IT Spending in Automotive Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434665 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

IT Spending in Automotive Market Size

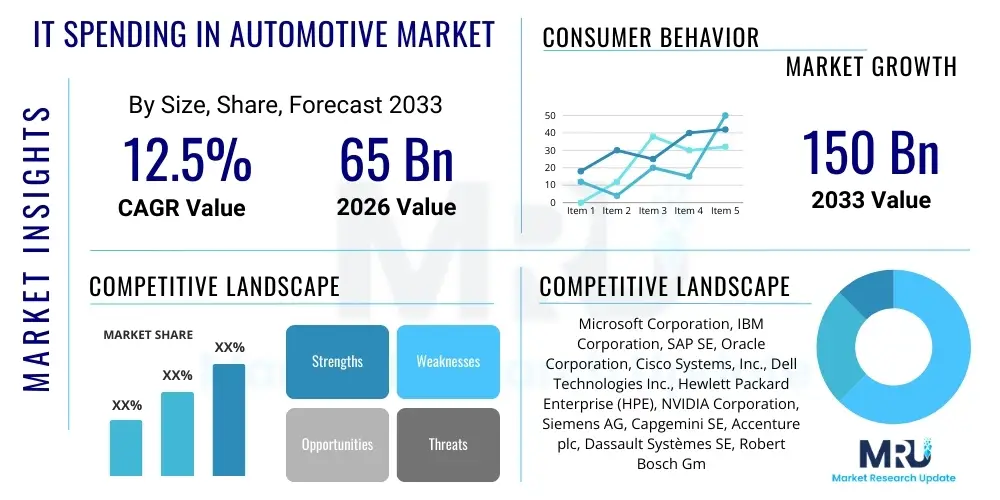

The IT Spending in Automotive Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 65 Billion in 2026 and is projected to reach USD 150 Billion by the end of the forecast period in 2033. This substantial expansion is primarily fueled by the pervasive digital transformation initiatives undertaken by automotive manufacturers (OEMs) and suppliers, driven by the shift towards electric vehicles (EVs), autonomous driving systems, and the implementation of sophisticated enterprise resource planning (ERP) solutions tailored for complex global supply chains. The necessity for advanced cybersecurity measures to protect connected vehicle ecosystems and proprietary design data further contributes to heightened IT investment across the value chain.

The increasing complexity of modern vehicle architecture, characterized by a transition toward software-defined vehicles (SDVs), demands continuous and significant investment in IT infrastructure, specialized software, and IT services. OEMs are rapidly adopting cloud computing environments to handle massive volumes of telemetry data generated by connected cars and to facilitate over-the-air (OTA) updates, crucial for maintaining vehicle functionality and security post-sale. This shift necessitates robust spending on analytics platforms, data centers, and advanced network solutions capable of managing high bandwidth and low latency requirements. Furthermore, competitive pressures require manufacturers to optimize production processes using IT-enabled solutions like predictive maintenance and digital twins, integrating operational technology (OT) with information technology (IT) systems for enhanced efficiency.

IT Spending in Automotive Market introduction

The IT Spending in Automotive Market encompasses all expenditures made by automotive industry stakeholders—including OEMs, component suppliers, dealerships, and mobility providers—on hardware, software, IT services, and telecommunications infrastructure essential for business operations, product development, and customer engagement. This domain extends beyond standard corporate IT to include investments directly supporting vehicle innovation, such as embedded systems software development tools, advanced simulation platforms for ADAS testing, and specialized cybersecurity software for in-vehicle networks. Key applications involve enhancing manufacturing processes through Industry 4.0 principles, streamlining global sales and marketing operations using advanced Customer Relationship Management (CRM) tools, and accelerating Research & Development (R&D) cycles via high-performance computing (HPC) and artificial intelligence (AI) integration.

The primary benefits derived from increased IT spending include improved operational efficiency, reduced time-to-market for new vehicle models, enhanced supply chain resilience, and the creation of new revenue streams through subscription-based services enabled by connected car technologies. Driving factors for this market expansion are multifaceted, anchored by the mandatory shift towards electrification and autonomous driving, which fundamentally transforms the vehicle from a mechanical product into a complex networked device. Regulatory demands regarding data privacy (e.g., GDPR, CCPA) and vehicle safety standards also necessitate substantial IT investments in data governance and security compliance. Moreover, the global push for sustainability and efficient resource management compels organizations to leverage advanced analytics and cloud solutions to optimize energy use in manufacturing and logistics.

IT Spending in Automotive Market Executive Summary

The global IT Spending in Automotive Market is characterized by robust growth, driven primarily by ongoing digital transformation and the industry’s pivot towards Software-Defined Vehicles (SDVs). Business trends indicate a shift in IT budgets from traditional ERP and back-office systems towards specialized product-related software (e.g., embedded software, ADAS stacks) and advanced cloud infrastructure services necessary to manage vehicle lifecycle data and Over-The-Air (OTA) updates. Key investments are concentrated in leveraging Big Data analytics to extract actionable insights from vehicle telemetry and enhancing cybersecurity defense mechanisms to protect sensitive intellectual property and consumer data against sophisticated cyber threats. Strategic mergers and acquisitions between technology providers and traditional automotive companies are accelerating the adoption of new technologies.

Regionally, Asia Pacific (APAC), particularly China, Japan, and South Korea, stands out due to massive investments in electric vehicle production capacity and smart infrastructure development, making it the fastest-growing market. North America and Europe maintain leading positions in terms of total spending, focusing heavily on R&D for autonomous driving technologies, sophisticated factory automation systems, and adherence to stringent data governance regulations. Segment trends highlight that the Software segment is expanding at the highest CAGR, specifically driven by enterprise applications (PLM, SCM) and the increasing complexity of embedded vehicle software. Furthermore, the Service segment, encompassing consulting, system integration, and managed services, is gaining prominence as OEMs rely on external expertise to navigate complex IT landscapes and expedite cloud migration.

AI Impact Analysis on IT Spending in Automotive Market

User inquiries regarding AI's influence on the automotive IT spending landscape frequently center on three critical themes: efficiency gains in R&D, operational expenditure optimization, and the necessity of specialized AI infrastructure. Users are keen to understand how AI implementations, such as generative AI for code development and predictive AI for manufacturing quality control, will redistribute IT budgets. Concerns often revolve around the high initial investment required for specialized hardware (e.g., GPUs for training large autonomous driving models) and the skills gap necessary to deploy and maintain these complex systems. Expectations are high regarding AI’s potential to accelerate the development cycle of ADAS and autonomous features, driving investment not only in AI software licenses but also in cloud services optimized for machine learning operations (MLOps) and substantial data labeling and preparation tools.

- AI enhances software development lifecycle (SDLC) through automated code generation and testing, reducing time-to-market and diverting IT spending towards development platforms.

- Predictive maintenance analytics, powered by AI, optimizes manufacturing processes, shifting spending from reactive maintenance to proactive monitoring systems and IoT infrastructure.

- Significant investment is directed towards high-performance computing (HPC) and specialized cloud instances required for training complex autonomous driving algorithms (AI compute infrastructure).

- AI-driven cybersecurity tools are becoming standard, increasing spending on intelligent threat detection and response platforms tailored for interconnected vehicle systems.

- Customer experience platforms utilize AI for personalized marketing, requiring substantial investment in advanced CRM systems and data integration capabilities.

- Generative AI tools are being implemented for vehicle design simulation and materials science, necessitating enhanced computational resources and specialized software licenses within R&D departments.

DRO & Impact Forces Of IT Spending in Automotive Market

The IT Spending in Automotive Market is primarily driven by the mandatory industry transition toward electric and autonomous vehicles, demanding unprecedented investment in digital infrastructure to support complex software functions and data management. Restraints primarily involve the substantial capital expenditure required for massive digital transformation projects and the critical shortage of specialized IT talent skilled in areas like embedded software security, cloud architecture, and AI/ML model deployment. Opportunities are vast, particularly in leveraging the connected vehicle ecosystem to create new subscription-based services, exploit efficiencies through sophisticated supply chain digitization, and monetize vehicle data, providing fresh impetus for ongoing IT investment. These factors converge to create powerful impact forces that reshape budgetary allocations, prioritizing agile, cloud-native solutions over legacy systems.

Drivers are centered on regulatory mandates for safety and emissions, which necessitate complex software development (e.g., ISO 26262 compliance requires robust documentation systems), and strong consumer demand for enhanced connectivity, infotainment, and driver assistance features. The need for global operational resilience, demonstrated during recent supply chain disruptions, pushes OEMs to adopt advanced Supply Chain Management (SCM) software integrated with real-time tracking and predictive analytics. This systematic digitization of the entire automotive lifecycle, from concept design using Product Lifecycle Management (PLM) tools to end-of-life recycling management software, ensures sustained growth in IT expenditures across all market segments.

Restraints often involve the inertia associated with migrating decades-old legacy systems (especially in manufacturing operations) to modern cloud environments, alongside inherent cybersecurity risks amplified by the sheer number of attack surfaces created by vehicle connectivity. Furthermore, fluctuating global economic conditions and raw material costs can temporarily impact discretionary IT spending, often leading companies to prioritize mission-critical R&D software over large-scale infrastructure upgrades. Addressing data privacy and interoperability challenges across diverse global markets also imposes complex compliance costs, which act as a subtle but persistent constraint on generalized IT deployment strategies.

Opportunities are predominantly found in the explosive growth of the Electric Vehicle (EV) segment, requiring specialized IT tools for battery management system development and charging infrastructure optimization. The rapid standardization of open-source software platforms within the industry (e.g., AUTOSAR) fosters innovation and lowers long-term integration costs, encouraging further IT adoption. Moreover, the strategic alignment of IT spending with sustainability goals, such as deploying cloud-based energy management systems in manufacturing plants, provides strong business justification for future investments. The continuous advancement in 5G and edge computing also opens new pathways for low-latency vehicle-to-everything (V2X) communication, demanding renewed investment in network and data processing infrastructure.

Segmentation Analysis

The IT Spending in Automotive Market is meticulously segmented based on Type (Hardware, Software, Services), Application (Manufacturing, Sales & Marketing, R&D, Corporate Functions), and Deployment (On-premise, Cloud). This segmentation provides a granular view of investment priorities within the industry. The Software segment currently holds the dominant market share, driven by the escalating need for sophisticated applications such as Product Lifecycle Management (PLM), Enterprise Resource Planning (ERP), and specialized embedded software for in-vehicle systems. The Services segment is anticipated to witness the fastest growth, primarily fueled by the increasing complexity of system integration tasks, managed security services, and specialized consulting required for large-scale digital transformation initiatives, particularly cloud migration and AI implementation projects across global operations.

From an application standpoint, R&D expenditure remains critically high, focusing on simulation tools, ADAS development platforms, and data analysis infrastructure necessary to validate autonomous technologies. However, the Manufacturing segment is rapidly increasing its share of IT spending due to the adoption of Industry 4.0 principles, including IoT integration, robotic automation control systems, and specialized Manufacturing Execution Systems (MES) to manage highly flexible production lines required for mixed-model manufacturing (e.g., producing both internal combustion engine and electric vehicles on the same line). The strategic shift toward subscription-based services post-sale is also driving spending in the Sales & Marketing segment on advanced analytics and customer engagement platforms.

- Type:

- Hardware (Servers, Storage, Networking Equipment, Telematics Hardware)

- Software (Enterprise Applications, Embedded Software, Security Software, Analytics Tools)

- Services (Consulting, System Integration, Managed Services, IT Outsourcing)

- Application:

- Manufacturing (MES, SCADA, Predictive Maintenance, IoT Integration)

- Sales & Marketing (CRM, Dealership Management Systems, Digital Retailing)

- Research & Development (PLM, CAD/CAE, Simulation, AI/ML Platforms)

- Corporate Functions (ERP, HCM, Finance, IT Infrastructure Management)

- Deployment:

- On-premise (Traditional data centers, legacy manufacturing IT)

- Cloud (Public Cloud, Private Cloud, Hybrid Cloud for scalability and data handling)

Value Chain Analysis For IT Spending in Automotive Market

The value chain for IT spending in the automotive sector is highly complex, involving multiple layers from upstream technology providers to downstream end-users (OEMs and suppliers). Upstream analysis focuses on core technology components supplied by semiconductor manufacturers, hardware vendors (e.g., server and storage providers), and fundamental operating system and platform providers (e.g., major cloud hyperscalers). These entities dictate the fundamental capabilities and cost structure of the IT solutions. The midstream involves specialized software vendors (for CAD/CAE, PLM, and embedded systems) and comprehensive IT service integrators who customize and deploy these solutions across the automotive enterprise, often requiring deep domain expertise in vehicle engineering and regulatory compliance.

Downstream analysis centers on how OEMs and Tier 1 suppliers consume these IT services to optimize operations (manufacturing efficiency, supply chain tracking) and enhance their final products (software-defined features, ADAS). Distribution channels are predominantly indirect, relying heavily on specialized channel partners, value-added resellers (VARs), and system integrators who bridge the gap between global IT providers (like Microsoft or SAP) and the specific needs of automotive clients. However, there is a growing trend toward direct engagement, particularly with major cloud providers for large-scale infrastructure contracts and with select embedded software specialists for core vehicle platform development, shifting the procurement model towards a more strategic partnership approach.

The integration of IT systems into the production line (OT/IT convergence) necessitates highly specialized integration skills, making the service layer a critical determinant of value delivery. Direct channels are more common for highly customized R&D software and large consulting projects, while indirect channels efficiently handle standardized enterprise applications and hardware procurement. This intricate ecosystem requires rigorous vendor management and long-term strategic planning by OEMs to ensure technological consistency and security across their global operations and extended supply chain network.

IT Spending in Automotive Market Potential Customers

The potential customers for IT spending in the automotive market span the entire ecosystem, primarily consisting of Automotive Original Equipment Manufacturers (OEMs), Tier 1 and Tier 2 component suppliers, and the expanding segment of mobility and fleet management providers. OEMs represent the largest market segment, requiring comprehensive IT investments across all applications, from advanced simulation in R&D to global enterprise resource planning and dealership management systems. Their needs are particularly focused on developing complex embedded systems, managing vast vehicle data lakes, and establishing secure OTA update capabilities, necessitating high investment in specialized software and cloud infrastructure.

Tier 1 suppliers are increasingly significant customers, mandated by OEMs to implement sophisticated IT systems—such as advanced SCM, quality management systems (QMS), and specialized engineering software—to ensure seamless integration into the OEM’s digital supply chain and quality processes. Mobility providers, including ride-sharing companies and autonomous vehicle fleet operators, form a high-growth customer segment focused on leveraging cloud and AI technologies for fleet optimization, predictive maintenance scheduling, and enhancing customer service platforms, driving demand for specialized telematics and data analytics services.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 65 Billion |

| Market Forecast in 2033 | USD 150 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Microsoft Corporation, IBM Corporation, SAP SE, Oracle Corporation, Cisco Systems, Inc., Dell Technologies Inc., Hewlett Packard Enterprise (HPE), NVIDIA Corporation, Siemens AG, Capgemini SE, Accenture plc, Dassault Systèmes SE, Robert Bosch GmbH, Continental AG, Harman International (Samsung), Tech Mahindra Ltd., Cognizant Technology Solutions, Tata Consultancy Services (TCS), Wipro Limited, Amazon Web Services (AWS) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

IT Spending in Automotive Market Key Technology Landscape

The IT spending landscape in the automotive sector is dominated by several pivotal technologies essential for facilitating the transition to software-defined mobility. Cloud computing, particularly hybrid and multi-cloud strategies, stands out as fundamental, offering the scalable infrastructure required to process petabytes of sensor data generated by test fleets and connected vehicles, and to support global ERP and PLM deployments. High-Performance Computing (HPC) remains critical in R&D for rapid crash testing simulations, aerodynamic analysis, and training complex AI models used in ADAS development. Furthermore, the integration of 5G and edge computing is accelerating, enabling low-latency processing of critical data closer to the vehicle or the factory floor, thereby supporting real-time decision-making in autonomous driving and manufacturing processes, demanding significant investment in optimized networking hardware and software.

The increasing focus on cybersecurity represents another major technological investment area. With vehicles becoming part of the Internet of Things (IoT), robust security solutions covering both enterprise IT (protecting intellectual property) and in-vehicle systems (protecting against remote hacking) are mandatory. This includes investment in encryption technologies, intrusion detection systems (IDS), Security Information and Event Management (SIEM) platforms, and specialized security consulting services focused on automotive standards (e.g., ISO/SAE 21434). Furthermore, the rise of specialized development tools, such as advanced DevOps platforms and MLOps tools, is crucial for managing the continuous integration and continuous deployment (CI/CD) pipelines necessary for frequent over-the-air software updates and feature improvements in modern vehicles.

Digital twin technology is rapidly moving from a niche concept to a mainstream tool, demanding significant IT expenditure on modeling software, data integration platforms, and visualization hardware. OEMs are leveraging digital twins to simulate entire production lines before physical construction (Manufacturing 4.0) and to create virtual representations of vehicles for continuous software validation, significantly reducing physical prototyping costs. This requires investment in specialized Industrial IoT platforms and data historization technologies capable of managing complex time-series data. The convergence of IT and Operational Technology (OT) necessitates sophisticated integration middleware and protocols, ensuring that shop-floor data is seamlessly accessible to enterprise planning systems, further driving software and service spending.

Regional Highlights

The dynamics of IT spending exhibit distinct characteristics across major global regions, influenced by regional manufacturing hubs, regulatory environments, and the speed of EV adoption.

- North America: Characterized by high R&D spending, particularly in Silicon Valley and Detroit, focusing heavily on autonomous driving technologies, advanced vehicle connectivity, and sophisticated cloud-based data management solutions. Significant investment is directed toward cybersecurity and regulatory compliance (e.g., California Consumer Privacy Act – CCPA) for handling sensitive customer and vehicle data.

- Europe: Driven by strict environmental regulations (mandating EV adoption) and stringent data privacy laws (GDPR). European OEMs prioritize investments in sustainable manufacturing IT systems, Supply Chain Resilience platforms, and robust PLM tools to manage complex global engineering projects across diverse European R&D centers.

- Asia Pacific (APAC): The fastest-growing region, led by massive IT investment in China for EV manufacturing scale-up and smart city infrastructure integration. Japan and South Korea focus on advanced factory automation (Industry 4.0) and leveraging 5G for V2X communications, driving spending on networking and edge computing hardware and specialized services.

- Latin America (LATAM): Growth is steady but focused primarily on modernizing core enterprise systems (ERP, SCM) to improve operational efficiency and competitiveness. Investments are generally pragmatic, often prioritizing cloud services for cost-effective scalability over large, on-premise hardware deployments.

- Middle East and Africa (MEA): Emerging market focused on building foundational digital infrastructure, often driven by government initiatives (e.g., Saudi Vision 2030). Spending targets modernization of dealership networks and establishing local data centers to support initial smart mobility projects and fleet management services.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the IT Spending in Automotive Market.- Microsoft Corporation

- IBM Corporation

- SAP SE

- Oracle Corporation

- Cisco Systems, Inc.

- Dell Technologies Inc.

- Hewlett Packard Enterprise (HPE)

- NVIDIA Corporation

- Siemens AG

- Capgemini SE

- Accenture plc

- Dassault Systèmes SE

- Robert Bosch GmbH

- Continental AG

- Harman International (Samsung)

- Tech Mahindra Ltd.

- Cognizant Technology Solutions

- Tata Consultancy Services (TCS)

- Wipro Limited

- Amazon Web Services (AWS)

Frequently Asked Questions

Analyze common user questions about the IT Spending in Automotive market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver of increased IT spending within the automotive sector?

The primary driver is the mandated transition towards Software-Defined Vehicles (SDVs), which requires vast investment in specialized embedded software development tools, high-performance computing (HPC) for R&D simulation, and robust cloud infrastructure to support continuous over-the-air (OTA) updates and handle massive data volumes generated by connected and autonomous features.

Which segment—Hardware, Software, or Services—is experiencing the fastest growth in automotive IT expenditure?

The Services segment is experiencing the fastest growth rate. This acceleration is driven by the industry's need for external expertise in complex areas like cloud migration strategy, AI model deployment (MLOps), system integration between new digital platforms and legacy manufacturing systems (OT/IT convergence), and specialized cybersecurity consulting.

How does the shift to electric vehicles (EVs) specifically influence IT budgets?

The shift to EVs requires significant IT investment in battery management system (BMS) software development, power electronics simulation tools, and dedicated cloud-based platforms for optimizing charging infrastructure and managing vehicle range data. Furthermore, EV manufacturing often utilizes highly automated, IoT-integrated production lines, increasing spending on Manufacturing Execution Systems (MES) and industrial control software.

What role does cybersecurity spending play in the automotive IT market?

Cybersecurity is a high-priority, non-negotiable IT expense. Spending is directed at protecting both the corporate IT environment (intellectual property, design data) and the vehicle itself (in-vehicle network security, secure communication protocols for V2X, and compliance with UNECE WP.29 regulations). Investments include intrusion detection, secure coding practices, and threat monitoring services.

Is the automotive industry preferring on-premise or cloud deployment for new IT solutions?

The industry is rapidly shifting towards hybrid and multi-cloud deployment models. While mission-critical manufacturing execution systems and certain proprietary R&D data often remain on-premise, new applications—especially data analytics platforms, connected vehicle backend services, and global ERP rollouts—are overwhelmingly deployed on the cloud to leverage scalability, global accessibility, and cost efficiencies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager