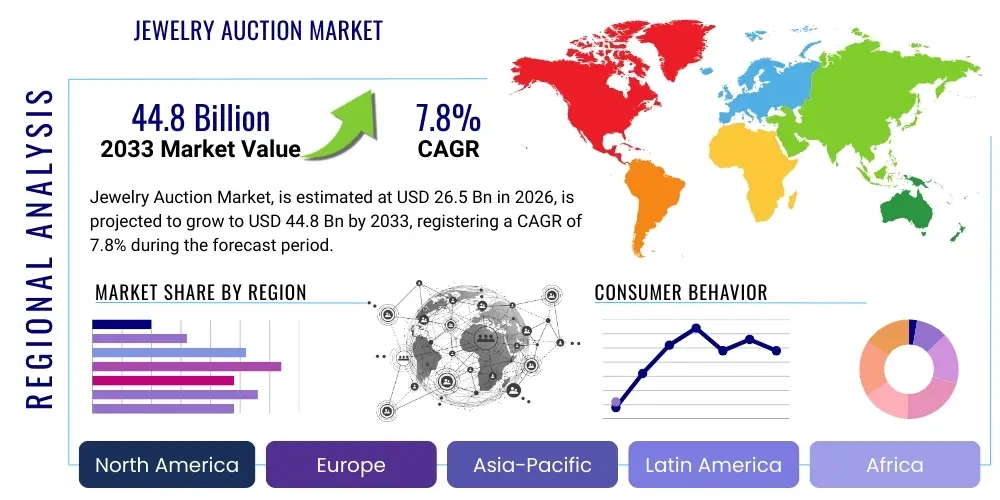

Jewelry Auction Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436801 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Jewelry Auction Market Size

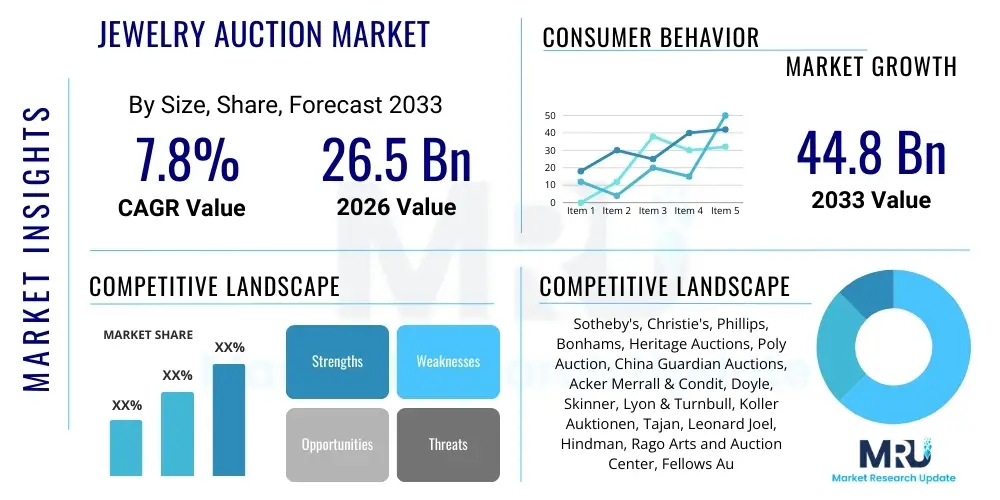

The Jewelry Auction Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at $26.5 Billion in 2026 and is projected to reach $44.8 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by the increasing global accumulation of wealth, particularly among High-Net-Worth Individuals (HNWIs) in emerging economies, coupled with the rising confidence in online platforms for high-value transactions. The intrinsic investment value of rare and unique jewelry pieces, often viewed as hedge against inflation, further stabilizes and propels market expansion, attracting both seasoned collectors and new investors seeking tangible luxury assets.

The market valuation reflects the convergence of several macroeconomic factors, including robust performance in traditional auction hubs like New York, London, Geneva, and Hong Kong, alongside significant expansion in digital auction participation. The shift towards online and hybrid auction formats has effectively lowered geographical barriers, widening the buyer pool and enabling greater price realization for consigned items. Furthermore, the strong emphasis on authenticated provenance, increasingly supported by technological advancements, reassures buyers, thereby encouraging higher spending and participation in specialized and marquee auctions globally.

Jewelry Auction Market introduction

The Jewelry Auction Market encompasses the systematic trading of fine jewelry, vintage pieces, gemstones, and watches through organized public bidding events, traditionally executed by established auction houses. This market serves as a crucial secondary platform for the reallocation of high-value luxury goods, providing transparent price discovery and certified provenance for assets. Products traded range from historical royal jewels and signed pieces by iconic houses like Cartier, Van Cleef & Arpels, and Tiffany & Co., to loose, investment-grade diamonds and colored stones. Major applications of this market include wealth preservation, luxury collecting, investment diversification, and museum acquisitions, positioning jewelry auctions as pivotal events in the global luxury goods ecosystem.

Key driving factors accelerating the market’s growth include the global proliferation of digital auction platforms, which have expanded accessibility and reduced operational overhead, making auctions more efficient and frequent. Furthermore, the sustained economic prosperity in regions like Asia Pacific, particularly China and Southeast Asia, has created a burgeoning class of HNWIs eager to acquire unique luxury items that offer both aesthetic pleasure and potential capital appreciation. The perceived scarcity and artistic merit of auction items, coupled with the rigorous authentication processes employed by leading houses, reinforce buyer trust and drive competitive bidding for exceptional lots.

The principal benefits derived from participating in the jewelry auction space include the opportunity to acquire authenticated, rare pieces often unavailable through retail channels, transparent valuation based on real-time market demand, and the potential for significant long-term investment returns. The market structure, defined by a few dominant global players, ensures high standards of professionalism and expertise, providing robust mechanisms for cataloging, valuation, and post-sale logistics. This sophisticated infrastructure supports the high-stakes transactions characteristic of fine jewelry auctions, maintaining the market's integrity and appeal to an elite global clientele.

Jewelry Auction Market Executive Summary

The Jewelry Auction Market is undergoing a rapid digital transformation, characterized by shifting business trends favoring hybrid and purely online sales formats. Business trends indicate a strong focus on enhancing virtual viewing capabilities, utilizing high-resolution imaging and 3D modeling, to replicate the in-person inspection experience for potential buyers globally. Leading auction houses are prioritizing the integration of advanced data analytics to predict demand and optimize cataloging strategies, ensuring maximum price realization. Furthermore, a critical operational shift involves streamlining logistics and security protocols for international shipping of high-value items, responding to the geographically dispersed nature of the contemporary collector base. This digitalization strategy not only improves transactional efficiency but also expands market reach into previously untapped affluent communities.

Regionally, the market exhibits sustained dominance in North America and Europe, which serve as established centers for major auction events and provenance expertise. However, the Asia Pacific region, particularly Greater China and Hong Kong, is emerging as the fastest-growing market, driven by substantial wealth creation and a cultural appreciation for tangible assets. Regional trends indicate a preference for classic Western jewelry designs alongside high demand for rare colored gemstones and jadeite, reflecting local collecting tastes. The Middle East also presents significant growth opportunities, characterized by a concentration of ultra-HNWIs and specialized interest in unique, large carat weight diamonds and bespoke pieces.

Segment trends underscore the enduring appeal of Fine Jewelry, which consistently commands the highest prices and drives market valuation. Within this segment, vintage and signed historical pieces are experiencing a surge in demand due to their intrinsic historical value and scarcity. The Online Auction format segment is experiencing the most significant growth in volume, democratizing access to lower-to-mid-tier luxury items, while Live Auctions remain essential for setting global benchmarks for the most exceptional, museum-quality lots. The dominance of High-Net-Worth Individuals (HNWIs) as primary end-users continues, though institutional buyers and specialized dealers also maintain crucial roles in maintaining market liquidity and inventory turnover.

AI Impact Analysis on Jewelry Auction Market

Common user questions regarding AI's impact on the Jewelry Auction Market revolve primarily around authentication reliability, fair valuation, and personalized discovery. Users frequently ask if AI can accurately detect sophisticated counterfeit items better than human gemologists, expressing both hope for enhanced security and concern over potential bias in AI-generated appraisals. There is significant interest in how AI tools can provide objective, real-time market comparisons (price discovery) across global auctions, moving beyond reliance on historical data alone. Key expectations center on AI improving the curation process, allowing auction houses to tailor catalog recommendations to individual collector profiles, thereby optimizing sales conversion and enhancing the personalized client experience in this highly relationship-driven sector.

The integration of Artificial Intelligence is fundamentally reshaping several core competencies within the jewelry auction ecosystem, moving beyond simple automation to sophisticated analytical applications. AI-powered image recognition systems are being deployed to analyze minute structural and facet details of gemstones, significantly enhancing the speed and accuracy of authenticity verification, thereby mitigating the risk associated with sophisticated fakes. Furthermore, predictive modeling algorithms are leveraging vast datasets of past sales, market indices, and macroeconomic indicators to generate highly accurate appraisal ranges, providing consignors and buyers with greater confidence in the reserve prices and investment potential of lots. This algorithmic approach to valuation promotes transparency and reduces human subjectivity in pricing luxury assets.

Additionally, AI plays a crucial role in optimizing market operations and buyer engagement. Machine learning is utilized to analyze buyer behavior, identifying specific collecting patterns, price sensitivities, and preferred aesthetic styles. This data enables auction houses to personalize marketing campaigns, curate bespoke digital catalogs, and recommend specific upcoming lots to individual HNWIs, dramatically improving targeted outreach and increasing participation rates. The deployment of AI-driven chatbots and virtual assistants also enhances customer service, providing instant, multilingual information on auction procedures, bidding rules, and lot details, ensuring a seamless and efficient digital interaction for a global clientele.

- Enhanced Authentication: AI image recognition for micro-detail analysis of gemstones and provenance documentation verification.

- Dynamic Price Discovery: Machine learning models generating real-time, objective valuation estimates based on global transactional data.

- Personalized Curation: AI algorithms recommending specific lots and catalogs to HNWIs based on historical purchasing behavior and collecting preferences.

- Fraud Detection: Sophisticated pattern recognition identifying anomalies in consignment history or suspicious bidding activity.

- Operational Efficiency: Automated cataloging, indexing, and translation of lot descriptions for global marketing efforts.

DRO & Impact Forces Of Jewelry Auction Market

The market is predominantly driven by the robust growth in global high-net-worth populations, who increasingly view fine jewelry as a stable and portable alternative asset class, particularly during periods of economic volatility. This demand is further amplified by the accessibility provided by sophisticated online auction platforms, which have successfully onboarded a younger generation of tech-savvy collectors. Restraints include the persistent challenge of counterfeiting, which requires continuous technological investment in authentication, and the sensitivity of luxury spending to global economic downturns and geopolitical instability, which can dramatically affect bidder confidence and price ceilings for ultra-high-end lots. Opportunities lie primarily in geographic expansion into emerging markets, particularly in Asia and the Middle East, and the utilization of emerging technologies like blockchain for immutable provenance tracking, which enhances trust and transactional security.

Impact forces within the Jewelry Auction Market are highly interconnected, where economic stability directly influences collector spending capacity, acting as a primary driver. Technological advancements, particularly in digitalization and AI authentication, serve as critical enabling forces, mitigating risks and expanding market reach. Regulatory compliance regarding the ethical sourcing of stones (e.g., Kimberley Process) and anti-money laundering (AML) laws act as necessary constraints but also enhance the market's long-term integrity. The intense competition among major auction houses drives continuous innovation in client services and catalog quality, ensuring the overall standard of the industry remains exceptionally high and attractive to discerning clients.

The net impact of these forces suggests a positive long-term outlook, predicated on the industry's ability to maintain high levels of trust and transparency. While economic cycles introduce short-term volatility, the fundamental appeal of rare and authenticated tangible luxury assets persists. The shift to online bidding is a structural change that lowers entry barriers for new participants, but the expertise and curated experience of established auction houses remain crucial for the premium segment. Therefore, strategic investment in both digital infrastructure and expert gemological knowledge is essential for navigating the dynamic intersection of these powerful market forces.

Segmentation Analysis

The Jewelry Auction Market is comprehensively segmented based on three critical axes: Product Type, Auction Format, and End-User. Analyzing these segments provides nuanced insight into current consumer preferences, price sensitivities, and technological adoption patterns across the industry. Product segmentation distinguishes high-value Fine Jewelry, characterized by precious metals and investment-grade stones, from Costume/Fashion Jewelry, which holds value primarily through designer reputation or artistic merit. The Auction Format segmentation highlights the ongoing structural shift, contrasting traditional, high-stakes Live Auctions with the volume-driven, accessible Online and Hybrid models. End-User classification identifies the dominant buyer groups, ranging from private collectors seeking unique pieces to professional dealers focused on inventory acquisition and resale.

- By Product Type:

- Fine Jewelry (including period pieces, signature pieces, and loose stones)

- Costume/Fashion Jewelry

- Vintage and Antique Jewelry

- By Auction Format:

- Live Auction

- Online Auction

- Hybrid Auction

- By End-User:

- High-Net-Worth Individuals (HNWIs) and Private Collectors

- Dealers and Wholesalers

- Museums and Institutional Buyers

Value Chain Analysis For Jewelry Auction Market

The value chain for the Jewelry Auction Market is complex and highly specialized, beginning with the upstream analysis involving the sourcing and consignment of high-value pieces. Upstream activities include rigorous authentication and appraisal by expert gemologists and historians, establishing clear provenance, and detailed cataloging. Consignment sourcing relies heavily on long-standing relationships with private estates, collectors, and sometimes direct acquisitions from specialized manufacturers, ensuring a steady inflow of rare and desirable inventory. The integrity of this upstream process, characterized by due diligence and valuation accuracy, is paramount to maintaining market trust and securing premium lots for sale.

The midstream phase focuses on the actual auction process and preparation. This includes marketing and exhibition (both physical and virtual viewings), setting competitive reserve prices, and managing the live or online bidding mechanism. Downstream analysis involves post-sale logistics, which are crucial due to the high-value nature of the assets. Key downstream activities include secure payment processing, export/import documentation, and highly secured global shipping and delivery. Efficient handling of these final stages ensures a positive client experience, vital for repeat business and maintaining the auction house's reputation for reliability in high-stakes transactions.

Distribution channels in this market are predominantly direct, utilizing the auction house’s own platforms and global network of salerooms and representative offices. Direct channels allow for strict control over security, client relationship management, and regulatory compliance. While some indirect influences exist through specialized dealers or brokers who advise clients on consignments or acquisitions, the core transaction remains directly between the consignor, the auction house, and the successful bidder. The shift towards robust online platforms represents a digitalization of the direct channel, broadening accessibility while maintaining centralized control over the high-value transaction environment, which is critical for market scalability and security.

Jewelry Auction Market Potential Customers

The primary customer base for the Jewelry Auction Market consists of High-Net-Worth Individuals (HNWIs) and Ultra-High-Net-Worth Individuals (UHNWIs), particularly those residing in established wealth centers like North America, Western Europe, and rapidly expanding economic hubs in Asia Pacific and the Middle East. These buyers are motivated by both collecting passion and investment diversification, seeking tangible assets with proven historical appreciation, distinct artistic merit, or inherent rarity. They demand absolute assurance of provenance, high-touch personalized service, and discretion during the acquisition process, making the reputation of the auction house a crucial factor in their selection criteria.

A secondary, yet highly critical, segment comprises professional dealers and wholesalers who participate to replenish inventory, acquire specialized stones for cutting or setting, or arbitrage price differentials across international markets. These buyers are typically more price-sensitive and volume-focused than private collectors. Furthermore, institutional buyers, including museums, royal collections, and corporate entities, form a niche but significant customer group, primarily seeking historically important or museum-quality pieces for preservation, exhibition, and cultural heritage documentation. Serving these diverse buyer groups requires auction houses to maintain a balanced inventory spanning historical significance, artistic quality, and investment value.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $26.5 Billion |

| Market Forecast in 2033 | $44.8 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sotheby's, Christie's, Phillips, Bonhams, Heritage Auctions, Poly Auction, China Guardian Auctions, Acker Merrall & Condit, Doyle, Skinner, Lyon & Turnbull, Koller Auktionen, Tajan, Leonard Joel, Hindman, Rago Arts and Auction Center, Fellows Auctioneers, Leslie Hindman Auctioneers, Morphy Auctions, Fortuna Auction. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Jewelry Auction Market Key Technology Landscape

The contemporary Jewelry Auction Market relies heavily on several advanced technologies to maintain security, transparency, and global reach. Digitalization platforms constitute the core technological infrastructure, enabling robust online bidding systems, high-definition virtual viewing rooms, and mobile applications tailored for rapid, secure transaction execution. Crucially, high-resolution imaging technology, often involving micro-photography and 3D modeling, is essential for accurately presenting the minute details and internal characteristics of gemstones to remote bidders, thereby overcoming one of the major trust hurdles associated with online luxury transactions.

Authentication and provenance tracking technologies are rapidly becoming mandatory tools. Spectroscopy and advanced gemological testing equipment are used to verify the origin and characteristics of stones with scientific precision, supplementing traditional human expertise. Furthermore, blockchain technology is emerging as a disruptive force, offering an immutable, decentralized ledger to record the entire history of a jewelry piece, from mine or fabrication to its current ownership. This distributed ledger approach significantly enhances buyer confidence by providing an unalterable history of ownership and ensuring ethical sourcing compliance, addressing major concerns in the luxury asset space.

In addition to core transactional and verification tools, data analytics and Artificial Intelligence (AI) play a vital role in market optimization. AI-driven predictive analytics models are used to forecast market trends, assess liquidity risk, and optimize catalog sequencing for maximum sales realization. Client relationship management (CRM) systems, integrated with AI, personalize client communications and track intricate buying preferences, allowing auction houses to maintain competitive advantage by offering bespoke, white-glove service even through digital channels. The convergence of these sophisticated digital, verification, and analytical tools defines the modern competitive landscape of the jewelry auction sector.

Regional Highlights

The geographical analysis of the Jewelry Auction Market reveals distinct patterns of demand, supply, and growth potential across major global regions. North America, particularly New York City, remains a fundamental powerhouse, serving as a critical hub for large-scale, high-value auctions, particularly for estate jewelry and important private collections. The region benefits from a mature collecting culture, significant wealth concentration, and a highly sophisticated legal and financial infrastructure, attracting global consignors and bidders for flagship sales. Demand in North America is stable, focusing on classic and modern fine jewelry pieces, characterized by high liquidity and transaction frequency.

Europe, anchored by Geneva, London, and Paris, holds historical significance, particularly in the sale of antique, period, and royal provenance jewelry. Geneva is globally recognized as the premier center for the sale of exceptional colored gemstones and high-quality diamonds, often achieving world-record prices. The European market maintains a traditional approach, often favoring live auction formats for the most prestigious items, emphasizing connoisseurship and deep art historical context in their sales strategies. Regulatory environments related to cultural heritage and importation also play a significant role in shaping inventory movement within this region.

Asia Pacific (APAC), led by Hong Kong, Mainland China, and Singapore, represents the primary engine of future growth. Rapid accumulation of private wealth in this region has generated massive demand for high-end luxury goods, driving competitive bidding for rare colored stones, jadeite, and signature pieces from Western design houses. The APAC market shows a strong preference for high carat weight and vibrant colors, often exhibiting a risk-on investment appetite for luxury assets. This region is also a rapid adopter of online and mobile bidding technologies, facilitating high participation rates and quick market penetration for international auction houses seeking expansion.

The Middle East and Africa (MEA) region, particularly the Gulf Cooperation Council (GCC) states, is characterized by a high concentration of ultra-HNWIs and specialized demand for extremely large, unique stones and custom-designed luxury pieces. While the volume of auctions may be lower than in established hubs, the average transaction value is significantly high. Latin America shows nascent growth, often serving as a source market for consignments of older estate jewelry, with local demand focusing on investment-grade diamonds and established international brands.

- North America (USA, Canada): Dominant market size, mature collector base, strong focus on modern and estate jewelry, critical hub for online sales infrastructure.

- Europe (UK, Switzerland, France): Historical center for provenance, world-leading expertise in colored gemstones, strong market for antique and period jewelry, established live auction traditions.

- Asia Pacific (China, Hong Kong, Singapore): Fastest-growing region, immense wealth creation driving demand for rare colored stones and high-carat diamonds, high adoption of digital auction formats.

- Middle East & Africa (GCC Nations): High average transaction value, specialized demand for unique, large-scale investment pieces, growing presence of regional auction houses.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Jewelry Auction Market.- Sotheby's

- Christie's

- Phillips

- Bonhams

- Heritage Auctions

- Poly Auction

- China Guardian Auctions

- Acker Merrall & Condit

- Doyle

- Skinner

- Lyon & Turnbull

- Koller Auktionen

- Tajan

- Leonard Joel

- Hindman

- Rago Arts and Auction Center

- Fellows Auctioneers

- Leslie Hindman Auctioneers

- Morphy Auctions

- Fortuna Auction

Frequently Asked Questions

Analyze common user questions about the Jewelry Auction market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Jewelry Auction Market?

The key drivers include the rising number of High-Net-Worth Individuals (HNWIs) globally, the increased accessibility and trust provided by high-quality online auction platforms, and the inherent investment appeal of rare and authenticated fine jewelry as a stable, tangible asset class.

How is technology, specifically AI, enhancing provenance and authentication in the market?

AI and machine learning are utilized for advanced image recognition to analyze micro-structural details of stones, improving authenticity verification and fraud detection. Additionally, blockchain technology is being adopted to create immutable digital records of a piece's ownership history, significantly bolstering provenance transparency.

Which geographical region exhibits the highest growth potential for jewelry auctions?

The Asia Pacific (APAC) region, particularly driven by markets in Hong Kong and Mainland China, demonstrates the highest growth potential due to rapid wealth creation, strong cultural demand for luxury assets, and high adoption rates of hybrid and online bidding formats.

What is the key difference between Live Auctions and Online Auctions in this sector?

Live Auctions typically handle the ultra-high-end, historically important, or museum-quality lots, setting market benchmarks with high-stakes bidding environments. Online Auctions focus on increasing volume, accessibility, and efficiency for mid-tier luxury and vintage pieces, widening the buyer pool globally.

What types of jewelry are considered most valuable in the current auction environment?

The most valuable types of jewelry are historically significant signed pieces from iconic design houses (e.g., Cartier, Van Cleef & Arpels), rare colored gemstones (especially pink and blue diamonds, Kashmir sapphires, and Burmese rubies), and large, investment-grade white diamonds with flawless provenance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager