, support, and asset management, significantly reduce the operational burden on internal IT departments, allowing them to focus on core strategic initiatives. These combined forces create a compelling environment for sustained market expansion.

IT Equipment Rental Market Executive Summary

The IT Equipment Rental Market is experiencing a period of significant growth and transformation, shaped by evolving business needs, technological advancements, and economic dynamics. Current business trends highlight a pronounced shift towards operational efficiency and capital preservation, making rental solutions increasingly attractive. Enterprises, irrespective of their size, are prioritizing agility and scalability in their IT infrastructure, particularly in response to fluctuating market demands and the imperative for digital transformation. This involves not only securing essential hardware but also ensuring that it is current, well-maintained, and easily upgradeable. The rise of project-based work, coupled with the widespread adoption of remote and hybrid work models, has created a sustained demand for flexible, on-demand IT equipment. Organizations are also keen on reducing the environmental footprint of their IT operations, making the sustainable practices offered by rental providers, such as extended product lifecycles and responsible disposal, a compelling value proposition. Furthermore, the market is seeing an expansion in specialized equipment rental for niche applications like AI/ML development, high-performance computing, and virtual reality, indicating a diversification of rental offerings beyond conventional IT assets. Competitive landscapes are evolving with both traditional rental companies and IT service providers expanding their portfolios to meet this broad spectrum of demands.

From a regional perspective, the IT Equipment Rental Market exhibits varied growth trajectories and adoption rates, reflecting local economic conditions, technological maturity, and business landscapes. North America and Europe, characterized by mature IT infrastructures and a high prevalence of large enterprises and technologically advanced SMEs, represent significant market shares. These regions are early adopters of flexible IT procurement models, driven by the need for continuous technological upgrades and robust support for hybrid workforces. The Asia Pacific (APAC) region is emerging as a high-growth market, propelled by rapid industrialization, increasing foreign direct investment, and a burgeoning startup ecosystem, particularly in countries like India, China, and Southeast Asian nations. The demand in APAC is largely fueled by new businesses seeking cost-effective entry into the digital economy and by established companies undergoing digital transformation initiatives. Latin America, the Middle East, and Africa (MEA) are also showing promising growth, albeit from a smaller base, as infrastructure development accelerates and businesses in these regions recognize the benefits of flexible IT solutions for both short-term projects and long-term operational needs. Regulatory environments and investment in digital infrastructure also play crucial roles in shaping regional market dynamics.

Segmentation trends within the IT Equipment Rental Market illustrate a dynamic landscape driven by diverse customer requirements. By type, the demand for laptops and desktops remains strong due to remote work, while servers and networking equipment witness significant uptake for data center modernization and cloud migration projects. Specialized equipment like high-end workstations and storage solutions also form a growing segment. In terms of rental duration, short-term rentals are popular for events and temporary projects, while medium-term and long-term leasing options appeal to businesses seeking to manage operational expenses and maintain access to updated technology without ownership. The end-use industry segmentation reveals robust demand from IT and telecommunications, BFSI (Banking, Financial Services, and Insurance), healthcare, and manufacturing sectors, each with unique requirements for performance, security, and compliance. Enterprise size segmentation highlights that both small and medium-sized enterprises (SMEs) and large enterprises are significant customer bases, though their motivations for renting may differ. SMEs often prioritize cost savings and scalability, while large enterprises leverage rental for strategic projects, peak demand management, and asset lifecycle optimization, reflecting the market's comprehensive appeal across the corporate spectrum.

AI Impact Analysis on IT Equipment Rental Market

The emergence and rapid integration of Artificial Intelligence (AI) across industries are profoundly influencing the IT Equipment Rental Market, prompting both new demands and operational shifts. Users and businesses are increasingly seeking clarity on how AI will transform their hardware needs, specifically questioning whether current rental offerings are sufficient for AI-intensive workloads, the implications for hardware refresh cycles, and the potential for AI to optimize rental operations. Common concerns revolve around the availability of specialized hardware such as GPUs and high-performance computing (HPC) clusters through rental models, the data security aspects when handling AI training data on rented equipment, and the cost-effectiveness of renting versus purchasing specialized AI infrastructure. There's also an expectation that AI could enhance the efficiency of rental processes, from predictive maintenance of equipment to automated inventory management and personalized customer recommendations. The overarching theme is how the rental market will adapt to the unique, evolving, and often demanding hardware requirements of AI development and deployment, alongside leveraging AI to streamline its own service delivery. This convergence creates a dynamic landscape where innovation in both rental offerings and internal operations becomes paramount for market players.

- Increased demand for specialized AI/ML hardware, such as high-performance GPUs, TPUs, and parallel processing servers, leading to new rental product categories.

- Predictive analytics powered by AI for equipment maintenance, reducing downtime and extending the operational life of rented assets.

- AI-driven optimization of inventory management, forecasting demand, and enhancing logistics for IT equipment rental companies.

- Enhanced cybersecurity measures on rented IT equipment through AI-powered threat detection and response systems, addressing data security concerns.

- Automation of customer support and personalized recommendations for rental solutions using AI chatbots and intelligent algorithms.

- Development of flexible rental models specifically tailored for AI development and testing environments, accommodating varying computational needs.

- Impact on hardware refresh cycles as AI applications demand newer, more powerful processors and memory, potentially accelerating equipment turnover in rental fleets.

- Operational efficiency gains for rental companies through AI in areas like contract management, pricing optimization, and client relationship management.

- Expansion of rental services to include AI software licenses and integrated AI platforms alongside hardware, offering comprehensive solutions.

- The potential for AI to influence sustainable practices in rental by optimizing equipment utilization and facilitating intelligent recycling and refurbishment programs.

DRO & Impact Forces Of IT Equipment Rental Market

The IT Equipment Rental Market is shaped by a complex interplay of drivers, restraints, opportunities, and broader impact forces that collectively dictate its growth trajectory and competitive landscape. Key drivers propelling the market forward include the imperative for businesses to manage capital expenditure effectively, transforming large upfront costs into predictable operational expenses, thereby freeing up capital for core investments. The accelerating pace of technological obsolescence is another significant driver; as new hardware and software iterations emerge rapidly, renting allows businesses to continually access cutting-edge technology without the burden of owning depreciating assets. Furthermore, the increasing adoption of flexible work models, including remote and hybrid setups, necessitates scalable and agile IT infrastructure solutions that rental providers are uniquely positioned to offer. The growing emphasis on sustainability also plays a role, with rental models contributing to a circular economy by extending the lifecycle of IT assets. Additionally, the need for temporary IT setups for events, training, and project-specific requirements further bolsters demand, as organizations seek short-term, high-performance solutions without long-term commitments, highlighting the strategic advantage of rental in modern business operations.

Despite its robust growth, the market faces several restraints. Data security and privacy concerns are paramount, particularly when sensitive corporate or personal data is handled on rented equipment. Clients often express apprehension about the security protocols of rental providers and the secure wiping of data post-rental. Another significant restraint is the potential for higher long-term costs compared to outright purchase, especially for equipment required for extended periods; while initial costs are lower, cumulative rental fees can eventually surpass the purchase price, creating a financial dilemma for long-term users. Furthermore, limited customization options for specific hardware and software configurations can be a deterrent for organizations with highly specialized IT requirements that cannot be met by standard rental offerings. Vendor lock-in, where a client becomes heavily reliant on a specific rental provider's ecosystem, can also limit flexibility and negotiation power. The logistical complexities associated with deploying, retrieving, and managing a large fleet of rented equipment, though typically handled by providers, can still present challenges for end-users, particularly in large, geographically dispersed organizations, impacting overall operational efficiency and satisfaction.

Opportunities for growth in the IT Equipment Rental Market are abundant and diverse. The global surge in digital transformation initiatives across all industries presents a fertile ground for rental providers, as companies transition to cloud-based solutions, modernize their infrastructure, and embrace new technologies, often requiring temporary or supplementary IT assets. The expanding ecosystem of small and medium-sized enterprises (SMEs) and startups, which often operate with limited capital and a strong focus on operational flexibility, represents a significant untapped customer base. Niche market specialization, such as providing high-performance computing (HPC) for AI/ML development, specialized equipment for virtual reality, or robust solutions for cybersecurity testing, offers avenues for differentiation and market penetration. Furthermore, the increasing demand for disaster recovery and business continuity planning solutions provides a consistent need for readily available, rapidly deployable IT equipment. The integration of advanced analytics and IoT for predictive maintenance and asset tracking within rental operations can enhance service quality and operational efficiency. Collaborations with IT service providers and managed service providers (MSPs) can also extend market reach, offering integrated solutions that encompass both hardware rental and comprehensive IT management, thereby unlocking new revenue streams and fostering deeper client relationships.

Segmentation Analysis

The IT Equipment Rental Market is comprehensively segmented to provide a detailed understanding of its diverse components and target customer bases. This segmentation allows market participants to identify specific opportunities, tailor their offerings, and develop targeted marketing strategies. The market can be broadly categorized by the type of equipment offered, the duration of the rental period, the end-use industry served, and the enterprise size of the client. Each segment reflects unique demand patterns, technological preferences, and budgetary considerations, underscoring the dynamic nature of IT procurement and the increasing preference for flexible access over outright ownership. Understanding these intricate layers of the market is crucial for stakeholders to effectively navigate the competitive landscape and capitalize on emerging trends and unmet customer needs, driving innovation in service delivery and product diversification. This structured approach helps in analyzing customer behavior and market potential across different verticals and operational scales, providing a granular view of the market dynamics.

- By Type

- Laptops

- Desktops

- Servers

- Storage Devices

- Networking Equipment (Routers, Switches, Firewalls)

- Peripherals (Monitors, Printers, Projectors, Scanners)

- Software Licenses (often bundled or rented with hardware)

- Specialized Equipment (Workstations, VR/AR gear, HPC components)

- By Duration

- Short-term (Daily, Weekly, Monthly)

- Medium-term (3-12 months)

- Long-term (1 Year and Above, often leases)

- By End-Use Industry

- IT & Telecommunications

- BFSI (Banking, Financial Services, and Insurance)

- Healthcare & Life Sciences

- Manufacturing

- Retail & E-commerce

- Government & Public Sector

- Education

- Media & Entertainment

- Events & Training Organizations

- Others (Logistics, Construction, etc.)

- By Enterprise Size

- Small & Medium Enterprises (SMEs)

- Large Enterprises

Value Chain Analysis For IT Equipment Rental Market

The value chain of the IT Equipment Rental Market is a complex ecosystem involving multiple stages, beginning from the acquisition of IT assets to their eventual deployment, maintenance, and end-of-life management. Upstream activities in this chain primarily involve sourcing new or refurbished IT equipment. This critical stage relies heavily on strong relationships with hardware manufacturers such as Dell, HP, Lenovo, and IBM, as well as specialized component suppliers for items like GPUs, memory modules, and storage drives. Rental providers must negotiate favorable terms to acquire a diverse and technologically advanced inventory to meet varied client demands. Additionally, some rental companies may engage with software vendors to offer bundled solutions that include operating systems, productivity suites, or specialized applications, ensuring that the rented hardware is immediately functional and productive for the end-user. The efficiency and cost-effectiveness of these upstream procurement processes directly impact the rental company's profitability and ability to offer competitive pricing, laying the foundation for the entire service delivery model and influencing the quality and modernity of the equipment available in their fleet.

Midstream activities in the value chain focus on the preparation, configuration, and management of the IT equipment fleet. This includes receiving equipment, quality checks, installation of operating systems and necessary software, testing, and secure data wiping for refurbished units. Crucially, it also involves logistics, warehousing, and inventory management, ensuring that the right equipment is available at the right time and location. Rental companies invest significantly in robust infrastructure for storage, maintenance, and technical support. A well-managed inventory system is paramount to minimize downtime and maximize equipment utilization, directly influencing customer satisfaction and operational efficiency. This stage also incorporates the ongoing maintenance, repair, and upgrade of equipment throughout its rental lifecycle, often including proactive monitoring and remote troubleshooting. The technical expertise of the rental provider's staff at this stage is a key differentiator, ensuring that equipment is delivered in optimal working condition and supported effectively throughout the rental period, directly contributing to the reliability and perceived value of the rental service.

Downstream activities center on distribution, delivery, and customer service, ultimately leading to the end-users. The distribution channel for IT equipment rental can be direct, where rental companies engage directly with clients through their sales teams and online platforms, offering personalized consultations and bespoke solutions. Alternatively, indirect channels involve partnerships with IT service providers, value-added resellers (VARs), or managed service providers (MSPs) who integrate rental options into their broader service portfolios, expanding market reach and offering more comprehensive solutions to clients. Once a rental agreement is finalized, the equipment is delivered, often installed, and configured on-site by the rental company's technicians. Post-delivery, robust customer support and technical assistance are vital, addressing any issues that arise during the rental period. Finally, the end-of-rental process involves the secure collection of equipment, certified data wiping, and either refurbishment for subsequent rentals or responsible recycling, adhering to environmental regulations. The efficiency and quality of these downstream services are critical for customer retention, building brand reputation, and fostering long-term client relationships within a highly competitive market environment.

IT Equipment Rental Market Potential Customers

The IT Equipment Rental Market serves a broad and diverse spectrum of potential customers, spanning various industries, organizational sizes, and operational requirements. At its core, any entity requiring access to IT hardware and software for a temporary period or seeking to optimize capital expenditure without compromising on technological capabilities represents a potential client. Small and Medium-sized Enterprises (SMEs) are particularly significant customers. These businesses often operate with limited IT budgets and fluctuating operational needs, making the cost-effectiveness, scalability, and flexibility of rental solutions highly appealing. Instead of investing heavily in rapidly depreciating assets, SMEs can leverage rental to access enterprise-grade equipment, stay current with technology, and scale their infrastructure up or down in response to business growth, project demands, or seasonal changes. This enables them to maintain a competitive edge and allocate capital to core business functions, circumventing the significant upfront costs and ongoing maintenance burdens associated with outright ownership. Startups also fall into this category, as they prioritize agility and financial prudence during their initial growth phases.

Large enterprises also represent a substantial customer segment for the IT Equipment Rental Market, though their motivations often differ from those of SMEs. While they typically possess significant IT budgets and established infrastructures, large corporations utilize rentals for strategic purposes, such as facilitating temporary projects, managing peak demand, supporting new employee onboarding or training programs, and conducting proof-of-concept testing for new technologies. For instance, a large multinational corporation might rent hundreds of laptops for a global training initiative, or a financial institution might require additional servers for a short-term data migration project. Disaster recovery and business continuity planning are other critical applications for large enterprises, where readily available, pre-configured IT equipment can be rapidly deployed in emergencies. Furthermore, enterprises with a global footprint often leverage rental services to ensure standardized IT infrastructure across diverse geographical locations without the logistical complexities and capital outlay of purchasing equipment in multiple countries, thereby streamlining operations and reducing administrative overhead.

Beyond traditional corporate entities, the market also caters to specialized segments and events. Educational institutions frequently rent IT equipment for short courses, exams, or specific research projects, providing students and faculty with access to advanced tools without permanent acquisition. Event management companies are consistent clients, requiring a wide array of IT equipment – from laptops and projectors to networking gear and interactive displays – to support conferences, trade shows, product launches, and temporary installations. Government agencies and public sector organizations, often operating under strict budgetary constraints and cyclical project funding, find IT equipment rental to be an efficient means of procuring necessary technology without long-term financial commitments. Individual professionals, contractors, or freelancers might also engage in short-term rentals for specific projects, specialized tasks, or when their personal equipment is undergoing maintenance. These diverse applications highlight the pervasive utility of IT equipment rental across a multitude of scenarios where temporary access to high-quality, reliable technology is paramount, cementing its role as a flexible and indispensable resource in the modern economy.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.5 Billion |

| Market Forecast in 2033 | USD 19.5 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Hewlett Packard Enterprise (HPE), Dell Technologies, IBM, Lenovo, Insight Enterprises, CHG-MERIDIAN, Rent-A-Center (RAC), Microlease (now Livingston), XTRA-LEASE, GE Technology Finance, Arrow ECS, CompuCom, PC-WARE, Atea, Softchoice, Connection, World Wide Technology, Presidio, ServerMonkey, Tech Data (TD SYNNEX) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

IT Equipment Rental Market Key Technology Landscape

The technological landscape underpinning the IT Equipment Rental Market is characterized by continuous innovation, driving both the demand for new rental offerings and the operational efficiency of rental providers. At the core, the available rental inventory reflects the latest advancements in computing hardware, including high-performance processors from Intel and AMD, advanced graphics processing units (GPUs) from NVIDIA and AMD essential for AI/ML workloads, and high-speed memory and storage solutions such as NVMe SSDs. Networking equipment includes cutting-edge routers, switches, and firewalls supporting gigabit and multi-gigabit speeds, Wi-Fi 6/6E, and advanced security protocols. Virtualization technologies, whether hardware-assisted or software-defined, are crucial, enabling rental companies to offer virtualized desktops, servers, and storage, providing greater flexibility and resource optimization for clients. The adoption of robust cloud management platforms allows for seamless integration of rented hardware with existing cloud infrastructure, supporting hybrid cloud strategies and simplifying IT operations for enterprises. These technologies are foundational to meeting the diverse and evolving performance, scalability, and reliability requirements of modern businesses, ensuring that rental solutions remain a viable and attractive alternative to outright purchase.

Beyond the core hardware, several emerging and enabling technologies are transforming the operational aspects and service delivery within the IT Equipment Rental Market. Asset tracking and management solutions, often leveraging IoT (Internet of Things) sensors and advanced GPS, provide real-time visibility into equipment location, status, and utilization, significantly improving inventory control, logistics, and preventing loss. Predictive maintenance, powered by AI and machine learning algorithms analyzing usage data, enables rental companies to anticipate equipment failures before they occur, reducing downtime, extending asset lifecycles, and enhancing customer satisfaction. Furthermore, robust cybersecurity technologies are paramount, including advanced encryption, intrusion detection systems, and secure data wiping protocols, ensuring the integrity and confidentiality of client data on rented devices. The integration of enterprise resource planning (ERP) and customer relationship management (CRM) systems streamlines various business processes, from order management and billing to customer support, enhancing overall operational efficiency. These internal technological adoptions are critical for rental providers to scale their operations, offer superior service, and maintain a competitive edge in a demanding market.

The future technology landscape for IT equipment rental is poised for further evolution with the increased integration of automation, advanced analytics, and edge computing. Automation, driven by AI and robotics, is expected to streamline warehousing, equipment preparation, and even some aspects of delivery and retrieval, reducing manual labor and speeding up turnaround times. Data analytics will become even more sophisticated, allowing rental providers to gain deeper insights into customer behavior, demand forecasting, and asset performance, enabling highly personalized rental offerings and dynamic pricing strategies. Edge computing solutions will likely become a more prominent rental category, supporting the growing demand for low-latency processing closer to data sources, particularly for IoT applications and localized AI inference. Blockchain technology could also play a role in enhancing the transparency and security of rental contracts and supply chain management, ensuring verifiable records of equipment usage and maintenance. These technological advancements collectively promise to make IT equipment rental an even more efficient, secure, and responsive service, further solidifying its position as an essential component of modern enterprise IT strategy and fostering continuous innovation within the market.

Regional Highlights

The global IT Equipment Rental Market exhibits distinct regional characteristics, with varying rates of adoption, market maturity, and driving forces. North America, comprising the United States and Canada, holds a significant share of the market, driven by a highly developed IT infrastructure, a large presence of multinational corporations, and a strong culture of adopting flexible and cost-effective business solutions. The region benefits from early adoption of advanced technologies and a dynamic startup ecosystem, which frequently leverage rental models to manage fluctuating IT needs and control capital expenditure. Furthermore, the widespread embrace of remote and hybrid work models has created consistent demand for scalable IT equipment solutions, particularly laptops, desktops, and networking gear for home offices. Stringent data security and compliance requirements in sectors like BFSI and healthcare also push organizations towards reputable rental providers who can ensure secure data handling and certified asset disposal, making North America a mature yet continuously growing market for IT equipment rental services due to its robust economic activity and technological leadership.

Europe represents another mature and substantial market for IT equipment rental, characterized by a diverse economic landscape and varying levels of digital maturity across countries. Western European nations, including Germany, the UK, France, and the Nordics, lead in adoption due to a strong emphasis on operational efficiency, sustainability, and robust regulatory frameworks. Businesses in these regions often utilize IT equipment rental for project-based work, temporary workforce expansions, and to adhere to environmental mandates by favoring solutions that promote the circular economy. Eastern Europe, while growing, is catching up, driven by increasing foreign investment and digital transformation initiatives across industries. The demand in Europe is also influenced by a strong focus on data protection regulations like GDPR, making certified data wiping and secure asset management critical factors for rental providers. The fragmented nature of the European market, with numerous national and regional players, also fosters innovation and competitive service offerings, catering to a wide range of enterprise sizes from SMEs to large corporations that require flexible IT procurement options for diverse operational contexts.

The Asia Pacific (APAC) region is projected to be the fastest-growing market for IT equipment rental, fueled by rapid economic expansion, increasing digitalization, and a burgeoning startup ecosystem, particularly in emerging economies like India, China, and Southeast Asian countries. The sheer volume of new businesses and the rapid pace of industrialization and technological adoption in this region create immense demand for scalable and affordable IT infrastructure. Many companies in APAC, especially SMEs, prefer rental options to minimize upfront capital investment and manage the rapid technological shifts characteristic of the region. Government initiatives promoting digital literacy and smart cities also contribute to the increased demand for IT equipment, much of which is sourced through rental models for various public sector projects and educational programs. While challenges like varying regulatory landscapes and infrastructure disparities exist, the overall trajectory for IT equipment rental in APAC is strongly upward. Latin America, the Middle East, and Africa (MEA) are also experiencing significant growth as digital infrastructure improves and businesses increasingly recognize the benefits of flexible IT solutions for both short-term projects and long-term operational efficiency, gradually transitioning from traditional ownership models to more agile rental frameworks.

- North America: Dominant market share, driven by advanced IT infrastructure, high digital adoption, strong enterprise presence, and demand from hybrid work models.

- Europe: Mature market, characterized by focus on operational efficiency, sustainability, and strong regulatory compliance; significant growth in Western Europe.

- Asia Pacific (APAC): Fastest-growing region, fueled by rapid digitalization, economic expansion, burgeoning startup ecosystem, and demand for cost-effective solutions in emerging economies.

- Latin America: Emerging market with increasing digital transformation initiatives, particularly in Brazil and Mexico, driving demand for flexible IT solutions.

- Middle East and Africa (MEA): Growing market influenced by infrastructure development, smart city initiatives, and diversification of economies away from oil, leading to increased IT expenditure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the IT Equipment Rental Market.- Hewlett Packard Enterprise (HPE)

- Dell Technologies

- IBM

- Lenovo

- Insight Enterprises

- CHG-MERIDIAN

- Rent-A-Center (RAC)

- Microlease (now Livingston)

- XTRA-LEASE

- GE Technology Finance

- Arrow ECS

- CompuCom

- PC-WARE

- Atea

- Softchoice

- Connection

- World Wide Technology

- Presidio

- ServerMonkey

- Tech Data (TD SYNNEX)

Frequently Asked Questions

Analyze common user questions about the IT Equipment Rental market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary benefits of renting IT equipment over purchasing it?

The main benefits include significant cost savings by converting capital expenditure to operational expenditure, enhanced financial flexibility, access to the latest technology without obsolescence concerns, scalability to meet fluctuating demands, and reduced maintenance and disposal burdens. It enables businesses to optimize cash flow and focus on core operations.

How does IT equipment rental support remote and hybrid work models?

IT equipment rental is crucial for remote and hybrid work by providing quick and scalable access to necessary hardware like laptops and networking devices for employees working from various locations. It simplifies deployment, ensures standardized equipment, and allows companies to adapt to workforce changes efficiently without large-scale permanent investments.

What types of IT equipment are commonly available for rental?

Commonly rented IT equipment includes laptops, desktops, servers, storage devices, networking equipment (routers, switches), peripherals (monitors, printers, projectors), and specialized hardware like high-performance workstations or GPUs. Many providers also offer bundled software licenses and technical support services.

Are there any data security concerns associated with renting IT equipment?

While data security is a concern, reputable rental providers implement stringent protocols including certified data wiping (e.g., NIST, DoD standards) at the end of the rental period to ensure no client data remains on returned devices. They also offer secure configuration and ongoing maintenance to protect data during the rental term, making it a secure option.

How does the IT Equipment Rental Market contribute to sustainability?

The IT Equipment Rental Market promotes sustainability by extending the lifecycle of IT assets through reuse and refurbishment. Rental companies manage the responsible recycling of equipment at its end-of-life, reducing electronic waste and minimizing the environmental impact compared to frequent individual purchases and disposals, aligning with circular economy principles.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager