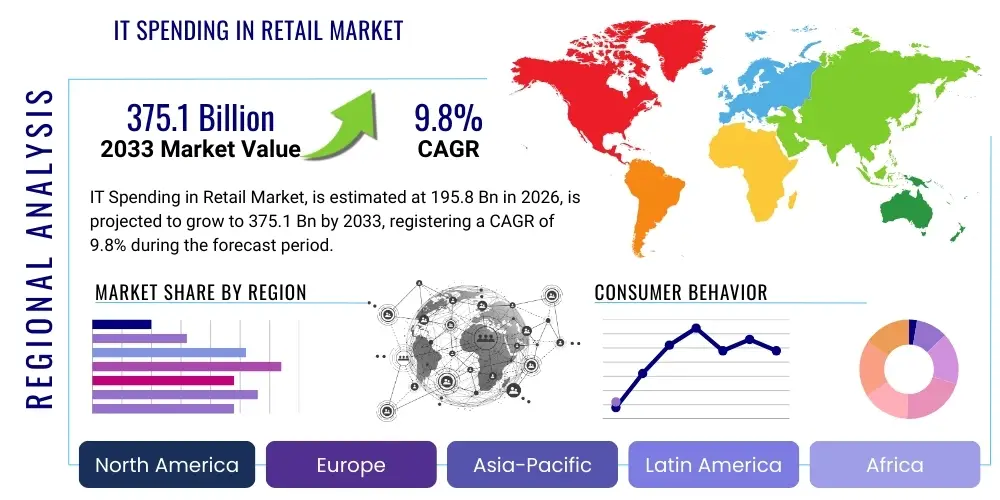

IT Spending in Retail Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439203 | Date : Jan, 2026 | Pages : 246 | Region : Global | Publisher : MRU

IT Spending in Retail Market Size

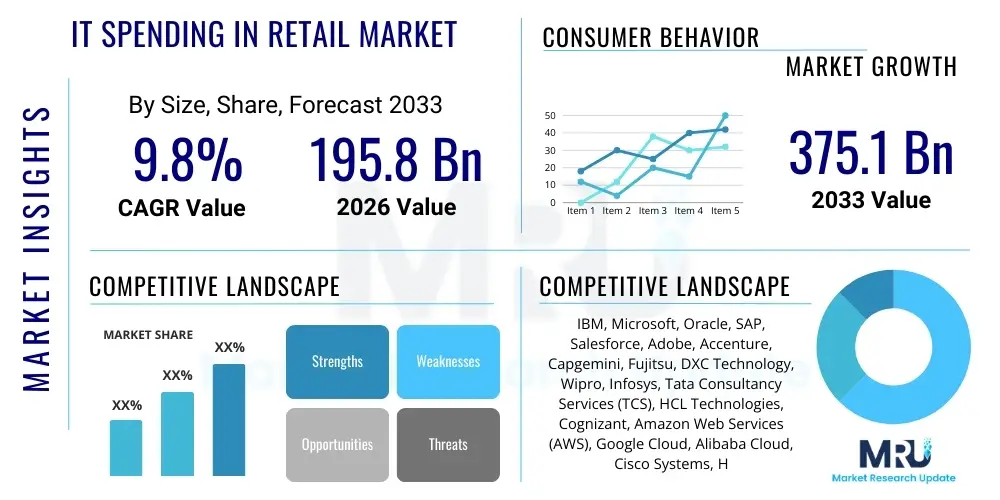

The IT Spending in Retail Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.8% between 2026 and 2033. The market is estimated at $195.8 Billion in 2026 and is projected to reach $375.1 Billion by the end of the forecast period in 2033. This substantial growth is primarily fueled by the accelerating pace of digital transformation initiatives across the global retail sector, as businesses increasingly recognize the critical role of advanced technology in enhancing operational efficiency, improving customer experiences, and maintaining a competitive edge. Retailers are investing heavily in a diverse range of IT solutions, from robust e-commerce platforms and sophisticated data analytics tools to advanced supply chain management systems and personalized customer engagement technologies. The shift towards omnichannel retail strategies, coupled with evolving consumer expectations for seamless and integrated shopping experiences, further underscores the necessity for sustained and strategic IT investments. The market encompasses a broad spectrum of hardware, software, and services, all geared towards modernizing retail infrastructure and processes to meet the demands of a dynamic digital economy. This growth trajectory reflects a fundamental change in how retail operations are managed, moving away from traditional models to highly integrated, data-driven, and technology-centric ecosystems that prioritize agility, responsiveness, and customer-centricity.

IT Spending in Retail Market introduction

The IT Spending in Retail Market encompasses the total expenditure by retail businesses on information technology solutions, infrastructure, and services aimed at enhancing operations, improving customer engagement, optimizing supply chains, and driving overall business growth. This includes investments in hardware such as Point of Sale (POS) systems, servers, networking devices, and barcode scanners; software solutions like Enterprise Resource Planning (ERP), Customer Relationship Management (CRM), Supply Chain Management (SCM), inventory management, e-commerce platforms, data analytics, and cybersecurity; and various IT services including consulting, system integration, implementation, and ongoing support and maintenance. The primary objective of these expenditures is to streamline processes, automate tasks, gain actionable insights from data, and deliver a superior, personalized shopping experience across all channels. Major applications span from front-office operations like online storefronts and in-store digital signage to back-office functions such as warehouse automation, logistics optimization, and financial management. These technologies are crucial for retailers striving to meet evolving consumer expectations, which increasingly demand convenience, speed, personalization, and seamless interactions regardless of whether they are shopping online, in-store, or via mobile devices. The benefits derived from strategic IT spending are extensive, including enhanced operational efficiency, reduced costs through automation, improved inventory accuracy, better customer retention through personalized marketing and service, increased sales conversion rates, and a stronger competitive position in an increasingly crowded market.

The market is driven by several pivotal factors that are reshaping the retail landscape. Foremost among these is the explosive growth of e-commerce and the imperative for omnichannel retail strategies, compelling businesses to invest in robust digital infrastructures that can support integrated online and offline operations. The escalating demand for data analytics and artificial intelligence (AI) is another significant driver, as retailers seek to leverage vast amounts of customer and operational data to inform strategic decisions, predict consumer behavior, and personalize offerings. Furthermore, the relentless pressure to enhance customer experience, coupled with the need for operational efficiencies to combat rising costs and tight margins, fuels continuous investment in advanced IT solutions. The proliferation of mobile devices and payment technologies also necessitates significant IT upgrades to accommodate secure and convenient transactions. Lastly, the dynamic competitive environment, characterized by rapid innovation and the entry of digitally native brands, forces established retailers to continuously innovate their IT ecosystems to stay relevant and attractive to modern consumers. These driving factors collectively create a compelling business case for sustained and increasing IT spending across the retail sector, signifying a fundamental transformation in how retailers operate and engage with their customer base in the digital age.

IT Spending in Retail Market Executive Summary

The IT Spending in Retail Market is experiencing robust growth, primarily propelled by an overarching imperative for digital transformation, enhanced customer experience, and operational efficiencies. Business trends indicate a strong focus on omnichannel integration, with retailers investing heavily in unified commerce platforms that seamlessly blend online and offline shopping experiences. Cloud adoption is becoming pervasive, offering scalability, flexibility, and cost efficiencies for various retail applications, from CRM to inventory management. Data analytics and artificial intelligence are critical for competitive differentiation, enabling personalized marketing, predictive inventory management, and optimized pricing strategies. Cybersecurity investments are also escalating as retailers grapple with increasing data breach threats and stringent data privacy regulations. Furthermore, the market is characterized by a drive towards automation in supply chain and warehouse operations, utilizing IoT and robotics to improve speed and accuracy. These trends collectively underscore a strategic shift towards technology-centric retail models designed for agility and customer-centricity, reflecting a long-term commitment to innovation as a core business driver. The retail sector's increasing reliance on IT to navigate evolving consumer behaviors and competitive pressures ensures sustained market expansion.

Regionally, North America and Europe continue to dominate the market in terms of IT spending, driven by early adoption of advanced technologies, a mature retail infrastructure, and high consumer spending power. However, the Asia Pacific (APAC) region is emerging as the fastest-growing market, primarily due to the rapid expansion of e-commerce, increasing disposable incomes, and the widespread adoption of mobile-first shopping strategies in countries like China and India. Latin America and the Middle East & Africa (MEA) are also showing promising growth, albeit from a smaller base, as retailers in these regions actively pursue modernization and digital initiatives to cater to a burgeoning middle class and increasing internet penetration. Segment-wise, software solutions, particularly those related to e-commerce, customer relationship management, and business intelligence, represent the largest and fastest-growing segment, reflecting the strategic importance of data-driven decision-making and seamless customer journeys. Services, including consulting and system integration, also command a significant share as retailers require expert guidance to implement complex IT infrastructures. Hardware spending remains substantial for essential infrastructure like POS systems and data centers, though it grows at a more moderate pace compared to software and services. The overall market trajectory indicates a future where IT is not merely a support function but a core strategic enabler for retail success across all geographic and operational segments.

AI Impact Analysis on IT Spending in Retail Market

Common user questions regarding the impact of AI on IT Spending in the Retail Market often revolve around its potential for Return on Investment (ROI), the complexity of integration with existing systems, concerns about data privacy and ethical AI use, the implications for workforce transformation, and the specific applications that yield the most significant competitive advantages. Users frequently inquire about the initial investment required for AI implementation versus the long-term cost savings and revenue generation, seeking clear justifications for allocating substantial budgets to AI technologies. There's also considerable interest in understanding how AI can personalize customer experiences without infringing on privacy, how it can optimize supply chains for greater efficiency and resilience, and how retailers can overcome the technical challenges and talent gaps associated with deploying sophisticated AI solutions. Furthermore, questions arise concerning the scalability of AI across different retail formats and sizes, and the extent to which AI will reshape the competitive landscape, pushing smaller businesses to adopt similar technologies or risk falling behind. These inquiries underscore a collective desire for practical insights into AI's transformative power, its potential pitfalls, and the strategic roadmap for successful adoption within the retail sector, all of which directly influence IT spending decisions.

- AI drives increased IT spending in advanced analytics platforms and specialized machine learning software for predictive insights.

- Significant investment in AI-powered personalization engines for e-commerce and in-store customer experiences.

- Enhances spending on AI-driven inventory optimization systems, reducing waste and improving stock availability.

- Promotes IT expenditure in automation tools for supply chain management, warehousing, and logistics, integrating robotics and smart sensors.

- Requires substantial IT investment in robust data infrastructure and cloud computing resources to support large-scale AI model training and deployment.

- Increases spending on AI-enabled cybersecurity solutions to protect sensitive customer data and transactional information.

- Drives demand for IT services focused on AI consulting, implementation, and ongoing maintenance, contributing to the services segment.

- Facilitates spending on conversational AI and chatbots for enhanced customer service and support, leading to better engagement.

- Spurs investments in computer vision technologies for in-store analytics, loss prevention, and automated checkout systems.

- Influences IT budgeting towards upskilling and reskilling existing IT teams to manage and leverage AI technologies effectively.

DRO & Impact Forces Of IT Spending in Retail Market

The IT Spending in Retail Market is profoundly shaped by a complex interplay of drivers, restraints, opportunities, and their combined impact forces. Key drivers include the relentless growth of e-commerce, compelling retailers to invest in robust online platforms and omnichannel capabilities to meet shifting consumer preferences for seamless shopping experiences. The imperative to enhance customer experience through personalization, rapid delivery, and efficient service further fuels IT expenditure on CRM, analytics, and mobile technologies. Moreover, the increasing need for operational efficiency, cost reduction, and supply chain optimization drives investment in ERP, SCM, and automation tools, enabling retailers to manage inventory more effectively and streamline logistics. The pervasive adoption of data analytics and AI for competitive intelligence and predictive insights is another significant driver, allowing retailers to make informed decisions and tailor their strategies. Conversely, several restraints impede market growth, notably the high initial capital expenditure required for advanced IT infrastructure and software, which can be a barrier for smaller retailers. Data privacy concerns and the complexities of regulatory compliance, such as GDPR and CCPA, necessitate significant investments in cybersecurity and data management solutions, adding to the cost burden. The challenge of integrating disparate legacy systems with new technologies often leads to implementation complexities and extended timelines, creating friction. Furthermore, the scarcity of skilled IT professionals capable of managing cutting-edge retail technologies can hinder adoption and effective utilization, while economic uncertainties and inflationary pressures may cause retailers to postpone or scale back non-essential IT projects, impacting overall market momentum. These restraints necessitate strategic planning and careful resource allocation to mitigate their impact on IT budgets and project success within the retail sector.

Despite these restraints, the market presents substantial opportunities for growth and innovation. The emergence of new technologies such as Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Augmented Reality (AR), and Virtual Reality (VR) offers retailers novel ways to engage customers, optimize operations, and create unique shopping experiences. Opportunities also abound in the expansion of advanced payment systems, including contactless and mobile payment solutions, enhancing convenience and security. The burgeoning potential of hyper-personalization, driven by advanced analytics and AI, allows retailers to deliver highly relevant product recommendations and promotions, fostering customer loyalty and driving sales. Furthermore, the continuous evolution of cloud computing provides scalable and flexible IT infrastructure solutions, democratizing access to powerful technologies for retailers of all sizes. The increasing focus on sustainable retail practices also opens avenues for IT solutions that optimize energy consumption, reduce waste, and improve supply chain transparency. The combined impact forces of these drivers, restraints, and opportunities create a dynamic market environment where strategic IT investment is not merely an option but a critical necessity for survival and growth. Retailers that effectively navigate these forces by adopting agile IT strategies, embracing innovation, and prioritizing customer-centric solutions are best positioned to capitalize on market opportunities, mitigate risks, and achieve sustainable competitive advantages in the rapidly evolving global retail landscape. The interplay of these elements dictates the pace and direction of technological adoption, shaping the future trajectory of IT spending across the retail industry.

Segmentation Analysis

The IT Spending in Retail Market is intricately segmented across various dimensions, including type, deployment, application, and retail format, each offering a distinct perspective on market dynamics and investment patterns. Understanding these segments is crucial for identifying specific growth areas, tailoring solutions to diverse retail needs, and assessing competitive landscapes. This comprehensive segmentation allows market participants to analyze spending behaviors, technology adoption rates, and strategic priorities within granular categories, providing a detailed roadmap for market entry and expansion. The segmentation highlights the diverse technological needs across different operational facets of retail, from customer-facing interactions to back-end logistical challenges. Each segment and subsegment represents a unique set of demands for IT solutions, reflecting the varied business models, customer expectations, and operational complexities prevalent within the global retail industry. This detailed breakdown serves as a foundational framework for strategic planning and resource allocation in a highly competitive and evolving market, offering clarity on where the most significant IT investments are being made and where future growth potential lies.

- By Type

- Hardware

- Point of Sale (POS) Systems

- Servers & Data Centers

- Networking Devices (Routers, Switches, Wi-Fi)

- Barcode Scanners & RFID Systems

- Digital Signage & Kiosks

- Printers & Peripherals

- Security & Surveillance Hardware

- Software

- Enterprise Resource Planning (ERP)

- Customer Relationship Management (CRM)

- Supply Chain Management (SCM)

- Inventory Management Systems

- E-commerce Platforms

- Business Intelligence & Analytics

- Cybersecurity Solutions

- Payment Gateways & Solutions

- Marketing Automation & Personalization

- Workforce Management

- Services

- Consulting & Advisory Services

- System Integration & Implementation

- Managed Services

- Support & Maintenance

- Cloud Services

- Data Management Services

- Hardware

- By Deployment

- On-premise

- Cloud (Public, Private, Hybrid)

- By Application

- Front-end Operations (POS, E-commerce, Customer Service)

- Back-end Operations (SCM, Inventory, ERP, Finance)

- Marketing & Merchandising

- Business Intelligence & Analytics

- Cybersecurity & Data Privacy

- By Retail Format

- Supermarkets & Hypermarkets

- Department Stores

- Specialty Stores

- Convenience Stores

- Online Retailers (Pure-play E-commerce)

- Discount Stores & Warehouse Clubs

- Pharmacies & Drugstores

Value Chain Analysis For IT Spending in Retail Market

The value chain for IT spending in the retail market is a multifaceted ecosystem involving numerous stakeholders from upstream technology providers to downstream end-users, interconnected through various distribution channels. Upstream analysis focuses on the foundational elements and components that enable IT solutions for retail. This primarily includes hardware manufacturers (producing POS terminals, servers, networking equipment, IoT devices, and digital signage), software developers (creating ERP, CRM, SCM, e-commerce, analytics, and cybersecurity platforms), and service providers (offering cloud infrastructure, data centers, and specialized consulting). These entities are responsible for the innovation, development, and initial supply of the technological building blocks that retailers integrate into their operations. Strategic partnerships and alliances among these upstream players are common, aimed at developing comprehensive and integrated solutions that address complex retail challenges. The quality, innovation, and cost-effectiveness of these upstream offerings directly influence the capabilities and overall value proposition of the IT solutions available to retailers, forming the bedrock upon which the entire retail technology ecosystem is built.

Downstream analysis in the retail IT spending value chain primarily involves the retailers themselves, who are the ultimate consumers and beneficiaries of these IT investments, and indirectly, their customers who experience the enhanced services. Retailers deploy these technologies across their diverse operations, from customer-facing points like online stores and physical checkouts to back-end functions such as inventory management, supply chain logistics, and financial reporting. The distribution channels for these IT solutions are varied and critical for market penetration and accessibility. Direct distribution occurs when large retailers procure software licenses or hardware directly from vendors, often involving bespoke solutions and significant in-house IT expertise. Indirect channels are more prevalent, involving a network of system integrators, value-added resellers (VARs), managed service providers (MSPs), and IT consulting firms. These intermediaries play a crucial role in customizing, implementing, and supporting IT solutions for retailers, particularly for small to medium-sized enterprises (SMEs) that may lack extensive internal IT capabilities. Cloud marketplaces also represent an increasingly important indirect channel, offering retailers scalable and subscription-based access to a wide array of software and services. The effectiveness of these distribution channels dictates the reach and efficiency of IT solution delivery, ensuring that retailers can access the right technologies to meet their specific business needs and strategic objectives, ultimately enhancing the value delivered to the end consumer.

IT Spending in Retail Market Potential Customers

The potential customers for IT spending in the retail market encompass a broad spectrum of retail enterprises, each with distinct needs, scales of operation, and digital maturity levels. Fundamentally, any business involved in selling goods or services directly to consumers stands as a potential buyer. This includes large multinational retail chains operating thousands of stores and extensive e-commerce platforms, requiring sophisticated, integrated enterprise-level solutions for managing complex global operations, extensive customer data, and intricate supply chains. These large enterprises are often early adopters of cutting-edge technologies like AI, IoT, and advanced analytics, driving significant IT investments for digital transformation initiatives, omnichannel unification, and enhanced cybersecurity measures to protect vast amounts of sensitive data. Their IT spending is characterized by large-scale, long-term projects aimed at achieving incremental operational efficiencies and providing highly personalized customer experiences across multiple touchpoints. The robust nature of their operations necessitates scalable and resilient IT infrastructures, often involving hybrid cloud deployments and extensive professional services for integration and maintenance, reflecting a continuous and strategic commitment to technological advancement as a core competitive advantage in a globalized market.

Beyond the large enterprise segment, the market extends to small and medium-sized enterprises (SMEs) across various retail formats, including independent boutiques, local grocery stores, specialty shops, and emerging online-only retailers. While their individual IT budgets may be smaller, their collective demand for accessible, scalable, and cost-effective solutions makes them a significant customer base. SMEs typically seek IT solutions that address immediate operational challenges such as efficient POS systems, basic inventory management, social media marketing tools, and user-friendly e-commerce platforms that facilitate online presence without heavy upfront investment. Cloud-based software-as-a-service (SaaS) offerings are particularly attractive to this segment due to their subscription-based models, reduced infrastructure requirements, and ease of deployment. Furthermore, retailers specializing in specific verticals—such as fashion, electronics, home goods, groceries, or pharmaceuticals—represent distinct customer segments, each requiring tailored IT solutions that cater to their unique product characteristics, regulatory environments, and customer engagement strategies. For instance, fashion retailers may prioritize AR/VR for virtual try-ons, while grocery stores focus on fresh food management and last-mile delivery optimization. The evolving landscape of direct-to-consumer (D2C) brands also represents a growing customer base, heavily reliant on IT for building strong online presences, managing direct customer relationships, and optimizing digital marketing efforts, showcasing the dynamic and diverse nature of potential customers within the IT spending in retail market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $195.8 Billion |

| Market Forecast in 2033 | $375.1 Billion |

| Growth Rate | 9.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | IBM, Microsoft, Oracle, SAP, Salesforce, Adobe, Accenture, Capgemini, Fujitsu, DXC Technology, Wipro, Infosys, Tata Consultancy Services (TCS), HCL Technologies, Cognizant, Amazon Web Services (AWS), Google Cloud, Alibaba Cloud, Cisco Systems, Honeywell. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

IT Spending in Retail Market Key Technology Landscape

The IT Spending in Retail Market is characterized by a rapidly evolving technology landscape, with several key innovations shaping investment priorities and operational capabilities. Cloud computing remains a foundational technology, offering retailers unparalleled scalability, flexibility, and cost-efficiency for hosting e-commerce platforms, ERP systems, CRM applications, and data analytics tools. Both public and hybrid cloud models are extensively adopted, enabling seamless data flow and integration across various retail functions. Artificial intelligence (AI) and Machine Learning (ML) are paramount, driving innovations in personalized marketing, demand forecasting, inventory optimization, fraud detection, and customer service through chatbots and virtual assistants. Retailers are investing heavily in AI-powered analytics to extract actionable insights from vast datasets, enabling hyper-personalization and predictive capabilities that enhance customer experience and operational efficiency. The Internet of Things (IoT) is another transformative technology, with smart shelves, RFID tags, and connected sensors providing real-time inventory visibility, optimizing supply chain logistics, and enhancing in-store experiences through location-based services and smart devices. These IoT deployments contribute significantly to operational intelligence, allowing retailers to monitor assets, track products, and understand customer behavior within physical spaces with unprecedented detail, thereby optimizing store layouts and merchandising strategies.

Big Data Analytics forms the backbone of data-driven retail, allowing businesses to process and analyze massive volumes of transactional, customer, and operational data to inform strategic decisions. Investments in data warehousing, data lakes, and advanced visualization tools are crucial for transforming raw data into competitive intelligence. Cybersecurity solutions are experiencing exponential growth in investment, as retailers prioritize protecting sensitive customer data, financial transactions, and intellectual property from sophisticated cyber threats. This includes advanced threat detection, identity and access management, encryption, and compliance management tools to meet stringent data privacy regulations. Mobile technologies continue to be central to retail IT spending, encompassing mobile POS systems, mobile payment solutions, retail apps for customer engagement, and in-store associate tools that enhance productivity and customer service. Augmented Reality (AR) and Virtual Reality (VR) are gaining traction, offering innovative applications such as virtual try-on experiences, interactive product visualizations, and immersive shopping environments, particularly in the fashion and home goods sectors. Finally, blockchain technology is emerging as a solution for supply chain transparency, product traceability, and secure payment processing, although its adoption is still in early stages compared to other established technologies. This dynamic technology landscape underscores a continuous need for retailers to invest strategically in IT to remain competitive, meet evolving consumer demands, and drive sustainable growth in a digital-first world.

Regional Highlights

- North America: This region consistently leads in IT spending in retail, characterized by a highly mature retail market, early adoption of advanced technologies, and a strong emphasis on e-commerce and omnichannel strategies. The presence of major technology providers and a competitive retail landscape drives continuous innovation and investment in areas such as AI-driven personalization, cloud-native platforms, and sophisticated supply chain management solutions. Consumer expectations for convenience and personalized experiences are high, compelling retailers to invest in cutting-edge IT.

- Europe: The European market demonstrates significant IT spending, with a strong focus on digital transformation, data privacy compliance (GDPR), and sustainable retail practices. Western European countries are at the forefront of adopting cloud, analytics, and mobile commerce solutions. However, the diverse regulatory landscape across the continent often necessitates tailored IT solutions, impacting deployment strategies. The shift towards unified commerce platforms and seamless customer journeys is a key driver for IT investments.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region for IT spending in retail, fueled by rapid e-commerce expansion, increasing disposable incomes, and a burgeoning tech-savvy consumer base, particularly in China, India, and Southeast Asian countries. Mobile-first strategies are prevalent, driving investments in mobile commerce, payment solutions, and social commerce platforms. Localized solutions and the adoption of emerging technologies like AI and IoT are key growth catalysts.

- Latin America: This region presents significant growth opportunities, driven by increasing internet penetration, urbanization, and a growing middle class. Retailers are investing in modernizing legacy IT infrastructure, adopting e-commerce platforms, and implementing basic analytics tools to improve operational efficiency and reach a wider customer base. Cloud adoption is gaining momentum due to its scalability and reduced upfront costs, supporting regional digital transformation efforts.

- Middle East & Africa (MEA): The MEA market is witnessing steady growth in IT spending, spurred by government initiatives to diversify economies, a young population, and increasing retail infrastructure development. Countries in the GCC are leading the way with ambitious digital transformation agendas, investing in smart retail technologies, e-commerce, and advanced logistics to cater to a sophisticated consumer base. Africa's growth is primarily driven by mobile commerce and financial inclusion technologies, though from a smaller base.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the IT Spending in Retail Market.- IBM

- Microsoft

- Oracle

- SAP

- Salesforce

- Adobe

- Accenture

- Capgemini

- Fujitsu

- DXC Technology

- Wipro

- Infosys

- Tata Consultancy Services (TCS)

- HCL Technologies

- Cognizant

- Amazon Web Services (AWS)

- Google Cloud

- Alibaba Cloud

- Cisco Systems

- Honeywell

Frequently Asked Questions

What factors are primarily driving the growth of IT spending in the retail market?

The growth is primarily driven by the explosive expansion of e-commerce, the imperative for omnichannel retail strategies, the escalating demand for enhanced customer experiences through personalization, the need for operational efficiency and supply chain optimization, and the pervasive adoption of data analytics and artificial intelligence for competitive advantage.

How is AI impacting IT investment priorities for retailers?

AI significantly impacts IT investment by driving spending in advanced analytics platforms, personalization engines, inventory optimization systems, automation tools for supply chain, robust data infrastructure, AI-enabled cybersecurity, conversational AI for customer service, and computer vision technologies for in-store analytics.

Which technology segments receive the most significant IT investments in retail?

Software solutions, particularly those related to e-commerce platforms, customer relationship management (CRM), business intelligence and analytics, and supply chain management (SCM), typically attract the most significant IT investments. Services like system integration and managed cloud services also represent a substantial and growing share.

What are the main challenges hindering IT spending growth in the retail sector?

Key challenges include the high initial capital expenditure for advanced IT infrastructure, concerns regarding data privacy and regulatory compliance, complexities in integrating new technologies with legacy systems, the scarcity of skilled IT professionals, and economic uncertainties that may lead to budget constraints or postponed projects.

Which geographic region is exhibiting the fastest growth in retail IT spending?

The Asia Pacific (APAC) region is currently exhibiting the fastest growth in IT spending in retail. This acceleration is largely due to the rapid expansion of e-commerce, increasing disposable incomes, and widespread adoption of mobile-first shopping strategies across key markets like China, India, and Southeast Asia.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager