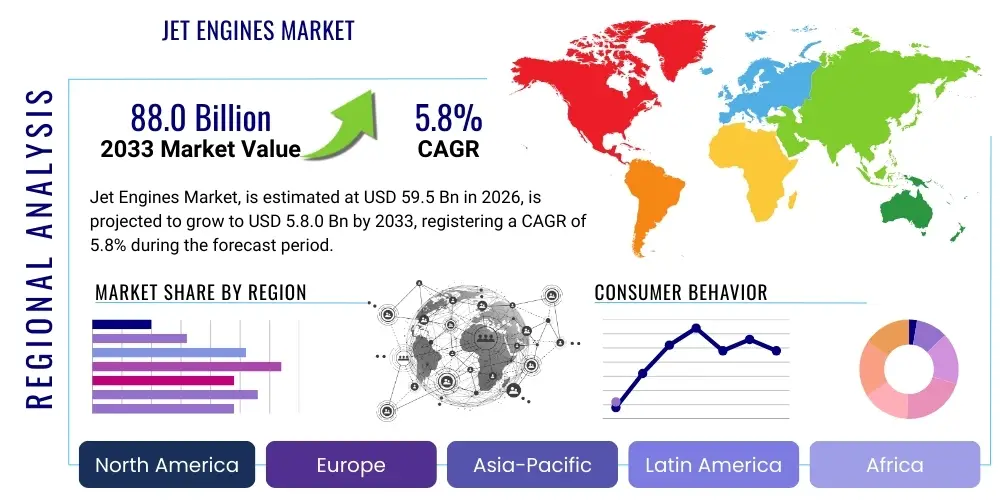

Jet Engines Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437856 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Jet Engines Market Size

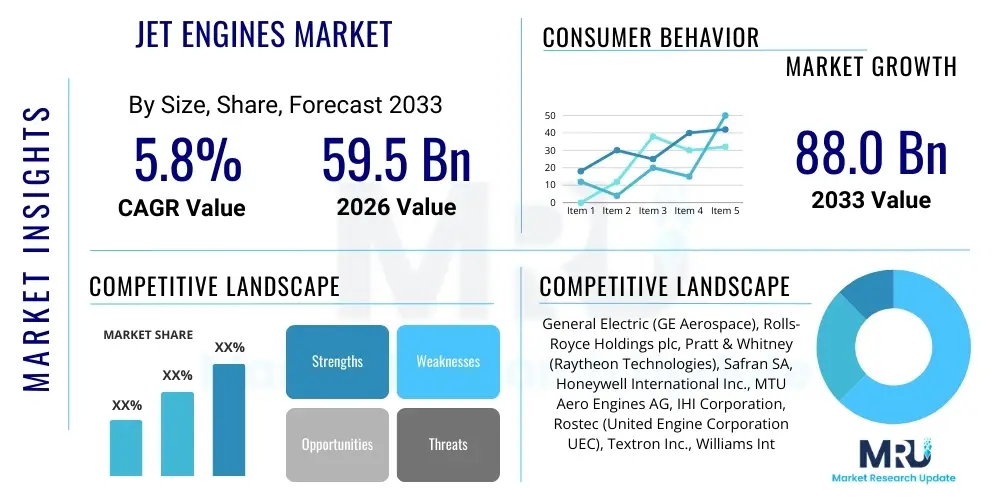

The Jet Engines Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 59.5 Billion in 2026 and is projected to reach USD 88.0 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by the continuous expansion of global commercial air travel, coupled with intensive military modernization programs across key geopolitical regions. The inherent cyclical nature of the aerospace industry, specifically the lengthy replacement cycles for aging fleets and the introduction of fuel-efficient next-generation aircraft, anchors the steady demand for new engine systems and extensive Maintenance, Repair, and Overhaul (MRO) services, thereby ensuring sustained revenue streams for market leaders.

Jet Engines Market introduction

The Jet Engines Market encompasses the design, development, manufacturing, and servicing of propulsion systems utilizing the reaction principle, primarily for aviation purposes. These complex, high-technology products, including turbofan, turbojet, and turboshaft variants, are essential components of commercial aircraft, military jets, helicopters, and advanced drones. Major applications span high-altitude long-haul commercial transport, tactical and strategic military operations, and specialized rotorcraft missions. The primary benefit derived from modern jet engines is superior thrust-to-weight ratios, enhanced fuel efficiency, and reduced noise emissions, directly addressing operational cost pressures and stringent environmental regulations faced by airlines globally. Key driving factors include increasing global passenger traffic, the necessity for lower carbon footprint propulsion solutions, and escalating defense expenditures aimed at maintaining air superiority and readiness.

Jet Engines Market Executive Summary

The global Jet Engines Market is characterized by intense oligopolistic competition, dominated by a few major original equipment manufacturers (OEMs) who possess proprietary technological expertise and extensive MRO networks. Current business trends indicate a significant shift towards sustainable aviation technologies, particularly the development of geared turbofan architectures and the preliminary research into hybrid-electric and hydrogen-powered concepts, driven by industry commitments to achieving net-zero carbon emissions by 2050. The competitive landscape is also witnessing heightened focus on long-term service agreements (LTSAs), shifting the financial risk and maintenance burden onto the engine manufacturers, thus ensuring stable recurring aftermarket revenue and locking customers into ecosystem dependency. Furthermore, advancements in materials science, particularly the utilization of ceramic matrix composites (CMCs) in the hot section, are crucial for achieving higher operating temperatures and improving engine performance metrics.

Regionally, North America and Europe remain the principal hubs for R&D and manufacturing, leveraging mature aerospace supply chains and substantial defense spending. However, the Asia Pacific (APAC) region is emerging as the dominant growth market, fueled by unprecedented expansion in middle-class air travel, significant fleet procurement by low-cost carriers (LCCs), and localized defense modernization efforts, particularly in China and India. This regional dynamic is compelling Western OEMs to establish local MRO centers and forge strategic alliances to penetrate high-growth jurisdictions and navigate complex trade regulations. Investment in infrastructure capable of supporting large volumes of MRO activities is a critical aspect of regional strategy moving forward.

Segment trends highlight the commercial turbofan segment as the largest revenue generator, benefiting directly from the backlog of orders for narrow-body aircraft, which rely heavily on efficient, high-bypass ratio engines. The military segment, while smaller in volume, demands extremely high performance, driving innovation in areas like adaptive cycle engines (ACEs) designed for high-speed, high-altitude flight regimes. The aftermarket segment (MRO) is exhibiting faster growth than the OEM segment, largely due to the increasing average age of the global fleet and the complexity of maintaining sophisticated, digitally-integrated engines. Technological segmentation points towards the inevitable integration of data analytics and artificial intelligence for predictive maintenance and real-time operational optimization, maximizing time-on-wing and minimizing unscheduled downtime, thereby profoundly influencing the economic viability of new engine platforms.

AI Impact Analysis on Jet Engines Market

User queries regarding AI in the Jet Engines Market predominantly revolve around three critical themes: efficiency enhancement, predictive maintenance reliability, and the security implications of integrated smart systems. Users frequently ask how AI can extend engine life, minimize fuel consumption through optimized flight paths, and prevent catastrophic failures before they occur. There is strong interest in the ability of machine learning algorithms to process vast datasets—including flight parameters, sensor readings, and maintenance history—to generate highly accurate predictions about component degradation and necessary service intervals. Concerns often center on the certification process for AI-driven components, the cyber vulnerability of networked engine control units (ECUs), and the ethical implications of autonomous decision-making in critical flight safety systems. The market expects AI to significantly reduce unscheduled downtime, optimize operational costs, and accelerate the design cycle for new, more efficient engine models, while simultaneously grappling with the technical challenges of ensuring data integrity and system robustness in high-stress aerospace environments.

Artificial Intelligence (AI) and Machine Learning (ML) are rapidly transitioning from auxiliary tools to core components within the jet engine lifecycle, fundamentally altering how these powerplants are designed, manufactured, operated, and maintained. In the design phase, generative AI is accelerating the optimization of complex component geometries, such as turbine blades and combustor liners, achieving unprecedented thermal efficiency and weight reduction that conventional computational fluid dynamics (CFD) alone cannot match. Furthermore, AI-driven simulations allow engineers to explore billions of design permutations under varying operational stresses, drastically reducing the physical prototyping costs and time-to-market for new engine programs. This computational capability allows for the integration of exotic materials and complex cooling schemes that require extremely precise control loops, moving the industry towards highly customized, application-specific propulsion systems.

Operationally, AI systems are instrumental in realizing the full potential of digital twins—virtual replicas of physical engines. These digital twins receive real-time sensor data from the engine’s Full Authority Digital Engine Control (FADEC) system, allowing ML models to diagnose incipient faults, predict performance degradation due to erosion or foreign object damage (FOD), and suggest immediate, actionable mitigation strategies to flight crew or ground maintenance teams. This shift from reactive or scheduled maintenance to highly accurate predictive maintenance (PdM) dramatically increases the engine's time on wing (TOW) and optimizes MRO logistics, saving airlines billions in operational expenses annually. AI also facilitates dynamic thrust optimization based on real-time atmospheric conditions, contributing directly to significant reductions in fuel burn per flight, aligning with global sustainability mandates and financial imperatives.

- AI optimizes predictive maintenance (PdM) through real-time sensor data analysis, increasing time-on-wing.

- Machine Learning accelerates engine design and optimization of complex components (e.g., turbine geometries).

- Generative AI reduces R&D cycle time and physical prototyping costs by enhancing simulation accuracy.

- AI-driven digital twins enable precise fault diagnosis and performance monitoring throughout the engine lifecycle.

- Intelligent systems improve operational fuel efficiency by dynamically optimizing thrust settings based on flight conditions.

- AI enhances quality control and defect detection during the high-precision engine manufacturing process.

- Neural networks are employed for cybersecurity monitoring of FADEC systems to prevent unauthorized access or manipulation.

DRO & Impact Forces Of Jet Engines Market

The dynamics of the Jet Engines Market are shaped by powerful Drivers and significant Restraints, moderated by strategic Opportunities, which collectively determine the Impact Forces on market growth. Major drivers include the substantial global growth in commercial air passenger volume, necessitating extensive fleet modernization and expansion, particularly within emerging Asian economies. Furthermore, sustained high defense budgets globally, focusing on fifth and sixth-generation military aircraft, drive demand for highly specialized and powerful engine variants. Restraints primarily encompass the exorbitant cost of R&D for next-generation propulsion systems, complex and time-consuming certification processes imposed by regulatory bodies like the FAA and EASA, and the inherent volatility of the aerospace supply chain, especially concerning high-grade specialty alloys and critical components. These factors create high barriers to entry, reinforcing the dominance of established OEMs.

Opportunities center around the urgent need for sustainable aviation solutions. The industry's pivot towards Sustainable Aviation Fuels (SAFs), hybrid-electric propulsion, and eventually hydrogen combustion presents immense potential for technological disruption and market differentiation. Geared Turbofan (GTF) technology, while mature, continues to evolve, offering incremental efficiency gains that appeal strongly to cost-sensitive airlines. The aftermarket segment offers a lucrative opportunity for expansion, as OEMs leverage advanced diagnostics and data analytics (AI/ML) to maximize the profitability of long-term service agreements (LTSAs). Strategic focus on additive manufacturing (3D printing) promises to revolutionize spare parts production, reducing lead times and inventory costs, thereby enhancing the responsiveness and profitability of MRO operations globally.

The collective impact forces favor growth, albeit measured and capital-intensive. The irreversible trend toward fuel efficiency and reduced emissions acts as a powerful accelerator, forcing immediate investment in new engine architectures. Geopolitical tension sustains the military demand side, insulating a portion of the market from cyclical commercial downturns. However, the immense financial leverage and long product cycles mean that technological advancements are incremental rather than revolutionary, often requiring decades of capital commitment before profitability is realized. Regulatory pressure regarding noise pollution and carbon emissions acts as a key constraining force, simultaneously driving innovation toward quieter and cleaner propulsion systems, ultimately benefiting the environment but increasing short-term development costs for market participants.

Segmentation Analysis

The Jet Engines Market segmentation provides a structural view of the diverse applications and technological frameworks within the industry. The market is primarily broken down by Engine Type, differentiating between high-bypass turbofans used extensively in commercial aviation and high-thrust turbojets and turboshafts utilized in military and helicopter platforms, respectively. Further segmentation is achieved by Platform, separating the high-volume commercial sector from the high-specification military sector. Technological segmentation tracks the adoption rate of advanced concepts like geared turbofans and adaptive cycle engines, vital for understanding future performance benchmarks. Finally, the market is differentiated by Application, providing a clear distinction between initial OEM unit sales and the extremely high-margin, stable aftermarket Maintenance, Repair, and Overhaul (MRO) services, which constitute the backbone of long-term OEM profitability.

The Engine Type segment is dominated by the turbofan category, specifically the high-bypass ratio engines that provide the unparalleled fuel efficiency required by modern commercial airliners. These engines represent the bulk of the market value due to the sheer volume of commercial aircraft orders and their higher manufacturing complexity compared to other types. The turboshaft segment, although smaller, exhibits unique growth driven by the expansion of the civil and military helicopter fleets, especially for search and rescue, offshore energy transport, and tactical troop deployment. The inherent demands of these segments—high reliability, rapid power response, and reduced footprint—drive specialized R&D efforts distinct from large-scale commercial turbofans, requiring tailored material science and gear system expertise.

Segmentation by Platform underscores the cyclical nature of the commercial sector, which is tied closely to global economic health and travel propensity, versus the comparatively stable, budget-driven military sector. The OEM versus MRO application breakdown is crucial for investment analysis. While OEM sales provide initial revenue spikes from major aircraft program launches, MRO generates steady, predictable revenue over the 30+ year lifespan of the engines, often accounting for more than half of an OEM's total lifetime earnings from a specific engine family. The strategic focus is increasingly shifting towards enhancing MRO profitability through data analytics, inventory optimization, and expanding localized service centers, particularly in high-growth regions like Asia and the Middle East where fleets are rapidly expanding.

- Engine Type

- Turbofan (High-Bypass and Low-Bypass)

- Turbojet

- Turboprop

- Turboshaft

- Platform

- Commercial Aircraft (Narrow-Body, Wide-Body, Regional Jets)

- Military Aircraft (Fighter Jets, Bombers, Transport Aircraft)

- General Aviation (Business Jets)

- Unmanned Aerial Vehicles (UAVs) & Missiles

- Technology

- Conventional Combustion Turbines

- Geared Turbofan (GTF)

- Adaptive Cycle Engines (ACE)

- Hybrid Electric Propulsion (Future Focus)

- Open Rotor/Propfan (R&D Stage)

- Application

- Original Equipment Manufacturer (OEM)

- Aftermarket (Maintenance, Repair, and Overhaul - MRO)

Value Chain Analysis For Jet Engines Market

The Jet Engines Market value chain is extraordinarily complex, capital-intensive, and vertically integrated, spanning raw material extraction to final operational services. The upstream segment involves highly specialized suppliers providing critical, high-temperature resistant materials such as nickel-based superalloys, titanium, and advanced composite materials, particularly Ceramic Matrix Composites (CMCs) and advanced polymers. These raw material suppliers and component manufacturers (for forging, casting, and machining) face immense regulatory scrutiny and must adhere to extremely tight tolerances and quality control standards. The relationship between Tier 1 suppliers, who often provide sophisticated sub-assemblies like fan blades, combustors, and gearbox components, and the major OEMs is characterized by long-term strategic partnerships and co-development agreements, ensuring intellectual property protection and supply stability for decades.

The midstream phase is dominated by the major engine OEMs (e.g., General Electric, Pratt & Whitney, Rolls-Royce). This stage involves extensive R&D, detailed design, final assembly, and rigorous testing and certification processes. Given the duopolistic nature of the large commercial aircraft market (Boeing and Airbus), engine OEMs compete fiercely for inclusion on new aircraft platforms, necessitating multi-billion dollar upfront investments. The manufacturing process utilizes advanced techniques, including additive manufacturing for complex internal parts and sophisticated robotic assembly, minimizing human error and maximizing material utilization. The capital expenditure required for state-of-the-art manufacturing facilities and advanced testing beds acts as a formidable barrier to market entry for new competitors.

Downstream analysis focuses heavily on the distribution channel and aftermarket activities. Direct channels involve OEMs selling engines directly to airframe manufacturers (like Boeing or Airbus) or directly to major airlines for replacement or new fleet acquisition. Indirect channels involve leasing companies, who purchase engines and aircraft and then lease them to operators globally, adding a layer of financial complexity. Crucially, the aftermarket (MRO) phase, handled directly by the OEM or authorized maintenance centers, generates the most substantial and stable revenues. This phase involves predictive diagnostics, parts management, and overhauls, utilizing proprietary data and specialized tooling. The strategic control over MRO services is vital, as it ensures long-term customer lock-in and maximizes the lifetime economic value extracted from each engine platform, relying heavily on data connectivity and digital service platforms for efficiency.

Jet Engines Market Potential Customers

The primary end-users and buyers in the Jet Engines Market exhibit diverse operational profiles, ranging from global commercial enterprises focused intensely on cost optimization to national defense organizations prioritizing performance and readiness. The largest customer segment consists of major commercial airlines (both mainline carriers and low-cost carriers) and cargo operators, whose purchasing decisions are dictated by engine fuel efficiency, reliability statistics, MRO contract terms, and initial acquisition costs. These operators seek engines with extended time-on-wing capabilities to minimize operational disruptions and maximize revenue flight hours, making factors like maintenance cost guarantees and global service network availability paramount during procurement negotiations.

The second substantial customer base is the military sector, comprising air forces and naval aviation divisions of various national governments. Procurement in this segment is less price-sensitive and more focused on cutting-edge technology, thrust vectoring capabilities, survivability, and stealth characteristics. Military buyers often demand customized engine variants that adhere to specific domestic requirements and often involve substantial domestic content requirements for national security and strategic autonomy reasons. The procurement process typically involves multi-year government contracts and requires extensive collaboration between the engine OEM and the government’s defense acquisition agencies, often funding large parts of the initial R&D costs.

An increasingly influential customer group includes aircraft leasing companies, such as AerCap and GECAS (now AerCap), who serve as crucial intermediaries in the global aviation financing ecosystem. These companies purchase engines and aircraft in large volumes, leveraging economies of scale, and then lease them to airlines worldwide. Leasing companies are highly risk-averse, favoring established, reliable engine platforms with proven resale value and strong MRO backing, thereby influencing the market selection toward widely adopted, proven technologies. Furthermore, business jet operators and regional aircraft manufacturers constitute smaller, yet important, segments, demanding engines optimized for performance at higher altitudes and requiring high reliability within shorter flight profiles, thus driving specialized demand in the smaller turbofan and turboprop engine categories.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 59.5 Billion |

| Market Forecast in 2033 | USD 88.0 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | General Electric (GE Aerospace), Rolls-Royce Holdings plc, Pratt & Whitney (Raytheon Technologies), Safran SA, Honeywell International Inc., MTU Aero Engines AG, IHI Corporation, Rostec (United Engine Corporation UEC), Textron Inc., Williams International, Aero Engine Corporation of China (AECC), Kratos Defense & Security Solutions, Hindustan Aeronautics Limited (HAL), BAE Systems, and Leonardo S.p.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Jet Engines Market Key Technology Landscape

The technological landscape of the Jet Engines Market is defined by a relentless pursuit of higher thermal efficiency, lighter weight, and drastically reduced noise and emission footprints, driven by both operational economics and stringent environmental mandates. A key enabling technology is the advancement of the Geared Turbofan (GTF) architecture, which utilizes a reduction gearbox to allow the fan and the low-pressure turbine (LPT) to spin at their respective optimal speeds. This decoupling permits the use of much larger fans, resulting in significantly higher bypass ratios, which translates directly into superior fuel efficiency (up to 15% better than previous generation engines) and substantial noise reduction, making it the dominant technology for next-generation narrow-body commercial airliners. Continuous improvements in GTF focus on reliability enhancements, addressing initial maintenance challenges, and increasing the overall robustness of the complex gearbox assembly to maximize time-on-wing performance.

Parallel technological efforts are concentrated on materials science and advanced manufacturing techniques. The introduction of Ceramic Matrix Composites (CMCs) in the hot section components—such as turbine shrouds and certain blade sections—is revolutionary. CMCs are significantly lighter than traditional nickel superalloys and can withstand much higher operating temperatures without requiring extensive cooling air. This temperature capability directly increases the engine's thermodynamic efficiency (Carnot efficiency) and reduces the amount of bleed air needed, channeling more energy to generate thrust. Furthermore, the increasing reliance on Additive Manufacturing (3D Printing) allows OEMs to produce complex, single-piece parts (like fuel nozzles or heat exchangers) with intricate internal cooling passages that are impossible to create using traditional casting methods. This drastically reduces part count, decreases weight, shortens the supply chain, and facilitates rapid design iteration.

Looking toward the future, the primary technological thrust is Sustainable Aviation Propulsion. This includes extensive research into Adaptive Cycle Engines (ACEs) for military applications, designed to optimize performance across diverse flight envelopes—from high-subsonic cruising efficiency to high-supersonic combat thrust. For the commercial sector, the emphasis is on hybrid-electric and pure electric propulsion systems, particularly for regional aircraft, though hybridization for large transport aircraft remains a major long-term R&D challenge, primarily due to battery energy density limitations. Crucially, the immediate transition involves the validation and certification of current engine architectures (like LEAP and GTF families) to operate on 100% Sustainable Aviation Fuels (SAFs). These technological shifts require substantial investment and regulatory alignment to move from research prototypes to certified, revenue-generating commercial products, ensuring that the technology landscape remains dynamic, highly specialized, and inherently capital intensive, cementing the market dominance of firms capable of sustained, multi-decade R&D commitments in complex thermodynamic and mechanical engineering fields.

Regional Highlights

- North America: North America, particularly the United States, represents the technological and strategic core of the Jet Engines Market. The region is home to two of the "Big Three" engine manufacturers (GE Aerospace and Pratt & Whitney), possessing mature manufacturing ecosystems, world-class R&D facilities, and a deep pool of highly skilled aerospace engineers. The market is characterized by robust domestic demand driven equally by a large installed base of commercial aircraft requiring constant MRO services and significant, sustained investment in military modernization programs (e.g., F-35 engine sustainment and B-21 bomber programs). Regulatory oversight by the FAA ensures extremely high safety and certification standards. The regional focus is heavily tilted towards advancing adaptive cycle engine technology for strategic military advantage and leading the implementation of digital thread integration across the design-to-service lifecycle, leveraging extensive data analytics capabilities to optimize fleet management.

- Europe: Europe is a powerful contender, anchored by Rolls-Royce and Safran, and supported by key partners like MTU Aero Engines. The European market focuses heavily on maximizing efficiency to comply with strict environmental policies imposed by the European Union, driving R&D into ultra-efficient turbofans and collaborative projects aimed at pioneering Sustainable Aviation Fuel (SAF) compatibility and early hybrid-electric demonstrators. The region benefits from strong governmental support through agencies like the European Space Agency (ESA) and Clean Sky initiatives, fostering technological collaboration across national borders. European OEMs maintain significant market share in the wide-body segment (Airbus A350 and A330neo), necessitating continuous investment in high-thrust engine families and global MRO expansion, particularly catering to Middle Eastern and Asian carriers who operate large European-manufactured fleets.

- Asia Pacific (APAC): APAC stands out as the fastest-growing regional market globally. This growth is predominantly driven by surging commercial air travel demand across nations like China, India, and Southeast Asia, necessitating massive fleet expansion, particularly of single-aisle aircraft. While local manufacturing capabilities are rapidly developing, especially in China (AECC) and India (HAL), the region remains highly dependent on Western OEMs for high-thrust, advanced engine technology and comprehensive MRO support. This reliance creates immense opportunities for Western manufacturers to establish regional service centers and joint ventures to capitalize on the increasing volume of engine cycles. The defense segment is also rapidly expanding, with numerous countries engaged in military aircraft acquisition and upgrade programs, often requiring licensed production or localized servicing agreements to bolster national technical capabilities and reduce reliance on external MRO services.

- Latin America & Middle East/Africa (LAMEA): These regions present strategic growth pockets, primarily centered around commercial fleet expansion (Latin America) and military dominance coupled with major airline hubs (Middle East). The Middle East, home to mega-carriers like Emirates and Qatar Airways, constitutes a critical MRO and wide-body engine customer base, driving demand for specialized service capabilities that handle high utilization rates in challenging environmental conditions (high heat, sand). Africa and Latin America represent growing, but more fragmented, markets where demand is focused on regional aircraft engines and robust, lower-maintenance turboprops and turboshafts for localized transport and resource management, although major hub expansion programs are increasingly driving advanced engine sales in select urban centers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Jet Engines Market.- General Electric (GE Aerospace)

- Rolls-Royce Holdings plc

- Pratt & Whitney (Raytheon Technologies)

- Safran SA

- Honeywell International Inc.

- MTU Aero Engines AG

- IHI Corporation

- Rostec (United Engine Corporation UEC)

- Textron Inc.

- Williams International

- Aero Engine Corporation of China (AECC)

- Kratos Defense & Security Solutions

- Hindustan Aeronautics Limited (HAL)

- BAE Systems

- Leonardo S.p.A.

- Mitsubishi Heavy Industries (MHI)

- StandardAero

- L3Harris Technologies

- Chromalloy Gas Turbine Corporation

- Snecma (Safran Group Subsidiary)

Frequently Asked Questions

Analyze common user questions about the Jet Engines market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth of the Jet Engines Market?

The primary driver is the sustained recovery and long-term forecast of global commercial air passenger traffic, particularly the expansion of middle-class travel in the Asia Pacific region, requiring massive fleet modernization and subsequent demand for new, fuel-efficient turbofan engines like the GTF and LEAP families.

How is the market addressing the goal of reducing aviation's carbon emissions?

The market is addressing emissions through two main strategies: immediate operational efficiency gains via advanced engine architectures (e.g., high-bypass geared turbofans) and long-term technological transition towards using 100% Sustainable Aviation Fuels (SAFs) and intensive R&D into hybrid-electric and eventual hydrogen propulsion systems.

What role does the aftermarket (MRO) segment play in overall engine OEM revenue?

The Maintenance, Repair, and Overhaul (MRO) segment is critical, often generating over 50% of an engine platform's total lifetime revenue. OEMs secure this high-margin revenue through proprietary parts, specialized tooling, and long-term service agreements (LTSAs), leveraging advanced predictive maintenance (PdM) technologies.

What is the significance of Ceramic Matrix Composites (CMCs) in jet engine technology?

CMCs are crucial for enhancing engine performance as they are significantly lighter than traditional alloys and can withstand much higher operating temperatures in the hot section. This enables improved thermal efficiency, reduced cooling air requirements, and ultimately lowers fuel consumption, representing a major materials science breakthrough.

Which geographical region is expected to demonstrate the fastest growth rate?

The Asia Pacific (APAC) region is projected to exhibit the fastest growth, primarily due to soaring demand for commercial aircraft to support expanding local and regional air connectivity, coupled with significant increases in national defense spending and aerospace manufacturing ambitions in countries like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager