Jewelry Appraisal Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438650 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Jewelry Appraisal Market Size

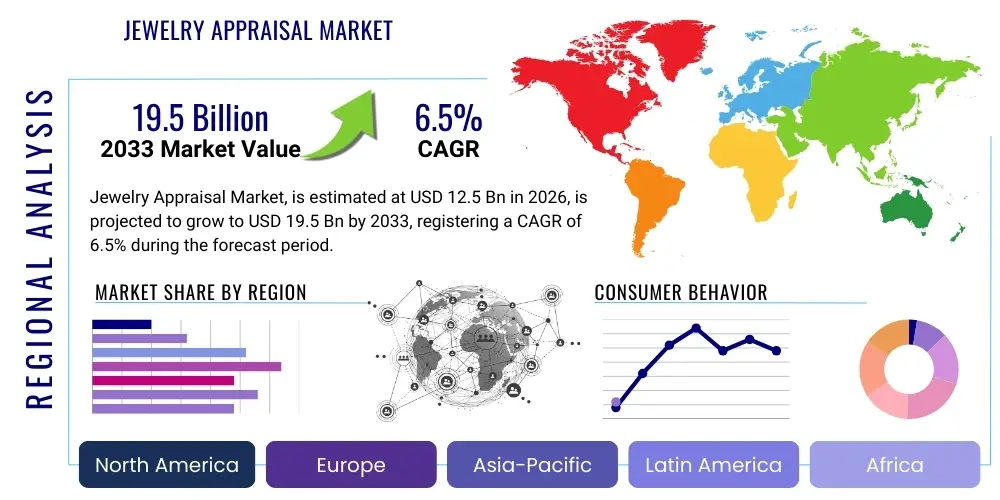

The Jewelry Appraisal Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 12.5 Billion in 2026 and is projected to reach USD 19.5 Billion by the end of the forecast period in 2033.

Jewelry Appraisal Market introduction

The Jewelry Appraisal Market encompasses specialized services aimed at accurately determining the monetary value of jewelry items, including loose gemstones, finished pieces, and antique collections. These services are crucial for various purposes such as insurance coverage, estate planning, equitable distribution, sales transactions, and collateral assessment for loans. The process involves meticulous examination, measurement, and grading of materials—specifically the four Cs (Cut, Color, Clarity, Carat weight) for diamonds, and specific parameters for colored stones and precious metals—conducted by certified gemologists or appraisers who adhere to recognized industry standards like the Uniform Standards of Professional Appraisal Practice (USPAP).

Major applications of jewelry appraisal extend across consumer and commercial sectors. Consumers primarily utilize appraisals for establishing replacement values necessary for insurance policies against loss, theft, or damage, thereby protecting significant financial investments. Commercially, auction houses, financial institutions, and specialized retailers rely heavily on independent appraisal reports to authenticate items, set reserve prices, and ensure transparency in high-value transactions. The demand for accurate valuation is rising concurrently with global wealth accumulation and increased consumer awareness regarding the intrinsic and collectible value of fine jewelry.

The driving factors propelling market expansion include the volatility in the prices of precious metals and gemstones, necessitating frequent re-appraisals; the globalization of the luxury goods market, leading to increased cross-border sales and import regulations; and heightened regulatory requirements, particularly in developed economies, mandating formal valuations for large estates and tax purposes. Furthermore, the rise of digital sales platforms and second-hand luxury markets requires verified appraisal documentation to build buyer trust and facilitate fair market value transactions, thus embedding appraisal services deeper into the transactional ecosystem.

Jewelry Appraisal Market Executive Summary

The Jewelry Appraisal Market is experiencing significant transformation, driven by technological advancements, evolving consumer behaviors, and increasing regulatory scrutiny regarding provenance and ethical sourcing. Current business trends indicate a shift towards hybrid appraisal models that integrate traditional physical examination with advanced digital tools, such as high-resolution microscopy and AI-assisted grading, enhancing efficiency and objectivity. The market is consolidating around established international laboratories and specialized independent appraisers capable of offering certified, globally recognized reports. Key strategic imperatives for market participants include improving turnaround times, ensuring compliance with anti-money laundering (AML) protocols related to high-value assets, and leveraging proprietary databases to benchmark values accurately against rapidly fluctuating commodity markets.

Regionally, North America and Europe remain the dominant markets due to high levels of insurance penetration, established auction house infrastructures, and mature legal frameworks requiring formal estate appraisals. However, the Asia Pacific (APAC) region is projected to exhibit the highest growth rate, fueled by substantial wealth creation in countries like China and India, leading to increased acquisition of high-end jewelry and a nascent but growing demand for formalized insurance and inheritance planning. Specific segment trends show that Insurance Appraisal remains the largest service type, while the Estate Appraisal segment is growing rapidly, driven by demographic shifts and the transfer of generational wealth. Furthermore, the segmentation by Gemstone highlights the sustained importance of diamond appraisal, though the market for colored stones and rare antique jewelry is seeing premiumization, requiring greater specialized expertise.

AI Impact Analysis on Jewelry Appraisal Market

Analysis of common user questions regarding the impact of Artificial Intelligence (AI) on the Jewelry Appraisal Market reveals key themes centered around accuracy, speed, and trust. Users frequently inquire: "Can AI accurately grade a diamond without human intervention?" and "Will AI reduce the cost of appraisals?" The primary expectation is that AI will automate repetitive, objective tasks such as measurement, weight calculation, and basic clarity mapping, thereby speeding up the certification process and reducing the potential for human error or subjectivity. Conversely, a major concern is whether AI can ever truly replace the nuanced, qualitative judgment required for grading colored stones, assessing craftsmanship (especially in vintage pieces), or determining the subjective 'marketability' value. Users are keenly interested in hybrid models where AI supports, but does not entirely supplant, the certified human appraiser, focusing on leveraging AI for enhanced data analysis and fraud detection.

AI's influence is fundamentally disrupting the traditional appraisal workflow by introducing unprecedented levels of consistency and scalability. Machine learning algorithms, trained on vast datasets of spectral analysis, microscopic images, and historical pricing data, are proving highly effective in identifying synthetic stones, detecting subtle treatments, and rapidly comparing an item's characteristics against millions of validated examples. This technological integration is particularly beneficial for high-volume tasks, such as initial screening for retailers or large-scale insurance portfolio valuations. The implementation of AI-driven systems not only enhances the technical precision of gemological reports but also addresses the industry's need for greater transparency and standardization in a historically subjective valuation process, ultimately elevating consumer confidence in the appraisal outcome.

While AI excels in the quantitative aspects of gemology, its current limitations in assessing artistic merit, provenance history validation, and complex damage assessment necessitate continued human oversight. The immediate impact is the creation of a 'super-appraiser' model, where human experts utilize AI-generated data as a foundation for their final, qualitative valuation. This symbiotic relationship ensures that the appraisal remains comprehensive, covering both objective, measurable data points and subjective market context. Furthermore, AI tools are enhancing security by utilizing blockchain integration for immutable record-keeping of appraisal reports, drastically reducing the incidence of fraudulent or tampered documentation, a critical requirement for high-value asset markets.

- Automated grading of geometric parameters (Cut and Clarity mapping) using computer vision.

- Enhanced detection of synthetic materials and undisclosed treatments through spectral analysis algorithms.

- Real-time market comparison and dynamic pricing recommendations based on current commodity and auction data.

- Fraud prevention through immutable digital appraisal certificates secured via distributed ledger technology.

- Reduction in appraisal turnaround time and operational costs for standardized valuation tasks.

- Improved consistency and reduced subjectivity across multiple appraisers and laboratories.

DRO & Impact Forces Of Jewelry Appraisal Market

The Jewelry Appraisal Market is shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively define the impact forces influencing its growth trajectory. The primary driver is the pervasive requirement for insurance validation, as homeowners and specific asset policies universally mandate professional appraisal for coverage. Coupled with this is the continuous growth in global High-Net-Worth Individuals (HNWIs) and Ultra-High-Net-Worth Individuals (UHNWIs), whose increasing investments in tangible luxury assets necessitate formal valuation for wealth management and portfolio diversification. Furthermore, the volatility of precious metal and gemstone markets compels routine re-appraisals to ensure accurate replacement value, fueling cyclical demand for services.

However, the market faces significant restraints. A major challenge is the inherent subjectivity and lack of universal standardization in appraisal methodology, particularly concerning colored stones and antique items, which can lead to value discrepancies and erode consumer trust. The high cost associated with advanced gemological equipment and the stringent educational requirements for certified appraisers act as substantial barriers to entry for smaller firms. Moreover, the increasing prevalence of sophisticated synthetic diamonds and treated gemstones requires continuous, costly investment in detection technology, pushing operational expenses higher and potentially slowing market accessibility in emerging regions.

Opportunities for market expansion are centered on technological integration and geographical penetration. The adoption of AI and blockchain technology offers a clear opportunity to standardize grading, improve transparency, and combat fraud, creating highly trustworthy digital appraisal reports that appeal to institutional buyers. Geographically, untapped emerging markets in Southeast Asia and Latin America represent vast potential, where rising disposable incomes are creating a new class of jewelry buyers seeking reliable valuation services. Additionally, the growing focus on ethical sourcing and provenance documentation presents a significant niche opportunity for appraisers who can integrate sophisticated tracking and historical data verification into their reports, aligning with modern consumer values.

The cumulative impact forces point toward a market favoring scalability and certified authenticity. Firms that successfully harness technology to reduce valuation discrepancies and offer globally recognized certifications (such as those from GIA or IGI standards) will dominate. Conversely, independent appraisers who fail to invest in new detection technologies risk obsolescence. The impact of regulatory frameworks, such as international AML and estate tax laws, acts as a continuous force ensuring mandatory demand, while the pervasive threat of counterfeits and synthetics acts as a persistent restraint demanding constant innovation in detection and verification services.

Segmentation Analysis

The Jewelry Appraisal Market is meticulously segmented based on the purpose of the appraisal, the type of material being valued, and the end-user utilizing the service. This segmentation is critical for market participants to tailor their specialized services, pricing strategies, and marketing efforts towards specific demographic and professional needs. The primary purpose dictates the methodology, as an insurance appraisal focuses on replacement cost, while an estate or liquidation appraisal targets fair market value or net realizable value, leading to distinct service offerings and pricing tiers across the industry. The intrinsic value differences and complexities involved in grading various materials necessitate specialized expertise, heavily influencing the Gemstone segment structure.

Service segmentation highlights the dominant role of insurance-driven valuations, which provide consistent, recurring revenue due to required policy updates. The rise of the secondary luxury market, facilitated by online platforms and consignment stores, has spurred growth in the liquidation appraisal segment, demanding rapid and standardized valuation methods. Furthermore, end-user segmentation shows that the traditional retail sector (Jewelry Stores) and the institutional sector (Banks and Auction Houses) are the largest consumers of appraisal services, relying on third-party certification to facilitate sales, lending, and inventory management, thereby maintaining the high standards required for luxury transactions.

The intersection of these segments—for instance, an estate appraisal (purpose) for a collection of colored stones (gemstone) commissioned by a private collector (end-user)—defines the specific skill set and certification required by the appraiser. This granularity ensures that highly specialized items, such as museum-quality antique pieces or rare colored diamonds, are handled by experts possessing the requisite historical context and technical knowledge beyond standard gemological training, thereby commanding premium pricing and higher-margin services within the overall market structure.

- By Type:

- Insurance Appraisal (Replacement Value)

- Estate Appraisal (Fair Market Value)

- Liquidation Appraisal (Net Realizable Value)

- Charitable Donation Appraisal

- Divorce/Equitable Distribution Appraisal

- By Gemstone:

- Diamond Appraisal

- Gold and Precious Metal Appraisal (Excluding primary stones)

- Colored Stones Appraisal (Sapphires, Rubies, Emeralds, etc.)

- Pearl Appraisal

- Antique and Period Jewelry Appraisal

- By Application (End-User):

- Jewelry Stores and Retailers

- Auction Houses and Specialty Dealers

- Banks and Financial Institutions (Collateral Lending)

- Insurance Agencies

- Private Collectors and Consumers

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Jewelry Appraisal Market

The value chain for the Jewelry Appraisal Market begins with the upstream procurement of necessary technical infrastructure, which primarily involves investment in advanced gemological tools such as high-powered microscopes, spectroscopic analysis equipment (e.g., Raman and UV-Vis spectroscopy for material identification), and specialized measuring devices (e.g., proportion scopes, electronic balances). Crucially, the primary upstream activity involves acquiring and maintaining high levels of professional certification and specialized training, often through internationally recognized bodies like GIA or AGS, which establishes the necessary credibility and technical expertise fundamental to the service's value proposition. Access to reliable, secure, and constantly updated market data and pricing indices also forms a vital upstream input, enabling accurate and defensible valuation calculations.

The core value creation stage is the appraisal process itself, where certified appraisers perform detailed examinations, conduct research into provenance and historical pricing, generate formalized reports, and apply recognized valuation methodologies (e.g., cost approach, market comparison approach). Downstream activities focus on the dissemination and utilization of the appraisal reports. This involves providing digital certificates, integrating the report into client management systems (for insurers or banks), and ensuring the documents meet all regulatory compliance standards for legal and financial institutions. The effectiveness of the value chain is largely determined by the perceived independence and reliability of the final report, translating directly into customer trust and the market acceptance of the assessed value.

The distribution channel for appraisal services is increasingly hybrid, incorporating both direct and indirect routes. Direct distribution occurs when independent appraiser laboratories or specialized retail appraisal departments interact immediately with the end consumer or private collector. Indirect channels involve institutional referrals; for example, insurance companies or banks mandate specific appraisal firms for their clients as a prerequisite for coverage or loan approval, effectively steering business to certified partners. The most sophisticated distribution method involves digital platforms, where appraisal reports are securely stored, shared with relevant third parties (e.g., auctioneers, legal counsel), and potentially linked to blockchain registries to enhance verification, streamlining the final delivery of the appraisal service and adding significant transactional value.

Jewelry Appraisal Market Potential Customers

The Jewelry Appraisal Market serves a diverse yet highly specific set of potential customers who require documented valuation for legal, financial, or protective reasons. The largest segment of end-users consists of individual consumers and private collectors who need appraisals primarily for insurance purposes to protect their assets against unforeseen risks. These customers often seek replacement value appraisals and are sensitive to the appraiser's certification and local reputation, preferring services that offer personalized interaction and clear explanations of the valuation methodology, especially for high-net-worth portfolios comprising multiple unique or custom pieces.

Institutional customers represent the most critical and high-volume segment. This group includes insurance carriers, who rely on appraisals to accurately calculate risk exposure and premiums; banks and financial institutions, which utilize formal reports for collateral assessment when issuing high-value loans; and estate planning attorneys and tax professionals, who require definitive valuations for inheritance tax calculations and equitable asset division in legal proceedings. These institutional buyers prioritize consistency, adherence to USPAP or international standards, and the ability of the appraiser to handle large volumes of items efficiently and discreetly.

A rapidly growing segment of potential customers is the secondary market, encompassing online luxury consignment platforms, auction houses (Sotheby's, Christie's, regional specialty auctions), and specialized antique dealers. For these entities, the appraisal serves as a crucial mechanism for authenticating provenance and establishing the legitimacy of the resale price, directly impacting their business reputation and profitability. As e-commerce in luxury goods expands, the reliance on verifiable digital appraisal reports as a guarantee of quality and value becomes paramount, driving demand for technologically integrated appraisal services that support secure online transactions globally.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 12.5 Billion |

| Market Forecast in 2033 | USD 19.5 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Gemological Institute of America (GIA), American Gem Society (AGS), International Gemological Institute (IGI), European Gemological Laboratory (EGL), World Gemological Institute (WGI), Professional Gem Sciences (PGS), National Association of Jewelry Appraisers (NAJA), Appraisal Service Center, Global Gemological Lab, Eurofins Scientific, Sotheby's (Appraisal Services), Christie's (Appraisal Department), Tiffany & Co. (Appraisal Services), De Beers Group, Gem World International, Gem Certification & Assurance Lab (GCAL), Forevermark, Guild Laboratories, JTV, Worthy.com (Appraisal Integration). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Jewelry Appraisal Market Key Technology Landscape

The technological landscape of the Jewelry Appraisal Market is undergoing rapid modernization, shifting from reliance solely on loupes and conventional measurement tools to incorporating high-precision analytical instrumentation and digital data management systems. A cornerstone technology is advanced spectroscopic analysis, including Fourier-Transform Infrared (FTIR) and Raman spectroscopy, essential for non-destructive testing to accurately identify synthetic materials (HPHT, CVD diamonds) and complex treatments (fillings, dyeing, heat enhancements) that significantly affect an item's value. These laboratory-grade instruments provide objective data points that support or challenge visual assessments, significantly enhancing the reliability and defensibility of the final appraisal report in a market plagued by sophisticated counterfeits.

Digital imaging and AI-powered grading software are profoundly influencing efficiency. High-resolution digital microscopy combined with computer vision algorithms can automate the precise mapping of internal and external characteristics, such as inclusions and blemishes, allowing for standardized clarity grading and objective cut proportion analysis faster than traditional manual methods. Furthermore, the integration of specialized databases—often proprietary and encrypted—that track global wholesale prices, auction results, and metal commodity fluctuations enables appraisers to generate dynamic valuations that reflect real-time market conditions. This data-driven approach moves beyond static pricing guides, providing a more accurate reflection of current fair market value.

The emergence of Distributed Ledger Technology (DLT), or blockchain, is a transformative force specifically addressing provenance and security concerns. Appraisal reports are increasingly being tokenized and recorded on blockchain networks, creating an immutable, tamper-proof record linked to the physical asset through unique identifier technologies (e.g., microscopic inscription, laser etching). This technology solves the historical problem of fraudulent paper certificates and enhances global trust, allowing institutions, insurers, and international buyers to instantly verify the appraisal's authenticity and history, fundamentally underpinning the transition toward a fully digital and secure appraisal ecosystem.

Regional Highlights

The global Jewelry Appraisal Market exhibits distinct regional characteristics influenced by economic maturity, cultural traditions concerning jewelry ownership, and regulatory frameworks governing asset valuation and insurance. North America, particularly the United States, represents the largest market share, driven by a highly developed insurance industry where appraisal is a mandatory prerequisite for luxury asset coverage, and strict legal requirements for estate and tax valuations. The concentration of leading independent appraisal organizations (like NAJA) and global gemological labs (GIA headquarters) ensures high standards and continuous technological adoption, making it the benchmark for service quality and professional standards.

Europe holds a substantial market position, underpinned by legacy auction houses in London, Paris, and Geneva, which necessitate continuous, high-value appraisal services for their consignments. The European market is characterized by a strong demand for antique and period jewelry appraisal, requiring specialized historical knowledge beyond standard gemology. Furthermore, robust regulations within the European Union regarding consumer protection and luxury goods import/export necessitate stringent, certified valuations. Germany, the UK, and Switzerland are key contributors, benefiting from strong financial sectors that integrate jewelry assets into collateral lending portfolios, driving institutional demand.

Asia Pacific (APAC) is forecast to be the fastest-growing region. This explosive growth is fueled by expanding middle and upper classes in China, India, and Southeast Asian nations, leading to massive consumption of gold and diamond jewelry. While traditional appraisal methods remain common, there is a swift movement toward adopting international standards (IGI/GIA certification) to facilitate global trade and address the rising concern over treatment and synthetic materials. The demand in APAC is shifting from traditional gold weight valuation to detailed gemological reports for colored stones and high-carat diamonds, signifying market maturation and a strong opportunity for digital appraisal platforms.

Latin America (LATAM) and the Middle East and Africa (MEA) present burgeoning markets. In the MEA, particularly the Gulf Cooperation Council (GCC) countries, significant wealth and cultural importance placed on gold and high-carat jewelry drive demand. This region often sees a high velocity of transactions, making quick, certified appraisals essential. LATAM, while fragmented, is beginning to establish clearer insurance and financial collateralization requirements, slowly formalizing the appraisal process and moving away from informal valuations, providing fertile ground for internationally certified appraisal services to establish a foothold.

- North America: Dominant market due to mandatory insurance requirements, established legal frameworks for estate planning, and high presence of key international gemological bodies.

- Europe: Strong growth driven by legacy auction markets, high demand for antique valuation, and institutional reliance on certified appraisals for financial portfolios.

- Asia Pacific (APAC): Highest CAGR, propelled by rapid wealth creation in India and China, increasing adoption of international grading standards, and rising interest in verifiable luxury goods.

- Middle East & Africa (MEA): Growth centered on high gold and diamond consumption, driven by cultural and investment demand, requiring rapid and certified valuation for high-velocity transactions.

- Latin America (LATAM): Emerging market characterized by increasing formalization of insurance and banking collateral systems, offering significant long-term expansion opportunities for certified providers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Jewelry Appraisal Market.- Gemological Institute of America (GIA)

- International Gemological Institute (IGI)

- American Gem Society (AGS)

- European Gemological Laboratory (EGL)

- World Gemological Institute (WGI)

- Professional Gem Sciences (PGS)

- National Association of Jewelry Appraisers (NAJA)

- Gem Certification & Assurance Lab (GCAL)

- Guild Laboratories

- Appraisal Service Center

- Global Gemological Lab

- Eurofins Scientific (Analytical Services Division)

- Sotheby's (Appraisal Services)

- Christie's (Appraisal Department)

- Tiffany & Co. (In-House Appraisal Services)

- De Beers Group (through specific brand certifications)

- Gem World International

- Worthy.com (Integrated Appraisal Solutions)

- Chrono24 (Appraisal Verification Partners)

- Rapaport Group (Pricing and Information Services affecting appraisal)

Frequently Asked Questions

Analyze common user questions about the Jewelry Appraisal market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for jewelry appraisals today?

The primary driver is the need for accurate insurance coverage. Insurance companies typically mandate a professional appraisal to establish the replacement cost value, ensuring the policy covers the asset's current market value against theft, loss, or damage.

How is AI specifically improving the accuracy of diamond grading?

AI systems use computer vision and machine learning trained on vast datasets of spectral and microscopic images to objectively assess the four Cs (Cut, Color, Clarity, Carat). This automation significantly reduces the inherent subjectivity found in manual grading, particularly for clarity mapping and cut proportion analysis, leading to more consistent reports.

What is the difference between an Estate Appraisal and an Insurance Appraisal?

An Insurance Appraisal determines the Retail Replacement Value, which is the cost to replace the item with a new one of comparable quality. An Estate Appraisal determines the Fair Market Value, defined as the price a willing buyer and seller would agree upon, often used for tax, inheritance, or liquidation purposes.

Why are appraisal reports now integrating blockchain technology?

Blockchain integration provides immutable security and verification for appraisal reports. It creates a tamper-proof digital record that proves the authenticity of the appraisal, thereby preventing fraud and enhancing trust for buyers, insurers, and financial institutions involved in the transaction.

Which geographic region is expected to experience the fastest growth in the Jewelry Appraisal Market?

The Asia Pacific (APAC) region is projected to exhibit the highest growth rate. This acceleration is due to rapid wealth creation, increased consumer desire for international gemological standards (GIA/IGI), and the formalization of asset insurance and inheritance processes in countries like China and India.