ITSM Tool Implementation, Consulting and Managed Services Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438640 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

ITSM Tool Implementation, Consulting and Managed Services Market Size

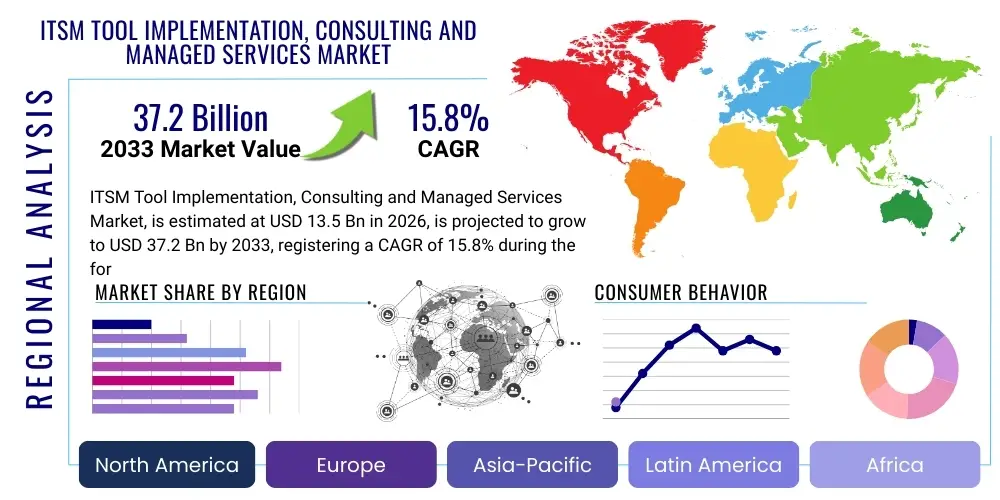

The ITSM Tool Implementation, Consulting and Managed Services Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.8% between 2026 and 2033. The market is estimated at $13.5 Billion in 2026 and is projected to reach $37.2 Billion by the end of the forecast period in 2033.

ITSM Tool Implementation, Consulting and Managed Services Market introduction

The ITSM Tool Implementation, Consulting, and Managed Services Market encompasses the specialized professional services required by organizations to successfully adopt, configure, optimize, and maintain sophisticated Information Technology Service Management (ITSM) software platforms such as ServiceNow, BMC Helix, and Freshservice. These services are crucial because modern ITSM tools are highly complex, requiring deep expertise in ITIL framework compliance, process redesign, integration with existing enterprise systems (ERP, CRM, security platforms), and custom workflow development. Implementation services focus on initial deployment and migration, ensuring the tool aligns perfectly with the client's unique operational needs and governance structure, moving beyond simple installation to deliver transformative business value through standardized service delivery.

The primary applications of these services revolve around enhancing operational efficiency, improving service quality, reducing IT operational costs, and supporting overarching digital transformation initiatives. Benefits derived from engaging specialized consulting firms include accelerated time-to-value for ITSM investments, expert guidance on ITIL best practices (now often incorporating VeriSM and SIAM models), and the establishment of robust, scalable service catalogs and self-service portals. Furthermore, managed services ensure the ongoing health, patching, optimization, and continuous improvement of the ITSM platform, allowing internal IT teams to focus on core business innovation rather than system administration.

Key driving factors propelling this market growth include the rapid global adoption of cloud-based ITSM solutions, which necessitate specialized integration knowledge; the increasing complexity of IT environments dueating to hybrid cloud and multi-cloud strategies; and the continuous need for enterprises to automate routine tasks using workflow automation and Artificial Intelligence (AI) capabilities embedded within these tools. The shift from basic ticketing systems to comprehensive enterprise service management (ESM) platforms further mandates expert consulting, broadening the scope of ITSM beyond IT into Human Resources, Facilities Management, and Legal departments, thereby expanding the potential market footprint significantly.

ITSM Tool Implementation, Consulting and Managed Services Market Executive Summary

The ITSM Tool Implementation, Consulting, and Managed Services market is experiencing robust expansion driven primarily by critical business trends emphasizing agility and service parity across the enterprise. A major trend involves the migration from legacy on-premise ITSM systems to modern, Software-as-a-Service (SaaS) platforms, compelling organizations to invest heavily in specialized implementation and migration expertise to ensure data integrity and minimal disruption. Furthermore, the convergence of IT Service Management (ITSM) with IT Operations Management (ITOM) and Security Operations (SecOps) is creating demand for highly integrated and sophisticated consulting projects that span multiple domains, often leveraging AIOps principles to automate incident resolution and performance monitoring.

Geographically, North America continues its dominance due to the early and extensive adoption of advanced cloud technologies and the presence of major platform vendors and top-tier consulting firms. However, Asia Pacific (APAC) is emerging as the fastest-growing region, fueled by rapid digital transformation across emerging economies, increasing regulatory compliance requirements, and substantial investments in cloud infrastructure by large enterprises and government entities seeking to modernize their service delivery mechanisms. Europe maintains a steady trajectory, characterized by high demand for governance-focused consulting, particularly regarding data privacy (GDPR) and IT financial management integration within ITSM implementations.

Segment-wise, Managed Services represent the fastest-growing component, as organizations increasingly prefer outsourcing the continuous maintenance, optimization, and administration of their ITSM tools to specialized providers, thereby reducing the burden on internal staff and ensuring platform capability remains aligned with vendor updates and evolving IT requirements. Consulting services focusing on organizational change management (OCM) and process maturity assessment are also witnessing heightened demand, reflecting the understanding that technology adoption success hinges equally on people and process readiness, not solely on technical configuration. The large enterprise segment remains the primary revenue generator, though small and medium-sized enterprises (SMEs) are rapidly adopting tailored, subscription-based managed service packages.

AI Impact Analysis on ITSM Tool Implementation, Consulting and Managed Services Market

Common user inquiries regarding AI’s impact often center on how automation will redefine the need for human consultants, whether current implementation methodologies will change significantly due to AIOps, and how quickly AI can transition from simply optimizing processes to autonomously managing IT services. Users are keenly interested in the integration complexity of AI/Machine Learning (ML) modules—such as natural language processing (NLP) for chatbots or ML for predictive incident routing—into existing ITSM frameworks. The primary expectation is that AI will necessitate a shift in consulting focus from transactional process mapping to strategic advisory roles centered on data strategy, governance, algorithm training, and high-value automation design, thus demanding consultants possess advanced data science skills alongside traditional ITIL expertise. The consensus is that AI will not eliminate the need for services but rather elevate the required skill set for service providers, focusing on optimizing the "intelligence layer" of the ITSM platform.

- AI drives the transition from reactive maintenance to proactive and predictive service delivery (AIOps).

- Increased demand for consulting services focused on data preparation, model training, and algorithmic governance within ITSM tools.

- Implementation services now include configuring and deploying intelligent virtual agents (IVAs) and chatbots, reducing reliance on Level 1 support.

- Automation capabilities embedded via AI reduce the manual labor component of ongoing managed services, shifting focus to strategic platform optimization.

- AI assists in auto-classification, intelligent routing, and anomaly detection, requiring consultants to specialize in sophisticated workflow integration.

- The impact necessitates upskilling within service provider teams to handle complex data integration and machine learning operations (MLOps) related to ITSM.

DRO & Impact Forces Of ITSM Tool Implementation, Consulting and Managed Services Market

The dynamics of the ITSM Tool Implementation, Consulting, and Managed Services Market are governed by a complex interplay of rapid technological advancements and intrinsic organizational demands for operational excellence. Key drivers include the pervasive shift to cloud infrastructure, making SaaS ITSM solutions highly accessible and scalable, which in turn fuels the need for expert cloud migration and integration services. Simultaneously, the persistent pressure on CIOs to reduce Total Cost of Ownership (TCO) while improving the quality of IT service delivery creates a significant opportunity for managed service providers offering specialized, cost-effective optimization and administration packages. However, the market faces restraints such as the significant initial capital outlay required for high-end enterprise ITSM tools and the complexity associated with integrating these new platforms with entrenched, legacy backend systems, which often results in extended project timelines and scope creep, posing risks to successful outcomes.

Opportunities are predominantly emerging from the rapid adoption of Enterprise Service Management (ESM), which extends the principles and platform capabilities of ITSM beyond traditional IT into non-IT business functions like HR, Finance, and Legal. This expansion dramatically increases the addressable market for consulting and implementation firms specializing in cross-departmental workflow design and governance structure establishment. Furthermore, the regulatory landscape, particularly concerning data privacy and IT security standards, presents an opportunity for providers to offer compliance-focused consulting services, ensuring ITSM processes adhere to frameworks like ISO 20000 and regional mandates like HIPAA or GDPR. The increasing maturity of AIOps and automation features within leading ITSM platforms also necessitates specialized consulting to unlock the full potential of these advanced capabilities.

Impact forces currently shaping the market include the disruptive nature of generative AI, which promises to revolutionize self-service capabilities and knowledge management, potentially reducing demand for basic support services but amplifying the need for sophisticated platform optimization advice. The ongoing global IT skills shortage is another critical force, driving enterprises towards fully managed services rather than building internal expertise, thus strengthening the managed services segment. Finally, vendor consolidation and platform feature parity among the top ITSM tool vendors intensify the competitive environment among service providers, forcing them to differentiate based on vertical specialization, proprietary methodologies, and deep expertise in niche areas like Software Asset Management (SAM) or Configuration Management Database (CMDB) reconciliation.

Segmentation Analysis

The ITSM Tool Implementation, Consulting, and Managed Services market is primarily segmented based on the type of service offered, the scale of the deployment, the size of the organization, and the industry vertical served. This segmentation provides a granular view of market dynamics, revealing specific demand characteristics and growth pockets. The core service types—Implementation, Consulting, and Managed Services—reflect the lifecycle stages of an ITSM platform, with consulting providing strategic advisory throughout the journey. Organization size dictates complexity; large enterprises require bespoke, large-scale integration projects, whereas SMEs typically opt for standardized, cost-effective managed solutions.

- By Service Type:

- Implementation Services (e.g., Configuration, Migration, Integration)

- Consulting Services (e.g., Strategy Definition, Process Optimization, ITIL/ITSM Roadmap)

- Managed Services (e.g., Platform Administration, Support, Optimization, Upgrades)

- By Deployment Type:

- Cloud-Based/SaaS (Dominant and fastest-growing segment)

- On-Premise (Declining, primarily for highly regulated sectors)

- By Organization Size:

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

- By Vertical:

- Banking, Financial Services, and Insurance (BFSI)

- Information Technology and Telecommunications

- Healthcare and Life Sciences

- Retail and E-commerce

- Manufacturing

- Government and Public Sector

Value Chain Analysis For ITSM Tool Implementation, Consulting and Managed Services Market

The value chain for the ITSM services market begins with the upstream activities centered on core ITSM platform vendors (e.g., ServiceNow, BMC, Atlassian). These vendors invest heavily in Research and Development (R&D) to create advanced SaaS tools with integrated AI, ITOM, and security capabilities, forming the foundational technology layer. Upstream analysis also involves the recruitment and rigorous certification of specialized talent by service providers, ensuring they possess deep expertise in specific platform configuration and ITIL frameworks. The quality and availability of vendor training and partner programs are critical upstream inputs that enable service providers to effectively execute complex projects.

The midstream phase focuses on service delivery, where consulting and implementation partners translate client business requirements into actionable platform configurations. This involves highly specialized activities like process assessment, custom application development (on platform), system integration, data migration, and comprehensive user training and change management. Managed services providers handle the continuous optimization and administrative tasks, leveraging automation tools and proprietary intellectual property to deliver high service level agreements (SLAs). Distribution channels are predominantly direct—via strategic partnerships with platform vendors—or through high-touch sales teams targeting large enterprise IT departments. Indirect channels include specialized marketplaces or referral programs.

The downstream analysis centers on the end-user organizations, which consume these services to achieve tangible business outcomes such as reduced mean time to resolution (MTTR), improved employee productivity, and enhanced compliance. Success in the downstream market is measured by user adoption rates and the realization of cost savings and efficiency gains promised during the consulting phase. Direct distribution is crucial for large-scale, transformative projects, ensuring close collaboration between the client and the implementation firm. Indirect channels sometimes facilitate the acquisition of smaller, standardized managed service contracts, often delivered through regional IT service partners catering to the SME segment.

ITSM Tool Implementation, Consulting and Managed Services Market Potential Customers

Potential customers for ITSM tool implementation, consulting, and managed services span all industries and organization sizes, fundamentally encompassing any entity reliant on formal, structured management of their IT services and assets. The primary end-users are CIOs, IT Directors, Heads of Infrastructure, and IT Service Managers who are tasked with overseeing the modernization of their internal service delivery mechanisms, reducing operational friction, and accelerating digital transformation. Large enterprises, particularly those operating globally or within highly regulated sectors such as BFSI, Healthcare, and Telecommunications, represent the most significant segment, as their highly complex, heterogeneous IT environments necessitate specialized expertise for seamless integration and optimization of premium ITSM tools.

The growing appeal of Enterprise Service Management (ESM) means that departmental heads outside of IT—such as Chief Human Resources Officers (CHROs) or Facilities Directors—are also becoming influential buyers, seeking consulting expertise to extend the ITSM platform capabilities to streamline HR onboarding, facility work orders, and legal compliance requests. Furthermore, medium-sized businesses transitioning from basic ticketing systems (like Jira Service Management or proprietary legacy solutions) to sophisticated cloud-based platforms constitute a rapidly growing customer base. These organizations typically seek bundled implementation and managed services packages to mitigate the complexity of platform migration without needing to hire extensive in-house platform administrators.

In essence, the market serves organizations grappling with outdated service delivery models, facing compliance pressures, or pursuing large-scale organizational modernization. Key triggers for purchasing these services include merger and acquisition activities (requiring rapid IT systems consolidation), significant growth or contraction (demanding platform scalability or optimization), or the decision to upgrade or replace an existing, end-of-life ITSM solution. Therefore, consultants who can articulate ROI in terms of efficiency, risk reduction, and competitive advantage are best positioned to capture these sophisticated customer segments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $13.5 Billion |

| Market Forecast in 2033 | $37.2 Billion |

| Growth Rate | 15.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Deloitte, IBM, Accenture, Atos, HCL Technologies, Capgemini, Fujitsu, DXC Technology, NTT DATA, Infosys, Wipro, Tech Mahindra, TCS, KPMG, PwC, Cognizant, LTI Mindtree, Sopra Steria, Unisys, Tietoevry |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

ITSM Tool Implementation, Consulting and Managed Services Market Key Technology Landscape

The technological landscape underpinning the ITSM services market is defined by the evolution of the platforms themselves and the sophisticated methods used by service providers to integrate and manage them. The shift to Software-as-a-Service (SaaS) models (e.g., cloud-native platforms like ServiceNow and Freshservice) is paramount, necessitating expertise in multi-tenant architecture, seamless quarterly update management, and cloud security frameworks. These modern platforms are characterized by extensive low-code/no-code development environments, allowing consultants to rapidly build custom applications and workflows, demanding implementation teams possess not just configuration skills but proficiency in rapid application development (RAD) methodologies tailored to these specific platforms.

A crucial technological dimension is the widespread integration of Artificial Intelligence (AI) and Machine Learning (ML) capabilities—often packaged as AIOps—directly into ITSM tools. This technology is leveraged by consultants to set up predictive incident management, enhance root cause analysis, and deploy intelligent automation across the IT Operations ecosystem. The services market is now focused on optimizing the consumption of these advanced features, requiring consultants to be proficient in data pipelines, algorithm tuning, and establishing robust Configuration Management Database (CMDB) governance, as AIOps efficacy is highly dependent on clean, accurate configuration data.

Furthermore, technology related to integration is vital. The market increasingly relies on modern Integration Platform as a Service (iPaaS) solutions and standardized API gateways to connect the core ITSM platform with peripheral systems, including HRIS, ERP systems (SAP, Oracle), and security information and event management (SIEM) tools. Service providers specializing in secure, scalable, and resilient enterprise integration capabilities are highly valued. Finally, the rise of specialized knowledge management systems, incorporating natural language processing (NLP) and generative AI, is transforming how services are structured, allowing for the creation of sophisticated self-help portals and deflection strategies, which require expert consulting to tailor the content strategy and knowledge architecture effectively.

Regional Highlights

Regional dynamics significantly influence the ITSM Tool Implementation, Consulting, and Managed Services Market, driven by varying degrees of digital maturity, regulatory environments, and expenditure on IT modernization. North America currently dominates the market share due to its early and aggressive adoption of cloud services, the strong presence of major platform vendors, and a high concentration of large enterprises with complex, mature IT infrastructures. The region exhibits high demand for advanced consulting focused on digital workflow transformation, AIOps adoption, and Enterprise Service Management (ESM) expansion into areas like HR and legal services. The competitive environment is intense, characterized by large, multinational consulting firms and specialized, high-expertise boutique providers.

Europe represents the second-largest market, characterized by stringent regulatory environments (especially GDPR), which drive significant demand for consulting services centered on compliance, data residency, and IT Financial Management (ITFM) integration within ITSM platforms. Western European countries like the UK, Germany, and France are primary revenue generators, showing a steady shift towards comprehensive managed services as organizations seek to maintain complex, multi-vendor ITSM ecosystems while adhering to diverse national labor laws and privacy mandates. The demand for process-centric consulting, rooted in strict ITIL adherence and often extending to Service Integration and Management (SIAM), remains very high.

Asia Pacific (APAC) is projected to be the fastest-growing market globally. This accelerated growth is primarily attributed to rapid industrialization, massive investments in cloud infrastructure, and increasing IT budgets aimed at digital transformation in countries like China, India, Japan, and Australia. While the market is highly fragmented, with strong local service providers competing alongside global giants, the demand is particularly strong for implementation services related to initial cloud migration and standardization of disparate IT operations across complex, multi-country organizational structures. The adoption of managed services in APAC is accelerating as organizations leverage outsourcing to rapidly gain access to specialized skills that are scarce locally.

- North America: Market leader, driven by SaaS adoption, high digital maturity, and strong focus on AIOps and ESM expansion.

- Europe: High demand for governance, compliance-focused consulting (GDPR), and SIAM expertise; stable growth in mature economies.

- Asia Pacific (APAC): Fastest-growing region; fueled by digital transformation initiatives, cloud adoption, and industrial growth in developing economies.

- Latin America (LATAM): Emerging market, showing increased adoption of standardized, regional managed services packages and basic ITSM implementation.

- Middle East & Africa (MEA): Growth tied to national digitalization strategies (e.g., Saudi Vision 2030, UAE), driving large-scale government and telecom sector modernization projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the ITSM Tool Implementation, Consulting and Managed Services Market.- Accenture

- Deloitte

- IBM

- HCL Technologies

- Capgemini

- Wipro

- Infosys

- Tata Consultancy Services (TCS)

- Cognizant

- Atos

- Fujitsu

- DXC Technology

- NTT DATA

- Tech Mahindra

- KPMG

- PwC

- LTI Mindtree

- Sopra Steria

- Unisys

- Tietoevry

Frequently Asked Questions

Analyze common user questions about the ITSM Tool Implementation, Consulting and Managed Services market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth in the ITSM services market?

The primary driver is the widespread global shift towards cloud-based ITSM platforms (SaaS), such as ServiceNow and BMC Helix. This migration necessitates specialized third-party services for complex implementation, integration with legacy systems, data migration, and ongoing platform optimization and management.

How is AI impacting the demand for ITSM consulting services?

AI is shifting the consulting focus from basic process mapping to sophisticated data strategy, governance, and AIOps implementation. While AI automates routine tasks, it increases the demand for high-value strategic advisory services centered on unlocking predictive capabilities and enterprise-wide automation through the ITSM platform.

What is Enterprise Service Management (ESM) and why is it important to this market?

ESM extends ITSM principles and platforms (like ServiceNow) beyond the IT department to non-IT functions such as HR, facilities, and finance. This expansion is critical as it significantly broadens the addressable market for implementation and consulting firms specializing in cross-functional workflow design and governance structure establishment.

Which service segment is experiencing the fastest growth?

Managed Services is the fastest-growing segment. Organizations increasingly outsource continuous platform administration, patching, upgrades, and optimization to specialized providers to reduce internal operational costs, ensure compliance, and quickly adopt new platform features without relying on scarce in-house expertise.

What are the main regional differences in demand for ITSM services?

North America demands highly advanced AIOps and ESM consulting. Europe focuses heavily on compliance, governance, and complex multi-vendor management (SIAM). Asia Pacific (APAC) exhibits the fastest overall growth, driven by foundational implementation and large-scale cloud migration projects across emerging economies.

This concludes the formal market insights report, optimized for depth, structure, and strategic content relevant to the ITSM Tool Implementation, Consulting, and Managed Services Market.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager