IT Staff Augmentation Service Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434888 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

IT Staff Augmentation Service Market Size

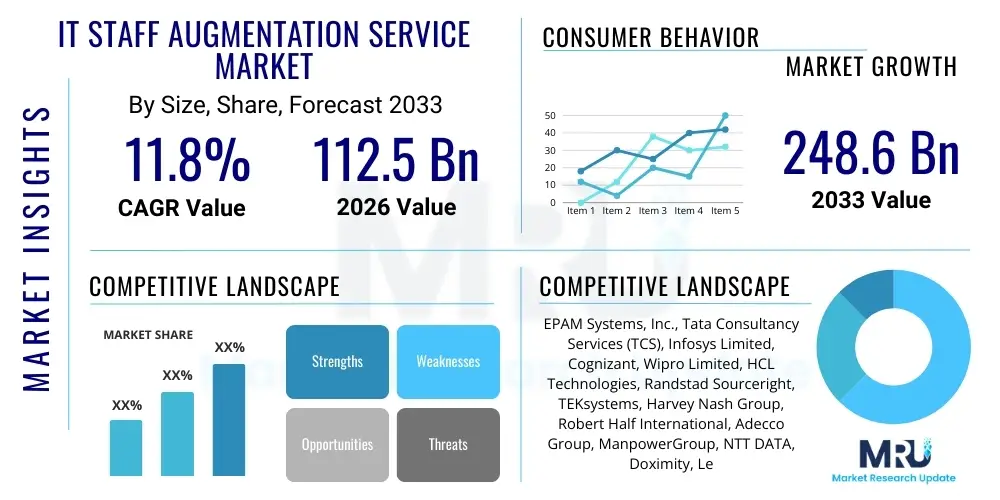

The IT Staff Augmentation Service Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.8% between 2026 and 2033. The market is estimated at USD 112.5 billion in 2026 and is projected to reach USD 248.6 billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the accelerated pace of digital transformation across global industries, necessitating specialized and flexible IT talent that internal teams often cannot quickly acquire or maintain. The shift towards project-based hiring models and the increasing complexity of emerging technologies like AI, machine learning, and advanced cybersecurity further amplify the demand for skilled contractors.

The flexibility offered by staff augmentation services allows organizations to scale their technical workforce rapidly in response to dynamic market conditions or specific project requirements without incurring the long-term overheads associated with full-time employment. This model is particularly critical for small and medium-sized enterprises (SMEs) and startups that require high-caliber IT expertise but operate with constrained capital expenditure budgets. Furthermore, globalization of the talent pool, facilitated by remote work trends, has made it easier for companies in high-cost regions to access cost-effective, specialized labor from international markets, fueling the market size growth.

Market growth is also significantly influenced by the continued skills gap prevalent in critical technology domains, such as data science, DevOps, and cloud architecture. Companies are increasingly relying on staff augmentation to bridge these internal competency deficits, treating augmentation as a strategic tool rather than merely a tactical stop-gap. Regulatory changes impacting employment laws and the increasing maturity of vendor management systems (VMS) that streamline the hiring process contribute positively to the market dynamics, ensuring efficiency and compliance in contingent workforce management.

IT Staff Augmentation Service Market introduction

The IT Staff Augmentation Service Market involves the outsourcing strategy where an organization hires external technical personnel on a temporary basis to complement their existing in-house development team. This strategy is fundamentally distinct from traditional project-based outsourcing, as augmented staff work directly under the client's management and integrate seamlessly into the client's operations and culture, providing specific expertise or capacity support. The primary application of these services spans software development, quality assurance (QA), system architecture, cloud migration, and specialized cybersecurity projects. The core benefit derived is improved time-to-market for critical projects, immediate access to rare technical skills, and enhanced operational flexibility, allowing companies to maintain lean internal teams while efficiently managing peak demands.

Key driving factors accelerating the adoption of IT staff augmentation include the relentless pressure on businesses to accelerate digital transformation initiatives, necessitating niche skills like blockchain and specialized AI engineering that are hard to recruit internally. The global shortage of experienced IT professionals, particularly in advanced development stacks, makes augmentation a pragmatic solution for maintaining project velocity. Moreover, the inherent cost-effectiveness compared to hiring full-time equivalents (FTEs) in high-cost geographies, combined with the ability to swiftly adjust team size based on project phases, positions staff augmentation as a highly valuable resource management tool in modern business operations.

The market has matured significantly, moving beyond simple capacity provision to offering strategic talent solutions across highly regulated and complex sectors like finance, healthcare, and telecommunications. Service providers now often offer specialized talent pools focused on compliance, data privacy (e.g., GDPR, HIPAA), and industry-specific software development standards. This specialization ensures that augmented teams not only bring technical proficiency but also domain knowledge, thereby maximizing project success rates and solidifying staff augmentation's role as an essential pillar in contemporary IT resource management strategies.

IT Staff Augmentation Service Market Executive Summary

The IT Staff Augmentation Service Market is experiencing robust growth fueled by several converging trends, primarily the persistent technological skills gap and the global push for flexible workforce models. Business trends indicate a strong preference for augmentation in high-growth areas such as cloud infrastructure management, data analytics, and generative AI development, where internal skill ramp-up is slow and expensive. Providers are shifting their focus from purely volume-based contracts to value-added services, including providing talent with specialized industry certifications and offering hybrid augmentation models that combine remote talent with occasional on-site support, adapting to the post-pandemic remote work environment and enhancing client integration.

Regionally, North America remains the largest market due to its high concentration of technology innovation hubs and rapid adoption of advanced digital solutions, particularly within the FinTech and Silicon Valley ecosystems. However, the Asia Pacific (APAC) region is demonstrating the highest growth trajectory, driven by increasing IT expenditure in emerging economies like India, China, and Southeast Asia, coupled with the establishment of large global capability centers (GCCs) that utilize augmentation to manage variable workloads. Europe is characterized by stringent labor laws, which paradoxically make staff augmentation highly attractive for circumventing complex hiring processes and quickly accessing specialized talent, especially in regulatory compliance and cybersecurity fields.

Segmentation trends reveal that the Short-Term project segment (less than 6 months) dominates in terms of volume, driven by urgent needs, while the Long-Term strategic augmentation segment (12+ months) contributes significantly to revenue stability, particularly within large enterprise clients seeking sustained support for multi-year digital transformation programs. By application, software development and testing services maintain the largest share, but specialized IT roles, particularly related to emerging technologies, are expanding at the fastest rate, signaling a market shift toward specialized expertise over generalized IT support.

AI Impact Analysis on IT Staff Augmentation Service Market

User queries regarding AI's impact on IT staff augmentation services primarily revolve around whether automation will displace human IT professionals and, conversely, whether AI expertise itself will become the primary driver of augmentation demand. Key concerns center on the potential disruption to traditional roles like basic coding, testing, and L1 support due to tools powered by Generative AI (GenAI). Simultaneously, users are highly interested in how augmentation providers will rapidly upskill their talent pools to meet the surging enterprise requirement for AI implementation, integration, and governance, which currently represents a severe global talent deficit. Users recognize that while AI may automate routine tasks, it creates a massive demand for high-level strategists, prompt engineers, ML Ops specialists, and data architects.

The consensus emerging from user analysis is that AI will function more as a transformation catalyst than a destructive force in this market. While low-level augmentation roles might see compression, the complexity introduced by integrating AI solutions requires highly specialized human oversight, prompt engineering expertise, and ethical governance frameworks. Consequently, staff augmentation firms are rapidly refocusing their offerings to provide elite, project-based AI specialists. This shift drives up the overall value and daily rates of augmented staff, transforming the market into one focused on niche, high-value technical consultancy rather than mere headcount provision, thereby securing the market's long-term relevance by supplying the talent necessary for AI implementation across enterprises.

- AI-powered coding assistants reduce demand for junior developers but increase demand for specialized architects and code reviewers.

- Surge in demand for Machine Learning Operations (ML Ops) and AI Governance experts, supplied primarily through augmentation models.

- Automation of routine QA and L1 support tasks leads to a market reallocation towards complex system integration and ethical AI implementation roles.

- AI technology stack specialization (e.g., TensorFlow, PyTorch, proprietary enterprise AI platforms) drives premium pricing for augmented talent.

- Staff augmentation providers must integrate AI tools into their internal talent management platforms to efficiently match highly specialized skills to client needs.

DRO & Impact Forces Of IT Staff Augmentation Service Market

The IT Staff Augmentation Service Market is shaped by powerful Drivers and significant Opportunities that outweigh typical Restraints, resulting in a positive impact force structure. Key drivers include the acceleration of cloud adoption, which necessitates temporary, specialized migration and architecture expertise, and the endemic global shortage of highly technical talent, forcing organizations to look externally. Opportunities are strongly linked to emerging technologies—specifically the rapid enterprise integration of Generative AI, blockchain, and advanced cybersecurity protocols—where the demand for specialized knowledge outstrips internal supply across all major corporate sectors. The ability of augmentation services to provide rapid, scalable deployment of these niche skills without long-term labor commitments acts as a critical enabler for corporate agility and digital competitiveness.

Restraints, while present, primarily involve operational challenges such as maintaining intellectual property (IP) security and ensuring seamless integration of contingent workers into the client's culture and security protocols. Data governance concerns, particularly across highly regulated European and North American sectors, necessitate stringent vetting and compliance mechanisms, adding complexity to the service delivery model. Additionally, market perception issues, occasionally equating augmentation with high-cost temporary labor rather than strategic skill acquisition, sometimes restrict adoption by smaller firms. However, advancements in secure remote collaboration tools and VMS platforms effectively mitigate many security and integration risks, thus minimizing their overall restrictive impact on market growth.

The aggregate impact forces are decisively positive, driven by macroeconomic factors like economic volatility, which encourages flexible, variable cost models (staff augmentation), and technological necessity (digital transformation). The market's resilience is further cemented by the fact that the skills gap in critical fields like quantum computing and advanced cloud security is widening faster than educational institutions and internal training programs can compensate. This systemic talent deficit ensures a continuous, non-cyclical demand for specialized augmentation services, positioning the market for sustained, high-double-digit growth through the forecast period as organizations prioritize access to elite technical talent over traditional full-time hiring stability.

Segmentation Analysis

The IT Staff Augmentation Service Market is broadly segmented based on Service Type, Technology, Organization Size, Application, and Industry Vertical. This multi-dimensional segmentation allows vendors to target specific client needs, from providing temporary capacity support for legacy systems to delivering highly specialized expertise in cutting-edge technologies. The segmentation reflects the diversity of IT needs across the corporate landscape, ensuring that services are tailored, whether a client is a small startup requiring rapid prototyping skills or a large financial institution undertaking a massive cloud transformation initiative. Understanding these segments is crucial for market participants to optimize their talent pool and geographical focus, aligning their offerings with high-demand, high-value sectors.

- By Service Type:

- Short-Term Augmentation (Less than 6 months)

- Mid-Term Augmentation (6 to 12 months)

- Long-Term Augmentation (More than 12 months)

- By Technology:

- Cloud Computing and Migration

- Data Science and Analytics (Big Data, ML, AI)

- Cybersecurity and Information Security

- Software Development and Engineering (Web, Mobile, Enterprise)

- DevOps and Infrastructure Management

- By Organization Size:

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

- By Application:

- Application Development and Maintenance

- Testing and Quality Assurance (QA)

- Business Process Management

- System Integration and Implementation

- Networking and Infrastructure Support

- By Industry Vertical:

- Banking, Financial Services, and Insurance (BFSI)

- Healthcare and Life Sciences

- Telecommunications and IT

- Retail and E-commerce

- Government and Public Sector

- Manufacturing

Value Chain Analysis For IT Staff Augmentation Service Market

The value chain for the IT Staff Augmentation Service Market begins with upstream activities focused on Talent Acquisition and Management, which is the most critical component. This involves extensive global sourcing, rigorous technical assessment, continuous upskilling and certification (especially in niche areas like hyperscale cloud platforms or AI frameworks), and the maintenance of a large, available talent pipeline. Efficiency in this stage determines the competitiveness of the service provider, as the quality and speed of talent matching directly impact client satisfaction and revenue. Investment in proprietary assessment platforms and robust HR management systems that track contractor performance and availability are vital upstream differentiators.

Midstream activities center on Service Delivery and Client Management. This involves contract negotiation, compliance management (especially regarding international labor laws and tax regulations), seamless onboarding and offboarding processes, and continuous performance monitoring of the augmented staff. The distribution channel is predominantly Direct, where service providers interact directly with client HR or IT departments, often via internal Vendor Management Systems (VMS) or MSP (Managed Service Provider) arrangements. Indirect channels, such as partnerships with larger consulting firms or niche technology integrators who embed augmentation services into broader solutions, also play a supportive, though less dominant, role in market penetration.

Downstream activities focus on Post-Service Relationship Management and Knowledge Transfer. This stage ensures successful project completion, collects client feedback, and manages the potential transition of augmented staff to FTEs if the client wishes (temp-to-perm models). The efficiency of knowledge transfer, ensuring that the client retains the intellectual capital developed by the temporary team, is a crucial value-add. Effective downstream operations foster long-term relationships and recurring revenue, establishing the augmentation provider as a trusted strategic partner rather than a transactional vendor. The entire chain is heavily optimized by technology, utilizing AI for talent matching and automated compliance checks.

IT Staff Augmentation Service Market Potential Customers

The primary customers for IT Staff Augmentation Services are organizations across all industry verticals facing internal technical skill shortages or needing flexible capacity scaling for specific projects. Large Enterprises constitute a significant customer base, particularly those undergoing massive, multi-year digital transformation initiatives (such as core banking system modernization or ERP implementation) that require hundreds of specialized temporary IT roles. These large entities leverage augmentation to rapidly staff up project teams, bypass lengthy corporate hiring protocols, and access globally distributed expertise, making operational agility the core driver of their procurement decisions.

Simultaneously, Small and Medium-sized Enterprises (SMEs) are emerging as critical potential customers. SMEs often lack the internal resources or capital to hire full-time, highly skilled technical staff (like dedicated cybersecurity analysts or senior cloud architects) due to prohibitive salary costs. Staff augmentation provides these smaller firms with access to world-class expertise on a part-time or project-by-project basis, democratizing access to high-end technical skills. Startups, particularly those in the rapid growth phase, rely heavily on augmentation to quickly build Minimum Viable Products (MVPs) and scale their development capabilities without diluting equity or incurring high fixed payroll expenses during uncertain market phases.

In terms of sector-specific customers, the Banking, Financial Services, and Insurance (BFSI) vertical is a prime buyer, driven by intense regulatory pressures (e.g., Basel IV, GDPR compliance) and the need for high-security development talent. Healthcare, driven by telemedicine expansion and Electronic Health Record (EHR) migration, also requires specialized data privacy and cloud integration expertise. Technology and Telecom companies frequently use augmentation to handle workload peaks during product launches or merger integrations, ensuring that the capacity of their core engineering teams is not overburdened by non-core, temporary requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 112.5 Billion |

| Market Forecast in 2033 | USD 248.6 Billion |

| Growth Rate | 11.8% CAGR ( Include CAGR Word with % Value ) |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | EPAM Systems, Inc., Tata Consultancy Services (TCS), Infosys Limited, Cognizant, Wipro Limited, HCL Technologies, Randstad Sourceright, TEKsystems, Harvey Nash Group, Robert Half International, Adecco Group, ManpowerGroup, NTT DATA, Doximity, Leidos, Insight Global, Collabera, Sii Group, Luxoft (DXC Technology), Ciklum. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

IT Staff Augmentation Service Market Key Technology Landscape

The operational landscape of the IT Staff Augmentation Service Market is heavily influenced by technologies used both by the clients (driving demand for skills) and by the service providers (optimizing service delivery). Client-side demand is overwhelmingly focused on expertise in Hyperscale Cloud Platforms (AWS, Azure, Google Cloud Platform), necessitating augmented staff proficient in migration strategy, cloud security, and FinOps. Furthermore, the rapid enterprise adoption of specialized technologies like Kubernetes for container orchestration, advanced MLOps tools for managing AI models, and sophisticated DevSecOps pipelines drives the need for high-end, certified augmentation specialists who can integrate these complex systems seamlessly.

On the provider side, service delivery efficiency is being revolutionized by AI and automation technologies. Staff augmentation firms now utilize sophisticated proprietary or commercial Applicant Tracking Systems (ATS) enhanced with Machine Learning algorithms to dramatically reduce the time taken for candidate sourcing and matching, often turning a weeks-long process into a matter of days. Furthermore, the use of automated technical screening and behavioral assessment tools ensures a higher quality match between the client's specific requirements and the contractor’s actual capabilities. This internal technological sophistication is critical for maintaining competitiveness, especially when servicing urgent client demands for niche technical talent.

Security and remote collaboration platforms form the third critical technological pillar. Since a significant portion of augmented staff now works remotely and often cross-border, secure Virtual Desktop Infrastructure (VDI), robust VPN solutions, and advanced Zero Trust Architecture (ZTA) frameworks are essential for protecting client intellectual property and sensitive data. Collaboration tools optimized for distributed teams, such as Slack, Microsoft Teams, and Jira, are mandatory for ensuring the augmented staff is fully integrated into the client’s project management workflows, ensuring smooth communication and high productivity regardless of geographical location. The maturity of these technologies has enabled the growth of global, distributed augmentation models.

Regional Highlights

- North America (U.S. and Canada): This region maintains market dominance primarily due to the highest concentration of advanced technology adoption, major corporate headquarters, and high IT spending power. The demand here is centered on premium, specialized skills such as Generative AI research, advanced data analytics, and high-level cybersecurity compliance, particularly within the heavily regulated BFSI and Healthcare sectors. Staff augmentation provides American and Canadian companies with a mechanism to rapidly scale complex, high-stakes projects without compromising on quality, leveraging specialized talent often sourced from nearshore or offshore locations to balance cost and expertise.

- Europe (Germany, U.K., France, Italy): Europe is characterized by strong demand driven by complex regulatory landscapes (like GDPR and EU AI Act), which necessitate augmentation specialists focused on compliance and data governance. Western European economies, particularly the U.K. and Germany, suffer from acute domestic IT skill shortages, making cross-border augmentation essential for cloud migration projects and modernization efforts. Nearshore augmentation from Eastern European countries (e.g., Poland, Ukraine, Romania) is highly favored due to cultural proximity, time zone alignment, and high technical proficiency in engineering roles.

- Asia Pacific (APAC) (China, India, Japan, South Korea): APAC is projected to exhibit the fastest growth rate, fueled by massive digital transformation investments across China, India, and Southeast Asia. India remains the global hub for IT services and augmentation sourcing, but domestic demand within APAC for internal digital transformation is surging. Countries like Japan and South Korea, facing aging populations and workforce scarcity, increasingly rely on augmentation for specialized tasks, while emerging economies use these services to build out their foundational IT infrastructure, driving demand for both volume and specialized expertise.

- Latin America (LATAM) and Middle East & Africa (MEA): LATAM is growing rapidly, benefiting from its advantageous time zone overlap with North America, establishing it as a highly attractive nearshoring destination, particularly for U.S.-based technology companies seeking Spanish and Portuguese speaking IT talent. Key growth markets include Brazil and Mexico. The MEA region, particularly the UAE and Saudi Arabia, is seeing significant demand driven by massive government-led digital initiatives (Vision 2030) and large infrastructure projects that require augmentation in areas like smart city technology, cybersecurity, and financial technology implementation.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the IT Staff Augmentation Service Market.- EPAM Systems, Inc.

- Tata Consultancy Services (TCS)

- Infosys Limited

- Cognizant

- Wipro Limited

- HCL Technologies

- Randstad Sourceright

- TEKsystems (Allegis Group)

- Harvey Nash Group

- Robert Half International

- Adecco Group

- ManpowerGroup

- NTT DATA

- Doximity

- Leidos

- Insight Global

- Collabera

- Sii Group

- Luxoft (DXC Technology)

- Ciklum

Frequently Asked Questions

Analyze common user questions about the IT Staff Augmentation Service market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the difference between IT Staff Augmentation and IT Outsourcing?

IT Staff Augmentation provides external personnel who integrate directly into the client's existing team and work under the client's management structure. Conversely, traditional IT Outsourcing involves contracting an external vendor to manage and deliver an entire project or service function independently, requiring minimal day-to-day client oversight.

Which technology segment drives the highest demand in IT Staff Augmentation?

Software Development and Engineering remains the largest segment by volume. However, the fastest growth and highest profitability are driven by specialized technology segments, particularly Cloud Computing and Migration expertise (AWS, Azure, GCP) and advanced Data Science/AI engineering roles, due to severe global skill shortages in these areas.

How does AI technology affect the future relevance of IT staff augmentation services?

AI transforms augmentation by increasing demand for high-value skills—like prompt engineering, ML Ops, and AI governance—while potentially automating lower-level coding and QA tasks. This shifts augmentation providers toward supplying specialized strategic talent crucial for enterprise AI implementation, enhancing the market's long-term value proposition rather than diminishing it.

What are the primary regional growth drivers for the IT Staff Augmentation Market?

North America is driven by high demand for premium, niche skills and rapid technological innovation. APAC exhibits the highest growth rate due to massive government and corporate digital transformation investments, coupled with India's role as a major talent sourcing hub, fueling both internal and external demands.

What is the main concern organizations have when adopting staff augmentation, and how is it addressed?

The main concern is Intellectual Property (IP) security and data confidentiality when using external, often remote, personnel. This is addressed through stringent legal contracts, the deployment of secure remote collaboration tools (VDI, ZTA), and robust internal security protocols implemented by the augmentation service provider.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager