ITO Sputtering Target Material Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437361 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

ITO Sputtering Target Material Market Size

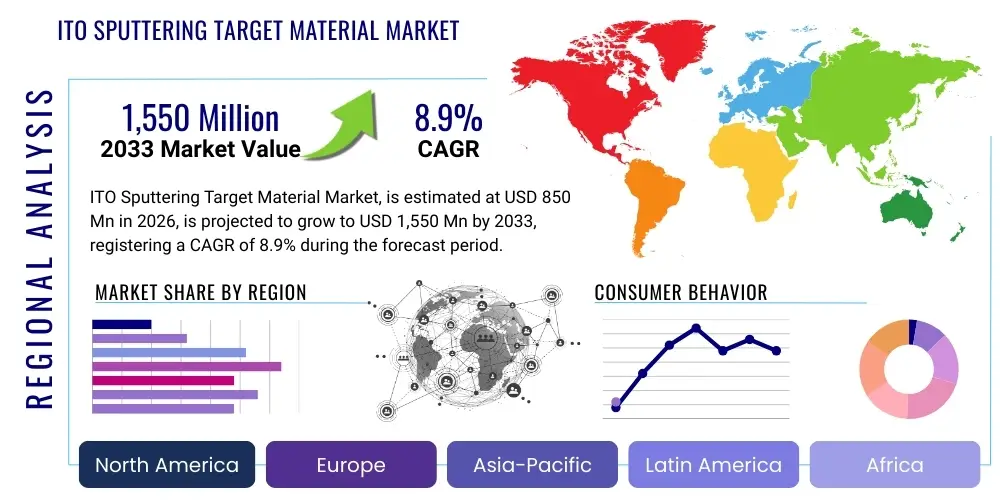

The ITO Sputtering Target Material Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.9% between 2026 and 2033. The market is estimated at $850 Million in 2026 and is projected to reach $1,550 Million by the end of the forecast period in 2033.

ITO Sputtering Target Material Market introduction

The Indium Tin Oxide (ITO) sputtering target material market forms a critical backbone for the modern electronics industry, serving as the premier material for transparent conductive oxides (TCOs). ITO targets, typically fabricated through advanced powder metallurgy techniques such as Hot Isostatic Pressing (HIP) or vacuum sintering, are essential precursors used in the physical vapor deposition (PVD) sputtering process to deposit thin, highly conductive, and transparent films onto substrates. These films are indispensable in devices requiring both electrical conductivity and optical transparency, driving their extensive adoption across consumer electronics, renewable energy, and automotive sectors.

The superior properties of ITO films, characterized by low sheet resistance and high transmittance in the visible spectrum, position them as the material of choice for displays and solar cells. Major applications include the manufacturing of Liquid Crystal Displays (LCDs), Organic Light-Emitting Diodes (OLEDs), touch panels, and thin-film photovoltaic devices. The benefits of utilizing high-purity ITO targets include enhanced film uniformity, minimized defect formation, and improved device performance, directly correlating target quality with the efficiency and longevity of end-products. As electronic devices evolve towards higher resolution, larger sizes, and flexibility, the demand for sophisticated ITO targets with specialized compositional ratios and structural integrity intensifies.

The market is primarily driven by the exponential growth of the flat panel display (FPD) industry, especially the rapid proliferation of OLED technology in smartphones, televisions, and wearable devices, which demands premium transparent conductors. Furthermore, the global push towards renewable energy stimulates demand from the solar cell manufacturing sector. Key driving factors also include the continuous technological advancements in touch sensor integration, expansion of automotive displays and smart windows, and the increasing adoption of flexible electronics, all reliant on high-performance TCO films derived from ITO sputtering targets.

ITO Sputtering Target Material Market Executive Summary

The ITO Sputtering Target Material Market is characterized by robust growth, fueled predominantly by transformative technological shifts in consumer electronics and renewable energy infrastructure. Current business trends indicate a strong focus on high-purity (5N and above) targets and the transition from planar to rotary targets, which offer enhanced material utilization efficiency and lower production costs, especially critical for high-volume manufacturing of large-area displays (like those used in OLED TVs). Furthermore, ongoing supply chain optimization, particularly concerning the sourcing and recycling of Indium, remains a paramount concern shaping market dynamics due to the inherent scarcity and price volatility of the raw material.

Regional trends highlight the enduring dominance of the Asia Pacific (APAC) region, which serves as the global hub for FPD and photovoltaic manufacturing, driven primarily by China, South Korea, and Japan. These nations host the majority of large-scale fabrication plants (fabs) that consume ITO targets. North America and Europe, while smaller in consumption volume, focus heavily on research and development of advanced TCOs and niche high-tech applications such as augmented reality (AR) devices and specialized sensor technology, influencing future innovation paths. The competitive landscape is intensely concentrated, necessitating continuous investment in sintering and pressing technologies to achieve superior target density and homogeneity.

Segmentation trends reveal that the Flat Panel Display (FPD) segment maintains the largest market share, driven specifically by the aggressive scaling of OLED production lines. Within product types, high-density targets fabricated using Hot Isostatic Pressing (HIP) are witnessing the fastest adoption rate due to their superior performance characteristics compared to vacuum-sintered targets. Looking forward, the market anticipates sustained growth contingent upon the successful scaling of new display technologies, such as Micro-LEDs, and the sustained adoption of flexible and foldable electronic devices, which place unique demands on the uniformity and mechanical flexibility of the deposited ITO films.

AI Impact Analysis on ITO Sputtering Target Material Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the ITO sputtering target market frequently revolve around themes of manufacturing optimization, material discovery, and AI-driven shifts in end-user demand. Key concerns focus on whether AI can mitigate Indium supply risks by accelerating the discovery of viable non-Indium TCO substitutes (e.g., ZTO, AZO) and how machine learning algorithms can enhance the efficiency and yield of the notoriously complex sputtering deposition process. Users expect AI to stabilize and refine the production of high-purity targets, leading to better material quality and reduced waste, thereby impacting the total cost of ownership for device manufacturers.

The influence of AI extends beyond manufacturing efficiency into core strategic areas, including predictive maintenance for expensive sputtering equipment, enabling manufacturers to minimize downtime and maximize throughput. Moreover, the accelerating trend of digital transformation and the increasing demand for high-resolution displays used in AI-enabled devices—such as advanced driver assistance systems (ADAS), high-performance computing (HPC) displays, and AR/VR headsets—directly stimulate demand for superior ITO films. AI models are also being deployed to analyze complex sensor data derived from these TCO layers, leading to faster quality control and improved reliability in electronic components.

Ultimately, AI technology is poised to act as a significant enabler for the market. By applying deep learning to material science, researchers can simulate and predict the optimal composition and microstructures required for next-generation targets tailored for flexible substrates or specialized light transmission requirements. This iterative process speeds up R&D cycles and helps fine-tune sputtering parameters in real-time within the production environment, ensuring that the performance characteristics of the deposited ITO films meet the rigorous specifications required by cutting-edge display and sensor technologies, reinforcing the market’s reliance on high-quality target materials.

- AI optimizes sputtering process parameters, reducing material waste and increasing deposition uniformity.

- Machine learning accelerates R&D for alternative Transparent Conductive Oxides (TCOs), addressing Indium dependency.

- Predictive maintenance using AI minimizes downtime of high-cost PVD equipment, enhancing production capacity.

- AI-driven consumer electronics (AR/VR, high-res displays) directly increases demand for high-quality ITO films.

- Automated quality control systems utilize AI to rapidly detect defects in target materials and deposited films.

DRO & Impact Forces Of ITO Sputtering Target Material Market

The ITO Sputtering Target Material Market is influenced by a complex interplay of drivers (D), restraints (R), and opportunities (O), which collectively define its impact forces. Primary drivers include the massive expansion of the OLED display market, particularly in high-end smartphones and large-format televisions, which rely heavily on ITO for transparent electrodes. Supporting this growth is the increasing penetration of touch panel technology across various sectors, including automotive infotainment systems and interactive public displays. Furthermore, the sustained global investment in renewable energy, particularly CIGS and amorphous silicon thin-film solar cells, provides a stable, high-volume demand stream for ITO targets, bolstering market stability and expansion.

However, the market faces significant restraints, chiefly revolving around the supply chain instability and high cost of Indium, a rare earth element. Price volatility and the concentration of Indium reserves create supply risks, prompting intensive research into substitute materials. Another restraint is the technical challenge associated with achieving ultra-high density and purity targets necessary for advanced display technologies, which require specialized and expensive manufacturing techniques like Hot Isostatic Pressing (HIP). Additionally, the development and commercial viability of alternative TCOs, such as silver nanowires (AgNWs) and carbon nanotubes (CNTs) in flexible applications, pose a long-term competitive threat to ITO’s dominance in specific segments.

Opportunities for growth are concentrated in emerging technologies and niche applications. The proliferation of 5G infrastructure is driving demand for advanced sensors and antenna structures that incorporate transparent conductive layers. The nascent but rapidly expanding markets for Augmented Reality (AR) and Virtual Reality (VR) devices require miniaturized, high-performance display components utilizing premium ITO films. Moreover, the development of flexible and foldable electronics presents a substantial opportunity for customized, high-performance ITO targets that can produce films capable of withstanding significant mechanical stress. These factors exert a strong cumulative impact force, dictating both innovation speed and pricing strategies across the value chain.

- Drivers: Rapid adoption of OLED technology; Expansion of touch panel and sensor markets; Growth in thin-film solar cell manufacturing.

- Restraints: High cost and supply volatility of Indium; Technical barriers to achieving ultra-high density and purity; Competition from alternative TCO materials (AgNWs, CNTs, AZO).

- Opportunities: Emergence of flexible and foldable electronics; Increased deployment of AR/VR devices; Demand driven by 5G-enabled high-resolution displays and advanced sensor applications.

- Impact Forces: High demand from APAC manufacturing hubs; Necessity for advanced manufacturing techniques (HIP); Continuous pressure for cost reduction through Indium recycling and material efficiency.

Segmentation Analysis

The ITO Sputtering Target Material market is highly diversified and segmented based on material composition (purity and stoichiometry), target type (shape and density), and application. Analyzing these segments is crucial for understanding market dynamics and competitive positioning. Key segmentations focus on the purity level, as higher purity targets (5N and 6N) are mandated by sophisticated applications like OLEDs to minimize electrical defects and maximize optical transmission, whereas slightly lower purity (4N) targets may suffice for certain solar applications. The target shape segmentation, dividing the market between planar and rotary targets, reflects the evolution of manufacturing efficiency; rotary targets, offering better utilization and thermal management, are increasingly favored in high-throughput facilities.

The application segment is dominated by Flat Panel Displays (FPDs), encompassing LCD, OLED, and Micro-LED technologies. This segment dictates pricing and purity requirements. The second major segment, Photovoltaics, provides steady demand, although the performance specifications differ slightly, often focusing on large-area, cost-effective targets. Other vital applications include specialized optical coatings, EMI shielding, automotive displays, and advanced sensor manufacturing. Understanding the specific material requirements for each application, such as high mechanical strength for flexible electronics or specific Indium/Tin ratio for optimal conductivity/transparency balance, is paramount for target manufacturers.

Further analysis of target density and manufacturing method reveals specialized sub-segments. Targets produced via Hot Isostatic Pressing (HIP) achieve significantly higher theoretical density (99.5%+) compared to conventional vacuum sintering. High-density targets yield denser, finer-grained films, which are critical for high-end applications, minimizing arcing during the sputtering process and improving overall device yield. The competitive differentiation often lies in a manufacturer's ability to consistently produce large, high-density targets with uniform microstructure, addressing the stringent demands of Tier 1 display fabricators worldwide.

- By Purity:

- 4N (99.99%)

- 5N (99.999%)

- 6N (99.9999%)

- By Target Type (Shape):

- Planar Targets

- Rotary (Cylindrical) Targets

- By Density/Manufacturing Method:

- High-Density Targets (HIP Processed)

- Medium-Density Targets (Vacuum Sintering)

- By Application:

- Flat Panel Displays (LCD, OLED, Micro-LED)

- Photovoltaics/Solar Cells (Thin-Film)

- Touch Sensors and Touchscreens

- Optical Coatings and Devices

- Automotive Electronics (Heads-up displays, Smart Windows)

Value Chain Analysis For ITO Sputtering Target Material Market

The value chain for ITO sputtering targets begins with the upstream sourcing and refining of raw materials, primarily Indium and Tin. Indium is often obtained as a byproduct of zinc or lead smelting, making its supply subject to the dynamics of the base metal mining industry. Upstream analysis focuses on securing stable, high-purity Indium supply and establishing robust recycling processes for Indium recovered from spent targets or scrapped electronic devices, which is critical due to Indium's scarcity. Raw material producers and specialized chemical suppliers concentrate on achieving ultra-high purity Indium (typically 6N) powder required for advanced target manufacturing.

The midstream segment involves the specialized production of the sputtering targets themselves. This stage is highly technical and capital-intensive, requiring advanced powder metallurgy techniques such as blending, pre-sintering, and high-pressure consolidation (e.g., Hot Isostatic Pressing or advanced vacuum sintering) to achieve specific density, stoichiometry (typically 90% In2O3: 10% SnO2), and mechanical stability. Manufacturers in this segment, who are typically the key market players, invest heavily in process control to ensure uniform microstructure and density, as target quality directly affects the performance and efficiency of the subsequent thin-film deposition process in the downstream segment.

Downstream analysis focuses on the end-users, mainly large-scale Flat Panel Display (FPD) fabs, solar cell manufacturers, and specialized electronics component producers. Distribution channels can be direct, where target manufacturers supply high-volume orders directly to Tier 1 display makers (e.g., Samsung, LG, BOE), often involving customized target specifications and dedicated technical support. Indirect channels involve distributors or agents who serve smaller, specialized end-users or specific regional markets, facilitating logistics and local inventory management. The efficiency of the distribution channel is vital, given the high cost and sensitivity of the target material, requiring specialized handling and rapid turnover.

ITO Sputtering Target Material Market Potential Customers

Potential customers and end-users of ITO sputtering target materials represent various high-technology sectors critically dependent on Transparent Conductive Oxide (TCO) films. The most significant category comprises global manufacturers of flat panel displays, including leading producers of LCD, high-resolution OLED, and next-generation Micro-LED panels for consumer electronics like smartphones, tablets, laptops, and large-screen televisions. These buyers demand stringent quality specifications, particularly for 5N and 6N purity targets, as defects in the TCO layer translate directly into display quality issues and low manufacturing yields, making material reliability paramount.

Another major customer base resides within the renewable energy sector, specifically companies manufacturing thin-film photovoltaic (PV) modules, such as CIGS (Copper Indium Gallium Selenide) and amorphous silicon solar cells. In this application, ITO films serve as the window layer and transparent electrode. While purity requirements might be marginally less stringent than those for high-end displays, the demand is volume-driven, requiring large-area, high-density targets to cover extensive surface areas efficiently and cost-effectively, balancing performance with scale economics.

Additionally, the rapidly expanding market for touch sensors and automotive electronics constitutes a crucial growth segment for ITO target consumption. Manufacturers producing sophisticated touchscreens for integrated vehicle cockpits, heads-up displays (HUDs), and smart windows are key customers. These applications often require targets capable of yielding films with enhanced mechanical properties and durability, capable of withstanding varying environmental conditions, alongside consumer electronics sensor makers developing advanced bio-sensors and specialized optical filtering devices.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $850 Million |

| Market Forecast in 2033 | $1,550 Million |

| Growth Rate | CAGR 8.9% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | JX Nippon Mining & Metals, Sumitomo Metal Mining, Praxair S.T. Technology (Linde), Tosoh SMD, Materion, Umicore, Fierce, Korea Rare Metal, Solar Applied Materials Technology, Mitsui Mining & Smelting, ANP Technologies, Plansee SE, Lesker Company, H.C. Starck, PVD Products |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

ITO Sputtering Target Material Market Key Technology Landscape

The technological landscape of the ITO sputtering target market is characterized by a persistent drive toward achieving higher material density, greater uniformity, and larger target sizes, all critical for optimizing the subsequent PVD process. The primary manufacturing technology utilized remains advanced powder metallurgy, specifically Hot Isostatic Pressing (HIP). HIP technology involves subjecting the pre-sintered ITO powder compact to high temperatures (up to 1,500 °C) and high isotropic gas pressures, resulting in a target density that often exceeds 99.5% of the theoretical maximum. This ultra-high density is crucial because it minimizes the incidence of micro-cracking and gas pores, which can lead to arcing during sputtering, thereby enhancing the uniformity and quality of the deposited TCO film and improving device yield for end-users.

Beyond the fundamental sintering and pressing techniques, significant technological advancements are centered on target geometry and composition control. The transition from traditional planar targets to rotary (cylindrical) targets is a major trend. Rotary targets offer a larger erosion area, leading to significantly higher material utilization rates (often exceeding 80% compared to 30-40% for planar targets) and enabling longer continuous operation cycles, which is essential for massive generation FPD fabs. Innovators are continually improving the bonding technology used to attach the brittle ITO target material to the metallic backing plate, ensuring superior thermal transfer and mechanical integrity under intense sputtering conditions.

Furthermore, research and development efforts are concentrated on fine-tuning the target stoichiometry, primarily the Indium-to-Tin ratio, to optimize the balance between electrical conductivity and optical transparency for specific applications (e.g., low-temperature process requirements for flexible substrates). There is also a continuous exploration of doping techniques and specialized powder preparation methods (e.g., nano-powder synthesis) aimed at producing targets that yield films with enhanced stability and reduced resistivity. This technological push is essential for staying competitive, particularly as the industry explores alternatives to conventional ITO and faces increasing pressure to maximize Indium recycling efficiency.

Regional Highlights

- Asia Pacific (APAC): APAC is the unquestioned market leader, accounting for the largest share of global consumption. This dominance is driven by the concentration of global electronic manufacturing supply chains, including major FPD producers (South Korea, China, Taiwan, and Japan). China, in particular, has seen massive investment in Gen 8.5 and Gen 10.5 display fabrication lines, driving explosive demand for high-purity ITO targets. South Korea remains pivotal due to its leadership in advanced OLED technology manufacturing.

- North America: This region holds a significant position in terms of R&D and specialized high-tech applications. Demand is steady, fueled by high-value niche sectors such as military optics, specialized sensor technology, advanced semiconductor packaging, and the rapidly growing AR/VR hardware sector. North American firms often focus on pioneering non-ITO TCO alternatives and advanced target manufacturing process control.

- Europe: The European market demonstrates steady growth, concentrated around advanced manufacturing sectors, automotive electronics (e.g., smart windows, specialized displays), and photovoltaic research. Europe is a key center for the development of high-efficiency thin-film solar technologies, which ensures consistent demand for standard-grade ITO targets, complemented by a focus on sustainable sourcing and Indium recycling initiatives.

- Latin America & Middle East/Africa (MEA): These regions represent emerging markets characterized by smaller consumption volumes. Growth in these areas is primarily linked to localized electronics assembly and the gradual adoption of solar energy projects. While not major producers, they are increasingly important as potential consumption hubs for finished TCO-coated components imported from APAC.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the ITO Sputtering Target Material Market.- JX Nippon Mining & Metals

- Sumitomo Metal Mining

- Praxair S.T. Technology (Linde)

- Tosoh SMD

- Materion

- Umicore

- Fierce

- Korea Rare Metal

- Solar Applied Materials Technology

- Mitsui Mining & Smelting

- ANP Technologies

- Plansee SE

- Lesker Company

- H.C. Starck

- PVD Products

- Ningbo Jiangfeng Electronic Materials

- China Rare Metal Material Co., Ltd.

- GRIKIN Advanced Materials Co., Ltd.

- Advanced Target Materials Inc. (ATM)

- Beijing Zhongcai Chemical Engineering Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the ITO Sputtering Target Material market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of ITO sputtering targets in electronics manufacturing?

ITO (Indium Tin Oxide) sputtering targets are the source material used in Physical Vapor Deposition (PVD) to create thin films that function as highly transparent and electrically conductive electrodes, essential for flat panel displays (OLED, LCD) and touchscreens.

Why are high-purity ITO targets crucial for modern display technologies?

High-purity targets (5N or 6N) are crucial because impurities cause electrical defects, reduced light transmittance, and process arcing during sputtering. Higher purity ensures film uniformity and maximizes the yield and lifespan of high-resolution OLED and advanced LCD panels.

What is the main manufacturing technology used to produce high-density ITO targets?

The main technology is Hot Isostatic Pressing (HIP). HIP subjects the target material to intense heat and pressure, achieving near-theoretical density (over 99.5%), which minimizes porosity and significantly improves sputtering efficiency and film quality.

Which segment currently drives the largest demand for ITO sputtering materials?

The Flat Panel Display (FPD) segment, driven by the rapid global expansion and adoption of OLED technology in consumer electronics and large-format televisions, accounts for the largest share of demand.

What key material risk affects the ITO sputtering target market?

The key risk is the high cost and supply chain instability associated with Indium, a critical raw component that is expensive and often sourced as a byproduct of zinc mining. This volatility drives continuous research into alternative TCO materials.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager