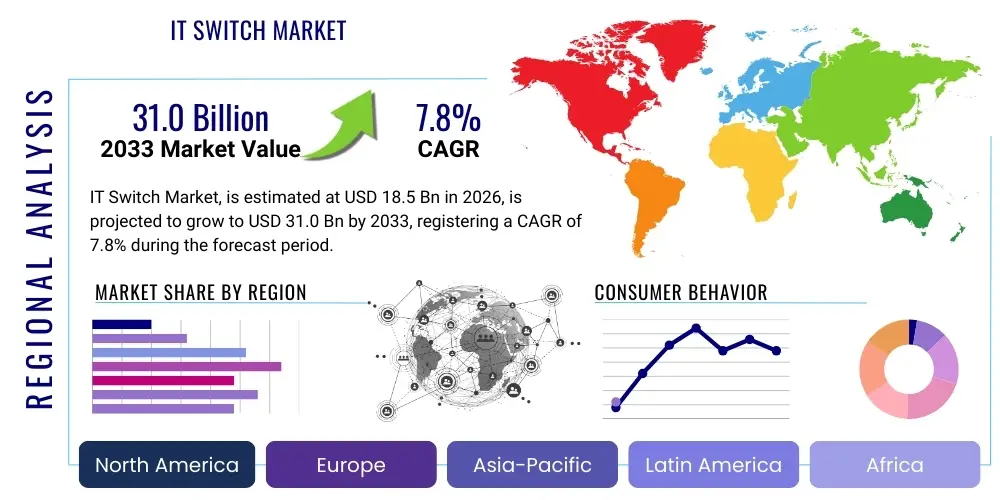

IT Switch Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438159 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

IT Switch Market Size

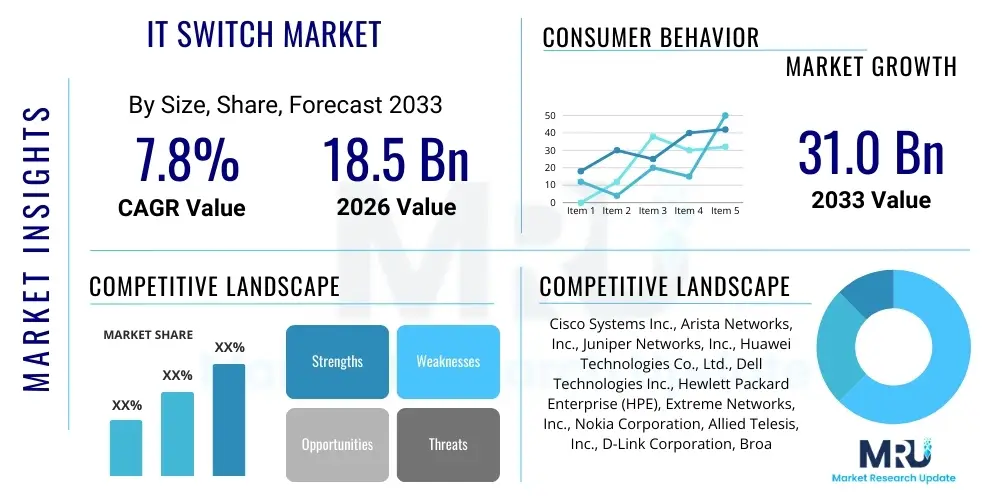

The IT Switch Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 18.5 Billion in 2026 and is projected to reach USD 31.0 Billion by the end of the forecast period in 2033. This robust expansion is primarily driven by the escalating demand for high-speed connectivity solutions necessary to support the global proliferation of cloud computing infrastructure, large-scale data centers, and advanced enterprise networking requirements. Investments in network infrastructure modernization across various industry verticals, particularly telecommunications and BFSI, are contributing significantly to market value appreciation.

IT Switch Market introduction

The IT Switch Market encompasses the manufacturing, distribution, and deployment of devices essential for connecting network segments and directing data traffic within a Local Area Network (LAN) or Wide Area Network (WAN). These devices, ranging from unmanaged desktop units to highly complex, modular chassis switches, form the backbone of modern digital communication infrastructure. Key products include Ethernet switches, which vary by port density, switching capacity, and operational layer (Layer 2, Layer 3, and Layer 4-7 switches). The core function of an IT switch is to ensure efficient packet forwarding, minimizing latency and maximizing throughput, thereby enabling seamless connectivity for end-users and server-to-server communications.

Major applications of IT switches span critical sectors, including corporate enterprise networks, large hyperscale and co-location data centers, government institutions, and service provider networks (telecoms). In data centers, high-performance switches supporting 100GbE, 400GbE, and emerging 800GbE standards are crucial for managing massive east-west traffic flows generated by virtualization and high-performance computing (HPC). For enterprises, Power over Ethernet (PoE) switches are widely adopted to power and connect IoT devices, IP cameras, and VoIP phones, streamlining network deployment and reducing cabling complexity.

The primary benefits derived from modern IT switches include enhanced network performance, improved security through features like access control lists (ACLs) and segmentation, and increased scalability to accommodate future growth in data volume. Driving factors for market growth are multifaceted: the sustained global digital transformation agenda, the accelerated migration of workloads to hybrid and multi-cloud environments, the commercialization of 5G networks necessitating new core and edge infrastructure, and the continuous evolution toward Software-Defined Networking (SDN) architectures which rely on programmable switch fabrics. These drivers collectively necessitate continuous hardware upgrades and higher-density deployments.

IT Switch Market Executive Summary

The IT Switch Market is currently characterized by significant momentum driven by the transition towards higher bandwidth requirements and network intelligence. Business trends indicate a strong shift from traditional fixed-function switches toward open networking and disaggregated hardware solutions, allowing for greater flexibility and reduced vendor lock-in. The demand for 400 Gigabit Ethernet (400GbE) is rapidly penetrating core data center networks, while 100GbE remains the workhorse for top-of-rack deployments. Furthermore, the convergence of wired and wireless networks is accelerating the adoption of unified network management platforms, influencing purchasing decisions across enterprise sectors. Security remains paramount, driving integration of advanced threat detection features directly into the switching hardware.

Regionally, North America maintains its dominance due to the presence of major hyperscale cloud providers and early adoption of cutting-edge networking technologies like SDN and white-box solutions. However, the Asia Pacific (APAC) region, particularly China and India, is registering the highest growth rate, fueled by massive digital infrastructure projects, surging mobile data consumption driven by 5G rollout, and increased governmental investment in smart city initiatives. Europe is seeing steady growth, primarily focused on network standardization and compliance with stringent data protection regulations, prompting investments in secure, high-availability networks. The Middle East and Africa (MEA) are emerging markets, capitalizing on significant governmental expenditure in digitalization and smart connectivity projects.

Segmentation trends highlight the increasing prominence of the Managed Switch segment, which offers advanced capabilities vital for complex environments, contrasting with the slower growth observed in Unmanaged switches. By speed, the 100GbE and Above segment is projected to exhibit superior CAGR, reflecting the relentless need for bandwidth in data center and core aggregation layers. The end-user analysis confirms that Telecommunications and Cloud Service Providers are the largest consumers, driving innovation in high-density, low-latency switching technology. Simultaneously, the manufacturing sector is increasingly integrating Industrial Ethernet switches to facilitate IoT and Industry 4.0 applications, opening up specialized market opportunities.

AI Impact Analysis on IT Switch Market

User inquiries regarding AI's impact on the IT Switch market frequently revolve around efficiency, automation, and performance demands. Common questions focus on: "How will AI-driven traffic optimization change switch requirements?", "Will AI demand faster switches than 400GbE?", and "Can AI be used to automate network configuration and troubleshooting, reducing reliance on human network engineers?". These questions underscore user concerns about future bandwidth thresholds, the shift from reactive to proactive network management, and the potential displacement of traditional network administration roles. The overarching theme is the integration of machine learning capabilities to create highly adaptive, self-optimizing network infrastructures capable of handling the volatile and intense traffic patterns generated by large-scale AI training models and inferencing workloads.

The development of AI and Machine Learning (ML) workloads directly necessitates ultra-high-speed, non-blocking switching fabrics, leading to a strong demand for 800GbE and future 1.6TbE technology, particularly within AI-centric data centers and research labs. AI models require extensive, rapid communication between GPUs and CPUs, often leveraging Remote Direct Memory Access (RDMA) over Converged Ethernet (RoCE), demanding switches optimized for extremely low latency and zero packet loss. This hardware requirement pushes manufacturers to design specialized silicon and network operating systems (NOS) that can support these stringent performance metrics. Furthermore, AI techniques are being implemented within the network control plane itself to enable predictive maintenance and intelligent load balancing.

AI's most profound systemic impact is observed in network operations (AIOps). AIOps leverages machine learning algorithms to analyze vast amounts of operational data, identifying anomalies, predicting outages, and automating routine configuration tasks. This capability fundamentally transforms network management from manual CLI-based provisioning to policy-driven, intent-based networking (IBN). While this reduces manual effort, it significantly increases the complexity and intelligence required of the switch's operating system, driving demand for switches that are highly programmable and API-accessible, facilitating seamless integration with centralized AI management platforms. This transition ensures networks can scale dynamically in response to real-time operational demands, crucial for maintaining service level agreements (SLAs).

- AI drives immediate requirement for ultra-high-speed switching (400GbE and 800GbE) to support inter-GPU communication in training clusters.

- Integration of AIOps platforms facilitates predictive maintenance, automated anomaly detection, and intent-based network provisioning.

- Increased demand for low-latency, loss-less switching protocols like RoCE essential for high-performance computing and AI workloads.

- AI algorithms are utilized for real-time traffic engineering and dynamic load balancing within the switch fabric itself, improving resource utilization.

- The need for programmable switches (SDN-enabled) is amplified to allow AI controllers to manage and optimize network paths instantaneously.

DRO & Impact Forces Of IT Switch Market

The IT Switch Market dynamics are governed by a robust combination of drivers accelerating growth, significant restraints limiting expansion, and lucrative opportunities for future innovation, all interacting to create powerful market impact forces. Key drivers include the massive global proliferation of data, demanding continuous upgrades to network bandwidth, and the pervasive adoption of hybrid cloud models which necessitate sophisticated inter-cloud connectivity solutions. Simultaneously, the global rollout of 5G wireless technology is creating substantial requirements for new aggregation and core switching infrastructure at the network edge to handle increased traffic density and low-latency demands. These forces collectively push network planners toward investing in next-generation high-capacity switches.

Conversely, significant restraints hinder market growth. The complexity and high initial capital expenditure (CapEx) associated with deploying advanced modular switches and implementing sophisticated Software-Defined Networking (SDN) solutions can be prohibitive, especially for small and medium enterprises (SMEs). Furthermore, growing concerns regarding network security, including protection against sophisticated Distributed Denial of Service (DDoS) attacks and supply chain vulnerabilities, require continuous software patching and hardware-level security features, adding to operational complexity and cost. The lack of standardized open interfaces in certain proprietary ecosystems also limits interoperability and increases vendor dependency, slowing down the adoption of newer technologies.

Opportunities for market players are abundant in the areas of smart networking and specialized applications. The emergence of Edge Computing necessitates specialized, ruggedized switches capable of operating outside traditional data centers, offering a new segment for growth. The increasing adoption of Power over Ethernet (PoE++) technology presents an opportunity for higher-density power delivery solutions to support advanced IoT ecosystems. Furthermore, the push towards open networking, white-box switches, and Network Function Virtualization (NFV) allows smaller players and systems integrators to introduce innovative, cost-effective solutions, democratizing the networking ecosystem. The central impact force is the inexorable rise of data center traffic, compelling a continuous cycle of infrastructure refresh and innovation, maintaining intense competition among vendors focused on performance and cost efficiency.

Segmentation Analysis

The IT Switch Market is broadly segmented based on crucial technological and application characteristics, including type, switching speed, product form factor, and end-user industry. This granular segmentation provides critical insights into market penetration and growth trajectories across various deployment scenarios. The analysis focuses heavily on differentiating between managed and unmanaged switches, as the shift toward intelligent, automated networks drives demand for managed solutions that offer granular control, advanced security features, and deep integration with SDN controllers. The product form factor segmentation helps identify the differential growth between modular chassis switches, typically used in core data centers and enterprise backbones, and fixed configuration switches, commonly used for access layers and smaller networks.

- By Type:

- Managed Switches

- Unmanaged Switches

- Smart Switches

- By Switching Speed:

- 10GbE and below

- 25GbE/40GbE

- 100GbE

- 200GbE/400GbE and Above

- By Form Factor:

- Fixed Configuration Switches

- Modular Chassis Switches

- By End-User:

- Data Centers

- Enterprises (SMEs and Large Enterprises)

- Telecommunication Service Providers

- Government and Public Sector

- Healthcare

- BFSI (Banking, Financial Services, and Insurance)

- Education and Research

Value Chain Analysis For IT Switch Market

The value chain for the IT Switch Market begins with the upstream activities centered on component manufacturing and raw material sourcing. This segment is dominated by specialized semiconductor companies that design and fabricate the critical Application-Specific Integrated Circuits (ASICs) or programmable logic devices (FPGAs) that form the core switching fabric, along with optical components (transceivers) and power supply units. The performance, latency, and port density of the final switch assembly are heavily dependent on the innovation and sourcing efficiency of these upstream component providers. Key activities include chip design, validation, and the complex manufacturing processes required to produce high-performance switching silicon necessary for 400GbE and above speeds.

The middle segment involves the actual production, system integration, and software development, primarily conducted by Original Equipment Manufacturers (OEMs) such as Cisco, Juniper, and Arista, as well as emerging white-box manufacturers. OEMs focus on designing chassis architectures, integrating components, developing proprietary or open-source Network Operating Systems (NOS), and performing rigorous quality assurance and certification processes. Distribution channels play a vital role in reaching the diverse customer base. Direct sales are common for large contracts with hyperscale data centers and major telecom operators, ensuring close technical collaboration and customized solutions. Indirect sales rely heavily on a network of global distributors, Value-Added Resellers (VARs), and system integrators who provide localized support, configuration services, and bundles, particularly to smaller enterprises and specialized sectors.

Downstream analysis focuses on deployment, network monitoring, and maintenance services delivered to the end-users. System Integrators are crucial in this stage, taking responsibility for physical installation, network provisioning, integration with existing infrastructure (security, management), and initial configuration. Direct engagement with IT departments of large enterprises and cloud providers ensures post-sales support and software updates, which are increasingly subscription-based, transforming the revenue model from CapEx to OpEx. The effectiveness of the downstream segment, particularly in providing rapid technical support and managing complex SDN rollouts, significantly influences customer satisfaction and long-term vendor loyalty, completing the cycle from silicon design to fully operational network connectivity.

IT Switch Market Potential Customers

The potential customers for the IT Switch Market are diverse yet concentrated in industries requiring massive bandwidth, high availability, and secure communication infrastructure. End-users fall primarily into five major categories: hyperscale and co-location data center operators, global telecommunication service providers (carriers), large multinational enterprises, the government/public sector, and specialized vertical industries such as healthcare and BFSI. Hyperscale data centers, operated by companies like Amazon, Google, and Microsoft, are consistently the largest buyers, focusing on density, 400GbE/800GbE speeds, and white-box solutions to achieve cost efficiency and extreme scalability necessary for cloud services.

Telecommunication service providers are undergoing massive infrastructure transformation due to 5G deployment, making them essential customers for high-performance core routers and aggregation switches capable of handling the exponential growth of mobile data traffic and supporting network slicing capabilities. Enterprises, spanning from medium-sized businesses to global corporations, constitute a continuous market for campus networking switches, requiring features like PoE, simplified management (cloud-managed switches), and robust security features integrated into the hardware, facilitating their shift towards hybrid work models and cloud-based applications. These buyers prioritize total cost of ownership (TCO) and ease of deployment.

The BFSI sector demands switches with exceptionally low latency for high-frequency trading applications and stringent security protocols to protect sensitive financial data, leading to premium investments in high-end, secure switching infrastructure. Similarly, the government and defense sectors require robust, secure, and often specialized ruggedized switches for mission-critical applications and secure network segmentation. Hospitals and healthcare systems are increasing their investment in switches to support large-scale deployment of IoT medical devices, Electronic Health Record (EHR) systems, and remote patient monitoring, prioritizing network reliability and compliance with regulatory standards such as HIPAA, making them a consistently growing customer segment focused on operational resilience.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 18.5 Billion |

| Market Forecast in 2033 | USD 31.0 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Cisco Systems Inc., Arista Networks, Inc., Juniper Networks, Inc., Huawei Technologies Co., Ltd., Dell Technologies Inc., Hewlett Packard Enterprise (HPE), Extreme Networks, Inc., Nokia Corporation, Allied Telesis, Inc., D-Link Corporation, Broadcom Inc., Mellanox Technologies (Nvidia), H3C Technologies, Ruijie Networks, ZTE Corporation, TP-Link, CommScope, Intel Corporation, Celestica Inc., Accton Technology Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

IT Switch Market Key Technology Landscape

The technology landscape of the IT Switch Market is undergoing a rapid evolution, primarily driven by the transition from traditional hardware-centric networking to agile, software-defined environments. The core technology remains Ethernet, but modern iterations feature significant advancements, including high-density port configurations (e.g., 64x400GbE ports) and specialized silicon that integrates features like deep packet inspection and network telemetry at wire speed. A major technological thrust is the migration from conventional copper cabling to high-speed fiber optics, particularly within and between data center racks, necessitating advanced optical transceivers and efficient thermal management within the switch chassis to sustain high-power operations. Specialized Application-Specific Integrated Circuits (ASICs), often designed in-house by major vendors or supplied by silicon specialists like Broadcom and Mellanox, are fundamental, enabling programmable forwarding pipelines and accelerating complex Layer 3/Layer 4 routing functions critical for modern networks.

Software-Defined Networking (SDN) and Network Function Virtualization (NFV) are foundational technologies reshaping the market. SDN separates the network control plane from the data plane, allowing centralized, programmatic control over the entire network topology. This decoupling facilitates intent-based networking and dramatically simplifies complex network operations, enabling automated provisioning and configuration updates. Switches compatible with SDN (often featuring OpenFlow or proprietary APIs) are increasingly preferred, especially by cloud providers seeking to manage thousands of devices efficiently. Furthermore, technologies like VXLAN (Virtual Extensible LAN) tunneling are extensively used to create massive Layer 2 domains over Layer 3 infrastructures, crucial for supporting large multi-tenant cloud environments and ensuring seamless mobility of virtual machines across the data center fabric.

Emerging technologies focus heavily on performance and energy efficiency. Power over Ethernet (PoE) standards (up to 90W for PoE++) are becoming standard features in campus switches, extending power and connectivity to a vast array of IoT endpoints and high-power access points, simplifying network edge deployment. Telemetry and observability are also critical technological advancements; modern switches continuously stream performance data (latency, buffer utilization, congestion metrics) using protocols like gRPC and OpenConfig. This rich data is fed into AIOps platforms for real-time analysis, enabling proactive network tuning and quicker troubleshooting. This integration of deep observability tools ensures that networks operate at peak efficiency, minimizing downtime and supporting demanding low-latency applications like high-frequency trading and AI model inference.

Regional Highlights

- North America: This region maintains market leadership due to the concentration of major technology hubs, hyperscale cloud service providers, and early and aggressive adoption of cutting-edge networking technologies like 400GbE and open networking solutions. High IT expenditure, driven by constant data center expansion and rapid deployment of 5G infrastructure by major carriers (AT&T, Verizon), ensures continuous high-value hardware refresh cycles. The demand here is highly focused on performance, automation (SDN), and specialized switching for AI/ML workloads.

- Asia Pacific (APAC): APAC is projected to exhibit the highest growth rate, fueled by rapid digitalization initiatives across developing economies (India, Southeast Asia) and massive infrastructure investments in China and Japan. Government initiatives supporting smart cities, coupled with exploding mobile data consumption driven by a huge user base, necessitate extensive core and access network expansion. The region is seeing significant adoption of both proprietary high-end solutions and cost-effective solutions from domestic manufacturers.

- Europe: Growth in Europe is stable and driven primarily by regulatory requirements (GDPR, data sovereignty) demanding robust, secure, and compliant network infrastructures. Enterprises and government sectors are investing heavily in network modernization to support digital public services and hybrid cloud adoption. Germany, the UK, and France are key markets, prioritizing vendor reliability, security certifications, and energy-efficient switching solutions, often adhering strictly to specific environmental and sustainability standards.

- Latin America: This region is characterized by steady market penetration, with growth accelerating due to increased foreign investment in digital infrastructure and the expansion of local data centers. Brazil and Mexico are primary markets, where modernization efforts focus on improving broadband connectivity and migrating enterprise workloads to the cloud. Affordability and TCO are often critical factors, influencing the adoption of fixed configuration and smart switches.

- Middle East and Africa (MEA): MEA is an emerging, high-potential market. Growth is propelled by ambitious governmental digital transformation visions (e.g., Saudi Vision 2030, UAE's smart initiatives) leading to significant investments in data centers, telecommunications, and high-speed campus networks. The market is defined by large-scale project deployments requiring cutting-edge, resilient networking infrastructure, though geopolitical instability in certain sub-regions remains a potential restraint.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the IT Switch Market.- Cisco Systems Inc.

- Arista Networks, Inc.

- Juniper Networks, Inc.

- Huawei Technologies Co., Ltd.

- Dell Technologies Inc.

- Hewlett Packard Enterprise (HPE)

- Extreme Networks, Inc.

- Nokia Corporation

- Allied Telesis, Inc.

- D-Link Corporation

- Broadcom Inc. (Silicon Provider)

- Nvidia (Mellanox Technologies)

- H3C Technologies

- Ruijie Networks

- ZTE Corporation

- TP-Link

- CommScope

- Intel Corporation

- Accton Technology Corporation

- Ciena Corporation

Frequently Asked Questions

Analyze common user questions about the IT Switch market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of 400GbE switches?

The increasing density of data center traffic, particularly "East-West" server-to-server communication generated by virtualization, AI/ML training, and multi-cloud environments, necessitates the massive bandwidth and reduced latency offered by 400GbE to prevent network bottlenecks and ensure operational efficiency for hyperscale operators.

How does Software-Defined Networking (SDN) influence IT switch purchasing decisions?

SDN shifts focus from hardware features to programmability and open APIs. Purchasers prioritize switches that can seamlessly integrate with centralized SDN controllers, allowing for automated provisioning, policy enforcement, and dynamic resource allocation, reducing CapEx and streamlining complex network management across large infrastructures.

What are the key differences between Managed, Unmanaged, and Smart switches?

Unmanaged switches are plug-and-play without configuration options. Managed switches offer full control, monitoring, VLAN support, and advanced security, suitable for complex environments. Smart switches offer limited management features, balancing ease of use with essential configuration capabilities, ideal for small to medium enterprises (SMEs).

Which end-user segment is exhibiting the fastest growth in the IT Switch Market?

The Data Center and Cloud Service Provider segment is experiencing the fastest growth, primarily driven by the continuous global expansion of hyperscale facilities and the constant need for high-speed infrastructure upgrades (100GbE and 400GbE) to support soaring demand for digital services and cloud migration projects.

What is the significance of PoE++ technology in modern enterprise switches?

PoE++ (802.3bt) is significant because it allows switches to deliver up to 90W of power over standard Ethernet cables. This capability is crucial for powering advanced network devices such as high-performance Wi-Fi 6/7 access points, complex IoT sensors, and pan-tilt-zoom (PTZ) security cameras, simplifying edge deployment and reducing the need for separate electrical infrastructure.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Circuit Switch Fall Back Csfb Voice Over Lte Technology Market Size Report By Type (Smartphones, Routers, Wireless Modems, Laptops, Notebooks, Tablets, Modules, Others), By Application (Corporate, Commercial, Government), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Rotary Limit Switch Market Statistics 2025 Analysis By Application (Wind Turbines, Hoisting Apparatus), By Type (Gear Type, Encoded Type), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager