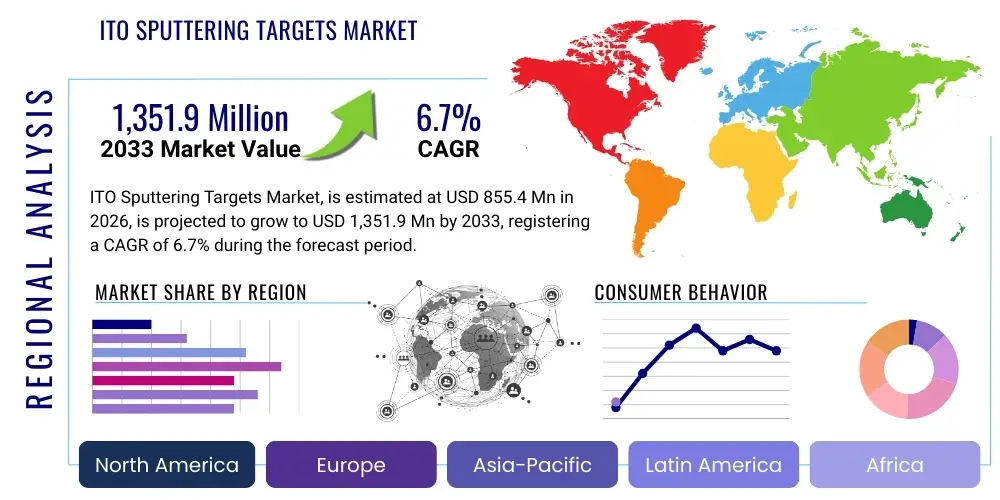

ITO Sputtering Targets Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434629 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

ITO Sputtering Targets Market Size

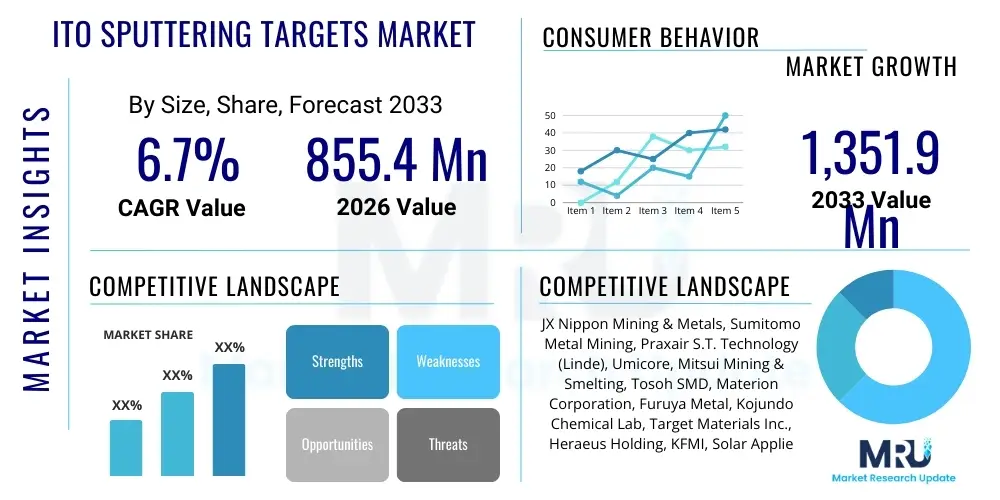

The ITO Sputtering Targets Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.7% between 2026 and 2033. The market is estimated at USD 855.4 million in 2026 and is projected to reach USD 1,351.9 million by the end of the forecast period in 2033.

ITO Sputtering Targets Market introduction

Indium Tin Oxide (ITO) sputtering targets are specialized ceramic materials utilized in physical vapor deposition (PVD) processes, specifically magnetron sputtering, to deposit thin films of ITO. ITO thin films are crucial due to their unique combination of high electrical conductivity and high optical transparency in the visible spectrum, making them the standard material for transparent conductive oxides (TCOs). The fundamental product serves as the raw material precursor for manufacturing electrodes, sensors, and protective layers in high-technology consumer and industrial electronics. This introduction covers the fundamental utility and accelerating factors propelling market expansion across global supply chains.

The primary applications for ITO sputtering targets span across flat panel displays (LCDs, OLEDs), touch panels, solar cells (photovoltaics), and energy-efficient architectural glass. The material’s high transparency allows light transmission while the excellent conductivity facilitates efficient charge collection and distribution. Key driving factors include the relentless demand for higher resolution and larger-sized displays, particularly in the OLED segment, coupled with the rapid integration of touch functionality across automotive interfaces, medical devices, and smart home technology. Furthermore, stringent governmental regulations promoting renewable energy sources, especially solar power, significantly bolster demand for high-performance TCO coatings essential for photovoltaic efficiency.

Benefits derived from utilizing high-purity ITO targets include enhanced film uniformity, minimized particle generation during sputtering, and improved throughput, which are critical for maintaining the high standards required by display and semiconductor manufacturing. Advances in target manufacturing technologies, focusing on achieving higher density and finer grain size, directly translate into superior film quality and reduced operational costs for end-users. The market is also driven by technological shifts, such as the gradual transition from traditional liquid crystal displays (LCDs) to advanced organic light-emitting diodes (OLEDs), which often require complex, multi-layered ITO structures for optimal performance and efficiency, thus increasing the consumption rate of these critical materials.

ITO Sputtering Targets Market Executive Summary

The ITO Sputtering Targets Market is characterized by robust growth anchored by persistent expansion in the display and photovoltaic sectors, alongside crucial advancements in material purity and manufacturing processes. Business trends indicate a strategic focus among manufacturers on securing long-term indium supply, given its scarcity, and investing heavily in high-density target fabrication technologies to cater to the exacting specifications of the OLED and flexible electronics industries. Regional trends highlight the Asia Pacific (APAC) as the undisputed leader, driven by the concentration of global display panel and solar cell manufacturing hubs, notably in China, South Korea, and Japan, which necessitates massive localized sourcing of high-purity targets. Segment trends reveal that the Planar segment maintains dominance due to standardized use in large area coating, but the Rotatable target segment is gaining significant traction due to its superior utilization efficiency and extended lifespan, aligning perfectly with high-volume, continuous manufacturing environments typical of large-scale display fabrication plants. Overall, the market remains highly competitive, demanding constant innovation in material science and strategic partnerships between target producers and leading panel manufacturers to ensure stable supply chains and product development alignment.

AI Impact Analysis on ITO Sputtering Targets Market

User queries regarding AI's influence frequently center on how artificial intelligence can optimize the highly technical and materials-intensive process of sputtering target production and utilization. Key themes revolve around AI-driven quality control, predictive maintenance for sputtering equipment, and the optimization of thin- film deposition parameters. Users are concerned about maintaining material consistency (purity and density) across large production batches and expect AI to offer solutions for real-time defect detection and corrective actions during the complex, high-vacuum manufacturing phase. Furthermore, there is anticipation that AI algorithms could accelerate materials discovery for next-generation transparent conductive materials, potentially impacting ITO’s long-term dominance, though currently, AI is seen primarily as an efficiency enhancer within the existing ITO production ecosystem, particularly regarding process yield improvement and supply chain efficiency modeling.

- AI-Driven Process Optimization: Utilizing machine learning algorithms to analyze real-time plasma characteristics and optimize power density, deposition rate, and gas flow during the sputtering process, leading to enhanced film uniformity and reduced material wastage.

- Predictive Maintenance: AI tools monitoring the lifespan and wear patterns of rotatable and planar targets, providing accurate predictions for replacement schedules, thereby minimizing unexpected downtime and maximizing equipment utilization rates.

- Quality Control Automation: Implementing computer vision and deep learning models to inspect finished target surfaces and deposited ITO thin films for microstructure defects, porosity, and uniformity inconsistencies at speeds unachievable by human inspection.

- Supply Chain Forecasting: AI models analyzing global indium supply fluctuations, geopolitical risks, and end-user demand spikes (especially from the volatile consumer electronics sector) to optimize inventory management and material procurement strategies for target manufacturers.

- Materials Informatics: Although nascent, AI is starting to be used to simulate and predict the properties of novel TCO compositions or dopant ratios, potentially leading to alternatives to ITO or significantly optimizing current ITO target formulation for specific applications like flexible displays.

DRO & Impact Forces Of ITO Sputtering Targets Market

The ITO Sputtering Targets Market is influenced by a complex interplay of Drivers (D), Restraints (R), and Opportunities (O), defining its Impact Forces. Major drivers include the ubiquitous adoption of touch screen technology and the rapid deployment of OLED displays, which demand high-performance, multilayered conductive films. However, the market faces significant restraints, primarily stemming from the inherent price volatility and geopolitical sensitivity associated with Indium, a rare and essential component of ITO, pushing manufacturers to explore alternative TCO materials. Opportunities abound in the burgeoning fields of flexible electronics, augmented reality (AR) devices, and smart window technology, all of which require specialized, high-purity targets. The impact forces are generally high due to the non-substitutable nature of ITO in many high-end display applications in the short term, compelling continuous research into target recycling and alternative materials (e.g., silver nanowires, carbon nanotubes) while optimizing the existing ITO supply chain for efficiency and sustainability.

Segmentation Analysis

The ITO Sputtering Targets market is comprehensively segmented based on its Purity Level, Target Type, and End-Use Application, reflecting the diverse technical requirements across various high-tech industries. Purity level segmentation is crucial, as the performance and uniformity of the deposited thin film are directly correlated with the target's purity, typically categorized into standard (99.9%) and ultra-high purity (99.99% and above) materials. Target type differentiation addresses manufacturing scale and efficiency, with planar targets historically dominating but rotatable targets rapidly gaining market share due to their cost-effectiveness in large-area coating processes. The application segmentation clearly delineates the market consumption landscape, with displays and photovoltaics representing the highest volume segments globally.

- By Purity Level:

- Standard Purity (99.9%)

- High Purity (99.99%)

- Ultra-High Purity (99.999% and above)

- By Target Type:

- Planar Targets

- Rotatable (Rotary) Targets

- By Application:

- Flat Panel Displays (LCD, OLED, Plasma)

- Touch Panels/Touch Sensors

- Solar Cells (Photovoltaics)

- LED/Lighting

- Automotive Electronics

- Others (e.g., Smart Windows, EMI Shielding)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For ITO Sputtering Targets Market

The value chain for ITO Sputtering Targets begins with the highly concentrated upstream segment, focusing on the mining, refining, and procurement of raw materials, primarily Indium and Tin. Indium supply is often a byproduct of zinc and lead mining, making its availability inherently volatile and subject to geopolitical and trade policies, dictating the initial cost structure. Key upstream activities involve processing the raw Indium into Indium Oxide (In2O3) and mixing it with Tin Oxide (SnO2) to create the precursor powder. Strategic control over high-purity Indium resources provides significant competitive advantages to target manufacturers capable of backward integration or securing exclusive long-term supply agreements, emphasizing the importance of securing material reliability and purity exceeding 99.99% for high-end applications.

The manufacturing process, which constitutes the core midstream activity, involves powder pressing, high-temperature sintering, and precision machining to form the final dense target structure, be it planar or rotatable. This stage is technically demanding, requiring stringent controls over density, grain size, and compositional homogeneity to ensure optimal sputtering performance and film quality. Downstream activities involve the direct sale and distribution of finished targets to major end-users, primarily large display fabrication plants (fabs) and photovoltaic manufacturers. Due to the sensitive nature of the materials and the just-in-time requirements of continuous manufacturing lines, the distribution channel often relies on direct sales models supplemented by highly specialized local distributors equipped to handle technical support and rapid replacement logistics.

The distribution channel is predominantly direct, especially when dealing with Tier 1 panel makers and large solar corporations, ensuring seamless technical communication and rapid customization of target dimensions and compositions. Indirect channels, involving specialized materials trading houses, are sometimes utilized for smaller volume orders or geographically dispersed end-users, but technical support remains paramount. The market structure inherently favors highly experienced manufacturers who can manage the technical complexities of both the materials synthesis (upstream) and the high-precision machining (midstream), creating high barriers to entry and reinforcing the strategic importance of long-term customer relationships built on consistent product quality and reliable supply.

ITO Sputtering Targets Market Potential Customers

The primary customers for ITO Sputtering Targets are global electronics manufacturers and renewable energy producers who rely on Transparent Conductive Oxide (TCO) films for device functionality. The largest consumer segment consists of companies operating large-scale display fabrication plants, including those specializing in LCD, OLED, and increasingly, micro-LED technologies. These fabs require vast volumes of targets, often custom-sized planar or rotatable versions, to coat millions of substrates annually for products ranging from smartphones and tablets to high-definition televisions and large interactive public displays. The stringent quality and uniformity demanded by display applications necessitate partnerships with target suppliers capable of delivering ultra-high purity materials consistently.

Another major segment encompasses manufacturers within the photovoltaic industry, particularly those focusing on thin-film solar cells, such as CIGS and amorphous silicon technologies, where ITO layers are essential for efficient light management and charge extraction. These customers prioritize target utilization efficiency and cost-per-unit-area coverage, driving demand for larger rotatable targets. Additionally, emerging customer segments include automotive component suppliers integrating touch screens and heads-up displays (HUDs), and architectural glass companies utilizing ITO coatings for low-emissivity (low-E) windows, leveraging ITO's infrared reflection properties to enhance energy efficiency in buildings.

In essence, the end-user base is characterized by high technological sophistication and rigorous qualification processes. Procurement decisions are not solely based on price but heavily weighted towards material quality, supplier stability, and the ability to meet demanding logistical schedules. Potential customers frequently engage in long-term qualification processes, sometimes lasting over a year, before fully integrating a supplier’s targets into their production line, underscoring the necessity for target providers to demonstrate impeccable consistency, robust R&D capabilities, and secured raw material supply chains to become preferred partners.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 855.4 Million |

| Market Forecast in 2033 | USD 1,351.9 Million |

| Growth Rate | CAGR 6.7% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | JX Nippon Mining & Metals, Sumitomo Metal Mining, Praxair S.T. Technology (Linde), Umicore, Mitsui Mining & Smelting, Tosoh SMD, Materion Corporation, Furuya Metal, Kojundo Chemical Lab, Target Materials Inc., Heraeus Holding, KFMI, Solar Applied Materials Technology, Plansee SE, VDL Enabling Technologies Group, Hitachi Metals (Metals Segment), Vacuum Technology Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

ITO Sputtering Targets Market Key Technology Landscape

The technological landscape of the ITO Sputtering Targets market is defined by advancements aimed at enhancing material purity, increasing target density, and improving sputtering yield for end-users. The key technological challenge lies in manufacturing targets with uniform microstructure and minimal porosity, as these factors directly dictate the quality of the deposited film and the consistency of the sputtering process. Current cutting-edge methods predominantly involve specialized powder metallurgy techniques, including hot pressing (HP) and hot isostatic pressing (HIP), which apply high temperature and pressure to achieve densities often exceeding 99% of the theoretical maximum. Achieving ultra-high density is crucial for reducing macro-particles, or "nodules," generated during sputtering, which can cause significant defects in highly sensitive electronics like high-resolution OLED displays.

A critical technological trend involves the transition towards large-format rotatable targets, particularly for Gen 8 and Gen 10 display production lines. Rotatable targets offer significantly higher material utilization rates and much longer operational lifecycles compared to planar targets, drastically improving the total cost of ownership (TCO) for display manufacturers operating at scale. Technological development here focuses on optimizing the bonding interface between the target material and the backing tube (usually copper or stainless steel) to ensure excellent thermal conductivity, efficiently dissipating heat generated during the high-power sputtering process and preventing target cracking or delamination, which would lead to costly production stops.

The market is also intensely focused on developing sophisticated analysis and quality control technologies, such as advanced spectroscopic techniques and scanning electron microscopy (SEM) analysis, to verify the exact stoichiometry (Indium/Tin ratio) and purity of the finished target, often requiring impurity levels to be maintained in the parts-per-million (ppm) or even parts-per-billion (ppb) range for critical elements. While ITO remains the industry standard, technological R&D is also exploring alternative TCO compositions, such as Indium Gallium Zinc Oxide (IGZO) or Aluminum-doped Zinc Oxide (AZO), spurred by efforts to mitigate dependence on Indium and to find materials better suited for flexible substrates. However, ITO’s combination of low resistance and high transparency currently ensures its technological lead in most commercial applications.

Regional Highlights

The Asia Pacific (APAC) region dominates the ITO Sputtering Targets market, accounting for the substantial majority of global consumption. This preeminence is directly attributable to the high concentration of the world’s leading flat panel display (FPD) manufacturers—including key players in OLED and LCD production—based in countries such as China, South Korea, Japan, and Taiwan. China, in particular, has seen massive state-backed investment in Generation 10.5 and Generation 11 display fabrication facilities, necessitating huge, continuous volumes of large-format sputtering targets. Furthermore, APAC is the global hub for photovoltaic production, cementing its status as the most critical consumer region, defining market pricing and technological demand.

Europe and North America represent secondary markets, characterized more by high-value, specialized applications rather than high volume display production. In North America, demand is driven significantly by the adoption of ITO targets in semiconductor fabrication, aerospace components, sophisticated sensor technology, and smaller, high-specification captive manufacturing operations. European demand is bolstered by advanced research in automotive displays, smart glass technology, and specialized thin-film solar cell R&D, focusing heavily on ultra-high purity materials for demanding scientific and industrial applications where material consistency and minimal defects are prioritized over sheer volume cost-efficiency.

The market dynamics in APAC are critical for global supply chains. Key regional trends include fierce competition among local target suppliers, who benefit from closer proximity to end-users and reduced logistical complexity. This proximity allows for rapid iteration and customization based on specific fab requirements. Conversely, established Japanese and Korean target manufacturers leverage their technological leadership and proven track records in high-purity material synthesis to command premium pricing and maintain strong relationships with Tier 1 domestic and international display makers, creating a bipolar market structure focused on technology versus volume and cost efficiencies.

- Asia Pacific (APAC): Leading market share due to global dominance in FPD (OLED, LCD) and photovoltaic manufacturing; China, South Korea, and Japan are the largest consumers. Demand focused on large-area, high-density rotatable targets.

- North America: Focus on high-specification, niche markets including advanced semiconductor packaging, aerospace systems, and sophisticated touch sensor technology; High demand for ultra-high purity (5N and above) materials.

- Europe: Strong demand driven by the automotive sector (in-car displays), architectural smart glass applications, and specialized thin-film research; Emphasis on sustainability and recycling initiatives for indium content.

- Latin America and MEA: Smaller, emerging markets primarily driven by local photovoltaic projects and assembly operations for consumer electronics, relying heavily on imported targets and finished coated products.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the ITO Sputtering Targets Market.- JX Nippon Mining & Metals Corporation

- Sumitomo Metal Mining Co., Ltd.

- Tosoh Corporation (Tosoh SMD)

- Umicore N.V.

- Materion Corporation

- Mitsui Mining & Smelting Co., Ltd.

- Plansee SE

- Heraeus Holding GmbH

- Vacuum Technology Inc. (VTI)

- Kojundo Chemical Laboratory Co., Ltd.

- Furuya Metal Co., Ltd.

- Solar Applied Materials Technology Corporation

- Praxair S.T. Technology (now Linde)

- KFMI (Korea Fine Materials Inc.)

- Target Materials Inc.

- VDL Enabling Technologies Group

- Hitachi Metals, Ltd. (Metals Segment)

Frequently Asked Questions

Analyze common user questions about the ITO Sputtering Targets market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for high-purity ITO Sputtering Targets?

The primary driver is the global transition toward advanced flat panel displays, particularly OLED technology, and the continuous requirement for higher resolution, larger screens, and complex touch sensors. These applications demand ultra-high purity (99.999%) targets to minimize defects and ensure superior film conductivity and transparency.

How do rotatable targets compare to planar targets in terms of market dynamics?

Rotatable (Rotary) targets are rapidly gaining market share over traditional planar targets, especially in large-area coating for Gen 8+ display fabs and solar production. Rotatable targets offer significantly better material utilization (up to 80%), reduced downtime, and longer service life, leading to lower overall manufacturing costs per substrate.

What are the key substitutes or alternative materials challenging ITO targets?

Key substitutes include silver nanowires (AgNWs), carbon nanotubes (CNTs), and materials like Aluminum-doped Zinc Oxide (AZO) and Indium Gallium Zinc Oxide (IGZO). While substitutes offer benefits like flexibility or lower cost, ITO retains dominance due to its established performance profile, chemical stability, and lower resistivity, which are critical for high-end display electrodes.

What is the main geopolitical risk associated with the ITO Sputtering Targets supply chain?

The major risk is the supply volatility and price fluctuation of Indium, a critical raw material. Indium is a rare element, often obtained as a byproduct of zinc and lead refining, and its primary reserves are concentrated in a few geographical regions, making the supply chain vulnerable to political trade restrictions and resource control.

In which application segment is ITO sputtering target consumption growing the fastest?

The fastest growth segment is expected to be Organic Light Emitting Diode (OLED) display manufacturing, driven by the increasing adoption of OLED panels in high-end smartphones, televisions, and flexible electronic devices, requiring highly optimized ITO transparent electrodes and charge injection layers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager