IT Financial Management (ITFM) Tools Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432907 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

IT Financial Management (ITFM) Tools Market Size

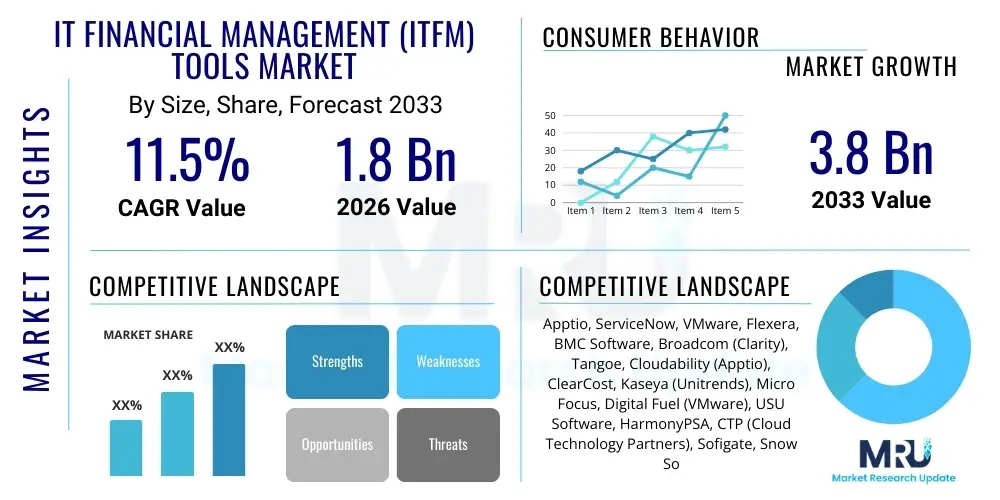

The IT Financial Management (ITFM) Tools Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 3.8 Billion by the end of the forecast period in 2033.

IT Financial Management (ITFM) Tools Market introduction

The IT Financial Management (ITFM) Tools Market encompasses software solutions designed to help organizations manage the costs, investments, and value of their information technology assets and services. These tools provide comprehensive transparency into IT spending, enabling CIOs and CFOs to make informed decisions regarding budgeting, forecasting, and resource allocation. The core functionalities include invoice management, chargeback/showback modeling, IT budget planning, and TCO (Total Cost of Ownership) analysis. Effective ITFM tools transform raw financial data into strategic insights, aligning IT expenditures with overall business objectives and facilitating optimized consumption of cloud and on-premises resources.

Major applications of ITFM tools span across various corporate functions, including cost accountability, regulatory compliance, and capacity planning. They are essential for modernizing financial processes within hybrid IT environments, particularly as organizations rapidly adopt multi-cloud architectures which introduce complex billing structures and unpredictable consumption patterns. By consolidating disparate financial data sources—such as general ledger entries, procurement invoices, and cloud provider usage bills—ITFM platforms offer a unified view of IT value delivery. This comprehensive perspective is critical for preventing shadow IT spending and ensuring that every dollar spent on technology yields measurable business results.

The market is significantly driven by the continuous pressure on organizations to demonstrate IT value and control escalating cloud costs. Benefits of adopting ITFM solutions include improved governance, enhanced financial accuracy, faster decision-making cycles regarding technology investment, and the ability to accurately communicate the cost of IT services to internal business units. The shift toward service-based delivery models (IT as a Service or TaaS) further accelerates the demand for robust ITFM solutions capable of sophisticated cost allocation and performance tracking. Consequently, ITFM tools are moving beyond mere accounting functions to become strategic business management platforms.

IT Financial Management (ITFM) Tools Market Executive Summary

The IT Financial Management (ITFM) Tools Market is currently experiencing robust growth, primarily fueled by the accelerating enterprise migration to complex multi-cloud and hybrid IT environments. A key business trend shaping the market is the increased demand for ‘FinOps’ capabilities—integrating financial accountability into agile development and operational workflows. Organizations are seeking tools that not only track historical spending but also provide predictive cost analytics and automated optimization recommendations, shifting IT finance from a reactive cost center reporting function to a proactive value enablement function. Furthermore, regulatory compliance demands, especially concerning data governance and financial transparency, are compelling large enterprises to adopt formal ITFM solutions.

Regionally, North America maintains the dominant market share due to the high concentration of major technology vendors, early adoption of advanced IT infrastructure, and sophisticated financial reporting standards across large corporations. However, the Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR), driven by rapid digitalization initiatives, increased penetration of cloud services among small and medium-sized enterprises (SMEs), and governmental push for digital transformation in economies like India and China. Europe follows as a mature market, emphasizing robust governance and compliance features within ITFM platforms.

In terms of segmentation trends, the Cloud-Based deployment segment is rapidly overtaking the On-Premises segment, reflecting the broader industry shift toward Software-as-a-Service (SaaS) models which offer scalability, lower initial costs, and faster implementation. Functionally, the IT Benchmarking and Reporting segment is experiencing significant traction as companies prioritize external comparisons and internal performance metrics to validate investment efficacy. Large Enterprises remain the primary consumer base, though the rise of tailored, subscription-based ITFM solutions is expanding adoption among SMEs, particularly those heavily reliant on public cloud infrastructure.

AI Impact Analysis on IT Financial Management (ITFM) Tools Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the IT Financial Management market frequently revolve around its potential to automate manual forecasting processes, improve the accuracy of cost allocation, and provide proactive optimization recommendations. Users are keenly interested in how AI can handle the extreme complexity and granularity of multi-cloud billing data, moving beyond simple rule-based systems. Key concerns include the trust level in AI-generated budget adjustments, the need for explainability in cost anomaly detection, and the integration effort required to merge legacy ITFM platforms with sophisticated machine learning (ML) engines for predictive budgeting. Expectations are high regarding AI's ability to drive efficiency gains and enable real-time, dynamic financial modeling.

The integration of AI and Machine Learning (ML) is fundamentally transforming the capabilities and strategic value proposition of ITFM tools. AI algorithms are deployed to analyze vast datasets encompassing historical spend, operational metrics, utilization rates, and contract data, enabling automated variance analysis and pinpointing cost inefficiencies that human analysts often overlook. Predictive modeling powered by ML allows ITFM platforms to generate highly accurate forecasts based on projected demand spikes, seasonality, and planned infrastructure changes. This shift from backward-looking reporting to forward-looking, prescriptive analytics significantly enhances IT planning accuracy and responsiveness.

Furthermore, AI plays a crucial role in enhancing the chargeback and showback functionalities. By analyzing resource consumption patterns at an granular level, AI ensures fairer and more accurate allocation of shared IT costs (such as network bandwidth or centralized data storage) back to the consuming business units. This increased fairness improves transparency and promotes behavioral changes among internal stakeholders, encouraging more cost-conscious consumption of IT services. The automation of identifying and flagging billing errors or anomalous spikes in cloud spending also significantly reduces administrative overhead and helps prevent financial leakage, securing AI's position as a core component of next-generation ITFM solutions.

- Automated Cost Anomaly Detection: AI identifies unusual spending patterns in cloud services instantly.

- Predictive Budgeting and Forecasting: ML models generate accurate future spend projections based on operational data.

- Optimized Resource Allocation: AI recommends specific actions for downsizing or rightsizing cloud resources to minimize wastage.

- Enhanced Cost Transparency: ML algorithms improve the granularity and fairness of internal cost allocation (chargeback).

- Intelligent Vendor Invoice Processing: AI automates the reconciliation and validation of complex multi-cloud invoices.

DRO & Impact Forces Of IT Financial Management (ITFM) Tools Market

The market for IT Financial Management tools is shaped by a powerful combination of growth drivers, structural restraints, and emerging opportunities, all consolidated under strong impact forces emanating from the digital transformation agenda. The principal driver is the explosive growth of complex, distributed IT environments, particularly the adoption of hybrid and multi-cloud strategies, which inherently lack unified financial visibility. Organizations are struggling to manage the economic complexity of pay-as-you-go consumption models, making ITFM tools essential for cost control and accountability. Opportunities are concentrated in the rise of specialized FinOps solutions and the increasing focus on TBM (Technology Business Management) frameworks, pushing IT finance out of the back office and into strategic planning sessions.

A significant restraint facing market expansion is the inherent complexity and resistance to change during the implementation phase of these tools. Integrating ITFM software requires significant effort to standardize data inputs across disparate systems—such as procurement, asset management, and general ledger—and often necessitates a complete overhaul of internal financial reporting procedures. Moreover, the initial high cost of licensing, especially for comprehensive enterprise-level platforms, coupled with the need for specialized IT finance expertise to manage and interpret the output, presents a substantial barrier to entry for smaller organizations or those with constrained budgets. Overcoming this inertia requires demonstrating immediate, tangible ROI.

Impact forces are heavily weighted toward market acceleration, primarily driven by the imperative to achieve cost optimization amid economic volatility and the strategic necessity of technology modernization. The shift toward subscription-based IT services and the increased executive demand for IT transparency amplify the necessity for robust ITFM governance. Furthermore, the emerging opportunity for incorporating environmental, social, and governance (ESG) reporting into IT spending (Green IT metrics) offers a new strategic use case for ITFM platforms, allowing companies to track and report on the sustainability of their technology investments, thus broadening the tool's relevance beyond traditional financial metrics.

Segmentation Analysis

The IT Financial Management (ITFM) Tools Market is extensively segmented based on Deployment Model, Component, Functionality, Enterprise Size, and Industry Vertical, reflecting the diverse needs of modern enterprises managing technology investments. The segmentation provides granular insights into specific demand pockets, such as the preference for SaaS deployment in the SME segment versus the continued reliance on customized on-premises solutions in highly regulated industries like banking. Analyzing these segments helps vendors tailor solutions that effectively address specific pain points, ranging from infrastructure cost allocation to application portfolio management across different scales and regulatory environments.

- By Component:

- Solutions (Software)

- Services (Consulting, Implementation, Support & Maintenance)

- By Deployment Model:

- Cloud-Based (SaaS)

- On-Premises

- By Functionality:

- IT Budgeting and Planning

- Cost Transparency and Allocation (Showback/Chargeback)

- Vendor and Contract Management

- Application Portfolio Management (APM)

- IT Benchmarking and Reporting

- By Enterprise Size:

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

- By Industry Vertical:

- Banking, Financial Services, and Insurance (BFSI)

- IT and Telecom

- Healthcare and Life Sciences

- Manufacturing

- Retail and Consumer Goods

- Government and Public Sector

- Others

Value Chain Analysis For IT Financial Management (ITFM) Tools Market

The value chain for the IT Financial Management (ITFM) Tools Market commences with the upstream segment, dominated by core technology providers supplying foundational components such as sophisticated data analytics engines, financial modeling algorithms, and cloud integration middleware. These providers focus on developing specialized modules capable of handling massive volumes of heterogeneous financial and operational data derived from cloud APIs, general ledgers, and IT Service Management (ITSM) systems. Research and development in this stage are crucial, focusing on incorporating advanced AI/ML capabilities for accurate forecasting and automated anomaly detection. Key upstream activities include software development, patent registration for specialized cost allocation models, and forming strategic partnerships with major cloud hyperscalers (AWS, Azure, GCP) to ensure seamless data ingestion and optimization capabilities.

The central manufacturing and distribution segment involves the ITFM solution developers and platform owners who integrate these foundational technologies into marketable products. This stage involves rigorous testing, system integration, and developing user-friendly interfaces suitable for both financial professionals (CFOs, Controllers) and technical leaders (CIOs, VPs of Infrastructure). Distribution channels are critical and are broadly categorized into direct and indirect methods. Direct distribution involves vendors selling licenses and SaaS subscriptions directly to enterprise customers, often bundled with professional consulting services for complex implementations. Indirect channels leverage a network of system integrators, value-added resellers (VARs), and technology consultants who specialize in deploying, customizing, and managing ITFM solutions within client ecosystems.

The downstream component of the value chain is focused on service delivery, implementation, and post-sales support, directly impacting customer satisfaction and tool adoption rates. Specialized IT consulting firms play a major role here, assisting clients in mapping their existing TBM frameworks onto the new software and ensuring organizational change management. Effective downstream activities include continuous training, provision of managed FinOps services, and ongoing software maintenance to handle updates in cloud vendor pricing structures and new regulatory requirements. This stage is vital for securing recurring revenue streams and driving high client retention, as the strategic value of ITFM tools is realized only through successful, long-term operational integration.

IT Financial Management (ITFM) Tools Market Potential Customers

Potential customers for IT Financial Management (ITFM) tools primarily comprise organizations across all sizes that maintain substantial and increasingly complex IT infrastructure, requiring rigorous financial control and transparency. The largest segment of buyers consists of Large Enterprises, particularly those operating globally across multiple business units and relying heavily on a hybrid blend of legacy on-premises systems and public cloud services. These enterprises face significant challenges in accurately allocating shared IT costs, managing complex vendor contracts, and justifying large capital expenditures for technology initiatives. The CIO and CFO offices within these entities are the key decision-makers, driven by the need to optimize spending, reduce waste, and demonstrate the tangible business value derived from technological investments.

The secondary, yet rapidly expanding, customer segment includes Small and Medium-sized Enterprises (SMEs) that are “born in the cloud” or have aggressively adopted cloud-native architectures. Although their IT budgets are smaller, the complexity of managing multi-cloud subscriptions and ensuring FinOps governance is equally critical. These SMEs typically prefer lighter, highly scalable, SaaS-based ITFM solutions that require minimal infrastructure investment and can integrate seamlessly with existing accounting and operational systems. The banking, financial services, and insurance (BFSI) sector represents a critical vertical market, driven by stringent regulatory reporting requirements (e.g., Basel III, GDPR) and the constant need to manage risk associated with vast technology portfolios, making them consistent high-value customers for specialized ITFM solutions.

Furthermore, any organization undergoing large-scale digital transformation initiatives—such as migrating core applications, implementing DevOps practices, or adopting widespread remote work technologies—becomes a prime prospect for ITFM tools. These tools are indispensable during periods of transformation to track costs associated with migration projects and accurately model the long-term operational expenses of new environments. Government and public sector bodies, facing increasing scrutiny over budget allocation and efficiency, also represent a growing customer base, seeking ITFM solutions to enhance fiscal accountability and optimize taxpayer-funded technology investments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 3.8 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Apptio, ServiceNow, VMware, Flexera, BMC Software, Broadcom (Clarity), Tangoe, Cloudability (Apptio), ClearCost, Kaseya (Unitrends), Micro Focus, Digital Fuel (VMware), USU Software, HarmonyPSA, CTP (Cloud Technology Partners), Sofigate, Snow Software, OneView, Calero, Turbonomic (IBM) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

IT Financial Management (ITFM) Tools Market Key Technology Landscape

The technological core of modern IT Financial Management (ITFM) tools is centered around robust data ingestion, integration, and advanced analytical capabilities designed to normalize and contextualize financial data originating from highly disparate sources. Key technologies utilized include APIs and connectors specifically developed for seamless integration with major cloud providers (AWS Cost Explorer, Azure Billing APIs, Google Cloud Billing), ensuring real-time data flow for consumption monitoring. Furthermore, sophisticated ETL (Extract, Transform, Load) processes are essential for cleaning and normalizing structured data from traditional ERP and general ledger systems alongside unstructured operational data from ITSM and asset management databases, ensuring data fidelity required for accurate financial modeling and allocation.

Another crucial technological development involves the adoption of Machine Learning (ML) and Artificial Intelligence (AI) algorithms, which are utilized for predictive modeling, automated anomaly detection, and optimization recommendations. These technologies analyze temporal trends in spending and utilization to forecast future budgets with high accuracy, moving ITFM beyond historical reporting. The underlying architecture often relies on big data processing frameworks, such as Apache Hadoop or Spark, to handle the vast scale and velocity of operational metrics generated by large enterprise environments, particularly those involving containerization (Kubernetes) and serverless computing, which introduce highly variable cost structures.

Furthermore, visualization technologies play a critical role in translating complex financial data into actionable business intelligence. Modern ITFM platforms utilize advanced data visualization libraries and dashboarding tools to provide granular, user-friendly views of spending patterns segmented by business unit, application, or service line. Cloud-native development practices, including microservices and containerization, are increasingly employed by ITFM vendors themselves to ensure their platforms are highly scalable, resilient, and capable of rapid deployment across various environments, facilitating the delivery of SaaS solutions that meet stringent enterprise security and performance standards.

Regional Highlights

North America currently holds the dominant position in the IT Financial Management (ITFM) Tools Market, characterized by early and widespread adoption driven by technological maturity and the presence of numerous large multinational corporations headquartered in the region. The culture of strict corporate governance, demanding high levels of financial transparency, along with the early and extensive migration to public cloud infrastructure, has necessitated sophisticated ITFM solutions. The United States, in particular, leads the investment, spurred by competitive pressures to optimize highly complex IT portfolios and a proactive approach to adopting advanced frameworks like Technology Business Management (TBM).

Europe represents a mature and significant market segment, defined by a strong focus on regulatory compliance, particularly GDPR, which influences data management and cost allocation processes. Western European nations, including the UK, Germany, and France, exhibit robust demand for ITFM tools to manage complex multinational operations and adhere to varied national tax and financial reporting standards. The European market often shows a higher preference for solutions that deeply integrate risk management and compliance features alongside traditional financial tracking capabilities. The ongoing digital transformation across key industries like automotive and financial services continues to drive steady demand.

The Asia Pacific (APAC) region is forecasted to be the fastest-growing market globally, buoyed by rapid economic expansion, increasing foreign direct investment, and massive state-sponsored digitalization initiatives across countries such as China, India, and Southeast Asia. As local enterprises rapidly scale their operations and leapfrog older legacy infrastructure directly into cloud and hybrid environments, the need for IT cost governance becomes critical. Although budget constraints in emerging economies can sometimes restrain uptake, the increasing penetration of SaaS models and the growing acceptance of FinOps principles are rapidly lowering the barrier to entry, making APAC a high-potential future growth engine for the ITFM market.

- North America: Dominant market share driven by technological maturity, high public cloud adoption, and strong emphasis on TBM frameworks.

- Europe: Strong demand fueled by regulatory compliance needs (GDPR) and complex multinational IT governance requirements.

- Asia Pacific (APAC): Highest CAGR due to rapid digitalization, significant investment in cloud infrastructure, and increasing SME adoption of SaaS solutions.

- Latin America: Emerging market focusing on essential cost allocation features, often driven by subsidiaries of global corporations seeking standardized IT reporting.

- Middle East and Africa (MEA): Growth concentrated in oil and gas, banking, and government sectors, focused on large-scale infrastructure projects requiring centralized financial visibility.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the IT Financial Management (ITFM) Tools Market.- Apptio

- ServiceNow

- VMware

- Flexera

- BMC Software

- Broadcom (Clarity)

- Tangoe

- Cloudability (acquired by Apptio)

- ClearCost

- Kaseya (Unitrends)

- Micro Focus

- Digital Fuel (acquired by VMware)

- USU Software

- HarmonyPSA

- CTP (Cloud Technology Partners)

- Sofigate

- Snow Software

- OneView

- Calero

- Turbonomic (acquired by IBM)

Frequently Asked Questions

Analyze common user questions about the IT Financial Management (ITFM) Tools market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of IT Financial Management (ITFM) tools in a modern enterprise?

The primary function of ITFM tools is to provide holistic financial transparency into an organization's IT spending, costs, and investments. These tools enable accurate budgeting, forecasting, and cost allocation (chargeback/showback), ensuring IT expenditures are aligned with business strategy and optimizing the total cost of ownership (TCO) across hybrid and multi-cloud environments.

How does the adoption of cloud computing influence the demand for ITFM tools?

Cloud computing significantly increases the demand for ITFM tools because the pay-as-you-go, consumption-based pricing models introduce extreme complexity and volatility into IT budgets. ITFM tools are essential for managing variable cloud usage, optimizing resource rightsizing, reconciling complex vendor invoices, and implementing robust FinOps practices to prevent cost overruns.

What are the main differences between ITFM and FinOps?

ITFM is a broader discipline focused on the financial management of all IT assets and services, often centralized within the finance or IT reporting teams. FinOps (Cloud Financial Operations) is a specific operational framework and cultural practice applied primarily to variable cloud spend, emphasizing collaboration between finance, technology, and business teams to enable real-time, data-driven financial decision-making on cloud usage.

Which industry vertical is the largest adopter of ITFM solutions?

The Banking, Financial Services, and Insurance (BFSI) sector is consistently the largest adopter of ITFM solutions. This high adoption rate is driven by the industry's significant technology dependence, large transaction volumes, strict regulatory reporting requirements, and the critical need to manage financial risk associated with massive and complex IT infrastructure portfolios.

How is AI transforming the capabilities of IT Financial Management solutions?

AI is transforming ITFM by introducing predictive and prescriptive capabilities, moving beyond historical reporting. AI/ML algorithms automate the detection of spending anomalies, generate highly accurate predictive forecasts based on demand signals, and provide specific, automated recommendations for optimizing cloud resource utilization, leading to enhanced efficiency and strategic financial planning.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager