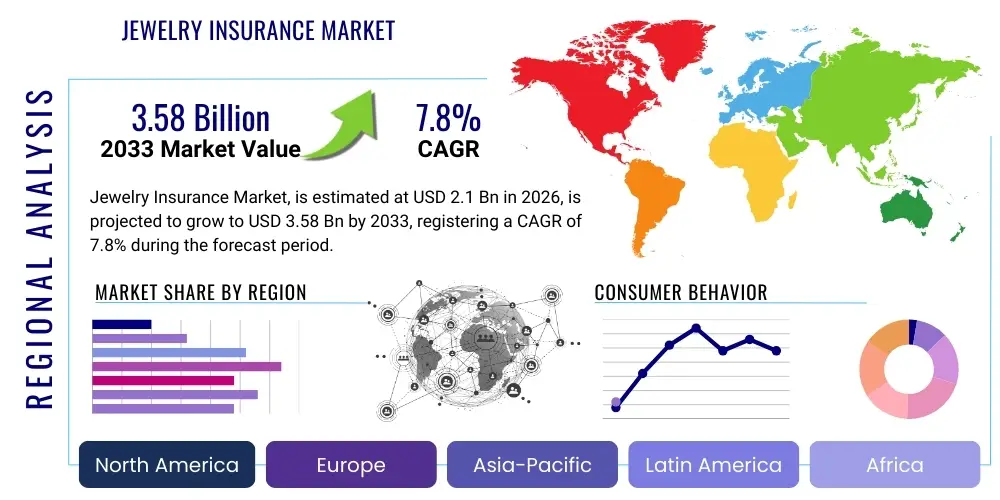

Jewelry Insurance Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437703 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Jewelry Insurance Market Size

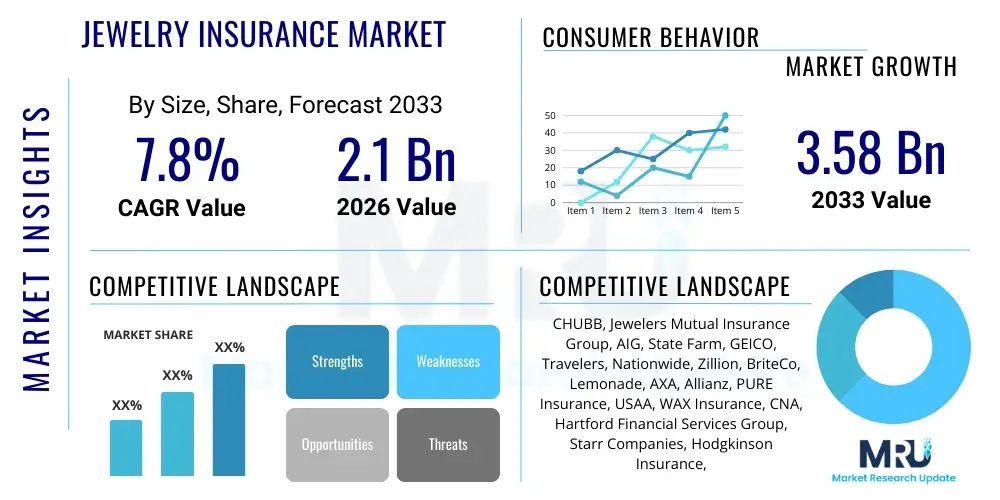

The Jewelry Insurance Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at $2.1 Billion in 2026 and is projected to reach $3.58 Billion by the end of the forecast period in 2033. This consistent expansion is primarily driven by the increasing global wealth accumulation, rising consumer awareness regarding asset protection, and the proliferation of high-value, designer, and custom jewelry pieces, necessitating specialized risk mitigation strategies beyond standard homeowner policies.

Jewelry Insurance Market introduction

The Jewelry Insurance Market encompasses specialized property and casualty policies designed to cover high-value personal jewelry items against a multitude of risks, including theft, accidental damage, disappearance, and loss. These products are critical for consumers whose jewelry assets often exceed the coverage limits or scope provided by general homeowner or renter insurance policies. The market includes policies that offer worldwide coverage and replacement guarantees, catering to affluent individuals and collectors seeking comprehensive financial protection for their valuable possessions. Major applications include coverage for engagement rings, heirloom pieces, watches, and custom-designed collections, often requiring specific appraisals and documentation for policy issuance.

The primary benefit of specialized jewelry insurance is the provision of "all-risk" coverage, which is far broader than the named perils found in standard property policies. Furthermore, these policies usually exempt the high deductibles associated with general insurance claims and allow for settlement options that include cash, replacement, or repair by a jeweler of the customer's choice. Driving factors accelerating market growth include increasing digitization, which streamlines the appraisal and claims process; growing e-commerce sales of luxury goods; and heightened geopolitical instability, which underscores the need for portable, robust asset protection.

Technological integration, particularly in utilizing advanced appraisal verification systems and blockchain for provenance tracking, is enhancing transparency and trust within the market. This technological push, coupled with personalized product offerings based on detailed risk profiles, is positioning jewelry insurance as an essential component of high-net-worth individual asset management. The shift towards micro-segmentation in policy design allows providers to offer highly customized coverage solutions, thereby maximizing client retention and attracting new demographics.

Jewelry Insurance Market Executive Summary

The Jewelry Insurance Market is witnessing robust expansion, characterized by significant shifts towards digital claims processing and personalized risk modeling. Business trends highlight a strong push toward partnerships between established insurers and specialty insurtech firms focusing on appraisal technology and fraud detection. Carriers are increasingly leveraging big data analytics to refine underwriting criteria for specific jewelry types, such as natural diamonds versus lab-grown diamonds, influencing premium structures. This digitalization wave is lowering operational costs and improving the customer experience, making specialized coverage more accessible and immediate, particularly for younger, tech-savvy consumers acquiring high-value assets earlier in life.

Regional trends indicate North America maintaining market dominance, driven by a high concentration of wealth and a deeply ingrained culture of specialized insurance adoption, especially in the United States. However, the Asia Pacific (APAC) region is emerging as the fastest-growing market, fueled by rapid economic development, increasing disposable incomes, and the cultural significance of owning and investing in gold and high-carat jewelry. European markets show stable growth, focusing on regulatory compliance and offering sophisticated, often multi-lingual policies tailored to cross-border ownership and travel risks.

Segment trends reveal a strong preference for Personal Coverage policies over Commercial Coverage, although the latter is growing due to increasing demand from small, independent jewelers and online retailers needing inventory and transit protection. Within product types, policies covering watches and engagement rings remain the core drivers. Distribution channels are experiencing a significant pivot, with direct-to-consumer online platforms gaining traction, challenging the traditional dominance of independent insurance agents and brokers, necessitating hybrid distribution models that combine digital efficiency with personalized consultation.

AI Impact Analysis on Jewelry Insurance Market

User inquiries regarding AI's influence in the Jewelry Insurance Market frequently center on three critical themes: efficiency in claims processing, accuracy in risk assessment, and the potential for reduced human interaction in valuation. Common user questions probe how AI can differentiate between genuine and fraudulent claims (especially concerning "mysterious disappearance"), whether AI-powered image recognition can accurately appraise complex vintage pieces, and if automated underwriting will lead to fairer, more granular pricing or, conversely, introduce algorithmic bias. Users also express keen interest in AI's role in proactive loss prevention, such as integrating AI with smart home security systems to lower premiums. The consensus concern revolves around maintaining the human element of trust and expert judgment necessary for assessing unique and sentimental items while benefiting from automation.

AI's primary transformative role lies in automating data-intensive processes, beginning with the initial policy application. Machine learning models analyze thousands of data points—including geographical risk scores, appraisal authenticity markers, repair costs, and historical claim patterns—to generate highly precise risk profiles, moving far beyond traditional actuarial tables. This granular assessment capability allows insurers to offer dynamic pricing and personalized policy conditions, significantly improving risk selection and reducing the adverse selection bias inherent in conventional underwriting. Furthermore, Natural Language Processing (NLP) is being deployed to instantly analyze detailed appraisal documents and sales receipts, extracting key attributes (carat weight, cut quality, metal type, provenance) to ensure policy accuracy and compliance.

In the post-event phase, AI is revolutionizing claims management. Computer vision algorithms, coupled with deep learning, are increasingly used to verify the condition and authenticity of damaged items submitted digitally. This rapid verification drastically shortens the claim cycle time, enhancing customer satisfaction. Moreover, predictive analytics identify potential fraud indicators by cross-referencing claim narratives against regional crime statistics and behavioral patterns. This proactive fraud detection minimizes losses for carriers, allowing for more competitive premium offerings to low-risk customers, thereby fundamentally reshaping the operational backbone of the entire jewelry insurance ecosystem towards speed, accuracy, and personalized risk mitigation.

- Automated Underwriting: AI algorithms analyze structured and unstructured data (appraisals, location, security) for instantaneous risk scoring and dynamic premium calculation.

- Enhanced Fraud Detection: Machine learning models identify anomalous claim patterns, suspicious disappearance reports, and appraisal inconsistencies, significantly lowering payout risks.

- Computer Vision for Valuation: Utilizing deep learning to analyze high-resolution images of jewelry for objective attribute grading (e.g., clarity, color, size) and verifying the integrity of submitted appraisals.

- Personalized Risk Mitigation: AI suggests specific security improvements (e.g., smart safes, alarm systems) to policyholders based on their item profile and location, offering premium discounts for adoption.

- Streamlined Claims Processing: NLP and robotic process automation (RPA) automate the intake, verification, and settlement authorization of simple, low-value claims, reducing human touchpoints.

- Behavioral Economics Integration: AI systems analyze customer interaction data to predict lapse rates and customize communication strategies for better policy retention.

- Market Trend Forecasting: Predictive AI models analyze macroeconomic factors and commodity price fluctuations (gold, diamonds) to adjust replacement cost valuations preemptively.

DRO & Impact Forces Of Jewelry Insurance Market

The dynamics of the Jewelry Insurance Market are shaped by powerful Drivers (D), Restraints (R), and Opportunities (O), which collectively exert significant Impact Forces. A key driver is the consistent global accumulation of wealth among high-net-worth and ultra-high-net-worth individuals, which naturally leads to increased investment in luxury assets requiring specialized protection. Coupled with this is the increasing consumer sophistication and awareness, particularly among younger generations who use digital tools to research and purchase specialized coverage upon acquiring significant assets like engagement rings. Furthermore, the global proliferation of organized retail crime and opportunistic theft acts as a potent external driver, compelling owners to seek robust, all-risk policies that exceed typical property coverage limitations.

Conversely, the market faces several notable restraints. High acquisition costs, stemming from the need for detailed, frequent professional appraisals and the specialized underwriting expertise required, often deter middle-income consumers. The complexity and lack of standardization in international regulations concerning item valuation and claim settlement across borders pose operational hurdles for global carriers. Additionally, the constant threat of sophisticated insurance fraud—specifically orchestrated theft or misrepresentation of value—forces insurers to maintain stringent, often burdensome, verification protocols, which can sometimes negatively impact the customer experience and inflate overall administrative costs.

The primary opportunities lie in technological integration and market expansion. The development of seamless, direct-to-consumer digital channels (Insurtech platforms) offers a chance to dramatically reduce distribution costs and improve speed-to-policy issuance. Leveraging blockchain technology for immutable jewelry provenance tracking presents a significant opportunity to combat fraud and simplify verification during claims. Furthermore, expanding coverage customization, such as micro-insurance for short-term travel or specific events, and targeting emerging markets in APAC where wealth creation is accelerating rapidly, represents substantial avenues for future growth and market penetration. These forces collectively dictate the premium structure, policy accessibility, and overall competitive landscape.

- Drivers (D)

- Growing global population of high-net-worth individuals (HNWIs).

- Increasing value of luxury watches and custom jewelry assets.

- Rising incidence of sophisticated theft and organized retail crime targeting luxury goods.

- Widespread adoption of e-commerce for high-value jewelry sales, increasing shipping and transit risk.

- Consumer demand for broader, 'all-risk' coverage policies that cover loss and mysterious disappearance.

- Digital advancements simplifying the application, appraisal submission, and claims notification process.

- Restraints (R)

- High cost and administrative burden associated with mandatory professional appraisals and frequent valuation updates.

- Prevalence of insurance fraud related to valuation misrepresentation and staged losses.

- Lack of standardized international regulatory frameworks complicating global policy administration.

- Perceived high cost of premiums compared to standard homeowner policy endorsements, discouraging mass-market adoption.

- Difficulty in verifying the authenticity and provenance of antique or uncertified heirloom pieces.

- Opportunities (O)

- Expansion into underpenetrated emerging markets, particularly in Asia.

- Integration of advanced technologies (AI, blockchain) to enhance accuracy in appraisal verification and fraud mitigation.

- Development of flexible, usage-based, or micro-insurance policies catering to specific short-term needs (e.g., travel insurance).

- Strategic partnerships with luxury watch brands, fine jewelry retailers, and online auction houses for embedded coverage options.

- Offering specialized policies for increasingly popular lab-grown diamond jewelry, requiring nuanced underwriting models.

- Impact Forces

- Economic Environment: Global economic stability directly influences discretionary spending on luxury goods and thus the insured value base.

- Technological Advancements: Insurtech platforms disrupt traditional distribution, forcing rapid digitization across legacy carriers.

- Regulatory Landscape: Data privacy laws and anti-money laundering regulations impact customer onboarding and due diligence procedures.

- Social Trends: Shifting consumer preference towards ethical sourcing and sustainable jewelry creates new valuation and provenance tracking challenges.

Segmentation Analysis

The Jewelry Insurance Market is systematically segmented based on Coverage Type, Distribution Channel, and End-User, allowing insurers to develop highly targeted products and pricing strategies. Coverage type segmentation distinguishes between policies designed for personal ownership, which dominate the market, and commercial policies tailored for businesses such as retailers, manufacturers, and wholesalers who require comprehensive protection for inventory, transit, and display assets. Analyzing these segments is crucial as the risk profile, claim frequency, and average claim severity differ dramatically between an individual policyholder and a commercial entity managing multi-million-dollar inventory in transit.

The distribution channel analysis highlights the ongoing transition from traditional intermediaries to digital platforms. While independent agents and brokers remain vital for high-value, complex policies requiring personalized consultation and risk advisory services, the rise of direct insurance channels and partnerships with jewelry retailers (embedded insurance) is capturing market share, especially for standardized products like engagement ring coverage. This dual-channel approach necessitates carriers to invest significantly in both relationship management with brokers and sophisticated, user-friendly digital interfaces to maintain a competitive edge and optimize customer acquisition costs.

End-user segmentation clearly differentiates between individual consumers and commercial entities, providing insight into purchasing behavior and product needs. Individual consumers prioritize coverage breadth (all-risk), low deductibles, and quick claims resolution, whereas commercial end-users require policies covering liabilities, complex supply chain risks, and specific perils like smash-and-grab theft during operational hours. Further segmentation often includes item category (e.g., watches, diamonds, precious metals), allowing for specialized underwriting and targeted marketing based on the inherent risk characteristics and replacement cost variability associated with each jewelry type.

- By Coverage Type

- Personal Coverage (Individual/Household)

- Commercial Coverage (Retailers, Manufacturers, Wholesalers)

- By Item Category

- Engagement and Wedding Rings

- Luxury Watches

- Heirloom Jewelry and Antique Pieces

- Precious Metals (Gold, Platinum)

- Loose Stones and Gemstones

- Designer and Custom Jewelry

- By Distribution Channel

- Insurance Agents and Brokers (Traditional Channels)

- Direct Insurers (Online Platforms and Direct Sales)

- Bancassurance

- Partnerships with Jewelry Retailers (Embedded Insurance)

- By End-User

- Individuals

- High-Net-Worth Individuals (HNWI)

- Jewelry Retailers and Stores

- Jewelry Manufacturers and Designers

- Wholesalers and Distributors

Value Chain Analysis For Jewelry Insurance Market

The Value Chain for the Jewelry Insurance Market begins with Upstream Activities focused on risk assessment and product development. This phase involves actuarial science, where insurers analyze historical loss data, catastrophic risk models, and commodity price trends to formulate premium structures and policy wording. Crucial upstream partners include professional appraisal services and authentication laboratories (e.g., GIA, AGS), whose verification processes determine the insured value. The efficiency and accuracy of this appraisal process are paramount, as they directly influence the underwriting profitability and the subsequent claims lifecycle.

The central activity is Policy Underwriting and Distribution. Distribution channels span both direct and indirect models. Direct channels (insurer websites, mobile apps) offer high speed and lower operational costs, catering to standard policies. Indirect channels, encompassing independent agents, brokers, and affinity groups, specialize in providing expert advice for complex, high-value portfolios, ensuring bespoke risk management solutions. Downstream activities focus heavily on Claims Management, which involves fraud investigation, repair/replacement negotiation (often with network jewelers), and final settlement. The effectiveness of the claims process is the ultimate determinant of customer satisfaction and brand reputation.

The market relies on specialized ancillary services throughout the chain. Technology providers deliver SaaS platforms for policy administration and AI tools for claim verification. Repair networks and specialized replacement jewelers form a critical part of the downstream process, ensuring that replacements meet the insured value and quality specifications stipulated in the policy. The increasing integration of Insurtech streamlines the flow of information from the initial appraisal submission (upstream) to the final policy issuance and replacement fulfillment (downstream), continuously driving optimization and reducing latency within the entire value chain.

Jewelry Insurance Market Potential Customers

The primary customer base for the Jewelry Insurance Market consists of individuals who own high-value, personal jewelry items, with a significant concentration in the High-Net-Worth Individual (HNWI) and Ultra-High-Net-Worth Individual (UHNWI) segments. These buyers possess complex portfolios of assets, including heirloom pieces, rare gemstones, and luxury watches, whose value often necessitates coverage limits far exceeding standard property insurance floaters. These customers prioritize comprehensive, worldwide coverage, discreet claims handling, and guaranteed replacement with a jeweler of choice, rather than replacement dictated by the carrier.

A rapidly expanding customer demographic includes younger Millennials and Gen Z individuals who are acquiring high-value engagement rings or luxury timepieces purchased through e-commerce or digital platforms. These end-users are highly accustomed to digital purchasing processes and seek instant quotes and immediate policy activation, making them prime targets for direct-to-consumer online insurance platforms. Their purchasing behavior is often driven by emotional connection to the item, demanding policies that cover 'mysterious disappearance' and accidental damage, reflecting active, mobile lifestyles.

Commercial customers constitute a secondary, yet highly lucrative, customer segment. This includes professional jewelers, high-end retailers (both physical and online), diamond manufacturers, and specialized logistics providers (e.g., armored transport). These entities require robust commercial policies (Jeweler's Block policies) covering inventory while in-store, in transit, at exhibitions, or held in safe custody. For these B2B customers, coverage for supply chain interruption and liability associated with high-value goods is paramount, requiring highly specialized underwriting expertise tailored to the unique risks of the luxury trade.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.1 Billion |

| Market Forecast in 2033 | $3.58 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | CHUBB, Jewelers Mutual Insurance Group, AIG, State Farm, GEICO, Travelers, Nationwide, Zillion, BriteCo, Lemonade, AXA, Allianz, PURE Insurance, USAA, WAX Insurance, CNA, Hartford Financial Services Group, Starr Companies, Hodgkinson Insurance, Berkley Insurance |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Jewelry Insurance Market Key Technology Landscape

The technology landscape of the Jewelry Insurance Market is rapidly evolving, driven primarily by the need for enhanced accuracy in risk assessment and efficiency in customer interaction. Advanced appraisal technologies utilizing high-resolution imaging and spectroscopic analysis are foundational, ensuring that the insured value accurately reflects the true market value and composition of the item. This reduces disputes during claims and minimizes carrier exposure to over-valuation fraud. Furthermore, sophisticated Customer Relationship Management (CRM) systems are integrated with policy administration platforms to personalize outreach, manage renewals, and track customer claims history seamlessly, improving policyholder retention and satisfaction.

The deployment of Artificial Intelligence (AI) and Machine Learning (ML) constitutes the core technological shift. AI is instrumental in underwriting, processing complex unstructured data from appraisal certificates, and assigning granular risk scores based on dozens of variables, often resulting in quicker policy approvals. Beyond underwriting, ML models are crucial for real-time fraud detection by analyzing behavioral patterns and geographical risk concentrations, flagging suspicious claims almost instantly. The adoption of cloud-based policy management systems is also key, enabling scalability, resilience, and rapid deployment of new insurance products across multiple regulatory jurisdictions.

Blockchain technology, while still nascent, holds significant promise for establishing an immutable, tamper-proof record of jewelry provenance, ownership transfer, and repair history. This distributed ledger technology could effectively eliminate many current challenges related to verifying authenticity and tracking stolen goods, thereby revolutionizing the claims process and building consumer trust. Furthermore, the development of specialized Insurtech platforms focusing exclusively on jewelry, often featuring mobile-first interfaces for policy management and digital submission of documents, is lowering the barrier to entry for specialized coverage and challenging the traditional dominance of monolithic insurance carriers by offering highly focused, technologically superior user experiences.

Regional Highlights

- North America (Dominant Market Share)

North America, particularly the United States, holds the largest market share, characterized by a highly developed insurance infrastructure and high consumer awareness regarding the necessity of specialized asset protection. The region benefits from a large population of HNWIs and a high average value of assets, especially engagement rings and luxury watches. The market here is mature but highly competitive, featuring both large multi-line carriers and specialty insurance providers. Key growth drivers include the integration of advanced Insurtech solutions and favorable regulatory environments for digital insurance distribution. The regional focus often centers on covering loss, mysterious disappearance, and domestic transit risks.

The US market leads in the adoption of advanced underwriting techniques, leveraging third-party data to verify home security measures and geographical risk exposures. Canada also contributes substantially, showing robust growth in specialized coverage tailored to urban centers where theft risks are perceived as higher. The consumer expectation in North America is high, demanding rapid claims settlements and flexibility in replacement options, pushing carriers to invest heavily in customer service technology and efficient appraisal networks.

- Europe (Stable Growth and Regulatory Focus)

The European market demonstrates stable, measured growth, driven by affluent markets in Western Europe (UK, Germany, France) which boast strong traditions of investing in high-end antique and collectible jewelry. The complexity of operating across the European Union involves navigating diverse regulatory and tax frameworks, requiring carriers to offer sophisticated pan-European policies. The UK remains a key hub, particularly for high-value watches and complex collections, often requiring coverage that extends to art and fine collectibles under one comprehensive policy structure.

European insurers place a strong emphasis on regulatory compliance (e.g., GDPR impacting data handling) and ethical sourcing verification for insured items. The distribution channels are heavily weighted towards professional brokers who manage complex client relationships across multiple jurisdictions. The demand for specialized coverage is increasing due to rising cross-border travel and the necessity of ensuring coverage validity regardless of the policyholder's physical location within the Schengen Area or internationally.

- Asia Pacific (APAC) (Fastest Growing Market)

The APAC region is projected to be the fastest-growing market, propelled by rapid economic expansion, particularly in China, India, and Southeast Asia, leading to an exponential increase in the HNWI population. Cultural affinity for investing in physical assets, especially gold and high-carat jewelry, creates a vast, untapped market for specialized insurance products. As wealth grows and assets become more sophisticated (e.g., rare diamonds, heritage pieces), the demand for protection against geopolitical instability and organized crime increases significantly.

The key challenge in APAC is low insurance penetration and a preference for informal protection methods, requiring intensive educational efforts by insurers. However, the region’s high propensity for mobile and digital technology adoption makes it ideal for direct-to-consumer Insurtech models. Markets like Hong Kong and Singapore serve as regional hubs for luxury trade, driving demand for commercial insurance (Jeweler’s Block) and highly specialized personal policies tailored to collectors and international traders.

- Latin America, Middle East, and Africa (MEA) (Emerging Opportunities)

MEA presents significant emerging opportunities, particularly in the Gulf Cooperation Council (GCC) countries (UAE, Saudi Arabia) where high oil wealth drives extraordinary demand for luxury jewelry and watches. These regions are characterized by a highly concentrated HNWI segment that demands premium, discreet insurance solutions with exceptional limits. Insurers focus on bespoke policies that cover risks associated with frequent international travel and high-profile ownership.

In Latin America and parts of Africa, the market penetration remains low but is gaining traction due to high perceived security risks, making specialized theft and loss coverage highly attractive. The main hurdle remains establishing trust, navigating complex local regulations, and countering currency volatility which impacts replacement cost calculations. Digital platforms are crucial for efficiently reaching the dispersed urban wealthy populations in these regions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Jewelry Insurance Market.- CHUBB

- Jewelers Mutual Insurance Group

- AIG

- State Farm

- GEICO

- Travelers

- Nationwide

- Zillion

- BriteCo

- Lemonade

- AXA

- Allianz

- PURE Insurance

- USAA

- WAX Insurance

- CNA Financial Corporation

- The Hartford Financial Services Group, Inc.

- Starr Companies

- Hodgkinson Insurance

- Berkley Insurance

Frequently Asked Questions

Analyze common user questions about the Jewelry Insurance market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the difference between specialized jewelry insurance and a homeowner’s policy endorsement?

Specialized jewelry insurance (scheduled coverage) provides broader 'all-risk' protection, covering perils like mysterious disappearance and accidental damage, which are typically excluded or limited under standard homeowner policy endorsements. Specialized policies often feature zero or low deductibles and maintain a higher appraised value for replacement without requiring proof of forcible entry for theft claims, providing superior financial security and streamlined claims handling.

How does the adoption of AI impact the premium costs for jewelry insurance?

AI adoption facilitates more granular and accurate risk assessment by analyzing real-time data on location, security measures, and item specifics. This enables insurers to move away from generalized risk pools, often resulting in lower premiums for customers categorized as low-risk due to superior security protocols or favorable claim histories, thereby promoting highly personalized and competitive pricing models across the market.

Is coverage for lab-grown diamonds different from natural diamonds in specialized jewelry insurance?

Yes, coverage models are evolving. While both types require appraisal and scheduling, some carriers offer nuanced policies, reflecting the generally lower market value and distinct sourcing risks associated with lab-grown diamonds compared to natural stones. Underwriters use segmented data to assess the replacement cost accurately, ensuring policies reflect the material difference in market pricing and supply chain dynamics.

What are the primary distribution channels driving growth in the jewelry insurance market?

The market growth is primarily driven by Direct-to-Consumer (D2C) online platforms (Insurtech) offering rapid policy issuance and competitive rates. Additionally, strategic partnerships that embed insurance options directly at the point-of-sale within major jewelry retailers (Embedded Insurance) are critical for capturing new customers immediately upon purchase, complementing the traditional, high-touch services provided by independent agents and brokers for complex assets.

What documentation is essential for a smooth jewelry insurance claims process?

To ensure a smooth claims process, policyholders must retain detailed, up-to-date professional appraisals (ideally conducted within the last two years), original sales receipts, high-quality photographs of the item, and Gemological Institute reports (GIA certificates) establishing authenticity and specifications. For loss claims, providing detailed police reports and clear communication regarding the time and location of the incident significantly expedites resolution and reduces investigation time.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager